Devsecops Market Size, Share & Industry Analysis, By Deployment (On-premises and Cloud), By Enterprise Type (Large Enterprises and SMEs), By Industry (BFSI, IT & Telecommunication, Government, Manufacturing, Retail & E-commerce, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

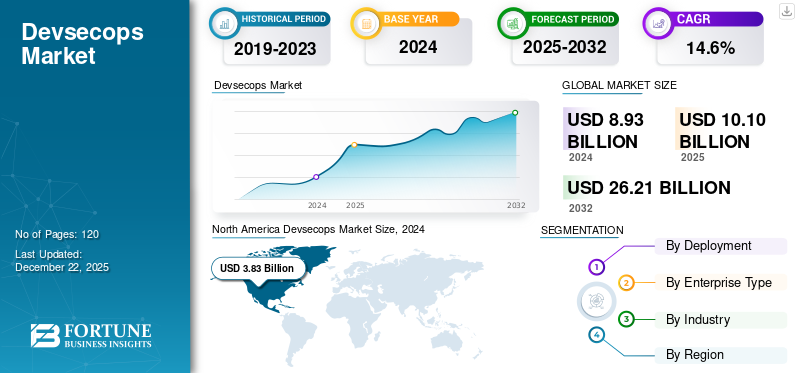

The global Devsecops market size was valued at USD 10.1 billion in 2025. The market is projected to grow from USD 11.49 billion in 2026 to USD 31.96 billion by 2034, exhibiting a CAGR of 13.65% during the forecast period. North America dominated the global market with a share of 42.18% in 2025.

Devsecops is a combination of development, security, and operations. This model ensures that security is embedded from the initial stages of development and is continuously maintained throughout the deployment and operational stages. The growth of cyberattacks and data breach incidents is forcing organizations to integrate security solutions during deployment. This factor plays a vital role in bolstering the market growth.

Further, governments and industries are focusing on implementing stricter regulations for data protection and cybersecurity. As this software helps to identify vulnerabilities and mitigate them early in the development stage, to reduce the risk of a cyber attack. This trend is gaining rapid pace to boost market growth.

The market is dominated by established key players, such as Aqua Security Software Ltd., Amazon Web Services, Inc., Fortinet, Inc., GitLab Inc., and Contract Security. These players focus on the acquisition of small players to augment their offerings. Market players with a broad range of product portfolios are capable of catering to diverse customer needs, which strengthens their market position. This is anticipated to fuel the market growth across the globe.

IMPACT OF GENERATIVE AI

GenAI Enhances Threat Detection, Response, and Developer Productivity in the Market

Generative AI technology has a positive impact on the market. It is capable of predicting security threats, detecting anomalies, and generating threat response recommendations. Further, a generative AI model assists in analyzing the root cause of the cyberattack and creating outputs with actionable insights. The use of gen AI model helps SMEs or startups to fill the skill professional gaps with limited security expertise and by providing real-time assistance and explanations. Key players operating in the market, such as AWS, Microsoft, Google LLC, GitLab, and Palo Alto Networks, are increasingly integrating GenAI models into their Devsecops platforms. Owing to these features, large enterprises and SMEs are primarily adopting this tool to enhance the productivity and security of their applications. For instance,

- According to industry experts, SMEs using generative AI tools for security operations observed a 35% improvement in threat response times.

MARKET DYNAMICS

Market Drivers

Rising Cybersecurity Threats and Breach Incidents are Fueling Market Growth

The rise in incidents of ransomware, data breaches, and supply chain attacks is forcing organizations globally to provide security for their software tools. The adoption of Devsecops enables IT companies to provide highly secure software. For instance,

- According to the IBM Cost of Data Breach Report, 2023, the global average cost of a data breach reached approximately USD 4.5 million in 2023, up 15% over 3 years.

Sometimes, cybersecurity incidents may result in legal liabilities and reputational damage to global organizations. Thus, the rise in cybercrime is acting as a major factor for the adoption of development, security, and operations, thus fueling the market growth.

Market Restraints

Shortage of Skilled Devsecops Professionals May Hinder Market Growth

Globally, there is a significant shortage of skilled professionals with expertise in cybersecurity and software development. The market requires a professional developer who is aware of security protocols and coding practices. For instance,

- According to industry experts, by 2025, 80% of development teams will lack security expertise to develop secure applications.

- SANS Institute study reveals that the average time required to take over a Devsecops role exceeds 6 months.

Thus, a shortage of developers with expertise in security protocols and coding knowledge may act as a barrier to market growth.

Market Opportunities

Growing Demand for Cloud-Native Security Solutions Creates Lucrative Opportunities for Market Growth

Enterprises across multiple industries are significantly adopting cloud-native technologies to enhance the security, scalability, and agility of solutions offered. Cloud-native solutions are scalable and cost-effective and hence are increasingly adopted by SMEs to manage their workloads efficiently.

In addition, Kubernetes security and Cloud Security Posture Management (CSPM) tools are becoming vital to ensure that cloud environments are properly configured and secure. Thus, these factors are expected to fuel the market growth during the forecast period.

DevSecOps Market Trends

Rising Popularity of Threat Detection Automation in Organizations is Emerging as a Prominent Market Trend

Devsecops platforms are increasingly deploying artificial intelligence and machine learning technologies to automate vulnerability scanning, threat detection, remediation guidance, and alert triaging. These intelligent systems enhance developer productivity and improve response times. Moreover, the automation process ensures that every application is updated frequently per day in real time. On the other hand, manual security monitoring cannot match the speed of the automation process. In addition, the adoption of an automation tool is beneficial for organizations as it lowers operational costs by eliminating dependency on manual security monitoring. For instance,

- According to IBM Cost of a Data Breach Report (2024), organizations that deploy automation and AI technology in cybersecurity applications save an average amount of USD 1.76 per breach compared to companies without automation.

Thus, these factors play a crucial role in fueling the Devsecops market growth during the forecast period.

SEGMENTATION ANALYSIS

By Deployment

Rising Demand for Secure and Flexible Platforms Propels the Adoption of Cloud-based Solutions in Organizations

Based on deployment, the market is bifurcated into on-premises and cloud.

Cloud deployment accounted for the largest market with a share of 71.1% in 2026, and it is expected to continue its dominance by growing at the highest CAGR during the forecast period, as it offers flexibility, scalability, and cost-effectiveness. Cloud deployment is easily integrated with cloud-native devsecops tools and offers real-time security monitoring from any remote location to provide higher flexibility. Also, cloud solutions support pay-as-you-go or tiered subscription pricing models, which makes them cost-effective and suitable for SMEs.

On-premises deployment is expected to grow at a moderate CAGR during the forecast period, as multiple businesses shift toward flexibility and the automation process offered by cloud deployment. Further, on-premise deployment requires high capital expenditure for hardware, software licenses, and skilled IT staff. Thus, their popularity is expected to decrease over time.

By Enterprise Type

High-Security Needs Fuel DevSecOps Investment in Large Organizations

Based on enterprise type, the market is classified into large enterprises and SMEs.

Large Enterprises captured the largest market with a share of 52.55% in 2026. Large enterprises have a complex IT infrastructure and require high-security solutions to manage risks. These types of organizations require customized security solutions that can be integrated into various workflows, systems, and platforms. Thus, large enterprises are ready to invest heavily in devsecops solutions market.

SMEs are anticipated to grow at a highest CAGR during the forecast period. SMEs are increasingly shifting to cloud-based infrastructure and development, security, and operations platforms as they do not require a large initial investment. Also, it enables SMEs to meet compliance standards such as GDPR, HIPAA, and others, easily. Thus, these factors are projected to boost the segment growth.

By Industry

To know how our report can help streamline your business, Speak to Analyst

Surge in Cyber Risks and Digital Banking Fuels DevSecOps Demand in BFSI

Based on industry, the market is categorized into BFSI, IT & telecommunication, government, manufacturing, retail & e-commerce, and others (media & entertainment, education, and others).

BFSI accounted for the largest market with a share of 27.81% in 2026, owing to a rise in ransomware, data breaches, and cyberattacks. Development, security, and operations solutions help financial institutions by embedding early protection in the development lifecycle. Further, with growing digital transformation in multiple sectors, digital banking and mobile payment systems are rising at a rapid pace. To provide quick and secure banking services, financial institutions are increasingly adopting Devsecops solutions.

Retail & E-commerce is projected to grow at the highest CAGR during the forecast period. Rise in demand for digital wallets and mobile apps among customers fuels the demand for development, security, and operations software, as it offers secure and continuous integration/continuous deployment (CI/CD) pipeline for online and in-store transactions. Moreover, it ensures secure authentication mechanisms and third-party risk mitigation, thus it is anticipated to showcase significant growth in the coming years.

DEVSECOPS MARKET REGIONAL OUTLOOK

Geographically, the market is segmented into North America, South America, Asia Pacific, Europe and Middle East & Africa.

North America

North America Devsecops Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest devsecops market share in 2026, owing to the early adoption of cloud, agile, and DevOps practices. North america dominated the market with a valuation of USD 4.26 billion in 2025 and USD 4.76 billion in 2026. The presence of an advanced digital infrastructure, and leading market vendors, such as AWS, Microsoft, Google, Palo Alto Networks, and GitLab, plays a pivotal role in driving market growth in the region. Also, the U.S. and Canada face massive data breaches and ransomware attacks in BFSI, retail, government, and other critical institutions. To tackle this situation, development, security, and operations tools are increasingly used in these institutions, which play an important role in fueling the market growth across the region. For instance,

- According to an industry survey report, North America accounted for 45% of global Devsecops spending in 2023, with strong focus on BFSI, IT & Telecom, and manufacturing sectors.

These factors bolster the market growth across the region.

Download Free sample to learn more about this report.

The U.S. is a leader in the adoption of development, security, and operations tools, driven by early adoption of cloud and a significant presence of cybersecurity mandates. Further, the U.S. has the presence of a significant number of skilled DevOps engineers and security analysts. However, to fill the gap for the shortage of security-focused developers, devsecops platforms are mainly used in organizations across various fields. These factors play an important role in fueling market growth across the U.S. The U.S. market is valued at USD 3.5 billion by 2026.

South America

The adoption of development, security, and operations is growing significantly in South America. Countries such as Brazil, Argentina, and Chile are witnessing significant investment in mobile payments, digital banking, and online shopping. Development, security, and operations tools are increasingly adopted in digital platforms to ensure quick and secure transactions while maintaining compliance with local regulations. These factors fuel the market growth across the region. For instance,

- Brazil’s PIX instant payment system uses devsecops tool to secure banks and fintechs with the help of CI/CD + security.

Europe

In Europe, the market is growing at a prominent pace, as banking sectors mainly use devsecops solutions, due to increasing incidents of cyberattacks. Moreover, the retail & e-commerce sector is adopting this solution to provide security to customer data and online payment infrastructure. The UK market is valued at USD 0.42 billion by 2026, and the Germany market is valued at USD 0.41 billion by 2026. Further, France is also investing in secure cloud ecosystems that support development, security, and operations tools adoption. For instance,

- In June 2025, Black Duck partnered with Arm, a European semiconductor and software design company. Through this collaboration, Black Duck aims to help organizations by aligning with new European software regulations for Arm64-based systems. These factors are contributing to market growth in the region.

Middle East & Africa

The Middle East & Africa are expected to showcase noteworthy growth during the forecast period. The deployment of cloud infrastructure is expanding at a rapid pace across the region, owing to the presence of local data center facilities of AWS, Azure, and Oracle in the UAE, Saudi Arabia, and South Africa. Moreover, in Nigeria, Kenya, and the UAE, the fintech sector is growing rapidly, as it requires a security tool to protect software from cyberattacks. These factors play a crucial role in fueling the market growth in the region.

Asia Pacific

Asia Pacific is expected to grow at the highest CAGR during the forecast period. Digital transformation is growing at a rapid pace in emerging economies, such as Indonesia, India, Philippines, and Vietnam, along with developed markets, including Australia, Japan, Singapore, and South Korea. Moreover, telecom operators in the region are integrating devsecops solutions to 5G infrastructure rollouts across the region. These factors play a vital role in fueling the market growth in the region. The Japan market is valued at USD 0.73 billion by 2026, the China market is valued at USD 0.79 billion by 2026, and the India market is valued at USD 0.59 billion by 2026. For instance,

- As per the industry experts, 65% of large telecom operators in Asia Pacific will adopt Devsecops in their CI/CD pipeline security by 2026.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Market Players Are Emphasizing on Partnership and Acquisition Strategies to Increase Their Customer Base

Key players are concentrating on expanding their presence by offering industry-specific services. They are tactically focusing on acquisitions and collaborations with regional players to sustain control across regions. Top market contributors are launching new solutions to escalate their consumer base. Rise in constant R&D investments for product innovations is improving their market expansion. Hence, firms are rapidly implementing these dynamic initiatives to withstand the market competition.

Long List of Companies Studied

- Amazon Web Services, Inc. (U.S.)

- Alphabet Inc. (Google LLC) (U.S.)

- Trend Micro Incorporated (Japan)

- CA Technologies (Broadcom) (U.S.)

- IBM Corporation (U.S.)

- GitLab Inc. (U.S.)

- Aqua Security Software Ltd. (Israel)

- Fortinet, Inc. (U.S.)

- Contrast Security, Inc. (U.S.)

- OpenText (Canada)

- Palo Alto Networks, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- Riverbed Technology (U.S.)

- Sonatype Inc. (U.S.)

- Atlassian Corporation Plc. (Australia)

- Black Duck Software (Synopsys, Inc.) (U.S.)

- Snyk Limited (U.S.)

- Checkmarx Ltd. (U.S.)

- Cisco Systems, Inc. (U.S.)

- Datadog Inc. (U.S.)

….and more

KEY INDUSTRY DEVELOPMENTS

- April 2025: Aqua Security launched Secure AI applications. It provides real-time protection against threats related to AI workloads.

- April 2025: Amazon Web Services engaged into partnership with GitLab. Through this collaboration AWS plans to integrate agentic artificial intelligence development assistant Q Developer. This integration is expected to accelerate Devsecops software workflows.

- June 2024: Datadog, Inc. introduced Datadog App Builder, a low-code development solution to help teams quickly create self-service applications. This application will help devsecops team to take actions on incidents, within Datadog.

- March 2024: GitLab, Inc. acquired Oxeye, a provider of cloud-native application security solutions. Through this acquisition, GitLab aims to boost its static and dynamic application security testing (SAST/DAST) project. This collaboration is expected to advance SAST by integrating AI and ML technologies.

- June 2023: Atlassian Corporation unveiled a novel security capabilities for Jira Software Cloud. This tool will help developers and engineers to streamline their workflow in a single software.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Key players operating in the market, such as Aqua Security Software Ltd., Amazon Web Services, Inc., Fortinet, Inc., GitLab Inc., and Contract Security, are increasingly investing in innovative AI and ML technologies to enhance detection, threat modeling, and automated remediation. These technologies are capable of predicting attacks before they occur. Thus, the ability to deliver proactive risk management with real-time anomaly detection is expected to create a lucrative opportunity for market growth.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.65% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Enterprise Type

By Industry

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

The market is expected to reach USD 31.96 billion by 2034.

In 2025, the market was valued at USD 10.1 billion.

The market is projected to grow at a CAGR of 13.65% during the forecast period.

By industry, BFSI led the market.

Rising cybersecurity threats and breach incidents are fueling market growth.

Amazon Web Services, Inc., Alphabet Inc. (Google LLC), Trend Micro Incorporated, CA Technologies (Broadcom), IBM Corporation, GitLab Inc., Aqua Security Software Ltd., Fortinet, Inc., Contrast Security, Inc., and OpenText are the top players in the market.

North America held the highest market share.

By industry, the retail & e-commerce sector is expected to grow with the highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us