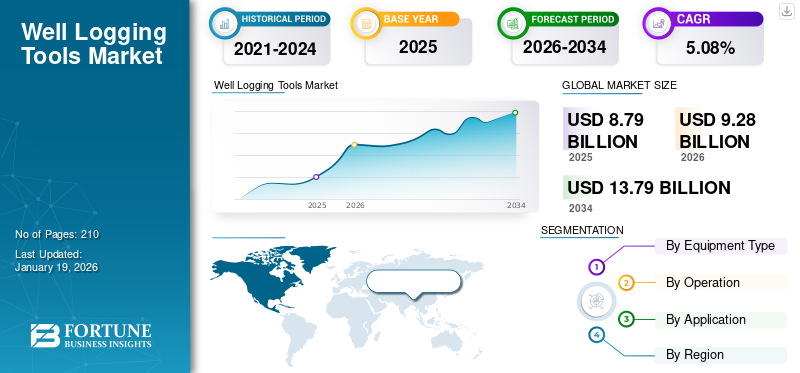

Well Logging Tools Market Size, Share & Industry Analysis By Equipment Type (Resistivity Logging, Acoustic Logging, Nuclear Magnetic Resonance (NMR) Logging Tools, Electromagnetic Logging, and Others), By Operation (Oil and Gas Exploration, Mineral and Geothermal Exploration, and Water Injection Well), By Application (Onshore and Offshore), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global well logging tools market size was valued at USD 8.79 billion in 2025 and is projected to be worth USD 9.28 billion in 2026 reach USD 13.79 billion by 2034, exhibiting a CAGR of 5.08% during the forecast period of 2026-2034. The North America accounts for largest market share of 34.36% in 2025. The market growth in the region is fueled by increased oil and gas exploration, particularly in unconventional resources such as shale formations.

Well logging tools are instruments lowered into boreholes (wells) to measure the physical properties of subsurface formations. These measurements are recorded on a well log, which is a detailed record of the borehole's characteristics. This information is crucial for understanding subsurface geology, identifying potential reservoirs of oil and gas, and assessing wellbore conditions.

- In May 2024, India’s Oil & Natural Gas Corporation (ONGC) announced significant offshore oil and gas discoveries in the Mumbai offshore basin. The company is expected to push oil and exploration activities to around 500,000 square kilometers over the coming years.

The demand for well logging tools is primarily driven by the increasing exploration and production activities in the oil and gas industry, particularly in unconventional hydrocarbon projects. Additionally, advancements in technology, such as real-time logging and automation, are further boosting product demand.

Schlumberger holds a prominent position in the market and is recognized as a leader in providing advanced technologies and integrated solutions for reservoir characterization, drilling, and production. Their prominence is fueled by a combination of innovative tools, digital solutions, and a global presence.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Oil and Gas Exploration to Drive Market Growth

Rising oil and gas exploration is a significant driver for the market. As exploration activities expand to meet growing energy demand, there is a greater need for tools that can accurately assess subsurface formations and well conditions, driving the demand for logging tools. Rising global energy demand necessitates the exploration of new oil and gas reserves. This leads to increased drilling activity and a greater need for these tools to evaluate potential reservoirs and ensure efficient extraction. The market is also being driven by the adoption of advanced logging technologies, such as logging while drilling (LWD) and real-time data acquisition, which provide more accurate and efficient data collection and analysis.

- In July 2024, ConocoPhillips announced plans to expand oil exploration in the National Petroleum Reserve-Alaska, U.S. The expansion plan includes the drilling of four wells and seismic exploration in the region.

Moreover, the increasing digitalization of the energy sector is further propelling growth of various applications to meet the demand for well logging tools. Cloud-based data management systems and advanced analytics are being adopted to optimize well logging operations and data interpretation.

Increasing Capital Investment in Upstream Activities to Boost the Market Growth

Increased capital investment in upstream oil and gas activities is a key driver for the market. These investments, focused on exploration and production, directly increase the demand for well logging services and technologies. This growth is further fueled by the need for efficient resource extraction, particularly in unconventional and deepwater reservoirs. Upstream activities in the oil and gas industry involve exploration and production.

- According to the International Energy Forum, the annual upstream investment is expected to increase from USD 135 billion to USD 738 billion by 2030 to cater to the rising demand.

Increased investment in these activities, such as expanding exploration into deeper and more challenging locations, necessitates the use of advanced well logging tools. The industry is increasingly reliant on real-time data for efficient resource management and well integrity. Well logging tools provide this crucial data, enabling operators to maximize recovery and minimize risks.

MARKET RESTRAINTS

High Cost of Advanced Logging Tools to Restrain Market Demand and Growth

The high cost of advanced well logging tools acts as a significant restraint on well logging tools market growth. This is due to the substantial initial investment required for both manufacturers and operators, encompassing research and development, sophisticated technologies, skilled labor, and stringent quality control. Additionally, the complexity of integrating these advanced tools with existing systems and the evolving regulatory landscape further contributes to the challenges.

Developing and manufacturing sophisticated well logging tools requires significant upfront costs in research, development, and specialized equipment. The complexity of these tools necessitates a skilled workforce for operation and data interpretation, which can be limited and costly.

MARKET OPPORTUNITIES

Geothermal Energy Explorations to Provide Lucrative Market Growth Opportunities

The global geothermal energy adoption is experiencing strong growth and this is creating lucrative opportunities for market players. Geothermal exploration, driven by the demand for renewable energy and sustainable solutions, is boosting the need for advanced well logging technologies to assess and characterize geothermal reservoirs.

- In July 2025, the Government of Germany announced plans to increase geothermal energy projects expansion with aim to phase out fossil fuels for heating systems by 2045. Such developments are expected to fuel the market growth in coming years.

The geothermal energy market is expected to continue its growth trajectory, driven by the increasing need for renewable energy and technological advancements in exploration and extraction. Future innovations in well logging tools and other exploration technologies will play a crucial role in unlocking the full potential of geothermal resources. The integration of geothermal energy into smart grids will further optimize energy distribution and utilization.

MARKET CHALLENGES

Operational Downtime and Rig Dependency to Create Challenges for Market Players

The global market faces challenges related to operational downtime, rig dependency, and fluctuating market conditions, particularly in the oil and gas sector. These factors impact both manufacturers and operators, influencing investment decisions and operational strategies. Well logging tools, especially those used while drilling (LWD), are susceptible to harsh conditions, leading to wear, tear, and failures. This downtime can significantly impact production and increase costs. The industry's reliance on drilling rigs for deployment also creates dependency and potential delays.

WELL LOGGING TOOLS MARKET TRENDS

Growing Demand for Automation in Log Interpretation

The demand for automation in log interpretation and well logging tools is growing due to increasing energy needs, technological advancements, and the need for more efficient and accurate data analysis. This trend is driven by the oil and gas industry's focus on optimizing exploration and production activities, while also addressing environmental concerns and cost pressures. Automation, AI (artificial intelligence), and machine learning are being integrated into well logging tools to improve data acquisition, analysis, and interpretation to cater to the evolving needs of the industry.

- In June 2025, Schlumberger announced a strategic collaboration with Cactus Drilling for the expansion and adoption of automated and autonomous drilling solutions. The collaboration aims to scale advanced digital solutions for enhancements of operational efficiency and consistency in execution.

The well logging tools industry is expected to continue growing, driven by increasing energy demand, technological advancements, and the need for more efficient and sustainable resource management. The integration of AI and automation will further transform the industry, leading to more sophisticated and data-driven solutions.

Download Free sample to learn more about this report.

IMPACT OF TARIFFS ON THE MARKET

The U.S. tariffs on steel, aluminum, and other materials are significantly impacting the global market by increasing production costs for manufacturers, potentially leading to higher prices for oil and gas operators. This could also cause delays in project timelines and supply chain disruptions. But some companies are responding by nearshoring production and sourcing components domestically.

Tariffs on imported steel, aluminum, and other materials used in well logging tools directly increase manufacturing expenses for companies in the U.S. These increased costs are often passed on to oil and gas operators and drilling companies, leading to higher prices for well logging services and equipment.

SEGMENTATION ANALYSIS

By Equipment Type

Resistivity Logging to Dominate the Market Due to High Compatibility with Subsurface Formations

Based on equipment type, the market is segmented into Nuclear Magnetic Resonance (NMR) logging tools, acoustic logging, resistivity logging, electromagnetic logging, and others.

The resistivity logging segment accounted for a dominating segment in the global market with share of 42.33% in 2026, due to its essential role in characterizing subsurface formations and identifying hydrocarbon reservoirs. It is a widely used method for determining the electrical resistivity of rock formations, which helps in differentiating between water-bearing and hydrocarbon-bearing zones. This information is crucial for various applications, including oil and gas exploration, groundwater resource management, and environmental monitoring.

- In May 2025, Halliburton launched EarthStar 3DX, the industry’s first 3D horizontal resistivity service. This technology provides geological insights to operators into horizontal wells upto 50 ft.

Nuclear Magnetic Resonance (NMR) logging tools are a prominent and increasingly important part of the well logging market, particularly in the oil and gas industry. They are valued for their ability to provide detailed information about subsurface formations, including porosity, fluid content, and permeability, which is crucial for assessing reservoir quality and producibility. While traditionally considered a specialized service, advancements in Logging While Drilling (LWD) NMR technology have made it more accessible and integrated into standard well logging operations.

By Operation

High Demand for Oil and Gas Exploration to Propel the Market Growth

Based on operation, the market is segmented into oil and gas exploration, mineral and geothermal exploration, and water injection wells.

The oil and gas exploration segment is expected to dominate the market with share of 62.71% in 2026. The primary driver for the well logging tools market in oil and gas exploration is the increasing demand for energy and the need to find and extract new oil and gas reserves. This demand is coupled with the ongoing exploration and production activities in the oil and gas industry, which require accurate and reliable subsurface data for successful drilling and reservoir management.

In mineral and geothermal exploration, water injection well applications significantly drive the market by enabling more accurate reservoir evaluation and improved resource extraction. Well logging tools provide crucial data about subsurface formations, including porosity, permeability, and fluid content, which are essential for identifying and characterizing geothermal reservoirs and mineral deposits. Water injection, particularly in geothermal systems, necessitates the use of well logging to monitor the impact of injection on reservoir characteristics and ensure efficient resource management.

By Application

To know how our report can help streamline your business, Speak to Analyst

Onshore Segment to Dominate the Market Owing to Increasing Onshore Drilling

Based on application, the market is broadly categorized into onshore and offshore.

The market is experiencing significant growth, with onshore applications playing a dominant role with market share of 77.16% in 2026. Onshore well logging, particularly in conventional and unconventional reservoirs, is the largest market segment, driven by the need for detailed reservoir characterization, production optimization, and well integrity monitoring. Advancements in technology, including AI and automation, are also boosting the market for both onshore and offshore applications.

- In February 2025, CNOOC and CNPC launched an onshore drilling campaign in China’s Xinjiang Uyghur Autonomous Region, which aims to reach oil and gas resources that are about 8,000 meters underground.

Offshore well applications significantly drive the market due to the increasing demand for energy and the exploration of deep-sea oil and gas reserves. Well logging tools are essential for characterizing subsurface formations, identifying potential reservoirs, and optimizing drilling and production operations in offshore environments.

WELL LOGGING TOOLS MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin Amea, and the Middle East & Africa. North America accounts for the largest well logging tools market share owing to the robust oil & gas production and exploration activities. Futhermore, Asia Pacific has emerged as fastest growing market due to government inclination toward increasing oil production in the region.

North America

[TGgLQFUCHq]

Increasing Drilling Activities in Unconventional Resources to Fuel Market Expansion in the Region

The North American market is leading the global market and experiencing strong growth with valuation of USD 3.02 in 2025, driven by increased oil and gas exploration, particularly in unconventional resources such as shale formations. This growth is fueled by the need for advanced logging technologies to optimize production and reservoir characterization. The market includes tools for both wireline and logging while drilling (LWD) operations, with a trend toward digital and high-resolution tools.

U.S.

Government Oil & Gas Production Plans to Propel Market Growth in the Country

The U.S. well logging tools market is experiencing significant growth. The development of unconventional hydrocarbon recovery, especially in shale and tight formations, is a major driver. These formations require advanced logging techniques for accurate characterization. The U.S. market is projected to reach USD 2.41 billion by 2026.

- In April 2025, the U.S. Department of the Interior announced an increase in estimated oil and gas reserves in the Gulf of America Outer Continental Shelf. Moreover, the Bureau of Ocean Energy Management revealed an additional 1.30 billion barrels of oil equivalent since 2021, with an increase of 22.6% of remaining recoverable reserves.

Technological advancements in logging tools and a focus on reservoir characterization are also contributing to market expansion. While the market is influenced by fluctuating oil prices and environmental regulations, overall, the trend points toward increased adoption of sophisticated well logging technologies.

Europe

Presence of Mature Oil and Gas Fields in the Region to Drive Market Growth

The European market is influenced by a combination of factors, including mature oil and gas fields, ongoing exploration, and increasing environmental regulations. The market is seeing a shift toward sustainable energy solutions and increased adoption of digital logging solutions, including AI and automation. While the overall market is experiencing growth, challenges remain, such as high implementation costs, complex integration processes, and regulatory pressures. The UK market is projected to reach USD 0.3 billion by 2026, while the Germany market is projected to reach USD 0.21 billion by 2026.

- In July 2025, Vaar Energi announced oil and gas discovery at the in the Norwegian Sea. According to Vaar Energi, the discovery holds recoverable reserves holds between 25 million and 40 million barrels of oil equivalent.

Asia Pacific

Robust Onshore and Offshore Exploration Activities Fuel the Market Growth in the Region

The Asia Pacific market is experiencing growth due to increasing energy demand and ongoing oil and gas exploration, particularly in mature fields. This market is characterized by a mix of onshore and offshore activities, with a rising need for advanced tools to optimize production and ensure well integrity. Technological advancements, including AI and cloud computing, are also playing a significant role in shaping the market. The Japan market is projected to reach USD 0.02 billion by 2026, and the India market is projected to reach USD 0.21 billion by 2026.

China

Rising Demand for Oil & Gas in the Country to Propel the Market Growth

The Chinese market for well logging tools is experiencing growth due to increasing energy demand and ongoing resource exploration activities. This market is characterized by advancements in technology, particularly in areas such as Wireline Logging, Logging While Drilling, and Slickline Logging, each serving specific needs in the oil and gas industry. The use of these tools is crucial for evaluating subsurface formations and identifying potential reservoirs. The China market is projected to reach USD 0.29 billion by 2026.

- In March 2025, under the 14th Five-Year Plan, the Government of China announced plans to increase domestic gas production to 230 Bcm with integrated gas storage capacity of 55-60 Bcm. Government’s inclination towards natural gas and oil production is expected gto propel market growth in coming years.

Latin America

Limited Oil & Gas Drilling Activities Drive the Moderate Market Growth in the Region

The Latin American market is experiencing growth driven by increased oil and gas exploration and production activities, coupled with advancements in logging technologies. This growth is supported by the need for efficient resource exploration and the valuable data these tools provide for understanding reservoir properties and well integrity.

Middle East & Africa

Presence of Large Oil & Gas Reserves to Fuel Market Growth in the Region.

The market in the Middle East and Africa is experiencing growth, driven by increased exploration and production activities in the oil and gas industry, particularly in offshore projects. This growth is fueled by a rising demand for energy and the need to evaluate subsurface formations for potential reservoirs. The market is primarily propelled by the need for accurate data on reservoir potential, well integrity, and formation evaluation. This data is crucial for guiding drilling decisions, optimizing well completions, and maximizing hydrocarbon recovery.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Focus on Technological Advancements to Gain a Competitive Edge in the Market

The global well logging tools industry is a dynamic landscape dominated by major players such as Schlumberger and Halliburton, who are actively investing in technological advancements and strategic partnerships to maintain their competitive edge. In December 2024, Halliburton launched the Intelli suite of diagnostic well intervention wireline logging services, which enables Halliburton to enhance production and reduce costs through enhanced insights. The market is experiencing steady growth, driven by increasing energy demand and exploration activities, particularly in the oil and gas sector. Key trends include the adoption of AI-powered and automated tools for enhanced efficiency and accuracy, as well as a focus on customer-centric solutions and real-time data analytics.

List of the Key Well Logging Tools Companies Profiled

- Schlumberger Limited (U.S.)

- Baker Hughes (U.S.)

- Weatherford (U.S.)

- NOV (National Oilwell Varco) (U.S.)

- China National Petroleum Corporation (China)

- Archer (U.S.)

- Felix Technology Inc. (Canada)

- Century Geophysical (U.S.)

- Integra Group Holdings (Switzerland)

- Mount Sopris Instruments (U.S.)

- Keller America (U.S.)

- Shanghai Shenkai Petroleum & Chemical Equipment Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS

- In June 2025, Halliburton Energy Services launched the Magnetic Resonance Imaging Logging While Drilling (MRIL-WD) tool, which is a joint development between Sperry-Sun Drilling Services and Halliburton Energy Services.

- In April 2024, Hertzinno collaborated with Ruili Acoustic to develop advanced well-logging technology solutions for oil field exploration and development across the globe.

- In December 2023, Di Drill Survey Services announced the expansion of a strategic partnership with Expro to strengthen the company’s well intervention and integrity services, including well logging.

- In July 2023, Excellence Logging announced the acquisition of Well Services Group for the expansion of market reach and capabilities. The acquisition strengthened Excellence Logging’s well testing capabilities mainly in the European market.

- In October 2021, Halliburton launched iStar Intelligent Drilling and Logging Platform which serves as comprehensive services platform logging and well drilling operations. Furthermore, the platform also supports machine learning, automation, and artificial intelligence.

Investment Analysis and Opportunities

The developing economies present a significant investment opportunity for market players:

- In June 2025, Egyptian General Petroleum Corporation (EGPC) announced an oil discovery in Abu Sennan, Egypt, with production capacity of 1,400 barrels of crude and 1 million cubic feet of gas per day. Moreover, the organization also invested USD 1.2 billion to drill 110 wells in 2024-25.

- In May 2025, the Governments of Saudi Arabia and Kuwait announced the discovery of oil fields located in the neutral zone shared between the two countries. The oil fields are located by Wafra Joint Operations (WJO), managed by Kuwait Gulf Oil (KGOC) and Saudi Arabia Chevron.

REPORT COVERAGE

The market report delivers a detailed insight into the market. It focuses on key aspects, such as leading companies in the market. Besides, the report offers regional insights and global market trends & technology, and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.08% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Equipment Type · Resistivity Logging · Acoustic Logging · Nuclear Magnetic Resonance (NMR) Logging Tools · Electromagnetic Logging · Others |

|

By Operation · Oil and Gas Exploration · Mineral and Geothermal Exploration · Water Injection Well |

|

|

By Application · Onshore · Offshore |

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size was USD 8.79 billion in 2025.

The market is likely to grow at a CAGR of 5.08% over the forecast period (2026-2034).

By application, the onshore segment is expected to lead the market over the forecast period.

The North America market size stood at USD 3.02 billion in 2025.

An increase in the number of oil and gas exploration activities is a key factor driving market growth.

Some of the top players in the market are Schlumberger, Baker Hughes, Weatherford, NOV, and others.

The global market size is expected to reach USD 13.79 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us