Ring Laser Gyroscope Market Size, Share & Industry Analysis, By Platform (Airborne, Ground, Maritime, and Space), By End User (Aerospace & Defense, Consumer Electronics, Marine/Naval, Automotive, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

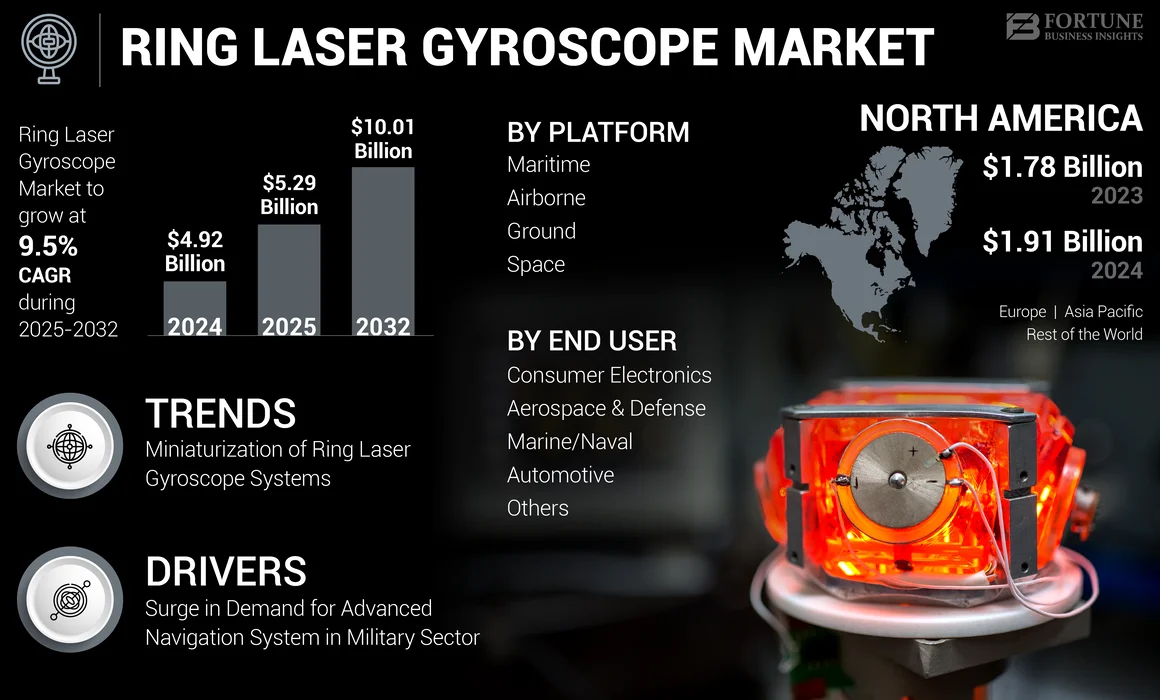

The global ring laser gyroscope market size was valued at USD 4.92 billion in 2024. The market is projected to grow from USD 5.29 billion in 2025 to USD 10.01 billion by 2032, exhibiting a CAGR of 9.5% during the forecast period. North America dominated the ring laser gyroscope market with a market share of 38.82% in 2024.

A Ring Laser Gyroscope (RLG) is an optical device that measures angular rotation using the Sagnac effect. It consists of a closed-loop laser cavity where two counter-propagating laser beams interfere, creating a phase shift proportional to the rotation rate. Unlike mechanical gyroscopes, RLGs have no moving parts, making them compact, durable, and free from friction-induced drift. They are widely used in inertial navigation systems for aircraft, missiles, and spacecraft due to their high accuracy and reliability. The rise in the use of autonomous vehicles, aviation, and military systems has driven the demand for precise inertial navigation solutions. Moreover, ring laser gyroscopes are in high demand as they provide precise angular rotation measurements with minimal drift, making them ideal for navigation in aerospace and defense applications.

Key players in the ring laser gyroscope market-Honeywell International Inc., Northrop Grumman, Safran Electronics & Defense, Kearfott Corporation, and Teledyne CDL-are advancing navigation and guidance technologies for aerospace, defense, and marine applications. Honeywell and Northrop Grumman are developing compact, high-performance RLGs for aircraft, spacecraft, and military vehicles

Ring Laser Gyroscope Market Snapshot & Highlights

Market Size & Forecast

- 2024 Market Size: USD 4.92 billion

- 2025 Market Size: USD 5.29 billion

- 2032 Forecast Market Size: USD 10.01 billion

- CAGR: 9.5% from 2025–2032

Market Share

- North America dominated the ring laser gyroscope market with a 38.82% share in 2024, driven by significant investments in aerospace and defense sectors, particularly in advanced navigation technologies for aircraft, missiles, and UAVs. The region benefits from robust R&D capabilities, leading manufacturers such as Honeywell and Northrop Grumman, and high defense budgets supporting modernization initiatives.

- By type, Portland Pozzolan Cement (PPC) (replace with RLG platform/type segmentation if needed) continues to retain a substantial share due to its durability and adaptability in critical applications across aerospace, defense, and marine navigation.

Key Country Highlights

- United States: Growth fueled by the Infrastructure Investment and Jobs Act and significant defense modernization initiatives, including investments in drones and electronic warfare systems.

- Japan: Demand is supported by precision navigation in earthquake-resistant infrastructure and compliance with stringent aerospace safety regulations.

- China: Through programs like the Belt and Road Initiative and expanding space exploration, China remains a leader in adopting advanced navigation solutions.

- Europe: Growth supported by the European Green Deal and defense upgrades, particularly in France, Germany, and the U.K., focusing on UAVs and advanced missile systems.

RING LASER GYROSCOPE MARKET TRENDS

Miniaturization of Ring Laser Gyroscope Systems

A key trend in the market is the ongoing miniaturization of gyroscope systems to cater to the growing need for compact, lightweight navigation solutions in aerospace and defense. Technological advancements-such as the use of fiber optics and solid-state components-are enabling manufacturers to develop smaller yet highly reliable and energy-efficient RLGs.

- North America witnessed ring laser gyroscope market growth from USD 1.78 Billion in 2023 to USD 1.91 Billion in 2024.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Surge in Demand for Advanced Navigation Systems in Military Sector to Stimulate Market Growth

Governments worldwide are investing heavily in upgrading defense capabilities, including advanced navigation systems for aircraft, drones, and ground vehicles, to improve operational efficiency and precision. For instance, in September 2024, the U.S. Army announced that it plans to make huge investments in drones and electronic warfare. Moreover, in February 2025, the Indian Army implemented a long-term strategy to modernize its fleet of Unmanned Aerial Vehicles (UAVs) and Remotely Piloted Aircraft (RPAs) to enhance Intelligence, Surveillance, Reconnaissance (ISR), and precision strike capabilities.

Drones require precise navigation systems for stability and accurate positioning during operations. Ring laser gyroscopes, known for their high precision and reliability, are integral to these systems. As military forces across the globe increase spending on Unmanned Aerial Systems (UAS) and electronic warfare tools, ring laser gyroscopes are increasingly integrated into UAVs and combat aircraft to ensure reliable inertial navigation.

MARKET RESTRAINTS

Emergence of Alternative Navigation Technologies to Limit Market Expansion

The emergence of alternative navigation technologies such as Fiber Optic Gyroscopes (FOGs) and Micro-Electro-Mechanical Systems (MEMS) gyroscopes is expected to limit the expansion of the Ring Laser Gyroscope (RLG) market. These alternatives offer advantages such as reduced size, lower power consumption, and cost-effectiveness, making them attractive for industries focused on compact and affordable solutions for applications, including aerospace and automotive.

In addition, advancements in these technologies enable comparable performance in precision navigation systems, challenging the dominance of RLGs in the aerospace and defense sectors. The growing adoption of MEMS gyroscopes in autonomous vehicles and FOGs in various applications further intensifies competition, potentially slowing RLG market growth.

MARKET OPPORTUNITIES

Rising Development of Autonomous Vehicles Driving Growth Potential

Autonomous vehicles, including self-driving cars, Autonomous Underwater Vehicles (AUVs), and drones, require highly accurate inertial navigation systems to ensure safe and efficient operations, especially in GPS-denied environments. RLGs provide precise angular velocity measurements and stability, enabling these vehicles to maintain orientation and follow their intended paths. In self-driving cars, RLGs enhance lane-keeping, collision avoidance, and route optimization by delivering real-time data on motion and orientation. Similarly, for AUVs and autonomous ships, RLGs are essential for underwater and maritime navigation where GPS signals are unreliable. The growing demand for drone-based delivery systems and autonomous trucks further drives the need for robust navigation solutions that RLGs can provide. Moreover, advancements in RLG technology, such as miniaturization and multi-axis capabilities, make them more suitable for integration into compact autonomous systems.

Segmentation Analysis

By Platform

Airborne Segment Dominated Market Due to Increase in Demand for Advanced Navigation Systems in Aircraft

By platform, the market is segmented into airborne, ground, maritime, and space.

The airborne segment is experiencing significant growth in the gyroscope market due to rising global air travel demand fueled by economic expansion. With the rise in global air travel, there is an increase in aircraft production, which has fueled the need for precise inertial navigation systems for operation in GPS-denied environments. Ring laser gyroscopes are integral to these systems as they ensure accurate navigation, flight control, and stability. Furthermore, advancements in aerospace technology and increased defense investments have accelerated the adoption of RLGs for military aircraft and Unmanned Aerial Vehicles (UAVs).

- For instance, the U.S. Army's fiscal 2025 budget heavily emphasizes investments in drones, counter-drone systems, and electronic warfare technologies. A total of USD 447 million has been allocated for Counter-small Unmanned Aerial Systems (C-sUAS), with USD 185 million dedicated to interceptors, including Raytheon’s Coyote drones. Such developments promote the investments in gyroscope-equipped UAVs.

By End User

Aerospace & Defense Dominated Market Due to Rise in Defense Modernization and Upgradation of Military Navigation Systems

Based on end user, the market is segmented into aerospace & defense, consumer electronics, marine/naval, automotive, and others.

The aerospace & defense segment is driving significant growth in the market due to increased investments in defense modernization and the rising demand for precise navigation systems in military operations. Governments globally are allocating higher budgets to upgrade existing navigation technologies, particularly for applications in aircraft, missiles, submarines, and Unmanned Aerial Vehicles (UAVs).

The marine and naval segment is expected to grow significantly in the market owing to a rise in demand for ring laser gyroscopes for accurate navigation. For instance, in May 2023, the U.S. Navy awarded Honeywell Aerospace a USD 11.3 million contract to supply ring laser gyroscopes for the AN/WSN-7 inertial navigation system used aboard Navy ships and submarines. The AN/WSN-7 system provides precise position, velocity, attitude, and heading data to support critical ship operations.

Gyroscope Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, and the rest of the world.

North America

North America Gyroscope Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominates the global market with a 38.7% share in 2024. The growth is driven by its strong Aerospace & Defense (A&D) sector. The U.S., specifically, is involved in significant investments in advanced navigation technologies. The region witnesses high military spending, particularly in the U.S., where RLGs are widely used in aircraft, missiles, and Unmanned Aerial Vehicles (UAVs) for precise navigation in GPS-denied environments.

Moreover, the country is heavily investing in the production of low-cost drones to upgrade its military capabilities. For instance, in March 2025, the Pentagon’s Defense Innovation Unit (DIU) of the U.S. awarded contracts to U.S. and Ukrainian companies to produce low-cost drone prototypes. In addition, the Artemis program is structured to produce large quantities of new drones more rapidly than conventional defense programs. Therefore, an increase in the production of drones is expected to increase the demand for ring laser gyroscopes installed in drones for navigation and stabilization.

Furthermore, the surge in the demand for commercial aviation, with the increased air travel and tourism, further propels market growth. In addition, the presence of leading manufacturers such as Honeywell and Northrop Grumman enhances technological innovation. Advancements in autonomous systems and electronic surveillance also contribute to the rising adoption of RLGs in military applications.

Europe

Europe's strong aerospace sector, led by France, Germany, and the U.K., contributes significantly to gyroscope market growth. In addition, the country made ambitious plans to double its passenger traffic by 2050 due to the increase in travel demand. There has also been a rise in the production and delivery of aircraft to meet the increase in air traffic demands. For instance, in January 2025, Airbus, one of the leading aircraft manufacturers, announced a boost in the 766 aircraft deliveries. These major aircraft manufacturers, such as Airbus, integrate ring laser gyroscopes into navigation and stabilization systems, which is expected to fuel the growth of the market.

Rising defense budgets across Europe, particularly in response to geopolitical tensions, are driving investments in advanced missile systems and UAVs that rely on gyroscopic technologies. France, Germany, and the U.K., are focusing on huge investments in military aircraft and UAVs. For instance, in December 2024, Russia planned to design autonomous drones with swarm technology to evade Ukrainian air defenses. These systems rely on ring laser gyroscopes for accurate inertial navigation, which is expected to drive the ring laser gyroscope market growth.

Asia Pacific

Asia Pacific is the fastest-growing region in the market during the forecast period. China, India, Japan, and South Korea are engaged in heavy investment in upgrading and modernizing their military capabilities, including advanced aircraft and UAVs. The following system uses RLGs for precise navigation. Therefore, the factors together, such as the growing commercial aviation sector, rise in air travel demand, and military system upgrading activities, drive the adoption of ring laser gyroscopes.

Moreover, the region has increased its focus on space exploration programs and has boosted the use of RLGs in satellite navigation systems. For instance, in November 2024, the Indian Space Research Organization (ISRO), an Indian space agency, revealed its plans to establish a lunar space station by 2040, building on the success of the Chandrayaan-3 mission and outlining a three-phase approach to lunar exploration that includes robotic missions and a crewed landing. The lunar space station initiative by ISRO and similar ambitious space exploration projects drive demand for highly accurate inertial navigation systems, boosting the market by expanding applications in spacecraft and deep space missions.

Rest of the World

The Rest of the World (RoW), including Latin America and the Middle East & Africa, showcases moderate growth in the market. In the Middle East, rising defense expenditures and investments in modernizing military fleets drive demand for RLGs in aircraft and missile systems. There is an increasing trend toward the modernization of aircraft fleets in the Middle East. For instance, according to Wouter van Wersch, Executive Vice President International at Airbus, passenger traffic is expected to increase over time, and the Middle East is expected to require around 3,700 new aircraft over the next two decades.

Single-axis ring laser gyroscopes are essential components in modern inertial navigation systems, providing precise measurements of angular velocity for various aerospace and defense applications. Therefore, the increase in the production of new aircraft also pushes the demand for ring laser gyroscopes as they are installed in the aircraft system to provide precision navigation data. In addition, adoption is slower in the African region but is growing due to increasing interest in UAVs for surveillance purposes.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products Results in Dominating Position of Key Firms

The global ring laser gyroscope market features prominent players such as Honeywell International Inc., Northrop Grumman Corporation, Thales Group, Safran Electronics & Defense, Murata Manufacturing Co. Ltd., Analog Devices Inc., Robert Bosch GmbH, and STMicroelectronics N.V. Companies such as Honeywell and Bosch lead in developing high-performance ring laser gyroscopes, including MEMS and fiber optic ring laser gyroscope, for diverse applications such as defense, aerospace, and consumer electronic. Major players engage in collaborations and acquisitions to expand their product portfolios, increase the ring laser gyroscope market share, and strengthen their global presence. Companies are investing significantly in research and development to create high-precision ring laser gyroscopes that meet the stringent requirements of aerospace and defense applications.

LIST OF KEY RING LASER GYROSCOPE COMPANIES PROFILED

- Honeywell International Inc. (U.S.)

- Northrop Grumman Corporation (U.S.)

- Safran Electronics & Defense SAS (France)

- Kearfott Corporation (U.S.)

- Teledyne CDL (U.K.)

- Raytheon Technologies Corporation (U.S.)

- Thales Group (France)

- BAE Systems plc (U.K.)

- Elbit Systems Ltd. (Israel)

KEY INDUSTRY DEVELOPMENTS

- May 2023: Honeywell Aerospace in Minneapolis was awarded a USD 11.3 million contract by the U.S. Navy to supply inertial navigation and ring laser gyro units for the AN/WSN-7 navigation system used on surface vessels and submarines. The contract supports the Cruiser/Destroyer Integrated Weapon Support Team and ensures precise navigation capabilities for Navy operations.

- July 2022: Thales announced plans to enhance employment in Nouvelle-Aquitaine, France, by opening a new center of excellence focused on airborne optronics equipment maintenance and support. This initiative builds on Thales's long-standing expertise in manufacturing Ring Laser Gyro (RLG) inertial navigation systems, which have been affected by the aerospace sector's challenges.

- October 2021: Northrop Grumman delivered the 500th AN/WSN-7 ring laser gyroscope Inertial Navigation System (INS) to the U.S. Navy, solidifying its role as the Program of Record for navigation systems on surface combatants such as AEGIS-equipped ships and submarines.

- July 2021: The U.S. Air Force awarded Kearfott a USD 82.12 million contract to repair navigation systems on B-2 Spirit bombers, specifically focusing on the Inertial Measurement Unit (IMU) and attitude motion sensor set. The IMU relies on data from the AMSS ring laser gyro inertial navigation platform, which is essential for the B-2's navigation system.

- April 2021: EMCORE launched the SDI170 Quartz MEMS Tactical Grade Inertial Measurement Unit (IMU) as a form, fit, and function compatible replacement for the HG1700-AG58 Ring Laser Gyroscope IMU, offering superior performance, higher MTBF, and longer life in rugged environments.

REPORT COVERAGE

The global ring laser gyroscope market research report provides an in-depth technical analysis of the market, covering its size, growth trends, and future projections. The report discusses key drivers such as technological advancements and increasing demand for precision navigation systems. It also examines the role of ring laser gyroscopes in emerging technologies such as autonomous vehicles and drones. It also identifies factors contributing to market growth during the forecast period.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 9.5% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Platform

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 4.92 billion in 2024 and is projected to record a valuation of USD 10.01 billion by 2032.

In 2024, the North America market value stood at USD 1.91 billion.

The market is expected to exhibit a CAGR of 9.5% during the forecast period of 2025-2032.

The airborne segment led the market by platform.

The key factors driving the market are the surge in the demand for advanced navigation systems in the aerospace & defense sector and the rising development of autonomous vehicles.

Honeywell International Inc., Northrop Grumman Corporation, and Safran Electronics & Defense SAS are some of the top players in the market.

North America dominated the market in 2024.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us