Beverage Ingredients Market Size, Share & Industry Analysis by Ingredient Type (Flavors, Sweeteners {Sugar, Stevia, Aspartame, and Others}, Colorants, Functional Ingredients {Proteins, Antioxidants, Prebiotics, and Others), and Others), By Nature (Natural and Synthetic), By Application (Alcoholic Beverages, Dairy & Plant-based Beverages, Soft Drinks, Functional Drinks, and Others), By Functionality (Acidulating, Preserving, Nutritional Enrichment, Flavoring, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

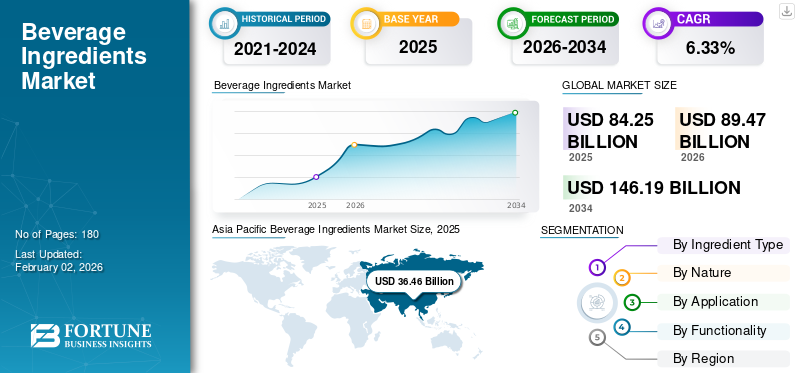

The global beverage ingredients market size was valued at USD 84.25 billion in 2025 and is projected to grow from USD 89.47 billion in 2026 to USD 146.19 billion by 2034, registering a CAGR of 6.33% over the forecast period. Asia Pacific dominated the beverage ingredients market with a market share of 43.28% in 2025.

Beverage ingredients are essential components that are utilized in the processing, formulation, enhancement, and preservation of drinks. Colorants, flavors, sweeteners, and functional ingredients are key ingredients used in the beverage sector. These components can be produced by both synthetic and natural extraction methods. Predominantly, they are utilized for sensory enhancement, improving nutrition & functionality, and strengthening mouthfeel and the texture of soft drinks, fortified juices, and alcoholic beverages. The shift toward health & wellness and growing natural/clean labels trend are major factors escalating the market’s potential. In terms of consumption, the Asia Pacific and Europe are the leading consumers of beverage components.

The improved food and beverage production and increasing incidences of health ailments propel the market’s potential. Some of the well-known key industry players include Cargill, Incorporated, Archer Daniels Midland Company (ADM), and Novozymes A/S.

Beverage Ingredients Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 84.25 billion

- 2026 Market Size: USD 89.47 billion

- 2034 Forecast Market Size: USD 146.19 billion

- CAGR: 6.33% from 2026–2034

Market Share:

- Asia Pacific dominated the global beverage ingredients market with a 43.28% share in 2025, supported by the strong presence of established beverage manufacturers, high consumption of fortified drinks, and increasing preference for clean-label and natural products. The Asia Pacific region followed closely, driven by rising disposable incomes, growing health awareness, and expanding packaged drink consumption in markets such as China, India, and Japan.

- By ingredient type, the sweeteners segment held the largest share in 2024, owing to its versatility and widespread use in dairy beverages, soft drinks, and plant-based drinks. The natural ingredients segment also maintained dominance due to strong consumer demand for plant-derived, minimally processed, and health-promoting beverage components.

Key Country Highlights:

- United States: Leads the North American market due to a mature beverage processing industry, high per-capita consumption of functional and fortified drinks, and growing demand for natural sweeteners and clean-label ingredients.

- China: Rising disposable incomes and urbanization are fueling demand for functional and fortified beverages, especially probiotics and protein-enriched drinks.

- India: Rapid growth in packaged beverages, along with increasing health consciousness and social media influence, is driving the adoption of natural and functional beverage ingredients.

- Germany: Strong consumer preference for vegan and plant-based beverages, coupled with expanding RTD (ready-to-drink) product innovation, supports steady market growth.

- Japan: Technological advancements and innovation in flavoring and functional beverage ingredients continue to propel demand for premium health-oriented drinks.

MARKET DYNAMICS

MARKET DRIVERS

Augmented Demand for Fortified Drinks Fuels the Market’s Momentum

The increased consumer preference for fortified beverages is a major driver propelling the beverage ingredients market growth. Today, most individuals are increasingly looking for fortified drinks with recognizable and simple ingredients, which offer advantages beyond basic nutrition. Probiotics, proteins, and antioxidants can be added to beverages as they are known to enhance immunity, minimize stress, and strengthen gut health. Moreover, other factors such as increasing awareness of the potential benefits of natural components and the risk of synthetic ingredients fuel the demand for natural-ingredient infused drinks. Additionally, the surging focus on reducing carbon footprint further drives the consumption of fortified beverages. By seeing such benefits, key players in the global market are aiming to launch new natural-ingredient-based beverages for consumers.

MARKET RESTRAINTS

Rising Prevalence of Health Ailments Impedes the Market’s Potential

One of the key obstacles in the global industry is the growing cases of chronic health conditions. In the beverage sector, a few of the common ingredients, such as caffeine, phosphoric acid, and sugar, when used in beverage production, pose substantial health risks, such as obesity, osteoporosis, tooth enamel erosion, and cardiac issues. Moreover, some botanicals utilized in beverage preparation may contain pyrrolizidine alkaloids, which are a type of toxin that can lead to liver damage. Additionally, the daily consumption of soft or carbonated drinks can result in insulin resistance, further increasing the chances of type 2 diabetes. These factors are responsible for hindering the global market expansion.

MARKET OPPORTUNITIES

Technological Advancements in the Beverage Industry Unlock Growth Possibilities

The adoption of advanced technology in the beverage sector builds numerous growth opportunities. Precision fermentation is one of the modern technologies that can be used by large-scale beverage producers. This biotechnology method utilizes microorganisms to produce specialized beverage ingredients with improved functional and nutritional properties, resulting in sustainable ingredient development. Moreover, the beverage producers can use advanced gene editing or other tools to enhance the quality of raw materials used for beverage production. Along with this, robotics is also gaining popularity in the food processing market and is used for packaging and ingredient sorting. This automation aids in minimizing manual labor and boosts consistency and speed.

BEVERAGE INGREDIENTS MARKET TRENDS

Surging Inclination toward Functional Ingredients is the Prominent Trend

The global industry is experiencing a remarkable and growing trend, with growing inclination toward functional ingredients. In today’s health-conscious era, most consumers are actively looking for beverages that offer health advantages such as improved immunity, digestion, and energy. These benefits can be achieved by using ingredients such as prebiotics, probiotics, and adaptogens. Beverages fortified with such ingredients strengthen mental wellness, metabolism, and gut health. Thus, to improve their market share, beverage manufacturers are capitalizing on this trend and are introducing new probiotic-enriched yogurt drinks, kombucha, kefir, and green tea for global consumers.

Download Free sample to learn more about this report.

Segmentation Analysis

By Ingredient Type

Sweeteners Dominated the Market Owing to their Versatility

On the basis of ingredient type, the market is divided into flavors, sweeteners, colorants, functional ingredients, and others.

The sweeteners segment is projected to dominate the beverage ingredients market, accounting for 46.61% of the global market share in 2026. In comparison to other beverage ingredients, sweeteners are the most popular and common component widely utilized in dairy drinks, plant-centric beverages, soft drinks, and others. This ingredient is mainly used to enhance the flavor of beverages. Moreover, sugar, among sweeteners, is more economical than sugar substitutes (stevia, monk fruit), further appealing to beverage producers. These factors are anticipated to boost the segment growth.

The flavors segment secured the second position in the global market.

By Nature

Natural Segment Led the Market Due to Wide Availability

Depending on nature, the market is segmented into natural and synthetic.

The natural segment is expected to lead by nature, contributing 83.42% globally in 2026. Globally, most of the ingredients utilized in beverages, such as vitamins, carotenoids, prebiotics, herbs, and others, are derived naturally from plants. These components are widely available and affordable to both high and middle-class income countries. In comparison to synthetic ingredients, these naturally-sourced products provide numerous health benefits as they are minimally processed, which appeals to consumers.

The synthetic segment is expected to flourish at a high CAGR of 4.50% during the study period.

By Application

Soft Drinks Led the Global Market due to their High Demand

Based on application, the market is segregated into alcoholic beverages, dairy & plant-based beverages, soft drinks, functional drinks, and others.

The soft drinks segment accounting for 38.96% of the global market share in 2026. Soft drinks comprise non-carbonated and carbonated fruit-flavored sodas, cola, and lemon drinks, which are highly popular and consumed by every age group. Moreover, these drinks have a prolonged shelf life and are available in various pack sizes, which captivates consumers’ attention. Additionally, the rising social acceptance and surging innovation in food products bolster the segment’s growth.

The alcoholic beverages segment is anticipated to grow at a high CAGR of 7.84% during the study period.

To know how our report can help streamline your business, Speak to Analyst

By Functionality

Flavoring Segment Dominated the Market Due to Demand for Flavorful Drinks

On the basis of functionality, the market is segmented into acidulating, preserving, nutritional enrichment, flavoring, and others.

The flavoring segment leads the market and is anticipated to grow at the same pace in the future. Globally, the majority of consumers are seeking attractive and flavorful beverages that provide both functional and taste advantages. Predominantly, individuals are inclined toward naturally-sourced flavors, when added, improve the overall taste of finished beverages. Trends fueling this demand include the growing social media influences and a spike in the RTD beverages sector.

The nutritional enrichment segment is projected to grow at a CAGR of 9.50% during the forecast period.

Beverage Ingredients Market Regional Outlook

On the basis of region, the market is segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Beverage Ingredients Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 36.46 billion in 2025 and USD 39.09 billion in 2026. In comparison to other regions, the Asia Pacific is recognized as the leading and fastest-growing region, due to the strong penetration of the packaged drinks sector and improved disposable income. Most of the consumers in Asian countries are struggling with lifestyle-related ailments, which necessitate them to opt for functional drinks. Moreover, the growing health & wellness trend is another substantial driver that increases the need for probiotic/protein-infused beverages. Additionally, the strong social media influence in China and India strengthens the marketing of functional beverage ingredients, driving the growth of the regional market. The Japan market reaching USD 3.88 billion by 2026, the China market reaching USD 17.72 billion by 2026, and the India market reaching USD 8.82 billion by 2026.

Europe and North America

Other regions, such as Europe and North America, are expected to witness considerable growth in the future. During the forecast period, the Europe beverage ingredients industry is predicted to record a growth rate of 6.38%, which is the second-highest amongst all the regions. The rising veganism trend and the surging demand for RTD beverages fuel this growth. After Europe, North America secured the third position in the global industry in 2024. The U.S. market reaching USD 12.68 billion by 2026.The enhanced health and wellness trend and the expanding food and beverage industry bolster the market’s growing potential. The U.S. is the leading nation in the North America region, followed by Canada and Mexico. The increasing demand for natural sweeteners and the wide production of clean-label ingredients bolster the market’s growth. The UK market reaching USD 3.95 billion by 2026 and the Germany market reaching USD 5.51 billion by 2026.

South America and the Middle East & Africa

Over the forecast period, South America and the Middle East & Africa are predicted to witness moderate growth in the near term. The rising awareness of functional beverage ingredients and the increased interest in plant-based beverages are likely to support the market growth.

COMPETITIVE LANDSCAPE

Key Industry Players

Dominating Players are Focusing on Product Launches to enhance their Image

Key players in the market include Cargill, Incorporated, Tate & Lyle, Archer Daniels Midland Company (ADM), and others. All the enterprises in the global industry are concentrating on product innovation, which appeals to a wide consumer base. Via such launches, the companies can strengthen their image in the operating marketplace.

List of Key Beverage Ingredients Companies Profiled

- Cargill, Incorporated (U.S.)

- Archer-Daniels Midland Company (U.S.)

- Kerry Group plc (Ireland)

- DuPont (U.S.)

- Tate & Lyle (U.K.)

- Ingredion (U.S.)

- Novozymes A/S (Denmark)

- Mevive International (India)

- Novasol Ingredients Pvt. Ltd. (India)

- Symega Food Ingredients (India)

KEY INDUSTRY DEVELOPMENTS

- September 2025: Lifeway Foods, Inc., an American supplier of fermented dairy items, announced the launch of functional drinks through the Muscle Mates brand. This beverage provides 20 grams of protein and contains active probiotic cultures.

- June 2025: Amul, a dairy brand of Gujarat Cooperative Milk Marketing Federation, revealed its new Amul protein water, which comprises 10 grams of whey protein isolate. This drink is specially launched for fitness-conscious individuals across the Indian market.

- April 2025: Nestlé S.A., a multinational food and beverage conglomerate in Switzerland, introduced protein-based drinks, particularly for individuals on their weight loss journey.

- February 2025: Fermenthe, a Thai-based health drinks enterprise, launched RTD kombucha, which is made with a blend of green tea and black tea and is available for Thai consumers.

- September 2024: Nura, a California-based enterprise, released its latest Madblend stevia extract blend, a low-calorie substitute for sugar. This ingredient offers a similar taste to sucrose and is available across the U.S. market.

REPORT COVERAGES

The market report includes quantitative and qualitative insights into the market. It also offers a detailed global market analysis of sizing and growth rate for all possible market segments. Various key insights presented in the market research report are an overview of related markets, competitive landscape, recent industry developments such as mergers & acquisitions, the regulatory scenario in critical countries, and global market trends.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 6.33% from 2026 to 2034 |

|

Segmentation |

By Ingredient Type · Flavors · Sweeteners o Sugar o Stevia o Aspartame o Others · Colorants · Functional Ingredients o Proteins o Antioxidants o Probiotics o Others · Others |

|

By Nature · Natural · Synthetic |

|

|

By Application · Alcoholic Beverages · Dairy & Plant-based Beverages · Soft Drinks · Functional Drinks · Others |

|

|

By Functionality · Acidulating · Preserving · Nutritional Enrichment · Flavoring · Others |

|

|

By Geography · North America (By Ingredient Type, Nature, Application, Functionality, and Country) o U.S. (Nature) o Canada (Nature) o Mexico (Nature) · Europe (By Ingredient Type, Nature, Application, Functionality, and Country) o Germany (Nature) o France (Nature) o Italy (Nature) o Spain (Nature) o U.K. (Nature) o Rest of Europe (Nature) · Asia Pacific (By Ingredient Type, Nature, Application, Functionality, and Country) o China (Nature) o India (Nature) o Japan (Nature) o Australia (Nature) o Rest of Asia Pacific (Nature) · South America (By Ingredient Type, Nature, Application, Functionality, and Country) o Brazil (Nature) o Argentina (Nature) o Rest of South America (Nature) · Middle East & Africa (By Ingredient Type, Nature, Application, Functionality, and Country) o UAE (Nature) o South Africa (Nature) o Rest of the Middle East & Africa (Nature) |

Frequently Asked Questions

Fortune Business Insights says that the global beverage ingredients market size was valued at USD 84.25 billion in 2025 and is projected to grow from USD 89.47 billion in 2026 to USD 146.19 billion by 2034.

The market is expected to grow at a CAGR of 6.33% during the forecast period (2026-2034).

By nature, the natural segment led the market.

The escalated demand for fortified drinks is a key factor fueling the market growth.

Cargill, Incorporated, Archer Daniels Midland Company (ADM), and Novozymes A/S are a few of the top players in the market.

Asia Pacific held the highest share of the market.

Technological advancements in the beverage industry are likely to unlock new growth possibilities for market players.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us