Commercial Renewable Energy Market Size, Share & Industry Analysis, By Type (Wind {Onshore and Offshore}, Solar {PV, CSP, and Thermal}, Bioenergy {Solid, Liquid, and Gas}, Geothermal {Shallow, Deep, and Great Depth}, Ocean Energy {Wave and Tidal}, and Hydropower {Small and Large}), By Deployment (On-Grid, and Off-Grid), By End-User (Retail and Malls, Corporate Office Buildings, Hotels, Hospitals, Data Centre, Educational Institutions, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

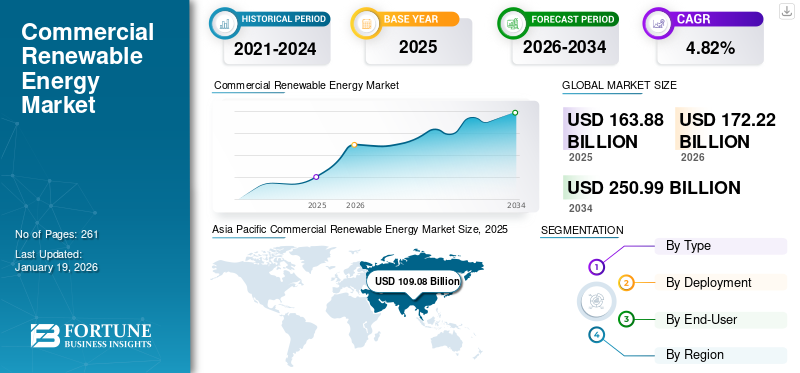

The global Commercial Renewable Energy market size was valued at USD 163.88 billion in 2025 and is projected to be worth USD 172.22 billion in 2026 and expected to reach USD 250.99 billion by 2034, exhibiting a CAGR of 4.82% during the forecast period. Asia Pacific dominated the global market with a share of 66.56% in 2025.

Increasing grid electricity tariffs and fuel prices are prompting commercial establishments to adopt renewables (solar, wind, hybrid) and reduce long-term operating costs. Renewable energy offers stable and predictable pricing through power purchase agreements (PPAs) or captive generation. The commercial renewable energy market is growing due to various economic, environmental, and technological factors.

Commercial renewable energy is increasingly replacing fossil fuels as businesses shift toward cleaner and more sustainable energy sources. It is playing a significant role in electricity generation across various sectors such as data centers, real estate and others. Green hydrogen is emerging as a key clean fuel within the commercial renewable energy landscape.

NextEra Energy, Orsted, and Vestas Wind Systems are few major vendors in the commercial renewable energy industry. NextEra is the world's largest producer of wind and solar energy, with over 70 GW of installed clean energy capacity. The company has a massive portfolio of corporate power purchase agreements with commercial users such as Data centers (e.g., Google and Microsoft).

MARKET DYNAMICS

MARKET DRIVERS

Growth of Commercial Infrastructure and Strategic Partnership with Energy Companies to Drive Market

The rapid development of commercial infrastructure such as office buildings, malls, hospitals, hotels, airports, data centers, and logistics parks significantly increases electricity demand from the commercial sector. Businesses are turning to renewable energy solutions to meet this growing need sustainably and cost-effectively. Auto manufacturers are shifting toward clean energy for manufacturing operations, EV production plants, and charging infrastructure. Both public and private entities are actively investing in commercial renewable energy projects to meet rising energy demands.

In August 2025, BayWa r.e. Solar Trade planned to increase its commercial storage options in Europe by partnering with Western Heat Energy Solutions for distribution. Under this agreement with the top-tier manufacturer, BayWa r.e. will distribute WHES battery storage systems in significant European markets. This deal gives BayWa r.e. exclusive rights to distribute in Germany, Italy, Belgium, Luxembourg, Spain, Portugal, Austria, Switzerland, Lithuania, Greece, Albania, and Kosovo. This partnership strengthens BayWa r.e.'s commercial renewable energy storage offerings in the region.

MARKET RESTRAINTS

High Initial Capital Costs to Hinder Market Growth

Installing renewable energy systems including solar panels, wind turbines, or battery storage units requires a large upfront investment. While these systems reduce electricity costs in the long term, the initial expenditure can be a major barrier for many businesses. Various small businesses operate on tight budgets and lack the capital or credit lines needed for large infrastructure investments. This results in delayed adoption or complete avoidance of renewable installations.

MARKET OPPORTUNITIES

Integration with Smart Energy Management Systems to Create Opportunity for Market

Smart Energy Management is a digital platform or software tool that help businesses monitor, control, and optimize their energy usage. These systems use real-time data, AI, and IoT sensors to track power consumption, predict demand, and manage distributed energy sources such as solar panels or batteries.

In May 2025, IQ Energy Management was released by Enphase Energy, Inc., a major global energy technology company and the top micro inverter-based solar and battery systems provider. IQ Energy Management works with Enphase solar and battery systems to enable intelligent management of variable electricity costs and certain third-party electric vehicle (EV) chargers, heat pumps, and resistive electric water heaters in France. Utilizing artificial intelligence (AI)-driven management of essential home energy equipment, through the Enphase App, it allows homeowners to reduce costs and increase self-consumption.

Commercial Renewable Energy Market Trends

Growth of Urban Microgrids has Emerged as a Significant Market Trend

Urban microgrids are localized energy systems operating independently or in conjunction with the main power grid. They integrate renewable energy sources, battery storage, and smart controls to supply reliable electricity to commercial buildings, tech parks, hospitals, data centers, and malls in cities.

In April 2024, Enphase Energy, a provider of energy technology, and Octopus Energy formed a strategic alliance to integrate their platforms and offer U.K. retail clients access to inexpensive residential energy. This has allowed Octopus Energy customers to build virtual power plants (VPPs), and support battery management to alleviate power grid congestion.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

Growing Grid Connectivity to Drive the Wind Energy Segment Growth

The market by type covers wind (Onshore and Offshore), solar (PV, CSP, and thermal), bioenergy (Solid, Liquid, and Gas), Geothermal (Shallow, Deep, and Great Depth), Ocean Energy (wave, tidal), and hydropower (small, large).

Wind energy is the dominating segment in the market. Onshore and offshore wind farms generate high volumes of electricity to the Power grid, supplying ideal amounts of electricity to the commercial buildings & infrastructure including data centers.

Solar is the second leading segment in the market. Commercial buildings often have large unused rooftops. These are ideal for rooftop solar installations, helping companies generate electricity and reduce grid reliance. Solar systems integrate efficiently with battery storage, smart meters, and energy management systems. This offers real-time control and efficiency for commercial energy users. Businesses adopt solar through third-party owned models, leasing, and power purchase agreements (PPAs).

By Deployment

Minimal Maintenance Requirement in the On-grid system to Lead the segment's growth

By deployment, the market is segmented into on-grid and off-grid.

The on-grid segment held the largest commercial renewable energy market share. On-grid systems allow commercial users to feed renewable energy into the main power grid seamlessly. On-grid setups support high energy demands of office buildings, shopping malls, manufacturing units, and warehousing hubs.

Off-Grid is the second largest segment in the market. Off-grid systems are ideal for commercial operations in remote locations with limited or unreliable grid access. Buildings are shifting to off-grid renewables to ensure an uninterrupted power supply and avoid disruptions due to grid instability, especially in rural or disaster-prone areas.

By End-User

High and Constant Energy Demand from Retail and Malls Sector to Drive the Segment Growth

The market is segmented by end-user into retails and malls, corporate office buildings, hotels, hospitals, data centers, educational institutions, and others.

Retails and malls dominate the commercial renewable energy market growth. Malls and big box retail stores have vast rooftop areas ideal for installing solar PV panels, capturing maximum sunlight with minimal obstruction. On-site solar reduces dependence on the grid, lowering utility bills and peak demand charges. Many retailers benefit from net metering, tax incentives, and faster ROI.

The data center is the second largest segment in the market. Power is one of the biggest recurring expenses for data centers. Renewable energy (solar, wind, hydro, and others) helps reduce grid dependency and long-term operational costs. Data centers are growing due to their high power needs, strong sustainability commitments, financial incentives, and global pressure to adopt green power.

COMMERCIAL RENEWABLE ENERGY MARKET REGIONAL OUTLOOK

The market has been divided geographically in North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Asia Pacific Commercial Renewable Energy Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Corporations in the U.S. and Canada are assuring net zero emissions and 100% renewable energy sourcing (e.g, RE 100 members such as Apple, Google, and Walmart). These commitments drive commercial-scale adoption of solar, wind, and other renewables. Commercial users face increasing utility prices, especially in peak demand seasons. Renewable energy offers long-term cost stability and protection from energy price volatility. Malls, warehouses, data centers, and office complexes are installing rooftop solar PV systems, using solar carports and battery storage. These reduce grid dependency and lower operating costs.

U.S.

The U.S. offers strong policy support, such as the Investment Tax Credit, Production Tax Credit, State Level Incentive, and Renewable Portfolio Standards. Rapid development in retail and malls, office buildings, warehouses, and logistics hubs also drives the country's market growth. Many businesses install rooftop solar panels, solar carports, and microgrids for energy independence. Investments in renewable energy projects is also the major factor driving market growth in the country.

Europe

Europe is leading in climate action through the European Green Deal, a net-zero emissions target by 2050, and mandatory corporate sustainability disclosures. These push businesses to adopt clean and renewable power. European companies including IKEA, Nestle, Unilever, and BMW are committing to 100% renewable energy, aligning with science-based targets. This is driving investment in on-site and purchased renewable power.

Asia Pacific

Asia Pacific held a dominant position in the market, with the market size valued at USD 109.08 billion in 2025 and increasing to USD 115.13 billion in 2026 owing to the increasing consumption of electricity in commercial sectors across emerging economies thus prompting the adoption of renewable energy. Booming economies such as China, India, and Southeast Asia are building more offices, malls, factories, and logistics hubs, hence increasing electricity consumption in commercial sectors. This drives the need for clean and cost-effective energy solutions in the Asia Pacific renewable energy sector. Asia is a global leader in manufacturing low-cost solar panels, batteries, and wind turbines. This makes renewable projects cheaper and more scalable for commercial use.

Latin America

Latin America has the world’s best solar and wind resources, especially in Chile's Atacama Desert, Brazil, and Argentina. This makes it highly cost-effective for commercial sectors to adopt renewables. In many Latin American countries, grid electricity prices are volatile and expensive, particularly during peak hours. To reduce operational costs, businesses are investing in on-site solar, wind, and battery systems.

Middle East & Africa

The Middle East & Africa region has some of the highest solar irradiance in the world, especially in GCC Countries (UAE, Saudi Arabia, and Oman), North Africa (Egypt, Morocco), and Sub-Saharan Africa. This makes solar PV highly efficient and cost-effective for commercial use. Rapid growth in malls, hotels, offices, logistics hubs, and industrial zones. These sectors demand stable, affordable, and clean electricity, pushing the adoption of renewables.

COMPETITIVE LANDSCAPE

Key Industry Players

Rising Strategic Partnership by the Leading Companies for Product Development to Beef Up their Market Share

Key players in the commercial renewable energy sector such as NextEra Energy, Orsted, Vestas Wind Systems and others, are staying ahead by focusing on technological innovation, strategic partnerships, and large-scale project development. They are heavily investing in advanced energy storage systems, smart grid integration, and next-generation solar and wind technologies to increase efficiency and reduce costs. Companies are also expanding their presence globally by securing long-term Power Purchase Agreements (PPAs) with major corporations and governments, ensuring stable revenue streams.

List of Key Commercial Renewable Energy Companies Profiled

- NextEra Energy (U.S.)

- Orsted (Denmark)

- Vestas Wind Systems (Denmark)

- Siemens Gamesa Renewable Energy SA (Spain)

- Brookfield Renewable Partners (Bermuda)

- Canadian Solar (Canada)

- First Solar (U.S.)

- Enphase Energy and SolarEdge Technologies (Israel)

- Jinko Solar (China)

- Neoen (France)

- ACMA Solar Holdings (India)

- ReNew Power (India)

- SMA Solar Technologies (Germany)

- Veolia (France)

- GridBeyond (Ireland)

- General Electric (U.S.)

KEY INDUSTRY DEVELOPMENTS

- In May 2025, ReNew Energy Global announced plans to invest approximately USD 2.57 billion in its hybrid renewable energy project in Andhra Pradesh, located in eastern India. This major initiative aims to support the country's rapidly growing demand for clean energy. The project will have a total capacity of 2.8 gigawatts (GW), combining 1.8 GW of solar power and 1 GW of wind energy. Designed to enhance grid stability, the facility will be capable of supplying electricity during peak demand periods for up to four hours each day.

- In May 2025, Germany-based TURN2X and the tech firm Siemens announced a Global Partnership, stating that the partnership would focus on fostering the manufacturing of sustainable natural gas via extensive technology cooperation. This collaboration addresses the market's increasing awareness of renewable natural gas as essential to a sustainable and balanced energy transition.

- In December 2024, First Solar and Juniper Green Energy agreed to purchase 1 GW of solar modules. According to a business statement, the renewable energy firm headquartered in Gurgaon intends to use these modules in the next fiscal year for its projects in Rajasthan, Gujarat, and Maharashtra.

- In July 2024, Enphase Energy, a worldwide energy technology business and provider of battery and solar systems based on microinverters, unveiled household and commercial products that may aid solar projects in meeting domestic content bonus credit requirements. Projects that employ particular Enphase microinverters purchased from U.S. production partners and solar racking gear manufactured in the United States may be eligible.

- In November 2023, with the opening of the biggest solar power facility on a seawater desalination plant in Oman, Veolia is collaborating with the Sultanate of Oman and its partner TotalEnergies to advance this shift to clean, renewable energy. This program is included as part of the Group's continuing efforts to decarbonize its operations and help its clients achieve their carbon neutrality goals.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product/service processes, competitive landscape, and the leading commercial renewable energy market. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.82% from 2026 to 2034 |

|

Unit |

Value (USD Billion), Volume (MW) |

|

Segmentation |

By Type

|

|

By Deployment

|

|

|

By End-User

|

|

|

By Geography

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 163.88 billion in 2025.

In 2025, the Asia Pacific market value stood at USD 109.08 billion.

The market is expected to exhibit a CAGR of 4.82% during the forecast period of 2026-2034.

The retail and mall segment led the market by end users.

Expansion of Commercial Infrastructure and increasing usage in the automotive industry to drive the Market.

Some of the top major players in the market are NextEra Energy, First Solar, Canadian Solar, and Others.

Asia Pacific dominated the market in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us