Automotive Camera Market Size, Share & Industry Analysis, By Type (Stereo and Monocular), By Application Type (Park Assist System, Lane Departure Warning System, Blind Spot Detection, Lane Keep Assist, Road Sign Assistance, Adaptive Cruise Control (ACC), Intelligent Headlight Control, and Others), By Technology Type (Digital Camera, Infrared Camera, and Thermal Camera), By Vehicle Type (Passenger Cars and Commercial Vehicles), and Regional Forecasts, 2026-2034

KEY MARKET INSIGHTS

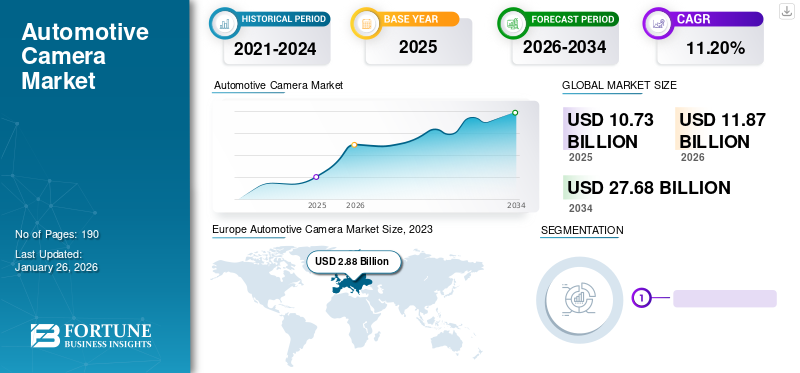

The global automotive camera market size was valued at USD 10.73 billion in 2025 and is projected to grow from USD 11.87 billion in 2026 to USD 27.68 billion by 2034, exhibiting a CAGR of 11.20% over the forecast period. Europe dominated the global market with a share of 32.90% in 2025.

Automotive cameras continuously capture and provide the vehicle's driver with a view of their surroundings. This enables them to make better decisions based on real-time images of the environment that meet vehicle maneuvers, thereby helping drivers and an imaging system that improves vehicle safety. Vehicle cameras can be installed inside and outside the vehicle, depending on the application.

The vehicle consists of various cameras and signaling components integrated into the ADAS system and helps improve vehicle safety. Onboard cameras are important in identifying obstacles, especially in blind spot areas. Camera and signaling components are mounted on the vehicle's rear, sides, and front. According to the World Health Organization, about 20 million to 50 million are injured and about 1.25 million people die each year in road accidents. The main cause of traffic accidents is the driver's carelessness and mistakes caused by fatigue.

Governments in developing countries are imposing strict safety regulations on manufacturers equipping entry-level vehicles with onboard cameras. Strict safety regulations have also proven to be an advantage for occupants in the event of an accident to make a case against insurance companies. Cameras and sensors are combined with the vehicle to provide a variety of applications such as lane departure warning, blind spot detection, and Adaptive Cruise Control (ACC) to help avoid collisions with obstacles and vehicles. Rising automobile sales and production and increasing consumer disposable income are the main factors driving the market growth during the forecast period. Fluctuating commodity prices are the main factors restraining the growth of the camera market during the forecast period.

In 2023, the global automotive camera market continued to feel the lingering effects of the COVID-19 pandemic. While the automotive industry showed signs of recovery, supply chain disruptions and semiconductor shortages persisted, impacting the production and distribution of automotive cameras. Despite the increasing demand for advanced driver assistance systems (ADAS) and in-car safety features, uncertainty and challenges related to the pandemic continued to pose hurdles for market growth.

Download Free sample to learn more about this report.

Automotive Camera Market Trends

Adoption of Artificial Intelligence (AI)-based Cameras to Drive the Automotive Camera Market Growth

Various suppliers and manufacturers of self-driving cars are focused on developing and deploying AI-based cameras. These systems provide safety features such as adaptive cruise control, forward collision warning system, adaptive headlight control, automatic braking, traffic sign recognition, and pedestrian detection. The advantage of AI-based cameras is that they are inexpensive and combine various advanced, safe, reliable, and high-precision technologies. The rising demand for self-driving cars is expected to boost demand for artificial intelligence (AI)-based cameras. For example, Tesla's latest car, the 2023 Model S, is expected to have improved autopilot capabilities and an active traffic sign recognition system that slows the car at traffic lights and stop signs. Additionally, in February 2022, Brigade Electronics Group PLC announced the launch of its new AI-based commercial vehicle safety system CAREYE (Safety Angle Turning Assistant) in European countries, including the U.K., France, Poland, and the Netherlands. This makes AI-based cameras one of the latest trends in the automotive camera industry.

Automotive Camera Market Growth Factors

Stringent Safety Norms Imposed by Governments to Drive the Market Growth

Due to increase in traffic accidents, various governments worldwide are mandating that vehicles be equipped with cameras to increase the safety of occupants and pedestrians. Stringent government-imposed standards are expected to drive the market over the forecast period. For example, the National Highway Traffic Safety Administration (NHTSA) requires new SUVs, LCVs, and HCVs to have rear-view cameras starting May 1, 2018. Additionally, in April 2021, three US senators proposed legislation requiring all new cars in the U.S. to have a driver monitoring system. They offer to equip all vehicles with Advanced Driver Assistance Systems (ADAS) and driver monitoring systems. By 2027, this law should be mandatory for all new cars.

Rising Adoption of 360-degree Cameras to Boost the Market’s Expansion

The 360-degree camera, also known as a top-view camera, bird’s-eye camera, or surround view camera, provides the driver with a real-time view of the area around the vehicle covering several feet. The cameras are omnidirectional, meaning it views and records each direction, roughly the whole sphere or at least a full circle horizontally, using either a single consumer camera or a rig with multiple camera lenses integrated into the device. Then, the footage from all directions is combined into one spherical video by camera or other software in the vehicle. 360-degree cameras also help the driver navigate safely through congested areas and crowded parking spaces and help to detect obstacles, pedestrians, and other vehicles in blind spots, subsequently reducing the risk of accidents. The rising awareness regarding advanced safety features among consumers has forced various car manufacturers to install 360-degree cameras combined with advanced technologies. These factors are also expected to drive the market growth over the forecast period.

RESTRAINING FACTORS

High Installation Cost to Restrain Market Growth

The high installation cost associated with automotive cameras presents a significant restraint to the growth of the global automotive camera market. While automotive cameras offer various benefits such as improved safety, enhanced driver assistance, and advanced parking assistance, the initial cost of installation can restrain many consumers and automotive manufacturers from product adoption.

One major contributing factor to the high installation cost is the complexity of integrating camera systems into vehicles, especially in older models or those with limited space for additional components. This complexity often requires specialized labor and expertise, driving up installation costs. Additionally, the need for calibration, testing, and integration with other vehicle systems further adds to the overall expense. Furthermore, the adoption of advanced camera technologies such as high-definition (HD) and ultra-high-definition (UHD) cameras can also contribute to higher installation costs. These cameras require more sophisticated hardware and software components, increasing both material and labor expenses.

To address this challenge, industry players are exploring strategies to reduce installation costs through standardization, modular design, and automation. By streamlining installation processes and leveraging economies of scale, manufacturers can potentially lower the overall cost of automotive camera systems, making them more accessible to a broader market segment.

Automotive Camera Market Segmentation Analysis

By Application Type Analysis

Park Assist System Segment Held the Largest Market Share due to Assistance in Vehicle Parking

By application type, the market is divided into park assist system, lane departure warning system, blind spot detection, lane keep assist, road sign assistance, Adaptive Cruise Control (ACC), intelligent headlight control, and others. The park assist system segment will account for 29.32% market share in 2026 and accounted for the largest market size of USD 2.59 billion in 2022, growing at a CAGR of 6.9% during the forecast period. Park assist is an Advanced Driver Assistance System (ADAS) that helps drivers park more safely in any parking space. Parking assistance systems are used in both passenger cars and commercial vehicles. The system allows the driver to park the vehicle in a row of parallel parked cars and exit the parking space.

The Adaptive Cruise Control (ACC) segment is expected to occupy the second-largest position in the market. ACC helps maintain a safe following distance between two vehicles. It warns the driver to brake when a car is approaching. If the driver doesn't step on the brakes, ACC automatically applies the brakes to avoid a collision. Rising consumer preference for advanced security technologies is expected to maintain the dominance of ACC during the forecast period. For instance, in January 2023, GM announced that the 2024 GMC Sierra HD would come with adaptive cruise control. In doing so, adaptive cruise control scans the road ahead using GM's forward collision warning sensors such as radar and cameras.

Blind spot detection segment occupies the third largest position in the market. The system uses cameras and sensors on each side of the vehicle. Blind spot detection uses cameras and sensors to warn the driver when the vehicle is approaching an obstacle. Warnings can come in the form of a soft pulsating sound in the driver's seat, a vibration in the steering wheel, flashing lights in the infotainment system, and more. Growing consumer awareness of security systems is driving the growth of the market. For example, in September 2022, Volkswagen unveiled its latest subcompact SUV, the VW Taos. It comes standard with a blind spot detection system.

By Type Analysis

Stereo Segment Captured a Major Share Owing to Advanced Functionalities

By type, the market is categorized into stereo and monocular.

The stereo segment accounted for USD 2.2 billion in 2022 and is expected to grow at a CAGR of 29.5% over the forecast period.The stereo segment led the market accounting for 51.56% market share in 2026. A stereo camera consists of two cameras that accurately calculate the distance between an obstacle and the vehicle. Stereo cameras ensure the proper functioning of various Advanced Driver Assistance System (ADAS) applications such as lane departure warning, collision warning, and adaptive cruise control. Therefore, increasing the adoption of stereo cameras in autonomous driving and collision detection devices will help maintain their dominance during the forecast period.

The monocular segment is expected to exhibit substantial growth during the forecast period as these cameras are increasingly used in entry-level vehicles. A monocular camera captures 2D-only images or videos using only one camera. Monocular cameras use advanced computer vision algorithms and machine learning techniques to provide detailed information and support ADAS applications. Passenger cars using monocular cameras are the BMW 5-series, 7-series, and X3, Hyundai Kona, Sonata, and Audi Q5, Q7, A6. The increasing implementation of these cameras in passenger cars is expected to take its second-largest position on the market.

By Technology Type Analysis

Digital Segment Captured Major Share owing to Advanced Functionalities

By technology type, the market is categorized into digital camera, thermal camera, and infrared camera. The digital camera segment accounted for a market size of USD 6.32 billion in 2022 and is expected to grow at a CAGR of 10.2% over the forecast period.

The digital camera segment segment will account for 77.76% market share in 2026. Digital dash cams are used for various purposes, including capturing video footage of the road in front of and inside the vehicle and providing additional safety features and driver assistance technologies. Digital car cameras also have advanced features such as GPS tracking, parking mode, and motion detection, and they can record video even when the car is parked.

For instance, in January 2023, Amazon launched its latest Launched Ring Car Camera. The camera can detect burglary, start recording, and send alerts and live videos to the owner. A few digital cameras also use features such as lane departure warning, ACC, and forward collision warning. These features, along with digital features, help drivers avoid traffic accidents.

The thermal camera segment occupies the second largest position in the technology type segment and is expected to maintain that position during the forecast period. Infrared thermography uses infrared radiation to detect and visualize heat signatures. They are used for night vision, security systems, and security applications. Thermal imagers are also used to diagnose the engine and the HVAC system. Identify engine hotspots and leaks in heating, ventilation, and air conditioning systems. The rising adoption of infrared cameras is expected to boost market demand during the forecast period. For example, in December 2020, GM announced to offer thermal imaging cameras as an option on some models of Chevrolet, GMC, and Cadillac vehicles.

By Vehicle Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Passenger Cars Segment to Display Healthy Growth Owing to Rise in Product Sales

Based on vehicle type, the market is segmented into passenger cars and commercial vehicles. The passenger cars segment will account for 67.82% market share in 2026, owing to an increase in the production and sales of passenger cars. For instance, the sale of passenger cars in the U.S. increased to 3,350.1 thousand units from 2,303.0 thousand units. Additionally, the rise in per capita income of consumers in developing countries is growing significantly. The rising adoption of safety features in passenger cars, such as ACC, blind spot detection, and lane keep assist, is also anticipated to drive the passenger cars segment over the forecast period.

The commercial vehicles segment is also expected to show robust growth during the forecast period. Moreover, increasing demand for cameras for detecting blind spots in commercial vehicles will help maintain the steady growth of the segment during the forecast period. Cameras for heavy commercial vehicles are also used to monitor cargo holds. These cameras are used in conjunction with connected software, such as online dashboards, to review incident footage and bus drivers and track safety improvements over time. With accident rates skyrocketing, in-cab distraction rising, and lawsuits surging, many fleets are adopting automotive camera systems as they prove to improve safety and reduce associated costs. These factors are also expected to occupy the second-largest position in the market.

REGIONAL INSIGHTS

Geographically, the market is studied across Europe, North America, Asia Pacific, and the rest of the world.

Europe Automotive Camera Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the market with a valuation of USD 3.53 billion in 2025 and USD 3.91 billion in 2026. Stringent safety norms imposed by governments in this region are expected to drive the market growth. For example, Europe has introduced new safety standards, such as pedestrian’s safety regulations (EC)78/2009 and general safety regulation (EC) 661/2009, for automobile manufacturers to lower road accidents. Additionally, in July 2019, the EU introduced a new set of safety regulations known as the General Safety Regulation (GSR). The GSR mandates the inclusion of a range of advanced safety systems, including Automatic Emergency Braking (AEB), lane departure warning, and driver fatigue monitoring, among others. Cameras are often used in these systems to provide visual input to the vehicle’s sensor.

Asia Pacific holds the second-largest position in the market and is anticipated to show healthy growth over the forecast period. The growing imports of Asian-made components from Europe and North America are expected to maintain the second-largest position in this market. Rising sales and production of vehicles are expected to drive the market expansion in this region. Additionally, increasing the disposable income of consumers and ease of availability of raw materials is also one of the reasons fueling the market growth in this region.

The drive recorder market is also expected to grow in North America. The U.S. is expected to dominate the region as the government imposes stringent safety regulations to reduce traffic accidents. For example, in May 2018, the U.S. Department of Transportation mandated backup cameras for vehicles under 10,000 lbs. The rising demand for luxury vehicles in the U.S. and Canada is another factor increasing the demand for dash cams in this region.

List of Key Companies in Automotive Camera Market

Companies Focus on Building Advanced Parking Systems and Partnerships to Gain Competitive Edge

The key players are focusing on strategic partnerships, cost-reduction strategies, and acquisitions to improve their product offerings. For instance, in July 2021, Vossloh signed an agreement to purchase ETS Spoor, a Dutch company. Vossloh aims to strengthen its position in the Dutch market. With the acquisition of ETS, Vossloh aims to offer technology-based products & services to meet the demand from the Dutch rail infrastructure market.

LIST OF KEY COMPANIES PROFILED:

- Robert Bosch GmbH (Germany)

- Autoliv, Inc (Sweden)

- Continental AG (Germany)

- ZF Friedrichshafen AG (Germany)

- Denso Corporation (Japan)

- Ricoh (Germany)

- Magna International Inc. (Canada)

- Garmin Ltd (U.S.)

- Valeo (France)

- OmniVision (U.S.)

- Mobileye (Israel)

- Aptiv Plc (Ireland)

- Brigade Electronics Group Plc (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: VIA Optronics AG signed a design and development contract with Immervision Inc. for VIA´s Next Generation Automotive Camera. Under the deal, VIA would work with Immervision to develop a specialized lens technology to customize and produce exterior automotive cameras.

- January 2024: Eyeris Technologies, Inc. and Leopard Imaging, Inc. announced their partnership on a production reference design to improve safety and comfort in the entire automobile cabin. The deal would help the joint development of an advanced monocular three-dimensional (3D) sensing AI software algorithm into Leopard Imaging’s 5-megapixel (MP) backside illuminated (BSI) global shutter (GS) camera for 3D in-cabin monitoring systems.

- April 2023: Ford announced the U.K. launch of BlueCruise, a Level 2 ADAS for hands-free driving. An evolution of Ford's Intelligent Adaptive Cruise Control, BlueCruise allows vehicles to keep pace with traffic within legal speed limits. It also helps to detect and track the position and speed of other vehicles on the road using radar and automotive cameras.

- April 2023: OmniVision and AVIVA Links Inc. have agreed to jointly develop automotive camera systems based on the Automotive SerDes Alliance (ASA) specifications. The initiative combines AVIVA's connectivity solutions with OmniVision sensor technology to enable and power the next generation of intelligent, connected, and autonomous vehicles.

- January 2023: ZF presents Smart Camera 6 for autonomous driving and ADAS systems. It helps reduce the number of discrete ECUs for ADAS/AD systems, improves vehicle-level software testing and validation, reduces system weight, and simplifies the assembly process. It also uses black box software integration, is Autosar compliant, ensures cyber security, and utilizes Ethernet/CAN interfaces.

REPORT COVERAGE

The market research report provides an analysis of the industry and focuses on key aspects such as leading companies, product/service types, and leading companies. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market growth in recent years.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.20% from 2025 to 2034 |

|

Unit |

Value (USD Billion) and Volume (Thousand Units) |

|

Segmentation |

By Type

|

|

By Application Type

|

|

|

By Technology Type

|

|

|

By Vehicle Type

|

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size was USD 10.73 billion in 2025.

The market is likely to grow at a CAGR of 11.20% over the forecast period (2026-2034).

The passenger cars segment is expected to lead the market due to the development of smart city projects.

Some of the top players in the market are Robert Bosch Gmbh, Autoliv Inc, and OmniVision.

Europe dominated the market in terms of market size in 2025.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us