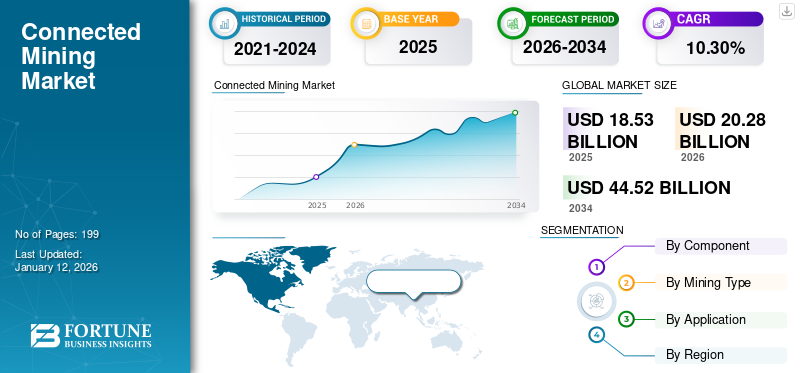

Connected Mining Market Size, Share & Industry Analysis, By Component (Equipment {Automated Mining Excavators, Load Haul Dump, Drillers and Breakers, and Others} and Software & Services {Asset Management and Security Software, Support and Maintenance Services, System Integration and Deployment Services, and Others}), By Mining Type (Surface Mining and Underground Mining), By Application (Exploration, Processing & Refining, and Transportation), and Regional Forecast, 2026-2034

CONNECTED MINING MARKET SIZE AND FUTURE OUTLOOK

The global connected mining market size was valued at USD 18.53 billion in 2025 and is projected to grow from USD 20.28 billion in 2026 to USD 44.52 billion by 2034, exhibiting a CAGR of 10.30% during the forecast period. North America dominated the global market with a share of 27.10% in 2025.

Connected mining is an integration of digital technologies, sensors, and communication networks. It assists in optimization of unearthing operation, monitoring equipment performance, and improves security and environmental sustainability. This system saves time and money, reduces physical workload, and minimizes production costs with real-time visibility of assets. This process is variously incorporated to manage industrial boring operations more efficiently. It is a multi-value solution that uses mobile, taking, analytics, and cloud technology.

The market is expected to expand considerably due to the utilization of innovative technologies, and rapid industrialization. The market is experiencing growth due to several factors such as

The main participants in the market include ABB Group, Caterpillar Inc., Cisco Systems Inc., Hexagon AB, Intellisense.IO, Komatsu Ltd., and Rockwell Automation.

MARKET DYNAMICS

Market Drivers

Increased Emphasis Toward Safety and Sustainability Contribute to Market Growth

The growing focus on safety and sustainability is a key driver for the connected mining market growth. Connected technologies allow for real-time site monitoring and remote operations, which assist in improving worker safety and minimizing accident risks. They also aid in environmental management by keeping a track of energy consumption, emissions, and waste.

For instance, according to IEA, by using energy monitoring systems, mining companies can reduce their carbon footprint and comply with regulations, addressing rising global energy-related CO₂ emissions, which reached 36.8 Gigatons in 2022.

Furthermore, rising emphasis on sustainability is opening avenues for market expansion. Incorporation of such skill facilitates companies to monitor and reduce their environmental effect. It helps in decreasing accident risks by predicting perilous situations. Additionally, the strict environmental regulations and corporate ESG (Environmental, Social, and Governance) commitments are pushing mining companies to adopt connected solutions.

Market Restraints

High Implementation costs and Operational Disruption Creates Barrier Limit Market Scalability

The limiting factor for the market impediment is the high implementation cost required for deploying the process and the potential operational disruptions. This adoption of advanced technologies, IoT devices, and communication networks can deter companies with restricted budgets from adoption. For instance, a mid-sized mine implementing a full connected equipment system may face costs running into several million dollars, along with temporary production slowdowns during workforce training and system integration.

Market Opportunities

Operational Efficiency and Cost Reduction Creates Substantial Growth Opportunities

Significant growth prospects in the connected mining business are being created by operational efficiency and cost reduction. Mining firms may increase productivity, lower labor costs, decrease downtime, and improve safety by utilizing technology such as automation, artificial intelligence (AI), and the Internet of Things (IoT). This will ultimately increase profitability.

For instance, the adoption of geospatial data analytics in mining has been shown to cut operational expenses by 10%–15%, highlighting the tangible benefits and strong potential for market expansion.

CONNECTED MINING MARKET TRENDS

Leveraging Technological Advancements in Mining Operations as a Major Market Trend

One of the most significant opportunities that may thrust market expansion is the incorporation of advanced technologies in the system. The incessant utilization of IoT, AI, and 5G technologies are enhancing ability and security of the procedure. These technologies enable real-time equipment monitoring, predictive maintenance, and optimized resource allocation, enhancing both safety and productivity.

For instance, in the U.K., the share of firms offering machine learning-based services across industries rose from 21% in 2022 to 35% in 2023, highlighting the accelerating adoption of these data-driven solutions in industrial operations.

SEGMENTATION ANALYSIS

By Component

Rapid Adoption of IoT-Enabled Machinery and Predictive Maintenance Systems Boosts Equipment Segment Growth

Based on the component, the market is segmented into equipment (automated mining excavators, load haul dump, drillers and breakers, and others) and software & services (asset management and security software, support and maintenance services, system integration and deployment services, and others).

The equipment segment held the largest revenue share of USD 10.54 billion in the overall global market in the year 2024. The increase in revenue is driven by the extensive deployment of automated excavators, haul trucks, and drilling equipment across large-scale mining operations to improve productivity and safety. The segment’s growth is also attributable to the rapid adoption of IoT-enabled machinery and predictive maintenance systems, along with ongoing investments in mine modernization and expansion projects that prioritize advanced equipment integration. The segment is therefore the backbone of the market, holding the major of the total revenue with a share of 63.76% in 2026.

Of all the segments, software & services holds the highest CAGR of 10.6% in the global market. The segment’s growth is attributable to the rising demand for real time data analytics, asset monitoring, and cybersecurity solutions to optimize mining operations. This growth is further supported by the increasing shift toward cloud based platforms, system integration, and remote management services, enabling miners to enhance efficiency, reduce downtime, and achieve greater operational visibility.

By Mining Type

Surface Mining Segment Dominates Market Owing to Its Widespread Application in Extracting Bulk Commodities

Based on mining type, the market is divided into surface mining and underground mining.

The surface mining segment dominates the connected mining market share with USD 9.53 billion. The high share is attributable to its widespread application in extracting bulk commodities such as coal, iron ore, and bauxite, which forms the backbone of many regional economies. Its relatively lower operating cost compared to underground mining and suitability for deploying large-scale automated equipment further reinforce its high market share.

Surface mining holds the highest CAGR of 10.5% in the global market with contribution of 58.68% globally in 2026. The strong growth is assisted by the ongoing investments in open-pit projects, rising demand for metals in construction and energy transition industries, and the increasing adoption of digital and connected technologies to enhance productivity and safety in large surface operations.

By Application

Improved Energy Efficiency and Higher Productivity Augments the Processing & Refining Segment Growth

Based on the application, the market is divided into exploration, processing & refining, and transportation.

The processing & refining segment accounted for the largest market share at USD 6.87 billion in 2024, with a share of 42.26% in 2026. The dominance stems from the central role these activities play in converting raw ore into usable metals for industrial supply chains. Mining companies prioritize connected solutions in refining plants to optimize throughput, improve energy efficiency, and ensure compliance with stringent environmental standards. The integration of advanced monitoring and automation technologies further supports higher productivity, cementing this segment’s leading share.

Transportation represent the largest CAGR at 10.7% in the global market. The segment is growing faster primarily due to increasing need for real-time fleet management, automated haulage, and predictive maintenance across mine-to-port logistics. The increasing investments in autonomous trucks, conveyor systems, and IoT-enabled tracking are transforming the efficiency of mineral movement. The shift toward digital logistics platforms and smart connectivity in long-distance transport networks is expected to accelerate adoption, underpinning the strong CAGR of the segment.

To know how our report can help streamline your business, Speak to Analyst

CONNECTED MINING MARKET REGIONAL OUTLOOK

Geographically, the market is segmented into North America, Europe, Asia Pacific, South America, and Middle East & Africa.

North America

The North American region held the market value of USD 5.03 billion and USD 5.47 billion in 2025 and 2026 respectively. The North America market is rapidly expanding owing to the existence of top companies. Early implementation of advanced technologies is also impelling market growth. The local markets are paying attention to scale automation solutions and leverage IoT to improve their operations.

Download Free sample to learn more about this report.

Additionally, increasing initiative such as development of control systems to reduce downtime and increase performance is propelling market growth. The U.S. is at the forefront of the North American market, with expected revenue of USD 3.45 billion in 2026. The growth is mainly driven by the growing focus on safety and environmental sustainability, and rapid advancements in technology.

Europe

The European market is substantially growing and is likely to contribute to a revenue share of USD 4.39 billion in 2026. The region’s growth is attributable to a strong focus on sustainability and stringent regulations, which are pushing for safer and more environmentally friendly practices. Key market segments include solutions, hardware, and services, with solutions such as asset tracking and data analytics being dominant. The U.K., Germany, and France are some of the leading contributors to the growth in the market, with the required revenue stake of USD 0.89 billion, USD 0.92 billion and USD 0.5 billion respectively by 2026.

Asia Pacific

Asia Pacific is currently at the forefront of the global market. The Asia Pacific connected mining market size was valued at USD 6.85 billion in 2025 and is expected to reach USD 7.62 billion in 2026. The region’s large base of high-volume surface mines (coal, iron ore, copper) and an accelerating pipeline of new projects that favor mechanization and digitalization. Strong demand from industrializing economies, widespread investments in fleet automation and telematics, and supportive national programmes for mine modernization and electrification combine to create both a large existing market and the quickest adoption curve for connected mining technologies. At the same time, Asia Pacific is also expected to have the highest CAGR of 11.82% further solidifying the market as the fastest growing. India and China are major contributors to the market growth with an expected revenue share of USD 1.25 billion, and USD 3.42 billion respectively by 2026 and the Japan market is projected to reach USD 0.73 billion by 2026

South America and Middle East & Africa

The markets of South America and Middle East & Africa are growing with an expected share of USD 1.48 billion and USD 1.11 billion respectively in 2025. The growth is particularly attributable to modernization and technology adoption. GCC countries are predicted to have a market share of USD 0.57 billion by 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focus On Partnerships and Acquisitions to Lead the Industry

The key players in the industry include Schneider Electric, Siemens AG, Sumitomo Metal Mining Co., Ltd., Symboticware Inc., Trimble Inc., Sandvik AB and others. These leading firms utilize extensive international networks, focusing on developing advanced IoT, automation, and data-driven solutions, and partnerships or acquisitions to lead the industry. Companies are also investing heavily in acquiring new technologies, focusing on product portfolio expansion, and tailoring regional strategies to navigate economic and geopolitical challenges, with a growing emphasis on sustainable practices.

LIST OF KEY CONNECTED MINING COMPANIES PROFILED:

- ABB Group (Switzerland)

- Caterpillar Inc. (U.S.)

- Cisco Systems Inc. (U.S.)

- Hexagon AB (Sweden)

- IO (U.S.)

- Komatsu Ltd. (Japan)

- Rockwell Automation (U.S.)

- Schneider Electric (France)

- Siemens AG (Germany)

- Sumitomo Metal Mining Co., Ltd. (Japan)

- Symboticware Inc. (U.S.)

- Trimble Inc. (U.S.)

- Sandvik AB (Sweden)

KEY INDUSTRY DEVELOPMENTS:

- February 2025- Bridgestone Corporation and Komatsu Ltd. have launched a proof of concept (PoC) for a collaborative initiative aimed at providing new solution services to mining customers.

- January 2025- Codelco announced its partnership with Saudi Arabia. This collaboration is for joint ventures in copper mining projects with an intention to enhance their production capabilities and to fulfill the growing requirement for copper.

- September 2024- Caterpillar’s advanced mining vision, launches digital mining solution Cat Precision Mining, which is designed to improve and streamline every step of the mining process, from extraction to processing, bringing mine-to-mill theory into reality. The initiative will bring everything together as a fully integrated, end-to-end solution that is customised to the mining operation’s specific requirements and unique orebody characteristics.

- September 2024- ABB unveils technology demonstrator of eMine™ Robot Automated Connection Device, a new power charging solution for mining trucks. Under development in collaboration with Boliden, BHP and Komatsu, Robot ACD aims to improve safety and enhance performance. The equipment will be on display to the public for the first time at MINExpo 2024 on Komatsu’s booth.

- August 2024- BHP increased utilization of AI technology in its operation. The main aim of the introduction of AI is to improve capability and discovery and offer machinery operation, data-driven decision making system, and real time monitoring and reporting.

- January 2024- Norway initiated a system in the Arctic, a Deep-sea mining exploration. The purpose of this plan was to explore and focus on minerals for instance copper, zinc, and cobalt to meet the rising demand for minerals.

REPORT COVERAGE

The global report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, deployment modes, types, and end users of the product. Besides this, it offers insights into the connected mining market trends and highlights key industry developments and market share analysis for key companies. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

| ATTRIBUTE |

DETAILS |

| Study Period | 2021-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Growth Rate | CAGR of 10.30% from 2026-2034 |

| Historical Period | 2021-2024 |

| Unit | Value (USD Billion) |

| Segmentation |

By Component

By Mining Type

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 20.28 billion in 2026 and is projected to reach USD 44.52 billion by 2034.

The market is expected to exhibit steady growth at a CAGR of 10.30% during the forecast period.

The growing focus on safety and sustainability is speeding up the market growth.

ABB Group, Caterpillar Inc., Cisco Systems Inc., Hexagon AB, Intellisense.IO, Komatsu Ltd., and Rockwell Automation are some of the top players in the market.

The North America region held the largest market share.

North America was valued at USD 5.03 billion in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us