Autonomous Data Platform Market Size, Share & Industry Analysis, By Deployment (Private Cloud, Public Cloud, and Hybrid Cloud), By Enterprise Type (Small & Mid-sized Enterprises and Large Enterprises), By Industry (BFSI, Healthcare, IT & Telecom, Retail & E-commerce, Manufacturing, Government, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

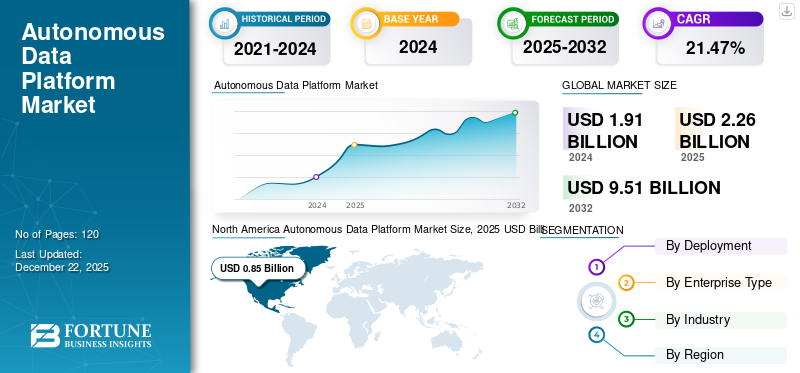

The global autonomous data platform market size was valued at USD 2.26 billion in 2025 and is projected to grow from USD 2.71 billion in 2026 to USD 12.83 billion by 2034, exhibiting a CAGR of 21.47% during the forecast period. North America dominated the autonomous data platform market with a market share of 37.67% in 2025.

Market Trends and Strategic Insights

- North America autonomous data platform market held the largest share of 37.67% of the global market in 2025.

- By deployment, Public cloud segment dominated the market in 2026 with a 48.56% share, driven by widespread adoption of scalable, low-maintenance data infrastructure.

- Based on enterprise type, Large enterprises segment held the highest market share in 2024 owing to their advanced data management needs and robust IT ecosystems.

- By industry, IT & telecom segment led the market in 2024 due to high adoption of data automation, governance, and compliance solutions.

- By region, Asia Pacific is expected to grow at the highest CAGR during the forecast period due to strong digital transformation and hybrid cloud adoption across enterprises.

Market Size and Growth Forecast

- 2025 Market Size: USD 2.26 Billion

- 2026 Market Size: USD 2.71 Billion

- 2034 Projected Market Size: USD 12.83 Billion

- CAGR (2026–2034): 21.47%

- North America: Largest market in 2025

- Asia Pacific: Fastest-growing region during the forecast period

An autonomous data platform refers to a big data infrastructure that both optimizes and manages itself. By continuously monitoring its environment and usage patterns, it performs tasks more effectively by learning how users interact with the data platform. It offers a comprehensive framework for managing the entire lifecycle of data. Such a platform operates independently, without requiring human intervention or external control while delivering capabilities such as self-provision, self-optimization, and self-healing. Hence, enterprises and organizations across different industries, such as BFSI, healthcare, and retail, are increasingly adopting modern data architectures to enhance productivity. For instance,

- According to the SONATA Software Insights, over 33% of enterprises have implemented a minimum of one modern data management infrastructure. Enterprises are also making substantial investments in the development of talent competencies to adapt to changing data management paradigms.

Market players such as Veritas Technologies, Cloudera, Inc., Oracle, and Qubole, are developing and enhancing autonomous data platforms to deliver end-users with self-securing, self-repairing, and self-driving capabilities.

IMPACT OF GENERATIVE AI

Enhanced Capabilities of Generative AI to Create Various New Prospects for Autonomous Data Platform

Generative AI, when incorporated with data platforms, can considerably improve data management and analysis. It allows automation of operations such as data cataloging, data quality checks, and metadata management. It can also generate synthetic data to bridge data gaps, test hypotheses, and mimic scenarios, particularly valuable in sectors that handle sensitive data. Moreover, it can help recognize data insights and trends, accelerating the decision-making process.

However, the efficient usage of generative AI needs precise, comprehensive, and reliable data aided by strong data quality management and governance frameworks. A modern data platform is vital for handling huge-scale data and performing advanced analytics. It plays a vital role in driving innovation and enabling informed decisions. For instance,

- In September 2024, Oracle introduced its Intelligent Data Lake and generative AI-enabled analytics as part of the Oracle data intelligence platform. Enterprises can more effortlessly make use of data from varied sources in a combined experience by combining data warehouses, data analytics, orchestration, and AI, within a Data Intelligence Platform, empowered by Oracle.

Such advanced capabilities of generative AI create various new prospects for the autonomous data platforms market.

Impact of Reciprocal Tariffs

Reciprocal Tariffs can affect the Overall Operations and Infrastructure Costs of Autonomous Data Platform

The reciprocal tariffs imposed by the U.S. government over more than sixty countries across the world can impact the overall trade agreements globally. Several impacts on the market include disruption in IT spending, supply chain, and an increase in operational costs.

New tariffs would have an inflationary effect on technology costs in the U.S., leading to considerable disruption across operations. While this impact can be most instant in devices, other areas such as storage, compute, and network hardware along with data center construction will also be affected. Even sectors such as services and software will be impacted.

An unintended consequence of the tariff is the negative impact on services and software. Vendors offering these solutions may face increased infrastructure costs required to develop and deliver their offerings. As a result, many software and services providers will be required to comprise augmented costs in their own pricing conventions.

MARKET DYNAMICS

AUTONOMOUS DATA PLATFORM MARKET TRENDS

Growing Popularity of Data Lakes to Boost Market Expansion

Data lakes are unified repositories developed to store huge amounts of raw data in their native format until the data is required for analysis. They are highly scalable and flexible, making them a robust complement to customary data warehouses. They enable enterprises to store and process several kinds of data, comprising structured, unstructured data, and semi-structured data.

- In May 2025, Informatica formed an alliance with Databricks that allows customers to enhance their on-premises, Hadoop-based data lakes by integrating the Intelligent Data Management Cloud platform of Informatica and the Data Intelligence Platform of Databricks, delivering a robust foundation for analytics and AI workloads.

Enterprises that can efficiently leverage data lakes are better equipped to manage and derive insights from the huge amounts of data they produce, offering them a substantial competitive advantage.

Market Drivers

Real-time Compliance and Risk Management to Drive Market Progress

AI-based technologies can monitor data admittance, identify risks, and implement compliance rules in real time through automated mechanisms. This modification can help users maintain reliable and accurate governance over massive datasets while reducing the risk of manual errors. Moreover, autonomous governance serves as a strong foundation for developing more scalable and reliable data ecosystems.

AI data platforms offer numerous benefits to enterprises, such as enhanced efficiency, improved accuracy, predictive systems capabilities, risk mitigation, and a competitive edge. Artificial intelligence platforms have transformed sectors such as healthcare, financial services, telecommunications, and many others across the globe. In financial services, leveraging AI enables better product development, process automation, and improved customer service.

- In March 2025, Databricks and Palantir announced a strategic product collaboration that combines Palantir's AI functioning system and platform for AI, data warehousing, and data engineering of Databricks. The partnership provides an accessible and open data architecture that unifies Palantir's Ontology System with processing scale and data and the AI platform of Databricks.

Such advancements and integrations of AI and ML within data platforms drive market progress.

Market Restraints

Higher Implementation Costs of Product to Hamper Market Growth

The implementation costs of an autonomous data platform can vary significantly depending on factors such as the chosen platform, specific implementation requirements, ongoing maintenance costs, subscription costs, and other related costs.

Implementation of the data platform comprises data migration, incorporation with prevailing systems, and user training. These services can be provided by the platform vendor, a dedicated consultant, or an in-house IT team. The cost depends on the intricacy of the execution and the vendor rates. It also requires employee training, which is necessary to exploit the value of the platform. This training may include vendor-led sessions, internal training sessions, and online courses. However, SMEs and start-ups may find it challenging to afford all these costs, which could limit the usage of these platforms and hamper market growth.

Market Opportunities

Self-healing Capabilities of Autonomous Data Platforms to Open-up New Market Opportunities

One of the key capabilities of the autonomous database is its self-driving proficiency. It automatically tunes performance, allocates resources, and implements security patches, ensuring optimal database performance without any human intervention.

The autonomous database automatically safeguards against unauthorized access and cyber threats by leveraging security updates and patches in real-time. This minimizes the risk of susceptibilities and improves data integrity. It reduces downtime with the help of its self-repairing competencies. It automatically identifies and addresses issues, assuring high reliability and availability. Hence, various enterprises are innovating and integrating new self-healing capabilities within their data platforms. For instance,

- In May 2025, Nom Nom Data Inc. secured an innovative self-healing Data and AI Patent from the USPTO (United States Patent and Trademark Office). The patent U.S. Patent No. 12,298,995, developed by Nom Nom helps in fixing performance issues and errors in ETL-associated data procedures by leveraging Generative AI and Natural Language Processing.

Thus, the incorporation of self-healing competencies within data platforms creates various new market opportunities.

SEGMENTATION ANALYSIS

By Deployment

Hybrid Cloud Deployment to Grow Rapidly due to Cost-Effective Access to Advanced Technologies

Based on deployment, the market is categorized into private cloud, public cloud, and hybrid cloud.

The hybrid cloud segment is anticipated to grow with the highest CAGR during the forecast period, owing to a rising preference for hybrid cloud deployments. It helps businesses to leverage the capabilities of both public and private cloud. Moreover, enterprises utilizing multi-cloud strategies can minimize operational costs by up to 30%, thereby providing cost effectiveness to enterprises. For instance,

- As per Gigamon Insights 2023, 72% of enterprises have deployed hybrid cloud infrastructure for security purposes. Traditional tools designed for on-premises infrastructure can be insufficient to monitor and safeguard the modern digital infrastructure.

The public cloud segment dominates the market with the highest CAGR during the study period. The public cloud segment led the market share by 48.40% in 2024. Public cloud platforms empower enterprises to adopt enhanced technologies such as data management, blockchain, AI, and large-scale analytics without the burden of high maintenance and setup costs. This democratization of technology empowers innovation and enhances customer satisfaction.

By Enterprise Type

Large enterprises Dominated due to its Ability to Handle Intricate Complex Data Needs

Based on enterprise type, the market is bifurcated into small & mid-sized enterprises and large enterprises.

Large enterprises held the highest market share in 2024. Autonomous data platforms are predominantly beneficial for large enterprises owing to their ability to manage complex data requirements and sophisticated infrastructure needs. These platforms offer advanced automation and robust security, which are essential for enterprises dealing with huge amounts of data. Large enterprises are expected to hold the highest market share by 51.31% in 2026.

Small & mid-sized enterprises are expected to grow with the highest CAGR of 24.46% during the forecast period. Autonomous data platforms are becoming essential for small & mid-sized enterprises (SMEs) as they help them automate data management, improve performance, and deliver real-time analytics in a cost-effective manner. These platforms automate several routine data management operations, providing more time to IT employees for more strategic projects. Moreover, automation minimizes the requirement for focused data management expertise, thereby lowering staffing costs.

By Industry

To know how our report can help streamline your business, Speak to Analyst

Numerous Applications and Benefits of Autonomous Data Platform Boosted IT & Telecom Segment’s Growth

By industry, the market is classified into BFSI, healthcare, IT & Telecom, retail & e-commerce, manufacturing, government, and others (transportation & logistics, utilities, etc.).

IT & telecom held the highest market share in 2024, owing to widespread usage of the product for IT operations automation, data governance, and compliance. These platforms offer several key benefits, such as enhanced customer experience, better network performance monitoring, and improved fraud prevention and detection. Hence, various market players are developing autonomous data solutions tailored for the industries. IT & telecom segment is projected to capture 27.36% in 2026. For instance,

- In February 2023, Google Cloud launched telecom data fabric, a data and analytics platform developed to support CSPs (Communications Service Providers) to capitalize on their data assets, address data issues, accelerate innovation, and manage their networks efficiently and effectively. Telecom Data Fabric, CSPs to fast-track data transformation by leveraging a streamlined and automated data platform.

BFSI is likely to grow with the highest CAGR of 27.43% during the forecast period, driven by rising digitization, growing usage of AI and ML technologies, and increasing preference for automation. As banks and financial institutions are able to minimize manual work operations, they can redirect resources toward innovations and developments and better customer service.

AUTONOMOUS DATA PLATFORM MARKET REGIONAL OUTLOOK

North America

North America Autonomous Data Platform Market Size, 2025 USD Billion

To get more information on the regional analysis of this market, Download Free sample

North America held the largest market value in 2026, accounting for USD 1.01 billion, and USD 0.85 billion in 2025.The region held the highest autonomous data platform market share in 2024, owing to the early adoption of cloud-driven data platforms, higher preference for hybrid cloud models, and the growing data management requirements of high-tech firms in the U.S. and Canada. The region also benefits from a larger presence of key players such as Oracle, IBM, Qubole, Cloudera, Inc., AWS, and others, which contributes significantly to higher market penetration in the region.

Download Free sample to learn more about this report.

The U.S. market is anticipated to hit USD 0.48 billion in 2026. The U.S. plays a key role in the adoption of autonomous technologies owing to its robust high-tech infrastructure and widespread implementation of AI and Machine Learning (ML) technologies across several states. This significantly contributes to the country's leading share in the autonomous data platform market growth. For instance,

- In January 2025, ServiceNow expanded Workflow Data Fabric competencies with new Oracle Autonomous Database, Oracle Database, and 23ai integration. This integration enables bi-directional data exchange and zero-copy data sharing between Oracle data sources and the ServiceNow platform, empowering smart decision-making and enhanced enterprise agility.

Europe

Europe is the second-fastest growing market projected to hit USD 0.74 billion in 2026 and anticipated to grow at the second-largest CAGR of 23.64% during the forecast period, owing to growing investments in data platforms, cloud, and AI across Spain, France, Italy, and other countries. The region is witnessing a significant adoption of data-driven innovations across sectors such as healthcare, banking, and manufacturing, which further fuels market progress. For instance,

- In October 2024, Amazon introduced a scalable data platform for the European Health Data Space (EHDS) using AWS. The platform enables organizations across Europe to build scalable and secure data platforms and infrastructure for secondary usage of healthcare data, supporting compliance in the healthcare sector.

The U.K. market is expected to gain USD 0.17 billion in 2026, accompanied by the estimated value of Germany to be USD 0.16 billion in 2026 and France’s market to be USD 0.10 billion in 2025.

Asia Pacific

Asia Pacific is projected to be the third-largest market, showcasing USD 0.56 billion in 2026 and grow with the highest CAGR during the study period due to the wider adoption of cloud computing, hybrid cloud deployments, and a higher preference for synthetic datasets. Additionally, several key market players are expanding their presence in Japan, Singapore, India, and other countries to extend their business reach and revenue streams. For instance,

- As per Industry Experts, most enterprises in Asia Pacific have started implementing hybrid cloud deployments. The trend is prominent in India, where 85% of organizations reported using one or more workloads in a hybrid cloud setting.

The Chinese market is expected to gain USD 0.18 billion in 2026, accompanied by the estimated value of Japan to be USD 0.14 billion in 2026 and India’s market to be USD 0.09 billion in 2026.

Middle East & Africa

The Middle East & Africa is the fourth-largest market and estimated at USD 0.30 billion in 2026, especially in South Africa, UAE, and Turkey, owing to rising investments in automation, cloud-driven infrastructure, and higher digital transformation efforts. Key benefits such as automation of data management operations, enhanced security, actual-time analytics, and reduced reliance on manual processes are further fueling market expansion in the region. The GCC market is projected to reach USD 0.10 billion in 2025.

South America

South America is experiencing significant growth in the autonomous data platform market. The progress can be credited to the region's economic evolution and the expanding digitization across different sectors in the region. Additionally, partnerships, mergers, and acquisitions, especially in Brazil and Argentina are contributing to market progress. For instance,

- In January 2024, Nubank, a Brazilian challenger, acquired the U.S.-based data intelligence start-up Hyperplane for an undisclosed sum. The deal enables Nubank to utilize Hyperplane's AI proficiency to empower its core machine learning infrastructure, aiming to deliver more personalized financial solutions and services to its customers.

Competitive Landscape

KEY INDUSTRY PLAYERS

Key Players are Presenting Advanced Solutions to Expand their Business Presence

Players in the market, such as Oracle, IBM, Microsoft, Databricks, Cloudera, Inc., and Teradata, are introducing new solutions to boost their position in the market. These players are using modernized technological amplifications, addressing growing demands and attaining a competitive edge. Their strategies focus on enhancing product offerings through strategic alliances, mergers, acquisitions, and investments. These progressive developments enable them to uphold their market share in a rapidly evolving industry.

Long List of Companies Studied:

- Oracle (U.S.)

- IBM (U.S.)

- Teradata (U.S.)

- Veritas Technologies LLC (U.S.)

- Databricks (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Microsoft (U.S.)

- Qubole (U.S.)

- Cloudera, Inc. (U.S.)

- Hewlett Packard Enterprise Development LP (MapR) (U.S.)

- Alteryx (U.S.)

- Denodo Technologies (U.S.)

- Ataccama (U.S.)

- Collibra (Belgium)

- DataRobot, Inc. (U.S.)

- Snowflake Inc. (U.S.)

- Informatica Inc. (U.S.)

- Google Cloud Platform (U.S.)

and Others

KEY INDUSTRY DEVELOPMENTS:

May 2025: Cloudera announced the launch of AI-driven unified data visualization for its on-premise data center to expand its AI proficiencies to customers working in on-premises environments. This new product offering is a high-enactment AI tool that democratizes understanding over the complete data lifecycle.

April 2025: Altair Partners formed an alliance with Databricks to fast-track data-driven innovations. The alliance offers a seamless connection between the Databricks Data Intelligence Platform and Altair RapidMiner, strengthening machine learning and data science capabilities.

October 2025: Ataccama introduced an AI agent, Ataccama ONE AI Agent, for data management. The independent data companion that profoundly changes and quickens data management. The agent intelligently selects the ideal approach for allocated tasks, self-corrects as required, manages the multifaceted data necessities independently, and offers transparent results for users to review.

September 2024: Oracle and Amazon Web Services collaborated to introduce Oracle Database@AWS, enabling customers to access Oracle Autonomous Database and Oracle Exadata Database Service on dedicated infrastructure within AWS. The partnership offers customers a combined experience between AWS and Oracle Cloud Infrastructure (OCI), offering streamlined database administration and integrated customer support.

September 2023: Cloudera and AWS formed an alliance to improve data solutions. The collaboration aims to simplify access to the Cloudera Data Platform (CDP) on AWS and enable customers to use credits to accelerate cloud workload migration.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Data-driven platforms are progressively becoming focal points for capital investments and funding. These platforms serve as a unified hub for data management and analytics, enabling informed, data-driven decision-making across different sectors such as banking, healthcare, retail, and others. Investment and funding secured by small enterprises and start-ups are actively aiding the development and implementation of these platforms, recognizing their potential to improve productivity and proficiency. For instance,

- In September 2023, Denodo secured USD 336 million in funding from TPG Growth. The data management provider aimed to leverage this capital to boost its research and development efforts and support worldwide expansion initiatives.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, service types, and leading applications of solutions and services. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 21.47% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Enterprise Type

By Industry

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

The market is projected to reach USD 12.83 billion by 2034.

In 2026, the market was valued at USD 2.71 billion.

The market is projected to grow at a CAGR of 21.47% during the forecast period.

The BFSI segment is expected to grow with the highest CAGR.

Real-time compliance and risk management to drive market progress.

Oracle, IBM, Microsoft, Databricks, Cloudera, Inc., Teradata, Amazon Web Services, Inc., and DataRobot, Inc. are the top players in the market.

North America held the highest market share in 2025.

By deployment, the hybrid cloud segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us