Lignin Market Size, Share & Industry Analysis, By Type (Lignosulfonates, Kraft Lignin, Soda Lignin, and Others), By End Use (Construction & Infrastructure, Animal Feed, Oil & Gas, Wood Products & Panels, Agriculture, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

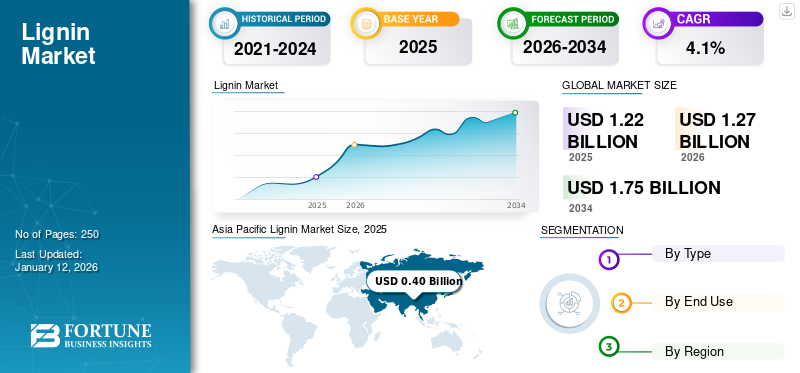

The global lignin market size was valued at USD 1.22 billion in 2025 and is projected to grow from USD 1.27 billion in 2026 to USD 1.75 billion by 2034, exhibiting a CAGR of 4.1% during the forecast period. Asia Pacific dominated the global market with a share of 33% in 2025.

Lignin is a large, aromatic biopolymer recovered mainly from kraft, sulfite, and soda pulping. It is engineered into dispersants (lignosulfonates) and technical intermediates. These products serve as binders, plasticizers, and partial phenol/formaldehyde substitutes across concrete admixtures, animal feed pellets, agrochemical formulations, wood panels/resins, and oil-field fluids. Sustainability mandates, carbon-intensity targets, and OEM decarbonization of materials are accelerating the product’s adoption as a bio-based, lower-cost aromatic alternative. Therefore, ongoing formulation advances and growing demand for carbon-rich precursors are expected to stimulate market growth throughout the forecast period.

The market encompasses several major players, with Lenzing, Nippon Paper Industries Co., Ltd., Sappi Ltd, and Stora Enso at the forefront. Their broad portfolio, innovative product launches, and strong geographic expansion have supported their dominance in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Growing Demand from Construction and Infrastructure to Fuel Market Growth

The global lignin market is growing due to increasing demand from the construction and infrastructure sectors, where it is utilized as a concrete additive and biopolymer. This growth is driven by government support promoting green building initiatives. The product’s role as a sustainable alternative to synthetic materials and its ability to improve the properties of materials such as concrete make the construction and infrastructure industries key consumers in the market, fueling the global lignin market growth during the forecast period.

- Europe's green building initiatives are driven by ambitious targets, including the EU's goal for climate-neutral buildings by 2050 and the "Renovation Wave" initiative, which aims to double the annual rate of building renovations by 2030.

MARKET RESTRAINTS

High Dependency on Pulp & Paper Industry Output and Economic Competitiveness May Restraint Market Growth

Economic factors related to feedstock availability and competitiveness may restrain the growth of the global market. Its supply is highly dependent on the output of the pulp and paper industry and the operational configurations of biorefineries, which determine both the quantity and quality of recoverable lignin. Any fluctuation in pulp production or limited adoption of advanced lignocellulosic biorefineries can constrain consistent feedstock flow, creating supply uncertainty.

Furthermore, while lignin-derived specialty products such as resins, carbon fibers, and dispersants offer sustainability advantages, their production costs remain significantly higher than those of petroleum-based alternatives. Limited economies of scale, process complexity, and inadequate policy incentives reduce their commercial competitiveness. As a result, despite its renewable nature and potential value addition, its commercialization is hindered by economic and infrastructural barriers that slow its broader adoption across industrial applications.

MARKET OPPORTUNITIES

Functionalized & Higher-Purity Product to Create Lucrative Opportunities in the Market

Functionalized and higher-purity product grade creates lucrative market opportunities by transforming this abundant, typically low-value biopolymer into a high-performance, sustainable material. This shift is enabled by advanced extraction and modification technologies that overcome its natural heterogeneity and recalcitrance, unlocking its potential in diverse applications. Advanced extraction and purification methods are changing the product’s conventional consumption, which was mainly burned for energy. Improving extraction and fractionation enables the production of consistent, high-quality products, which in turn reduces processing costs and increases commercial viability, creating new opportunities for high-purity lignin products.

Furthermore, investment in lignin-based carbon fiber (LCF) and other high-value materials presents strategic opportunities to achieve higher profit margins and enter new markets. Historically treated as a low-value byproduct of the pulp and paper industry, it is now gaining traction as a renewable and abundant resource poised to support more profitable applications.

LIGNIN MARKET TRENDS

Rising Interest in Valorization of Lignin as a Renewable-Based Compound to Propel Market Growth

A key trend shaping the global lignin market is the rising interest in its valorization as a renewable, bio-based compound. Industries and research institutions are increasingly exploring products’ potential as a sustainable feedstock for high-value applications such as carbon fibers, bioplastics, adhesives, and specialty chemicals. This shift aligns with the global movement toward circular bioeconomy models and the reduction of reliance on fossil-based inputs. Advances in biorefinery technologies and fractionation processes are enabling the extraction of more uniform and functional grades suitable for downstream conversion. As these innovations continue to mature, lignin valorization is expected to transform it from a low-value byproduct into a strategic renewable raw material, opening new avenues driving market growth.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Lignosulfonates Segment Led the Market due to its Wetting Characteristics

On the basis of type, the market is classified into lignosulfonates, kraft lignin, soda lignin, and others.

The Lignosulfonates segment dominated the global lignin market share 59.06% in 2026. It is available in several commercial types, each differing in the extraction process and properties. Lignosulfonates, derived from the sulfite pulping process, are water-soluble and widely used as dispersants and plasticizers in concrete, animal feed, and agrochemicals due to their excellent binding and wetting characteristics.

Kraft lignin, obtained from the kraft pulping process, is less soluble but offers higher purity and reactivity, making it suitable for high-value applications such as adhesives, carbon fibers, and battery anodes.

Soda lignin, produced through soda pulping of non-wood materials, is sulfur-free and finds growing demand in environmentally friendly resins and coatings.

The “others” segment includes organosolv and hydrolysis lignins, which are typically purer and less degraded, supporting their use in biochemicals, composites, and specialty polymers.

By End Use

Construction & Infrastructure to Maintain Dominance Due to High Demand in Cementitious Systems

Based on end use, the market is segmented into construction & infrastructure, animal feed, oil & gas, wood products & panels, agriculture, and others.

To know how our report can help streamline your business, Speak to Analyst

The construction & infrastructure segment is projected to dominate the market Share 51.18% in 2024. It is widely used as a water-reducing plasticizer and dispersant in cementitious systems. It improves slump retention, reduces water demand, and helps achieve target strength at lower cement content, supporting cost and CO₂ savings. In ready-mix and precast concrete, it stabilizes particle dispersion to cut bleeding and segregation, while aiding pumpability in high-flow mixes, making this segment a prominent consumer in the global market.

In the animal feed, it functions mainly as pellet binders and flow improvers. Lignosulfonates enhance pellet durability index (PDI), reducing fines, improving feed conversion, and lowering energy use during pelleting. Additionally, they help homogenize micro-ingredient distribution in premixes. Demand for the product in animal feed is mainly driven by regions emphasizing cost efficiency and pellet quality.

The wood products & panels are another significant consumer in the global market, where modified kraft and organosolv types are utilized for co-polymerization or as phenol extenders. Advances in lignin depolymerization and activation improve reactivity, press times, and bond strength. In fiberboard and particleboard, it functions as an internal binder, sizing agent, or additive to enhance water resistance and dimensional stability, driving the segment’s growth moderately.

Lignin Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Lignin Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region held the dominant share in 2026, valued at USD 0.42 billion, and is expected to maintain its lead during the forecast period. The region is the fastest-growing market, propelled by urbanization, massive concrete demand, intensive agriculture, and rising compound feed output. China’s advancements in sodium-ion and lithium-ion initiatives are spurring demand for lignin-derived hard carbon, while Southeast Asia and India are driving growth in dispersants for fertilizers, crop protection, and construction applications. The region’s growth is further reinforced by increasing investments in cost-effective manufacturing processes and the ready availability of raw materials.The Japan market is projected to reach USD 0.04 billion by 2026, the China market is projected to reach USD 0.22 billion by 2026, and the India market is projected to reach USD 0.09 billion by 2026.

China's extensive infrastructure and building boom have made it a massive consumer of lignin-based products, particularly lignosulfonates. These are used as concrete admixtures to improve concrete's strength, durability, and workability while also controlling dust emissions. Though growth in this sector is expected to moderate, the sheer scale of China's construction activities will naturally drive demand in the foreseeable period.

To know how our report can help streamline your business, Speak to Analyst

Europe leads the market in terms of value, supported by integrated pulp mills and specialty producers, underpinned by stringent carbon policies, circular-economy targets, and green public procurement. Construction chemicals, agro-formulations, and animal feed remain core driving factors in the region. In addition, chrome restrictions in drilling and disclosure on embodied carbon will fuel the product adoption. Nordic Kraft capacity, process upgrades, and consistent quality control contribute to premium pricing and export strength competitiveness across Europe.

Europe is followed by North America in terms of value and secures the position of the third-largest region in the market. Demand is anchored by applications in construction admixtures, oil & gas drilling/cementing additives, dust suppression, and wood panels. Growth is further driven by the U.S. infrastructure push, ESG-led substitution of fossil-based dispersants, and a mature pulp industry enabling kraft lignin extraction.The UK market is projected to reach USD 0.04 billion by 2026, while the Germany market is projected to reach USD 0.09 billion by 2026.

The Latin America and Middle East & Africa regions would witness a moderate growth over the forecast period. Latin America’s pulp and sugar/ethanol industries enable the production of soda and kraft lignin supply from bagasse and wood, improving logistics and cost efficiency.

In the Middle East & Africa, demand is concentrated in concrete admixtures for large infrastructure, oil & gas drilling/cementing, dust control, and water treatment. Ongoing giant infrastructure projects in the GCC are set to further drive regional growth in the coming years.

COMPETITIVE LANDSCAPE

Key Industry Players

Scaling Production and Expansion Initiatives are Essential Aspects for the Growth of Companies Operating in the Market

The competitive landscape of the global lignin market is increasingly shaped by a few major players that are investing in technology, sustainability, and new application development. Leading companies such as Borregaard ASA, Stora Enso Oyj, Domtar Corporation, UPM Biochemicals, and Ingevity Corporation dominate the market. Key strategies adopted by these companies include scaling up product extraction and purification processes, expanding into higher‐value applications, and strengthening sustainability credentials. However, barriers such as cost competitiveness against petroleum‐based alternatives and feedstock variability remain a hurdle for new entrants.

LIST OF KEY LIGNIN COMPANIES PROFILED

- Boreal Bioproducts (Finland)

- Borregaard AS (Norway)

- Domsjö Fabriker (Sweden)

- Green Arochem (China)

- Lenzing (Austria)

- Lignin Industries AB (Sweden)

- Nippon Paper Industries Co., Ltd. (Japan)

- Sappi Ltd (South Africa)

- Stora Enso (Finland)

- UPM Biochemicals (Germany)

KEY INDUSTRY DEVELOPMENTS

- May 2023: Borregaard invested around USD 10 million to fund a green technology platform and to establish a 1,000-ton/year demonstration plant at the Sarpsborg plant site. The investment would enable next-generation lignin biopolymers and product granulation for home care, water treatment, and agriculture, broadening the application scope.

- March 2024: Swedish bioplastics startup Lignin Industries, based in Knivista, announced that it has raised over USD 2.2 million through a share issuance. The company plans to use these funds to strengthen its market position, expand its team, and increase its manufacturing capacity.

- June 2024: Stora Enso and Altris have formed a partnership to adapt Lignode®, a hard carbon derived from lignin, as anode material for sodium-ion batteries. This collaboration aims to advance a European bio-based battery value chain, accelerating the transition from pilot projects to industrial scaling, and diversifying the sustainable anode supply for future electrification markets.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.1% from 2026-2034 |

|

Unit |

Value (USD Billion), Volume (Kiloton) |

|

Segmentation |

By Type, End Use, and Region |

|

By Type |

· Lignosulfonates · Kraft Lignin · Soda Lignin · Others |

|

By End Use |

· Construction & Infrastructure · Animal Feed · Oil & Gas · Wood Products & Panels · Agriculture · Others |

|

By Geography |

· North America (By Type, End Use, and Country) o U.S. o Canada · Europe (By Type, End Use, and Country/Sub-region) o Germany o France o U.K. o Italy o Spain o Rest of Europe · Asia Pacific (By Type, End Use, and Country/Sub-region) o China o India o Japan o South Korea o Rest of Asia Pacific · Latin America (By Type, End Use, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Type, End Use, and Country/Sub-region) o GCC o South Africa o Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 1.22 billion in 2025 and is projected to reach USD 1.75 billion by 2034.

In 2025, the market value stood at USD 0.40 billion.

The market is expected to exhibit a CAGR of 4.1% during the forecast period (2025-2034).

The lignosulfonates segment led the market by type in 2025.

The key factors driving the market are the rising demand for lignosulfonates and kraft lignin in construction and concrete admixtures.

Lenzing, Nippon Paper Industries Co., Ltd., Sappi Ltd, and Stora Enso are some of the prominent players in the market.

Asia Pacific dominated the market in 2025.

Increased focus on high-purity and functionalized grades of lignin will favor the product adoption.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us