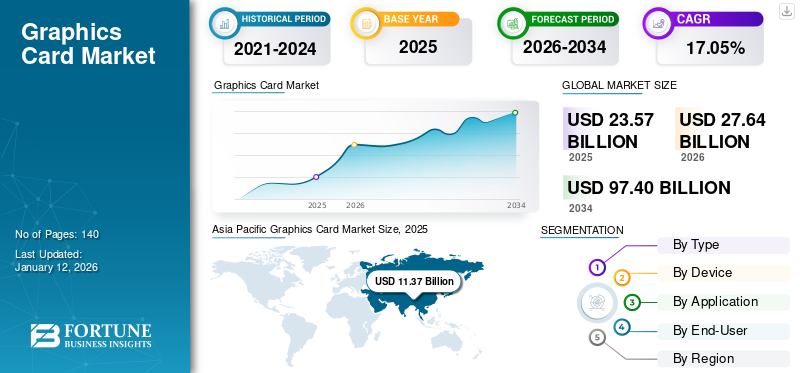

Graphics Card Market Size, Share & Industry Analysis, By Type (Discrete and Integrated), By Device (Servers/Data Center, Gaming Consoles, Desktops, Laptops, and Smartphones), By Application (Gaming, Education and Training, Multimedia Editing, and Cryptocurrency Mining), By End-User (Consumer Electronics, Industrial, Media and Entertainment, Healthcare, IT and Telecommunications, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global graphics card market size was valued at USD 23.57 billion in 2025 and is projected to grow from USD 27.64 billion in 2026 to USD 97.4 billion by 2034, exhibiting a CAGR of 17.0% during the forecast period. Asia Pacific dominated the graphics card market with a market share of 48.22% in 2025.

A graphics card is a piece of hardware designed to enhance a computer's video memory and improve its display quality to a higher definition. It enhances the computer's performance and enables it to handle more advanced tasks efficiently.

The demand for graphics cards is rising due to advancements in gaming and content creation technology. The market is driven by increasing interest in immersive video games alongside Virtual Reality (VR) and Augmented Reality (AR) applications that need potent graphics performance. As 4K and 8K displays become more common, graphics cards must advance in video decoding and rendering performance to meet these demands. For instance, Exploding Topics reported that there were around 3.32 billion active video gamers worldwide in 2024. The demand for these cards continues to rise as they are increasingly used for cryptocurrency mining and machine learning tasks. Advanced GPUs with real-time ray tracing and AI features are being adopted across multiple sectors. These elements are responsible for the expansion of graphics card market share.

The computer sector experienced a significant shortage of graphics cards due to supply and demand complexities that drove up their average price. The principal reason for this situation emerged from the closure of many factories throughout China during the COVID-19 pandemic until safety conditions allowed operations to restart. Computer chip demand rose sharply as China stopped all the major manufacturing activities. The automobile, computer, and smartphone industries experienced substantial impacts from the chip shortage.

IMPACT OF GENERATIVE AI

Integration of Generative AI with Graphics Card Enhanced the Capabilities, Further Fueling Market Growth

Generative AI creates profound and varied effects across the graphic card market. The rise in demand for advanced computing power required by AI applications drives the market for graphic cards. Graphic cards play a crucial role in powering generative AI models, allowing these systems to learn from extensive datasets and produce high-quality content.

- In January 2024, NVIDIA introduced GeForce RTX SUPER desktop graphics cards designed to deliver enhanced generative AI capabilities, along with new AI laptops from leading manufacturers and a suite of NVIDIA RTX-accelerated AI software and tools tailored for both developers and consumers. These offerings aim to improve PC experiences through generative AI: NVIDIA TensorRT acceleration for the widely-used Stable Diffusion XL model to enhance text-to-image processes, NVIDIA RTX Remix featuring generative AI texture tools, NVIDIA ACE microservices, and a growing number of games utilizing DLSS 3 technology with Frame Generation.

MARKET DYNAMICS

Graphic Card Market Trends

Integration of Ray Tracing with Graphics Card to Emerge as a Key Market Trend

Graphic cards have an essential role in the operation of ray tracing. They deliver all the processing power and specific hardware for crucial calculations. It also can offer more natural shadows, lighting, reflections, and other visual effects that were almost impossible to attain. Integrating ray tracing with graphic cards is expected to significantly improve the visual quality frequency of video games and other graphics-heavy applications. This is immensely changing the trend into a new level of involvement and realism in gaming and other visual experiences.

Download Free sample to learn more about this report.

Market Drivers

Rising Competitive Gaming, Cryptocurrency Mining and AI Fuels Market Development

The processing power assigned by graphic cards is crucial for AI and ML applications. Graphic cards with parallel tasking ability stand out in hastening the operation of AI and ML workloads. AI and ML are highly progressive and applicable in data analytics, image recognition, autonomous vehicles, and other areas; thus, the demand for graphic cards optimized for these workloads is increasing. Graphic cards are a core part of applications for developing content and videos for multimedia editing programs. The progression of eSports and online streaming activities has led to an increased need for high-performance graphic cards. Higher refresh rates and low latency enable esports gamers to perform more competitively during gameplay. This shift provides an opportunity in the graphics card market. Also, graphic cards are essential in the processing power required for cryptocurrencies, facilitating smooth gaming experiences. While there is an increase in the value of cryptocurrency, there is higher demand from miners looking to profit from active markets, therefore increasing the graphic card market size.

Market Restraints

Higher Power Consumption, Heat Dissipation, Compatibility Issues, and Less Driver Support to Impede Market Development

Multimedia applications associated with high-volume treatment tend to overheat computer units. For example, when using intensive computer applications, a high-quality graphics card is supposed to work with maximum performance to maintain the video output quality. Computer cooling systems paired with relevant power management techniques help reduce overheating. Along with such issues, meeting the software and hardware compatibility requirements is also challenging, as providing enough driver support is necessary to retain a compatible multi-operating system environment.

Market Opportunities

Growing Expansion of Cloud Gaming Services to Create Lucrative Market Opportunities

The expansion of cloud gaming is helping the graphics card manufacturers to create an opportunity in this market. Cloud gaming services allow users to access and play high-performance games on any device with an internet connection without costly equipment or software. Graphic cards play a crucial role in cloud games as they present graphics and provide a smooth gaming experience. The popularity of Cloud Gaming Services, such as Google Stadia, Microsoft Xbox Cloud Gaming, and Amazon Luna, is expected to create graphics card market growth opportunities in the coming years.

SEGMENTATION ANALYSIS

By Type Analysis

Increased Demand for Discrete Graphic Cards from Gaming and Content Creation Places it at the Top Spot

Based on type, the market is segmented into discrete and integrated.

The discrete segment dominated the market in 2026 with a share of 60.5%, due to increased demand for games, creating professional content and applications. Discrete graphic cards offer outstanding performance and are specially designed for tasks such as play and industrial use.

The integrated segment is expected to register the highest CAGR during the forecast period due to the demand for low-power consumption and compact computing devices. They are built into computer processors and are fit for essential tasks such as web surfing and office work.

By Device Analysis

Surging Requirement for High-performance Calculations and Data Processing in Cloud Boosted Need for Servers/Data Centers

The market is segmented, based on device into servers/data center, gaming consoles, desktops, laptops, and smartphones.

In terms of share, the servers/data center segment dominated the market in 2024, driven by the growing demand for high-performance calculations and data processing in cloud and corporate applications. Professional visualization and maintenance of industries such as engineering, design, and scientific research are a few of its crucial applications that contribute to the segment's overall growth. The segment is likely to capture 31.95% of the market share in 2026.

- In February 2025, G42, an AI technology group based in Abu Dhabi, UAE, declared a strategic investment in France in collaboration with DataOne, Europe's first-ever gigascale AI hosting infrastructure data center. Led by Core42, a subsidiary of G42 that focuses on sovereign cloud and AI infrastructure, this initiative could create an AI data center in Grenoble. This facility, equipped with AMD GPUs, provides enterprises, researchers, and innovators access to advanced AI infrastructure.

The laptop segment is anticipated to register the highest CAGR of 22.08% during the forecast period, due to rising interest in exclusive laptops equipped with enhanced features, the surging trend of cloud gaming, and the need for skilled machines in data analysis and AI tasks. In addition, a combination of advanced display technologies, smart conceptions, and improved cooling mechanisms increases the performance.

By Application Analysis

Growing Popularity of Smartphones, Tablets, PCs, and Consoles Boosted the Need for Gaming Applications

Based on application, the market is segmented into gaming, education and training, multimedia editing, and cryptocurrency mining.

The gaming segment dominated the market in 2024. The growing popularity of gaming smartphones, tablets, PCs, and consoles has increased the demand for advanced computer systems designed for graphics games. This growing need for professional processors that can control the complex mathematical calculations associated with the 2D and 3D graphics required for games drives the demand for graphics cards. The segment is foreseen to attain 34.55% of the market share in 2026.

The cryptocurrency mining segment is anticipated to register the highest CAGR of 21.34% during the forecast period. The graphics cards designed to explore cryptocurrency have the advantage of managing simple instructions on several cores simultaneously, making them more effective than other types of processors. They have many Arithmetic Logical Units (ALUs) that conduct mathematical operations, leading to better performance for cryptographic mining.

By End-User Analysis

Consumer Electronics Segment Dominated Market Majorly Due to Growing Innovation in Field of Electronics

The market is categorized into consumer electronics, industrial, media and entertainment, healthcare, IT and telecommunications, and others, based on end-user.

In 2024, the consumer electronics segment dominated by holding the largest graphics card market share. This segment growth could be linked to increased innovation in electronics. Graphic cards are the basis for visual experience and increased processing power, enhancing the need for graphics cards. Integrated graphics cards are a critical aspect of consumer electronics, including graphics cards that are highly confined in gadgets, such as laptops, tablets, smartphones, intellectual televisions, and others, to provide smooth and optimal graphics characteristics. The segment is forecasted to hold 27.74% of the market share in 2025.

- According to an industry expert, by 2026, more than 1.1 billion households worldwide, 51% of all households, are waiting for an intelligent television. The market extends due to the growing demand for visually exciting applications and content, which includes mobile games and high-condition video transmission.

The healthcare segment is anticipated to depict the highest CAGR of 21.73% over the analysis period owing to the growing implementation of video cards for applications such as medical visualization, data analysis, and AI / ML, which has led to the expansion of the broader market outside traditional game applications.

To know how our report can help streamline your business, Speak to Analyst

GRAPHIC CARD MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: Asia Pacific, South America, Europe, the Middle East & Africa, and North America.

Asia Pacific

Asia Pacific Graphics Card Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held a significant market share with a valuation of USD 11.37 billion in 2025 and USD 13.33 billion in 2026, driven by the expanding demand for consumer electronics and the robust manufacturing environment for graphical chipsets. Fast industrial growth alongside foreign investments, the establishment of manufacturing facilities, and technological progress in India, South Korea, China, and Japan are driving the market expansion in this area. Increasing investments in the gaming and automotive sectors to improve user experiences are also expected to boost the region's industry.

China is one of the largest and fastest-growing markets for graphics card technology. The market in China is expected to gain USD 4.98 billion in 2026. The adoption of these cards is increasing owing to its intense demand for cryptocurrency and gaming and rapid development of digital infrastructure. Researchers in China have attained nearly a tenfold increase in performance compared to high-performance supercomputers from the U.S., utilizing graphics processors made domestically. India is poised to hold USD 1.65 billion in 2026, while Japan is estimated to gain USD 2.94 billion in the same year.

To know how our report can help streamline your business, Speak to Analyst

South America

The market in South America is growing steadily, owing to the recent shifts in the local economy and improved government investments in research activities. Brazil and Mexico are the leading nations in this market, with increasing gaming enthusiasts and content creators and rising demand for innovative products such as televisions and wearables.

Europe

Europe is the third leading region, expected to gain USD 3.35 billion in 2026. The region is estimated to grow at the highest rate during the forecast period with the latest innovations in the gaming industry with technologies such as loT and 3D visualization. The U.K. market continues to grow, projected to reach a value of USD 0.71 billion in 2026. Germany, France, and the U.K. are major European market countries. Germany is set to be valued at USD 0.66 billion in 2026, while France is estimated to hit USD 0.34 billion in the same year.

Middle East & Africa

The Middle East & Africa is the fourth largest market, estimated to hold USD 1.1 billion in 2026. The region has a smaller market presence. However, the latest technological developments and funding for advanced research activities will create business opportunities in this area in the future. The GCC market is likely to gain USD 0.36 billion in 2025.

North America

North America is the second leading region, anticipated to hold USD 9.11 billion in 2026, exhibiting a CAGR of 18.49% during the forecast period. North America is an integral part of the global video card industry. The rising usage of streaming devices, cloud computing, gaming, and other stimulating data applications has generated demand for fast graphics cards. The U.S. stands out as a significant country in the region, demonstrating a high-level implementation of gaming, home appliances, and wearable technologies within the population. Additionally, it is expected that the coverage of innovative technologies such as artificial intelligence, virtual reality, and the Internet of Things will increase, with market revenues in the sector increasing over the next few years.

The increasing consumption of high-definition (HD) video, 4K/8K streaming, cloud applications, online gaming, and social media has led to a massive surge in the use of graphic cards, mainly in the U.S. The U.S. market is expanding and is estimated to hold USD 7.78 billion in 2026.

COMPETITIVE LANDSCAPE

Key Industry Players

Industry Leaders Focus on M&As and Collaborations to Increase Customer Base

Market players are offering graphics cards to enhance visual quality and performance in graphics-intensive tasks while improving overall system performance by clearing functions from the CPU. To extend business activities, leading firms are developing strategies and partnering with domestic companies. Additionally, M&As, collaborations, and financial aid for product development are anticipated to increase the demand and boost market growth.

List of Graphic Card Companies Profiled:

- Nvidia Corporation (U.S.)

- Advanced Micro Devices, Inc. (U.S.)

- ASUSTeK Computer Inc. (Taiwan)

- Micro-Star INT'L CO., LTD. (Taiwan)

- GIGA-BYTE TECHNOLOGY CO., LTD. (Taiwan)

- EVGA Corporation (U.S.)

- SAPPHIRE Technology Limited (China)

- ZOTAC Technology Limited (China)

- PNY Technologies (U.S.)

- Intel Corporation (U.S.)

- XFX Inc. (U.S.)

- PowerColor (Taiwan)

- Innovision Multimedia Pte. Limited (Singapore)

- ASRock Inc (Taiwan)

- Apple Inc. (U.S.)

- Galaxy Microsystems Ltd. (China)

KEY INDUSTRY DEVELOPMENTS:

- March 2025: MSI introduced the latest video card using the recently released GPU Nvidia Geforce RTX 5070. These cards include the Game Trio, Inspire, Vanguard, and Ventus. These cards, created using advanced graphic technologies and optimized thermal solutions, meet the needs of high-performance games and artificial intelligence applications and create content.

- August 2024: MSI and Blizzard Entertainment teamed up to launch "The War Within" expansion along with a special edition graphics card. The GeForce RTX 4070 SUPER 12G GAMING SLIM World of Warcraft EDITION is crafted to provide an exceptional gaming experience driven by the Nvidia 4070 SUPER GPU. This graphic card includes advanced technologies such as DLSS tracing and shelves to provide first-class graphic quality and fluid gameplay.

- January 2024: NVIDIA introduced the GeForce RTX 40 SUPER Series Graphic Cards for enhanced gaming and creative experiences, featuring ultra-fast AI capabilities.

- November 2023: AMD unveiled the AMD Radeon PRO W7700, a professional graphics card for workstations priced below USD 1,000. It provides an excellent blend of reliability, stability, and impressive price/performance suitable for content creation, CAD, and AI tasks.

- April 2023: AMD introduced the AMD Radeon PRO W7000 Series of graphic cards. These new graphics processors are based on the AMD DNR 3 architecture, offering significantly better performance compared to the latest generation and exceptional efficiency at a price compared to competitors. The latest graphic cards are designed for professionals. This allows users to create and manage high-discharge models effectively, get outstanding image quality and color accuracy, launch graphics, and calculate applications simultaneously without interrupting workflows.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The graphics card industry is a dominant segment of the broader graphics market. Investing in this industry could be a prominent opportunity as users expect these chips to remain strong. Companies using GPUs in their data centers and AI applications can also be essential investment opportunities. Also, investing in emerging technologies such as VR, AR, and autonomous vehicles could create new opportunities for the card manufacturers. For instance,

- In July 2023, AMD announced that it aims to invest around USD 400 million over the next five years to improve India's research, development, and engineering efforts.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects, such as leading companies, product types, and leading product end-users. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 17.05% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

Type, Device, Application, End-User, and Region |

|

Segmentation |

By Type

By Device

By Application

By End-User

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

The market is projected to reach a valuation of USD 97.4 billion by 2034.

In 2025, the market was valued at USD 23.57 billion.

The market is projected to record a CAGR of 17.05% during the forecast period.

By type, the discrete segment led the market in 2024.

Rising competitive gaming cryptocurrency mining and AI to aid market growth.

Nvidia Corporation, Advanced Micro Devices, Inc., ASUSTeK Computer Inc., Micro-Star INT'L CO., LTD., GIGA-BYTE TECHNOLOGY CO., LTD., EVGA Corporation, SAPPHIRE Technology Limited, ZOTAC Technology Limited, PNY Technologies, and Intel Corporation are the top players in the market.

Asia Pacific held the highest market share in 2026.

By end-user, the healthcare segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us