Medical Devices Market Size, Share & Industry Analysis, By Type (Orthopedic Devices, Cardiovascular Devices, Diagnostic Imaging Devices, In-vitro Diagnostics (IVD), Minimally Invasive Surgery Devices, Wound Management, Diabetes Care Devices, Ophthalmic Devices, Dental Devices, Nephrology Devices, General Surgery, and Others), By End-User (Hospitals & ASCs, Clinics, and Others), and Regional Forecast, 2026-2034

Medical Devices Industry Analysis

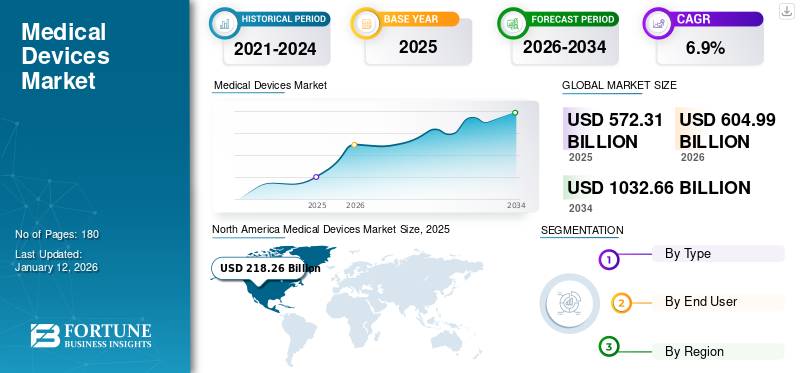

The global medical devices market size was valued at USD 572.31 billion in 2025 and is projected to grow from USD 604.99 billion in 2026 to USD 1032.66 billion by 2034, exhibiting a CAGR of 6.90% during the forecast period. North America dominated the medical devices market with a market share of 38.1% in 2025.

The increasing number of patients suffering from acute and chronic diseases, including diabetes, cancer, and others, coupled with growing awareness regarding treatment options, is resulting in a growing number of patients undergoing diagnostic and surgical procedures. The rising number of surgical procedures, including cardiac, orthopedic, neurological, and others globally, is expected to contribute to market expansion.

- For instance, according to the data provided by the National Center for Biotechnology Information (NCBI) in August 2023, nearly 422.0 million people across the world are diagnosed with diabetes, with the majority living in low-and middle-income countries, and 1.5 million deaths are directly attributed to diabetes every year.

The rise in inpatient admissions and the increasing number of surgical and diagnostic procedures are fueling demand for products, including capital equipment and consumables, across developed and emerging countries.

Moreover, growing research and development initiatives by key market players such as Medtronic, Johnson & Johnson Services, Inc., and others to develop and introduce novel equipment to cater to the increasing demand for novel devices are expected to support the global market share.

- For instance, according to the 2023 report of the MedTech Dive, breakthrough designations were awarded to 167 devices in 2023, as compared to 135 in 2022.

- Additionally, as of June 2023, 109 devices were granted breakthrough designations by CDRH and the Center for Biologics Evaluation and Research (CBER).

The market is poised for substantial growth, driven by technological innovations and increasing healthcare demands. However, challenges such as regulatory complexities and trade tensions require strategic navigation by industry stakeholders.

Medical Devices Industry Landscape Overview

Market Size & Forecast

- 2025 Market Size: USD 572.31 billion

- 2026 Market Size: USD 604.99 billion

- 2034 Forecast Market Size: USD 1032.66 billion

- CAGR: 6.90% (2026–2034)

Market Share

- By Region: North America dominated the medical devices market in 2025 with a 38.10% share, driven by a strong healthcare infrastructure, favorable reimbursement policies, and high adoption of advanced technologies across the U.S. and Canada.

- By Type: In-vitro Diagnostics (IVD) held the largest market share in 2025, attributed to the high number of clinical diagnostic tests performed globally and the increasing prevalence of infectious and chronic diseases. Ongoing innovation and product launches in this category further supported its dominance.

Key Country Highlights

- United States: The U.S. market is propelled by frequent regulatory approvals and robust R&D investment. The Infrastructure Investment and Jobs Act and favorable Medicare reimbursement policies have accelerated adoption of advanced medical devices. In 2024, Boston Scientific received FDA approval for the FARAPULSE Pulsed Field Ablation System, reflecting ongoing innovation.

- China: A booming population, rising incidence of chronic diseases, and large-scale government investment in healthcare infrastructure have positioned China as a major consumer of medical devices. Initiatives such as expanding MRI production by Siemens Healthineers in India support the broader Asia Pacific market.

- Japan: Japan continues to be a hub for innovation in medical technology, with demand driven by an aging population and strong regulatory compliance. Recent product introductions like NIDEK’s Cube α Ophthalmic Surgical System highlight Japan’s role in ophthalmic and surgical innovations.

- Europe: Europe is expected to register steady growth owing to increased product approvals, home healthcare adoption, and portable medical device offerings. Countries like Germany and France are central to this growth. For example, Abbott’s CE Mark approval for the Assert-IQ cardiac monitor in March 2024 reflects regulatory support for advanced solutions.

Market Dynamics

Market Drivers

Increasing Prevalence of Chronic Diseases Among Patients to Drive Market Growth

The growing prevalence of acute and chronic diseases, including diabetes, cancer, and others, is resulting in a growing number of patients requiring therapies and treatment procedures. The growing initiatives by various major companies and healthcare agencies operating in the market to raise awareness regarding these novel therapies and treatment options among patients are further supporting the increasing product demand.

- According to the 2022 report published by the Centers for Disease Control and Prevention (CDC), it was reported that there will be an approximately 700% increase in the prevalence of diabetes among young adults by 2060, which indicates that about 526,000 young people will have diabetes by 2060. This patient population is expected to use glucose monitoring and other devices, boosting product demand during the forecast period.

Furthermore, the rising geriatric population is leading to an increasing prevalence of age-related disorders, including cataracts, glaucoma, hypertension, hearing loss, and arthritis, among other conditions. This, along with a rising emphasis on early diagnosis and treatment boosted by initiatives undertaken by various national and regional healthcare agencies, is leading to an increasing number of admissions to inpatient and outpatient departments in healthcare settings globally.

- According to the WORLD SOCIAL REPORT 2023, the number of people aged 65 years or older worldwide is projected to more than double, rising from 761.0 million in 2021 to 1.6 billion in 2050. The number of people aged 80 years or older is growing more rapidly.

- Additionally, according to the 2022 data published by the Centers for Disease Control & Prevention (CDC), it was reported that about 53.9% of people aged 75 years and older have arthritis.

Therefore, the aforementioned factors, along with increasing per capita healthcare expenditure, improving reimbursement policies in developed and emerging countries, are leading to the rising number of patients undergoing diagnosis and treatment, further supporting the global medical devices market growth.

Market Restraints

High Costs of Devices and Inadequate Reimbursement Policies in Developing Countries to Limit Market Growth

In the last decade, medical devices have witnessed significant developments in the implementation of new technologies and further design modifications. Medical devices have revolutionized the healthcare industry, introducing various fitness and activity trackers and therapeutic devices. These devices have a wide range of prices. Specifically, the high cost of large medical equipment such as CT scanners and MRI machines limits its acquisition in emerging nations where affordability plays a significant role.

Additionally, the treatment procedures involving high-tech devices, including surgical robots and others, are also higher, which is anticipated to limit the adoption of medical devices in the market.

- For instance, as per the data provided by the National Center for Biotechnology Information in August 2023, the DaVinci Robotic X System is much more expensive than the tower laparoscopy system, with a purchase price of over USD 2.2 million (EUR 2.0 million). Such high costs create adoption barriers in developing and emerging nations that limit market growth.

This leads to a comparatively higher cost of ownership for hospitals and surgical centers. Additionally, reimbursement for medical devices has also been a restricting factor in their adoption in emerging countries. Thus, the above factors, along with inadequate reimbursement policies, have been responsible for the comparatively limited adoption of these devices in emerging countries.

Market Opportunities

Investments in Research and Development Activities to Present an Opportunity

The key manufacturers are currently focusing on strategies to increase innovation toward achieving breakthrough technologies with a strong emphasis on R&D investments, further likely to boost the global medical device market growth.

This, along with increasing investments in research activities to develop and introduce technologically advanced products, is leading to increased consumer benefits, such as improved patient outcomes along with improved accessibility, further anticipated to cater to the growing unmet need for advanced products.

Additionally, the prominent players are emphasizing showcasing their product portfolios at various national and international conferences to strengthen their geographical presence. This creates lucrative opportunities in the untapped and underpenetrated markets for the expansion of the demand for innovative medical devices.

- For instance, in May 2023, Royal Philips showcased its cardiology devices portfolio, including diagnostic imaging devices, software, and services, at the European Association of Percutaneous Cardiovascular Interventions 2023.

Market Challenges

Stringent Government Regulations to Hinder Market Growth

The regulations in developing countries constantly embrace safe, authentic, and quality medical products, equivalent to international standards, with a constriction on the price of lifesaving devices. However, the constant upgradation, continuous changes, and complexity of regulatory requirements have complicated the overall process for the companies in the market. It becomes challenging for manufacturers to keep up with the stringent regulatory approval procedure in such a dynamic environment.

- For instance, in May 2022, the EU Medical Device Regulatory Authority updated the regulations for in vitro diagnostic products from the In Vitro Diagnostic Medical Devices Directive (IVDD) to the In-Vitro Device Regulation (IVDR). The new regulation brought numerous challenges to lateral flow device manufacturers.

The medical devices industry in developing countries, especially India and China, is nascent. Medical equipment is imported from mature geographies and is required to meet Indian or other emerging countries' government regulations, and thus face challenges in approval of the medical device.

Thus, manufacturers must adhere to product safety, standards, and regulatory compliance set by different countries during the export and import of these devices. This, along with lengthy regulatory processes and indefinite timelines required for approvals, especially in emerging countries, are factors projected to restrain the market's growth during the forecast period.

Other Prominent Challenges

Trade Protectionism: Recent tensions, such as the European Union's threat to restrict Chinese medical device manufacturers due to discriminatory practices, highlight the impact of trade policies on market dynamics.

Market Saturation in Developed Regions: Intense competition in mature markets can limit growth opportunities.

Medical Devices Market Trends

Increasing Preference for Wearable Devices Among Population to Boost Market Growth

The increasing focus on fitness among the adult population globally and the growing focus of national and regional healthcare agencies on monitoring and diagnosis have been pivotal in creating a higher demand for fitness trackers. Despite these limitations of wearable devices, such as security concerns and data privacy, there is still a significantly high preference for fitness trackers and activity monitors owing to their easy usability and advantages.

Due to the outbreak of the COVID-19 pandemic and rising concerns about the population's health, the demand for these devices fueled up in the market. For instance, according to 2023 statistics published by the National, Heart, Lung and Blood Institute (NHLBI), it was reported about one in three Americans uses a wearable device, such as a smartwatch or band, to monitor their health or fitness.

Additionally, the introduction of advanced models with new features and reduced prices by market players has increased the customer pool for the devices.

- In October 2024, Noise launched the NoiseFit Diva 2 smartwatch, which focused on women’s wellness, featuring female cycle tracking, advanced cycle analysis, a detailed cycle calendar, and others.

The factors above present a huge growth opportunity for new entrants and established players to focus on this segment and launch new wearable devices to meet the growing demand.

Other Prominent Trends

Aging Population: An increasing elderly demographic is driving the need for devices addressing age-related health issues.

Personalized Medicine: Devices tailored to individual patient needs are gaining traction, improving treatment outcomes.

Download Free sample to learn more about this report.

Impact of COVID-19

The impact of the COVID-19 pandemic on the global market was negative due to the significant decrease in the number of elective surgical procedures and emergency room visits in hospitals. The overall demand for the devices decreased during the pandemic, resulting in a decline in revenues for these medical device companies.

- For instance, according to the article published by the National Center for Biotechnology Information (NCBI), it was reported that there was a 48.0% decrease in total surgical volume from January 2019 to January 2021 after elective surgical procedures were cancelled during COVID-19.

Supply chain disruptions of these devices and essential medical supplies were prominent in 2020, especially due to travel and trade restrictions in Europe, Asia Pacific countries, and later in the U.S. which also impacted the market globally.

Various reforms were implemented, including national lockdowns, travel restrictions, social distancing, and others, to stop the rapid spread of the COVID-19 pandemic globally. Medical procedures were classified as elective and essential procedures, and all elective procedures were banned, or healthcare facilities were directed to postpone elective procedures during Q1 and Q2 2020.

Trade Protectionism

The European Union has recently threatened to impose restrictions on Chinese medical device manufacturers, citing discriminatory practices that limit EU suppliers' access to China's public procurement tenders.

Segmentation Analysis

By Type

Increasing Number of Clinical Diagnostic Tests Led to Dominance of In-vitro Diagnostics (IVD) Segment

By type, the market is segmented into orthopedic devices, cardiovascular devices, diagnostic imaging devices, in-vitro diagnostics (IVD), minimally invasive surgery devices, wound management, diabetes care devices, ophthalmic devices, dental devices, nephrology devices, general surgery, and others.

The in-vitro diagnostics (IVD) segment dominated the medical devices market share by 13.53% in 2026 due to factors including the growing prevalence of infectious diseases among the population and the rising number of tests among the patient population, among others. This, along with rising research and development activities among the major players to develop and introduce innovative test kits and products to cater to the increasing demand among the population, is likely to support the segmental growth in the market.

- For instance, in November 2023, Newland EMEA introduced a novel in vitro diagnostics product line for the healthcare industry.

The diabetes care devices segment is expected to grow at a considerable CAGR during the forecast period. The rapid rise in the prevalence of diabetes, especially in European and Asian countries, is likely to increase the uptake of diabetes care devices, such as blood glucose monitors, insulin pens, and others, in these regions. This, coupled with rising disease awareness among the population, is estimated to boost the expansion of the diabetes care segment during the forecast period.

The rising number of general and minimally invasive surgeries in developed and emerging countries is a significant factor contributing to the growth of minimally invasive surgery and general surgery segments.

Dental and ophthalmic segments are anticipated to grow at a considerable rate during the forecast period. The increasing number of product approvals and launches by key players operating in the market in these segments favors growth globally.

- For instance, in February 2023, NIDEK CO., LTD., a Japanese company specializing in ophthalmic, optometric, and lens edging equipment, launched Cube α Ophthalmic Surgical System incorporating Gyro torsional technology in a compact body.

The nephrology segment is expected to grow at a considerable rate during the forecast period. The increasing number of patient pools suffering from various kidney disorders and the rising number of dialysis treatments among the patients is anticipated to fuel the growth of the segment.

To know how our report can help streamline your business, Speak to Analyst

By End-User

Increasing Number of Patient Visits to Hospitals & ASCs Supported Segment’s Dominance

Based on end-user, the market is segmented into hospitals & ASCs, clinics, and others.

The hospitals & ASCs segment dominated the global market in 2026. The dominance is due to the emergence of multispecialty and community hospitals in emerging countries which propelled the demand for high-end diagnostic instruments. Also, the cutting-edge medical advancements being used in ambulatory surgery centers that offer an alternative to hospitals for patients undergoing routine surgical procedures are projected to boost the growth of this segment during the forecast period. The hospitals & ASCs segment is set to capture 48.97% of the market share in 2026.

- For instance, as per the data provided by Becker's Healthcare in April 2024, there are a total of 6,087 Medicare-certified ASCs operating in all 50 states of the U.S. California has 848 surgery centers while Colorado has 141 ASCs.

On the other hand, clinics and others segments are expected to grow at a considerable CAGR during the forecast period. The increasing preference of the patients owing to the specialized care and efficient treatment options in the setting is a significant factor supporting the segment's growth. Clinics segment is likely to exhibit a CAGR of 6.5% during the forecast period.

Medical Devices Market Regional Outlook

According to region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Medical Devices Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America to Dominate Owing to Growing Number of Product Approvals

The market size in North America stood at USD 218.26 billion in 2025, and in 2026, the market value was USD 230.62 billion. The presence of adequate and favorable reimbursement policies, a well-developed healthcare infrastructure, rapid adoption of advanced medical technologies, and key players in the region are some of the major factors contributing to the dominance of the region. Additionally, significant penetration of high-end life science instruments in the U.S., strong presence of key companies, and favorable reimbursement policies in the region are some of the major factors anticipated to boost the growth of the medical device industry in North America by 2032.

U.S.

The strong and established presence of major players in the U.S. and favorable reimbursement policies by Medicare for these devices are anticipated to drive the market's growth. The U.S. market size is estimated to be USD 210.45 billion in 2026. Additionally, the rising emphasis of the U.S. government authorities on the approval of novel products for chronic disease indications such as diabetes, cardiovascular diseases, cancer, and others is propelling the adoption of advanced devices in the country.

- For instance, in January 2024, Boston Scientific Corporation announced that it had received the U.S. FDA approval for its FARAPULSE Pulsed Field Ablation (PFA) System. The increasing number of regulatory approvals has resulted in the launch of new products in the U.S. market.

Europe

Europe is expected to be the second-largest market value of USD 154.82 billion in 2026 and grow at the second-fastest CAGR of 25.9% during the forecast period owing to increasing healthcare expenditure, well-established infrastructure, and growing product approvals of advanced diagnostic and treatment devices. A strong focus toward a shift of medical care in home care settings and the introduction of portable medical equipment by leading global and domestic players, especially in Germany, France, and the U.K., is poised to drive market growth during the forecast period. The market value in U.K. is expected to be USD 20.04 billion in 2026.

On the other hand, Germany is projecting to hit USD 40.85 billion in 2026 and France is likely to hold USD 25.15 billion in 2025.

- For instance, in March 2024, Abbott received the CE mark approval for its Assert-IQ insertable cardiac monitor. This device can monitor abnormal heartbeats.

Asia Pacific

Asia Pacific is expected to be the third-largest market with a value of USD 153.58 billion in 2026 and to grow at the fastest CAGR due to the increasing prevalence of diseases such as cardiovascular disorders, infectious diseases, dental disorders, diabetes, and others, along with the growing focus of market players to expand its direct presence in emerging countries, including China, India and fulfill the demand for these devices in this region. Additionally, rapid urbanization, increasing healthcare spending, rising investment, and findings by associations and governments provide opportunities for emerging players and contribute to the growth of the market in the region. The market in China is expected to hit USD 47.42 billion in 2026, whereas India is likely to reach USD 17.86 billion and Japan is projected to hit USD 43.86 billion in 2026.

- In April 2023, Siemens Healthineers expanded its MRI scanner manufacturing facility in India by introducing a new production line.

Latin America

Latin America registered a substantial market share in 2025. The region is likely to hit USD 39.87 billion in 2026, as the fourth-largest market. The higher prevalence of non-communicable diseases (NCDs) such as diabetes mellitus, hypertension, and cancers among patients is resulting in growing demand for these products in the market. Additionally, increasing export of these devices is another factor driving the market's growth.

- For instance, as per the data provided by the Brazilian Association of the Health Technology Industry in September 2023, the export of these devices earned Brazil USD 909.0 million in 2022, which represented a 14.13% increase in international sales compared to 2021.

Middle East & Africa

Middle East & Africa is also expected to grow at a considerable rate during the forecast period. The GCC market size is expected to be USD 8.31 billion in 2025. Developing healthcare infrastructure coupled with higher demand for advanced devices among the patient population is offering a lucrative business opportunity for new entrants as well as established key players. Additionally, increasing government initiatives to raise awareness and growing acquisitions and mergers among the key players are expected to boost the adoption of these products and, subsequently, drive the growth of the market.

- For instance, in May 2021, Aster DM Healthcare signed a MoU with Roche Diagnostics, with an aim to enable countries such as UAE, Saudi Arabia, Oman, and Qatar to adopt the latest diagnostic innovations and solutions, thus enhancing patient care and quality.

Competitive Landscape

Key Market Players

Major Players Focus on R&D Activities to Meet Rising Product Demands

The global market is fragmented, with several players, such as Medtronic, Johnson & Johnson Services, Inc., GE Healthcare, and Stryker, accounting for a significant share in 2024. The rising R&D focus of these top players to develop and introduce technologically advanced devices to meet increasing product demands is a significant factor contributing to their market shares.

- In January 2024, Medtronic received the U.S. FDA approval for the Percept RC Deep Brain Stimulation (DBS) system. This system helped physicians to personalize treatment for patients with brain-related disorders.

Other major players operating in the market include Abbott, Koninklijke Philips N.V., Siemens Healthineers AG, BD, and Cardinal Health, among others. The robust efforts of these companies to expand their geographical footprint, along with a vast global distribution network, favor the growing market shares of these companies.

- In May 2023, Cardinal Health expanded its distribution footprint by opening a new distribution center in Canada with the aim of catering to the rising demand for medical and surgical products in the country.

List of Key Medical Device Companies Profiled

- Medtronic (Ireland)

- Johnson & Johnson Services, Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Boston Scientific Corporation (U.S.)

- Fresenius Medical Care AG (Germany)

- GE Healthcare (U.S.)

- Siemens Healthineers AG (Germany)

- Stryker (U.S.)

- Abbott (U.S.)

- BD (U.S.)

- Cardinal Health (U.S.)

Key Industry Developments

- February 2024 – Fresenius Medical Care AG received the U.S. FDA clearance for its 5008X Hemodialysis System.

- February 2024 – Boston Scientific Corporation received U.S. FDA approval for its WaveWriter spinal cord stimulator systems used in the treatment of chronic lower back and leg pain.

- January 2024 – GE Healthcare entered into an agreement to acquire MIM Software, one of the leading providers of medical imaging analysis and AI solutions. The company specializes in areas such as radiation oncology, molecular radiotherapy, diagnostic imaging, and urology in various healthcare settings.

- January 2024 – Boston Scientific Corporation announced the acquisition of Axonics, Inc. This acquisition expanded the company’s product portfolio, especially for urology devices.

- January 2024 – BD collaborated with Techcyte, a leading provider of artificial intelligence (AI)-based digital diagnostics, to offer an AI-based algorithm digital cervical cytology system for PAP testing.

REPORT COVERAGE

The global medical devices market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, products, and end-users. Besides this, it offers insights into the global market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Growth Rate |

CAGR of 6.90% from 2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 572.31 billion in 2025 and is projected to record a valuation of USD 1032.66 billion by 2034.

In 2025, the North American market size stood at USD 101.98 billion.

The market is projected to exhibit steady growth at a CAGR of 6.90% during the forecast period of 2026-2034.

The rising prevalence of chronic disorders and the shift toward homecare settings among the general population are the key drivers of the market.

Medtronic, Johnson & Johnson Services, Inc., Abbott, and Stryker are the markets top players.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us