Self-checkout System Market Size, Share & Industry Analysis, By Type (Fixed and Mobile-based), By Component (Solutions and Services), By Sales Channel (Direct and Indirect), By End-user (Retail, Hospitality, and Others), and Regional Forecast, 2026 – 2034

SELF-CHECKOUT SYSTEM MARKET OVERVIEW AND FUTURE OUTLOOK

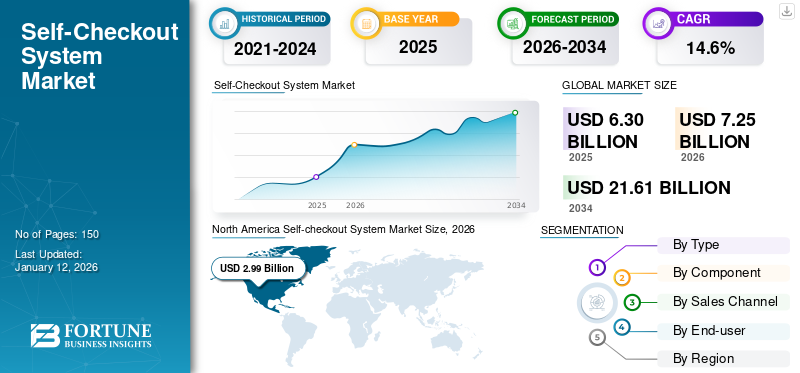

The global self-checkout system market size was valued at USD 6.30 billion in 2025. The market is projected to grow from USD 7.25 billion in 2026 to USD 21.61 billion by 2034, exhibiting a CAGR of 14.6% during the forecast period. North America dominated the global market with a share of 41.8% in 2025.

The self-checkout system market covers the solutions and services that enable customers to independently scan, bag, and pay for their purchases without the need for cashier assistance. These systems, comprising hardware components such as barcode scanners and payment terminals integrated with advanced software, are widely adopted across industries, including retail, hospitality, and others. The market is driven by increasing consumer preference for convenience, the need for operational efficiency, and advancements in automation technology.

Major companies, including NCR Voyix Corporation, Diebold Nixdorf, Inc., Toshiba Global Commerce Solutions, Fujitsu Limited, and ITAB Group, dominate by delivering reliable systems across industries, including retail and hospitality.

The COVID-19 pandemic significantly accelerated the market as businesses prioritized contactless solutions to enhance safety and minimize human interaction. This surge in demand was further driven by shifting consumer preferences for faster, hygienic shopping experiences and the need for operational efficiency amid labor shortages.

SELF-CHECKOUT SYSTEM MARKET TRENDS

Integration of AI and Computer Vision Technologies to Drive Market Growth

Download Free sample to learn more about this report.

AI-enabled systems can accurately identify products, address real-time operational issues, and enhance transaction security. These technologies can detect unscanned items or flag suspicious activity, helping retailers minimize shrinkage and improve customer trust in the checkout process.

- For instance, in January 2024, Diebold Nixdorf introduced Vynamic Smart Vision Shrink Reduction, an AI-driven solution designed to reduce shrinkage at self-checkout stations. These solutions are easily deployable across locations, addressing shrinkage without requiring infrastructure changes.

Computer vision technology is accelerating and simplifying self-checkout operations. Unlike traditional barcode scanning, this technology uses advanced image recognition to identify items based on their appearance. This capability benefits retailers dealing with items such as fresh produce or loose goods, where scanning barcodes is impractical. It reduces checkout times, enhances accuracy, and delivers a more seamless customer experience, particularly in busy retail environments such as grocery stores. For instance,

- In April 2024, German retailer REWE Group announced the launch of a Pick&Go store in Hamburg, Germany. Customers can choose from four payment options: the Pick&Go app, self-checkout terminals, computer vision technology, or traditional cashier payment.

MARKET DYNAMICS

Market Drivers

Rising Demand for Improved Customer Convenience and Shopping Experience to Drive Market Development

The growing demand for enhanced customer convenience and an improved shopping experience has emerged as a key market driver. Modern consumers prioritize efficiency and time-saving solutions in their shopping journeys, leading retailers to adopt advanced technologies that cater to these expectations. These systems allow customers to complete their transactions independently, reducing reliance on traditional cashier-assisted methods. This capability minimizes waiting times, streamlining the shopping process.

- For instance, according to the Payments Association, 91% of retailers report that self-checkouts contribute to increased sales, as they are preferred by 77% of customers. Furthermore, self-checkouts accelerate the transaction process by 30%.

Retailers also recognize the importance of adopting customer-centric solutions to remain competitive. Integrating these systems enhances customer satisfaction and optimizes in-store operations. The technology enables businesses to reallocate staff to other value-adding activities, improving retail store efficiency. Furthermore, they support various payment methods, aligning with consumer preferences for digital and digital payments, which have risen significantly post-pandemic.

- For instance, NMI reports that self-checkout adoption surged during the COVID-19 and continues to grow, with 96% adoption in grocery chains. Retailers offering self-checkouts are expected to double to over 24,000 by 2030, driving a 13.4% compound annual growth rate.

These factors are projected to enhance efficiency and customer experience across the non-retail sectors, driving the global self-checkout system market growth.

Market Restraints

Data Security Concerns to Impede Market Progress

Data security concerns pose a significant barrier to the growth of the market. These systems handle sensitive customer information, such as payment details and personal data, making them prime targets for cyberattacks and data breaches. Without robust security measures, retailers risk losing consumer trust, making reluctance to use self-checkout systems. The vulnerability of payment processing systems is a major concern, as self-checkout kiosks and mobile integrations transmit sensitive financial data. Hackers can intercept this data without proper encryption, leading to reluctance to use self-checkout systems. Businesses must implement strong encryption protocols and security practices to safeguard payment information and maintain consumer confidence.

Market Opportunities

Adoption of Self-Checkout Systems in Non-Retail Sectors to Open New Opportunities for Market Players

The adoption of these systems in non-retail sectors is emerging as a significant opportunity for market growth. While traditionally used in retail environments, industries such as healthcare, transportation, hospitality, and entertainment now incorporate them to enhance customer service, optimize operations, and reduce labor costs. These sectors are progressively embracing automation, increasing the adoption of self-checkout solutions for improving efficiency and creating new avenues in the market.

The transportation industry also presents potential for market expansion. Airports, train stations, and bus terminals increasingly deploy self-service kiosks for ticket purchases, baggage check-ins, and upgrades. These self-checkout options provide travelers with quicker, more convenient ways to manage their journey, easing congestion and improving operational efficiency.

- For instance, in June 2024, Delhi International Airport Limited launched the Self-Service Bag Drop Quick Drop tool at Delhi Airport, making it the first in India and the second globally, after Toronto. This technology streamlines the baggage drop process and reduces wait times, enhancing the passenger experience.

SEGMENTATION ANALYSIS

By Type

Extensive Adoption of Fixed Self-Checkout Systems in High-Traffic Environments Drives Segment growth

Based on type, the market is divided into fixed and mobile-based.

Fixed systems held the highest market share of 73.24% in 2025, due to their widespread adoption in high-traffic retail environments such as supermarkets and hypermarkets, where robust and durable systems are essential for handling large transaction volumes. Their integration with store infrastructure and ability to support advanced functionalities make them a preferred choice for retailers seeking to enhance customer service efficiency.

Mobile-based systems are expected to grow at the highest CAGR due to their flexibility, cost-effectiveness, and compatibility with emerging technologies such as ) apps and QR code payments. The increasing demand for personalized, on-the-go shopping experiences and the rise of smaller retail formats further fuel their adoption across diverse industries.

By Component

Rising Need for Seamless Customer Transactions Fuel Solutions Segment Growth

Based on component, the market is categorized into solutions and services.

The solutions segment holds the highest market share valued at 73.41% in 2026, as it includes the essential hardware and software components that form the core of self-checkout systems, enabling seamless customer transactions. Retailers prioritize these integrated solutions to enhance operational efficiency, improve customer satisfaction, and ensure system reliability.

The services segment is expected to grow at the highest CAGR of 16.91% during the forecast period (2025-2032), due to the increasing need for installation, maintenance, and technical support to ensure the optimal performance of these systems. As retailers adopt advanced technologies, the need for ongoing software upgrades, system customization, and training services is further driving the self-checkout system market share.

By Sales Channel

Direct Sales Channel Leads Owing to its High Preference by Large-Scale Retail

Based on sales channel, the market is divided into direct and indirect.

The direct sales channel is anticipated to hold the highest market share of 59.72% in 2026, as it allows manufacturers to establish direct relationships with end-users, providing tailored solutions and personalized support. This approach ensures greater control over pricing, customization, and system integration, making it the preferred choice for large-scale retail and enterprise clients.

The indirect sales channel is expected to grow at the highest CAGR of 16.20% during the forecast period (2025-2032), due to its ability to reach a broader customer base through distributors, resellers, and system integrators. This channel caters to small and medium-sized businesses seeking cost-effective solutions and localized support, driving its rapid adoption in emerging markets.

By End-user

To know how our report can help streamline your business, Speak to Analyst

Growing Volume of transactions from Retail Space makes it a Dominant End-user

By end-user, the market is categorized into retail, hospitality, and others.

The retail sector is expected to hold the highest share of the market that will be 75.03% in 2026, due to the high volume of transactions and the need for efficient, cost-saving solutions in supermarkets, hypermarkets, and convenience stores. Retailers prioritize self-checkout systems to enhance customer experience, reduce waiting times, and manage operational costs effectively.

The hospitality sector is expected to grow at the highest CAGR of 16.89% during the forecast period (2025-2032), as businesses such as hotels, restaurants, and entertainment venues increasingly adopt self-checkout systems to streamline processes such as check-ins, order placement, and payments. The demand for self-checkout and contactless service experiences, coupled with the integration of advanced technologies, drives growth in this segment.

SELF-CHECKOUT SYSTEMS MARKET REGIONAL OUTLOOK

North America

North America Self-checkout System Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 2.63 billion in 2025 and USD 2.99 billion in 2026, due to the early implementation of advanced retail technologies and the presence of leading market players. High consumer demand for contactless and efficient shopping experiences has driven significant investments in self-checkout solutions by major retailers. Additionally, the robust infrastructure and technological advancements in countries such as the U.S. and Canada further driving the global market size.

The U.S. holds the highest share of the North American market valued at USD 2.99 billion in 2026, due to the country's advanced retail infrastructure and early adoption of automation technologies. Major retail chains, such as Walmart and Target, have invested heavily in deploying self-checkout systems to enhance operational efficiency and improve customer experiences. Furthermore, the high penetration of technology-savvy consumers and a strong focus on innovation by key market players drive the dominance of the U.S. in this market.

Download Free sample to learn more about this report.

Asia Pacific

Asia Pacific is the third largest region with a valuation of USD 1.31 billion in 2026. Asia region is expected to grow at the highest CAGR due to increasing disposable incomes, rapid urbanization, and the expansion of organized retail. China is projected to reach a market value of USD 0.58 billion in 2026. The growing demand for convenient shopping experiences, especially in densely populated countries such as China and India, is fueling market growth. Additionally, rising investments in technological advancements and infrastructure development are accelerating the adoption of self-checkout systems in the region. India is estimated to encounter a share of USD 0.28 billion in 2026, while Japan is poised to be valued at USD 0.22 billion in the same year.

Europe

Europe holds the second-highest share of the market in 2026 with a value of USD 1.87 billion and is anticipated to grow at the highest CAGR of 16.22% during the forecast period (2025-2032), due to the growing emphasis on automation and digital transformation in the retail and hospitality sectors. The region's strong regulatory focus on operational efficiency and sustainability aligns with the adoption of these systems. The U.K. market continues to grow, and is expected to be valued at USD 2.33 billion in 2026. The U.K., Germany, and France are leading contributors, driven by high consumer adoption rates and advanced retail ecosystems. Germany is poised to be valued at USD 0.48 billion in 2026, while France is projected to be valued at USD 0.33 billion in the same year.

Middle East and Africa (MEA) and South America

Middle East & Africa and South America are expected to grow at a slower rate due to economic instability and limited investments in advanced retail technologies across the region. South America is the fourth largest market and is set to be valued at USD 0.26 billion in 2025. The adoption of self-checkout systems is primarily concentrated in Brazil and Argentina, where organized retail is expanding. However, challenges such as high implementation costs and a lack of technological infrastructure restrict the market's growth potential in this region. Market in GCC is anticipated to be worth USD 0.09 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Launch New Products to Strengthen Market Position

Players launch new product portfolios to enhance their market position by leveraging technological advancements, addressing diverse consumer needs, and staying ahead of competitors. Companies in the market prioritize portfolio enhancement and strategic collaborations, acquisitions, and partnerships to strengthen their product offerings. Such strategic product launches help companies maintain and grow their market share in a rapidly evolving industry.

List of Key Self-checkout System Companies Studied:

- NCR Voyix Corporation (U.S.)

- Diebold Nixdorf, Inc. (U.S.)

- Toshiba Global Commerce Solutions (U.S.)

- Fujitsu Limited (Japan)

- ITAB Group (Sweden)

- StrongPoint ASA (Norway)

- Glory Ltd. (Japan)

- Pan-Oston (U.S.)

- Qingdao CCL Technology Co., Ltd. (China)

- Qingdao Wintec System Co., Ltd. (China)

- ECR Software Corporation (U.S.)

- Erply (U.S.)

- Shopsense Retail Technologies (India)

- Retail7 (Germany)

- Encore (U.S.)

- ConnectPOS (Vietnam)

- AdamPos (Turkey)

..and more

KEY INDUSTRY DEVELOPMENTS:

- December 2024: VusionGroup announced an international partnership with StrongPoint to drive the digitalization of physical commerce. The collaboration aims to deliver advanced end-to-end physical e-commerce solutions, enabling retailers to efficiently fulfill online orders directly from their existing stores. This initiative is designed to enhance operational efficiency and profitability.

- September 2024: CCL TECH, a provider of innovative self-checkout solutions, announced its participation in Gitex Technology Week 2024, which will be held at the Dubai World Trade Centre. The company would showcase its latest products and services at Stand H4A-13.

- January 2024: NCR Voyix Corporation, the largest self-checkout vendor, launched its Next Generation Self-Checkout Solution, driven by the NCR Voyix Commerce Platform. This advanced solution enhances the retail checkout experience, adapts to evolving shopper behaviors, supports diverse demographics and payment methods, and features a modern SaaS technology stack with flexible hardware design.

- January 2024: ITAB Group entered into an agreement with a major European grocery chain to supply 7,200 self-checkouts for its stores across multiple countries. The implementation has commenced and is expected to be completed by February 2025. The total value of the contract is estimated at approximately USD 16.63 million in 2024.

- December 2023: Glory declared its plans to acquire Flooid, a prominent provider of cloud-based commerce software solutions for the retail sector. The acquisition which will be completed by Inflexion Private Equity Partners, involves Glory obtaining 100% of Flooid's issued share capital.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The market presents significant investment opportunities driven by the increasing demand for automation, contactless solutions, and enhanced customer experiences across various sectors. Key opportunities are emerging in developing regions such as Asia Pacific, where rapid urbanization and expanding organized retail sectors are driving product adoption. Additionally, advancements in AI, IoT, and cloud-based technologies offer scope for innovation, enabling market players to deliver cost-effective, scalable, and highly integrated solutions. For instance,

- In January 2024, Diebold Nixdorf launched its new AI-based checkout solutions, first unveiled at the NRF Big Show. The Smart Vision technology addresses loss prevention at self-service and POS checkouts, complementing existing AI solutions for fresh produce scanning and age verification. This integrated approach provides a scalable, comprehensive anti-shrink solution that seamlessly integrates into retailers' systems.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects such as leading companies, product types, and leading product applications. Besides, the report offers insights into the market trends and highlights vital industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Estimated Year |

2026 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Unit |

Value (USD Billion) |

|

|

Growth Rate |

CAGR of 14.6% from 2026 to 2034 |

|

| Segmentation |

By Type, Component, Sales Channel, End-user, and Region |

|

|

Segmentation |

By Type

By Component

By Sales Channel

By End-user

By Region

|

|

|

Companies Profiled in the Report |

|

|

Frequently Asked Questions

The market is projected to reach USD 21.61 billion by 2034.

In 2025, the market size stood at USD 6.30 billion.

The market is projected to grow at a CAGR of 14.6% during the forecast period.

By end-user, the retail segment lead the market.

The rising demand for improved customer convenience and shopping experience is a key factor driving market growth.

NCR Voyix Corporation, Diebold Nixdorf, Inc., Toshiba Global Commerce Solutions, Fujitsu Limited, and ITAB Group are the top players in the market.

North America holds the highest market share.

Asia Pacific is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us