MiFi Market Size, Share & Industry Analysis, By Type (High Density Wi-Fi, Enterprise-Class Wi-Fi, Consumer Grade MiFi, and Others), By Enterprise Type (SoHo, Small and Medium-sized Enterprises(SMEs), and Large Enterprises), By Cellular Technology (4G/LTE (Wi-Fi 5) and 5G (Wi-Fi 6/Wi-Fi 6E)), By Application (IT & Telecom, Hospitality, Healthcare, Military & Defense, Financial Services, Retail, Government & Public Sector, Transportation, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

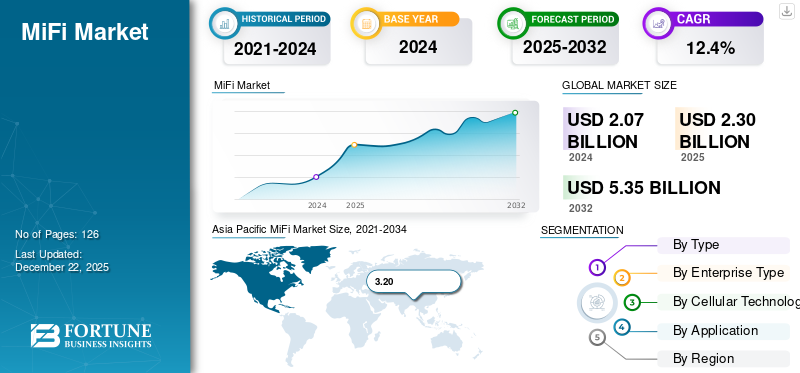

The global MiFi market size was valued at USD 2.30 billion in 2025. The market is projected to grow from USD 2.57 billion in 2026 to USD 6.54 billion by 2034, exhibiting a CAGR of 12.4% during the forecast period.

The adoption of MiFi devices has surged in recent years, as these portable devices are highly beneficial for travelers, multiple device owners, and heavy internet users who need a reliable connection on the go. MiFi devices provide easy internet access through cellular networks, allowing users to connect several devices without the need for traditional wired connections. The performance of MiFi devices has improved significantly with the advent of 4G LTE and 5G technology. Furthermore, the adoption of 5G networks is also driving market growth.

Download Free sample to learn more about this report.

As per 5G Americas, global 5G connections are growing from 1.9 billion (2023) to 8 billion (2028), driving demand for Mi-Fi devices worldwide. This expansion of 5G makes Mi-Fi solutions valuable for travelers, remote workers and areas with limited broadband access. Emerging markets will witness rising demand for affordable 5G Mi-Fi options, while developed regions require high-speed portable connectivity.

Market players, including Inseego, Huawei, NETGEAR, ZTE Corporation, and others, are focusing on acquiring technology firms and hardware manufacturers to accelerate product development cycles, optimize supply chains, and improve the performance and connectivity of their devices.

IMPACT OF RECIPROCAL TARIFF

Reciprocal tariffs are significantly impacting the MiFi market, as it relies heavily on an international supply chain for hardware components, including antennas, batteries, chipsets, displays, and printed circuit boards. Tariffs can disrupt the supply chain, leading to higher manufacturing costs, and this can force companies to relocate their sources to non-tariff countries or promote domestic manufacturing of MiFi devices. Brands may reevaluate their market entry or expansion plans based on tariff regimes. Due to tariffs, MiFi providers may witness a drop in demand as it is a budget friendly device for students, users in rural areas, and small businesses.

MiFi Market Trends

Increasing Awareness of Online Security and Privacy to Aid Market Growth

Awareness of online security and privacy among businesses, consumers, and others is increasing as cyber threats are becoming more prevalent. Users are concerned about the risks associated with public Wi-Fi networks, including identity theft, malware attacks, and data interception. As per the Norton report, in 2023, around 53% of global internet users expressed concerns related to public Wi-Fi. It also stated that 1 in 3 users reported data breach while connected to unsecured connections. Due to this, awareness about online security is increasing among users and are shifting toward personal, encrypted internet connections.

MiFi devices create private, password protected mobile hotspots, ensuring that users have secure access to the internet wherever they go. MiFi device adoption is increasing among healthcare workers, journalists and corporate employees, as they handle sensitive information and need a secure channel to transmit information.

Thus, increasing awareness of online security and privacy is driving MiFi market growth.

MARKET DYNAMICS

Market Drivers

Recovery of Travel and Tourism to Boost Market Growth

The resurgence of global travel and tourism is fueling the demand for MiFi devices. International tourism is reaching near pre-pandemic levels, as around 1.1 billion tourists travelled internationally in the first 9 months of 2024, representing 98% of recovery compared to 2019.

Travelers need seamless connectivity to navigate, communicate, and access digital services, which surges the adoption of MiFi. It is a cost effective alternative to expensive international roaming, and provides secure and high speed internet access that can connect multiple devices simultaneously.

Moreover, technological advancements in MiFi devices, including 5G compatibility, enhanced battery life, and improved security features, are making them more attractive for travelers who seek reliable and secure internet connections.

Therefore, the recovery of travel & tourism is boosting the MiFi market share.

Market Restraints

Competition from Alternative Technologies to Hamper Market Growth

MiFi devices face strong competition from multiple alternative connectivity solutions, which pose a significant restraint on market growth. Most notably, smartphones as tethering allows users to share their phone’s internet connection via a hotspot, eliminating the need for a separate MiFi device. Since smartphones are ubiquitous and multifunctional, many users prefer this convenient and cost-effective option, especially for casual or short-term use. Thus, high implementation and maintenance costs hampers the market growth.

Market Opportunities

Expansion of Internet Access in Developing Regions is Expected to Create Opportunities

In many countries across Southeast Asia, Africa, and Latin America, the rollout of fiber-optic or cable internet is slow due to high deployment costs, difficult terrain, and low population in rural areas. However, mobile coverage, including 3G and 4G, is expanding much faster, offering a viable alternative for internet connectivity. According to GSMA, in 2024, around 55% of the population in Sub-Saharan Africa had access to mobile internet, and this figure is expected to grow to over 65% by 2030.

MiFi devices are well-positioned to capitalize on this trend, offering portable, cost effective, and flexible internet access to communities where fixed broadband is expensive or unavailable. These devices are deployed in healthcare centers, community hubs, schools, and other places to enable internet access in underserved areas.

Therefore, the expansion of internet access in developing regions provides a lucrative opportunity for the players in the market.

SEGMENTATION ANALYSIS

By Type

Enterprise-Class WiFi to Dominate Owing to Its Adoption for Monitoring Network

Based on type, the market is segmented into high density Wi-Fi, enterprise-class Wi-Fi, consumer grade MiFi, and others.

Among these, enterprise-class Wi-Fi dominated the market share in 2026 by 43.58%. These devices offer centralized management, usage monitoring, device-level analytics, and automatic firmware updates. These features allow IT departments to control, monitor, and secure networks remotely, which is essential for large-scale business operations.

High density Wi-Fi is estimated to grow with the highest CAGR during the forecast period. High-density MiFi devices are deployed for temporary, high-user-demand zones, offering fast deployment, portability, and cost-efficiency compared to fixed setups.

By Enterprise Type

Rapid Adoption of MiFi by Large Enterprises to Offer Portable Internet Access Boosted Segment Growth

Based on enterprise type, the market is trifurcated into SoHo, small and medium-sized enterprises, and large enterprises.

Large enterprises captured a leading market share in 2024. Employees in large enterprises travel across countries and regions for various purposes. During traveling MiFi devices offer portable, low-cost internet access, avoiding expensive roaming or unreliable hotel Wi-Fi. According to Cisco’s Internet Report, enterprise mobile data usage is growing faster than consumer usage globally, driving demand for robust portable networking solutions such as MiFi devices. The Large enterprises segment is likely to hold a 41.63% of the market share in 2026.

SMEs are expected to showcase the highest CAGR of 15.02% during the projected period. According to IDC, 60% of SMEs in emerging markets adopted mobile internet solutions in 2023 to reduce network infrastructure costs and enhance operational flexibility.

By Cellular Technology

4G/LTE (Wi-Fi 5) to Dominate the Market Owing to Reliability and Accessibility of 4G

Based on cellular technology, the market is bifurcated into 4G/LTE (Wi-Fi 5) and 5G (Wi-Fi 6/Wi-Fi 6E).

4G/LTE (Wi-Fi 5) dominated the market in 2024. According to GSMA, 4G/LTE networks are already established globally, covering over 90% of the world’s population. This makes 4G the most reliable and universally accessible mobile broadband standard for MiFi connectivity. According to OpenSignal (2024), the average global 4G LTE speed is ~35 Mbps, and WiFi 5 can comfortably handle that without bottlenecks. Therefore, the demand for 4G/LTE (Wi-Fi 5) is increasing. 4G/LTE (Wi-Fi 5) is expected to dominate the market share in 2026 by 56.43%.

5G (Wi-Fi 6/Wi-Fi 6E) is expected to witness the highest CAGR of 15.87% during the forecast period. According to GSMA (2024), 5G connections will surpass 2 billion globally by 2025, and is driving the demand for 5G-capable MiFi.

By Application

Healthcare to Lead Market Owing to Rising Adoption of MiFi for Providing Employees Consistent Internet Access

The market is segmented by application into IT & telecom, hospitality, healthcare, military & defense, financial services, retail, government & public sector, transportation, and others.

Healthcare dominated the market in 2024 and is expected to showcase the highest CAGR during the forecast period. Mobile health units, vaccination vans, emergency teams, and community health workers operate in remote or temporary locations, and need a stable internet connection, so the adoption of MiFi devices is increasing. MiFi provides portable, high-speed internet for patient registration, insurance verification, and teleconsultation support. Healthcare is anticipated to dominate the market share in 2025 by 20.17%.

IT & telecom is estimated to grow significantly in coming years. Telecom companies often deploy MiFi-based failover systems to maintain VoIP, cloud platforms, and ticketing systems. Both industries have remote workers, freelance developers, and global project teams. MiFi enables secure, portable, and consistent internet access for professionals working from homes, client sites, or co-working spaces. According to industry experts, over 30% of IT and telecom workers globally engage in hybrid or remote work, making mobile connectivity essential. Therefore, the demand for MiFi devices is increasing in the sector.

The transport segment is expected to grow significantly with a CAGR of 15.46% during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

MIFI MARKET REGIONAL OUTLOOK

The market is geographically studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

Asia Pacific

Asia Pacific MiFi Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific region is expected to register highest the CAGR during the forecast period and is witnessing a significant surge in the demand for MiFi devices, propelled by several factors, including increasing adoption of 5G, rising mobile and internet penetration, and others. Mobile internet user penetration in this region reached 51% in 2023 and is projected to grow 61% by 2030, particularly in underserved countries, as telecom operators offer promotional/discounted plans to drive subscriber growth. The region held the dominant market value of USD 1.05 billion in 2026, and in 2025, the regional value was USD 0.93 billion.

Asia Pacific MiFi Market Size, 2021-2034 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

China dominates the market, as China is home to some of the largest manufacturers of MiFi devices, such as ZTE, Huawei, TP-Link, and others. Leading Chinese companies such as Huawei and ZTE are at the forefront of 4G and 5G technology. They produce high-performance MiFi devices, including 5G-enabled models, which offer faster speeds and better connectivity. The price sensitivity in emerging countries makes Chinese MiFi devices highly attractive. The combination of low-cost manufacturing and robust product offerings allow Chinese companies to offer competitive pricing.

North America

The investments in 5G infrastructure across North America, particularly in the U.S. is a major factor driving market growth. Major telecom operators are expanding 5G networks to fulfill the increasing demand for high speed internet connectivity, which in turn boosts the demand for 5G-compatible MiFi devices. The regional value in 2026 was USD 0.58 billion and in 2025, the market value held at USD 0.53 billion.

The U.S. captured the largest market share in 2024, and was among the first countries to roll out widespread 4G LTE and now 5G networks, providing the foundation for reliable, high-speed mobile internet. This infrastructure maturity drives the demand for MiFi devices. The U.S. market size is expected to be USD 0.43 billion in 2026.

Europe

Europe is expected to be termed as the third-largest regional market with USD 0.48 billion in 2026. The market is witnessing growth in the region due to several factors. Average mobile data consumption in Europe is projected to grow from approximately 15 GB/month in 2022 to 75 to 80 GB/month by 2030, representing an annual growth rate of 25%. As of 2022, over 80% of Europe’s population accessed the internet via mobile devices, with countries such as Denmark, Norway, and the U.K. exceeding 90% penetration rates. The U.K. market size is estimated to be USD 0.09 billion in 2026 , along with Germany likely to reach USD 0.07 billion in 2026 and French market is projected to hit USD 0.10 billion in 2025.

Middle East & Africa

The adoption of MiFi devices is increasing across the Middle East & Africa due to the increasing number of mobile subscriptions, increasing internet penetration, and other factors. The total number of mobile subscriptions in the MEA region is projected to rise by 30%, from 1.764 billion in 2023 to 2.293 billion by 2029. This region is the fourth-largest region and is expected to hit USD 0.28 billion in 2026. The GCC countries are expected to hit USD 0.12 billion in 2025.

South America

The demand for MiFi devices is experiencing significant growth in South America, driven by various factors, including technological advancements, infrastructural developments, and changing consumer behaviors. The rollout of 5G infrastructure is a major factor driving the market growth in the region.

Competitive Landscape

Key Industry Players

Market Players Opt for Merger & Acquisition Strategies to Expand Their Presence

Key players in the market are entering into strategic partnerships and acquisitions with other players. Mergers and Acquisitions (M&A) have become a strategic pathway for leading players in the Mi-Fi device market to enhance their technological capabilities, expand market reach, and strengthen competitive positioning. These transactions enable companies to acquire proprietary technologies, integrate complementary product lines, and unlock synergies that drive operational efficiency and innovation. By acquiring network technology firms, software integrators, and hardware manufacturers, Mi-Fi providers can accelerate product development cycles, optimize supply chains, and enhance the performance and connectivity of their devices. These

List of Key MiFi Companies Profiled:

- Huawei Technologies Co, Ltd. (China)

- NETGEAR (U.S.)

- D-Link Corporation (Taiwan)

- Inseego (U.S.)

- ZTE Corporation (China)

- Simo Holdings,Inc. (U.S.)

- TP-Link System, Inc. (U.S.)

- Orange (France)

- uCloudLink Group Inc. (Hong Kong)

- ASUSTeK Computer, Inc. (Taiwan)

- Zyxel (Taiwan)

- Jio (India)

- Vodafone Idea Limited (India)

…and more

KEY INDUSTRY DEVELOPMENTS:

- March 2025 – Globacom Nigeria has launched a 200% value-back offer on MiFi devices, available at Gloworld and authorized outlets nationwide. New customers registering with a Glo SIM receive 30GB of data valid for 30 days plus a 2.5GB monthly bonus for 12 months with a data plan purchase.

- January 2025 – Baseus introduced the EnerGeek MiFi Power Bank, a 20,000mAh device that functions as both a portable charger and a built-in 4G mobile hotspot. It supports up to 10 devices and offers speeds of up to 50Mbps. This costs USD 89.99 and was released in April 2025. This power bank provides versatile charging options and internet connectivity without any monthly fees.

- November 2024 – Telecel Ghana launched a limited-time promotion offering its 4G MiFi device at a discounted price, along with a free 10GB data bundle. This promotion aims to improve affordable, high-speed internet access across Ghana, supporting activities such as remote work, streaming, and browsing.

- September 2024 – Neoway introduced the P816 5G MiFi device, providing fast and reliable mobile internet with download speeds up to 1.96 Gbps. It also supports up to 20 devices, has a 5000mAh battery that doubles as a power bank, and offers broad 5G coverage with dual-mode SA/NSA.

- July 2024 – Vodafone Qatar and ZTE launched the ZTE MU5120, a compact 5G hotspot device featuring dual-band Wi-Fi 6 that can connect up to 64 users with speeds up to 3.6Gbps. It includes a 2.4-inch touchscreen, a 10,000mAh battery lasting up to 16 hours, and supports power bank functionality.

REPORT COVERAGE

The market research report provides a detailed analysis and focuses on key points, such as leading companies, offerings, and applications. Besides this, it offers an understanding of the latest market trends and highlights key industry developments. In addition to the above-mentioned factors, it contains several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.4% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

Type, Enterprise Type, Cellular Technology, Application, and Region |

|

Segmentation |

By Type

By Enterprise Type

By Cellular Technology

By Application

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

The market is projected to record a valuation of USD 6.54 billion by 2034.

In 2026, the market was valued at USD 2.57 billion.

The market is projected to grow at a CAGR of 12.4% during the forecast period of 2026-2034.

The high density Wi-Fi is expected to lead the market in terms of share.

Recovery of travel & tourism boosts the market growth.

Huawei, Inseego, NETGEAR, D-Link Corporation, ZTE Corporation are the top players in the market.

Asia Pacific is expected to hold the highest market share.

By application, the healthcare sector is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us