3D Printed Packaging Market Size, Share & Industry Analysis, By Material (Plastic, Metal, Paper & Paperboard, and Others), By Technology (Fused Deposition Modeling (FDM), Selective Laser Sintering (SLS), Stereolithography (SLA), Direct Metal Laser Sintering (DMLS), Multi Jet Fusion (MJF), Digital Light Processing (DLP), Binder Jetting, Electron Beam Melting (EBM), Laminated Object Manufacturing (LOM), and Others), By End-use Industry (Food & beverages, Pharmaceuticals & Healthcare, Electronics & Home Appliances, Personal Care & Cosmetics, and Others), and Regional Forecast, 2026-2034

3D PRINTED PACKAGING MARKET SIZE AND FUTURE OUTLOOK

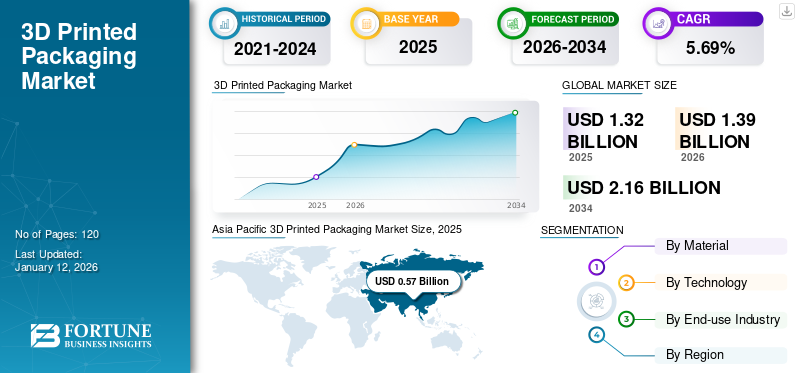

The global 3D printed packaging market size was valued at USD 1.32 billion in 2025. The market is projected to be worth USD 1.39 billion in 2026 and reach USD 2.16 billion by 2034, exhibiting a CAGR of 5.69% during the forecast period. Asia Pacific dominated the 3D printed packaging market with a market share of 43.28% in 2025.

3D printed packaging involves the production of packaging materials through additive manufacturing or 3D printing techniques, which construct objects layer by layer based on a digital design. The market is experiencing substantial growth, fueled by improvements in additive manufacturing technologies and a rising need for sustainable, tailored packaging options across different sectors. Both customers and companies are progressively looking for distinctive designs that represent personal tastes and brand images. 3D printing technology offers remarkable design versatility, allowing for the production of complex and customized packaging that conventional techniques find difficult to replicate. This trend is especially prominent in areas, such as cosmetics, luxury items, and food and beverages, where packaging plays a crucial role in distinguishing products and increasing consumer appeal.

Stratasys Ltd. and 3D Systems Corporation are the leading 3D printed packaging manufacturers, accounting for the largest global market share.

Global 3D Printed Packaging Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 1.32 billion

- 2026 Market Size: USD 1.39 billion

- 2034 Forecast Market Size: USD 2.16 billion

- CAGR: 5.69% from 2026–2034

Market Share:

- Asia Pacific dominated the 3D printed packaging market with a 43.28% share in 2025, driven by rapid e-commerce expansion, growing demand for customized packaging, and supportive government initiatives for 3D printing technologies in countries such as China and Japan.

- By material, Plastic is expected to retain the largest market share in 2025, attributed to its adaptability, affordability, and suitability for aesthetic and functional packaging applications.

Key Country Highlights:

- China & Japan (Asia Pacific): Rapid urbanization, rising disposable incomes, and strong R&D support are accelerating the demand for customized and sustainable 3D printed packaging solutions.

- United States: Technological advancements, sustainability regulations (e.g., California’s mandate for recyclable plastics), and leading players like Stratasys and 3D Systems drive strong market presence.

- Europe: High environmental awareness and strict EU packaging waste regulations (e.g., 83.4 million tons of packaging waste in 2022) foster demand for eco-friendly, personalized packaging.

- Latin America: Growth driven by increasing personalization, sustainable materials, and rising e-commerce activity.

- Middle East & Africa: 3D printing adoption fueled by urbanization, the Dubai 3D Printing Strategy, and increasing demand for custom, sustainable packaging solutions.

MARKET DYNAMICS

MARKET DRIVERS

Brands Seeking Unique, Sustainable Packaging Solutions that Use Flexible 3D Printing Drive Market Growth

Brands seek unique packaging solutions that differentiate their products in a competitive landscape, and 3D printing offers unparalleled design flexibility. This technology enables the design of intricate and personalized packaging that enhances the customer experience, particularly in sectors, such as luxury products and cosmetics. Additionally, sustainability initiatives are propelling market growth as businesses aim to minimize waste associated with traditional manufacturing processes, aligning with global environmental goals.

Additive Manufacturing Boosts Demand for 3D Printed Packaging with Advancements in Customization and Higher Speed

Advancements in additive manufacturing are aiding the demand for 3D printed packaging. The development of faster and more precise 3D printers enables mass customization and shorter manufacturing durations. This is particularly beneficial in industries, such as food and beverage, where packaging needs to be produced quickly and in large quantities. For example, in January 2024, Coca-Cola employed 3D printing technology to create unique bottles, showcasing how this technology enables mass production while maintaining design flexibility.

MARKET RESTRAINTS

High Costs and Durability Concerns Hinder the Adoption of 3D Printing in Packaging

The cost of sophisticated machinery and specialized materials can be extremely high, particularly for small and medium-sized companies. This financial barrier hinders the widespread adoption and expansion of 3D printing technologies in packaging. Additionally, concerns regarding the durability and lifespan of 3D printed materials exist as compared to traditional packaging options, which could affect their efficiency in real-world situations, such as shipping and handling.

MARKET OPPORTUNITIES

Growth in Adoption of 3D Printing to Reduce Waste and Enhance Eco-Friendly Practices is Emerging as a Trend in the Market

As consumers become increasingly conscious of environmental concerns, companies are exploring innovative ways to reduce their carbon footprint. 3D printing technology allows the use of biodegradable and recyclable materials, minimizing waste as compared to traditional packaging methods. This capability not only connects with global sustainability initiatives but also enables brands to gain a competitive advantage through eco-friendly practices. Additionally, advancements in 3D printing can facilitate rapid prototyping and production of distinctive designs, enhancing market appeal and responsiveness to consumer demands.

MARKET CHALLENGES

Less Strength in 3D Printed Materials due to the Inherent Nature of the Manufacturing Process Creates a Huge Challenge for Market Growth

Despite advancements, many 3D printed materials still exhibit reduced strength and durability compared to traditional packaging options, mainly due to the inherent nature of the manufacturing process. This limitation might hinder their capacity to protect items while being transported and managed, resulting in concerns among manufacturers about their reliability. Additionally, the restricted range of material options available obstructs the ability to meet specific industry requirements, making it more difficult to fully embrace 3D printing as a viable packaging solution in various sectors.

Download Free sample to learn more about this report.

3D PRINTED PACKAGING MARKET TRENDS

Increasing Brand Differentiation and Consumer Engagement Emerges as a Key Trend

Incorporating 3D packaging enhances the company’s marketing approach. It provides them with additional choices for the design and allows them to be more innovative in promoting the brand. Employing colors through 3D printing also invokes feelings in consumers that may encourage them to purchase products. Various forms, personalization, and additional visual elements aid in conveying the brand's values, character, and excellence. The rising utilization of 3D printed products increases brand differentiation and thus emerges as a market trend. Moreover, as customers enjoy sharing their experiences on social platforms, many brands opt for 3D packaging. This technique provides customers with a distinct message to share with others, which also leads to a growing trend.

IMPACT OF COVID-19

The COVID-19 pandemic had a considerable effect on the 3D printed packaging market growth. Initially, interruptions in the supply chain resulted in material scarcities and production holdups, impacting the accessibility of 3D printed packaging options. Nonetheless, the pandemic also accelerated the demand for e-commerce and healthcare packaging as online shopping increased rapidly, leading to the growth in the requirement for safe and sanitary packaging. During the pandemic, businesses adjusted by improving their manufacturing abilities and emphasizing sustainable methods, which set them up for increased growth in an evolving market environment. In general, despite facing challenges, the pandemic ultimately encouraged innovation and resilience within the industry.

TRADE PROTECTIONISM

While specific examples of trade protectionism impacting the market are not outlined in the existing sources, international trade policies can affect the accessibility and affordability of materials and technologies, possibly influencing market dynamics.

SEGMENTATION ANALYSIS

By Material

Plastic Dominates the Market due to Its Higher Adaptability and Affordability

Based on the material, the market is segmented into plastic, metal, paper & paperboard, and others.

Plastic material held the largest 3D printed packaging market share of 65% in 2024. The adaptability and affordability of plastic materials mainly influence the segment’s growth. The lightweight characteristics and availability of varied aesthetic choices of plastics enhance their increasing use in the packaging industry, satisfying both business and consumer needs.

Metal holds the second largest share in the market. Metals, such as titanium and stainless steel, provide outstanding resistance to corrosion and lightweight features, improving product safety while lowering total weight. Moreover, the accuracy and resource efficiency of metal printing aid in achieving sustainability objectives in the packaging sector.

By Technology

Significant Features of the Stereolithography (SLA) Technology Boosts its Demand

Based on technology , the market is segmented into fused deposition modeling (FDM), selective laser sintering (SLS), stereolithography (SLA), direct metal laser sintering (DMLS), multi jet fusion (MJF), digital light processing (DLP), binder jetting, electron beam melting (EBM), Laminated object manufacturing (LOM), and others.

Stereolithography (SLA) holds the dominating share in the market. SLA employs a liquid UV-curable resin, enabling the creation of complex designs and highly detailed components essential for the aesthetics and functionality of packaging. Its rapid prototyping features allow for fast iterations and shorter time-to-market, which is crucial for satisfying consumer needs. Stereolithography (SLA) is anticipated to hold 22% of the market share in 2025.

Fused deposition modeling holds the second-largest share in the market. Its capability to generate intricate shapes and tailored designs improves product differentiations in the marketplace. Moreover, FDM's rapid manufacturing abilities shorten lead times, allowing businesses to react promptly to customer needs and trends, thereby fostering innovation in sustainable packaging options. Fused deposition modeling is expecting to exhibit 6.59% during the forecast period.

By End-use Industry

3D Printing Enhances Sustainable and Attractive Packaging Solutions in the Food and Beverage Industry, Leading to Segment Growth

Based on the end-use industry, the market is segmented into food & beverages, pharmaceuticals & healthcare, electronics & home appliances, personal care & cosmetics, and others.

Food and beverages is expecting to hold the dominating share of the market by 36.68% in 2026. The capability of 3D printing to create lightweight, robust packaging with complex designs aids in maintaining product freshness and preservation. As companies strive to stand out in a crowded market, 3D printing provides creative, sustainable solutions that align with consumer preferences for environmentally friendly practices.

Pharmaceuticals and healthcare hold the second-largest share of the market. 3D printing technology facilitates the creation of tamper-resistant, sterile packaging that can be customized for particular drug formulations and dosages, improving patient safety and adherence. Moreover, the capacity to incorporate anti-counterfeiting elements into packaging designs contributes to the increasing demand regarding the authenticity of drugs. Pharmaceuticals and healthcare is projected to exhibit a strong CAGR of 5.50% during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

3D PRINTED PACKAGING MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

E-commerce Growth and the Need for Sustainable, 3D-Printed, and Adaptable Packaging Solutions Drive Market Growth in Asia Pacific

Asia Pacific 3D Printed Packaging Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is the dominating region of the global market with a value of USD 0.57 billion in 2025. The region also acquired the largest market value of USD 0.52 billion in 2023. Asia Pacific’s swift e-commerce expansion demands lightweight, adaptable, and eco-friendly packaging options, which are efficiently offered by 3D printing. Furthermore, the rising demand for customized packaging in industries such as food and beverage boosts brand distinction and consumer involvement. Robust governmental backing and funding in R&D enhance the 3D printing ecosystem, especially in nations, such as China and Japan. Additionally, increasing disposable incomes and evolving consumer preferences for sustainable practices drive the implementation of 3D printed packaging solutions in multiple industries within the region. The market size of China is expecting to hit USD 0.3 billion in 2026. Japan’s market size is likely to reach USD 0.12 billion and India’s market size is projected to hit USD 0.09 billion in 2026.

- For instance, major companies driving this growth include Alibaba, JD.com, and Pinduoduo, and Alibaba alone generated around USD 1.3 trillion in sales in 2022.

North America

3D Printing Innovations Enable Custom Packaging Driven by Sustainability in the North American Market

North America region is anticipated to be the second-largest market with a USD 0.41 billion in 2026, exhibiting the second-fastest CAGR of 4.80% during the forecast period. Innovations in 3D printing allow for the creation of uniquely tailored and complex packaging options catering to various consumer needs. The area includes a robust industrial framework and an experienced ecosystem of prominent firms such as Stratasys and 3D Systems, encouraging advancements in additive manufacturing technologies.

Moreover, there is an increasing focus on sustainability as businesses pursue environmentally friendly materials and practices to minimize waste. The strong consumer market in North America additionally drives demand in multiple industries, such as food, beverages, and pharmaceuticals. The U.S. market size is estimated to be USD 0.35 billion in 2026.

- For instance, the Governor of California passed a law requiring a 25% reduction in single-use plastics by 2032, mandating that at least 30% of plastic items sold be recyclable by 2028.

Europe

Sustainability, Personalization, and Innovation Drive Demand for Eco-Friendly Packaging in Europe

Europe region is anticipated to be the second-largest market with a USD 0.28 billion in 2026. A significant focus on sustainability is driving the market in Europe since consumers and companies value eco-friendly methods, leading to a transition toward packaging options that reduce waste and carbon emissions. Moreover, the need for personalization enables brands to develop distinct packaging designs that improve consumer interaction and product uniqueness. Innovations in additive manufacturing enhance efficiency and lower production expenses, thereby fostering market expansion. The combination of regulatory adherence with strict environmental standards also speeds up the use of 3D printing technologies in different industries. The market in U.K. is likely to hit USD 0.07 billion in 2026. Germany’s market size is expected to hit USD 0.09 billion in 2026. France is likely to hit USD 0.05 billion in 2025.

- According to the European Union, in 2022, the EU generated an estimated 83.4 million tons of packaging waste, with a per capita generation of 186.5 kg. This figure varies by country, with Ireland generating the most at 233.8 kg per inhabitant and Bulgaria the least at 78.8 kg.

Latin America

Demand for Personalized and Sustainable Packaging Solutions Drives Market Growth in Latin America

Latin America is projected to hit USD 0.06 billion in 2026 as the fourth-largest market. The increasing need for personalized packaging solutions enables brands to develop distinctive and customized products, boosting consumer interaction. The area's growing emphasis on sustainability encourages the utilization of environmentally friendly materials and methods, matching worldwide ecological trends. Moreover, improvements in technology and manufacturing processes enable efficient production and less lead times. The growth of the e-commerce industry increases the demand for creative packaging solutions that meet various product needs. Collectively, these factors contribute toward the expansion of the market in Latin America.

Middle East & Africa

3D Printing Fosters Customizable, Sustainable Packaging Due to Urbanization, E-Commerce, and Technology Boosts Market Growth in Middle East & Africa

Rapid urbanization and the growth of e-commerce in the Middle East & Africa region demand innovative, customizable packaging solutions that are provided by 3D printing. Additionally, government initiatives promoting advanced manufacturing technologies, such as the UAE's Dubai 3D Printing Strategy, encourage investment in 3D printing capabilities. The increasing focus on sustainability and reducing waste also propels the adoption of eco-friendly materials in packaging. Furthermore, advancements in technology enhance production efficiency and reduce costs, making 3D printed packaging an attractive option for various industries in the region. Saudi Arabia region is likely to hit USD 0.01 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Market Participants Witness Significant Growth Opportunities with New Product Launches

The global market is highly fragmented and competitive. Several major players are leading the market by providing creative packaging solutions in the packaging sector. These leading market participants consistently aim to broaden their customer reach across areas by enhancing their current product offerings. Numerous other companies operating in the market are focused on market scenarios and delivering advanced packaging solutions.

Key participants in the sector comprise Stratasys Ltd., 3D Systems Corporation, Materialise NV, EOS GmbH, SLM Solutions Group AG, and Nexa3D. Many other firms in the industry are concentrating on market conditions and providing sophisticated packaging options.

List of Key 3D Printed Packaging Companies Profiled:

- Stratasys Ltd. (U.S.)

- 3D Systems Corporation (U.S.)

- Materialise NV (Belgium)

- EOS GmbH (Germany)

- SLM Solutions Group AG (Germany)

- Nexa3D (U.S.)

- Protolabs Inc. (U.S.)

- GE Additive (U.S.)

- Carbon, Inc. (U.S.)

- Desktop Metal, Inc. (U.S.)

- Formlabs, Inc. (U.S.)

- Xometry, Inc. (U.S.)

- CELLINK AB (Sweden)

- Markforged, Inc. (U.S.)

- HP, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- In May 2024, Unilever—the consumer goods giant housing brands, such as Dove, Persil, and Ben & Jerry’s—adopted additive manufacturing to fulfill its prototyping requirements. Instead of printing prototypes of its product packaging directly, it has opted for a different approach by utilizing SLA 3D printing to create blow molding tools. This strategy, implemented in collaboration with packaging producer Serioplast and Formlabs, has significantly reduced product development timelines for new plastic bottle packaging and tooling expenses.

- In April 2024, Baralan partnered with 3D printing expert Stratasys and coatings specialist ICA to introduce GP3DPrint, a water-soluble 3D decoration service for cosmetic packaging. The initiative makes personalized, distinctive, and high-end decor available to a broader range of brands.

- In April 2024, Unilever and Serioplast Global Services demonstrated a significant advancement in packaging technology through 3D-printed molds designed for stretch blow molding. By utilizing Rigid 10K Resin, these molds decreased lead times by six weeks. They lowered costs by as much as 90%, providing a quicker, more affordable option compared to conventional metal tooling for packaging manufacturing.

- In March 2024, Harpak-ULMA introduced a 3D printing service for prototype tray packaging, allowing quick and affordable customization. This innovative service dramatically shortens prototyping durations from weeks to hours, cuts expenses, and decreases waste, providing improved flexibility and ecological advantages for merchandisers in need of swift and creative packaging options.

- In January 2024, the Austrian food-tech firm Revo Foods introduced the Food Fabricator X2, a novel high-throughput 3D printer for food. The company claims that this is the ‘world’s first industrial technique for producing 3D printed foods. The Food Fabricator X2 is said to deliver large-scale production of various whole-cut meat substitutes and other food items with tailored shapes, textures, and structures.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The global 3D printed packaging market will foresee remarkable growth with the growing collaborations, mergers, and investments. These initiatives help increase the importance of 3d printing packaging and boost its demand. In February 2024, Tetra Pak’s recent collaboration with Alier marks a significant move in boosting carton recycling across the EU, emphasizing the pivotal role of recycling food packaging. With a nearly 40 million Euro investment in 2023 and plans for further expansion, Tetra Pak aims to enhance the recycling capacity for beverage cartons, including the polyethylene and aluminum layers known as ‘polyAl.’ In Sweden, Tetra Pak and Axjo Group’s joint investment of up to 24 million Euros will facilitate the construction of a new recycling line for polyAl, incorporating it into injection-molded plastic products, including items such as cable drums and plastic storage boxes.

REPORT COVERAGE

The market research report provides a detailed market analysis of the 3D printed packaging market. It also focuses on key aspects, such as top key players, competition landscape, product/service types, market segments, Porter's five forces analysis, and leading segments of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market intelligence & growth in recent years.

Request for Customization to gain extensive market insights.

Research Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.69% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Technology

|

|

|

By End-use Industry

|

|

|

By Region

|

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us