Flooded Lead Acid Battery Market Size, Share & Industry Analysis, By Voltage (Upto 4 Volts, 6 Volts to 12 Volts, 12 Volts to 24 Volts, and Others), By Sales Channel (OEM and Aftermarket), By Application (Automotive, Renewable Energy Systems, Energy Storage, Telecom & Electric Utilities, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

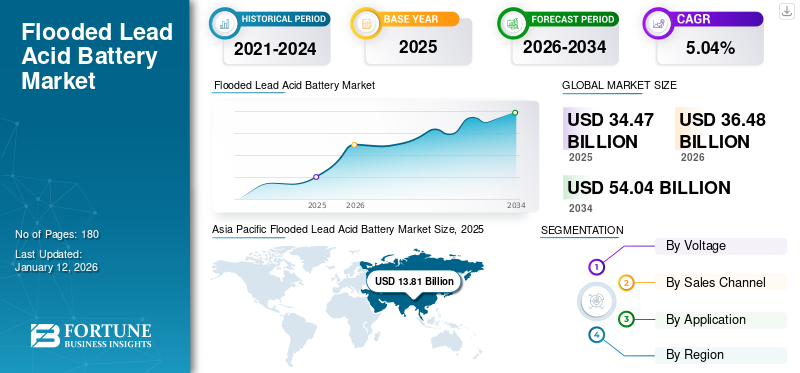

The global flooded lead acid battery market size was valued at USD 34.47 billion in 2025 and is projected to grow from USD 36.48 billion in 2026 to USD 54.04 billion by 2034, exhibiting a CAGR of 5.04% during the forecast period. Asia Pacific dominated the flooded lead acid battery market with a share of 40.06% in 2025.

Flooded lead acid batteries are gaining significant popularity in the automotive industry owing to their use in electric vehicles. Flooded lead acid batteries are used in electric vehicles owing to their longer life cycle and high power density. Also, these batteries are cheaper compared to lithium-ion batteries. The high energy density of these batteries is vital for applications such as powering large appliances or starting vehicles. As these batteries can withstand various charge-discharge cycles, they are used in deep-cycle applications. They are majorly used in utilities, data centers, and industrial applications. These factors are anticipated to drive the market share in the coming years. For instance, C&D Technologies, Inc., Contemporary Amperex Technology Co., Limited, East Penn Manufacturing Company, Inc., EnerSys, Exide Industries Limited, and GS Yuasa Corporation are the major players in the flooded lead acid battery industry.

- The Trojan DC-8V 8V Flooded Lead Acid Battery with Master Vent has high capacity & provides high energy for electric vehicles, golf carts, and solar applications. Due to flooded battery technology, these batteries offer outstanding performance & rugged durability while keeping the cost low.

- According to the International Energy Agency (IEA), in 2023, battery manufacturing reached 2.5 TWh, and the battery capacity added in 2023 was 25% higher than in 2022. Also, by 2030, the battery manufacturing capacity is estimated to reach 9 TWh. Thus, a rise in battery production is anticipated to drive the demand for flooded lead acid batteries owing to their use in the electric vehicle sector.

MARKET DYNAMICS

MARKET DRIVERS

Rising Popularity in Renewable Energy Systems to Drive Market Growth

Flooded lead acid batteries are widely used in solar and wind power plants as they are reliable, affordable, and can store large amounts of energy. These batteries are used in hybrid energy systems to provide backup power solutions when the primary storage system fails. Also, lead acid batteries have a 99% recyclability rate, which contributes to the sustainability measures. Thus, these batteries are primarily used to store electricity generated from wind turbines or solar panels. For instance, in remote locations or off-grid, where grid access is limited, these batteries act as a renewable power storage source when renewable energy production is low or unavailable. These factors are anticipated to boost the flooded lead acid battery market growth during the forecast period.

- IEA has stated that in 2024, wind power accounted for 8.2% of electricity generation, and solar PV accounted for a 6.8% share. By 2029, solar PV is anticipated to account for over 80% of global renewable capacity.

MARKET RESTRAINTS

Environmental Impact & Regular Maintenance to Limit Market Expansion

The flooded lead acid batteries contain free liquid, which requires periodic inspection and maintenance. The external climatic conditions significantly impact the battery life, as the electrolyte solution present inside the battery can freeze or evaporate. Also, these batteries emit gases, including oxygen and hydrogen, during charging and discharging. Thus, adequate ventilation is necessary to avoid the buildup of hazardous gases. For instance, the risk of spillage owing to the presence of liquid electrolytes is high when the battery is tipped or damaged. Adequate ventilation is required, as the buildup of hydrogen gas increases the explosive risks in small areas.

MARKET OPPORTUNITIES

Technological Advancements Generate Excellent Opportunities in the Market

The rapid technological advancements owing to the integration of the Internet of Things (IoT), which includes the deployment of smart sensors & monitoring systems to track the charge cycles, battery health, and real-time performance, present significant growth opportunities. Also, these batteries adhere to the sustainability and circular economy models, owing to which these batteries are the most recycled consumer product, with 95% of the material being reused and recycled. Also, an improved plate design with an optimized grid pattern and increased surface area enhances the battery’s ability to store & deliver power. The growing applications of flooded lead acid batteries in start-stop technology for automotive vehicles are gaining traction.

- JYC Battery, the leading battery manufacturer, has stated that lead acid batteries are used in automotive systems using start-stop technology. They offer fuel efficiency by automatically turning off the engine when the vehicle is idle. Also, these batteries offer a quick burst of power when the engine restarts. Also, these batteries are capable of handling frequent charge-discharge cycles linked with start-stop systems.

FLOODED LEAD ACID BATTERY MARKET TRENDS

Growing Demand for Stationary Power are a Recent Market Trend

Flooded lead acid batteries are widely used in stationary power applications that require high discharge currents and the ability to handle high temperatures through free electrolytes. These batteries are widely used in stationary power applications such as grid-connected energy storage, telephone & computer centers, and off-grid residential power systems. These batteries are used in uninterruptible power supplies (UPS) to provide backup during outages to ensure continuous operations of critical equipment.

- For instance, in July 2024, the Spaceflight Power Supply Co., Ltd., the ongoing research & development in lead-acid battery technology with a focus on improving the energy density, lifespan, and efficiency of flooded-lead acid batteries with advanced plate designs, better manufacturing processes, and others are the recent market trends.

Download Free sample to learn more about this report.

Segmentation Analysis

By Voltage

Growing Applications in Industrial Equipment Drive the 6 Volts to 12 Volts Segment Growth

Based on voltage, the market is classified into upto 4 volts, 6 volts to 12 volts, 12 volts to 24 volts, and others.

The 6 volts to 12 volts segment dominated the market share. The 6 volts to 12 volts flooded lead acid batteries are affordable and offer excellent reliability & power output, which makes them an ideal choice for low voltage applications. Also, these batteries are easy to maintain & readily available, and are mainly used in marine vessels, golf carts, and other industrial equipment.

- For instance, the T-105 6V deep cycle flooded lead acid battery offers excellent performance and durability, and it is widely used in applications such as floor cleaning machines, solar, and recreational vehicles. The technology inside the battery implemented by Trojan offers increased total energy, sustained performance, and longer life.

By Sales Channel

Low Cost & High Power Delivery to Boost the Growth in the OEM Segment

Based on sales channel, the market is divided into OEM and aftermarket.

The OEM segment accounted for the larger share of the market. The flooded lead acid batteries derived from OEM are popular as they are readily available, cost-effective, and can deliver high power surges. Considering the low price point of OEM, these batteries are a practical choice for vehicle applications. OEM-based batteries are widely used rechargeable electrochemical batteries suitable for small to medium-sized energy storage applications.

- For instance, Clarios is the leading OEM of flooded lead acid batteries that offers a wide range of automotive batteries. Also, Exide Industries is another prominent OEM in the Indian market, offering a wide range of lead-acid batteries, including the flooded lead-acid batteries that are used for deep-cycle applications.

By Application

Increase in Adoption of Flooded Lead Acid Battery for Automotive Applications Drives the Market Demand

Based on application, the market is segmented into automotive, renewable energy systems, energy storage, telecom & electric utilities, and others.

The automotive segment dominated the market. The flooded lead acid batteries are primarily used in automotive applications as they can deliver the high surge current required to start an engine. Also, these batteries are strong enough to handle temperature fluctuations & vibrations of vehicles. These batteries serve as a cost-effective option for starting car engines despite having low energy density compared to their counterparts.

- For instance, the flooded lead acid batteries manufactured by GS Yuasa Corporation are known for their performance & reliability. Also, these batteries have the high cranking power required to start a car.

Flooded Lead Acid Battery Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Flooded Lead Acid Battery Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominates the global flooded lead acid battery market share with a 40.06% share in 2026. The region generated revenues of USD 13.81 billion in 2025. The Asia Pacific countries, namely China, Japan, and India, have well-established automotive markets owing to ease of raw material availability, lower production cost, and an established manufacturing base. For instance, lead is easily available in China, which contributes to lower production costs. Some of the leading manufacturers in this region are Exide Industries, Amara Raja Batteries, GS Yuasa, and others.

- Exide Industries, headquartered in India, manufactures flooded lead acid batteries that are used in a wide range of applications due to their excellent tolerance to thermal environments.

Europe

Europe is the second-largest market for the flooded lead acid battery. The stringent regulations on vehicular emissions have led to an increase in the adoption of micro-hybrid vehicles that use advanced lead acid batteries, namely, flooded lead acid batteries. These batteries serve as a cost-effective solution for automotive manufacturers that are transitioning to greener technologies. Also, Europe has one of the leading automotive markets, with 10.6 million new cars being registered across 27 member states in 2023, which represents a 14% increase compared to 2022.

- As of October 2024, the European Union (EU) had 255 automotive plants that excel in the manufacturing of engines, batteries, and vehicles.

North America

North America accounted for a significant share of the market. In this region, the demand for flooded lead acid batteries is driven by an extensive fleet of vehicles that rely on these batteries for starting, lighting, and ignition (SLI) systems in traditional vehicles. In addition, rapid growth in data center infrastructure majorly contributes to this growth.

In the U.S., flooded-lead acid batteries are majorly used in automotive applications such as backup power systems, renewable energy storage, and automotive starting. In the U.S., the electric-golf carts and lower-end electric vehicles (EVs) widely use flooded lead acid batteries owing to their ability to deliver high surge currents for engine cranking.

- For instance, as of October 2024, the U.S. has 5,388 data centers, which is significantly higher than any other country except China. The leading data center markets in this region are Northern Virginia, Silicon Valley, Dallas, Phoenix, New York, New Jersey, Chicago, Portland, and Atlanta. Flooded lead acid batteries are widely used in data centers owing to their high power density, discharge rate, and ease of maintenance.

Latin America

The demand for flooded lead acid batteries in Latin America is driven by its rising adoption in the telecom & electric utilities sector. In the telecom & electric utilities sector, these batteries are used in backup power supplies such as Uninterruptible Power Supply (UPS), industrial machinery, and various marine applications. For instance, in marine applications, these batteries are used to start diesel engines on boats. Also, they are used in hospitals & communication systems owing to their high surge current capability.

- For instance, in Latin American countries, namely Brazil, Mexico, Argentina, and others, the demand for flooded lead acid batteries is driven by growing urbanization, increased investments in infrastructure projects, and the industrial sector. In 2021, the machinery & heavy technology industry exhibited a remarkable growth rate of over 20%.

Middle East & Africa

The popularity of flooded lead acid batteries in the Middle East & Africa is driven by their adoption across renewable energy storage systems. The rising energy investment in the Middle East & Africa has led to an increase in the use of flooded lead batteries in the renewable energy sector. For instance, the International Energy Agency (IEA) has stated that the energy investment in the Middle East & Africa had reached approximately USD 175 billion in 2024, with clean energy accounting for 15% of the total investment.

- For instance, in 2023, 5% of the Middle East’s electricity was generated from clean sources, with solar and wind accounting for a 2% share. The flooded lead acid batteries serve as a cost-effective energy storage solution for intermittent renewable energy sources, namely wind and solar.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Technologies by Key Companies Resulted in their Dominating Position in the Market

The global flooded lead acid battery market is fragmented, with companies such as Amara Raja Batteries Ltd., Clarios, Contemporary Amperex Technology Co., Limited, Exide Industries Limited, GS Yuasa Corporation, Trojan Battery Company, and others accounting for the highest share. The dominance can be attributed to their strong focus on the expansion of brand presence through various strategic initiatives, such as collaboration, acquisitions, product development, and technological advancements.

C&D Technologies, Inc., East Penn Manufacturing Company, Inc., and EnerSys accounted for a notable share of the global market. C&D Technologies, Inc. offers flooded vented lead-acid batteries (VLA batteries) designed for enhanced performance and reliability throughout their lifespan.

Additionally, HOPPECKE Battery GmbH & Co. KG. and Leoch International Technology Limited Inc. are among the other major players in the market. Focus on significant investments in the research & development of innovative products has supported the companies’ share in the market.

- For instance, as stated in February 2025 by Trojan Battery Company, the Trojan T-105 Batteries are quite popular golf cart batteries that are reliable and have excellent life cycles. These batteries discharge at a slower rate, which enables them to drive carts for a long time.

LIST OF KEY FLOODED LEAD ACID BATTERY COMPANIES PROFILED

- Amara Raja Batteries Ltd. (India)

- Clarios (U.S.)

- Crown battery (U.S.)

- C&D Technologies, Inc. (U.S.)

- Contemporary Amperex Technology Co., Limited (China)

- East Penn Manufacturing Company, Inc. (U.S.)

- EnerSys (U.S.)

- Exide Industries Limited (India)

- GS Yuasa Corporation (Japan)

- HOPPECKE Battery GmbH & Co. KG. (Germany)

- Leoch International Technology Limited Inc. (China)

- Trojan Battery Company (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2025: Clarios announced a USD 6 billion plan to expand U.S. battery manufacturing that aims to advance energy and promote mineral independence by strengthening the domestic battery supply. Also, Clarios will boost the development of advanced energy storage for data centers and Artificial Intelligence (AI), supercapacitors, and more.

- August 2024: Amara Raja established a battery pack assembly, which served as the basis for the customer qualification plant in its Giga Corridor. This plant, with an overall capacity of 5 GWh and 16 GWh, was established in Divitipalli of the Mahbubnagar district.

- August 2024: Clarios invested approximately USD 215.8 million (EUR 200 million) in its European plants between 2022 and 2026 to expand its advanced battery production capacities.

- May 2024: GS Yuasa Corporation and Osaka Gas Co., Ltd. signed an agreement to establish a storage battery facility featuring a new type of power conditioner (PCS) that GS Yuasa is currently developing, with operation to commence in April 2025. In April 2025, GS Yuasa Corporation stated that the lithium-ion storage battery system combined with a 2MWh capacity power conditioner(“PCS”), which was ordered by Tokyo Gas Engineering Solutions Corporation (“TGES”) and delivered to Hosoe Outboard Engine Plant (Hamamatsu-shi, Shizuoka Prefecture) of Honda Motor Co., Ltd. had begun its operation.

- May 2023: Honda Motor Co., Ltd. (Honda) and GS Yuasa International Ltd. (GS Yuasa) announced that they have signed a joint venture agreement toward the establishment of a new company to enhance the battery production methods.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.04% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Voltage

|

|

By Sales Channel

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 36.48 billion in 2026 and is projected to record a valuation of USD 54.04 billion by 2034.

In 2025, the market value stood at USD 13.81 billion.

The market is expected to exhibit a CAGR of 5.04% during the forecast period.

The automotive segment led the market by application.

The key factors driving the market are the increasing adoption in the automotive, data center, and utilities sectors.

Amara Raja Batteries Ltd., Exide Industries Limited, GS Yuasa Corporation, Trojan Battery Company, and others are the top players in the market.

Asia Pacific dominated the market in 2025.

Rising adoption of flooded lead acid batteries in the renewable energy storage sector, owing to the growing focus on clean energy transition, are some of the factors that are expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us