Neopentyl Glycol Market Size, Share & Industry Analysis, By Grade (Flakes, Molten, and Slurry), By Application (Lubricants, Plasticizers, Coatings & Resins, and Others), By End-use Industry (Automotive, Construction, Electronics, Pharmaceutical, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

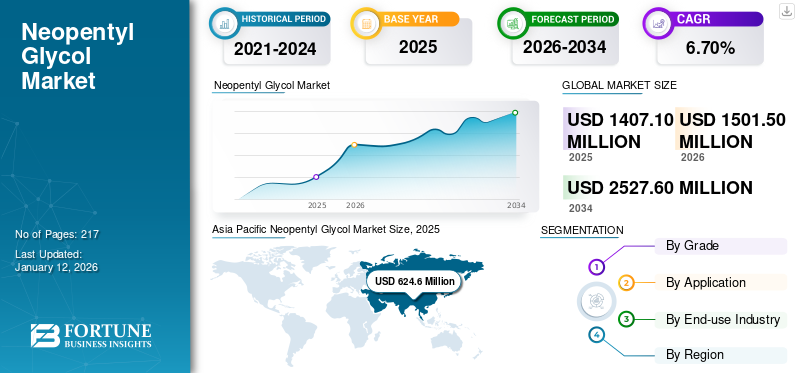

The global neopentyl glycol market size was valued at USD 1407.1 million in 2025. The market is projected to grow from USD 1501.5 million in 2026 to USD 2527.6 million by 2034 at a CAGR of 6.70% during the forecast period. Asia Pacific dominated the neopentyl glycol market with a market share of 44.00% in 2025.

Neopentyl Glycol (NPG) is a versatile chemical compound used in various industries. It’s primarily employed in the production of polyester resins, coatings, and lubricants. The growing demand for NPG is driven by its increasing use in automotive coatings, powder coatings, and construction materials. Its excellent durability, weather resistance, and eco-friendly properties contribute to its rising popularity in these applications. Major players in the market are LG Chem, Perstorp Holding AB, BASF, MITSUBISHI GAS CHEMICAL COMPANY, INC., and Eastman Chemical Company.

Global Neopentyl Glycol Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 1407.1 million

- 2026 Market Size: USD 1501.5 million

- 2034 Forecast Market Size: USD 2527.6 million

- CAGR: 6.70% from 2026–2034

Market Share:

- Asia Pacific dominated the neopentyl glycol market with a 44.00% share in 2025, driven by rapid industrialization, infrastructure expansion, and rising consumption in automotive, electronics, and construction sectors across China, India, and Southeast Asia.

- By grade, the Flakes segment held the largest share in 2024 due to ease of handling and storage. However, Molten NPG is gaining momentum in large-scale applications due to cost-effectiveness.

- By application, Coatings & Resins dominated due to their widespread use across automotive, construction, and industrial applications.

Key Country Highlights:

- China: Leads in both production and consumption of NPG. Demand is supported by expansion in automotive manufacturing, electronics, and construction industries, especially under the influence of rapid urbanization and industrial development.

- United States: High demand in the coatings and lubricants sectors, especially for automotive and industrial use. Growth is supported by initiatives promoting sustainability and adoption of bio-based NPG alternatives.

- Germany (Europe): Strong demand for powder and water-based coatings in the automotive and construction sectors. Stringent environmental regulations and innovation in polyester polyols drive growth.

- Japan: Presence of key market player (Mitsubishi Gas Chemical) and increasing demand for high-performance materials in automotive and electronics sectors contribute to market expansion.

NEOPENTYL GLYCOL MARKET TRENDS

Catalyst & Process Breakthroughs and Digital Manufacturing Integration to Transform NPG Market

The NPG industry is witnessing advancements in catalyst technology and production processes. Manufacturers are developing novel metal-organic catalysts that significantly improve reaction selectivity while operating at lower temperatures, reducing energy consumption. Simultaneously, continuous flow manufacturing systems are replacing traditional batch processes, enabling reaction control and consistent product quality.

Leading NPG producers are embracing Industry 4.0 principles by implementing advanced analytics, process optimization, and real-time monitoring systems. These digital technologies enable predictive maintenance, automated quality control, and dynamic production adjustments that maximize yield while maintaining strict quality parameters.

MARKET DYNAMICS

MARKET DRIVERS

Automotive Industry’s Evolution Propels Market Growth

The automotive industry plays a significant role in driving the neopentyl glycol market growth, primarily through its extensive use in automotive coatings and lubricants. NPG-based products are valued in this sector for their durability, resistance to weathering, and superior performance characteristics.

NPG is an important component in automobile coatings, helping to provide high-quality, long-lasting finishes that protect vehicles against corrosion, UV radiation, and normal wear and tear. As consumer demand for automobiles with improved looks and longer-lasting exteriors rises, so does demand for innovative coating solutions that use NPG. This tendency is especially noticeable in the premium and high-end automobile markets, where quality finishes are key selling features.

Furthermore, the shift to Electric Vehicles (EVs) is opening up new potential for NPG in the automotive sector. EVs require specialized lubricants and thermal management solutions, which NPG-based products excel at due to their stability and performance at different temperatures. The expansion of the EV sector is projected to increase demand for NPG.

The growing emphasis on sustainability in the automotive industry also favors NPG use. Many NPG-based coatings and lubricants offered improved environmental profiles compared to traditional alternatives, aligning with the industry’s push toward more eco-friendly practices and products.

Download Free sample to learn more about this report.

MARKET RESTRAINTS

Raw Material Volatility and Emerging Alternatives Hinder NPG Market Expansion

Fluctuating raw material prices significantly affect the market. NPG production relies heavily on petrochemical feedstock, particularly isobutyraldehyde and formaldehyde. The volatility in crude oil prices directly affects the cost of these raw materials, leading to unpredictable production costs for NPG manufacturers. This instability can erode profit margins and make long-term planning challenging, potentially deterring investment in the sector.

Competition from alternative materials also poses a challenge to NPG market growth. As technology advances, new materials with properties similar to or superior to NPG-based products are being developed. For instance, in the coating industry, alternative polyols and bio-based materials are gaining traction. These substitutes can offer comparable performance at potentially lower costs or with enhanced environmental benefits, hampering NPG’s market share in certain applications.

MARKET OPPORTUNITIES

Surging Eco-Consciousness Fuels Demand for NPG-Based Sustainable Solutions

The growing demand for eco-friendly products is creating significant opportunities for the NPG market, driven by increasing environmental awareness and stricter regulations across industries.

NPG-based materials often offer improved environmental profiles compared to traditional alternatives. In the coatings industry, for instance, NPG is used to create powder coatings and water-based counterparts. This is consistent with global efforts to minimize air pollution and enhance indoor air quality, resulting in a significant market for NPG in both industrial and consumer applications.

In the plastics industry, NPG is used to make polyester more durable and weather-resistant. These traits help to make long-lasting products, reducing the need for frequent replacements and ultimately reducing waste. As consumers and organizations value sustainable and long-lasting materials, the demand for NPG-based plastics is expanding.

Furthermore, NPG’s role in producing bio-based and biodegradable polymers positions it favorably in the expanding market for sustainable packaging solutions. As governments worldwide implement stricter regulations on single-use plastics, manufacturers are turning to NPG-based alternatives, further driving the market growth.

MARKET CHALLENGES

Energy Volatility Reshapes Neopentyl Glycol Production Economics

The market faces significant challenges from price volatility, primarily driven by fluctuating petrochemical feedstock costs. Manufacturers remain heavily dependent on petroleum-based raw materials, making NPG production sensitive to energy market dynamics.

High transformation costs for converting NPG into molten or slurry forms create additional economic pressure for specialized industrial applications. These conversion processes require substantial energy input, sophisticated equipment, and precise temperature control, further complicating manufacturing and impacting overall market competitiveness and pricing strategies.

IMPACT OF COVID-19

The COVID-19 pandemic initially disrupted the NPG market due to supply chain interruptions and reduced demand from end-use industries such as automotive and construction. However, the market showed resilience and recovery, driven by increased demand for hygiene products and packaging materials. The shift toward sustainable and eco-friendly products has also boosted NPG usage in paints and coatings. As global economies rebound, the market is expected to regain momentum, with growth in the construction and automotive sectors fueling demand.

SEGMENTATION ANALYSIS

By Grade

Flake Segment Dominated Market Owing to Ease of Handling and Storage

Based on grade, the market is classified into flakes, molten, and slurry.

The flakes segment held the highest share of the global market, accounting for 72.81% in 2026 and is estimated to record a significant growth rate during the forecast period. This dominance is attributed to the ease of handling and storage that flakes offer, making them preferred in many industrial applications. The flakes segment is characterized by steady growth, driven by consistent demand across various industries.

The molten grade of NPG is experiencing rapid growth, outpacing the growth rate of flakes. This surge is primarily due to its cost-effectiveness in large-scale operations. As industries seek to optimize their processes and reduce costs, molten NPG is becoming increasingly attractive. This segment is expected to continue its fast growth trajectory, potentially challenging the market share of flakes in the long run.

By Application

Coatings & Resins Dominated Market Owing to Widespread Use of NPG-based Products in Various Industries

Based on application, the market is classified into lubricants, plasticizers, coatings & resins, and others.

The coatings & resins segment held the highest share of the global market in 2024. This prominence stems from the widespread use of NPG-based products in various industries, where they offer superior durability, weather resistance, and performance characteristics. The growth in this segment is consistent, supported by ongoing demand in the construction, automotive, and industrial sectors. Innovations in eco-friendly and high-performance coatings are likely to further drive growth in this sector. The coatings & resins segment is projected to dominate the market with a share of 54.51% in 2026.

The lubricant sector, while second in size, is experiencing rapid growth. This expansion is fueled by increasing demand in both the automotive and industrial sectors. NPG-based lubricants offer superior performance characteristics, including improved stability and efficiency. The growth in this segment is expected to continue at a pace driven by technological advancements in machinery and automotive industries that require high-performance lubricants.

By End-use Industry

To know how our report can help streamline your business, Speak to Analyst

Automotive Dominated Market Due to Improved Vehicle Aesthetics, Longevity, and Performance

In terms of end-use industry, the market is segmented into automotive, construction, electronics, pharmaceutical, and others.

The automotive segment held the largest neopentyl glycol market share in 2024. The segment sees rapid growth, propelled by increasing global vehicle production and the demand for high-performance, durable coatings. The use of NPG in this sector contributed to improved vehicle aesthetics, longevity, and performance. As the automotive industry continues to evolve, particularly with the shift toward electric vehicles, the demand for specialized NPG-based products is likely to increase. The automotive segment will account for 35.80% market share in 2026.

The construction segment is predicted to witness notable growth in the coming years. This sector shows strong growth potential, especially in developing regions experiencing construction booms. NPG-based products are valued in construction for their durability, weather resistance, and performance in harsh environments. The growth in this segment is expected to be robust, driven by urbanization trends, infrastructure development, and the increasing focus on sustainable building materials.

NEOPENTYL GLYCOL MARKET REGIONAL OUTLOOK

By region, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Neopentyl Glycol Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific occupies the dominant share of the global market and might emerge as the fastest-growing region. China is the largest producer and consumer, with several domestic companies playing crucial roles. The region’s rapid industrialization, particularly in India and Southeast Asian countries, is driving NPG demand in various end-use industries. There is increasing consumption in the electronics sector, especially for circuit board coatings. The automotive industry’s growth is also boosting demand for NPG-based coatings and lubricants. The region is seeing increased use of NPG in synthetic lubricants for industrial machinery. Market growth is further supported by the expansion of the construction industry and increasing urbanization. The Japan market is forecast to reach USD 71.5 billion by 2026, the China market is set to reach USD 356.2 billion by 2026, and the India market is likely to reach USD 154.3 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

The North America NPG market is characterized by high demand in the coatings and resins sector, particularly for automotive and industrial applications. The region’s focus on high-performance, low-VOC coatings has boosted NPG consumption. The U.S. leads in NPG production and consumption, with several major chemical companies having a significant presence. Growing interest in bio-based NPG alternatives and sustainability will contribute to the growing U.S. market size. The U.S. market is estimated to reach USD 245.7 billion by 2026.

Europe

Europe’s NPG market is shaped by stringent regulations favoring environmentally friendly products. This has led to increased adoption of NPG in water-based coatings and powder coatings. Countries such as Germany and Italy are key markets, with strong demand from the automotive and construction sectors. The region is witnessing innovation in NPG-based polyester polyols for polyurethane applications. The market is also witnessing growing demand for NPG in the production of plasticizers, especially as alternatives. The region’s emphasis on energy-efficient buildings is driving the use of NPG in insulation materials. The UK market is expected to reach USD 61.5 billion by 2026, while the Germany market is anticipated to reach USD 105.5 billion by 2026.

Latin America

In Latin America, the market is primarily driven by the automotive and construction industries. Brazil and Mexico are the key markets, with growing demand for NPG in automotive coatings and refinishes. There’s also growing demand in the furniture industry for NPG-based wood coatings. The market is benefitting from the expansion of multinational coating manufacturers in the region, which are introducing advanced NPG-based formulations. However, the market faces challenges due to economic instabilities and fluctuating raw material prices.

Middle East & Africa

The Middle East & Africa, particularly GCC countries, leads the market in this region due to its strong petrochemical industry. The region’s hot climate drives demand for heat-resistance and durable coatings, boosting NPG consumption. Increasing construction activities drive the growing use of NPG in powder coatings for architectural applications. The region is seeing increased demand for NPG in the production of unsaturated polyester resins used in the growing composite industry.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Business Expansion and Increasing Production Capacities is Strategic Initiative Implemented by Key Companies

The market is experiencing growth driven by industrial applications in polyester resins, coatings, and automotive sectors. Market dynamics are shaped by emerging economies, technological innovations, and a focus on sustainable chemical solutions. The market is witnessing strategic consolidation, with manufacturers focusing on expanding production capacities, improving efficiency, and developing specialized product formulations to maintain competitive advantage.

Major players in the market are LG Chem, Perstorp Holding AB, BASF, MITSUBISHI GAS CHEMICAL COMPANY, INC., and Eastman Chemical Company.

LIST OF KEY NEOPENTYL GLYCOL COMPANIES PROFILED

- LG Chem (South Korea)

- Perstorp Holding AB (Sweden)

- BASF (Germany)

- OQ Chemical GmbH (Germany)

- MITSUBISHI GAS CHEMICAL COMPANY, INC. (Japan)

- Eastman Chemical Company (U.S.)

- Zibo Ruibao Chemical Co., LTD. (China)

- Ataman Chemicals (Istanbul)

- The Chemical Company (U.S.)

- DHALOP CHEMICALS (India)

KEY INDUSTRY DEVELOPMENTS

- July 2023: Zhejiang Guanghua Technology Co., Ltd. and BASF entered a letter of intent to provide Neopentyl glycol from the Zhanjiang Verbund site to KHUA. This collaboration will help BASF cater to the increasing demand for low-emission powder coatings in the Asia Pacific region and China.

- October 2022: BASF invested in a new Neopentyl glycol in China with a production capacity of 80,000 metric tons. The new plant will boost BASF’s Neopentyl glycol capacity to 335,000 metric tons annually. The new plant will mainly cater to the growing demand for powder coatings in China.

- September 2022: BASF introduced Neopentyl glycol with a cradle-to-gate product carbon footprint (PCF) of zero. The product named NPG ZeroPCF is produced from renewable raw materials through BASF’s biomass balance approach.

- September 2022: OQ Chemicals launched Neopentyl Glycol Diheptanoate for the personal care and cosmetics industry. The new product will be utilized in skin care, color cosmetics, sun care, hair care, and antiperspirant formulations. With the introduction of Neopentyl Glycol Diheptanoate, OQ Chemicals addresses the cosmetic industry’s demand for silicone-free solutions.

- September 2020: BASF-YPC Co., Ltd, a joint venture between SINOPEC and BASF, expanded the Neopentyl Glycol production capacity to 40,000 metric tons in China. The expansion reinforces the growing demand for environmentally friendly powder coatings and focuses on localized production.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies, grades, compositions used to produce these products, and end-use industries of the product. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Million) and Volume (Kiloton) |

|

Growth Rate |

CAGR of 6.70% from 2026 to 2034 |

|

Segmentation |

By Grade

|

|

By Application

|

|

|

By End-use Industry

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 1407.1 million in 2025 and is projected to record a valuation of USD 2527.6 million by 2034.

Recording a CAGR of 6.70%, the market will exhibit steady growth during the forecast period of 2026-2034.

In 2025, the Asia Pacific market value stood at USD 624.6 million.

The automotive end-use industry led the market in 2025.

The automotive industrys evolution propels the growth of the market.

China held the highest market share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us