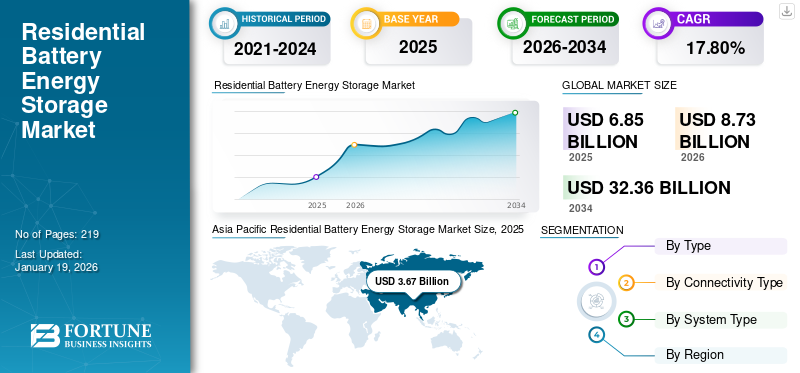

Residential Battery Energy Storage Market Size, Share & Industry Analysis, By Type (Lithium-ion (Li-ion) and Lead Acid), By Connectivity Type (On-Grid and Off-Grid), By System Type (Standalone Systems and Solar and Storage Systems), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The global residential battery energy storage market size was valued at USD 6.85 billion in 2025. It is projected to be worth USD 8.73 billion in 2026 and reach USD 32.36 billion by 2034, exhibiting a CAGR of 17.80% during the forecast period. Asia Pacific dominated the global market with a share of 53.49% in 2025.

Many homeowners install solar panels, and batteries help store excess energy at night or during power outages. Solar + storage packages are becoming more common, especially in regions with net metering reforms (e.g., California, Germany). Grid instability, extreme weather, and climate change events (including wildfires and storms) push consumers to seek backup power at home. The global market share is growing due to a combination of technological, economic, regulatory, and consumer-driven factors. Installing solar panels in a residential battery energy storage system is a small solution for enhancing energy independence. The supply chain for battery energy storage systems is growing rapidly due to the soaring global demand.

In Italy, Enel X launched pilot projects (in Brescia, Bergamo, Mantua) aggregating home batteries into UVAM virtual units, allowing homeowners to participate in grid services, including balancing frequency and voltage. Previously limited to industrial plants, residential units now offer flexibility to the network.

MARKET DYNAMICS

MARKET DRIVERS

Rising Adoption of Renewable Energy Sources to Drive Market Growth

The increasing installation of rooftop solar PV systems in residential areas is a major driver of battery energy storage. Solar energy is intermittent; it’s only generated during the daytime. To maximize the use of this energy, homeowners are increasingly pairing solar systems with residential batteries. Batteries allow users to store excess solar power generated during the day for use at night or during power outages, enabling greater energy independence and reduced reliance on the grid. The energy storage capacity in the residential battery energy storage market is growing rapidly, owing to homeowners demanding larger, more capable systems that can do more than just back-up lights.

In August 2024, Siemens Digital Industries Software declared that it has connected the Global Battery Alliance (GBA), a cooperation platform that brings together major international organizations, NGOs, industry actors, academics, and multiple governments to align together in a pre-competitive approach, to increase structured change together the whole battery manufacturing value chain.

MARKET RESTRAINTS

High Initial Costs to Restrain Market Growth

Battery systems, especially Lithium-ion, are expensive. High upfront investment for battery and inverter systems discourages middle and lower-income households. Many consumers lack knowledge of battery systems and their benefits. Installation and maintenance require technical know-how, which limits adoption in some regions. In some areas, utility regulations or a lack of net metering policies restrict battery integration.

MARKET OPPORTUNITIES

Rising Demand for Energy Independence to Drive Product Demand

The growing desire among homeowners to reduce reliance on traditional power grids is a major driver of the residential battery energy market growth. Consumers are increasingly motivated by frequent grid outages, rising electricity prices, and a growing awareness of energy security. Residential batteries allow households to store energy generated from rooftop solar systems or during off-peak hours, providing backup during blackouts and enabling greater control over energy usage. Lithium-ion batteries store excess solar energy during the day and supply it at night, and it is used in residential battery energy storage.

In May 2023, LG Energy Solution, formerly known as LG Chem, introduced a new home energy storage system called Prime+, which offers adaptable capacity tailored to the backup requirements of American households.

RESIDENTIAL BATTERY ENERGY STORAGE MARKET TRENDS

Smart Energy Management System to Surge Market Growth

The increasing adoption of smart energy management systems is playing a pivotal role in accelerating the growth of the residential battery energy storage market. This system enables homeowners to monitor, control, and optimize energy consumption in real time. The ability to enhance energy efficiency, reduce costs, and improve convenience makes smart EMS a core component of modern residential battery systems. Thus, smart energy management system is the key market trend to drive the residential battery energy storage market share.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Technology

High Energy Density to Lead Growth of Lithium-ion Technology

The market, by technology covers lithium-ion and lead acid.

Lithium-ion (Li-ion) is the dominating segment in the market. Lithium-ion batteries store more energy in a compact size, making them ideal for space-constrained residential installations. This allows for longer backup power with smaller systems.

Lead acid is the second dominating segment in the market. Many U.S. areas are experiencing more frequent power outages due to storms, wildfires, and grid issues. Lead acid batteries are a proven, reliable technology for short-term backup during emergencies.

By Connectivity Type

Rise in Rooftop Installation to Drive On-grid Segment Growth

By connectivity type, the market is segmented into on-grid and off-grid.

On-grid dominates the residential battery energy storage market share. Many countries, e.g. U.S, Germany, and Australia, offer subsidies, tax credits, or rebates for on-grid battery systems. Some utilities also offer incentives for grid services or participation in virtual power plants. On-grid batteries allow homeowners to store energy when rates are low and use it when rates are high, saving money.

Off-grid is the fastest-growing segment in the market. Off-grid battery systems ensure uninterrupted power during emergencies, which drives segment growth.

By System Type

Backup Power during Grid Outages Boosted Standalone Systems Growth

By system type, the market is segmented into standalone systems and solar and storage systems.

Standalone systems dominated the market in 2024. Many households face frequent power cuts due to extreme weather, aging infrastructure, or grid instability. Standalone batteries can store grid electricity and provide backup during blackouts. Utilities in many regions charge higher rates during peak hours.

Solar and storage systems are the second dominating segment in the market. With increasing blackouts and grid instability in areas such as California and Texas, solar+ storage offers reliable backup power. This factors drive segment growth.

RESIDENTIAL BATTERY ENERGY STORAGE MARKET REGIONAL OUTLOOK

The market has been analyzed geographically into North America, Europe, Asia Pacific, and the Rest of the World. Asia Pacific is the dominating region in the market.

Asia Pacific

Asia Pacific Residential Battery Energy Storage Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 3.67 billion in 2025 and USD 4.59 billion in 2026. Countries including Australia, Japan, South Korea, and India are experiencing a surge in residential solar adoption. Homeowners are increasingly pairing solar with batteries to store excess power and reduce grid dependency. Power reliability remains a concern in countries including India, Southeast Asia, and parts of rural China. Batteries provide backup power and help stabilize household electricity use.

North America

North America, particularly the U.S., is one of the fastest-growing markets for residential battery energy storage, driven by solar adoption, power outage concerns, and federal/state incentives. Strong growth in rooftop solar (especially in California, Texas, and Arizona). Homeowners are increasingly pairing solar with batteries for self-consumption and back-up power. Wildfires, hurricanes, and aging infrastructure cause frequent outages.

U.S.

Many U.S. homeowners are installing rooftop solar panels and batteries, as it helps them to store excess solar energy. Due to wildfires, storms, and aging grid infrastructure, households seek reliable backup power. Batteries provide uninterrupted power during outages, increasing their appeal. Batteries help optimize energy use during time-of-use pricing and demand charges.

Europe

Countries including Germany, Italy, Spain, and the Netherlands are seeing strong growth in rooftop solar PV. Homeowners pair solar with batteries to store excess energy and increase self-consumption. The Russia-Ukraine war triggered record-high energy prices. Many households turned to solar + storage to lower dependency on the grid and cut energy costs. Germany offers grants and loans, e.g. KfW program. Italy, Austria, and Belgium provide regional or national incentives for battery storage.

Rest of the World

Many countries in the region (e.g, Brazil, Argentina, and Venezuela) face unreliable grid infrastructure and regular blackouts. Households are adopting batteries to ensure backup power and energy reliability. Some countries face volatile or rising electricity tariffs. Battery systems help homeowners avoid peak prices by storing energy during cheaper, off-peak hours. Brazil and China have introduced net metering tax incentives and energy transition programs. While support for batteries is still limited, clean energy frameworks are paving the way for storage growth.

Additionally, many countries in Sub-Saharan Africa (e.g., Nigeria, South Africa, and Kenya) face frequent and prolonged power cuts. Residential batteries are increasingly used for backup power and to ensure energy reliability. High solar irradiation in both Middle Eastern and African nations is also a major factor driving market growth in the region.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Vendors Are Collaborating And Launching New Products To Provide More Advanced Systems

In a bid to enhance residential energy storage solutions, Sungrow Power has unveiled its latest hybrid, next-generation ESS lineup. In July 2025, China's Sungrow Power has announced the launch of its latest hybrid, next-generation residential energy storage system (ESS), with its MG Series 5/6RL already available. An MG8/10RL model, and including MGL060 battery, will be available in Q4.

In May 2025, Sonnen, a provider of energy storage virtual power plants (VPPs), is collaborating with Abundance Energy and Energywell Technology Licensing to create a battery-powered VPP in Texas, USA. Based in Lubbock, Texas, Abundance Energy is a utility company, while Energywell Technology Licensing is an energy technology firm located in Green Farms, Connecticut.

Some of the Key Companies Profiled in the Report

- Enel X (Italy)

- AlphaESS (China)

- SUNGROW (China)

- Siemens AG (Germany)

- Tesla (U.S.)

- Sonnen (Germany)

- Tata Power (Mumbai)

- Enphase Energy (U.S.)

- BYD (China)

- LG Chem (South Korea)

- AES Indiana (U.S.)

- ACE Battery (China)

- CATL (China)

- Toshiba (Japan)

- Johnsons Control (U.S.)

KEY INDUSTRY DEVELOPMENTS

- In May 2025, CATL introduced the TENER Stack, the first ultra-large energy storage system with a capacity of 9MWh, which is scheduled for mass production at ees Europe 2025. This development marks a significant advancement in capacity, deployment versatility, safety, and ease of transport.

- In May 2025, BYD declared its new Gen4 home battery named HVB, which is anticipated to be a popular incorporation to residential storage space.

- In April 2025, Tata Power plans to establish a 100 MW battery energy storage system to enhance peak load management in Mumbai's electricity network. The system will be deployed across ten strategically chosen locations in Mumbai, with centralized monitoring and control from its power system control center.

- In September 2024, Aden Energies is proud to declare a prolonged collaboration with Johnson Controls on an energy storage project in Wuxi, Jiangsu Province, China.

- In May 2022, South Korean battery manufacturer LG Energy Solution showcased its newest inventions at the Smarter E event in Munich last week. It also declared its transformation from nickel-manganese-cobalt (NMC) battery chemistry to lithium iron phosphate (LFP) in its succeeding products.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product/service processes, competitive landscape, and leading residential battery energy storage sources. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 17.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion), Volume (MW) |

|

Segmentation |

By Type

|

|

By Connectivity Type

|

|

|

By System Type

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 6.85 billion in 2025.

In 2025, the Asia Pacific market value stood at USD 3.67 billion.

The market is expected to exhibit a CAGR of 17.80% during the forecast period.

The lithium-ion segment led the market by type.

Rising adoption of renewable energy to drive the market growth.

Some of the top major players in the market are AlphaESS, Siemens AG, Toshiba, and Others.

Asia Pacific dominated the market share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us