Aromatic Hydrocarbon Market Size, Share & Industry Analysis, By Application (Fuel, Solvent, Chemical Synthesis, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

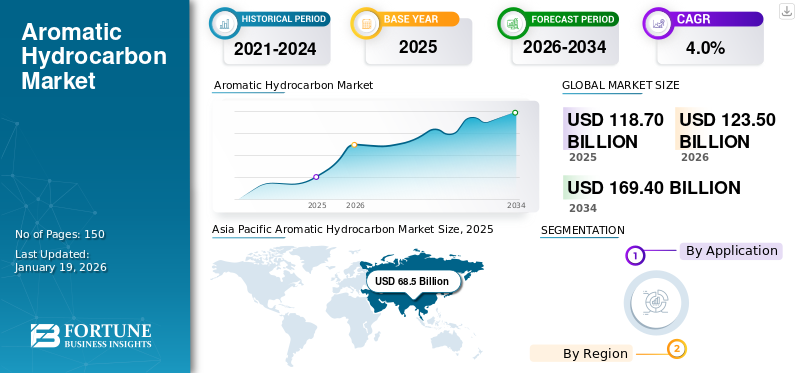

The global aromatic hydrocarbon market size was USD 118.7 billion in 2025. The market is projected to grow from USD 123.5 billion in 2026 to USD 169.4 billion by 2034 at a CAGR of 4.0% during the 2026-2034 period. The Asia Pacific dominated the aromatic hydrocarbon market, accounting for a 58% market share in 2025.

Aromatic hydrocarbons, also known as arenes, are a class of organic compounds characterized by one or more planar rings of atoms with delocalized π-electron systems, typically derived from benzene. These compounds exhibit high chemical stability and unique reactivity due to their conjugated ring structures. Common examples include benzene, toluene, and xylene. A major driving factor for increased demand is their extensive use in the manufacturing of industrial solvents and intermediates, particularly in rapidly expanding sectors such as automotive, construction, and consumer goods. Rising industrialization and urbanization across emerging economies continue to promote demand, driving market growth.

Companies operating in the market include key players such as INEOS, SABIC, Shell, and China National Petroleum Corporation, among others.

GLOBAL AROMATIC HYDROCARBON MARKET TAKEAWAYS

Market Size & Forecast:

- 2025 Market Size: USD 118.7 billion

- 2026 Market Size: USD 123.5 billion

- 2034 Forecast Market Size: USD 169.4 billion

- CAGR: 4.0% from 2026–2034

Market Share:

- Asia Pacific led in 2025 with a 58% share, rising from USD 68.5 billion in 2025 to USD 71.4 billion in 2026.

- By application: Chemical synthesis dominated due to high use as intermediates in plastics, fibers, and dyes.

- By end use: Industrial and construction sectors drove demand for solvents and resins.

Key Country Highlights:

- China & India: Major contributors with rapid industrialization and expanding petrochemical capacity.

- U.S.: Strong demand from automotive, construction, and packaging industries supported by shale-based feedstocks.

- Germany & France: Focus on sustainable production and specialty aromatic derivatives.

- Brazil & Mexico: Rising consumption in adhesives, textiles, and infrastructure sectors.

- Saudi Arabia & UAE: Expanding petrochemical complexes reinforcing regional aromatic supply.

AROMATIC HYDROCARBON MARKET TRENDS

Energy Companies’ Diversification into Petrochemical Business to Aid Market Growth

Major investments are seen in regions, including the Middle East and Asia Pacific, where governments and private players aim to diversify their energy portfolios and increase value-added exports. This global expansion of integrated petrochemical complexes is significantly influencing the market. These complexes are increasingly being developed in proximity to refineries to ensure a consistent feedstock supply and improve production efficiency.

- Asia Pacific witnessed a Aromatic Hydrocarbon Market growth from USD 63 billion in 2023 to USD 65.7 billion in 2024.

Such vertical integration allows for better cost management, optimized resource utilization, and enhanced control over the aromatic production chain, particularly for benzene, toluene, and xylene derivatives. This expansion supports rising demand from downstream industries such as plastics, textiles, and automotive, thus reinforcing aromatics as critical building blocks in industrial manufacturing and driving market growth in tandem.

MARKET DYNAMICS

MARKET DRIVERS

Rise in Demand for Aromatic Compounds in Industrial Activities to Drive Market Growth

Rising industrial activities across the globe strongly support the growth of the market. Compounds such as benzene, toluene, and xylene are crucial raw materials in producing solvents, dyes, surfactants, and resins, which are widely used in industries such as chemicals, textiles, rubber, and packaging. Amid rapid industrialization, particularly in emerging economies such as China and India, the demand for these intermediates continues to increase. This is further driven by infrastructure expansion, manufacturing sector growth, and the emergence of small-scale chemical units. In addition to this, the role of aromatics in specialty and performance chemicals adds to their value, solidifying their place as essential building blocks in diverse industrial processes and driving aromatic hydrocarbon market growth in tandem.

MARKET RESTRAINTS

Increasing VOC Restrictions by Regulatory Bodies Globally to Limit Market Growth

Stringent environmental regulations significantly restrain the demand for aromatic hydrocarbons due to the hazardous nature of compounds, including benzene, toluene, and xylene, which are classified as volatile organic compounds. Regulatory agencies such as the EPA and ECHA enforce strict limits on emissions and workplace exposure, increasing operational costs for manufacturers. Compliance often requires investments in advanced emission control systems, safer production technologies, and continuous environmental monitoring. These regulations are likely to push companies to explore alternative feedstocks and adopt greener chemical processes, making it challenging for traditional producers to maintain profitability while meeting evolving sustainability and safety standards. This, in turn, is likely to slow down and limit market growth.

MARKET OPPORTUNITIES

Rising Demand for Aromatic-Based Polymers to Create Market Growth Opportunities

The rising global demand for plastics presents a significant market opportunity for the aromatic hydrocarbons industry. Aromatics such as benzene, toluene, and xylene are essential feedstocks for producing key polymers, including polystyrene, PET, and nylon, which are widely used in packaging, automotive parts, electronics, and textiles. As consumer markets grow, particularly in emerging economies, the need for plastic-based products is increasing rapidly. In addition to this, the push for lightweight materials in vehicles to enhance fuel efficiency is boosting the use of aromatic-derived polymers. This growing reliance on plastics across diverse industries is anticipated to create a strong opportunity for aromatic hydrocarbon producers to expand their market presence and strengthen their role in global petrochemical supply chains.

MARKET CHALLENGES

Rising Emphasis on Environmental Sustainability to Create Challenges in Market Growth

The market for aromatic hydrocarbons is under increasing pressure to adopt sustainable practices amid global climate goals and stricter environmental regulations. Traditional production, reliant on fossil fuels, leads to high emissions, prompting a push toward cleaner technologies and bio-based alternatives. However, transitioning is hindered by high capital costs and limited scalable solutions. Achieving sustainability while maintaining cost competitiveness, especially in price-sensitive regions, poses a significant challenge. Regulatory initiatives, including the EU Green Deal, further intensify the need for greener operations. To remain viable, companies must innovate across production and supply chains, balancing environmental responsibility with operational efficiency and market competitiveness.

TRADE BARRIERS AND PROTECTIONISM

Evolving Trade Landscape to Realign Global Petrochemical Supply Chain

Current U.S. tariffs on petrochemical imports and exports, particularly those involving China and other key trading partners, are likely to disrupt the global aromatic hydrocarbon industry. These tariffs increase production costs, reduce cross-border trade efficiency, and create pricing volatility for key aromatics such as benzene, toluene, and xylene. Export-dependent producers, especially in Asia Pacific, may face reduced access to the U.S. market, while U.S.-based manufacturers could experience higher raw material costs due to retaliatory measures. This may lead to supply chain realignment, regional production shifts, and increased investment in domestic capacity, thereby reshaping global trade flows and intensifying competition among regional suppliers.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Application

Chemical Synthesis to Dominate Due to Product Usage as an Intermediate in a Wide Range of Chemical Compounds

Based on the application, the market is segmented into fuel, solvent, chemical synthesis, and others.

The chemical synthesis segment is anticipated to hold the dominant aromatic hydrocarbon market share during the forecast period. A major factor driving the demand for chemical synthesis products is the growing need for downstream petrochemical products such as plastics, synthetic fibers, dyes, and agrochemicals. Aromatics such as benzene and toluene serve as essential feedstocks for the production of phenol, styrene, and aniline, which are key inputs in a wide range of industrial and consumer goods. With rising consumption in the construction and automotive industries, manufacturers are increasing aromatic capacity to support the production of high-performance, cost-effective synthetic materials.

The primary factor boosting demand for aromatic hydrocarbons in solvent applications is the expansion of the paints, coatings, and adhesives industries, particularly in construction and automotive manufacturing. Aromatics such as toluene and xylene are widely used as industrial solvents due to their strong solvency and fast evaporation rates. Rapid urbanization, infrastructure development, and growth in vehicle production are increasing the need for coatings and finishes, thereby driving solvent consumption. In addition to this, the usage of aromatic solvents in cleaning agents and chemical processing supports consistent demand across various industrial sectors.

AROMATIC HYDROCARBON MARKET REGIONAL OUTLOOK

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Aromatic Hydrocarbon Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 68.5 billion in 2025 and USD 71.4 billion in 2026. The region leads global demand for these hydrocarbons due to rapid industrial growth in China, India, and Southeast Asia. Expanding end-use industries such as automotive, packaging, textiles, and construction drive strong consumption of benzene, toluene, and xylene. The presence of low-cost production, growing petrochemical capacity, and rising domestic demand further boosts market expansion. Thus, Asia Pacific remains the prominent global hub for both the production and consumption of these hydrocarbons.

North America

North America remains competitive due to technological advancements and strong internal consumption across a wide range of industrial applications. This includes the sustained demand for aromatic hydrocarbons from its advanced automotive, construction, and chemical sectors. The U.S. benefits from mature petrochemical infrastructure and abundant shale-based feedstocks, supporting efficient and cost-effective production. Aromatics are widely used in solvents, coatings, synthetic fibers, and adhesives. Although stringent environmental policies pose limitations, innovation in cleaner technologies helps offset regulatory challenges. Growth in packaging, specialty chemicals, and infrastructure investment ensures steady demand.

Europe

Europe’s aromatic hydrocarbon demand is led by its advanced manufacturing and specialty chemical sectors, particularly in Germany, France, and the Netherlands. Aromatics play a key role in producing plastics, resins, and detergents. Sustainability regulations and the circular economy push producers toward greener and more efficient production methods. Despite regulatory pressures, innovation and strong demand in high-value automotive, electronics, and healthcare industries support market growth. Europe also benefits from its robust research and development activities, which enable the development of value-added aromatic applications in an environmentally conscious manufacturing setting.

Latin America

In Latin America, rising demand for these hydrocarbons is driven by infrastructure growth, automotive production, and packaging needs, especially in Brazil and Mexico. Aromatics are used in paints, adhesives, and synthetic textiles, aligning with growing consumer demand. The region relies heavily on imports due to underdeveloped petrochemical capacity, creating opportunities for investment. Government initiatives to expand industrial sectors may boost local production during the forecast period, driving market growth in tandem.

Middle East & Africa

Demand in the Middle East & Africa is growing due to large-scale petrochemical investments in the Gulf region, particularly in Saudi Arabia and UAE. Strategic diversification efforts are positioning the Middle East as a petrochemical hub. Thus, these hydrocarbons can support regional manufacturing of plastics, solvents, and detergents. Rising regional consumption and export-oriented production models present long-term opportunities for aromatic growth in the regions. In addition to this, Africa’s demand is driven by urbanization and infrastructure development.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Invest in Integrated Refineries to Diversify Their Product Offerings

The aromatic hydrocarbon market is highly competitive, with major players, including INEOS, SABIC, Shell, and China National Petroleum Corporation, competing on price, production scale, and feedstock access. The market is characterized by limited product differentiation and strong regional advantages, especially in Asia Pacific and the Middle East, where lower production costs intensify global pricing pressures. Companies are also investing in integrated refinery operations and technological upgrades to maintain competitiveness. In addition to this, rising demand from key sectors such as automotive and packaging, along with growing interest in sustainable alternatives, is driving innovation.

LIST OF KEY AROMATIC HYDROCARBON COMPANIES PROFILED

- Chevron Phillips Chemical Company LLC (U.S.)

- China National Petroleum Corporation (China)

- Haldia Petrochemicals Limited (India)

- INEOS (U.K.)

- LyondellBasell Industries Holdings B.V. (U.S.)

- Maruzen Petrochemical (Japan)

- Reliance Industries Limited (India)

- SABIC (Saudi Arabia)

- Shell (U.K.)

- Sumitomo Chemical Co., Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS

- January 2021 – Ineos completed the acquisition of BP p.l.c’s global Aromatics and Acetyls businesses for a consideration of USD 5.0 billion. This acquisition includes 15 sites across the world, along with 10 joint ventures. The move is part of the company’s plan to enhance its product offerings and global reach.

- April 2024 – Ineos completed the acquisition of TotalEnergies' petrochemical assets at Lavera, France. The company acquired a 50% share of TotalEnergies for assets in Naphtachimie, Gexaro, and Appryl, which were previously operated as a 50:50 joint venture between INEOS and TotalEnergies. The acquisition includes an aromatics business with an annual capacity of 270,000 tons at the Gexaro site.

REPORT COVERAGE

The global market report provides a detailed analysis of the market. It focuses on key aspects such as profiles of leading companies and leading applications of the product. Besides this, it offers insights into the analysis of key market trends and highlights key industry developments. In addition to the aforementioned factors, it encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 4.0% during 2026-2034 |

|

Segmentation

|

By Application

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 118.7 billion in 2025 and is projected to record a valuation of USD 169.4 billion by 2034.

In 2025, Asia Pacific stood at USD 68.5 billion.

Registering a CAGR of 4.0%, the market will exhibit steady growth during the forecast period of 2026-2034.

The chemical oilsegment leads the market.

Rise in demand for aromatic compounds in industrial activities to drive market growth.

INEOS, SABIC, Shell, and China National Petroleum Corporation are the major players operating in the market.

Asia Pacific is expected to dominate the market during the forecast period.

Energy companies diversification into the petrochemical business is expected to drive higher adoption and positively impact market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us