Programmable Logic Controller (PLC) Market Size, Share & Industry Analysis, By Type (Modular, Rack Mounted, and Compact), By Component (Hardware {CPU, Memory Module, Power Supply Unit, Communication Module, and Others (Input/Output Module, HMI)}, Software, and Services), By End-use Industry (Automotive, Food & Beverages, Energy & Utilities, Pharmaceuticals, and Others {Water and Wastewater Treatment}), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

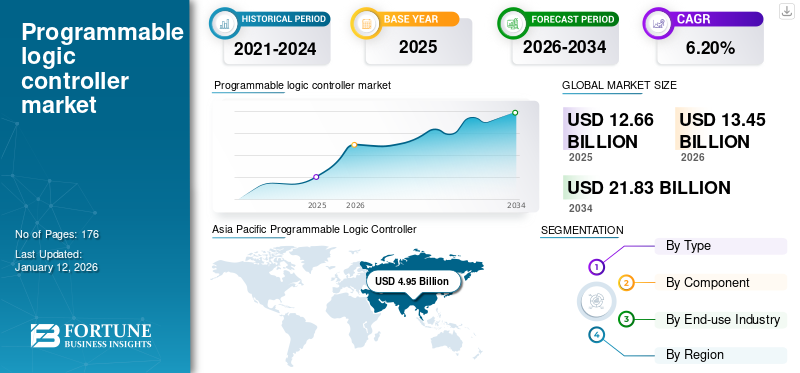

The global Programmable Logic Controller (PLC) market size was valued at USD 12.66 billion in 2025. The market is projected to grow from USD 13.45 billion in 2026 to USD 21.83 billion by 2034, exhibiting a CAGR of 6.20% during the forecast period. Asia Pacific dominated the Programmable Logic Controller (PLC) market with a share of 39.10% in 2025.

Programmable Logic Controller (PLC) is known as an industrial computer control system. PLCs play a crucial role in monitoring the state of input devices constantly. They support making decisions based on a custom programs to manage the state of output devices. PLCs have become indispensable devices for automating manufacturing methods. These systems are used in several sectors, for instance automobile, energy, steel, and chemical industries.

The market is estimated to grow considerably attributed to rising demand for automation across a variety of sectors. The rising significance of energy conservation and sustainability among end-users and rapid advancements in PLC technology are fostering market expansion.

Few major players in the market are Mitsubishi Electric Corporation, Schneider Electric SE, Siemens AG, Rockwell Automation, Inc., Honeywell International Inc., Emerson Electric Co., ABB Ltd., and others.

MARKET DYNAMICS

Market Drivers

Shifting Towards Industry 4.0 and Smart Manufacturing Propel the Market Expansion

One of the key attributes for the global Programmable Logic Controller (PLC) market growth is raising transformation of industry 4.0 and smart manufacturing by firms. The PLCs are surfacing into intelligent controllers by supporting predictive maintenance and allowing remote monitoring. The change towards industry 4.0 emphasizes on necessities for intelligent automation and data exchange in manufacturing settings. The smart manufacturing transformation is implementing PLCs integration that facilitates seamless communication between machines and systems. According to the U.S. Department of Energy, in the U.S., the manufacturing sectors alone invest USD 182 billion on automation and control systems in 2022.

Market Restraints

High Initial Investment & Integration Costs Hinders the Market Growth

The market is facing hurdles due to the requirement for high initial investment required for the systems installation. Various organizations are struggling to integrate the existing system with the new system, posing barriers for small scale firms. These organizations face difficulty in allocating funds for sophisticated automation systems. Thus, several SMEs often hesitate to adopt PLCs due to high costs with respect to the low-cost microcontrollers and relays are hampering market growth.

Market Opportunities

Expansion of EV and Battery Gigafactories Offers Great Growth Opportunities

Rising expansion of electric vehicles and escalating requirement of battery gigafactories are presenting a great opportunity for market growth. The process of EV manufacturing and battery assembly requires highly automated lines. This automation is enabling control on welding, coating, and material handling to enhance efficiency and scalability.

Furthermore, rising demand for PLCs in the renewable sector is offering another opportunity for market expansion. Governments across the world are spending on green energy, which is promoting adoption of PLCs. This tool is vital for controlling and optimizing processes in solar, wind, and hydropower plants, and fostering market growth.

PROGRAMMABLE LOGIC CONTROLLER (PLC) MARKET TRENDS

Rapid Shift Toward Compact, Micro, and Nano PLCs Has Surfaced as a Major Market Trend

Growing inclination towards smaller PLCs among end-users is one of the prominent trends in the market. The preference among consumers is demand for compact PLCs that act as all-in-one units with fixed L/O configurations. The micros PLCs are providing basic automation with moderate I/O capacity and are attracting small-scale firms. Whereas, the nano PLCs are ultra-compact controllers often used for assigning basic automation and standalone systems are propelling market growth. Hence, this trend is encouraging SMEs and machine builders to adopt smaller PLCs due to its cost efficiency and space savings.

Download Free sample to learn more about this report.

Impact of Gen AI

Gen AI Enables Automated Code Generation, Leading to Increased Demand of the Product

Generative AI is transforming the PLC market significantly. This is supporting automating code generation and enabling predictive maintenance that is heightening demand for the systems and consequently fostering market expansion. Furthermore, this Gen AI is also enabling simplifying human-machine interaction that is attracting number consumers to install these solutions.

Impact of Reciprocal Tariff

The sudden imposition of tariffs has adversely impacted almost every market. Tariffs on electronic components and cross-border trade have raised PLC manufacturing costs. This has raised import costs that leads to higher end-user prices and thus, potentially declined in adoption of the solutions. This tariff has a specific impact on the emerging markets that are cost-sensitive, consequently hindering market growth. Conversely, it is encouraging domestic manufacturers to expand their market presence.

SEGMENTATION ANALYSIS

By Type

High Adoption in Complex Industrial Automaton Boosts Modular Segment Growth

Based on the type, the market is segmented into modular, rack mounted, and compact.

In 2026, modular segment held the largest Programmable Logic Controller (PLC) market share of 43.42% with the valuation of USD 5.37 billion. This dominance is attributed to their scalability, flexibility and I/O expansion. Additionally, this is suitable for complex industrial automation across large-scale sectors including energy, automotive, and process industries.

Compact segment is expected to grow with a highest CAGR of 8.16% over the forecast period. This is due to high implementation of the solution among SME and packaging, and food & beverage sectors. The machine builders are gradually installing the solution due to their cost-effective and space-saving controllers with integrated connectivity for industry 4.0 applications.

To know how our report can help streamline your business, Speak to Analyst

By Component

Growing Demand for Hardware Installation in Several Core Components to Impel the Segment Growth

Based on component, the market is divided into hardware, software, and services. The hardware segment is further divided into CPU, memory module, power supply unit, communication module, and others (input/output module, and HMI).

Among these, the hardware segment dominated the market with a revenue share of USD 7.06 billion in 2024 & accounting for 57.81% market share in 2026. It is due to rising requirements of installation of the product in every core physical component. The parts include CPU, I/O modules, and power supply units that account for the bulk system costs with respect to software and services.

Additionally, the services segment is growing substantially with highest CAGR segment of 9.31%, due to rising demand of PLC installation, migration, and maintenance in various industries, growing requirement for remote support to modernize legacy systems, and ensure constant uptime.

By End-use Industry

Expansion of Corporate Real Estate Augments the Office Buildings & Corporate Campuses Segment Growth

Based on the end-use industry, the market is divided into automotive, food & beverages, energy & utilities, pharmaceuticals, and others (water and wastewater treatment).

In 2026, the automotive segment is leading in the market with the highest market share of 36.51%. This expansion is driven by the existence of automated production lines for vehicles and EV batteries. These vehicles are extensively relying on PLCs to control robotics, conveyors, and assembly processes.

In contrast, the pharmaceuticals segment is fastest growing in the market with the highest CAGR of 8.23%. This expansion is attributed to imposition of stringent regulations and its compliance. Besides, rising demand for high-precision production and automated packaging are encouraging implementation of PLC-based control systems.

PROGRAMMABLE LOGIC CONTROLLER (PLC) MARKET REGIONAL OUTLOOK

Geographically the market is segmented into North America, Europe, Asia Pacific, South America and Middle East & Africa.

North America

Asia Pacific Programmable Logic Controller (PLC) Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America Programmable Logic Controller (PLC) market is growing significantly, driven by the rising smart infrastructure initiatives and growing Industry 4.0. High spending on incorporation of AI and IoT into PLC systems for automation and predictive maintenance in numerous sectors is propelling market growth. The U.S. leads the North American market with an anticipated revenue share of USD 2.73 billion in 2026. It is owing to the existence of major PLC vendors along with top companies and R&D centers, tailoring solutions for a diverse consumer base.

Europe

The European market is experiencing significant growth and is expected to contribute to a revenue share of USD 2.55 billion in 2025. This is attributed to the existence of leading automotive robotics and industrial automation firms. Moreover, the rising importance of renewable energy management and changes towards industrial automation are boosting requirements for PLC systems. U.K., Germany, and France are some of the major contributors to the market growth in the region with an expected revenue share of USD 0.51 billion, USD 0.5 billion in 2026, and USD 0.41 billion respectively by 2025.

Asia Pacific

Asia Pacific is leading the market with a revenue share of USD 4.95 billion in 2025 and expected to reach USD 5.31 billion in 2026. The region is also anticipated to grow with the largest CAGR of 7.25% over the forecast period. This regional growth is due to the presence of a massive manufacturing base. Growing fast industrialization and urbanization are amplifying the demand for the systems. Furthermore, rising strong execution of automation across electronics, process, and automotive sectors are impelling market growth. India and China are expected to contribute to a revenue share of USD 0.76 billion and USD 1.07 billion respectively in 2026.

In addition, increasing smart manufacturing initiatives by governments are promoting adoption of the systems. Additionally, rising industrial automation and intensifying expenses on electronics, automotives, and infrastructure projects are supporting market growth.

To know how our report can help streamline your business, Speak to Analyst

South America and Middle East & Africa

The markets of South America and Middle East & Africa are growing with an expected share of USD 0.65 billion and USD 0.89 billion respectively in 2025. This is due to rising demand for agricultural packaging and food and beverage industry automation. The development of smart grid for enhanced energy distribution is supporting growing adoption of the system. GCC countries are expected to have a market share of USD 0.28 billion by 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Growing Focus of Key Players on Advanced Technology Adoption Leads to Their Prominence in the Market

The global programmable logic controller (PLC) market is well fragmented with diverse players operating in the market. These include Delta Electronics, Inc., ABB Ltd., Fuji Electric Co., Ltd., Ormron Corporation, General Electric Company (GE), IDEC Corporation, and others. These companies utilize several strategies including mergers, acquisitions, strategic partnerships, and investment in AI powered automation to maintain the market competition.

LIST OF KEY PROGRAMMABLE LOGIC CONTROLLER (PLC) COMPANIES PROFILED

- Siemens AG (Germany)

- Rockwell Automation, Inc. (U.S.)

- Schneider Electric SE (France)

- Mitsubishi Electric Corporation (Japan)

- ABB Ltd. (Switzerland)

- Ormron Corporation (Japan)

- Honeywell International Inc. (U.S.)

- Emerson Electric Co. (U.S.)

- Bosch Rexroth AG (Robert Bosch GmbH Group) (Germany)

- Hitachi, Ltd. (Japan)

- Panasonic Industry Co., Ltd. (Japan)

- Delta Electronics, Inc. (Taiwan)

- Fuji Electric Co., Ltd. (Japan)

- IDEC Corporation (Japan)

- General Electric Company (GE) (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2025- Mitsubishi Electric Corporation recognized with an honor from Control Engineering Product of the Year Awards in the Safety & Cybersecurity category. This award is given for their incorporation of Dispel’s Zero Trust Engine into its OT remote access solutions. This system offers secure, scalable remote monitoring, and maintenance in industrial environments.

- April 2025- Rockwell Automation introduces a cloud-connected PLC system equipped with advanced cybersecurity features. The aim of this product is to strengthen protection against threats in industrial control networks across the world.

- April 2025- ABB introduced its new PLC, the Micro PLC 800 XA, features advanced cybersecurity measures and an easy to use programming interface. This tool enables to address the rising concerns regarding industrial control systems security and intended to simplify the programming process for engineers and technicians.

- February 2025- Siemens unveiled a novel modular PLC platform in North America. This platform is providing faster processing speeds and built-in AI capabilities with an objective to enhance industrial automation

- September 2024- Schneider launched a new manufacturing plant at Prospace Industrial Parks Pvt. Ltd in Kolkata. Covering 9 acres, the plant represents an investment of USD 167 million to expand in smart factories to strengthen their market presence.

REPORT COVERAGE

The global report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, deployment modes, types, and end users of the product. Besides this, it offers insights into the programmable logic controller (PLC) market trends and highlights key industry developments and market share analysis for key companies. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Growth Rate |

CAGR of 6.20% from 2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type · Modular · Rack Mounted · Compact |

|

By Component · Hardware o CPU o Memory Module o Power Supply Unit o Communication Module o Others (Input/Output Module, HMI, etc.) · Software · Services |

|

|

By End-use Industry · Automotive · Food & Beverages · Energy & Utilities · Pharmaceuticals · Others (Water and Wastewater Treatment, etc.) |

|

|

By Region · North America (By Type, Component, End-use Industry, and Country/Sub-region) o U.S. (By Type) o Canada (By Type) o Mexico (By Type) · Europe (By Type, Component, End-use Industry, and Country/Sub-region) o U.K. (By Type) o Germany (By Type) o France (By Type) o Italy (By Type) o Spain (By Type) o Russia (By Type) o Benelux (Type) o Nordics (Type) o Rest of Europe (By Type) · Asia Pacific (By Type, Component, End-use Industry, and Country/Sub-region) o China (By Type) o Japan (By Type) o India (By Type) o South Korea (By Type) o ASEAN (By Type) o Oceania (By Type) o Rest of Asia Pacific (By Type) · South America (By Type, Component, End-use Industry, and Country/Sub-region) o Brazil (By Type) o Argentina (By Type) o Rest of Latin America (By type) · Middle East & Africa (By Type, Component, End-use Industry, and Country/Sub-region) o Turkey (By Type) o Israel (By Type) o GCC (Type) o North Africa (Type) o South Africa(Type) · Rest of the Middle East & Africa (By Type ) |

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 13.45 billion in 2026 and is projected to reach USD 21.83 billion by 2034.

The market is expected to exhibit steady growth at a CAGR of 6.20% during the forecast period.

Industry 4.0 and smart manufacturing drives the market growth.

Siemens AG, Rockwell Automation, Inc., Schneider Electric SE, and Mitsubishi Electric Corporation are some of the top players in the market.

Asia Pacific dominated the Programmable Logic Controller (PLC) market with a share of 39.10% in 2025.

Asia Pacific was valued at USD 5.31 billion in 2026.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us