Tuna Fish Market Size, Share & Industry Analysis, By Species (Skipjack, Albacore, Yellowfin, Bigeye, Bluefin, and Others), By Type (Canned, Fresh, and Frozen), and Regional Forecast, 2026-2034

Tuna Fish Market Size Overview 2026-2034

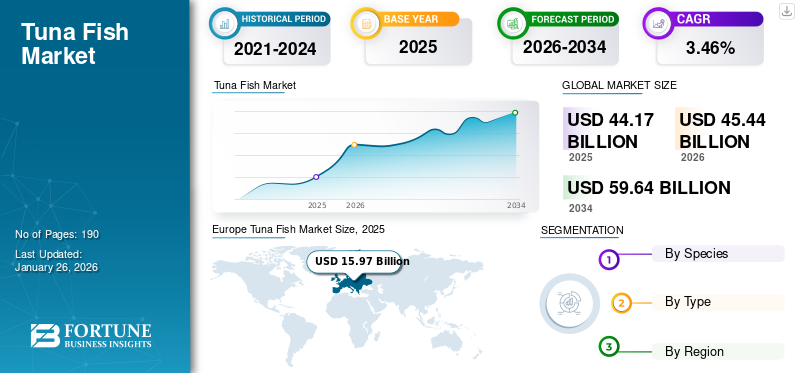

The global tuna fish market size was valued at USD 44.17 billion in 2025. The market is projected to grow from USD 45.44 billion in 2026 to USD 59.64 billion by 2034, exhibiting a CAGR of 3.46% during the forecast period. Europe dominated the tuna fish market with a market share of 36.17% in 2025.

Tuna is considered one of the crucial and commercially valuable fish and is an essential part of the marine ecosystem. Commercial tuna fishery forms a key part of the blue economy, and its six significant varieties are Southern Bluefin, Skipjack, Bigeye, Atlantic, Yellowfin, and Pacific. In recent years, the seafood market has observed new trends in terms of consumers’ consumption patterns. People across the globe are opting for healthy and convenient foods, which has significantly boosted the demand for protein-rich foods such as tuna, thus driving the tuna fish market. Bolton Group, Century Pacific Foods Inc., Thai Union Group Inc., and FCF Co. Ltd. are few of the key players in the market.

The COVID-19 pandemic had a major effect on the market value growth. Governments imposed various safety measures and restrictions during the outbreak, significantly impacting commercial fish landings due to reduced labor mobility, restaurant closures, and social distancing protocols. According to the Food and Agriculture Organization (FAO), the pandemic affected the demand for canned tuna as the restaurant trade declined by 80-90%.

Global Tuna Fish Market Key Takeaways:

Global Market Size

- 2025: USD 44.17 billion

- 2026: USD 45.44 billion

- 2034: USD 59.64 billion

- CAGR (2026–2034): 3.46%

Top Regional Markets

- Europe is the largest market at USD 15.97 billion, led by consumption in Mediterranean countries and seafood processing in 2025.

- Asia Pacific is expected to reach USD 14.49 billion, and is also the fastest-growing region with a CAGR of 3.58% in 2025.

- North America is projected at USD 10.37 billion, driven by demand for canned tuna and sustainability in 2025.

- South America is estimated to reach USD 2.35 billion, supported by growing exports and coastal consumption in 2025.

Key Country-Level Markets

- Japan will reach USD 10.16 billion in 2025.

- The U.S. will grow to USD 8.30 billion in 2025.

- France will reach USD 2.32 billion in 2025.

- The U.K. will record USD 1.81 billion in 2025.

- Germany is projected at USD 1.37 billion in 2025.

- China will reach USD 1.39 billion in 2025.

- India is expected to hit USD 0.31 billion in 2025.

- Saudi Arabia will stand at USD 0.32 billion in 2025.

By Species

- Skipjack tuna held 46% of the market due to its affordability and use in canned products in 2024.

By Type

- Canned tuna dominated with a 67% share, favored for its shelf life and convenience in 2025.

- Fresh tuna is growing at a CAGR of 3.43%, driven by sushi and gourmet demand in 2025.

Tuna Fish Market Trends

Proliferating Demand for Sustainably Sourced Fish to Augment Market Growth

Sustainable lifestyle is one of the key concerns among individuals globally. The increasing concern regarding health and environmental sustainability has pushed the demand for value-added and sustainably sourced seafood. Moreover, several fishery management organizations are focusing on creating a sustainable supply chain in the tuna fishing industry. For instance, in November 2022, the International Commission for the Conservation of Atlantic Tunas (ICCAT) adopted a modernized fishery management plan for Atlantic Bluefin tuna species.

The new plan was a result of extensive collaboration with scientists, stakeholders, and managers while ensuring long-term sustainability, reduction of post-harvesting loss, and achieving profitability. For instance, in October 2021, the World Wide Fund for Nature (WWF)-Philippines launched a new EU SWITCH-Asia-funded project to improve product quality, tackle post-harvesting loss of tuna, and achieve sustainability from fishing. Such governments and organizations' emphasis on improving fishing and achieving sustainability drives the global tuna fish market growth. Europe witnessed a growth from USD 15.24 Billion in 2023 to USD 15.60 Billion in 2024.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Longer Shelf-life and Affordability of Tuna Fish to Drive Demand for Canned Tuna

Canned tuna fish consumption across the world has increased exponentially in recent years. It is a highly sought-after protein source that is not just convenient to store but also does not need refrigeration. Moreover, it is an easy-to-ship product as it has no-to-low refrigeration costs. Moreover, a rise in the working population has augmented the demand for ready-to-eat, ready-to-cook, and processed foods. The incredibly high shelf-life of the product and the low price of canned tuna as compared to its other forms, such as frozen and fresh fish, makes it an ideal choice for consumers seeking affordable animal protein and convenient food.

Furthermore, key leaders in the market are introducing novel products to meet the consumers’ requirements. It is another positive factor to propel the market’s growth. For instance, in September 2021, Thai Union brand John West announced the launch of a new nutrient-rich canned tuna range in the U.K. grocery outlets. The product is available in three different flavors: Energy, Immunity, and Heart.

Augmented Use of Frozen Tuna in Foodservice Industry Triggers Consumption Rate of Product

The expanding food service industry and the need for frozen tuna represent growth opportunities for the tuna fish market due to its high utilization in culinary applications and convenience. The surge in popularity of Asian cuisines, which mainly feature frozen tuna in several dishes, such as sashimi, poke bowls, and sushi, is a considerable factor contributing to the acceptability of frozen tuna fish globally. Additionally, the rising popularity of Chinese and Japanese cuisines in Western countries also drives the demand for fresh forms of tuna fish. Expanding Asian food service chains in European and U.S. markets will significantly contribute to the global tuna fish market growth. For instance, in April 2023, Sushi Shop, one of the most famous food chains of European restaurants renowned for their Japanese specialties (sushi and sashimi), opened a new franchise in Clapham, a district in England. This outlet is counted as the first restaurant in Clapham that offers a spectrum of appealing, healthy & fresh food options that suit the consumer’s requirement for dinner, lunch, or snacks.

Market Restraints

Growing Consumer Inclination Toward Plant-based Protein May Restrict Market Growth

More individuals are adopting vegetarian and vegan eating trends due to environmental concerns and dairy allergies, which are negatively impacting the sales of seafood and meat in different regions. The rising popularity of plant-sourced food products among consumers has led to more artificial meat producers. Despite the rising seafood demand, plant-based alternatives are gaining traction as they minimize overfishing and help protect biodiversity. Furthermore, rapid innovation and technology lead to the uptake of plant-based foods to the next level. According to the Good Food Institute’s 2023 outlook on the plant-based foods industry, retail dollar sales of plant-based meat category products in the U.S. increased to USD 1.4 billion in 2022. Therefore, the increasing veganism trend is poised to hamper market growth in the forthcoming years.

Market Opportunities

Investment in Product & Technology Innovation to Change Industry Outlook

Product innovation is the tool to success in almost every industry, and the tuna market is no exception. In mature markets such as Europe and the U.S., the demand for innovative products such as flavored canned tuna, uniquely packaged frozen tuna, and others is rising at a significant pace. In fact, some of the key players have already started capitalizing on these opportunities to generate higher revenue. For instance, in February 2024, Tonnino, a gourmet brand of tuna in the U.S., introduced its new line of six yellowfin tuna canned products and in exotic flavors, which include chipotle sauce, spicy bell pepper, carrots & peas, and others. Moreover, all the products launched are kid-friendly and available at Walmart in the U.S.

Segmentation Analysis

By Species

Skipjack Segment to Hold Major Market Share due to its Easy Availability and Rich Nutritional Profile

Based on species, the market is segmented into albacore, skipjack, bigeye, yellowfin, bluefin, and others.

The skipjack segment is expected to account for the largest market share of 45.95% in 2026, owing to its easy availability in the market and high nutritional value. According to the statistics of the National Oceanic and Atmospheric Administration (NOAA), approximately 216 pounds of Atlantic skipjack tuna commercially landed in 2022. Furthermore, more than 70% of overall tuna catches in the Indian Ocean and the Western and Central Pacific regions are Skipjack tuna, as per the Asia Pacific – Fish Watch. Skipjack fish is predominantly consumed for commercial canning purposes. This species of tuna has a moderate level of cholesterol and is an excellent source of low-fat protein and sodium, which is further aiding the growth of the segment.

Skipjack tuna accounted for 46% of the global tuna market in 2024, due to its availability, lower cost, and widespread use in canned products.

Bluefin tuna is gaining popularity among consumers owing to its excellent texture and rich taste. This species is popularly consumed in sushi and sashimi. The sale of Bluefin tuna is expected to grow considerably in the forthcoming years due to its increasing utilization in several restaurants for preparing exotic dishes.

Bigeye species is one of the red meat species of tuna commonly preferred in sushi and sashimi. Sales of bigeye tuna are anticipated to increase with a promising growth rate with rising commercial landing, increasing product price, and growing product usage. According to the NOAA Fisheries statistics, the commercial landing value of Atlantic bigeye tuna increased from USD 61.29 million in 2020 to USD 84.12 million in 2022.

By Type

To know how our report can help streamline your business, Speak to Analyst

Canned Segment Dominates Due to Surge in Convenience Food Consumption

Based on type, the market is segmented into canned, fresh, and frozen.

The canned segment is the leading product type. It is predicted to maintain its dominance market share of 66.92% in 2026, owing to the rising awareness of its health benefits and convenience in usage. Furthermore, the adoption of Western food culture in Asian countries such as India, China, and Japan is further propelling the canned product demand. According to the statistics from Japan Customs, the import volume of processed and canned tuna increased from 65,000 tons in 2018 to 69,000 tons in 2022. In addition, the solidification of the food industry's supply chain and the growth of e-commerce channels have actively supported the growth of canned tuna demand. Moreover, online grocery shopping platforms have recently grown and have eased access to processed foods, contributing to the segment’s growth.

- Canned tuna dominates the market in 2025, holding a 67% share, owing to its long shelf life and convenience.

- Fresh tuna is projected to grow at a CAGR of 3.43% from 2025 to 2032, driven by rising consumption in sushi and gourmet cuisine.

The fresh segment is expected to witness substantial growth during the forecast period with rising consumer interest in Asian cuisines, including fresh tuna. The dynamic growth of sushi bars and restaurants in European countries also positively affected the demand for fresh tuna.

TUNA FISH MARKET REGIONAL OUTLOOK

Regionally, the market is segregated into the Asia Pacific, Europe, North America, the Middle East & Africa, and South America.

Europe

Europe Tuna Fish Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the market with a valuation of USD 15.97 billion in 2025 and USD 16.39 billion in 2026. Due to high per capita fish and seafood consumption and an established seafood industry across the region. According to the European Market Observatory for Fisheries and Aquaculture Products (EUMOFA), the household expenditure on fishery and aquaculture products in Europe grew to 11% in 2022 compared to 2021. Tuna is one of the five favorite consumed species in Europe, accounting for about 10% of total seafood consumption in 2022. The consumption increased by 1% in terms of volume and 29% in terms of value, as compared with 2021.

- U.K is expected to hit USD 1.86 billion by 2026 due to steady retail demand for ready-to-eat tuna.

- Germany will record USD 1.42 billion by 2026, supported by health trends and tuna use in salads.

- France will reach USD 2.32 billion by 2025 with growing demand for sustainable seafood and culinary use.

In addition, tuna import value from Ecuador increased by 24% in 2022. Furthermore, market players across the region are focusing on responding to the increased consumer demand for products with functional benefits by introducing new products to the retail shelves, which is anticipated to drive market growth in the upcoming years.

Europe was the largest regional market in 2023, valued at USD 15.26 billion, and rose to USD 15.57 billion in 2024, driven by strong consumption in Mediterranean countries and a well-established seafood processing industry.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

The Asia Pacific market for tuna fish is likely to hold the second-largest share during the forecast period. The Asian seafood and aquaculture production, as well as processing is growing at a crucial pace owing to the increase in demand for animal protein. In low-income developing nations, the demand for affordable animal protein is high, which presents an opportunity for tuna processors to tap into these economies.

- Japan is projected at USD 10.48 billion by 2026, led by high consumption of fresh and sashimi-grade tuna.

- China will grow to USD 1.45 billion by 2026, driven by urbanization and global food exposure.

- India will reach USD 0.33 billion by 2026 as awareness of protein-rich diets and exports increase.

Moreover, the aquaculture sector offers huge employment opportunities to the local people. Hence development of this sector by the government is slated to aid the market growth. Moreover, Japan is one of the leading markets for the product globally, and the demand for fresh and frozen tuna peaks for sashimi usage during winter months, for traditional celebrations. However, in China, during autumn festive holidays, there is an increased consumption of sashimi tuna.

Asia Pacific is projected to be the second-largest regional market in 2025, with a value of USD 14.49 billion, growing at the fastest CAGR of 3.58% during the forecast period.

North America

North America has been one of the major markets for seafood as consumers in the region are well aware of the importance of a healthy diet. Thus, they rely on various foods, including seafood. The demand for fresh seafood products is also rising across the region. The demand for Bluefin and Bigeye tuna remains strong from Japanese restaurants in the U.S.

North America is expected to be the third-largest market, reaching USD 10.37 billion in 2025, supported by demand for canned tuna and sustainable sourcing.

Moreover, the growing consumption of cultural foods, which leads to the wide intake of various Asian cuisines, such as sushi, tekkadon, and curries, further improved the fresh tuna fish market growth in the region. According to the Food and Agriculture Organization, the import of fresh Bluefin increased by nearly 13.4% to 1,090 tons, and fresh Bigeye increased by 7.8% to reach 950 tons during the first quarter of 2023. U.S. will reach USD 8.30 billion by 2025, driven by demand for canned tuna and omega-3-rich foods.

South America

South American seafood consumption patterns have evolved considerably over the past few years. The growing demand for tuna is primarily attributed to the emerging popularity of seafood as a good quality & healthy source of protein as compared to chicken, pork, and beef products. According to Trade Statistics from Vietnam Customs, Chile imported around 3 million worth of tuna items from Vietnam in the first two months of 2024, thus marking a 58% hike, in comparison to the same period in 2023. The augmented trend of natural nutrition and high-protein diet has significantly influenced the seafood industry in the region. Manufacturers and processors are concentrating on launching a variety of processed tuna products, such as canned tuna infused with olive or soybean oil, to cater to the modern consumer demand for healthy, protein-rich fish options.

South America ranks fourth, forecast to reach USD 2.35 billion in 2025, driven by export activity and coastal consumption.

Middle East & Africa

The Middle East & Africa is expected to be the fastest-growing region due to the growing popularity of premium products in the developing countries of the region. The rising demand for canned tuna products is primarily attributed to their diverse flavor and taste notes. It is gaining a mainstream position as a premium product in the retail market. Advancements in the region’s food supply chain network have also contributed to the boom in the canned tuna market.

Saudi Arabia will stand at USD 0.32 billion by 2025, fueled by canned imports and retail expansion.

COMPETITIVE LANDSCAPE

Key Industry Players

New Product Launches by Key Players to Aid Market Growth

The key players across the market are focused on introducing innovative and exotic seafood variations to meet the growing consumer demand. These companies are also responding to the increased consumer demand for products with functional benefits. For instance, in December 2023, Tonnino, one of the popular seafood brands, launched six new varieties of canned Yellowfin tuna, which include Premium Yellowfin Tuna chunks with sweet corn in water and Premium Yellowfin Tuna with carrots and peas in vegetable oil. These products are available at Walmart stores across the U.S.

LIST OF KEY TUNA FISH COMPANIES PROFILED

- Bolton Group (Italy)

- Century Pacific Foods Inc. (Philippines)

- The Jealsa Rianxeira S.A.U. Group (Spain)

- Grupo Albacore S.A. (Spain)

- ITOCHU Corporation (Japan)

- Thai Union Group Inc. (Thailand)

- Dongwon Enterprises Co. Ltd. (South Korea)

- IBL Ltd. (Mauritius)

- FCF Co. Ltd. (Taiwan)

- Sea Delight (U.S.)

KEY INDUSTRY DEVELOPMENTS

- December 2024 – Echebaster, a Spanish brand, introduced its two new frozen tuna products, mini burgers and nuggets, via its brand Alakrana, which is available in Spain.

- December 2024 – Simak, a brand owned by Fisheries Development Oman, released the launch of its line of commercial canned tuna items across the domestic market.

- June 2024 – Thai Union Public Limited Company, a Thailand-based firm, introduced a new packaging named “Ecotwist” for its tuna products in the U.K. The newly launched sustainable packed canned tuna are available at all Asda stores across the country.

- July 2023 – Big Fish Maldives Pvt Ltd., an emerging Asian seafood manufacturer, launched ultra-low temperature, negative 60 degrees Celsius tuna product processing technology at its new factory in Himmafushi. The company also invested USD 5 million to equip and increase its production capacity. The factory has a tuna fish production capacity of 6,000 metric tons annually.

- May 2023 – Sealect brand, a global fishery company Thai Union Group’s brand, introduced canned tuna steak in Himalayan pink brine to serve health-conscious consumers across Thailand.

REPORT COVERAGE

The research report provides qualitative and quantitative insights into the market. It also offers a detailed analysis of its types, applications, market size, and growth rate for all segments in the market. Along with this, the report offers an elaborative analysis of the market dynamics and competitive landscape. Various key insights presented in the report are an overview of related markets, research methodology, recent industry developments, such as mergers & acquisitions, the regulatory scenario in critical countries, and key industry trends.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Thousand Tons) |

|

Growth Rate |

CAGR of 3.46% from 2026 to 2034 |

|

Segmentation |

By Species

By Type

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the market value was at USD 44.17 billion in 2025.

The market will grow at a CAGR of 3.46% during the forecast period of 2026-2034.

Based on species, the skipjack segment is expected to lead during the forecast period.

The rising consumption of animal protein is driving the market growth.

Bolton Group, Century Pacific Foods Inc., Thai Union Group Inc., and FCF Co. Ltd. are a few of the key players in the market.

Europe dominated the tuna fish market with a market share of 36.17% in 2025.

Based on type, the canned segment is expected to dominate during the forecast period.

The proliferating demand for clean-label and eco-friendly seafood products is one of the leading market trends.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us