Pharmaceuticals Market Size, Share & Industry Analysis, By Type (Drugs {Prescription & OTC} and Vaccines {Bacterial & Viral}), By Disease Indication (Oncology, Diabetes, Infectious, Cardiovascular, Obesity, Autoimmune, Ophthalmic, Gastrointestinal, Dermatology, Hematology, Hormonal, Allergies), By Drug Type (Biologics & Biosimilars {Antibodies [Monoclonal Antibodies, Antibody-Drug Conjugates], Vaccines, Peptide-Drug Conjugates}, & Conventional Drugs), By Route of Administration, By Distribution Channel (Hospitals, Drug Stores, Retail & Online Pharmacies), & Regional Forecast, 2026-2034

Pharmaceuticals Market Overview

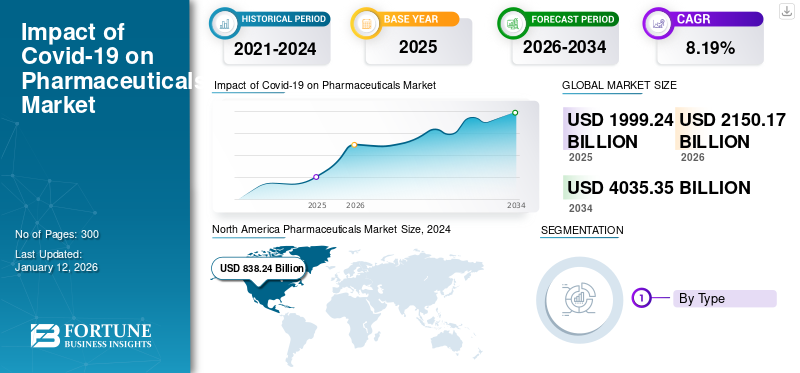

The global pharmaceuticals market size was valued at USD 1,999.24 billion in 2025. The market is projected to grow from USD 2,150.17 billion in 2026 to USD 4,035.35 billion by 2034, exhibiting a CAGR of 8.19% during the forecast period. North America dominated the pharmaceuticals market with a market share of 44.81% in 2026.

Pharmaceuticals play an important role in public health and economic development. They are crucial for the prevention and treatment of chronic diseases, thereby improving quality of life and supporting economic growth. The market is witnessing significant growth, driven by factors such as increasing demand for innovations and technologies in the healthcare sector, rising cases of various chronic and life-threatening diseases.

- For instance, according to data published by the International Diabetes Federation (IDF), in 2024, the number of adults suffering from diabetes in India was 89,826,900.

The rising emphasis on research and development of advanced therapies by key players operating in the market also supports market growth. Some of these players include Pfizer Inc., Johnson & Johnson Services Inc., AstraZeneca, and Novartis AG.

MARKET DYNAMICS

MARKET DRIVERS

Rising Public Health Concerns to Propel Market Growth

One of the prominent factors that has driven the pharmaceuticals market growth is the rising public health concerns due to the high prevalence of chronic diseases. In recent years, several factors, such as a rise in obesity, growing adoption of a sedentary lifestyle, and higher intake of unhealthy diets, have contributed to the rising prevalence of non-communicable diseases (NCDs) at a concerning rate. This results in a significant demand for medications to treat these diseases.

- According to 2025 statistics published by the American Cancer Society (ACS), the estimated number of breast cancer cases in the U.S. is approximately 316,950 in 2025.

Such high numbers of patients also create a large financial burden on the population for disease management. Chronic diseases can lead to disability, reduced quality of life, and increased healthcare costs. They also impact workforce participation and economic productivity.

- For instance, according to the study published by the National Center for Biotechnology Information (NCBI) in January 2024, the cost of managing chronic diseases is extensive, with estimates reaching USD 47 trillion globally by 2030.

MARKET RESTRAINTS

Stringent Regulatory Framework to Hinder Market Growth

The increasing volume of drug sales globally is leading to greater regulatory scrutiny in several areas, such as drug development, sales and marketing practices, government drug price reporting, clinical operations, and post-marketing drug safety reporting. This is creating a higher barrier for players, especially new entrants, to develop and market drugs and other pharmaceutical products.

The launch of complex drugs for chronic diseases requires various regulatory approval processes. Since these drugs often involve various innovations, regulatory bodies have enforced active efforts to evaluate their performance and safety. Additionally, constant advancements in smart drug delivery systems have substantially increased the burden on regulatory bodies for product classification and evaluation.

MARKET OPPORTUNITIES

Adoption of Digital Technologies to Create Lucrative Growth Opportunities

The pharmaceutical industry is undergoing a deep digital transformation aimed at improving operational efficiency, enhancing patient engagement, and accelerating drug development, potentially reducing the 12–15 years typically required to develop new drugs. Companies such as Johnson & Johnson Services Inc., Merck KGaA, and Eli Lilly and Company are training their employees in artificial intelligence to effectively incorporate these technologies. Additionally, digital twin technology enables simulations of patient responses, allowing for better trial design and safety monitoring.

MARKET CHALLENGES

Supply Chain Disruptions Pose a Significant Challenge to Market Growth

The pharmaceutical industry faces significant supply chain challenges, ranging from sourcing raw materials to final delivery. Limited domestic capacities of U.S.-based pharmaceutical companies and other developed countries to produce essential medical ingredients result in increasing imports of the products, creating a major supply chain crisis. Most APIs and raw materials are sourced from a handful of countries, especially China and India. Disruptions such as factory shutdowns, export restrictions, or political tensions in these countries can halt supply, causing a shortage of critical materials for drug manufacturing.

Furthermore, many pharmaceutical products often need cold chain logistics, meaning that delays or failures in maintaining constant temperatures during transit can result in product spoilage. Moreover, port congestion, driver shortages, and increases in freight costs (especially post-pandemic) further complicate supply chain management.

PHARMACEUTICALS MARKET TRENDS

Rising Investment in Innovative Therapeutics is a Key Market Trend

The pharmaceutical industry is moving from small molecules and monoclonal antibodies (mAbs) as drug modalities toward new types of therapies that can treat complex diseases. This shift is driving R&D investment in innovative therapeutics and pushing mergers and acquisitions to bolster pipelines. Gene and cell therapies are leading the way, offering potential cures for genetic disorders through tailored gene-based or cellular therapies.

Treatments for rare diseases such as myasthenia gravis, acute myeloid leukemia, and novel therapies for other conditions are being developed at a notable pace in recent years.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Increasing Incidence of Various Chronic Conditions Encouraged Drugs Segment Growth

Based on type, the pharmaceuticals market is segmented into drugs and vaccines. The drugs segment is further segmented into prescription and OTC.

The drugs segment led the market accounting for 95.55% market share in 2026. The growing prevalence of various chronic conditions such as cancer, diabetes, cardiovascular disorders, and others, along with increasing efforts of the pharmaceutical manufacturers to raise awareness regarding the availability of various novel therapies, is driving the adoption of pharmaceutical drugs in the market.

- For example, according to a report published by the World Health Organization (WHO) in April 2024, based on 2022 data from 187 countries, approximately 254 million people globally, around 3.3% of the world’s population, were infected with hepatitis B.

On the other hand, the vaccines segment, which includes both viral and bacterial vaccines, is anticipated to grow at a moderate rate in the coming years. An increasing number of approvals for various types of vaccines has resulted in increasing adoption in the market.

- For instance, in May 2025, Bavarian Nordic received marketing authorization from the UK Medicines and Healthcare products Regulatory Agency for Vimkunya to prevent the spread of disease caused by the chikungunya virus.

To know how our report can help streamline your business, Speak to Analyst

By Disease Indication

Increasing Cases of Cancer Impelled Oncology Segment Growth

In terms of disease indication, the global pharmaceuticals market is segmented into oncology, diabetes, infectious, cardiovascular, neurology & psychiatry, respiratory, renal, obesity, autoimmune, ophthalmic, gastrointestinal, dermatology, hematology/blood, liver/hepatology, genetic, hormonal/endocrine, women’s health, reproductive, allergies, and others.

The oncology segment dominated the market accounting for 17.62% market share in 2026. The growing demand for efficient treatment for various cancer types has driven increased demand for pharmaceutical products across the world. Additionally, the increase in incidence of cancer across all age groups is also supporting segment growth.

- According to 2025 statistics published by the American Cancer Society (ACS), the estimated number of cancer cases in the U.S. is approximately 2,041,910.

- Similarly, according to a report published by the Global Cancer Observatory (GLOBOCAN) in 2022, prostate cancer ranked 4th among all types of cancers, with a total incidence of 1,467,854.0 (1.47 million) cases in 2022.

The neurology & psychiatry segment is anticipated to grow at a considerable CAGR in the coming years. Factors supporting this growth include a growing aging populations, the increasing incidence of neurological disorders, and rising R&D investments in novel drug development for various neurological diseases.

- For instance, according to the data provided by the World Health Organization (WHO) in March 2024, around 1 in 3 individuals were affected by neurological conditions across the world.

By Drug Type

Small Molecules/Conventional Drugs Segment Led the Market due to its Affordability

Based on drug type, the global market is categorized into biologics & biosimilars and small molecules/conventional drugs.

The small molecules/conventional drugs segment held the leading position in the global market in 2024. Factors supplementing this dominance include an established manufacturing and regulatory framework for small molecules, oral bioavailability and patient convenience, cost-effectiveness, and the wide availability of generic drugs.

The pharmaceutical industry remains focused on small molecules due to their lower cost of manufacturing, ease of administration, broad applicability, and stability. Small molecule drugs tend to be cheaper than biologics, which are often manufactured using cell culture processes and require strict handling requirements. In addition, a strong focus by key players on new product launches and other strategic initiatives also supports the segment’s growth.

- For instance, in November 2023, Pfizer Inc. signed an agreement with Serina Therapeutics to license its drug delivery technology for small molecules.

The biologics & biosimilars segment is projected to dominate the market with a share of 39.09% in 2026. This is majorly due to the growing shift from traditional small molecule drugs to the large molecule biopharmaceutical drugs. These biologics encompass therapies such as the antibody drug-conjugates, monoclonal antibodies, and others, which are redefining the treatment regimen for complex conditions.

- For instance, as per the data given by Catalent Biologics, biopharmaceutical products account for an estimated 40% of the total drug pipeline, and this number is expected to increase in the near future.

By Route of Administration

Oral Segment Dominated due to its Safety

On the basis of route of administration, the global market is divided into oral, parenteral, topical, inhalation, and others.

The oral segment held the highest share of the market in 2024. This can be attributed to factors such as convenience, safety, cost-effectiveness, and patient friendliness of oral drugs, which make it the most widely used and preferred route for drug administration globally. Unlike infusions or injections, oral administration avoids the need for needles and the associated discomfort or anxiety, thereby improving patient acceptance, especially for chronic or long-term therapies.

The parenteral segment is poised to grow at a considerable CAGR during the forecast period. The segment growth can be attributed to the increasing usage of the parenteral routes of administration in treating various chronic conditions. The parenteral administration allows for the direct and efficient delivery of drugs into the bloodstream.

- For instance, bulevirtide, the only approved medication in Europe used to treat hepatitis D, is administered through the parenteral route.

By Age Group

Increasing Demand For Treating Viral Diseases Boosted Adults the Segment Growth

On the basis of age group, the global market is distributed into adults and pediatrics.

The adults segment accounted for the highest market share in 2024 and is anticipated to grow at the highest CAGR during the projection period. This growth is primarily attributed to the increasing demand for treating viral diseases such as smallpox/Mpox in adults in the region. In order to meet this rising demand, regional regulatory authorities are increasingly approving vaccines to protect against such viruses.

- For instance, in March 2024, Bavarian Nordic received approval from the Swiss Agency for Therapeutic Products, Swissmedic, for JYNNEOS to treat smallpox and Mpox viruses in individuals 18 years of age and older.

The pediatrics segment accounted for the major share of the market in 2024. The growing efforts by global players to expand the reach of their vaccines to prevent bacterial diseases among the pediatric population are expected to boost product adoption.

- For instance, in March 2024, Pfizer Inc. announced that it received marketing authorization for its PREVENAR 20 from the European Commission (EC) to protect infants and children against pneumococcal disease.

By Distribution Channel

Easy Access to Specialized Medicines Boosted the Hospital Pharmacies Segment Growth

In terms of distribution channel, the global market is divided into hospital pharmacies, drug stores & retail pharmacies, and online pharmacies.

The hospital pharmacies segment held a major share of the global market in 2024, attributed to the shift of patients toward these settings. Easy access to specialized medicines and provisions for inpatient treatment, along with insurance coverage, have contributed to the segment growth. Furthermore, the presence of a large number of hospitals and in-house pharmacy departments is expected to boost the adoption of pharmaceuticals through hospital pharmacies and propel the segment’s growth.

- In 2024, according to the data published by ABDA, the Federal Union of German Associations of Pharmacists, on average, there were an average of 21 pharmacies per 100,000 inhabitants in Germany. Such a ratio effectively fulfills the demand for pharmaceutical drug products and supports the growth of the segment.

The retail pharmacies segment held the second-largest share of the market, owing to enhanced accessibility, support services, and community engagement initiatives that help effectively manage patients’ conditions. Additionally, retail pharmacies offer a broad range of pharmaceutical products, including both prescription and OTC medications, health supplements, and personal care items.

PHARMACEUTICALS MARKET REGIONAL OUTLOOK

In terms of regions, the market is segmented into Europe, Asia Pacific, North America, Latin America, and the Middle East & Africa.

North America

North America Pharmaceuticals Market Size, 2024 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

In North America, the market was valued at USD 959.40 billion in 2026 and is expected to maintain its dominance throughout the forecast period. The strong presence of well-established players, a high number of approved products, and the rising prevalence of chronic diseases are some of the prominent aspects supplementing the region’s growth in the market.

U.S.

The U.S. captured the highest share of the market in North America in 2024. Supportive regulatory bodies, an increasing number of approved products, and an increasing influx of investment in research & development of innovative therapies have primarily driven market growth. The U.S. market is projected to reach USD 908.5 billion by 2026.

- For instance, according to the study published in the European Journal of Medicinal Chemistry journal in March 2025, the U.S. FDA approved 18 biological entities (NBEs) and 32 new chemical entities (NCEs) in the year 2024.

Europe

The European region is projected to maintain its second-leading position over the forecast period. The growth in the region can be attributed to major factors, including rising patient population demanding various novel therapies for chronic and life-threatening conditions, increasing awareness regarding the available treatment options, and the rising introduction of new drugs and products in the countries. The UK market is projected to reach USD 52.74 billion by 2026, while the Germany market is projected to reach USD 79.32 billion by 2026.

- For instance, in July 2024, New Amsterdam Pharma Company N.V. announced positive topline data from the Phase 3 BROOKLYN clinical trial designed to evaluate obicetrapib in adult patients with heterozygous familial hypercholesterolemia.

Asia Pacific

The pharmaceuticals market in the Asia Pacific region is projected to grow at the fastest rate over the study period. The increasing geriatric population prone to various chronic and age-related disorders, along with increasing healthcare expenditure, improving healthcare infrastructure in China, India, Australia, and other countries, are some of the vital factors fueling the growth of the region. The Japan market is projected to reach USD 119.59 billion by 2026, the China market is projected to reach USD 301.03 billion by 2026, and the India market is projected to reach USD 79.34 billion by 2026.

- According to 2023 data published by the Indian Ministry of Finance, the health expenditure increased to 1.9% of GDP in 2022-2023 compared to 1.4% of GDP in 2017-2018.

Latin America and the Middle East & Africa

The market in the Latin America and Middle East & Africa regions is predicted to grow at a slower CAGR over the forecast period. However, with the improvements in healthcare infrastructure, changing reimbursement scenarios, and collaborations between global players and domestic players, these regions are anticipated to witness growth in the coming years.

- For instance, in January 2025, the 2024 Vaccination Week in the Americas (VWA) announced the administration of more than 65.0 million vaccine doses in Latin America and the Caribbean countries, which includes mRNA vaccines as well.

COMPETITIVE LANDSCAPE

Key Market Players

Key Players in the Market Focus on Strengthening their Product Offering to Sustain Market Competition

The competitive scenario for the global pharmaceutical market represents a combination of both well-established and emerging players. Some of the key players in the market include Pfizer Inc., Johnson & Johnson Services Inc., AstraZeneca, and Novartis AG. Strong global presence of these companies, coupled with emphasis on strengthening their portfolio of vaccines and drugs for various indications through research collaborations with other market players, has supported the dominance of these companies.

Other key market players operating at the global level are AbbVie Inc., AstraZeneca, F. Hoffmann-La Roche Ltd, and others. These companies are undertaking various strategic initiatives to maintain their market positions.

LIST OF KEY PHARMACEUTICAL COMPANIES PROFILED

- Merck & Co., Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Johnson & Johnson (U.S.)

- AbbVie Inc. (U.S.)

- AstraZeneca (U.K.)

- Hoffmann-La Roche Ltd (Switzerland)

- Novartis AG (Switzerland)

- Bristol-Myers Squibb Company (U.S.)

- Eli Lilly and Company (U.S.)

- Sanofi (France)

- Novo Nordisk A/S (Denmark)

- GSK plc. (U.K.)

- Amgen Inc. (U.S.)

- Gilead Sciences, Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

KEY INDUSTRY DEVELOPMENTS

- July 2025: GSK plc announced the extended review period for the Biologics License Application (BLA) for Blenrep combinations by the U.S. FDA.

- June 2025: AstraZeneca received the U.S. FDA approval for Datroway (datopotamab deruxtecan or Dato-DXd) to treat adult patients with locally advanced or metastatic EGFR-mutated non-small cell lung cancer (NSCLC) who have received prior EGFR-directed therapy and platinum-based chemotherapy.

- March 2025: Precision BioSciences, Inc. received clearance from the U.S. FDA for the Investigational New Drug (IND) application for PBGENE-HBV. PBGENE-HBV is Precision’s lead wholly owned in vivo gene editing program designed to cure chronic hepatitis B.

- October 2024: Pfizer Inc. announced that the U.S. Food and Drug Administration (FDA) has approved HYMPAVZI, which is used for the treatment of adults and adolescents with hemophilia A or B.

- May 2024: Novartis AG acquired Mariana Oncology, a preclinical-stage biotechnology company, to strengthen its radioligand therapy pipeline.

REPORT COVERAGE

The global pharmaceuticals market report provides a detailed and comprehensive analysis of the market. Some of the key insights that the report provides include, the prevalence of key chronic diseases by key countries, regulatory overview of pharmaceutical products by key regions, recent industry developments, and new product launches in the market. The research report also includes the key market dynamics that have contributed to the growth of the market across the forecast period. The market analysis also encompasses the profiles of the major companies operating in the market and the global competitive landscape. In addition, the report is also inclusive of pipeline analysis and insights on investment trends in pharmaceutical & biotechnology industry.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.19% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type · Drugs o Prescription o OTC · Vaccines o Bacterial o Viral |

|

By Disease Indication · Oncology · Diabetes · Infectious · Cardiovascular · Neurology & Psychiatry · Respiratory · Renal · Obesity · Autoimmune · Ophthalmic · Gastrointestinal · Dermatology · Hematology/Blood · Liver/Hepatology · Genetic · Hormonal/Endocrine · Women’s Health · Reproductive · Allergies · Others |

|

|

By Drug Type · Biologics & Biosimilars o Antibodies § Monoclonal Antibodies (mAbs) § Bispecific Antibodies § Antibody-Drug Conjugates (ADCs) § Others o Vaccines o Peptides/Peptide-Drug Conjugates (PDCs) o Others · Small Molecules/Conventional Drugs |

|

|

By Route of Administration · Oral · Parenteral · Topical · Inhalation · Others |

|

|

By Age Group · Pediatric · Adults |

|

|

By Distribution Channel · Hospital Pharmacies · Drug Stores & Retail Pharmacies · Online Pharmacies |

|

|

By Region · North America (By Type, Disease Indication, Drug Type, Route of Administration, Age Group, Distribution Channel, and Country) o U.S. o Canada · Europe (By Type, Disease Indication, Drug Type, Route of Administration, Age Group, Distribution Channel, and Country/Sub-Region) o Germany o France o U.K. o Spain o Italy o Scandinavia o Rest of Europe · Asia Pacific (By Type, Disease Indication, Drug Type, Route of Administration, Age Group, Distribution Channel, and Country/Sub-Region) o China o Japan o India o South Korea o Singapore o Vietnam o Australia o Rest of the Asia Pacific · Latin America (By Type, Disease Indication, Drug Type, Route of Administration, Age Group, Distribution Channel, and Country/Sub-Region) o Brazil o Mexico o Colombia o Rest of the Latin America · Middle East & Africa (By Type, Disease Indication, Drug Type, Route of Administration, Age Group, Distribution Channel, and Country/Sub-Region) o Saudi Arabia o Rest of GCC o South Africa o Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 2,150.17 billion in 2026 and is projected to record a valuation of USD 4,035.35 billion by 2034.

The market is projected to grow at a CAGR of 8.19% during the forecast period (2026-2034).

In 2025, North America stood at USD 895.79 billion.

Based on type, the drugs segment led the market in 2025.

Increasing cases of various chronic and life-threatening diseases and rising efforts by operating players for the development of innovative therapies are the key factors driving market growth.

Pfizer Inc., Johnson & Johnson Services Inc., AstraZeneca, and Novartis AG are the leading players in the market.

North America is likely to dominate the market during the study period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us