Europe Quantum Computing Market Size, Share & COVID-19 Impact Analysis, By Component (Hardware, Software, and Service), By Deployment (On-Premise and Cloud), By Application (Machine Learning, Optimization, Biomedical Simulations, Financial Services, Electronic Material Discovery, and Others), By End User (Healthcare, Banking, Financial Services and Insurance (BFSI), Automotive, Energy and Utilities, Chemical, Manufacturing, and Others), and Regional Forecast, 2025-2032

Europe Quantum Computing Market Size

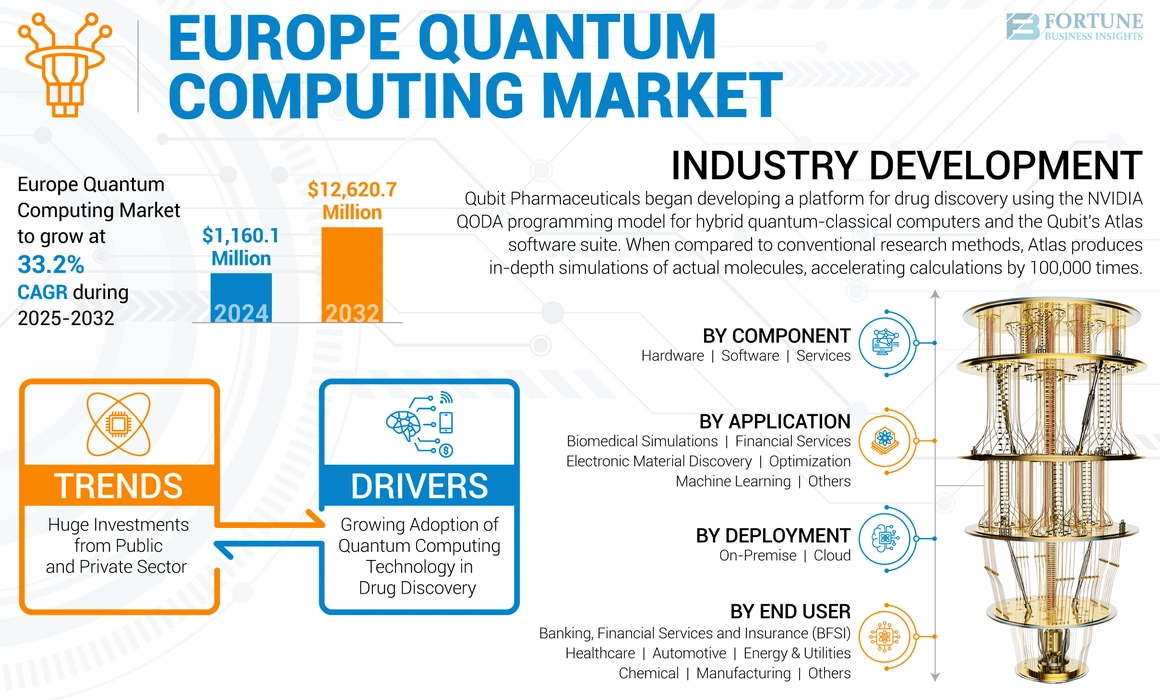

Europe showcases a healthy growth rate in the global quantum computing market, after Asia Pacific and North America. The Europe quantum computing market size projected to grow at a CAGR of 33.2% during the forecast period. The global quantum computing market size is projected to grow from USD 1,160.1 million in 2024 to USD 12,620.7 million by 2032.

By combining the established expertise of European HPC centers with the emerging European quantum ecosystem, Europe has a unique opportunity to develop supercomputing infrastructure combined with quantum technology. On top of ion traps and superconducting circuits, general-purpose quantum computers are built by the Austrian company AQT and the Finnish company IQM in Europe.

Our report on the European market covers the following countries – the U.K., Germany, France, Italy, Spain, Russia, Benelux, Nordics, and the Rest of Europe.

Europe Quantum Computing Market Trends

Huge Investments from Public and Private Sector to Boost Product Demand

Europe is gradually recognizing the opportunity and investing funds in quantum technologies as the U.S. and China threaten to dominate the Europe quantum computing market share. The long-term research and development initiative known as the Quantum Technologies Flagship aims to position Europe at the forefront of the second quantum revolution.

With an anticipated budget of USD 1.1 billion from the EU, the Quantum Technologies Flagship is determined to support the work of quantum researchers over a ten-year period. The flagship, which was launched in 2018, helped in the expansion of European scientific leadership and excellence in quantum technologies, following the Quantum Manifesto in 2016.

Europe Quantum Computing Market Growth Factors

Growing Adoption of Quantum Computing Technology in Drug Discovery to Drive the Europe Quantum Computing Market Growth

In recent years, investors have been paying a lot of attention to quantum computing. The pharmaceutical industry, specifically drug discovery, could be one of the earliest and most lucrative applications. In 2022, two European startups that use quantum computing to discover drugs have already raised funds: Algorithmiq, based in Finland, raised USD 4 million in February, and Qubit Pharmaceuticals, based in Paris, raised USD 17 million in June. In addition, in March, Swiss company Terra Quantum raised USD 75 million for its quantum-as-a-service model, which has pharma applications.

RESTRAINING FACTORS

Insufficient Digital Infrastructure to Hinder Market Expansion

Digitalization is a significant driver of industry expansion and enhanced competitiveness. However, when European industrial companies attempt to adopt digital technologies, they face numerous obstacles. Companies' capacity for digitalization is negatively impacted by lack of resources, digital skills, and know-how. The ongoing effects of the COVID-19 pandemic and the Russian invasion of Ukraine have exacerbated these difficulties in recent years.

In 2022, the industrial landscape of Europe faced a number of significant obstacles. A period of economic turmoil was sparked by the COVID-19 pandemic. This was followed by Russia's invasion of Ukraine resulting in intensified supply chain crisis. By simultaneously making digitalization more necessary and more difficult, these developments have had contradictory effects on the digital transformation of industries. As a result, these factors are likely to restrict Europe market expansion in the near future.

KEY INDUSTRY PLAYERS

Major Market Players Focused on Expanding their Customer Base across Europe

To stay ahead of the competition in the market, vendors are concentrating on expanding their customer base. As a result, key players are pursuing a number of strategic initiatives, including partnerships and mergers and acquisitions.

LIST OF TOP EUROPE QUANTUM COMPUTING COMPANIES:

- IQM Quantum Computers (Finland)

- HQS Quantum Simulation (Germany)

- ParityQC (Austria)

- KEEQquant (Germany)

- ID Quantique SA (Switzerland)

- Alpine Quantum Technologies (Austria)

- Quantum Motion Technologies (U.K.)

- Nu Quantum (U.K.)

- Atos Quantum (France)

- Riverlane (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- November 2022: Qubit Pharmaceuticals began developing a platform for drug discovery using the NVIDIA QODA programming model for hybrid quantum-classical computers and the Qubit's Atlas software suite. When compared to conventional research methods, Atlas produces in-depth simulations of actual molecules, accelerating calculations by 100,000 times.

- November 2021: IQM Quantum Computers announced the operation of its new cryogenic characterization and fabrication facility, which increased its production capacity for quantum processors as part of its long-term growth strategy. This is the company's largest investment to date, and is located in Espoo, Finland, close to its headquarters and quantum labs.

REPORT COVERAGE

The market research report provides qualitative and quantitative insights on the market and a detailed analysis of the Europe market size & growth rate for all possible segments in the market. Along with the Europe market forecast, the report provides an elaborative analysis of the market dynamics and competitive landscape. Various key insights presented in the report are an overview of the number of procedures, an overview of price analysis of types of products, overview of the regulatory scenario by key countries, pipeline analysis, new product launches, key industry developments – mergers, acquisitions & partnerships and the impact of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 33.2% from 2025 to 2032 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Component, Deployment, Application, End User, and Country/Sub-Region |

|

By Component |

|

|

By Deployment |

|

|

By Application |

|

|

By End User |

|

|

By Country/Sub-Region |

|

Frequently Asked Questions

Growing at a CAGR of 33.2%, the market will exhibit healthy growth in the forecast period (2025-2032).

Huge investments from public and private sector, significantly boosts the growth of the market.

Atos Quantum, Riverlane, IQM Quantum Computers, HQS Quantum Simulation, and ParityQC, are the major market players in the Europe market.

U.K. dominated the market in 2022.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us