Wire and Cable Materials Market Size, Share & Industry Analysis, By Product Type ((Insulation Material (Polyvinyl Chloride (PVC), Cross Linked Polyethylene (XLPE), Thermoplastic Polyurethane (TPU), Polyphenylene Ether (PPE), Polypropylene (PP), Polyethylene (PE), Elastomer, LSFH/HFFR, and Others), and Conductor Material (Copper, Aluminium, and Others)), By Application (Electronic Wire, Power Cable, Flexible and Specialty Cable, Control & Instrumentation Cable, and Communication Cable), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

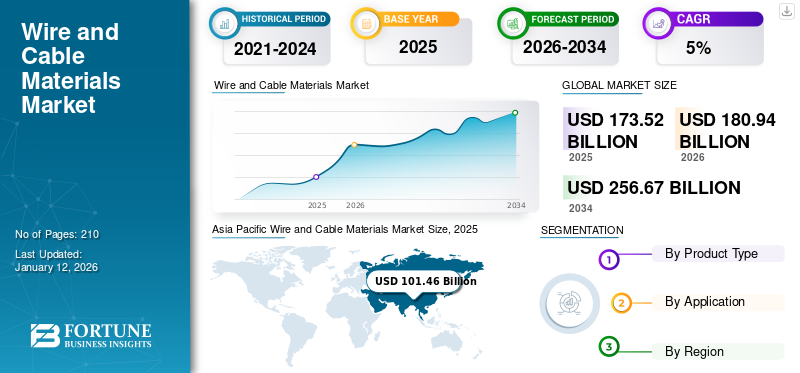

The global wire and cable materials market size was valued at USD 173.52 billion in 2025. It is projected to grow from USD 180.94 billion in 2026 to USD 256.67 billion by 2034 at a CAGR of 5.0% during the forecast period. Asia Pacific dominated the wire and cable materials market with a market share of 59% in 2025.

Wires and cables materials are essential components in electrical and electronic systems, consisting of conductors & insulation materials. Conductors, typically made of copper, aluminum or other metals, are responsible for carrying electrical current, while insulation materials such as PVC, polyethylene, or XLPE protect and prevent current leakage. Material selection depends on such as conductivity, thermal resistance, flexibility, and cost, ensuring suitability for applications ranging from power transmission to data communication in industries such as construction, automotive, and telecommunications.

Exxon Mobil Corporation, Dow Inc., BASF SE, DuPont, and ITW Formex are the key players operating in the market.

MARKET DYNAMICS

WIRE AND CABLE MATERIALS MARKET TRENDS

Growing Focus on Renewable Energy and Sustainable Practices to Support Market Growth

Renewable energy sources, such as solar, wind, and hydropower, require specialized cabling solutions to generate and distribute power efficiently. These power generation methods often produce electricity at a higher voltage and require cables that can transmit this energy over long distances with minimal loss. For instance, offshore wind turbines require cables that can handle both the electrical power generated by the turbines and the harsh environmental conditions at sea. Submarine cables designed for offshore wind farms must be able to resist saltwater corrosion, high pressures, and temperature extremes. The cables used in these applications are specially designed with enhanced insulation and sheathing materials. Solar power plants require cables that can connect photovoltaic (PV) panels to the grid and between panels within the solar array. These cables must be resistant to UV radiation, high temperatures, and other environmental factors. Solar cables, which are typically made from UV-resistant materials such as XLPE or PVC, have been further improved for fire resistance and energy efficiency.

- Asia Pacific witnessed a wire and cable materials market growth from USD 94.74 billion in 2023 to USD 102.06 billion in 2024.

Moreover, the growing interest on green building practices is driving demand for sustainable wire and cable solutions. In modern construction, energy-efficient cables are essential for systems managing lighting, HVAC, and electrical loads to reduce overall energy consumption. The wire and cable materials used in these applications need to meet strict environmental standards, such as being free from toxic substances and made from recyclable materials.

MARKET DRIVERS

Technological Advancements in Wire and Cable Materials to Boost Market Growth

Technological innovation has been a major driving force behind the growth of the market. These advancements improve the performance of wire and cable products and lead to the creation of entirely new materials and design strategies that meet modern demands for efficiency, durability, and sustainability. Traditional wire and cable materials, such as copper and aluminum, have seen significant improvements due to innovations in metallurgy and polymer science. Copper remains the primary choice for electrical conductivity due to its low resistance, but manufacturers are continuously improving its ability to withstand extreme environmental conditions, corrosion, and wear. Aluminum, while less conductive than copper, is lighter and more cost-effective, which makes it an attractive alternative, especially for long-distance transmission.

Additionally, innovations have led to the development of new composite materials, combining metals with high-performance polymers. For example, hybrid materials such as copper-clad aluminum are increasingly used in cables to combine the conductivity benefits of copper with the lightweight properties of aluminum, resulting in products that are both efficient and cost-effective. Moreover, the insulation and sheathing materials used in wires and cables are critical for ensuring safety, durability, and reliability. Advancements in polymer technology have led to the development of advanced cross-linked polyethylene (XLPE), which is more resistant to heat, moisture, and chemicals compared to conventional PVC (polyvinyl chloride). This makes XLPE particularly suitable for use in power transmission, industrial environments, and renewable energy installations, where durability and safety are paramount.

Download Free sample to learn more about this report.

MARKET RESTRAINTS

Raw Material Price Volatility to Restrict Market Growth

The prices of raw materials used in wire and cable production, such as copper, aluminum, and plastics, experience significant fluctuations, directly impacting the overall cost of wire and cable manufacturing, posing a major challenge for manufacturers and end-users. Several factors, including global supply chain disruptions, geopolitical tensions, natural disasters, and shifts in demand for these commodities, often drive this volatility.

The raw materials used for insulation, such as plastics and rubber, also subject to price increases due to fluctuations in the prices of petrochemicals and oil. The growing environmental concerns and regulatory pressures on the use of non-biodegradable and hazardous materials add a layer of complexity to the supply chain, influencing prices and limiting material availability.

As the world becomes more focused on environmental sustainability and climate change, the wire and cable materials market faces increasing pressure from governments and environmental agencies to comply with stricter environmental regulations. The production of cables often involves the use of harmful chemicals and materials, such as PVC (polyvinyl chloride) and lead, which can have detrimental effects on both human health and the environment.

MARKET OPPORTUNITIES

Advancements in Smart Grid Technology to Fuel Market Growth

Smart grids are advanced electrical systems that use digital communication and monitoring technologies to improve the efficiency, reliability, and flexibility of power distribution. These systems rely heavily on specialized cables to transmit both electricity and data, creating new opportunities for wire and cable manufacturers.

Smart grids incorporate a range of technologies, including smart meters, sensors, and communication cable systems, to allow real-time monitoring and control of power distribution. The cables used in smart grids must be capable of carrying both power and data signals, which requires the development of advanced materials that can transmit information efficiently and safely. Copper and fiber-optic cables are commonly used in smart grid applications, with copper serving as the primary material for power transmission and fiber-optic cables enabling high-speed data communication.

In addition to the transmission of electricity, smart grids require communication cables to connect and synchronize various components of the grid. These cables must support bidirectional communication to facilitate energy usage monitoring, faults detection, and optimization of grid operations. Manufacturers are developing cables with improved shielding and insulation properties to ensure that data signals are transmitted without interference and that cables can withstand the environmental conditions of power distribution networks.

MARKET CHALLENGES

Supply Chain Disruptions and Geopolitical Tensions May Hamper Market Growth

Supply chain disruptions and geopolitical tensions are significant factors that could impede the wire and cable materials market growth. The industry heavily relies on the steady supply of raw materials such as copper, aluminum, and polymers, which are vulnerable to logistical bottlenecks, transportation delays, and production halts caused by global supply chain challenges. Geopolitical tensions, including trade wars, sanctions, and regional conflicts, further exacerbate these issues by disrupting trade routes, increasing tariffs, and creating uncertainty in raw material availability.

Additionally, fluctuating inputs prices due to geopolitical instability can lead to higher production costs, squeezing profit margins for manufacturers. These combined factors may deter investments, delay projects, and reduce demand for wire and cable materials, ultimately hampering market growth. Companies in the sector must navigate these complexities by diversifying supply chains, investing in local sourcing, and adopting risk mitigation strategies to sustain operations and remain competitive.

IMPACT OF COVID-19

The COVID-19 pandemic significantly disrupted the global market, affecting production, supply chains, and demand across various end-use industries. Many countries imposed lockdowns, leading to factory closures and labor shortages. This particularly affected the production and transportation of key raw materials such as copper, aluminum, and insulation polymers. Supply chain bottlenecks, coupled with restrictions on international trade, caused delays and increased costs for manufacturers. The reduced availability of raw materials also led to price volatility, further straining market stability.

The slowdown in the construction, automotive, and industrial sectors during the initial phases of the pandemic led to a sharp decline in demand for wire and cable materials. Large-scale infrastructure projects were postponed and manufacturing plants operated at reduced capacities due to health restrictions and economic uncertainty. The automotive industry, a major consumer of wire and cable materials, experienced a significant drop in vehicle production, reducing the demand for wiring harnesses and other electrical components.

TRADE PROTECTIONISM AND GEOPOLITICAL IMPACT

The wire and cable industry is a critical component of global infrastructure, supplying materials for energy transmission, telecommunications, construction, and industrial applications. However, the demand for wire and cable materials is increasingly influenced by trade protectionism and geopolitical tensions, which disrupt supply chains, alter market dynamics, and impact global trade flows.

Many wire and cable materials, such as copper, aluminum, and polymers, are subject to tariffs in various regions. For example, the U.S.-China trade war led to increased tariffs on Chinese-made materials, raising costs for manufacturers and disrupting supply chains. Higher costs of raw materials can reduce demand or force manufacturers to seek alternative suppliers, often at higher prices.

Additionally, The decoupling of Western economies from China and the emergence of new trade blocs (e.g., U.S.-EU partnerships and China's Belt and Road Initiative) are reshaping supply chains. Companies are diversifying suppliers to mitigate risks, but this transition is costly and time-consuming. Moreover, protectionist policies are leading to the fragmentation of global markets, with regional supply chains becoming more isolated. This could result in uneven demand growth and pricing disparities across different geographies.

RESEARCH AND DEVELOPMENT (R&D) TRENDS

R&D efforts are focused on improving the electrical, mechanical, thermal, and environmental properties of wire and cable materials to meet the needs of emerging technologies such as renewable energy, electric vehicles (EVs), 5G networks, and smart grids.

High-performance insulation materials are widely used for insulation due to their excellent electrical properties, thermal stability, and resistance to environmental stress. R&D is focused on enhancing their performance for high-voltage applications. In addition, researchers are exploring biodegradable and renewable materials, such as polylactic acid (PLA) and bio-based polyethylene, to reduce the environmental impact of wire and cable production.

SEGMENTATION ANALYSIS

By Product Type

Conductor Material Segment Dominated Due to its Essential Role in Electrical Conductivity

Based on product type, the market is classified into insulation material and conductor material.

The conductor material segment held the highest share of 92.02% in 2026 and is estimated to record a significant annual growth rate during the forecast period. Conductors, typically made from copper or aluminum, are selected for their excellent electrical conductivity, allowing the effective flow of electricity. Copper is widely preferred due to its superior conductivity, flexibility, and durability. At the same time, aluminum is often used in larger applications such as power transmission lines due to its lighter weight and cost-effectiveness. As the core of a wire or cable, the conductor’s size, shape, and material directly impact the current-carrying capacity and overall performance.

Surrounding the conductor is the insulation material that is anticipated to have significant growth rate in the market. Insulation serves to prevent electrical leakage, shield the conductor from environmental factors, and ensure user safety during operations. Common insulation materials include Polyvinyl Chloride (PVC), Polyethylene (PE), Cross-linked Polyethylene (XLPE), and rubber. These materials are chosen based on their dielectric strength, thermal stability, flexibility, and resistance to moisture, chemicals, and abrasion. Insulation safeguards the conductor and determines the cable's suitability for specific environments, such as high temperatures, outdoor use, or industrial settings. Together, the conductor and insulation materials ensure the reliable and safe operation of wires and cables in diverse applications.

By Application

To know how our report can help streamline your business, Speak to Analyst

Electronic Wire Segment Led Due to its Widespread Use in Residential, Commercial, And Industrial Buildings

By application, the market is segmented into electronic wire, power cable, flexible and specialty cable, control & instrumentation cable, and communication cable.

The electronic wire segment accounted for the largest global wire and cable materials market share 34.5% globally in 2026. Electronic wires are insulated wires used primarily in residential, commercial, and industrial buildings for electrical wiring. They are designed to carry electrical current safely within buildings. They are expected to dominate the market due to the increasing electrification and reliance on electronic equipment in daily life.

Power cables segment holds a substantial share as they are used for transmitting electrical power from one location to another. They can be categorized into various voltage levels, including low, medium, and high voltage. The flexible and specialty cable segment is expected to hold a 24.6% share in 2024.

The demand for power cables is significantly influenced by the growth in renewable energy projects and infrastructure development across various sectors.

WIRE AND CABLE MATERIALS MARKET REGIONAL OUTLOOK

Based on region, the market is studied across Asia Pacific, North America, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Wire and Cable Materials Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the dominant share in the market in 2024 due to high demand from developing countries in the region. Countries including India, China, and Southeast Asian countries are witnessing propelling demand for wires and cables due to rapid expansion of building and construction industry. The Japan market is projected to reach USD 7.59 billion by 2026, the China market is expected to reach USD 77.67 billion by 2026, and the India market is projected to reach USD 11.13 billion by 2026.

China is the largest manufacturer and consumer of wire and cable materials. Manufacturers are transforming their manufacturing plants into a smart plant, which includes digitalization, new equipment, process engineering, and automation. Furthermore, the companies are also adopting new technology to produce wires and cable materials for the construction industry.

- In China, the flexible and specialty cable segment is estimated to hold a 24.7% market share in 2024.

To know how our report can help streamline your business, Speak to Analyst

Europe

The demand for wire and cable materials in Europe is expected to expand significantly due to Germany’s strong industrial base, particularly in automotive, manufacturing, and electronics sectors. These industries requires a reliable supply of wires and cables for various applications, including vehicle wiring harnesses and power distribution systems. Rest of Europe includes countries such as Russia, Poland, the Netherlands, Denmark, and Sweden. These countries are propelling the growth of the market associated with the rising adoption of modern construction methods and advanced production practices. The UK market is expected to reach USD 5.43 billion by 2026, while the Germany market is projected to reach USD 8.03 billion by 2026.

North America

The growth of the market in North America is propelled by the rising adoption of modern construction methods and advanced product production practices. The region is also witnessing rising demand for high-voltage power transmission systems such as HVDC cables. Additionally, factors such as a surge in affordable housing and public infrastructure such as educational facilities and hospitals, are contributing to the growing need for wire and cable materials. Technological advancement in building techniques further support this trend. The U.S. accounted for largest share in 2024 and is expected to continue its dominance during the forecast period. The growth of market in the country is associated with the rising adoption of modern construction methods and advanced product production practices. The U.S. market is projected to reach USD 17.51 billion by 2026.

Latin America

Latin America market is expected to grow due to strong housing demand from the growing population. Brazil is the largest market for wires and cables in Latin America, driven by its large population, industrial base, and infrastructure projects. Brazil is also a significant producer of aluminum, which is used in power transmission lines. Mexico is a major manufacturing hub, particularly for the automotive and electronics industries, driving demand for wires and cables. Its proximity to the U.S. and strong export-oriented industries continue to boost demand for industrial cables.

Middle East & Africa

The demand in the Middle East & Africa is driven by large-scale construction, energy projects, and the expansion of telecommunications networks. Countries such as Saudi Arabia, the UAE, and South Africa are the leading consumers due to their robust infrastructure investments and growing energy sectors. Egypt’s booming construction industry and growing focus on renewable energy initiatives are contributing to the growing demand for wires and cables.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Adopted Product Development Strategy to Maintain Their Dominance in the Market

Exxon Mobil Corporation, Dow Inc., BASF SE, DuPont, and ITW Formex are the key players in the market. Major investments by companies are in developing additives that address evolving demands for sustainability and performance. Furthermore, the companies have formed partnerships to develop new products and gain competence. Partnerships with raw material suppliers and metal manufacturers are the strategies used by the market players to increase their presence globally and maintain their mark in the competition.

List Of Key Wire And Cable Materials Companies Profiled

- Celanese Corporation (U.S)

- BASF SE (Germany)

- Henan Jinhe Industry Co., Ltd (China)

- Alphagary (U.S)

- DuPont (U.S)

- Dow Inc. (U.S)

- ITW Formex (U.S)

- Elantas (Germany)

- Exxon Mobil Corporation (U.S)

- Dr. Dietrich Mueller GmbH (Germany)

KEY INDUSTRY DEVELOPMENTS

- September 2024 – DOW introduced a new line of REVOLOOP Recycled Plastics Resins for cable jackets, designed to incorporate post-consumer recycled (PCR) materials into cable jacketing. This innovative product aims to support customers’ sustainability goals by offering a more circular approach to plastic use.

- July 2024 – Dow launched the NORDEL REN Ethylene Propylene Diene Terpolymers (EPDM), a bio-based version of its widely used EPDM rubber material. This sustainable alternative is targeted for automotive, infrastructure, and consumer applications, contributing to industry’s shift toward renewable materials.

- June 2024 – Orbia Polymer Solutions (Alphagary), a globally renowned provider of innovative polymer solutions for wire and cable applications, in partnership with Shakun Polymers, introduced a new series of semi-conductive compounds to the America’s wire and cable market under the brand name ESCONTEK. The new series of semi-conductive compounds offer exceptional performance and reliability and are tailored specifically to meet the unique physical and electrical requirements of the region.

- February 2024 – Elantas has announced a significant investment to create a top sustainable technology hub for high-voltage insulation materials at the Von Roll site in Breitenbach. From 2024 to 2026, the company will invest USD 13.8 million to consolidate operations in Büsserach and upgrade existing buildings to highest technology and sustainability standards.

- January 2024 – BASF expanded its Thermoplastic Polyurethane (TPU) plant at the Zhanjiang Verbund site. The new plant is the largest single TPU production line for BASF globally. The smart factory is built with advanced technologies, including automated guided vehicles and advanced automation systems that translate into efficiency improvements. The plant will enable BASF to meet the growing market demand for TPU in Asia Pacific – particularly in the industrial, eMobility, and new energy segments, as well as to be closer to key customer industries in China and Asia Pacific.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, product types, and applications. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 5.0% from 2026 to 2034 |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 180.94 billion in 2026 and is projected to reach USD 256.67 billion by 2034.

Recording a CAGR of 5.0%, the market is slated to exhibit steady growth during the forecast period.

By application, the electronic wire application segment led the market in 2025.

Asia Pacific held the highest market share in 2025.

Technological advancements in wire and cable materials is a key factor drivoing market growth.

Growing demand from the electronic wire application to drive product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us