Big Data in Manufacturing Market Size, Share & Industry Analysis, By Offering (Solution and Services), By Deployment (On-Premise, Cloud, and Hybrid), By Application (Customer Analytics, Operational Analytics, Quality Assessment, Supply Chain Management, Production Management, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

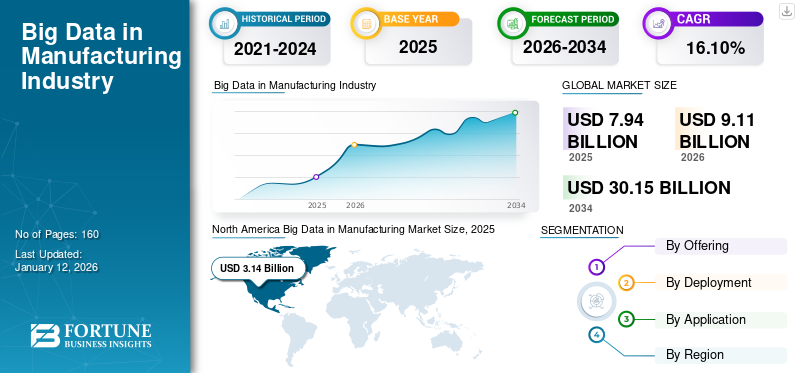

The global big data in manufacturing market size was valued at USD 7.94 billion in 2025. The market is projected to grow from USD 9.11 billion in 2026 to USD 30.15 billion by 2034, exhibiting a CAGR of 16.10% during the forecast period. North America dominated the big data in manufacturing market with a market share of 39.50% in 2025.

Big data in manufacturing refers to the gathering, storing, and analyzing of large quantities of defined and undefined data from manufacturing processes. This helps achieve real-time, analytical, and predictive insights for addressing operational efficiency in a competitive digital environment.

The market is evolving and growing strongly due to the increasing types of data available through connected devices, sensors, and systems. This data in manufacturing consists of a wide range of analytical products/solutions, such as analytics platforms and IoT-connected systems/devices. It also includes consulting and system integration services for optimizing production efficiency, supply chain, and/or predictive maintenance.

The market is highly competitive due to top players such as SAS Institute, Altair Engineering, IBM, Microsoft, and Accenture developing and implementing next-generation analytics solutions with targeted services or advanced offerings through broader studios or connections.

Download Free sample to learn more about this report.

The COVID-19 pandemic accelerated the use of big data solutions in manufacturing and developing optimal operational resilience and remote monitoring. However, supply chain gaps were barriers to extending vision, observation, analytics, and proactive advancements. Smart factories, through increased data connectivity, usage of machine learning (ML), artificial intelligence (AI), and cloud services, are noticing advancements and growing use cases for making decisions in real or near real-time and developing sustainable practices. Current challenges hampering the adoption of big data patterns, or connectivity, include data and information security issues, interoperability, and the shortage of qualified and experienced data-talented individuals.

IMPACT OF GENERATIVE AI

AI Enhances Big Data Analytics by Improving Data-Driven Operational Efficiency and Decision-Making

Generative AI is profoundly transforming the market by increasing data-based decision-making and the efficiency of operations. The technology allows manufacturers to produce synthetic data, simulate and optimize designs, and forecast maintenance requirements more accurately, thus cutting expenses and downtime. Integrating big data analytics and generative AI creates workflow efficiencies such as supply chain management and quality control, encouraging innovation in smart factories. It can also be used in prototyping and customized manufacturing as the market changes.

However, with the change offered by generative AI, challenges such as data privacy and security still exist. This ensures that the system can be integrated sufficiently, enhancing the need for qualified talent to use generative AI and big data analytics. Furthermore, as generative AI, IoT, and cloud computing continue to advance, generative AI will drive growth and provide an intelligent solution for automated acceptance. Overall, generative AI has enormous implications for the future of the manufacturing industry and shifts in restructuring.

Big Data in Manufacturing Market Trends

Increasing Adoption of Industry 4.0 Technologies Drives Adoption of Advanced Analytics in Manufacturing

The increased penetration of Industry 4.0 technologies such as IoT, AI, and cloud computing in manufacturing is embracing a new way to engage with big data. There is a growing shift away from traditional manufacturing toward these new methods of manufacturing that characterize smart factories. This utilizes different technologies to enable real-time data analysis automation, optimize production processes, ensure quality control, and reduce operational costs, thus reorganizing the factory into a data-driven ecosystem.

The market is witnessing the emergence of generative AI and synthetic data generation for replicating the manufacturing process for predictive maintenance that allows for a new level of productivity. Further, manufacturers are increasingly using big data platforms and linking them with other machine learning capabilities to analyze and find actionable insights to streamline supply chains and encourage sustainable manufacturing practices. These advancements are fueling big data in manufacturing market growth, as businesses prioritize data-driven decision-making and operational efficiency. The integration of these networks into intelligent systems is shifting the manufacturing processes. North America is foremost due to infrastructure advantages, however, other regions are also expected to showcase prominent growth in the future owing to several digital transformation initiatives.

MARKET DYNAMICS

Market Drivers

Growing Data Generation from Manufacturing Processes Fuels Demand for Big Data Solutions

The surge in the use of IoT devices and sensors in manufacturing leads to the generation of high volumes of data, necessitating robust big data analytics to process and extract information. Data explosion enables a wide range of capabilities, such as advanced planning, predictive maintenance, real-time monitoring, supply chain optimization, and others, through enhanced operational efficiency in manufacturing, aerospace, and automotive sectors, and smart device consumption. Moreover, increased government initiatives, such as Brazil's Nova Indústria Brasil policy, foster digital transformation and encourage product adoption. Integrating cloud computing and artificial intelligence (AI) further increases organizations' ability to analyze complex data sets and aids in innovative smart manufacturing. The rapid growth of data makes scaling more difficult and pushes investment in advanced platforms. As manufacturers focus on data-driven strategies and related outcomes, the demand for these services is rising from organizations such as SAS Institute and IBM, and in strong industrial economies.

Market Restraints

Data Security Risks and System Integration Challenges Restrict Big Data Adoption in Manufacturing

Cyberattacks targeting big data solutions allow manufacturers to expose significant operational and customer data. Integrating big data platforms into existing legacy systems and enabling interoperability across different technologies is complicated, especially for manufacturers with a legacy infrastructure, as it becomes more expensive with higher lead time. Uncertainty, high costs, and slower lead times also constrain adoption due to a lack of standardized and commonly accepted data-sharing protocols initiated in a global supply chain.

Smaller-scale manufacturers struggle with limited financial and human resources, resulting in more delays in implementation. To overcome these constraints, manufacturers need to develop frameworks to secure cybersecurity and access interoperable solutions that enable secure and efficient adoption of big data technologies across the global manufacturing industry.

Market Opportunities

Advancements in AI and Sustainability Initiatives Create New Opportunities for Market

Emerging technologies such as generative AI and ML present remarkable opportunities for manufacturers to elevate big data usage and enable innovation through advanced simulation, accelerated prototypes, and rapid product customization. Manufacturers can use this technology to optimize design and predict potential equipment failures. Big data can increase efficiency, save costs, and maintain consistent global operations.

Additionally, as countries focus on sustainability, there is an opportunity for big data to aid in energy efficiency, waste reduction, and environmentally conscious manufacturing processes and practices to follow regulations. The growth of cloud-based analytics platforms also enables manufacturers and industries, including automotive and pharmaceutical, to enhance their operations and have real-time insight across the business. Companies such as Accenture and Altair Engineering are set to help deliver a tailored solution and aid manufacturers to take advantage of the opportunities, innovate, and maintain a competitive advantage in the global marketplace.

SEGMENTATION ANALYSIS

By Offering

Solutions Segment Dominates Market Due to the Growing Demand for AI and IoT Analytics Platforms

By offering, the market is segmented into solution and services.

The solution segment holds the highest big data in manufacturing market share due to the growing demand for analytics platforms and IoT tools. These solutions optimize production and enable predictive maintenance using AI. With the highest CAGR, the solution segment provides scalable cloud-based software for real-time insights. Additionally, manufacturers adopt AI and IoT for operational efficiency. This reflects the ongoing investments in analytics for smart factories. Prominent companies provide expertise, but Solutions lead due to their direct impact on production and supply chain optimization globally. The solution segment is projected to dominate the market with a share of 65.53% in 2026.

The services segment, including consulting and integration, supports the deployment of solutions. Companies such as IBM and SAS Institute offer services to ensure seamless implementation. However, they hold a small market share due to the growing focus on software-driven transformation. Services also enable customization and integration, helping manufacturers leverage complex platforms.

To know how our report can help streamline your business, Speak to Analyst

By Deployment

Cloud Deployment Leads Market Share Due to Its Cost-effectiveness and Real-time Analytics Capabilities

By deployment, the market is segmented into on-premise, cloud, and hybrid.

The cloud segment leads the market in terms of revenue share. Cloud deployment is attractive due to its cost-effectiveness, agility, and facilitation of real-time data analysis for efficient manufacturing of products and services. It provides easy access to analytics software and enhances the adoption of IoT technologies for intelligent manufacturing. The rising popularity of cloud deployments is further fueled by growing technology vendors such as Microsoft, AWS, and Google, which offer analysis platforms to numerous industries. The cloud segment is expected to lead the market, contributing 52.36% globally in 2026.

However, key industries, including aerospace and defense, prefer on-premise deployment due to sensitive environments, data security, and regulatory compliance. For such manufacturers, the security and control of their data (especially when it is proprietary and system-critical) is paramount in business operations.

The hybrid segment is increasing with the highest CAGR. Hybrid deployment provides flexibility by combining the security and data control of on-premise systems with the scalability, overall cost of operation, and management of cloud solutions. One prominent advantage of hybrid deployments is their ability to satisfy different regulatory environments and operational flexibility that many global manufacturers face. New entrants in the hybrid localization models utilize integrated features of proprietary platforms offered by providers such as Microsoft, Google, and Oracle. This allows manufacturers to increase productivity and gain security, scaled growth, and regulatory compliance.

By Application

Operational Analytics Leads the Market as it Optimizes Production and Minimizes Downtime

By application, the market is segmented into customer analytics, operational analytics, quality assessment, supply chain management, production management, and others (machine maintenance, new product & service innovation).

Operational analytics holds the largest market share as it utilizes real-time data to maximize production operations, minimize downtime, and enhance factory productivity in industries such as automotive and electronics. The operational analytics segment will account for 32.82% market share in 2026.

Customer analytics is experiencing the highest CAGR and has benefited from its rapid growth, as it relies on the analysis of consumer data to create personalized product offerings, improve customer satisfaction, and create solutions that meet the demands of continually changing needs.

Quality assessment expertise uses big data analysis to ensure that products perform reliably. This is critical for the electronics and pharmaceuticals sector, where maintaining high standards and product quality is essential.

Supply chain management supports logistics and inventory by pulling down costs while helping manufacturers monitor their global supply chain more clearly.

Production management is responsible for optimizing planning, allocating resources, and scheduling to make the output efficient for manufacturers worldwide.

Other data analytics applications, such as machine maintenance, utilize predictive analytics to understand equipment failure. Similarly, new product innovation promotes competition in industries with data-driven strategies by using data to support innovation in designs and product delivery to the global marketplace.

BIG DATA IN MANUFACTURING MARKET REGIONAL OUTLOOK

By region, the market is divided into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America

North America Big Data in Manufacturing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America leads the market due to its superior and growing technological infrastructure and adoption of Industry 4.0 technologies. Since the region highly utilizes artificial intelligence (AI), the Internet of Things (IoT), and analytics, it can develop advanced analytical, performance optimization, and data interpretation solutions for manufacturing, especially in the automotive and aerospace sectors. Major companies, such as IBM and Microsoft, provide superior advanced solutions, as analytics provides machine learning, real-time and predictive maintenance, and supply chain optimizations. The North American ecosystem has a strong inclination toward innovation and an optimized digital footprint that is emergent and will facilitate growth in big-data applications.

The U.S. has a significant proportion of the big data in the manufacturing market, as different sectors (e.g., electronics and pharmaceuticals) have accessed analytical platforms, apps, and other big data and data analytics solutions. Additionally, the ongoing analytics will be used for predictive maintenance. American companies such as SAS Institute and Altair Engineering provide different major advancements in analytics solutions. The U.S. is committed to improving smart manufacturing and AI-driven innovation, as big data will be an integrated feature of operations efficiency and product development. The U.S. market is estimated to reach USD 2.72 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

South America

The South American market continues to expand and mature, backed by an increasing digital transformation across industries such as automotive and agriculture. Manufacturers are adopting analytics, which has resulted in improvements to supply chain efficiency and improved competencies in production, among other benefits of big data. Cloud-based solutions are also gaining traction, supported by companies such as Accenture. The macroeconomic environment is complex. However, the region is focused and optimistic on the modernization of industrial processes, which is supporting the continued growth and adoption of big data technologies.

Europe

Europe's market is strong due to its deep industrial base in sectors such as automotive and machinery. Countries, including Germany and the U.K., are deploying numerous IoT and analytics use cases to improve production quality, quality control, and increasingly effective sustainable manufacturing processes. Companies, including SAP SE and Siemens, provide different solutions while also leading digital transformation initiatives. The growing focus on sustainability encourages manufacturers to adopt big data technologies to reduce energy, decrease waste, and move toward sustainability in managing business processes. The UK market is expected to reach USD 0.76 billion by 2026, while the Germany market is anticipated to reach USD 0.77 billion by 2026.

Middle East & Africa

The Middle East & Africa region is an emerging market for big data in manufacturing, with adoption driven by the oil, gas, and mining sectors. Manufacturers use analytics for operational optimization and predictive maintenance, supported by cloud platforms from providers such as Oracle. Infrastructure development and increasing digitalization efforts contribute to gradual growth in big data applications across the region.

Asia Pacific

The market in Asia Pacific is expanding rapidly, fueled by industrial growth in India and China. The region adopts IoT and AI analytics for production and supply chain efficiency, particularly in the electronics and automotive sectors. Companies such as Hitachi Vantara provide innovative solutions, supporting smart factory initiatives. Rapid urbanization and technology investments also drive significant market growth across the region. The Japan market is forecast to reach USD 0.67 billion by 2026, the China market is set to reach USD 0.90 billion by 2026, and the India market is likely to reach USD 0.46 billion by 2026.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Industry Players Such as SAS Institute, IBM, and Microsoft Drive Market Growth by Delivering Innovative Analytics Solutions

A highly competitive big data in manufacturing market is driven by key industry players delivering innovative analytics solutions and services to optimize manufacturing processes. SAS Institute, IBM, Microsoft, Altair Engineering, and Accenture hold significant market share through analytical platforms integrating AI, the Internet of Things (IoT), and cloud computing strategies. These technologies provide real-time insights, predictive maintenance, and supply chain efficiency. These key players also demonstrate an integrated model - hardware options, data analytics software, and consulting and integrated services for different manufacturing areas - with industries such as aerospace, electronics, and automotive. New and emerging vendors are creating specialized vendors for specific niche applications as they work to carve out their distinct markets. While current/emerging players and intact users will continuously assess the local and global market scene and innovate to meet the demands of the smart manufacturing paradigm, they aid in the chronological evolution of big data in manufacturing and its global industry adoption.

List of Key Big Data in Manufacturing Companies Profiled

- IBM (U.S.)

- SAS Institute (U.S.)

- Microsoft (U.S.)

- Oracle (U.S.)

- SAP SE (Germany)

- Accenture (Ireland)

- Altair Engineering (U.S.)

- TIBCO Software (U.S.)

- Alteryx (U.S.)

- FICO (U.S.)

- Amazon (U.S.)

- Google (U.S.)

- Informatica (U.S.)

- Snowflake (U.S.)

- Cloudera (U.S.)

- Teradata (U.S.)

- Hitachi Vantara (Japan)

- Dell Technologies (U.S.)

- Hewlett Packard Enterprise (U.S.)

- Siemens (Germany)

KEY INDUSTRY DEVELOPMENTS

- May 2025: HD Hyundai and Altair Heavy Industries signed a strategic MoU to advance eco-friendly marine engine development using AI and simulation technologies. The project objectives include improving design efficiency, decreasing the development timeline, and optimizing performance to comply with global shipping regulations. Using Altair simulation-driven design techniques, HD Hyundai will aid Altair's predictive analytics technology to accomplish these objectives.

- May 2025: Altair partnered with MILIZE Inc. to distribute its RapidMiner data analytics and AI platform to Japan’s financial services sector, combining Altair’s AI technology with MILIZE’s financial expertise. This collaboration supports digital transformation by enabling rapid, low-code AI solutions for risk management, compliance, and customer analytics, enhancing operational efficiency.

- March 2025: Teradata’s Enterprise Vector Store, powered by NVIDIA NeMo Retriever, manages billions of vectors for trusted AI applications such as RAG and agentic use cases, such as augmented call centers. It supports structured and unstructured data across cloud, on-premises, or hybrid environments, ensuring cost-effective scaling and real-time insights. Expanded NVIDIA integration is planned for 2025.

- December 2024: Teradata integrated VantageCloud with Amazon Bedrock to enable rapid-start generative AI use cases, including retail item discovery and insurance contract retrieval, available in Q2 2025. The Teradatagenai Python package supports scalable text analytics APIs, leveraging models from AI21 Labs and Anthropic to enhance customer experiences and streamline enterprise processes.

- October 2024: Teradata collaborated with NVIDIA to enhance VantageCloud with NVIDIA AI Enterprise, integrating NeMo and NIM microservices for custom large language models, RAG, and agentic workflows. This partnership enables high-performance AI workloads across public and private clouds, with initial AWS available in November 2024 and broader capabilities rolling out through Q1 2025.

REPORT COVERAGE

The report provides valuable insights into the market and focuses on key aspects such as leading companies, offerings, deployment, and leading applications of big data in manufacturing. Besides, the report offers insights into market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 16.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Offering

By Deployment

By Application

By Region

|

|

Companies Profiled in the Report |

IBM (U.S.), SAS Institute (U.S.), Microsoft (U.S.), Oracle (U.S.), SAP SE (Germany), Accenture (Ireland), Altair Engineering (U.S.), TIBCO Software (U.S.), Alteryx (U.S.), and FICO (U.S.) |

Frequently Asked Questions

The market is projected to reach USD 30.15 billion by 2034.

In 2025, the market was valued at USD 7.94 billion.

The market is projected to grow at a CAGR of 16.10% during the forecast period.

The cloud segment is leading the market in terms of revenue.

Growing data generation from manufacturing processes fuels demand for big data solutions, driving market growth.

SAS Institute, IBM, Microsoft, Altair Engineering, and Accenture are the top players in the market.

North America holds the highest market with a share of 39.50% in 2025.

By application, the customer analytics segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us