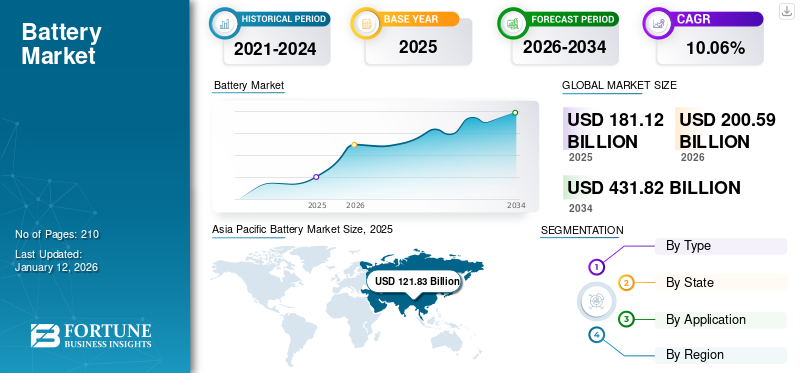

Battery Market Size, Share & Industry Analysis, By Type (Lithium-ion Battery, Lead-acid Battery, Nickel–cadmium Battery, Nickel-metal Hydride Battery, and Others), By State (Primary and Secondary), By Application (Electric Mobility, Energy Storage, Consumer Electronics, and Others), and Regional Forecast, 2026-2034

Battery Market Size and Future Outlook

The global Battery market size was valued at USD 181.12 billion in 2025. The market is projected to grow from USD 200.59 billion in 2026 to USD 431.82 billion by 2034, exhibiting a CAGR of 10.06% during the forecast period. Asia Pacific dominated the battery market with a market share of 67.27% in 2025.

A battery is an electrochemical device composed of one or more cells that convert chemical energy into electrical energy. It consists of two electrodes, the cathode (positive terminal) and anode (negative terminal), separated by an electrolyte. Batteries supply electrical power to external devices through redox reactions, enabling energy flow in various applications from small electronics to electric vehicles.

- According to the International Energy Agency, electric cars accounted for 18% of overall cars sold in 2023, up from 14% in 2022. The robust growth in EV adoption and sustainability concerns is expected to foster market growth over the forecast period.

Furthermore, the market encompasses several major players. CATL, BYD, and LG Energy Solution are dominant players in the battery market, with CATL leading market share, followed by BYD and LG leading market players despite experiencing some market share decline. CATL and BYD, both Chinese companies, hold a significant combined market share, emphasizing Asia's overall dominance in the industry.

MARKET DYNAMICS

MARKET DRIVERS

Increasing adoption of electric vehicles (EVs) drives the Market Growth

The rapid rise in electric vehicle (EV) sales drives the battery market growth, as EV requires a significant battery pack. Government incentives and stringent emissions regulations encourage this trend, leading to massive investments in battery production and innovative technologies. Key drivers for the market include demand for higher energy density, longer-lasting, and faster-charging batteries, pushing manufacturers to emphasize on improvements in lithium-ion technology and the development of next-gen solutions and sources such as solid-state batteries.

- According to the International Energy Agency, electric vehicles are expected to account for 40% of global car sales by 2030, owing to the large-scale adoption and decreasing prices.

MARKET RESTRAINTS

High Capital Requirements to Restrain Manufacturing Expansion

The battery industry, particularly in lithium-ion and next-generation chemistries, is highly capital-intensive. Establishing large-scale manufacturing facilities, often referred to as gigafactories, requires multi-billion-dollar investments. These costs are not only associated with the construction of advanced production lines but also include expenditures on research and development, safety systems, quality control, and skilled workforce training. Smaller companies and new entrants often find it difficult to secure the required funding, creating barriers to entry and limiting competition.

MARKET OPPORTUNITIES

Growing Demand from Consumer Electronics and IoT Devices to Support Expansion

The rapid proliferation of smartphones, laptops, tablets, and wearable devices continues to drive steady demand for compact, lightweight, and long-lasting batteries. Additionally, the Internet of Things (IoT) ecosystem, ranging from smart home devices to industrial sensors, is creating new avenues for battery consumption. These applications require reliable power sources with high energy density, faster charging, and longer lifespans. As global connectivity and digitization expand, the consumer electronics and IoT sectors will remain major contributors to battery market growth, offering consistent revenue opportunities and encouraging manufacturers to innovate in miniaturized and efficient battery technologies.

- For instance, in May 2025, SYNergy ScienTech Corp launched ultra-fast charging battery cells using Echion’s XNO niobium anode, highlighting its fast charging, long cycle life, high energy density, and safety for diverse electronic applications.

BATTERY MARKET TRENDS

Robust Investments for Domestic Battery Manufacturing is one of the Significant Market Trends

The global battery market is witnessing a strong push toward localization as governments and companies aim to reduce dependence on a few dominant regions for raw materials and manufacturing. Countries such as the U.S., India, and members of the EU are investing heavily in gigafactories and encouraging domestic supply chains through incentives and policy frameworks. This trend is driven by energy security concerns, geopolitical risks, and the need to meet growing demand for electric vehicles and energy storage systems. Localized hubs also foster innovation, create jobs, and reduce logistical costs while safeguarding more resilient production networks.

- For instance, in September 2025, the Faraday Institution announced investment of USD 10 million in two battery research projects to enhance production, costs, and innovate next-generation battery technologies.

MARKET CHALLENGES

Raw Material Scarcity and Price Volatility to Create Challenges for Market Players

The global battery market faces significant challenges due to scarcity and fluctuating prices of critical raw materials such as lithium, cobalt, and nickel. These resources are concentrated in a few regions, making supply chains highly vulnerable to geopolitical tensions, export restrictions, and mining disruptions.

Price volatility directly impacts production costs, affecting profitability for manufacturers and raising prices for end-users. Moreover, concerns over unethical mining practices and environmental impacts further adds to the complexity. To mitigate these risks, companies are exploring alternative battery chemistry, long-term supply agreements, and investments in recycling, but raw material instability remains a major market challenge.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

High Adoption of Lithium-Ion Battery in Consumer Electronics and Energy Storage Applications Contributes to Segmental Growth

Based on type, the market is classified into lithium-ion battery, lead-acid battery, nickel–cadmium battery, nickel-metal hydride battery, and others.

The Lithium-ion Battery segment accounted for a significant Battery market share of 51.37% in 2026. Key factors for this growth include the high energy density, long cycle life, and fast-charging capabilities of Li-ion batteries, making them ideal for portable devices and grid-scale storage. Continuous innovation in consumer electronics and government initiatives such as the FAME and PLI schemes in India are further boosting demand and investment, contributing to the ongoing expansion of the Li-ion battery segment.

- For instance, in December 2025, CATL and Stellantis announced an investment of USD 4.7 billion in a joint venture for the development of a large-scale LFP battery plant in Spain.

By State

Rising Demand for Rechargeable Batteries is Driving the Segment Growth

Based on the State, the market is segmented into Primary and Secondary.

The Secondary segment held the dominating position with a market revenue share of 100.00% in 2026. The secondary battery market demand is accelerating, driven by surging electric vehicle adoption, renewable energy sources integration, and rising use in consumer electronics and industrial applications, supported by advancements in lithium-ion, solid-state, and other next-generation technologies offering higher efficiency and sustainability.

- For instance, in April 2025, Toshiba Corporation launched a new SCiB lithium-ion rechargeable battery module for EV buses, electric ships, and stationary applications. Featuring an aluminum baseplate that doubles heat dissipation, the product is available globally.

By Application

High Investments in EV battery production across the Globe are expected to Propel Segment Growth

Based on the application, the market is segmented into Electric Mobility, Energy Storage, Consumer Electronics, and Others.

In 2026, Electric mobility accounted for the largest share of 54.36% in the market. The rising adoption of electric vehicles, e-bikes, and electric buses is fueling demand for high-performance, efficient, and durable batteries, supported by government incentives, charging infrastructure expansion, and sustainability goals. Furthermore, the segment is set to hold a 53.86% share in 2026.

- For instance, in September 2025, Imec announced the development of a lithium-metal solid-state battery with an energy density of 1070 watt-hours per liter (Wh/L). These new batteries surpass typical lithium-ion batteries, which max out at 800 Wh/L. Their higher energy density allows more energy storage in the same space, enabling longer range and greater power for electric vehicles. Continuous development in battery technology for electric vehicles is expected to fuel market growth in the coming years.

To know how our report can help streamline your business, Speak to Analyst

In addition, the consumer electronics segment is projected to grow at a CAGR of 10.06% during the study period.

Battery Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Battery Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific held the dominant share in 2025, valued at USD 121.83 billion, and also took the leading share in 2026 with USD 136.38 billion. Battery demand in Asia Pacific is surging, driven by rapid electric vehicle adoption, strong consumer electronics manufacturing, and expanding renewable energy projects. Government initiatives, large-scale industrialization, and rising investments in localized gigafactories further strengthen the region’s dominance in global battery consumption. In 2026, the China battery market is estimated to reach USD 91.77 billion.

- For instance, in September 2026, Ashok Leyland announced an investment of USD 571 million in EV battery production in India. Such large-scale developments are fostering the market growth in the region.

Europe

Other regions, such as Europe and North America, are anticipated to witness a notable growth in the coming years. During the forecast period, the European region is projected to record a growth rate of 10.28%, which is the second highest amongst all the regions, and touch the valuation of USD 33.32 billion in 2026. This is primarily due to the electric mobility adoption and supportive regulations, and rising regional manufacturing capacity. Backed by these factors, countries including Germany are expected to record the valuation of USD 10.78 billion, the U.K. to record USD 7.94 billion in 2026. Italy to record USD 5.30 billion in 2025.

North America

After Europe, the market in North America is estimated to reach USD 21.17 billion in 2026 and secure the position of the third-largest region in the market. Passenger EVs and commercial EVs (buses, light trucks, vans) are the single largest demand source for lithium-ion cells and packs in North America. In addition, multiple battery cell and pack plants are under construction or planned across the U.S. and Canada as the on-shoring wave accelerated by subsidies and automaker commitments.

Latin America and Middle East & Africa

Over the forecast period, the Latin America and Middle East & Africa regions would witness a moderate growth in this market. The Latin America market in 2026 is set to record USD 3.24 billion in its valuation. Governments are promoting EVs with incentives and charging infrastructure expansion, boosting demand for batteries in these regions. In the Middle East & Africa, GCC is set to attain the value of USD 3.70 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players Adopting Collaboration and Strategic Partnership Strategies to Expand Regional Presence

The global market is highly fragmented, with key players and some medium-scale regional players delivering a wide range of power technology at local and country levels across the value chain. Numerous companies are actively operating across different countries to cater to specific customer demands. With a highly fragmented structure, the global market consists of a prominent player alongside medium-scale regional industry participants. These players offer a wide array of power technology at the country and local levels throughout the value chain to meet specific needs of customers.

In January 2025, Clarios and Altris entered into a collaboration agreement to accelerate the advancement of sustainable sodium-ion battery technology. The partnership aims to create low-voltage sodium-ion batteries for the automotive industry, paving the way for automakers to explore innovative multi-batteries solutions that integrate lithium-ion, Absorbent Glass Mat (AGM) lead-acid batteries, and other chemistries in vehicles. Meanwhile, lead-acid batteries have emerged as a prime example of a successful circular economy approach in the industry.

LIST OF KEY BATTERY COMPANIES PROFILED

- CATL (China)

- LG Energy Solution (South Korea)

- Panasonic (Japan)

- BYD (China)

- Samsung SDI (South Korea)

- SK Innovation (South Korea)

- GS Yuasa Corporation (Japan)

- EVE Energy Co., Ltd. (China)

- Toshiba Corporation (Japan)

- Exide Industries Ltd (India)

- Tesla, Inc. (U.S.)

- A123 Systems LLC (U.S.)

- EnerSys (U.S.)

- East Penn Manufacturing Co. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- September 2025: Epsilor Electric Fuel Ltd. unveiled the world’s most powerful lithium-ion batteries for military vehicles. The ELI-52526-GM battery, developed in a compact NATO 6T form factor, delivers an exceptional energy capacity of 4,400 watt-hours (Wh), representing the highest available in its class.

- July 2025: Cygni Energy partnered with XDLE Battery to co-develop cost-effective, ultra-long-life energy storage solutions ranging from 20kWh to 1MWh for India's Commercial and Industrial sectors. This collaboration aims to reduce electricity tariffs, accelerate renewable energy adoption, and offer solutions with an industry-leading warranty of 10+ years to encourage financing partner participation and drive investments.

- June 2025: Neuron Energy Neuron Energy announced the launch of its Gen 2 lithium-ion battery packs, specifically engineered for electric two-wheelers, three-wheelers, and light commercial vehicles. The new battery series will be available across India starting July 2025.

- April 2025: Hyundai Motor Company and Kia Corporation announced a strategic partnership with Exide Energy Solutions Ltd. to localize electric vehicle (EV) battery production in India. This collaboration enables Hyundai and Kia to equip their future EVs in the Indian market with locally manufactured lithium-iron-phosphate (LFP) batteries.

- April 2025: Contemporary Amperex Technology Co. Limited (CATL) launched a new brand, Naxtra, for its sodium-ion batteries, with mass production slated to begin in December 2025. Moreover, CATL also introduced the second generation of its fast-charging battery technology for electric vehicles, further advancing its portfolio of high-performance energy storage solutions.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 10.06% from 2026-2034 |

|

Unit |

Value (USD Billion) & Volume (GWh) |

|

Segmentation |

By Type · Lithium-ion Battery · Lead-acid Battery · Nickel–cadmium Battery · Nickel-Metal Hydride Battery · Others |

|

By State · Primary · Secondary |

|

|

By Application · Electric Mobility · Energy Storage · Consumer Electronics · Others |

|

|

By Geography · North America (By Type, By State, By Application, and Country) o U.S. (By Type) o Canada (By Type) · Europe (By Type, By State, By Application, and Country) o Germany (By Type) o UK (By Type) o Italy (By Type) o France (By Type) o Spain (By Type) o Rest of Europe (By Type) · Asia Pacific (By Type, By State, By Application, and Country) o China (By Type) o India (By Type) o Japan (By Type) o South Korea (By Type) o Southeast Asia (By Type) o Rest of Asia Pacific (By Type) · Latin America (By Type, By State, By Application, and Country) o Brazil (By Type) o Mexico (By Type) o Rest of Latin America (By Type) · Middle East & Africa (By Type, By State, By Application, and Country) o GCC (By Type) o South Africa (By Type) · Rest of the Middle East & Africa (By Type) |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 181.12 billion in 2025 and is projected to reach USD 431.82 billion by 2034.

In 2025, the market value stood at USD 121.83 billion.

The market is expected to exhibit a CAGR of 10.06% during the forecast period of 2026-2034.

The lithium-ion battery segment led the market by type.

The key factors driving the market are increasing adoption of electric vehicles (EV) and Growing Demand from Consumer Electronics and IOT Devices.

CATL, LG Energy Solution, Panasonic, BYD, and Samsung SDI are some of the prominent players in the market.

Asia Pacific dominated the market in 2025.

Major factors favoring battery product adoption include technological advancements improving performance (such as range and charging speed), falling battery costs, expansion of charging infrastructure, supportive government policies and incentives, growing consumer environmental awareness, and established social norms including peer pressure and social influence.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us