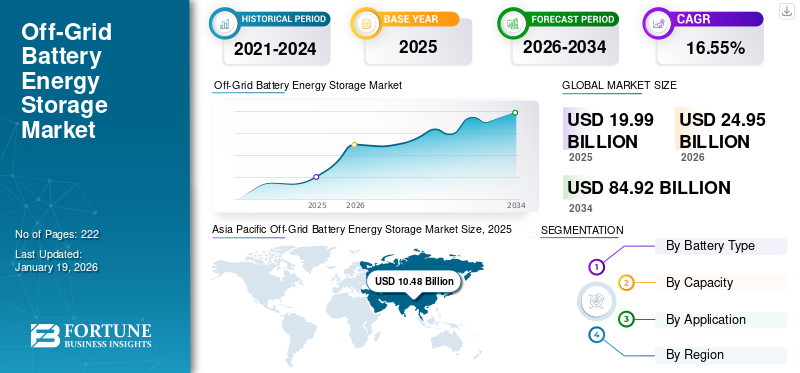

Off-Grid Battery Energy Storage Market Size, Share & Industry Analysis, By Battery Type (Lithium-ion Batteries, Lead-acid Batteries, Flow Batteries, and Others), By Capacity (Small Scale, Medium Scale, and Large Scale), By Application (Residential, Commercial, and Industrial) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global off-grid battery energy storage market size was valued at USD 19.99 billion in 2025 and is projected to grow from USD 24.95 billion in 2026 and is expected to reach USD 84.92 billion by 2034, exhibiting a CAGR of 16.55% during the forecast period. Asia Pacific dominated the global market with a share of 52.43% in 2025.

The off-grid battery energy storage system market is witnessing significant growth due to rising demand for reliable, clean, and independent power solutions, especially in remote, rural, and under-electrified regions. Off-grid battery energy storage is growing as it provides a reliable and independent energy source where grid connectivity is unavailable or unstable.

Remote areas and isolated regions often lack access to centralized power grids due to geographical, infrastructural, or economic challenges. In such areas, off-grid battery energy storage systems are being deployed to provide reliable, clean, and independent electricity. These systems store energy generated from renewable sources such as solar and wind for use during periods of low or no generation.

EnerSys, SAFT, and LG Energy Solution are the major vendors in the global market. They offer a wide range of industrial batteries, including sealed lead acid, lithium-ion, and nickel-based chemistries tailored for off-grid and backup power use in telecom, defense, and remote infrastructure. LG Energy Solution provides advanced lithium-ion and LFP battery modules designed for residential, commercial, and industrial-scale energy storage systems.

MARKET DYNAMICS

MARKET DRIVERS

Growth of Telecom and Remote Infrastructure to Drive Market Progress

The rapid expansion of telecommunication networks and remote infrastructure projects is a significant driver of the off-grid battery energy storage market. As telecom operators extend services into rural and isolated regions, especially in Asia, Africa, and Latin America, there is a growing need for reliable and continuous power in locations where grid connectivity is limited or non-existent.

In May 2025, Sonnen, a leading energy storage and VPP provider, announced a collaboration with Abundance Energy and Energywell Technology Licensing to establish a battery-enabled virtual power plant (VPP) in Texas, U.S. A Texas-based utility called Abundance Energy is located in Lubbock. Energywell Technology Licensing is an energy technology firm situated in Green Farms, Connecticut. By utilizing SonnenConnect house battery systems, Abundance Energy customers can assist in maintaining grid stability and reducing their energy expenditures.

MARKET RESTRAINTS

High Initial Investment to Hinder Market Growth

Off-grid battery energy storage systems require significant upfront investment in components such as lithium-ion batteries, inverters, controllers, and solar PV panels. This high capital cost poses a major barrier for low-income households, rural communities, and small enterprises, especially in developing regions where affordability is a key concern. As a result, many potential users either delay adoption or continue to rely on cheaper but more polluting alternatives such as diesel generators. Although the product offers significant long-term benefits in terms of operational savings and environmental sustainability, the lack of financing, subsidies, or leasing models limits near-term adoption.

MARKET OPPORTUNITIES

Government Investment in Grid & Storage to Create Opportunity for Market Players

Millions of people in rural and remote regions, especially in Africa, South Asia, and Island nations, still live without access to electricity. Extending the main grid to these areas is often economically or technically unfeasible due to challenging terrain, low population density, and high infrastructure costs.

In June 2025, the Indian government authorized viable gap financing of USD 616.24 million for 30 GWh of battery storage to facilitate the integration of renewable energy sources. Additionally, it announced intentions to increase land compensation under Right of Way regulations and construct 1100 kV UHVAC transmission lines. These programs aim to enhance grid infrastructure, entice investment, and guarantee the availability of clean energy around the clock throughout the country.

OFF-GRID BATTERY ENERGY STORAGE MARKET TRENDS

Increased Adoption of Solar and Battery Kits to Support Market Growth

Solar and battery kits offer a self-contained, independent energy system that does not require connection to the main power grid. These kits are ideal for remote homes, farms, small shops, and schools where grid access is unavailable or unreliable. Modern solar battery kits are increasingly affordable due to falling solar panel and lithium battery prices. Designed as plug-and-play solutions with simple setup, they are ideal for rural households or small business owners who may lack technical expertise.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Battery Type

Lithium-ion Batteries Lead due to their Compact Designs

By battery type, the market is divided into lithium-ion batteries, lead acid batteries, flow batteries, and others. Lithium-ion batteries are the dominating segment in the market due to their higher energy storage capacity per unit weight and size compared to traditional lead-acid batteries. This makes them ideal for compact, space-constrained off-grid systems such as rural homes, telecom towers, and mobile units. Lithium-ion batteries have a lower fire risk, which is crucial in remote areas with limited fire response capabilities. The lithium ion battery also provides higher energy density, longer lifespan, deep discharge capability, higher efficiency, and compact design compared to lead-acid batteries.

Lead acid batteries are the second-leading segment in the market. Lead acid batteries are significantly cheaper upfront than lithium-ion batteries, making them an attractive choice for low-income households, government-funded rural electrification programs, and NGO backed off-grid installations.

By Capacity

Deployment of off-grid Battery Systems in Remote Mining Sites Boots Large Scale Segment Growth

By capacity, the market is segmented into small scale, medium scale, and large scale. Large scale dominates the market, with off-grid battery systems increasingly deployed to power remote mining sites, oil and gas facilities, construction camps, and agricultural operations. Telecom towers, railway signaling stations, and military outposts in rural or hostile environments need uninterrupted, scalable power, further driving growth in this segment.

Small-scale is growing at the fastest rate in the market as small-scale off-grid systems provide affordable, clean, and decentralized energy solutions for basic household and community needs. Even in urban slums or informal settlements, small-scale battery storage is used for backup power due to frequent blackouts or lack of access to the legal grid.

By Application

Cost Saving and Energy Independence Boosts Residential Segment Growth

By application, the market is segmented into residential, commercial, and industrial. The residential segment captures the key off-grid battery energy storage market share. Homeowners are increasingly installing solar photovoltaic systems to reduce electricity bills and become energy independent. Off-grid battery energy storage solutions allow them to store excess solar power generated during the day for use at night or during power outages.

Commercial is growing at a considerable rate in the market due to the need for reliable power supply, cost savings, sustainability goals, and operational continuity in businesses and institutions.

OFF-GRID BATTERY ENERGY STORAGE MARKET REGIONAL OUTLOOK

The market has been analyzed geographically in North America, Europe, Asia Pacific, and the rest of the world.

Asia Pacific

Asia Pacific Off-Grid Battery Energy Storage Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 10.48 billion in 2025 and USD 12.98 billion in 2026. Asia Pacific is the dominating region in the market. Many countries in the region, especially India, Indonesia, Myanmar, the Philippines, and parts of Southeast Asia and the Pacific islands, still have millions of people without access to the main grid. Off-grid battery systems provide a reliable and clean power solution for these regions. High solar irradiation throughout the year, especially in countries such as India, Australia, Thailand, and Vietnam, further supports the off-grid battery energy storage market growth.

North America

A large part of Canada, Alaska, and the Western U.S. consists of isolated communities or critical infrastructure located far from the main grid. Off-grid battery systems are used to power cabins, farms, ranches, telecommunications towers, and mining operations. Wildfires, hurricanes, and storms are disrupting grid infrastructure more frequently in North America. Households and businesses in vulnerable areas use off-grid battery energy storage for emergency backup and energy resilience.

U.S.

States such as California, Texas, and Florida have experienced increased grid failures due to wildfires, storms, and extreme temperatures. Off-grid battery storage systems provide energy independence and backup power, especially during blackouts and natural disasters. A large number of homeowners are installing solar panels with battery storage, e.g., Tesla Powerwall, to achieve off-grid capability or maintain backup power. Growing use of renewable energy sources such as solar and wind is further driving the adoption of off-grid battery energy storage in the U.S.

Europe

Europe's off-grid battery storage market is growing due to a convergence of clean energy goals, rural electrification needs, sustainability mandates, and advancements in energy storage technologies. The EU Green Deal and various national energy transition plans aim to cut emissions and increase the share of renewable energy. Off-grid battery storage systems support solar and wind integration in remote or standalone applications, reducing fossil fuel dependency.

Rest of the World

The Latin America off-grid battery energy storage market is expanding, driven by rural electrification, renewable energy integration, and the need for energy resilience in remote and underserved regions. Countries such as Brazil, Peru, Colombia, Bolivia, and Guatemala have vast rural and mountainous areas with limited or no grid access. Off-grid battery storage is crucial for electrifying homes, schools, clinics, and farms in these isolated communities.

In Sub-Saharan Africa, over 500 million people still lack reliable electricity access, especially in rural areas. Battery storage systems paired with solar or wind energy are essential to deliver clean and reliable off-grid electricity to homes, schools, and clinics. The MEA region benefits from strong solar resources and good wind potential in parts of Morocco, Egypt, Kenya, and South Africa.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Companies Focus on Investments to Help Businesses Optimize Energy Consumption

Leading players are increasingly investing in the development of highly technically advanced products, which is accelerating the overall growth of the market. Innovations such as high-capacity batteries, long lifecycle products, and smart energy management technologies are making off-grid applications possible in remote sites, industrial facilities, and solar and wind power facilities, and therefore are encouraging market penetration.

- In February 2025, Enersys, a U.S. manufacturer and distributor of batteries, created a battery energy storage system and charger designed to help businesses optimize energy consumption and reduce operational expenses.

The firm highlights that its novel offerings enable more efficient use of energy generated from renewable sources, such as wind and solar power. Features such as Peak shaving, storing low-cost energy for usage during peak rate times, enhance operational performance for end-users.

List of Off-grid Battery Energy Storage Key Companies Profiled

- EnerSys (U.S.)

- SAFT (France)

- LG Energy Solution (South Korea)

- Samsung SDI (South Korea)

- BYD ESS (China)

- Sonnen (Germany)

- Tesla Energy (U.S.)

- Aquion Energy (U.S.)

- Exide Industries (India)

- Su-Kam Power Systems (India)

- Loom Solar (India)

- SunGarner Energies (India)

- Okaya Power Group (India)

- CATL (China)

- Schneider Electric (France)

KEY INDUSTRY DEVELOPMENTS

- In February 2025, Exide Technologies unveiled a new energy storage device for transportation called the Solution Powerbooster Mobile. The system is available with a storage capacity of 200 kWh or 400 kWh. The first setup makes use of two 100 Ah lithium iron phosphate (LFP) batteries, while the second uses four.

- In December 2024, Sonnen residential solar battery virtual power plant (VPP) was deployed to provide grid primary control (PC) power to a third German power transmission system operator (TSO). Transnet BW prequalified the aggregated system of home batteries created by Sonnen and following approvals for that TSO Tennet in 2018 and Amprion in 2021.

- In October 2024, Schneider Electric, the industry leader in the digital revolution of energy management and automation, launched Schneider OffGrid. This entirely new portable power station offers long-lasting battery life and flexible power outputs.

- In September 2024, Samsung SDI announced its participation in the biggest renewable energy trade fair in North America, Renewable Energy Plus 2024, to promote its most recent battery solutions for energy storage systems (ESS).

- In April 2024, CATL, a lithium-ion battery maker, announced that its newest grid-scale BESS product, which has 6.25MWh per 20-foot container and no degradation over the first five years, has been released. With claims of industry-leading technical features, the company, headquartered in China, unveiled the "Tener" battery energy storage system (BESS) solution.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product types, and competitive landscape. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 16.55% from 2026 to 2034 |

|

Unit |

Value (USD Billion) and Volume (MW) |

|

Segmentation |

By Battery Type

|

|

By Capacity

|

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 19.99 billion in 2025.

In 2025, the Asia Pacific market value stood at USD 10.48 billion.

The market is expected to exhibit a CAGR of 16.55% during the forecast period (2026-2034).

By battery type, the lithium-ion segment leads the market.

Growth of telecom and remote infrastructure is the key factor driving market growth.

Some of the top major players in the market are EnerSys, Su-Kam Power Systems, Okaya Power Group, and Others.

Asia Pacific dominates the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us