Asset Integrity Management Market Size, Share & Industry Analysis, By Solution (Risk-Based Inspection, Corrosion Management, Pipeline Integrity Management, Hazard Identification Study, Structural Integrity Management, and Others), By Technology (Digital Twin, Edge AI, Internet of Things (IoT), Quantum Computing, Life Cycle Assessment (LCA), Condition Assessment Program (CAP) with Robotics, Data Analytics and Machine Learning, 3D Laser and PAUT, Blockchain, AR and VR, BIM, METAVERSE), By Industry (Office Spaces, Infrastructure and Mobility), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

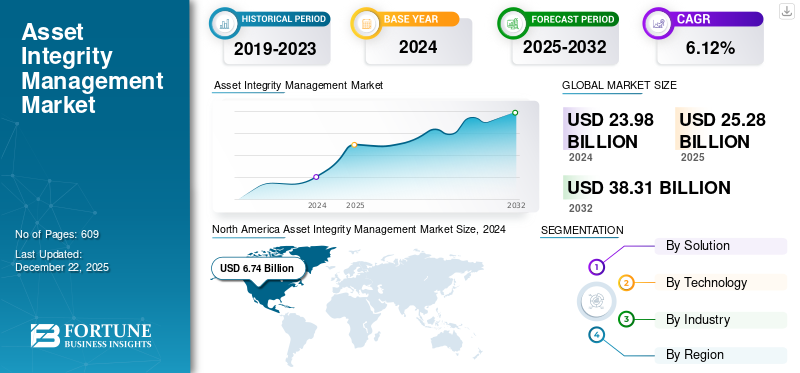

The global asset integrity management market size was valued at USD 23.98 billion in 2024. The global market size is projected to grow from USD 25.28 billion in 2025 to USD 38.31 billion by 2032, exhibiting a CAGR of 6.12% during the forecast period. North America dominated the global market with a share of 28.1% in 2024. North America is expected to account for largest market share owing to the large scale investments in construction and manufacturing industry in the region supporting market growth.

Asset integrity management (AIM) refers to the practice of visualizing and managing different assets, such as refineries, power plants, oil rigs, and many others, to ensure that they are able to perform the required functions effectively, safely, and efficiently throughout their lifetime. The AIM applies to the entirety of an asset’s operation, from its designing phase to its decommissioning & replacement. Some of the key components of AIM include design & engineering, inspection & monitoring, maintenance & repair, risk management, and data management. By combining proactive planning, real-time tracking, and data-driven decision-making, AIM enhances the asset lifespan operational performance and safeguards business, people, and the environment.

These advancements allow for instantaneous monitoring, predictive maintenance, and enhanced operational efficiency. The incorporation of digital advancements such as the Internet of Things (IoT), Artificial Intelligence (AI), and digital twins is changing the AIM market. These advancements allow for instantaneous monitoring, predictive maintenance, and enhanced operational efficiency.

TUV SUD is an international technical services organization that provides extensive asset integrity management (AIM) services. Their AIM framework guarantees that assets function safely and effectively during their entire life span, from design to decommissioning. TÜV SÜD and Fluor Corporation offer a systematic method to AIM, which encompasses risk evaluation, construction quality assurance, engineering, corrosion control, and reliability-centered maintenance. They also carry out audits to enhance asset performance and lower maintenance expenditures.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand for Operational Safety and Efficiency Across Industries to Drive the Market Growth

The need for operational safety, especially in high-risk sectors such as oil and gas, mining, and power generation, is a significant driving factor. These sectors demand ongoing inspection and maintenance to guarantee asset dependability and prevent accidents. The aging of current infrastructure within various sectors requires advanced AIM solutions to uphold asset integrity and adhere to regulatory specifications. The combination of digital technologies like IoT, AI, and machine learning improves predictive maintenance abilities, minimizes downtime and increases asset longevity.

In May 2023, Stork, a company under Fluor, obtained a five-year asset integrity agreement from Harbour Energy, an oil and gas producer based in the U.K. The companies have not disclosed the financial worth of the contract, which includes five options for one-year extensions. According to the agreement, Stork will provide asset integrity services in the North Sea for Harbour Energy’s Armada, Everest, Lomond, and Erskine (AELE) hub.

Rising Investment in the Industrial Sector to Drive the Market Development

The rapid expansion of industrial sectors worldwide is a major catalyst for the growth of asset integrity management (AIM). Industries such as oil and gas, petrochemicals, mining, power generation (both traditional and renewable), and pharmaceuticals have witnessed significant investment, particularly in emerging markets across Asia Pacific, Middle East & Africa, and Latin America.

According to the International Energy Agency (IEA), the global investment in clean energy rose from USD 1.41 trillion in 2021 to USD 1.62 trillion in 2022. Additionally, the investment in clean energy has increased from USD 914 billion in 2021 to around USD 1 trillion in 2022.

As companies build new facilities to meet rising global demand for energy, raw materials, and manufactured goods, there is an immediate and long-term need to implement robust asset integrity strategies from the outset. New plants, pipelines, offshore structures, refineries, and manufacturing units require comprehensive inspection, maintenance, risk assessment, and regulatory compliance programs to ensure operational safety, reliability, and profitability.

MARKET RESTRAINTS

High Initial Investment to Restrain the Market Growth

Implementing AIM systems entails complex integration procedures, necessitating specialized knowledge and resources. This intricacy results in elevated installation expenses, posing a significant obstacle for numerous organizations. The upfront investment for contemporary AIM solutions, comprising hardware, software, and training, is considered.

Apart from the initial investment, continuous maintenance, and operational expenses linked to AIM systems also serves as limitations. These expenses encompass updates, training, and ensuring adherence to changing regulatory standards. This financial strain might discourage smaller or less economically stable firms from embracing these systems. Although AIM offers advantages like enhanced operational efficiency and safety, the cost barrier restricts market asset integrity management market growth in some industries or regions.

MARKET OPPORTUNITIES

Expansion of the Power Sector in Emerging Economies to Create Growth Opportunity

As developing economies make significant investments in new power infrastructure, which includes renewable energy initiatives, the demand for AIM services is expected to increase to ensure the dependability and durability of these assets. In areas where current infrastructure is deteriorating, AIM can assist in prolonging asset lifespan and enhancing operational efficiency, thereby lowering downtime and maintenance expenses.

In March 2024, Oceaneering International entered into a strategic partnership agreement with Global Design Innovation (GDi) to provide digital asset management solutions for asset-heavy industries such as oil and gas, utilities, and power generation. The agreement will be executed through its Integrity Management and Digital Solutions team will enable the company to offer digital solutions, including a technology-oriented approach to remote support, inspection, and digital asset management services. Under the collaboration agreement, Oceaneering will leverage GDi’s Vision software solution to enhance inspection processes.

Overall, the expansion of the power sector in emerging economies creates a fertile ground for the growth of the AIM market, driven by the need for efficient, reliable, and sustainable energy infrastructure management.

MARKET CHALLENGES

Aging Infrastructure and High Maintenance Cost to Restrain the Market Growth

Aging infrastructure, especially in sectors such as oil and gas, petrochemicals, and utilities, necessitates more regular and comprehensive maintenance to maintain ongoing operation and safety. This raises the need for AIM services to oversee asset integrity, forecast possible failures, and plan maintenance. As infrastructure deteriorates, the likelihood of equipment malfunction, leaks, and other integrity problems increases. This not only creates safety hazards but also threatens operational continuity, resulting in expensive downtime, environmental harm, and regulatory fines. High upkeep costs linked to deteriorating infrastructure contribute to the total operational expenses of industries. This encompasses expenses for asset evaluations, preventive maintenance, and risk management, which can be a significant financial strain.

ASSET INTEGRITY MANAGEMENT MARKET TRENDS

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML algorithms examine past and current data from sensors, IoT devices, and enterprise asset management systems to forecast when maintenance will be necessary. By recognizing patterns and relationships that suggest possible failures, AI develops predictive models that determine the best time to carry out preventative maintenance, minimizing unexpected downtime. AI, coupled with IoT, enhances the integrity and performance of assets by facilitating real-time data gathering. This merging enables sectors to move from preventive to predictive asset management while equipping them to implement quick and actionable measures.

In March 2024, industrial data and engineering consultancy Imrandd created a groundbreaking asset management solution that utilizes artificial intelligence (AI) to minimize inspection time and expenses for offshore operators.

After USD 12.93 million investment, the company’s proprietary monitoring and intervention ALERT software has been crafted to surpass conventional methods of routine asset integrity monitoring. To bolster this newest innovation, Imrandd also secured financial support from the Net Zero Technology Centre (NZTC). ALERT is Imrandd’s fifth product, contributing to its collection of digital instruments created for the energy and industrial industries.

Thus, AI enables the remote supervision and management of assets, allowing organizations to track and address problems instantly, no matter where they are located. All these factors contribute to market growth.

IMPACT OF COVID-19

The pandemic, initially had a negative impact on the AIM market due to lockdowns and travel restrictions. These led to delays in on-site inspections and routine maintenance caused by the shutdown of various projects, especially in the oil and gas, power plants, and industrial sectors.

Also, the limited workforce availability has led to a slowdown in various field activities such as non-destructive testing, inspections, risk assessments, and more. In addition, the companies faced challenges in meeting the regulatory compliance timelines due to pandemic-induced delays leading to operational shutdowns.

A surge in demand for asset integrity management has been observed in the post-pandemic period due to the resumption of operations in numerous industries. Market growth is being driven by a significant increase in demand from infrastructure & mobility, residential & commercial buildings, renewable energy, oil & gas, defence, chemicals, and other sectors.

SEGMENTATION ANALYSIS

By Solution

Convergence of Safety Requirements to Propel the Expansion of the NDT Services

By solution, the market is segmented into non-destructive testing services (ultrasonic testing, radiographic testing, magnetic particle testing, dye penetrant testing, and others), risk-based inspection (risk assessment services, inspection planning and scheduling, and data analysis and reporting), corrosion management (corrosion monitoring, corrosion mitigation strategies, coating and surface treatment services), pipeline integrity management (pipeline inspection and monitoring, leak detection services, and maintenance and repair services), hazard identification study (risk analysis and assessment, and safety studies and reporting), structural integrity management (structural health monitoring, load testing and analysis, and maintenance and repair services), and others (training and certification, consultancy services, and asset management software solutions).

Among these, non-destructive testing accounted for the highest market size, and it is estimated to show the fastest growth during the forecast period. NDT offers various advantages, such as cost savings by reducing material waste and replacement costs. The NDT methods have a faster turnaround time, which allows for faster inspections and quick turnaround time for the identification of potential issues.

Risk-based inspection is the second leading segment in the asset integrity management fueled by industries seeking to optimize maintenance costs and prioritize high-risk assets over traditional time-based inspections. The oil & gas, petrochemical, and power sectors are the largest adopters of RBI methodologies. With increasing regulatory pressure and digitalization, RBI’s share is expected to expand further in the coming years.

By Technology

Real-Time Data Analysis Decision-Making at Asset Locations to Boost the Edge AI Share in the Market

By technology, the is classified into digital twin, edge AI, internet of things (IoT), quantum computing, life cycle assessment (LCA), condition assessment program (CAP) with robots, data analytics & machine learning, 3D laser & PAUT, blockchain, AR & VR, BIM, and METAVERSE.

Among these, edge AI holds the largest market share, while digital twin is expected to witness the fastest growth during the forecast period. Edge AI is quite popular as it offers real-time data analysis decision-making at asset locations. It helps reduce cost, latency, and dependency on cloud infrastructure by improving predictive capabilities and operational efficiency. Edge AI analyzes the sensor data in real-time by identifying potential issues and predicting when the assets are likely to fail, thereby minimizing downtime and facilitating proactive maintenance.

Digital twins are the fastest-growing segment as they act as virtual replicas of physical assets. Their ability to simulate various scenarios helps in predictive maintenance, improves decision-making, offers real-time data monitoring and aggregation, and facilitates risk assessment, thereby preventing costly repairs and replacements.

By Industry

To know how our report can help streamline your business, Speak to Analyst

Reliance on Maintaining Safety and Reliability of Offshore Condition to Surge the Segment’s Share of Oil & Gas Industry

By industry, the global market is segmented into oil and gas (upstream, midstream, and downstream), renewables (solar and wind), mining, aerospace, defense chemicals, steel farm, marine (ports and ships), residential building (proptech integrated and non-integrated), office spaces (proptech integrated and non-integrated), infrastructure and mobility (tunnels, dams, bridges, highways, airports & civil aviation, public transport, and others), and others.

The oil & gas segment accounted for the highest market share, and infrastructure & mobility is anticipated to show the fastest growth during the forecast period. AIM solutions are widely used in the oil & gas sector, as their operations involve high-risk activities and potential environmental hazards such as spills, leaks, and explosions. Hence, to prevent such incidences, asset integrity management solutions are widely used in the oil & gas sector.

The demand for AIM in the infrastructure and mobility sector is growing rapidly owing to the rising demand for efficient, sustainable transportation, advancements in mobility technologies, urbanization, and other factors.

ASSET INTEGRITY MANAGEMENT MARKET REGIONAL OUTLOOK

The market has been studied across five main regions: North America, Europe, Asia Pacific, Latin America, Middle East, and Africa.

North America

North America Asset Integrity Management Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Expanding Industrial Sector to Lead the Market Growth

North America leads with the dominating asset integrity management market share due to its crucial role in ensuring reliable & safe operations of energy & utilities including power plants, pipelines, and other energy infrastructure. In the oil & gas sector, AIM maintains the integrity of refineries, oil & gas pipelines, and other critical factors.

Similarly, growth in the manufacturing and construction sectors has led to an increase in the need to ensure the reliability and safety of manufacturing equipment, processes, and infrastructure assets, such as roads, bridges, and buildings.

Canada is a major oil and gas producer, and Alberta being the largest producer of synthetic crude, conventional crude oil, natural gas, and natural gas liquids. According to the Canadian Association of Petroleum Producers (CAPP), the oil and natural gas industry accounted for USD 71.4 billion (3.2%) of Canada's overall gross domestic product (GDP) in 2022.

U.S.

Increasing Production in Petroleum Products to Drive the Market Growth

Advanced inspection technologies, including drones, 3D laser scanning, and non-destructive testing (NDT), offer more precise and efficient evaluations of assets. These technologies are capable of identifying problems early, which minimizes downtime and enhances overall asset performance.

By utilizing technologies such as drones for structural health monitoring and condition evaluations, organizations can significantly reduce inspection expenses compared to conventional approaches. Moreover, the increasing production, consumption, and export/import of petroleum products significantly contribute to the need of asset integrity management. According to the Energy Information Agency (EIA), in 2023, the U.S. exported about 10.15 million b/d of petroleum to 173 countries and 3 U.S. territories (American Samoa, Puerto Rico, and U.S. Virgin Islands). Crude oil exports of about 4.06 million b/d accounted for 40% of total U.S. gross petroleum exports.

Europe

Several Strategic Initiatives to Drive the Demand for AIM Solutions in Europe

The presence of leading AIM providers in Europe, namely Bureau Veritas, Intertek Group plc, TechnipFMC plc, SGS Société Générale de Surveillance SA, and others, drives the demand for effective asset integrity management solutions in Europe. In addition, various strategic initiatives such as partnerships, technological advancements, business expansion, and others drive the demand for AIM solutions in Europe. For instance, in December 2024, FORCE Technology, headquartered in Denmark, signed a strategic partnership with Asia Offshore Solutions (AOS) to enhance access to structural monitoring, advanced subsea inspection, and cathodic protection services to the Australian offshore industry.

Asia Pacific

Significant Advancements in Infrastructure & Mobility to Fuel the Demand for AIM Solutions

Significant advancements in infrastructure & mobility, office spaces, residential buildings, oil & gas, chemicals, and other sectors drive the demand for AIM solutions. The developments in transport infrastructure, including the construction of high-speed railways, roads, and metro infrastructure, are driving the demand for AIM solutions in this region. According to the data published by Asian Transport 2030, it is estimated that by 2030, Asia could have a high-speed rail network length of 70,000 km, i.e., an increase of about 28,000 kilometers from 2020 to 2030. This means that about 25% of all railway expansion in Asia would consist of high-speed rail.

Further, the region is experiencing robust developments in residential and office spaces, including the rise in co-living spaces, sustainable construction, and mixed-use developments in Seoul, Singapore, Shanghai, and others. The use of AIM solutions in these industries offers greater asset safety and reliability, fewer equipment failures, strong business performance, and reduced unplanned downtime.

China

Rapid Industrialization and Infrastructure Development to Drive the Market Growth

China's rapid industrial growth and infrastructure enhancement are fueling the need for dependable, secure, and effective functioning of essential assets throughout different sectors. This encompasses industries such as oil and gas, power generation, and manufacturing, where AIM solutions are vital for preserving operational efficiency and safety.

The aging infrastructure in sectors like power and petrochemicals is driving demand for AIM solutions as companies seek to extend the life of these assets without compromising safety. The growing need for oil and gas in the area has led to a rise in investments in the local energy sector, which has further enhanced the AIM market.

Latin America

Strategic Partnership Between Oil & Gas Companies and AIM Solution Providers to Push the Market Growth

Latin American countries, namely Brazil, Mexico, Guyana, and Venezuela, account for significant oil & gas production and accounts for the world's second-largest oil & gas production. In 2022, the share of oil in the total energy supply accounted for 40.8%, with a global share of 6%.

Further, strategic partnerships between oil and gas companies and asset integrity management solution providers are driving the demand for the AIM market. For instance, in February 2025, Petrobras, headquartered in Brazil, signed a research and development contract with Abyss Solutions. This partnership focuses on deploying autonomous inspection technology across the fleet.

Middle East

Requirement for Operational Safety of Aging Assets in Risk-Based Industries to Influence the Market Growth

The Middle East region, the world's leading oil-producing countries, namely Saudi Arabia, UAE, Iraq, Iran, and Kuwait. Iran, Qatar, and the UAE are also among the top ten global natural gas-producing countries. Approximately 95% of the electricity in the Middle East is generated from natural gas and oil.

Further, in 2024, the investments in the energy sector accounted for approximately USD 175 billion, with clean energy accounting for 15% of the total investments. As the clean energy transition, which focuses on reducing the dependence on fossil fuels, is taking place, the number of oil & gas producers in this region are developing plants to build low-carbon energy sources. As the oil & gas sector faces increasing scrutiny regarding safety & environmental impact, leading to stricter regulations, the need for asset integrity management is increasing, which helps prevent leaks, accidents, and environmental damage.

Africa

Substantial Growth in Power Generation Capacities to Positively Impact the Market Growth

Africa is experiencing substantial growth in the power generation, manufacturing, mining, oil & gas, and infrastructure sectors. This growth has led to an increase in demand for asset integrity management solutions owing to stringent regulations related to safety, efficiency, and environmental protection.

Further, the strategic initiatives by various companies, such as investment, partnership, and others, are driving the demand for asset integrity management solutions. For instance, in April 2024, Petrofac was awarded a Technical Services Contract by Compañía Nacional de Petróleos de.

Guinea Ecuatorial (GEPetrol), the National Oil Company of Equatorial Guinea, will support operations for the region's offshore Block B asset.

COMPETITIVE LANDCSAPE

KEY INDUSTRY PLAYERS

Key Market Players Are Leveraging Various Strategies to Gain Competitive Edge

The global market is mostly fragmented, with key players operating in the industry. Globally, SGS Société Générale de Surveillance SA is dominating the market. In November 2021- Supply Chain Tracking (SCT) Technology signed an agreement with SGS to deliver the Consignment Management Application 'tag, track and trace' (CMA 3T) to enhance the SGS OMNIS Electronic Cargo Tracking service. SGS OMNIS offers users immediate tracking to ensure goods are in motion and preserve their quality while navigating various regions, across nations, and through customs-regulated zones.

List of Key Asset Integrity Management Companies Profiled in the Report

- SGS Société Générale de Surveillance SA (Switzerland)

- TÜV SÜD (Germany)

- TWI Limited (U.K.)

- Intertek (U.K.)

- Aker Solution (Norway)

- Bureau Veritas (France)

- Oceaneering International, Inc. (U.S.)

- Applus+ (Spain)

- Genesis Oil and Gas Consultants Ltd. (U.K.)

- ABS Group (U.S.)

- L&T Hydrocarbon Engineering (India)

- Asset Integrity Engineering (UAE)

KEY INDUSTRY DEVELOPMENTS

- February 2025- Intertek completed an extensive risk assessment for five offshore wind export cables in the North Sea and Baltic, which was conducted for Danish transmission system operator Energinet. These cables will link offshore wind power from the North Sea I, Kattegat, and Kriegers Flak II wind farms to the Danish mainland, bolstering Denmark's dedication to renewable energy. As a component of the project scope, Intertek Metoc delivered a comprehensive Burial Assessment Study (BAS). This research assessed different cable installation techniques to identify the most efficient method for guaranteeing the cables' safety and functionality.

- December 2024- TÜV SÜD formed a strategic alliance with SustainCERT to enhance their digital verification platform. The SustainCERT Platform is the sole digital verification platform for Validation/Verification Bodies (VVBs). The two companies will unite their knowledge to tackle the challenges of a swiftly expanding carbon market by digitizing verification processes using data science and Artificial Intelligence (AI). This will enhance the efficiency, transparency, and reliability of the validation and verification processes, leading to greater integrity in carbon markets.

- October 2023- Aker Solutions, SLB, and Subsea7 announced the completion of their previously declared joint venture. The new enterprise, which is named OneSubsea, will promote innovation and efficiency in subsea production by assisting clients in accessing reserves and minimizing cycle time. One Subsea consists of SLB'sSLB's and Aker Solutions'Solutions' subsea operations, which feature a broad, complementary technology portfolio for subsea production and processing, exceptional manufacturing scale and capacity, access to top-tier expertise in a reservoir and digital domains, unique pore-to-process integration abilities, and enhanced research and development capabilities.

- July 2020- SGS announced the opening of its cutting-edge commercial geochemistry lab in Tarkwa, Ghana. The lab can handle 50,000 to 60,000 samples monthly, and it is set to replace the existing facility, greatly enhancing the sample processing capacity from preparation to final analysis. This will allow the company to carry out sample preparation for both grade control and exploration samples, enabling us to meet the strict turnaround times demanded by our clients.

- March 2020- KTT entered into a Memorandum of Understanding with TWI Technology Group to advance the VN market for its Plant Integrity Management software and services. TWI'sTWI's integrity management software will provide a next-generation solution for asset integrity management systems: automating fracture and fatigue assessment procedures, effectively targeting and scheduling inspections and maintenance, and life assessment.

INVESTMENT ANALYSIS AND OPPORTUNITIES

In March 2024, Aberdeen-based Imrandd, a consultancy specializing in industrial data and engineering, has introduced ALERT, a solution for asset integrity powered by AI, after securing a USD 1,277.91 million investment. This cutting-edge software, designed to improve asset management while minimizing inspection time and costs, facilitates real-time monitoring of corrosion risks, equipping organizations to take proactive measures. Imrandd has obtained further funding from the Net Zero Technology Centre to aid in the progression of this project.

REPORT COVERAGE

The global asset integrity management market report delivers a detailed insight into the market and focuses on key aspects such as leading companies and their operations offering asset integrity management solutions. Besides, the report offers insights into market trends and technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

To gain extensive insights into the market, Download for Customization

REPORT SCOPE AND SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.12% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Solution

|

|

By Technology

|

|

|

By Industry

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 23.98 billion in 2024.

The market is likely to grow at a CAGR of 6.12% over the forecast period.

Oil & gas segment leads the market.

The market size of North America stood at USD 6.74 billion in 2024.

Increasing demand for operational safety and efficiency across industries to drive the market

TUV SUD, Applus+ (Spain), Genesis Oil and Gas Consultants Ltd. (U.K.), ABS Group (U.S.) and others are some of the market's top players.

The global market size is expected to reach USD 38.31 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us