Europe Large Scale Heat Pump Market Size, Share & Industry Analysis, By Type (Air Source, Water Source, and Geothermal), By Capacity (10-20 MWth, 20-40 MWth, 40-80 MWth, and Above 80 MWth), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

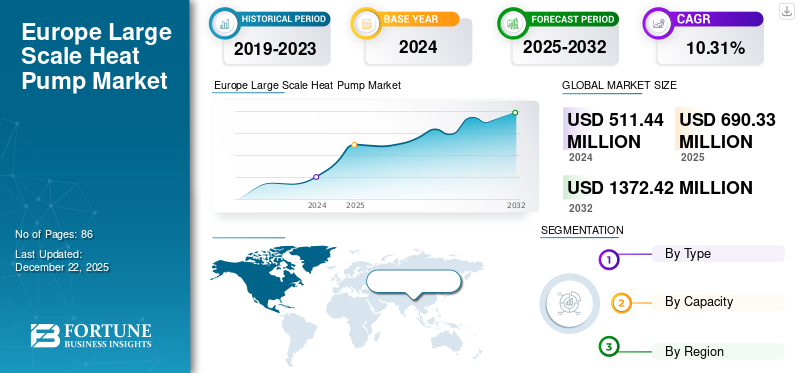

The Europe large scale heat pump market size was valued at USD 511.44 million in 2024. It is projected to be worth USD 690.33 million in 2025 and reach USD 1,372.42 million by 2032, exhibiting a CAGR of 10.31% during the forecast period.

The industrial-scale heat pump is used in commercial or industrial settings, as well as district heating networks. It requires higher input temperatures than those used in residential heating applications. These temperatures can be obtained from waste heat generated by industrial processes, data centers, or wastewater.

The European Union's emphasis on cutting emissions and reaching net-zero goals is boosting the need for clean and energy-efficient heating solutions such as heat pumps. In addition to this, the EU aims to reduce its dependency on fossil fuels, which is driving market growth.

Man Energy Solutions is one of the key players in the market. It focuses on industrial high-temperature heat pumps for district heating and the process industry with the aim of delivering sustainable heating and facilitating the heat transition. In addition, Man Energy’s industrial heat pump systems utilize multiple heat sources efficiently. Powered by renewable electricity, they generate nearly no emissions. Furthermore, it is also focusing on environmental friendly coolants, which enhances its position in the European heat pump market.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Rising Energy Security Concerns is Driving the Demand for Heat Pumps in Europe

Europe is significantly dependent on natural gas. The majority of the gas imports were from Russia. According to the Council of the EU and the European Council, the proportion of Russia’s pipeline gas in EU imports fell from more than 40% in 2021 to approximately 8% in 2023. For both pipeline gas and LNG together, Russia represented under 15% of total gas imports to the EU.

Energy security is one of the primary concerns in today’s world. Uncertainty in geopolitical situations creates volatility in energy prices, which is why technologies such as heat pumps play a significant role in Europe. Heat pumps enhance the industrial value chain and promotes energy autonomy which helps to reduce reliance on fossil fuels. As stated in the IEA special report The Future of Heat Pump, “The majority of buildings globally, including residences, workplaces, educational institutions, and manufacturing facilities, continue to depend on fossil fuels for heating, especially natural gas.

Heat pumps solutions represent a highly efficient and eco-friendly option that aids consumers in reducing their bill expenses while allowing nations to lessen their dependence on imported fossil fuels.

Heat Pump’s Technical Benefits are Helping Decarbonization, which is Driving the Market Growth

Europe is actively striving for carbon neutrality, with district heating systems being vital in lowering emissions. For instance, the EU Green Deal and the Fit for 55 initiative aim for a bold goal of cutting greenhouse gas (GHG) emissions by 55% by 2030.

In addition, the significant benefit of high-capacity large scale heat pumps is their capacity to harness waste heat from industrial operations, wastewater treatment facilities, and data centers. Due to which the adoption of heat pumps is increasing in the Europe large scale heat pump market growth.

According to IEA Executive Director Fatih Birol, heat pumps are a crucial element of any strategy to reduce emissions and natural gas consumption, and they are an immediate priority in the European Union. The technology has been proven effective, even in the harshest climates. Decision-makers ought to support this technology, which is currently experiencing remarkable momentum. Heat pumps will play a key role in ensuring that all can warm their house in winter as well as safeguarding households and businesses from soaring costs, and achieving climate goals.

MARKET RESTRAINTS

Availability of Alternatives to Heat Pump Hampers the Market Growth

The implementation of large-scale heat pumps (>10 MWth) in Europe encounters considerable obstacles because of the presence of alternative heating options, which frequently offers reduced initial expenses, existing infrastructure, and greater technological development. As heat pumps become increasingly popular for decarbonization, district heating operators, industries, and municipalities continue to view competing technologies like biomass boilers, combined heat and power (CHP) plants, waste-to-energy (WTE) systems, and direct electrification as feasible options.

A commonly embraced alternative is district heating powered by biomass, especially in Scandinavian and Central European nations. Biomass boilers are viewed as a dependable and economical option for district heating systems, while utilizing established fuel supply networks.

Another effective option is combined heat and power (CHP) facilities, which produces both electricity and heat efficiently. Numerous European cities, especially in Germany, Poland, and the Czech Republic, continue to run CHP plants that utilize natural gas or biomass. Governments persist in backing CHP because of its capacity to enhance grid stability and energy efficiency.

MARKET OPPORTUNITIES

Industrial Process Heating Shift Toward Electrification is Expected to Offer Lucrative Opportunities

The manufacturing sector represents almost 26% of Europe's overall energy usage, with a significant share allocated to process heating. Historically, industries have depended on natural gas, coal, and oil for thermal energy; however, rising carbon prices, energy security issues, and emissions regulations are hastening the transition to electrified heating options. The EU Emission Trading System (ETS), which imposes costs on industrial plants for their CO₂ emissions, has experienced carbon prices exceeding USD 104 per ton of CO₂ in 2023, rendering fossil fuel-based heating financially impractical.

Industrial heat pumps (>10 MWth) are currently being incorporated into the food & beverage, chemicals, pulp & paper, and textile industries for process heating needs between 80–150°C. In contrast to traditional boilers, heat pumps can capture and enhance low-grade waste heat while greatly boosting energy efficiency. A report by the International Energy Agency (IEA) suggests that nearly 50% of industrial heat demand can be satisfied with heat pump technology, significantly lessening dependence on fossil fuels.

MARKET CHALLENGES

Fluctuating Raw Material Prices to Create Challenge for Market Growth

The expense for crucial materials like steel, aluminum, copper, and plastics utilized in the production of large scale heat pumps can greatly differ due to market fluctuations, geopolitical conflicts, and supply chain interruptions. Such variations result in erratic changes in production costs, which directly influence manufacturers' profit margins.

As the prices of raw materials increase unexpectedly, manufacturers find it challenging to keep their product prices competitive. This scenario leads to heightened production expenses that are hard to transfer to consumers without threatening heat pump sales or market share. As a result, businesses may encounter reduced profit margins and financial uncertainty.

EUROPE LARGE SCALE HEAT PUMP MARKET TRENDS

Rising Integration of the Internet of Things (IoT) and the Emergence of Natural Refrigerants are Emerging Trends

Natural refrigerant is one of the emerging trends in the market. For instance, a coalition of European NGOs dedicated to environmental issues has contacted the European Commission to advocate for backing the implementation of top-tier natural refrigerant heat pumps.

Integration of advanced technologies is also one of the emerging trends in the market. The integration of AI in the heat pump is also one of the trends in the market and it is expected to help increase efficiency and energy consumption.

For instance, Wondrwall, a U.K.-based provider of energy equipment and solutions, introduced the most advanced heat pump system for home use. According to Wondrwall, the new product is completely aligned with its AI-driven Home Energy Management System (HEMS). The new monobloc air source heat pump transforms low-carbon heating efficiency by cutting energy usage, decreasing operating expenses, and aiding grid flexibility. By utilizing Wondrwall HEMS and smart heat pump controls, heating energy costs can be lowered by more than 80% when compared to similar homes that use standalone heat pumps.

IMPACT OF COVID-19

A significant and immediate effect of COVID-19 was the disruption of global supply chains, impacting the accessibility of essential components like compressors, heat exchangers, refrigerants, and electronic controls. Numerous elements are produced in China and other industrial centers, which encountered factory closures, shipping hold-ups, and higher logistics expenses during the pandemic. This led to extended times for heat pump producers, hindering the manufacturing and distribution of large-scale heat pumps across Europe.

SEGMENTATION ANALYSIS

By Type

Air Source Heat Pump is Majorly Deployed Due to its Beneficial Characteristics

On the basis of type, the market is segmented into air source, water source, and geothermal.

Air-source heat pumps dominating segment in Europe owing to their efficiency, affordability, and capacity to utilize renewable energy sources, along with escalating (non-renewable energy sources) energy prices and heightened consumer awareness of energy-efficient technologies.

Additionally, in coming years, water sources are expected to see considerable growth and outpace the air source type. Water source heat pumps are becoming popular in certain areas that have access to significant water bodies, wastewater treatment plants, and industrial waste heat sources. These systems draw heat from rivers, lakes, seawater, or industrial discharges, providing greater efficiency than ASHPs since water temperatures are more consistent year-round.

For instance, in December 2024, RheinEnergie tasked MAN Energy Solutions with providing a complete riverine heat pump facility at its Cologne-Niehl power plant location. Boasting a heating capacity of 150 MW. The heat pump system will draw water from the Rhine as its energy source, functioning with a natural refrigerant in a closed-loop setup.

To know how our report can help streamline your business, Speak to Analyst

By Capacity

10-20 MWth Range Leads the European Market Regarding Installations Due to its Ability in Seamless Integration

On the basis of capacity, the market is divided into 10-20 MWth, 20-40 MWth, 40-80 MWth, and above 80 MWth.

10-20 MWth segment held the dominant share in the market in 2024. A crucial aspect contributing to the prominence of this category is its seamless integration and scalability. Towns that already have district heating systems can swiftly substitute fossil fuel-based systems with these heat pumps without needing significant infrastructure alterations.

The 20–40 and 40-80 MWth segments are gaining traction, especially in major urban centers with advanced district heating systems. These heat pumps offer a compromise between capacity and operational efficiency, making them ideal for cities with populations between 100,000 and 500,000 inhabitants.

EUROPE LARGE SCALE HEAT PUMP MARKET COUNTRY OUTLOOK

The market has been studied country-wise across Germany, the U.K., France, Italy, Spain, Sweden, Poland, Finland and Rest of Europe.

Sweden

Sweden is the Leading Country Due to its Focus on Decarbonizing District Heating Networks

Sweden is leading the Europe large scale heat pump market share and one of the major countries in heat pump market. In Sweden, the implementation of a carbon tax in 1991 and continuous rises in the tax rate have prompted a significant transition from oil boilers to heat pumps. In 2022, the carbon price in Sweden hit around USD 134.5 per tonne of CO2 – among the highest globally. As a result, oil boilers have mostly been discontinued, with heat pumps representing over 90% of current heating system sales.

Finland

Finland is Focusing on Large Scale Heat Pump Deployment to Reduce the Carbon Emission

Finland is also one of the major countries in the market. Finnish energy firm Helen Oy has engaged MAN Energy Solutions to provide an air-to-water heat pump for its Patola heating plant complex located in Helsinki. The new heating facility, featuring an industrial-scale heat pump along with two electric boilers of 50 MW each, is expected to lower CO2 emissions by a total of 56,000 tons. The air-to-water heat pump facility will be the largest facility globally, featuring a total heating output capacity between 20 and 33 MW, contingent on air temperature. The facility is anticipated to commence production in the heating season of 2026-2027.

Denmark

Denmark's Goal Of Fossil Fuel-Free Heating Is Driving The Heat Pump Deployment In The Country

Denmark is considered one of the key countries in the market. Following the decision by the Danish Energy Agency to shut down the Esbjerg coal power plant in 2018, the Danish firm DIN Forsyning focused on establishing fossil-free heat production. This is expected to create opportunities for heat pump solutions in the coming years.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Rising Deployment of Heat Pumps with Higher Capacities Leads to Siemens Energy’s Market Share

The European large scale heat pump market share is consolidated, with key players operating in the industry, such as Siemens Energy, Man Energy Solutions, etc.

Siemens Energy has positioned itself as an important contender in Europe's large industrial heat pump sector. The firm provides high-capacity heat pumps that can supply up to 70 MWth, which is ideal for numerous industrial uses. Their vast expertise in energy solutions and solid presence in Europe have led to a significant growth of the market.

In addition, Man Energy Solutions, recognized for its proficiency in industrial machinery and energy solutions, has also engaged in the large-scale heat pump sector. Their participation in several industrial projects indicates a significant presence. As the use of heat pumps in industrial sectors rises, man energy solutions have seen expansion in this area.

List of the Key Europe Large Scale Heat Pump Companies Profiled in the Report

- Calefa (Finland)

- FRIOTHERM AG (Switzerland)

- Siemens Energy (Germany)

- IESenergy A/S (Denmark)

- Johnson Controls (U.S.)

- Turboden S.p.A. (Italy)

- Thermax (India)

- ARANER (UAE)

- Aalborg CSP A/S (Denmark)

- Baker Hughes (U.S.)

- MAN Energy Solutions (Germany)

- Atlas Copco (Sweden)

KEY INDUSTRY DEVELOPMENTS

- December 2024 - MAN Energy Solutions and Vicinity Energy have formally joined forces to promote urban decarbonization through an innovative heat pump initiative in Boston. The collaboration expands upon a deal revealed in April 2023, where Vicinity Energy and MAN Energy Solutions detailed their intentions to create a low-temperature source heat pump system for steam production in district energy uses. MAN Energy Solutions will provide a 35 MW industrial-grade steam heat pump to Vicinity's Kendall Station plant in Cambridge, Massachusetts.

- October 2024 - Aalborg CSP collaborated with the Danish geothermal heating firm Innargi to deliver a combined heat pump facility of around 18 MW designated for a significant geothermal initiative in Aarhus, Denmark. The heat pump facility, featuring a 10 MW electric heat pump, will harness energy from subterranean geothermal water, which will subsequently be delivered to the client's supply zone in the northern area of Aarhus.

- August 2024 - The Finnish energy firm Helen Oy has contracted MAN Energy Solutions to provide an air-to-water heat pump for its Patola heating plant facility in Helsinki. The new heating facility, featuring a large-scale heat pump and a pair of 50 MW electric boilers, is expected to cut CO2 emissions by 56,000 tons in total. The air-to-water heat pump facility will be the world’s largest, having a total heating output capacity between 20 and 33 MW, contingent on the air temperature.

- May 2023 - Johnson Controls will supply four large-scale heat pumps for the Hamburg wastewater heat project. Johnson Controls will install a new heat pump system at the Dradenau location of Hamburg's main wastewater treatment facility, reducing CO2 emissions by approximately 66,000 tons each year. As part of the agreement, Johnson Controls will implement four sizable, 15 MW heat pumps that will provide eco-friendly heating to over 39,000 residential units.

- February 2023 - Turboden, a member of the Mitsubishi Heavy Industries group and a global leader in technological solutions for industry decarbonization, will produce high-temperature heat (steam) devoid of CO2 emissions through its second large-heat pump (LHP) initiative. Turboden agreed with a top European firm in the pulp and paper sector, which aimed to supply its operations with decarbonized steam. The cutting-edge heat enhancement system, utilizing the combination of Turboden LHP and a mechanical vapor compressor, will harness low-grade heat (between 10°C and 20°C) to generate, while absorbing green electricity, 12 MWth of superheated steam at 170°C required in the paper manufacturing process.

INVESTMENT ANALYSIS AND OPPORTUNITIES

To achieve net zero emissions, the heating and cooling sector must first decarbonize this factor is expected to create more investment opportunities in the European large-scale heat pump sector. Heating is needed in industrial and district heating. And Europe sees heat pump technology as dependable and extremely efficient for decarbonizing industrial heating and district heating.

A prime example of effective investments is the project mentioned below: in November 2024, MAN Energy Solutions successfully launched the first unit of its large-scale heat pump in Esbjerg, Denmark, signaling the provision of its initial heat. Managed by the multi-utility firm DIN Forsyning, the new heat pump facility is set to provide around 280,000 MWh of climate-friendly heat each year to the district heating systems of Esbjerg and the nearby town of Varde.

REPORT COVERAGE

The Europe largescale heat pump market report delivers a detailed insight into the market. It focuses on key aspects such as leading companies and their operations offering largescale heat pumps. Besides, the report provides insights into market trends and technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 10.31% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Capacity

|

|

|

By Country

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 511.44 million in 2024.

The market is likely to grow at a CAGR of 10.31% over the forecast period.

The air source segment is expected to lead the market in the forecast period.

The market size of Sweden stood at USD 172.59 million in 2024.

Heat pumps role in decarbonization will drive the market growth.

Siemens, Man Energy Solution Aalborg CSP A/S, and others are some of the markets top players.

The European market size is expected to reach USD 1,372.42 million by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us