Commercial Display Market Size, Share & Industry Analysis, By Type (Digital Signage Displays, Interactive Displays, LED Video Walls, and Outdoor Displays), By Display Technology (LCD, LED, and OLED), By Screen Size (Below 32 Inches, 32 to 55 Inches, 56 to 75 Inches, and Above 75 Inches), By Industry (Retail, Hospitality, Healthcare, Education, Entertainment, Corporate, and Government/Public Infrastructure), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

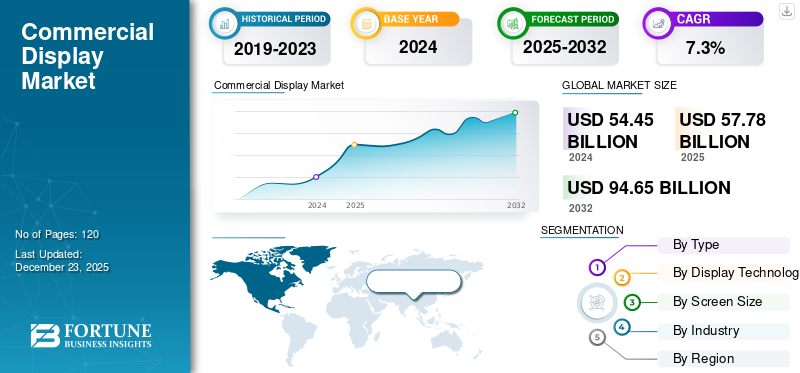

The global commercial display market size was valued at USD 57.78 billion in 2025 and is projected to grow from USD 61.55 billion in 2026 to USD 107.79 billion by 2034, exhibiting a CAGR of 7.30% during the forecast period. North America dominated the global market with a share of 35.30% in 2025.

The demand for commercial displays is increasing, driven by rapid digital transformation across industries, the expansion of digital out-of-home (DOOH) advertising, and the rising need for immersive and dynamic customer engagement tools. Businesses in sectors such as retail, transportation, education, hospitality, and healthcare are increasingly investing in digital signage, interactive displays, LED video walls, and outdoor displays to enhance communication, streamline operations, and improve user experience. Due to digitalization in the retail sector, around 75% of major retail chains globally are deploying in-store digital signage for dynamic pricing, real-time promotions, and interactive shopping experiences.

Key players, including Samsung, LG, NEC, Sony, Barco, and Absen, are constantly upgrading their offerings to meet evolving customer expectations, focusing on Ultra-HD (4K/8K) and fine pixel pitch LED for better visual clarity, System-on-Chip (SoC) displays to reduce TCO and eliminate the need for external media players.

IMPACT OF RECIPROCAL TARIFF

The impact of reciprocal tariffs on the market is significant, due to the industry’s globally interdependent supply chain. Most commercial display hardware components, such as LCD panels, LED modules, semiconductors, and control boards, are manufactured in the Asia Pacific region, especially in China, South Korea, Japan, and Taiwan. When countries such as the U.S. or the European Union (EU) impose tariffs on display imports or key components from these countries, the affected nations often respond with their own countermeasures, disrupting trade flows and increasing procurement costs. These tariffs result in higher landed costs for finished displays and display components, which directly affect display manufacturers and system integrators in the importing countries.

Download Free sample to learn more about this report.

Commercial Display Market Trends

Technological Advancements in Display Hardware to Accelerate Market Growth

Technological advancements in display hardware are playing a pivotal role in increasing the adoption and expansion of the market. These innovations are improving visual quality and durability and also enhancing energy efficiency, interactivity, and scalability, thereby increasing ROI for businesses across sectors such as retail, hospitality, education, transportation, and public infrastructure.

One of the most significant developments is the evolution of LED technology, particularly fine pixel pitch LED displays (<1.5mm), that offer near-seamless visuals for indoor applications such as control rooms, luxury retail stores, and broadcast studios. Similarly, OLED and MicroLED technologies are transforming premium commercial spaces. OLED enables transparent, bendable, and ultra-thin panels, widely adopted in automotive showrooms, airports, and flagship retail environments. For instance, LG’s transparent OLED series has been deployed in over 40 countries for use in museums, shopping malls, and financial service centers.

Energy efficiency is another key area where hardware innovation is impacting purchasing decisions. Modern commercial displays come with auto-brightness sensors, fanless designs, and low-power LED backlighting, helping reduce power consumption by up to 40% compared to legacy systems. For outdoor environments, manufacturers are producing displays with high brightness (>3,000 nits) and IP56/IP65 ratings for weather resistance, allowing reliable year-round operation in diverse climates. Overall, technology advancements are making commercial displays sharper, smarter, and more sustainable, directly contributing to market growth.

Thus, technological advancements in display hardware to drive the commercial display market growth.

MARKET DYNAMICS

Market Drivers

Growth of Smart Cities and Infrastructure Modernization to Boost Market Growth

The growth of smart cities and infrastructure modernization is driving demand for outdoor digital signage, public information displays, and integrated LED video walls. As cities globally aim to enhance urban living through real-time information, automation, and sustainability, commercial displays are becoming essential infrastructure components for communication, safety, and citizen engagement. Governments are investing heavily in digital infrastructure, including intelligent transportation systems, smart bus stops, digital kiosks, and environmental monitoring displays, to improve city services. These deployments rely on high-brightness, weatherproof displays equipped with features such as live data integration, touch interactivity, and remote monitoring. According to Industry experts, more than 150 cities worldwide are implementing smart city frameworks, with digital signage playing a vital role in over 70% of these initiatives.

As per Fortune Business Insights, the global smart cities market is projected to reach around USD 4 trillion by 2032, with a substantial portion allocated to smart transportation, public communication systems, and civic engagement technologies. As a result, the deployment of digital signage and smart displays is increasing among airports, metro stations, traffic junctions, municipal buildings, and public parks. For instance, Dubai's Smart City initiative includes over 5,000 digital displays integrated across transit hubs.

Therefore, the growth of smart cities and infrastructure modernization is boosting the commercial display market share.

Market Restraints

High Initial Costs to Hamper Market Growth

High costs continue to restrict the widespread adoption of commercial displays, especially among small and medium-sized enterprises (SMEs), educational institutions, and government organizations with limited budgets. Thus, high initial setup and integration cost hampers market growth. Commercial-grade displays, including digital signage, interactive flat panels, LED video walls, and outdoor units, are significantly more expensive than consumer displays due to their enhanced durability, brightness, 24/7 operation capabilities, and integration with content management systems (CMS).

Market Opportunities

Adoption of Display-as-a-Service (DaaS) & Subscription Models to Create Opportunities for Market Players

Traditionally, commercial display deployments required significant capital expenditure (CapEx) for hardware, installation, and content software. However, the shift toward operational expenditure (OpEx) through DaaS models is helping companies deploy large-scale digital signage networks without the burden of upfront costs. DaaS models bundle hardware (digital signage, interactive displays, LED video walls) with software (content management systems), analytics, remote monitoring, maintenance, and technical support offered under a single monthly or annual subscription. This model is especially attractive for small and medium-sized businesses (SMBs), retail chains, quick-service restaurants (QSRs), educational institutions, and public sector entities, which often operate under tight budgets but require dynamic digital communication tools.

For key players, DaaS opens up recurring revenue streams, improves customer retention, and provides greater control over the content and software ecosystem. Companies such as Samsung (Smart Signage powered by MagicINFO), LG, BrightSign, and Stratacache are increasingly offering turnkey DaaS packages, often in collaboration with local AV integrators or managed service providers (MSPs).

SEGMENTATION ANALYSIS

By Type

Digital Signage Displays Led Market Due to Their Rising Efficiency in Improving Customer Engagement

Based on type, the market is segmented into digital signage displays, interactive displays, LED video walls, and outdoor displays.

The digital signage displays segment is projected to dominate the market with a share of 37.23% in 2026, owing to its growing effectiveness in enhancing customer engagement, real-time communication, and delivering dynamic content across various sectors. Businesses are increasingly adopting digital signage to replace static displays with interactive and visually rich content that can be updated remotely and instantly, reducing operational costs and improving marketing agility.

LED video walls are estimated to register the highest CAGR during the forecast period. This growth is attributed to their ability to offer seamless, high-resolution content across large surfaces with excellent brightness, color uniformity, and long lifespan, making them ideal for both indoor and outdoor environments.

By Display Technology

Surge in Demand for Interactive Displays Boosted LCD Segment Growth

Based on display technology, the market is trifurcated into LCD, LED, and OLED.

The LCD display technology segment is expected to lead the market, accounting for 37.65% of the total market share in 2026 due to its technological maturity, cost efficiency, widespread availability, and versatile performance across multiple applications. Growth in interactive displays, especially in education, corporate collaboration, and customer engagement applications, is fueling LCD demand, as most interactive panels are still based on LCD technology.

The OLED segment is expected to register the highest CAGR during the forecast period, due to its exceptional visual quality, flexibility, and premium appeal, especially in high-end and design-sensitive environments. OLED panels are flexible, curved, transparent, or even rollable, opening new possibilities for architectural integration, edge displays, and creative installations in luxury retail, museums, and modern offices.

By Screen Size

32 to 55 Inches Segment Led due to Its Space-Efficiency and Versatility

By screen size, the market is segmented into below 32 inches, 32 to 55 inches, 56 to 75 inches, and above 75 inches.

The 32 to 55 inches screen size segment is anticipated to hold a significant market share of 35.67% in 2026, as this size range offers the ideal balance between versatility, visibility, space-efficiency, and cost-effectiveness, making it suitable for a wide array of applications across industries. Displays in this size range are large enough to capture attention in public areas such as lobbies, retail aisles, and conference rooms, yet compact enough to fit in smaller commercial spaces without being intrusive.

The above 75 inches segment is estimated to grow with the highest CAGR during the forecast period, driven by the increasing need for immersive, large-format visual experiences across sectors such as corporate, education, retail, control rooms, entertainment venues, and transportation hubs. These displays support 4K/8K resolution, delivering cinematic-level clarity for presentations, product showcases, or data visualization.

By Industry

To know how our report can help streamline your business, Speak to Analyst

Retail Segment Dominated Due to Its Increasing Focus on Digital Transformation

By industry, the market is segmented into retail, hospitality, healthcare, education, entertainment, corporate, and government/public infrastructure.

The retail segment dominated the market in 2024, driven by the sector’s increasing focus on digital transformation, customer engagement, and omnichannel strategies. Digital signage and interactive screens play a key role in creating dynamic in-store experiences, enabling real-time promotions, product information, and targeted advertising. Studies show that over 70% of shoppers are influenced by digital signage, and stores using dynamic displays have reported a 10% to 30% increase in sales for promoted items.

The healthcare segment is estimated to grow with the highest CAGR during the forecast period, due to the growing need for digital communication, patient engagement, operational efficiency, and real-time information delivery across hospitals, clinics, and diagnostic centers.

COMMERCIAL DISPLAY MARKET REGIONAL OUTLOOK

The market is geographically studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

North America

North America dominated the market, capturing the maximum share in 2025. The region's strong focus on smart city projects, airport modernization, and entertainment venue digitalization is increasing demand for large-format displays, video walls, and outdoor LED. Strong CAPEX spending by large enterprises, coupled with the presence of leading display manufacturers and systems integrators, is further accelerating market growth across the region. The U.S. market is projected to reach USD 16.81 billion by 2026.

In the U.S., the market is expected to experience strong growth during the forecast period. The U.S. retailers are increasingly adopting digital signage, interactive kiosks, and video walls to enhance in-store engagement and support omnichannel strategies. Around 70% of U.S. retailers use some form of digital display technology to drive promotions, influence purchasing decisions, and reduce perceived wait times.

Asia Pacific

The Asia Pacific region is expected to grow with the highest CAGR during the forecast period due to the increasing digitalization, booming retail and e-commerce ecosystems, expanding urban infrastructure, and increasing investments in smart technologies. The region is home to some of the world’s largest and most innovative store chains and malls, where digital signage, interactive displays, and video walls are widely deployed to support promotions, smart shelf systems, and immersive customer experiences. The Japan market is projected to reach USD 3.55 billion by 2026, the China market is projected to reach USD 6.27 billion by 2026, and the India market is projected to reach USD 2 billion by 2026.

Europe

Europe is estimated to witness significant growth in the coming years, due to increasing digitization of public spaces and transport infrastructure across key markets such as the U.K., Germany, France, and the Nordics. Governments and municipalities are investing in dynamic signage, digital billboards, and passenger information displays across airports, metros, and railway stations. The UK market is projected to reach USD 2.07 billion by 2026, while the Germany market is projected to reach USD 2.46 billion by 2026.

Middle East & Africa

The region is estimated to witness robust growth, as governments are investing heavily in smart cities development, infrastructure modernization, and expansion of the retail and hospitality sectors. Airports, malls, stadiums, and hospitality complexes in cities such as Dubai, Riyadh, and Doha have become major deployment zones for high-resolution commercial displays.

South America

The region is expected to grow at a steady rate during the study period. Brazil leads the region in digital signage deployments, with over 30,000 retail locations having adopted display networks in 2024.

Competitive Landscape

Key Industry Players

Market Players Opt for Merger & Acquisition Strategies to Expand Their Presence

Players in the market are adopting a combination of technology innovation, vertical-specific customization, strategic partnerships, and expansion into emerging markets to drive growth and maintain competitiveness. A key strategy involves the development of advanced display technologies such as OLED, MicroLED, 4K/8K resolution, and interactive touchscreens to cater to evolving customer expectations for high-definition, immersive visual experiences. Companies are increasingly offering end-to-end display solutions tailored for industries such as healthcare (digital wayfinding and patient boards), education (interactive panels for hybrid classrooms), and retail (AI-integrated digital signage for targeted advertising). This strategic shift from selling hardware alone to offering integrated software, analytics, and content management systems (CMS) enhances customer value.

Long List of Commercial Display Companies Studied

- Samsung Electronics (South Korea)

- LG Electronics (South Korea)

- Sony Corporation (Japan)

- Sharp NEC Display Solutions (Japan)

- Panasonic Corporation (Japan)

- BOE Technology Group Co., Ltd. (China)

- Barco NV (Belgium)

- SMART Technologies (Canada)

- BrightSign LLC (U.S.)

- NanoLumens (U.S.)

- Daktronics Inc. (U.S.)

- AOTO Electronics (China)

- Koninklijke Philips N.V. (Netherlands)

… and more

KEY INDUSTRY DEVELOPMENTS

- June 2025 – Samsung launched 32-inch Color E-Paper and expanded its portfolio of digital signage solutions that is energy efficient. This product features advanced digital ink technology and delivers ultra-low power consumption, a light-weight design, and high visibility.

- June 2025 – Sony Electronics launched the Crystal LED Capri series and expanded its lineup of LED walls.

- February 2025 – Samsung introduced its next generation of commercial displays with AI-powered solutions at Integrated Systems Europe (ISE) 2025.

- January 2025 – LG launched Advanced Commercial Display Advertising Solutions for B2B clients.

- January 2025 – Sharp NEC Display Solutions Europe introduced a comprehensive range of Large Format Displays at Integrated System Europe (ISE) 2025.

REPORT COVERAGE

The market research report provides a detailed market analysis. It focuses on key points, such as leading companies, offerings, and applications. Besides this, it offers an understanding of the latest market trends and highlights key industry developments. In addition to the above-mentioned factors, it contains several factors that have contributed to its growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Display Technology

By Screen Size

By Industry

By Region

|

|

Companies Profiled in the Report |

• Samsung Electronics (South Korea) • LG Electronics (South Korea) • Sony Corporation (Japan) • Sharp NEC Display Solutions (Japan) • Panasonic Corporation (Japan) • BOE Technology Group Co., Ltd. (China) • Barco NV (Belgium) • SMART Technologies (Canada) • BrightSign LLC (U.S.) • NanoLumens (U.S.) |

Frequently Asked Questions

The market is projected to record a valuation of USD 107.79 billion by 2034.

In 2025, the market was valued at USD 57.78 billion.

The market is projected to grow at a CAGR of 7.3% during the forecast period (2026-2034).

The digital signage led the market in terms of share.

Growth of smart cities and infrastructure modernization is a key factor driving market growth.

Samsung, LG, Sony, Sharp, Panasonic, and Barco NV are the top players in the market.

North America held the highest market share.

By industry, the healthcare segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us