Wearable Technology Market Size, Share & Industry Analysis, By Type (Passive and Active), By Technology (IoT Based, AR and VR, and Others), By End-Use (Health & Fitness, BFSI, Gaming & Entertainment, Fashion, Travel, Education, and Logistics & Warehouse), and Regional Forecast, 2026 – 2034

Wearable Technology Market Analysis 2026-2034

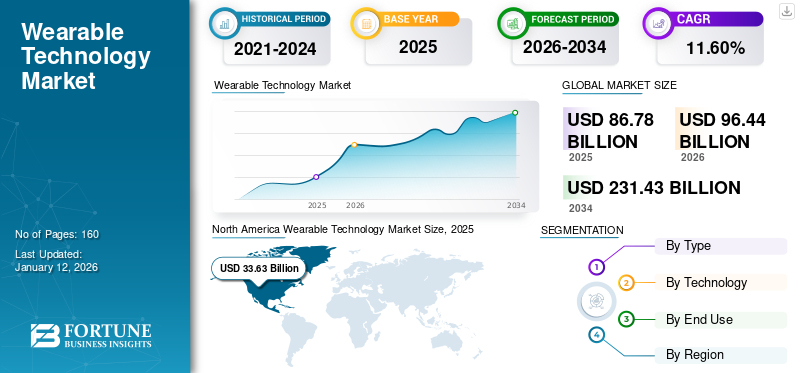

The global wearable technology market size was valued at USD 86.78 billion in 2025 and is projected to grow from USD 96.44 billion in 2026 to USD 231.43 billion by 2034, exhibiting a CAGR of 11.60% during the forecast period. In 2025, North America held the largest wearable technology market share, accounting for 38.80% of the global market.

Wearable technology is a form of device or an electronic device that can be worn on the body (e.g., watch, jacket, belt), implanted in the body (e.g., tracker heart rate monitor, birth control chip), or in some cases, body tattoo (i.e., glowing or discolored tattoo). Wearable devices are powered by AI, and advanced sensors are used to detect and manage chronic illnesses.

According to industry experts, approximately 400 million units of health and wellness wearable devices were shipped in 2024. The COVID-19 pandemic underscored the importance of smartwatches for health monitoring. During this time, the adoption of smartwatches surged as models of watches that measure blood oxygen saturation (SpO2) became widely available. These devices alert users about low SpO2 levels, which can be a life-threatening condition that is often difficult to detect without assistance.

Several companies including Apple, Samsung, and Fitbit, are leveraging its strong brand and loyal customer base. This diversity helps them capture a larger market share as these companies focus on product launches with cutting-edge technology, such as ECG monitoring, blood oxygen levels, and advanced AI integration, making it easier for them to penetrate the market.

IMPACT OF GENERATIVE AI

Gen AI is Being Integrated in Wearable Devices to Enhance User Experience

The impact of generative AI on wearable technology is transformative, enhancing the capabilities, user experience, and functionalities of wearable devices. Generative AI includes various techniques, including GANs and VAEs, to create data similar to the input it is trained on. Wearable devices, such as smartwatches and fitness trackers, provide a platform for integrating generative AI to improve user experiences and device functionalities.

Integrating generative AI with these devices can enhance user experiences by providing tailored recommendations and personalized content. Several examples highlight the advantages of this integration, including Muse headbands for stress management, OrCam MyEye for assisting individuals with visual impairments, and Garmin devices for analyzing sports performance.

IMPACT OF RECIPROCAL TARIFF

Higher tariffs on the global semiconductor industry by the U.S. will influence costs, innovation, supply chains, and geopolitical dynamics, negatively affecting the semiconductor industry. Tariffs ranging from 10% to 32% have been imposed on imports from various countries, including China, Europe, and other regions. This has led to a rise in the cost of components essential for wearable devices, such as semiconductors, sensors, and batteries. The tariffs have disrupted global supply chains, causing delays in sourcing components and finished goods. Companies have been compelled to raise the prices of wearable devices to offset the increased production costs.

Companies may relocate production to countries unaffected by tariffs to avoid additional costs, impacting regional manufacturing hubs and employment. Smaller or newer players might struggle more with tariff-related cost pressures than large established companies with more flexible supply chains and financial buffers. Tariffs may encourage companies to innovate using alternative materials or more affordable substitutes.

MARKET DYNAMICS

Wearable Technology Trends

Increasing Popularity of AR Wearable among Users is a Significant Trend

Today, most wearable categories have various products in the market to suit every budget.

Wearables will likely be directed toward the lifestyle rather than the business or technology market. For instance,

- Snapchat's Spectacles is tightly integrated with Snapchat's social sharing and messaging service. It allows users to upload images and videos directly on the app from their device and is packed with fun AR technology that has garnered popularity.

Increasing integration of Augmented Reality (AR) and Virtual Reality (VR) technologies with digital and physical landscapes helps humans interact with the increasingly intelligent world. For instance,

- As per Engine Creative Agency Ltd, Augmented reality has gained huge popularity in the past few years owing to its capability to improve user experiences and offer possibilities for interaction.

Market Drivers

Rising Adoption of Smart Clothing Drives Market Growth

Smartwear is expected to witness increased mainstream consumer adoption. The move is often fueled by collaborations between fashion and tech brands, such as the Levi Commuter x Jacquard Jacket, which allows users to control their mobile phone to access Google services or use gestures to control the phone and track users’ Uber location. For instance,

- According to a research survey 2023, the smart clothing sector holds a 9% share in the development of wearable trends as people become aware of fitness and activity patterns.

Moreover, companies continue to see more specialized wearable technology applications, such as connecting the Nadi smart yoga pants to the wearer's smartphone app. The advantage of clothing over small accessories, such as watches and bracelets, is that it covers a larger body area and may have deeper and more useful reasons.

Market Restraints

Limited Battery Life of Wearable Devices Restricts Market Growth

The lack of a reliable and efficient battery structure without negotiating the ease of use and compactness of wearable devices is a limiting factor in the market. The big challenges are power demand management, power consumption, and battery recharging. Cost-effectively controlling power consumption to achieve energy efficiency in portable devices is a factor anticipated to have a limiting impact on the market.

Market Opportunities

Wearable AI is Redefining Technology and Accelerating Market Momentum

AI is changing traditional interaction methods such as screens, trackpads, and keyboards and moving toward more natural, voice-controlled interfaces. This shift leads to the development of lightweight wearable devices and screenless computers that fit smoothly into everyday life. These devices promote a more intuitive, user-centric technology experience by minimizing screen fatigue and reducing intrusive elements. Key companies in the market are planning to introduce AI-enabled wearables to broaden their product portfolios and drive new revenue streams. For instance,

- Apple is planning to launch AI-powered smart glasses by the end of 2026. These glasses will have cameras, microphones, and speakers. This move will make Apple compete with Meta’s Ray-Ban smart glasses and marks Apple’s entry into the AI wearable market.

Thus, the rising inclination toward wearable AI is expected to boost the wearable technology market growth in the coming years.

Major Developments in AI Wearables from Major Companies

SEGMENTATION ANALYSIS

By Type

Rising Focus on Real Time Connectivity Boosted Active Segment Growth

Based on type, the market is analyzed into active and passive. Active wearables are further studied into smart glasses, VR headsets, and smart watches. Passive wearables are further categorized into wristbands, rings, key rings, brooches, and clothing.

The active segment dominated the market with a share of 80.62% in 2026 and is estimated to grow with the highest CAGR during the forecast period. Active wearables, including smartwatches, help users track their physical activity and bring the necessary changes to enhance productivity. Smartwatches even offer important notifications to users while they are busy doing other work, allowing greater real-time connectivity and collaboration. GPS in smartwatches also helps fitness enthusiasts, especially bikers, trekkers, and hikers, find their way back when they get lost outdoors.

The passive segment is predicted to grow significantly during the forecast period. Increasing elderly population drives demand for wearables that can monitor health and support managing chronic conditions. For instance,

- The U.S. Department of Health and Human Services stated that 129 million people in the U.S. have at least one major chronic disease (e.g., cancer, diabetes, heart disease, obesity, hypertension).

By Technology

Continuous Advancements in Microelectronics Fueled IoT Based Segment Growth

The market, analyzed, based on technology is segmented into IoT based, AR and VR, and others.

The IoT based segment captured the largest market share with a share of 50.29% in 2026 and is estimated to grow with the highest CAGR during the forecast period. Internet of Things (IoT)- based technology is a rapidly growing field that has the potential to revolutionize various industries and enhance our daily lives. Continuous advancements in microelectronics have allowed for the development of smaller and energy-efficient components. These advancements have enabled the integration of various sensors, processors, and communication modules into compact wearable devices. IoT-based wearables have found significant applications in the healthcare sector, including early detection of medical conditions, remote patient monitoring, and continuous health tracking, contributing to the growth of IoT-based technology.

Furthermore, the AR and VR segment is expected to grow significantly in the coming years. These technologies have been gaining traction owing to advancements in display technology. Developing high-resolution and low-latency displays has significantly improved the visual experience in AR & VR wearable devices. These advancements enable a more immersive and realistic virtual environment, leading to better user engagement.

By End-Use

To know how our report can help streamline your business, Speak to Analyst

Rising Health Consciousness among Individuals Fostered Health & Fitness Segment Expansion

Based on end-use, the market is divided into health & fitness, BFSI, gaming & entertainment, fashion, travel, education, and logistics & warehouse.

Among these, the health & fitness segment held the majority market share with a share of 32.42% in 2026 and is estimated to grow with the highest CAGR during the forecast period, owing to rising health consciousness. Individuals are increasingly aware of the importance of fitness and health. Wearable devices provide real-time data on vital health metrics, encouraging people to approach their well-being proactively. Additionally, rising remote health monitoring allows healthcare providers to track patients' conditions and progress without requiring them to be physically present at healthcare facilities. This is particularly valuable for patients with chronic illnesses and contributes to segment’s growth.

The gaming & entertainment segment is expected to witness significant growth in the coming years, as wearables, including smartwatches and fitness bands, help gamers monitor their physical health during extended gaming sessions. By tracking heart rate, movement, and stress, wearables help users maintain well-being and improve focus.

WEARABLE TECHNOLOGY MARKET REGIONAL OUTLOOK

The market is geographically studied across North America, Europe, Asia Pacific, the Middle East & Africa, and South America. They are further categorized into countries.

North America

North America Wearable Technology Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 33.63 billion in 2025 and USD 37.05 billion in 2026. North America has a strong health consciousness and fitness culture, with millions actively seeking tools to monitor their wellness. Wearables such as smartwatches and fitness trackers provide real-time insights into physical activity, heart rate, sleep patterns, and other vital metrics, helping users manage their health proactively. Brands, including Apple and Fitbit, are widely used to track fitness goals and encourage healthier lifestyles. The Apple Watch Series 8 introduced FDA-cleared ECG and blood oxygen sensors, which appeal to health-conscious users. Such innovations have propelled the Apple Watch to become the market leader in North America, with around 50% market share in 2024.

Download Free sample to learn more about this report.

Among other countries, U.S. dominated the market in 2024. In the U.S., the ownership rate of smartwatches among internet users exceeds the average at 26%, which is approximately 80.9 million people. The contactless payment trend gained more popularity during the COVID-19 pandemic and increased the demand for wearables in the U.S. In 2023, around 30% of the U.S. population used wearable devices for payments. The U.S. market is valued at USD 29.55 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

The European market is anticipated to grow at a considerable CAGR during the forecast period. The region has a significant aging population, leading to increased interest in wearable devices that can assist in elderly care, remote patient monitoring, fall detection, and other healthcare applications. Internet-connected devices have increased since 2020, highlighting their growing significance in modern life. Similarly, the adoption of smart wearables has seen a substantial rise. Over 26% of individuals aged 16 to 74 now utilize fitness bands, smartwatches, safety trackers, connected clothing or shoes, goggles or headsets, and other internet-connected accessories. The UK market is valued at USD 4.36 billion by 2026, while the Germany market is valued at USD 5.21 billion by 2026.

Asia Pacific

Asia Pacific is estimated to hold the highest CAGR during the forecast period. The region’s rapid urbanization and increasing disposable income have increased demand. Asia Pacific is known for its strong mobile-first approach, with a high penetration of smartphones and mobile devices. The technology related to wearables integrated with mobile apps and services fits seamlessly into the region’s digital lifestyle, contributing to the region's market growth. Similarly, increasing the integration of 5G technology into wearables used in different industries, such as manufacturing and logistics, ensures operational efficiency and improves employee safety. The Japan market is valued at USD 4.98 billion by 2026, the China market is valued at USD 6.09 billion by 2026, and the India market is valued at USD 3.44 billion by 2026.

Middle East & Africa

The demand for wearable technology in the Middle East is experiencing strong growth. The use of wearable devices for payments is rising in the region. According to the Mastercard New Payments Index, 95% of consumers in the Middle East & North Africa (MENA) are considering adopting emerging payment methods, including wearables, biometrics, digital wallets, cryptocurrencies, and QR codes, alongside contactless payments.

South America

The demand for wearable devices in South America is increasing, driven by various factors, including technological advancements, infrastructural developments, and changing consumer behaviors. The rapid increase in smartphone adoption in South America facilitates wearable device use, as most wearables sync with smartphones via Bluetooth, Wi-Fi, or cellular networks. The smartphone adoption in the region is estimated to reach 92% by 2030, up from around 80% in 2023.

Competitive Landscape

Key Market Players

Key Players Focus on Ecosystem Integration to Cater Users' Evolving Requirements

Ecosystem integration is one of the major strategies for wearable technology market players to address users’ evolving needs by creating seamless connectivity across multiple devices and platforms. By integrating wearables with smartphones, smart home systems, health apps, and cloud services, companies enhance user experience through synchronized data, personalized insights, and expanded functionality. This approach boosts customer loyalty and opens new revenue streams by enabling developers and partners to innovate within a unified ecosystem, driving sustained growth in the wearable tech market. For instance,

- In September 2024, Apple expanded the Apple Watch's capabilities with watchOS 11. It integrates new health insights, enhanced personalization, and improved connection features. This update offers deeper insights into daily health, supports fitness journeys with customizable Activity rings, and provides new ways to stay connected with features such as Check In and the Translate app.

Long List of Companies Studied

- Samsung Group (South Korea)

- Apple, Inc. (U.S.)

- Fitbit, Inc. (U.S.)

- Sony Corporation (Japan)

- Xiaomi (China)

- LG Electronics (South Korea)

- Huawei (China)

- Microsoft Corporation (U.S.)

- Garmin Ltd (Switzerland)

- Fossil Group (U.S.)

- Imagine Marketing (India)

- WHOOP (U.S.)

- Lenovo (Hong Kong)

- HTC (Taiwan)

…and more

KEY INDUSTRY DEVELOPMENTS

- April 2025: Google has partnered strategically with Samsung and several leading eyewear manufacturers to develop and bring its upcoming Android XR glasses. This next-generation wearable device will combine augmented reality (AR) and extended reality (XR) technologies.

- April 2025: Garmin introduced the Instinct 3 Series in India, raising the bar for rugged smartwatch innovation. The Instinct 3 Series delivers robust features to endure the most demanding environment and is tailored for adventure seekers, outdoor enthusiasts, and fitness lovers.

- November 2024: Sony Group Corporation (Japan) and CardioComm Solutions (U.S.) partnered to integrate its advanced ECG technology into Sony’s mSafety platform, enhancing wearable technology capabilities. This collaboration allows users to monitor heart health directly through a wearable device without a smartphone connection.

- November 2024: Xiaomi entered into the artificial intelligence (AI) glasses market, aiming to expand its wearable technology portfolio in collaboration with Goertek. Xiaomi plans to develop AI-powered smart glasses integrating advanced technologies, including augmented reality (AR), voice interaction, and AI-driven features.

- April 2023: QMS MAS (Medical Allied Services) launched a wide range of products under the Q Devices banner. This event was organized in cooperation with Varanium Cloud Ltd. It also announced Vyana, a revolutionary medical wearable. Vyana objects meet the growing requirement for medical wearables that deliver timely assistance. It is designed to constantly monitor critical parameters, send immediate notifications, and communicate directly to users and their emergency contacts in the event of significant fluctuations.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects such as leading companies, product/service types, and leading product applications. Besides, it offers insights into the wearable technology trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Technology

By End Use

By Region

|

Frequently Asked Questions

The market value is projected to record a valuation of USD 231.43 billion by 2034.

In 2025, the market was valued at USD 86.78 billion.

The market is projected to record a CAGR of 11.60% during the forecast period.

By type, the active segment led the market.

The rising adoption of smart clothing and footwear is driving the market growth.

Samsung Group, Apple, Inc., Sony Corporation, Microsoft Corporation, and Huawei Technologies are the top players in the market.

North America held the highest market share in 2025.

By End-Use, the health & fitness segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us