Electric Vehicle Battery Management System Market Size, Share & Industry Analysis, By Battery Type (Lithium-Ion (Li-Ion), Nickel-Metal Hydride, and Others), By Propulsion Type (Battery Electric Vehicle and Hybrid Electric Vehicle), By Topology (Modular BMS, Decentralized BMS, and Centralized BMS), By Vehicle Type (Passenger Car, Commercial Vehicles, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

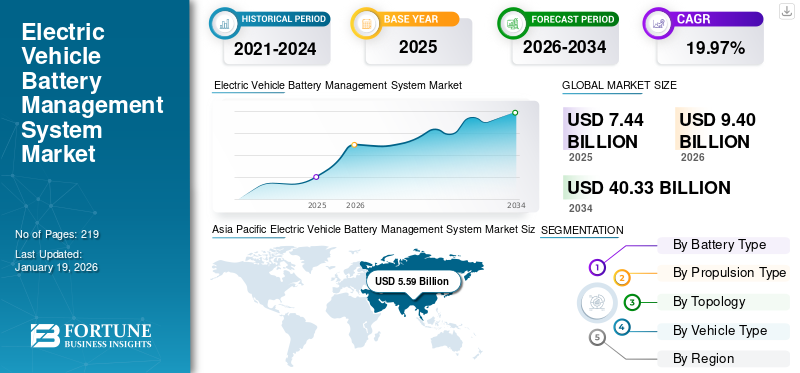

The global electric vehicle battery management system market size was valued at USD 7.44 billion in 2025 and is projected to be worth USD 9.4 billion in 2026 and reach USD 40.33 billion by 2034, exhibiting a CAGR of 19.97% during the forecast period. Asia Pacific dominated the electric vehicle battery management system market with a market share of 11.53% in 2025.

An EV battery management system is an electronic control unit that monitors and manages the battery pack's performance, safety, and lifespan in electric vehicles. EV batteries can be risky if not monitored carefully. These systems protect batteries against overcharging, overheating, short circuits, fires, and explosions. Safety is the biggest reason every EV needs a good battery management system.

Battery management system helps to improve battery efficiency, lengthen lifespan, and increase driving range which is extremely important for lithium-ion powered EVs. Continuous advancements in lithium ion batteries and fast-charging capabilities are driving the growth of smart BMS solutions.

Lithium-ion battery segment will have a strong CAGR during the forecast period due to higher energy density, lower weight, a longer cycle life, and growth in electric vehicle batteries.

Panasonic, Zebra, and Cyient are global leaders in EV-ion batteries. Moreover, only Panasonic is considered a global leader in the market in directly manufacturing and supplying batteries and BMS components.

MARKET DYNAMICS

MARKET DRIVERS

Rapid Growth of Electric Vehicles to Drive the Market Expansion

Electric Vehicles (EVs) use electric motors instead of internal combustion engines for propulsion. EVs are powered by rechargeable batteries, which store electrical energy and provide it to the motor. These batteries are paired with an electric vehicle's battery management system. As electric vehicle sales surge globally, demand for electric vehicle battery management system increases because every EV requires a reliable system to manage battery health, performance, and safety.

In December 2024, Infineon Technologies AG and Eve Energy Co., Ltd. (EVE Energy), a lithium battery manufacturer, registered a Memorandum of Understanding (MoU). These two companies aim to authorize complete battery management system solutions for the automotive market.

MARKET RESTRAINTS

High Initial Costs to Hinder Market Growth

The high initial cost of the system is a major factor restraining the electric vehicle battery management system market growth. Advanced BMS solutions incorporate costly components such as sensors, microcontrollers, communication interfaces, and thermal management systems, significantly increasing the overall system cost. Additionally, integrating sophisticated technologies namely wireless BMS, cloud-based monitoring, and artificial intelligence further escalates expenses.

MARKET OPPORTUNITIES

Advancements in Battery Technology to Drive Market Growth

Advancements in battery technology are emerging as a key driver for the growth of the electric vehicle battery management system market. With continuous improvements in battery chemistries such as solid-state batteries, lithium iron phosphate, and lithium sulfur batteries, there is a rising need for advanced electric vehicle battery management system solutions to manage these new battery types efficiently. Each of these chemistries has different characteristics in terms of energy density, thermal behavior, and charging/discharging patterns, which require a specialized BMS for effective monitoring and control.

In September 2024, India's largest producer of sustainable critical minerals, Lohum Cleantech Ltd, partnered strategically with U.S.-based ReElement Technologies Corporation and American Metals LLC to build the U.S.'s first completely integrated battery recycling and crucial material manufacturing facility.

Electric Vehicle Battery Management System Market Trends

Surging Traction of Wireless Vehicle Battery Management System to Positively Impact the Market Growth

The increasing demand for wireless electric vehicle battery management systems is becoming a major driver of market growth. Unlike traditional wired BMS, which requires complex wiring harnesses to connect individual battery cells and modules, wireless BMS eliminates physical connections, reducing vehicle weight, complexity, and assembly time.

Wireless BMS also enables greater design flexibility, allowing automakers to optimize battery pack layouts for different vehicle platforms, including passenger cars, trucks, buses, and even three-wheelers. In addition, it improves scalability and makes maintenance easier by facilitating easier replacement of cells or modules.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Battery Type

Superior Performance Compared to Other Batteries Drive Lithium-Ion Segment Growth

The market, by battery type covers lithium-ion, nickel-metal hydride, and others.

Lithium-ion is the dominating segment in the market owing to its high energy density, lightweight nature, and long cycle life. Lithium-ion batteries last longer than older battery types such as lead-acid or nickel metal-hydride.

Nickel-metal hydride is the second leading segment in the market. These batteries are widely used in hybrid electric vehicles. These vehicles still represent a large share of the EV market, contributing to strong demand for NIMH compatible battery management system.

By Propulsion Type

Inclination toward Zero Carbon Neutrality to Surge Battery Electric Vehicles Segment Growth

The market is segmented, by propulsion type into battery electric vehicle and hybrid electric vehicle.

Battery electric vehicles is the dominating segment in the market. This segment is experiencing significant growth, driven by the accelerating global shift towards electric mobility, technological advances, and shifting energy infrastructure.

Hybrid electric vehicles is the second dominating segment in the market, they have been on the market longer than fully electric vehicles, with strong adoption in Japan, U.S., and Europe.

By Topology

Adaptation of Modular BMS of Different Pack Sizes to Lead the Segment Growth

By topology, the market is segmented into modular BMS, decentralized BMS, and centralized BMS.

Modular BMS is the dominating segment in the market. This BMS easily adapts to different battery pack sizes and configurations. EV manufacturers scale up or down by adding or removing BMS modules, making it ideal for passenger vehicles, commercial EVs, and energy storage systems.

Decentralized BMS is the fastest growing segment in the market. This BMS supports a modular battery design, making it easier to add, remove, or replace battery modules. This is ideal for scalable EV platforms, especially in commercial or heavy duty electric vehicles.

By Vehicle Type

High Sales of Passenger Cars to Boost the Segment Growth

By vehicle type, the market is segmented into passenger cars, commercial vehicles, and others.

The passenger cars segment dominates the electric vehicle battery management system market, as passenger vehicles make up the majority of EV sales worldwide. In 2023, over 85% of total EV sales were passenger cars, including battery and plug-in hybrid electric vehicles.

Commercial vehicles segment requires larger and more powerful batteries, increasing the need for sophisticated BMS to ensure safety, longevity, and efficiency. Governments are imposing zero emissions mandates for commercial fleets.

ELECTRIC VEHICLE BATTERY MANAGEMENT SYSTEM MARKET REGIONAL OUTLOOK

The market has been analyzed regionally in to North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific region dominated the market owing to their higher demand for battery management systems to monitor and control the battery performance.

North America

Asia Pacific Electric Vehicle Battery Management System Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America, particularly the U.S. and Canada, is witnessing rapid EV adoption. EV sales in the region are growing due to rising consumer demand for clean transportation, government incentives for EVs, and expanding charging infrastructure. Battery electric vehicles and plug-in hybrid EVs are boosting demand for advanced BMS solutions. The U.S. Inflation Reduction Act (IRA) offers tax credits for EV purchases, investments in domestic battery production.

U.S.

The U.S is witnessing strong growth in EV sales, driven by automakers such as Tesla, Ford, GM, and Rivian. Federal programs including the Inflation Reduction Act (IRA) and state level rebates, subsidize EV production and purchase, boosting electric vehicle battery management system demand. BMS is critical for compliance with safety and energy efficiency regulations.

Europe

Europe is among the largest EV markets globally, especially in Germany, Norway, U.K., France, Netherlands, and Sweden. EV sales in Europe are driven by government incentives and subsidies for EV buyers, rapid charging infrastructure growth, and growing consumer environmental awareness. European regulators and automakers place high emphasis on vehicle and battery safety.

Asia Pacific

Asia Pacific dominated the global EV sales market, driven primarily by China, Japan, South Korea, and India, with the electric vehicle battery management system market valued at USD 5.59 billion in 2025 and expanding to USD 7.19 billion in 2026. There is a higher demand for BMS to monitor and control battery performance. In China, there are EV purchase subsidies, new energy vehicle mandates, and zero emission goals. A growing number of battery gigafactories in China, South Korea, India, and Japan is boosting the demand for BMS to manage battery performance, safety, and durability.

Latin America

Latin America is witnessing steady growth in EV sales, especially in countries such as Brazil, Mexico, Chile, Colombia, and Argentina. Several Latin American countries are introducing incentives and tax benefits for EVs: import tax exemptions, subsidies on EV purchases, and zero-emission transportation policies. Policies encouraging EV use directly increase electric vehicle battery management system demand, as every EV requires a BMS for battery safety and performance.

Middle East and Africa

Many MEA countries are pushing for cleaner mobility to meet Vision 2030 goals and net-zero targets. UAE aims for 50% of road cars to be electric by 2050. Smart city projects in Dubai, Abu Dhabi, Riyadh, and other cities encourage sustainable transport. Extreme heat and dust in many Middle Eastern countries create battery safety challenges. Growing investment in EV charging infrastructure across the Middle East, UAE, Saudi Arabia, and Israel is leading with fast charging stations.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Manufacturers Focus on Strategic Partnerships and Technology Sharing To Gain Competitive Advantage

Major battery manufacturers are collaborating to strengthen next-generation battery technology through research and developments, partnerships and investing in new battery technologies.

In February 2025, Infineon Technologies AG, a worldwide semiconductor leader in power systems and IoT, and Eatron, a global contributor to AI-powered battery optimization software, increased their operating collaboration for battery management solutions in automotive to a complete electric vehicle battery management system portfolio comprising several industrial and consumer applications.

List of Key Electric Vehicle Battery Management System Companies Profiled

- Infineon (Germany)

- Zebra (U.S.)

- Panasonic (Japan)

- Cyient (India)

- SRM Technologies Private Ltd. (India)

- Monolithic Power Systems, Inc. (U.S.)

- Aptiv (Ireland)

- LOHUM (India)

- eInfochips (U.S.)

- STMicroelectronics (Switzerland)

- LocoNav (India)

- Cavli Inc. (U.S.)

- Tata Elxsi (India)

- Bacancy Company (India)

- LEM International SA (Switzerland)

KEY INDUSTRY DEVELOPMENTS

- In June 2025, Tata Elxsi, a worldwide leader in design and technology services, and Infineon Technologies, a global leader in semiconductor solutions, signed a Memorandum of Understanding (MoU) to expand application-ready EV solutions customized to the Indian market cooperatively.

- In June 2025, STMicroelectronics declared the establishment of the STGAP4S, a galvanically isolated automotive gate driver created for use with Silicon Carbide (SiC) MOSFETs and Insulated-Gate Bipolar Transistors (IGBTs). The device assists scalable inverter designs for Electric Vehicle (EV) powertrains and comprises incorporated diagnostics and preventions to meet ISO 26262 ASIL D functional safety regulations.

- In January 2025, Aptiv PLC declared its purpose to detach its Electrical Distribution Systems (EDS) business through a spin-off, creating two autonomous companies. This decision was accepted by the company’s Board of Directors and is anticipated to be finished by March 31, 2026, uncertain regulatory acceptance and other customary conditions.

- In April 2024, Tata Motors Ltd is increasing its battery obtaining for electric vehicles (EVs) by collaborating with Octillion Power Systems India Private Limited, an Indian subordinate of the US-based Octillion Power Systems, Inc., announced LiveMint.

- In December 2020, Panasonic Corporation provided a modern, cloud-based battery management service, the UBMC (Universal Battery Management Cloud) service, using a proprietary AI-based technology leveraging its battery expertise. The technology can ascertain the state of various types of batteries installed in Electric Mobility (e-mobility) vehicles in real time to ensure their easy utilization.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product processes, competitive landscape, and leading sources of electric vehicles' battery management systems. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 19.97% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Battery Type

|

|

By Propulsion Type

|

|

|

By Topology

|

|

|

By Vehicle Type

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 7.44 billion in 2025.

In 2025, the Asia Pacific market value stood at USD 5.59 billion.

The market is expected to exhibit a CAGR of 19.97% during the forecast period.

The lithium-ion segment is leading the market by battery type.

Rapid growth of electric vehicles to drive the market growth.

Some of the top major players in the market are Infineon, Zebra, and others.

Asia Pacific dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us