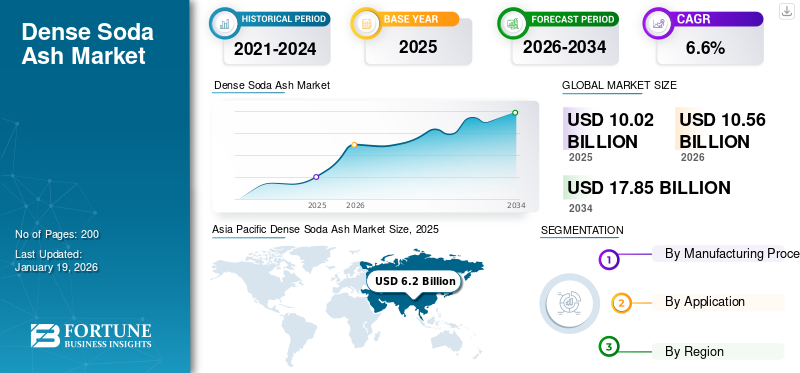

Dense Soda Ash Market Size, Share & Industry Analysis, By Manufacturing Process (Solvay Process and Trona Ore Processing), By Application (Glass, Soaps & Detergents, Chemicals, Alumina & Mining, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global dense soda ash market size was valued at USD 10.02 billion in 2025. The market is projected to grow from USD 10.56 billion in 2026 to USD 17.85 billion by 2034, exhibiting a CAGR of 6.6% during the forecast period. The Asia Pacific dominated the dense soda ash market, accounting for a 62% market share in 2025.

Dense soda ash is a chemical compound also recognized as sodium carbonate with a high bulk density, commonly used as a raw material in numerous industrial processes. It serves as a fundamental element in the manufacturing of glass, detergents, chemicals, alumina, and mining applications. It is produced mainly through the Solvay process or extracted from natural trona ore deposits. The market dynamics are influenced by factors such as industrial growth, technological advancements in production processes, and environmental regulations. Rising demand from the glass and chemical sectors, supported by urbanization and infrastructure development, will significantly drive market growth.

The main players working in the market include Solvay, Tata Chemicals Ltd., Şişecam, Eti Soda Elektrik, and GHCL Limited.

DENSE SODA ASH MARKET TRENDS

Increasing Adoption of Sustainable Production Methods to Boost Market Expansion

The dense soda ash market is witnessing a growing trend toward sustainable production methods as manufacturers struggle to reduce their environmental impact, with innovations in the Solvay process by transitioning toward carbon capture-integrated production models. Companies are investing in progressive technologies such as carbon capture and utilization (CCU) to control greenhouse gas emissions. Additionally, the use of naturally occurring trona ore, which has a lesser environmental footprint compared to synthetic processes, is gaining traction.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Product Demand from Glass Manufacturing Industry to Propel Market Growth

The glass manufacturing industry is one of the largest consumers of dense sodium carbonate, driving significant market growth. Dense sodium carbonate is an important raw material in the production of glass products such as containers, flat glass, and fiberglass. Its role in reducing the melting temperature of raw materials improves energy efficiency during glass production, lowering costs and environmental impact. The growing preference for sustainable and durable glass products in various sectors supports continuous growth in soda ash demand. Hence, the growing automotive and construction industries are expected to boost the dense soda ash market growth in the coming years.

MARKET RESTRAINTS

Environmental Concerns Related to Soda Ash Production Could Limit Market Growth

The production of dense sodium carbonate poses significant environmental challenges that act as a restraint on market growth. The Solvay process, the dominant manufacturing method, generates considerable waste, which can contaminate water bodies and soil if not properly managed. Additionally, mining natural soda ash (trona) involves land degradation and disruption of local ecosystems. Strict environmental rules aimed at reducing pollution and promoting sustainable mining practices increase operational costs for manufacturers; these regulations can limit production capacities.

MARKET OPPORTUNITIES

Expansion of Chemical Industry Brings Great Opportunity for Market

The chemical industry offers significant growth opportunities for dense soda ash due to its wide range of applications. Soda ash is used as a primary raw material in the manufacturing of various sodium-based chemicals such as sodium bicarbonate, sodium silicate, and sodium phosphate. These compounds find extensive use in industries such as pharmaceuticals, water treatment, pulp and paper, and textiles. The increasing demand for specialty chemicals and industrial additives supports soda ash consumption. Furthermore, growing industrialization and advancements in chemical manufacturing processes drive the need for high-purity soda ash.

- As per the International Trade Administration (ITA), India's chemical industry covers almost 80,000 commercial chemical products, which are classified into bulk chemicals, specialty chemicals, petrochemicals, agrochemicals, polymers, and fertilizers. In 2024, the Indian chemical market is valued at USD 220 billion and is projected to grow at 9-12% per annum to reach USD 300 billion by 2026. This brings a major opportunity for the market, as it is used in chemical manufacturing.

MARKET CHALLENGES

Fluctuating Raw Material Prices Pose a Major Challenge to Market

One of the primary challenges facing the market is the volatility in raw material prices. The production of soda ash heavily depends on raw materials such as trona ore and various chemicals used in the Solvay process. Price fluctuations in these inputs can increase production costs, reducing manufacturers' profit margins. Additionally, supply chain disruptions and geopolitical factors can worsen these price swings, making it difficult for companies to maintain stable pricing. The uncertainty around raw material availability and cost forces manufacturers to adopt cautious pricing strategies that could limit revenue growth.

TRADE PROTECTIONISM

Trade protectionism is increasingly shaping the market as countries implement measures to safeguard domestic industries. Tariffs, import quotas, and anti-dumping duties are common tools that restrict foreign competition and support local producers. Trade barriers can disrupt global supply chains, leading to increased costs and supply shortages for manufacturers who rely on imported raw materials.

Segmentation Analysis

By Manufacturing Process

Solvay Process Dominates Market due to Its Consistent Purity Levels

Based on the manufacturing process, the market is classified into the Solvay process and Trona Ore Processing.

The Solvay process holds the largest dense soda ash market share. The process is used for the reaction of sodium chloride, ammonia, and carbon dioxide to form sodium carbonate. This synthetic process is mostly used due to its controlled production, consistent purity levels, and scalability for industrial needs. The production is done via the Solvay process and is highly valued in industries requiring reliable quality, such as glass manufacturing and chemical synthesis. The process’s continuous operation allows producers to meet large-volume demands efficiently.

Trona ore processing involves mining natural deposits of trona, a natural mineral rich in sodium carbonate. This method offers an environmentally friendly substitute to synthetic processes, as it requires less energy and produces fewer emissions. Dense sodium carbonate derived from trona ore is appreciated for its natural origin and relatively lower carbon footprint. Mining locations such as the U.S. and Turkey have large trona reserves, making this process geographically significant.

By Application

Glass Segment Leads Market Due to Growing Construction & Automotive Industries

Based on the application, the market is classified into glass, soaps & detergents, chemicals, alumina & mining, and others.

The glass segment holds the major share in the dense soda ash industry as it is a vital raw material, where it acts as a flux to decrease the melting temperature of silica. This reduces energy consumption during production and enhances the glass’s durability and clarity. The demand for dense sodium carbonate in this sector is driven by growth in the construction, automotive, and packaging industries, which rely heavily on various glass products. High-quality soda ash ensures uniform glass composition and prevents defects, making it an essential ingredient for container and flat glass production.

In the soaps and detergents sector, dense sodium carbonate serves as a key alkali component that is used to manufacture soaps and detergents. It helps remove grease and dirt while maintaining the pH balance of detergent formulations. The growth of household and industrial cleaning products, fueled by rising hygiene awareness globally, directly increases the demand for dense sodium carbonate in this industry. Furthermore, the shift toward eco-friendly and biodegradable cleaning agents has encouraged manufacturers to optimize soda ash usage for improved environmental compliance.

Dense sodium carbonate plays a critical role in the chemical industry as a raw material for producing sodium-based chemicals such as sodium bicarbonate, sodium silicates, and sodium phosphates. These chemicals find applications in water treatment, pulp and paper, textiles, and food processing. The rising demand for specialty chemicals and ecological water treatment solutions is further boosting soda ash consumption.

Dense Soda Ash Market Regional Outlook

By region, the market is categorized into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Dense Soda Ash Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 6.2 billion in 2025 and USD 6.55 billion in 2026, driven by rapid industrialization, urbanization, and rising consumer demand. China and India are the dominant players in this region, with significant contributions from Southeast Asian countries. The expanding glass manufacturing sector, coupled with rising demand from detergents, chemicals, and alumina mining, drives substantial soda ash consumption. Government initiatives promoting infrastructure development, automotive production, and construction activities are key growth factors.

North America

The North American market is driven by an advanced industrial sector with strong demand from glass manufacturing, chemicals, soaps, and alumina mining industries. The U.S. dominates this region, and a well-established manufacturing infrastructure and technological advancements support it. Increasing investments in the automotive and construction sectors further stimulate demand for the dense soda ash industry, primarily used in glass production. Additionally, the detergent industry relies heavily on dense sodium carbonate as a key raw material.

Europe

The European market is characterized by its focus on sustainability and innovation, which is driven by strict environmental policies. Countries such as Germany, France, and the U.K. lead the region’s demand, with the glass and chemical sectors being the major consumers of the soda ash industry. The detergent and alumina mining industries also contribute to market growth. European manufacturers prioritize eco-friendly production processes, reducing emissions and energy consumption in line with regulatory mandates.

Latin America

The Latin American market is experiencing steady growth, mainly driven by industrial expansion in Brazil and Mexico. These countries exhibit increasing demand from the chemical, glass, soap, and alumina mining industries. Infrastructure development and urbanization trends contribute to the expanding market for soda ash in construction and automotive glass manufacturing. The detergent sector also remains a significant consumer due to rising hygiene awareness among the population.

Middle East & Africa

The Middle East & Africa market is gradually developing, supported by increasing industrial activities and infrastructure projects. Countries such as Saudi Arabia, UAE, and South Africa are key contributors, with growing demand from glass manufacturing, chemicals, alumina mining, and detergent sectors. The existence of oil and gas industries in the Middle East also indirectly supports chemical sector growth, contributing to market expansion.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in Their Dominating Market Positions

The dense soda ash industry is highly competitive, with key players focusing on capacity expansion, sustainability, and mergers & acquisitions to strengthen their market presence. Key global companies include Solvay, Tata Chemicals Ltd., Şişecam, Eti Soda Elektrik, and GHCL Limited, among others. These companies compete based on product innovation, cost efficiency, and regional dominance. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY DENSE SODA ASH COMPANIES PROFILED

- Solvay (Belgium)

- Tata Chemicals Ltd. (India)

- Sudarshan Mineral (India)

- Şişecam (Turkey)

- Eti Soda Elektrik (India)

- InoChem. (Saudi Arabia)

- GHCL Limited (India)

- Tokuyama Corporation (Japan)

- QEMETICA (Poland)

- Tangshan Sanyou Group Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS

- December 2023: Solvay introduced a new soda ash production process named e.Solvay process. This new technology promises to cut CO₂ emissions by 50%, reduce energy, water, and salt consumption by 20%, and decrease limestone use and residues by 30%.

- June 2023: Tata Chemicals has announced a USD 968.0 million capex plan, including a 380 KT salt capacity addition in the U.K. and Mithapur, India. This will boost India's global salt capacity to 2.3 MT and 1.8 MT. The investments support growth, sustainability, and increased production across key product lines.

- May 2022: Solvay has acquired the remaining 20% minority stake from AGC in their Green River, Wyoming, soda ash joint venture for USD 120 million, making Solvay the sole owner of the facility. This move strengthens Solvay’s leadership in trona-based soda ash production and aligns with its sustainability goals by expanding its supply of lower carbon-intensive soda ash.

- September 2019: Solvay has increased its soda ash production capacity by 600 KT at its Green River, Wyoming, U.S. facility to meet rising global demand, especially for glass manufacturing and lithium extraction.

REPORT COVERAGE

The global dense soda ash market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information about the key regions/countries, key industry developments, new product launches, details on partnerships, mergers & acquisitions, and a number of dense sodium carbonate manufacturers in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.6% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Kilotons) |

|

Segmentation

|

By Manufacturing Process

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 10.56 billion in 2026 and is projected to reach USD 17.85 billion by 2034.

In 2025, the market value in the Asia Pacific stood at USD 6.2 billion.

The market is expected to exhibit a CAGR of 6.6% during the forecast period of 2026-2034.

The Solvay process segment leads the market by manufacturing process.

The increasing glass manufacturing industry is the major factor driving the market.

Solvay, Tata Chemicals Ltd., Şişecam, Eti Soda Elektrik, and GHCL Limited are some of the leading players in the market.

Asia Pacific holds the largest share of the market.

The growing construction industry and increasing need for quality glass for buildings are expected to drive product adoption in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us