Fleet Management Software Market Size, Share & Industry Analysis, By Type (Operation Management, Vehicle Maintenance & Diagnostics, Performance Management, Fleet Analytics & Reporting, and Others), By Fleet Type (Commercial Fleet and Passenger Cars), By Deployment (Cloud and On-premises), By Industry (Manufacturing, Logistics, Transportation, Oil and Gas, Chemical, and Others), and Regional Forecast, 2026 – 2034

Fleet Management Software Market Size

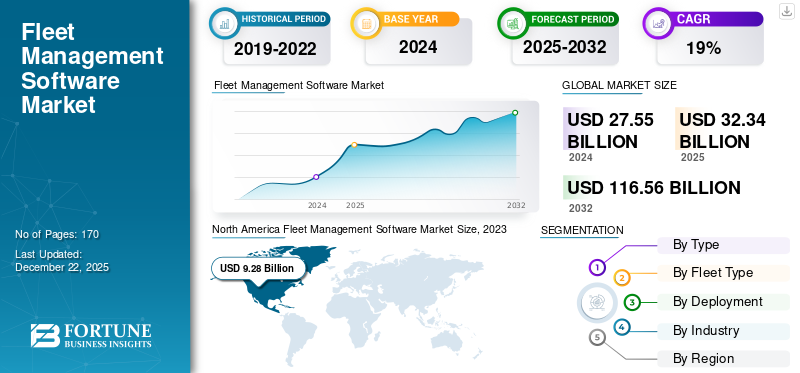

The fleet management software market size was valued at USD 32.36 billion in 2025. The market is projected to grow from USD 38.28 billion in 2026 to USD 152.89 billion by 2034, exhibiting a CAGR of 18.9% during the forecast period. North America dominated the global market with a share of 38.6% in 2025.

Fleet management software helps fleet managers monitor their equipment, drivers, and vehicles efficiently from a single application. The solution offers businesses access to the relevant data in an easy-to-understand format. The cloud-based solution offers decision-makers the required information, from location information and vehicle diagnostics to driver behavior and other data.

Currently, key players operating in the market are incorporating emerging technologies, such as generative AI and machine learning to enable companies to spot and solve anomalies. In the coming years, the market is expected to flourish owing to the increase in EV adoption, growing use of mobility-as-a-service, rising investments in corporate vehicle fleets, and companies executing relevant business strategies.

GENERATIVE AI IMPACT

Increasing Inclination of Fleet Managers Toward Generative AI Applications to Drive Market Growth

Generative AI had a positive impact on the fleet management software market growth. The year 2022 witnessed a huge wave of investments in generative AI technology across the globe. Fleet managers, too, started accessing its applications to enhance their services. Key market players, such as Uber Freight and Geotab have started providing generative AI-enabled solutions. For instance,

December 2023: TomTom and Microsoft collaborated with each other to leverage generative AI capabilities in the automotive industry. Through the collaboration, the companies will be developing an end-to-end AI-based conversational assistant that improves voice-based interaction with location search, infotainment, and vehicle command systems.

June 2023: Geotab enhanced its data experience by leveraging the expertise of generative AI. The company started a beta project that introduces generative AI models to its platform. The new launch is expected to revolutionize the connected transportation industry.

Fleet Management Software Market Trends

Increase in EV Adoption and Growing Use of Mobility-as-a-Service to Drive Market Growth

The increased focus on sustainability is driving the adoption of EVs. Currently, the EV market is still in its infancy and is expected to thrive in the coming years and further drive the demand for fleet management software. In addition, several EV fleet-as-a-service providers are engaged in executing various business strategies to support the growth of the market. For instance,

March 2023: Revolv, an electric medium-to-heavy commercial fleet provider, secured USD 15 million in a Series A funding round led by Greenbacker. With this funding, the company intends to expand its operations across North America to support the increasing adoption of decarbonized commercial fleets with medium, light, and heavy-duty trucks.

Along with this, the growing use of Mobility-as-a-Service (MaaS) is shaping the market’s outlook. The major factor driving this adoption is the innovation and advancement that MaaS brings to a traditional fleet management software. In addition, the improved data security provided by MaaS is expected to create a healthy future for the market in the coming years.

Download Free sample to learn more about this report.

Fleet Management Software Market Growth Factors

Investments Made in Corporate Vehicle Fleets to Accelerate Market Growth

A major factor driving the market is the investments made in corporate vehicle fleets for employees. In the past, companies internally managed and owned their cars and fleets. However, this scenario is changing, and the relevance of fleet management is increasing at a strong pace. This outsourcing of solutions is leading to the growth of the vehicle leasing business, resulting in increased investments in technology.

Moreover, to cater to the increasing demand for fleet management systems, companies are engaged in conducting strategic business operations, such as partnerships & collaborations with established players, and acquisition of innovative firms. For instance,

December 2023: Procureship, an e-procurement platform for marine buyers and suppliers, entered a strategic partnership with BASSnet, which specializes in providing ERP maritime solutions. This partnership was made to conduct procurement processes seamlessly between BASSnet Procurement and Procureship.

RESTRAINING FACTORS

Low Signal and Employee Pushback May Impede Market Growth

The mechanism of fleet management software works by interpreting signals from various satellites. The chances of these signals getting affected by big buildings, storms, and other obstructions are high. In this scenario, the components used in this software, such as GPS become weak and inefficient. This can create havoc if a driver travels to a new place and requires continuous assistance from the service provider.

Besides, an employee may find it difficult to get acquainted with new software. It might take a considerable amount of time to understand and learn about the software, especially if the employee has never used a fleet management system before. These are some of the factors that might hinder the growth of the fleet management software market.

Fleet Management Software Market Segmentation Analysis

By Type Analysis

Operation Management to Gain Traction as It Guarantees Effective Supply Chain Management

By type, the market is classified into operation management, vehicle maintenance & diagnostics, performance management, fleet analytics & reporting, and others. The operation management segment is further segmented into fleet tracking & geo-fencing and routing & scheduling, and the performance management segment is divided into driver management and fuel management.

The operation management segment is expected to hold the largest fleet management software market share. Many industries focus heavily on the proper operational management of their fleets to ensure effective supply chain management. This factor is expected to drive the segment’s growth. The segment dominated the market with a share of 40.66% in 2026.

In the coming years, the performance management segment is also expected to dominate the market due to the growing popularity of predictive maintenance technologies that help reduce the chances of engine downtime. For instance, built-in sensors provide operational data about components, such as hydraulics, tires, engines, and others.

By Fleet Type Analysis

Commercial Fleet Owners to Increase Software Use Due to High Dependence on Supply Chains

Based on fleet type, the market is classified into commercial fleet and passenger cars.

The commercial segment dominated the market in 2023 and is expected to continue its dominance during the forecast period. Industries, such as manufacturing, logistics, transportation, and others depend highly on strong supply chain networks and on-time delivery. This segment is set to capture 57.9% of the market share in 2026. Maintaining fleet timings is essential to ensure the proper interchange of material tracking and scheduling. Many industries are adopting fleet management software on a large scale in their commercial fleets to cater to such requirements.

Similarly, the rising demand for advanced passenger cars, such as connected and electric vehicles will offer huge opportunities for the market to grow. The software can enhance the car’s self-driving capabilities, while improving road safety with innovative technologies, such as collision avoidance. The passenger cars segment is likely to grow with a considerable CAGR of 19.21% during the forecast period (2024-2032).

By Deployment Analysis

On-premises Deployment Segment Dominated Due to its Beneficial Features

By deployment, the market is classified into cloud and on-premises.

The on-premises segment captured the maximum market share owing to the model’s ability to help users make an upfront investment, minimize monthly expenses, and offer in-house data storage & security control, among others. This segment is foreseen to gain 58.2% of the market share in 2026.

In the coming years, the cloud segment is expected to record the highest CAGR of 21.20% during the forecast period (2024-2032), owing to its hassle-free and cost-efficient integration capabilities. Cloud-based connectivity has offered effective ways of managing fleet activity. For instance, GPS tracking has become more efficient by connecting with the cloud and can work properly in low-connectivity areas. Also, leading players are developing advanced cloud-based software solutions. For instance,

March 2023: Pro-Vision, a mobile video solutions provider, made advancements in its fleet video management solution with CloudConnect, a cloud-based software. The new launch is expected to simplify the access, management, storage, and sharing of video-based data.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Manufacturing Industry to Increase Product Use Due to Minimized Production Delays

By industry, the market is classified into manufacturing, logistics, transportation, oil & gas, chemical, and others.

The manufacturing segment is set to lead the market owing to the sector’s high dependency on the timely delivery of materials and components to minimize production delays. In addition, fleet management helps in planning efficient routes, reducing cost, and further enhancing productivity. The software helps in real-time tracking of fleets which ensures driver safety, timely deliveries, and overall productivity. The segment is expected to attain 23.15% of the market share in 2026.

The adoption of this software is likely to gain momentum in the logistics industry as well owing to fleet managers' growing preference for real-time tracking solutions. As the industry is entirely based on the transportation of goods, any disturbance in this flow can disrupt work. This factor is expected to increase the software’s demand in the logistics industry. The logistics segment is foreseen to grow with a substantial CAGR of 21.42% during the forecast period (2024-2032).

For example, in October 2023, LogiNext announced that it had helped several companies achieve over 95% of the fleet management compliance requirements, lowered insurance premiums by 50%, and reduced accidents by 30% with the help of their Vehicle Tracking System.

Similarly, transporting oil, gas, and chemicals requires efficiency, timely distribution, and safety. This software manages and coordinates with the fleet by improving efficiency, reducing operational costs, and helping fleet operators follow government regulations. This factor is likely to create growth opportunities for the market.

REGIONAL INSIGHTS

Based on region, the market is studied across five key regions, such as North America, South America, Europe, the Middle East & Africa, and Asia Pacific. They are further classified into countries.

North America

North America Fleet Management Software Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 12.484 billion in 2025 and USD 14.609 billion in 2026. The region dominates the global fleet management software market share due to the large-scale deployment of real-time tracking solutions across industries to conduct seamless business operations. The adoption of vehicle tracking systems has also increased among automobile companies in the U.S., such as General Motors, Ford, and Fiat-Chrysler. Also, the region is known to be among the early adopters of innovative technologies, which will further contribute to the growth of the market in this region. The U.S. market is projected to reach USD 7.855 billion by 2026.

Europe

Europe is the second leading region expected to hold USD 9.90 billion in 2025, documenting a CAGR of 20.28% during the forecast period (2024-2032). The region holds a significant market share as Germany is the world's largest automotive hub. Commercial vehicle fleets play an important role in the European economy. The U.K. market is foreseen to grow with a value of USD 2.21 billion in 2025. Besides, the factors increasing the adoption of fleet management solutions across the region include a strong decline in the relevance of owning a car for social status and increasing urbanization. The UK market is projected to reach USD 2.609 billion by 2026, while the Germany market is projected to reach USD 1.947 billion by 2026. while France is expected to reach USD 1.96 billion in the 2025.

Asia Pacific

Asia Pacific is the third largest market anticipated to gain USD 6.32 billion in 2025. The region is expected to dominate the global market in the coming years owing to the expanding radio cab industry and increasing demand for mobility services in this region. China is set to reach USD 1.62 billion in 2025. The presence of a large number of manufacturing facilities in China, Japan, and India is expected to further enhance the market’s growth in Asia Pacific. India is likely to record rapid growth due to the country's stringent emission and fossil fuel policies. Many start-up companies, such as LocoNov and AerisCommunications are collaborating with global players to provide fleet solutions in India. The Japan market is projected to reach USD 1.537 billion by 2026, the China market is projected to reach USD 1.911 billion by 2026, and the India market is projected to reach USD 1.705 billion by 2026.

Middle East & Africa

The Middle East & Africa is the fourth largest market poised to reach USD 1.90 billion in 2025. However, the MEA and South American regions have showcased a slower growth rate as compared to other regions across the globe. This is due to the moderate adoption of fleet management software solutions by leading automotive manufacturers. However, in the coming years, South America is expected to witness a promising CAGR due to the growing adoption of this software by industries, such as oil & gas, chemical, and others. The GCC market is projected to reach a market value of USD 0.77 billion in 2025.

KEY INDUSTRY PLAYERS

Key Players to Partner with Vehicle Manufacturers to Cement their Market Positions

Leading players operating in the market are constantly engaged in expanding their product portfolios by investing in software development and advanced research processes. These players are entering strategic partnerships and collaborations with established and innovative market players to provide enhanced fleet management with improved tracking, accurate GPS, and better support to the drivers. Besides, small and medium-scale companies are raising funds to develop their fleet management solutions. These vendors are bringing enhancements to their product to gain an edge over other competitors in the market.

List of Top Fleet Management Software Companies:

- Motive Technologies, Inc. (U.S.)

- Verizon Communications Inc. (U.S.)

- Samsara Inc. (U.S.)

- Azuga (Bridgestone Company) (U.S.)

- Rarestep, Inc. (U.S.)

- Lytx Inc. (U.S.)

- Onfleet (U.S.)

- Trimble Inc. (U.S.)

- Teletrac Navman U.S. Ltd. (U.S.)

- GPSWOX (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: Komatsu completed the acquisition of iVolve Holdings through its wholly-owned subsidiary in Australia. With this acquisition, the company expects to cater to iVolve’s customers in North America and Australia and target mid-tier operations.

- December 2023: Traxall International, a sister company of Fleet Operations, completed the acquisition of Fleet Logistics Group. This acquisition was done to develop one of the largest independent mobility and fleet management providers with over 400,000 contracts under management in Europe.

- June 2023: ZEVX, an EV systems provider, introduced OpenZEVX, a SaaS fleet management software dedicated to e-mobility solutions and battery-electric powertrains. The new launch is expected to enable fleet managers to enhance EV powertrains and charging systems to optimize EV range, performance, and driver safety.

- June 2023: Webfleet, Bridgestone‘s fleet management software, introduced a trailer management solution, named Webfleet Trailer. The new solution is dedicated to supporting transport and logistics firms with trailer fleets operating long haul.

- October 2022: Pocket Box introduced an SME fleet management solution to maintain compliance, reduce risk, and save cost and time. The new solution will be used to streamline fleet-related tasks and processes to ensure that the vehicles are safe and kept road-legal.

REPORT COVERAGE

The report provides an overview of the market and focuses on important aspects that impact the market’s growth. These key aspects include leading companies that operate in the market, their different solution/service types, and leading applications of these solutions. In addition, it offers insights into the market trends and highlights key industry developments. Moreover, the report provides a complete picture of the several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 18.9% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Fleet Type

By Deployment

By Industry

By Region

|

Frequently Asked Questions

The market is projected to be worth USD 152.89 billion by 2034.

In 2025, the market was valued at USD 32.36 billion.

The market is expected to record a CAGR of 18.90% during the forecast period.

By type, the operation management segment is leading the market.

Investments made in corporate vehicle fleets is accelerating the market’s growth.

Motive Technologies, Inc., Verizon Communications Inc., Samsara Inc., Azuga (Bridgestone Company), Rarestep, Inc., Lytx Inc., Onfleet, Trimble Inc., Teletrac Navman US Ltd, and GPSWOX are the top players in the market.

North America is expected to hold the highest market share.

The logistics segment is expected to record the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us