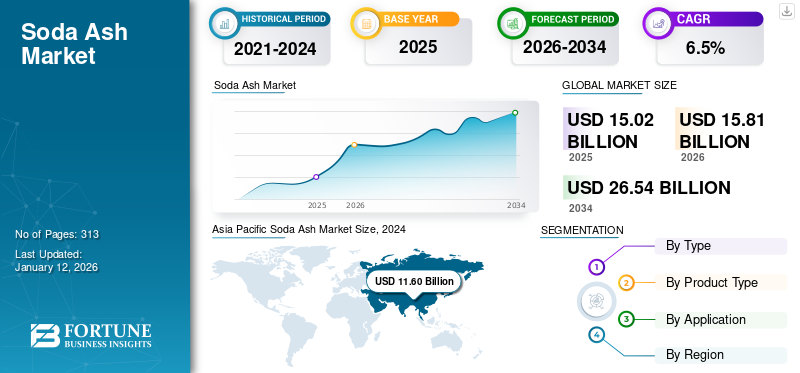

Soda Ash Market Size, Share & Industry Analysis, By Type (Synthetic and Natural), By Product Type (Dense Soda Ash and Light Soda Ash), By Application (Glass, Soaps & Detergents, Chemicals, Alumina & Mining, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global soda ash market size was valued at USD 15.02 billion in 2025. The market is projected to grow from USD 15.81 billion in 2026 to USD 26.54 billion by 2034, exhibiting a CAGR of 6.5% during the forecast period. Asia Pacific dominated the soda ash market with a market share of 62.05% in 2025.

Soda ash, or sodium carbonate, is a flexible alkali chemical widely used in various industrial methods. It plays a vital role in glass manufacturing, where it decreases the melting temperature of silica. It is also integral in detergent production, helping soften water to enhance cleaning efficiency. Additionally, it is used in the paper industry for cooking pulp and as a pH regulator in various chemical processes, including water treatment. Its applications in food and textiles further underline its importance across different sectors. Beyond its industrial applications, it is a vital ingredient in the dyeing process for textiles, ensuring colors adhere well to fabric. It is also used as a food additive in the food industry, regulating acidity and acting as a leavening agent in some baked products.

The Solvay, Şişecam, Tata Chemicals Ltd., Ciner Group, & DCW Ltd. are the key players operating in the market.

SODA ASH MARKET TRENDS

Development of Advanced Mining and Processing Technologies to Create New Lucrative Opportunities in Market

In recent years, the industry has witnessed significant advancements in mining technologies, enhancing efficiency and environmental sustainability. One notable innovation is the introduction of solution mining methods, which allow for the extraction of sodium carbonate from deep underground without traditional open-pit mining, thereby minimizing surface disruption. Additionally, implementing advanced sensor technology and real-time data analysis has improved resource management, allowing for more precise access to sodium carbonate deposits. Moreover, developing more efficient water recycling systems has further reduced the ecological footprint of mining operations. Automated conveyor systems have also been introduced, streamlining the transportation of raw materials and reducing labor costs.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Infrastructure Investments to Drive Market Growth

Soda ash is a major component in the glass manufacturing process, accounting for a significant portion of the total sodium carbonate consumption globally. The demand for glasses such as flat glass, container glass, and specialty glass has risen substantially in recent years due to rapid urbanization, increasing infrastructure investments, rising automobile production, and a global shift toward sustainable packaging solutions. These factors together make glass manufacturing one of the most dominant growth drivers in the market. The architectural segment is witnessing strong growth due to the increased construction of smart cities, commercial buildings, and residential complexes. The trend toward using energy-efficient windows and solar control glass is further boosting demand. Simultaneously, the rise in automotive production, especially electric vehicles (EVs), is increasing the need for lightweight and durable glass for improved aerodynamics and energy efficiency. Modern vehicle incorporates several square meters of glass, significantly boosting consumption. Glass, being 100% recyclable and non-toxic, is increasingly preferred for beverage and food packaging.

Rising Use of Industrial Chemicals Drives Market Expansion

Soda ash is a fundamental raw material used in the production of a wide range of chemicals, including sodium silicates, sodium bicarbonate, and detergents. The chemical industry’s growth and the rising demand for industrial chemicals, pushed by global economic recovery and industrialization, are some major factors driving product consumption. The growth of various sectors, such as manufacturing, water treatment, and agrochemicals, continues to strengthen the market’s upward trajectory. The increasing focus on industrial sustainability, environmental protection, and eco-friendly chemistry across industries is one of the driving forces behind the rising demand for sodium carbonate. With governments around the world implementing stricter regulations on wastewater treatment and chemical waste management, industries are turning to more effective and environmentally friendly chemical processing techniques that rely on sodium carbonate as a key component. The Asia Pacific region, particularly China and India, remains a key driver for the chemical industry, with robust growth in both industrial production and chemical manufacturing.

MARKET RESTRAINTS

Rising Environmental Concerns Regarding Soda Ash Production May Hinder Market Growth

Environmental concerns related to the making and use of sodium carbonate are becoming increasingly significant. The product is primarily produced through two methods: the Solvay process and the Trona process, both of which involve the extraction of minerals and chemical reactions that can release dangerous elements into the atmosphere. As governments across the globe continue to enforce stringent ecological regulations to reduce carbon footprints and promote sustainability, sodium carbonate manufacturers are under pressure to adopt more eco-friendly production methods. Governments globally are implementing strict regulations on industrial emissions, waste management, and resource usage. Large corporations, especially in the glass and chemical industries, are increasingly prioritizing sustainable sourcing of raw materials.

MARKET OPPORTUNITIES

Shift toward Eco-Friendly Products Creates New Opportunities for Market Growth

In recent years, there has been a growing global focus on sustainability, with businesses, governments, and consumers becoming increasingly concerned about environmental issues such as carbon emissions, waste management, and the reduction of chemical pollutants. This shift toward sustainability is driving demand for environmentally friendly products and production processes, creating significant opportunities for sodium carbonate manufacturers. Sodium carbonate, due to its role in producing a wide range of eco-friendly products such as green glass and bio-based detergents, is benefiting from this trend. Governments globally are implementing regulations and providing incentives to boost the use of sustainable products and production methods. For instance, restrictions on the use of harmful chemicals in cleaning products are driving the demand for safer, eco-friendly alternatives such as glass and bio-based detergents, which rely on sodium carbonate. As sustainability becomes a key driver in the global market, sodium carbonate producers must adapt by aligning their operations with these evolving environmental expectations.

MARKET CHALLENGES

Fluctuating Raw Material and Energy Costs May Present a Significant Challenge to Market

Growth

The production of a synthetic type of product depends heavily on key raw materials such as limestone, salt, and energy sources such as coal and natural gas. Volatility in these input prices directly impacts production costs and profit margins. Energy-intensive manufacturing processes, particularly in regions with high utility rates, make cost control a major challenge. Additionally, geopolitical tensions, disruptions in supply chains, and inflationary pressures can lead to sudden spikes in energy or transportation costs. Manufacturers operating on tight margins struggle to pass these costs onto consumers without affecting competitiveness. This volatility hinders long-term planning and investment in expanding production capacity. Companies must continuously adapt to market fluctuations and explore energy-efficient technologies or alternative raw materials to remain sustainable.

IMPACT OF COVID-19

The COVID-19 pandemic had a significant impact on the global market, disrupting supply chains, production, and demand across multiple industries. As countries imposed lockdowns and movement restrictions to control the spread of the virus, industrial operations slowed or came to a complete halt, particularly during the early stages of the pandemic. Major end-use sectors such as construction, automotive, and glass manufacturing experienced sharp declines in activity, which directly reduced the product consumption. With construction projects postponed and car production lines temporarily shut down, demand for flat and container glass, both key applications of sodium carbonate, dropped considerably. Additionally, limited workforce availability and transportation bottlenecks created challenges in both raw material procurement and product distribution. In response, many sodium carbonate producers were forced to scale back production or temporarily suspend operations due to declining demand and logistical constraints.

TRADE PROTECTIONISM AND GEOPOLITICAL IMPACT

Trade protectionism and rising geopolitical tensions have increasingly shaped the dynamics of the global market. In recent years, countries have implemented tariffs, export restrictions, and anti-dumping measures to protect domestic industries, which has created significant uncertainty in international trade. Protective trade measures often lead to price volatility and restrict the free flow of goods, making it difficult for manufacturers and buyers to maintain stable sourcing strategies. Additionally, geopolitical conflicts such as the Russia-Ukraine war, China-U.S. trade tensions, and unrest in the Middle East have further complicated global supply chains. These events impact energy availability, transportation routes, and raw material supplies, all of which are critical for product production and distribution.

RESEARCH AND DEVELOPMENT (R&D) TRENDS

Research and development (R&D) in the market is gaining momentum as companies seek to improve production efficiency, reduce environmental impact, and diversify product applications. One of the main focuses of R&D is the development of more energy-efficient and sustainable manufacturing processes. Traditional methods, such as the Solvay process, are highly energy-intensive and generate significant CO₂ emissions. In response, several producers are investing in cleaner technologies and new production processes such as e.Solvay process is designed to cut CO₂ emissions. Additionally, technologies such as carbon capture, utilization & storage (CCUS), waste heat recovery, and alternative raw material sourcing are being explored to minimize the environmental footprint of product manufacturing.

SEGMENTATION ANALYSIS

By Type

Synthetic Segment Held Largest Share Owing to Its Key Role in Enhancing Glass Quality

Based on type, the market is segmented into synthetic and natural.

The synthetic segment held the largest soda ash market share by 82.22% in 2026. Synthetic type plays a crucial role in enhancing the quality and efficiency of glass. Its consistency and purity contribute to the creation of higher-quality glass with fewer defects, and it is designed to melt at specific temperatures to improve energy efficiency. The synthetic segment also enables the production of specialized glasses with unique properties. Furthermore, a synthetic type of product enhances the transparency and brightness of the final glass products by facilitating the removal of impurities in the silica. This is particularly important for applications requiring clear and defect-free glass, such as windows, bottles, and optical lenses.

The natural segment is expected to register significant growth during the forecast period. It is used as a key ingredient in detergents and cleaning products, where it softens water to enhance cleaning efficiency. Additionally, in the chemical industry, it serves as a raw material for producing various chemical compounds, including baking soda and sodium silicate. In environmental applications, it is instrumental in reducing acidity in water treatment processes, aiding in preserving aquatic life and ecosystems. Its use in the paper manufacturing industry as a pH regulator helps improve paper quality, making the production process more sustainable.

By Product Type

Dense Soda Ash Segment Dominated Due to Its Increasing Usage in Water Treatment

Based on product type, the market is classified into dense soda ash and light soda ash.

The dense soda ash segment held the largest market share in 2024. The segment is expected to acquire 66.79% of the market share in 2026. Dense sodium carbonate is a granular form of sodium carbonate with a higher bulk density compared to light sodium carbonate. It is specifically engineered for applications requiring strength, stability, and minimal dust generation. These properties make it ideal for glass manufacturing and industrial-scale processes. Dense sodium carbonate is also used in metallurgy, chemical production, and water treatment. Due to its higher density, dense sodium carbonate requires less storage space per ton compared to its light counterpart. It is also preferred in processes where precise feed control is essential for maintaining consistent product quality.

The light soda ash segment holds a significant share of the global market. The segment is likely to display a CAGR of 6.33% during the forecast period. The product, also known as light sodium carbonate, is a white, odorless, and fine-grained powder primarily used in industries that require chemical processing, blending, or solution preparation. Its lower bulk density makes it particularly suitable for applications where easy solubility and rapid mixing are important. This form of light sodium carbonate is widely used in the detergent, chemical, textile, and paper industries. In detergents, it functions as a water softener and pH regulator, enhancing the effectiveness of cleaning agents.

By Application

To know how our report can help streamline your business, Speak to Analyst

Glass Segment Led Market Due to Sustainable Construction Demand

Based on application, the market is classified into glass, soaps & detergents, chemicals, alumina & mining, and others.

The glass segment held the largest market share in 2024. The segment is expected to hold 61.16% of the market share in 2026. In the building and construction industry, glass produced using sodium carbonate plays a crucial role in windows and facades, enhancing natural light entry and energy efficiency. It is also used in insulation materials, contributing to thermal efficiency and promoting green building certifications. Glass is instrumental in creating decorative elements and safety features, such as fire-resistant and bulletproof glass, adding aesthetic and functional value to structures. Additionally, sodium carbonate-based glass is applied in solar panels, supporting the industry's shift toward sustainable energy solutions.

The chemicals segment is predicted to witness notable growth in the coming years. Sodium carbonate plays a crucial role in the chemical industry, notably in pH regulation and water softening, which are essential for many industrial processes. It is used to remove sulfur and phosphorus from various ores, which enhances the quality of the extracted metals. They are also involved in the processing and refining of alumina for aluminum production. In the production of soaps and detergents, it serves as a water softener to enhance cleaning efficiency. They stabilize pH levels, boost the effectiveness of detergents, and emulsify oil and grease, facilitating their removal.

The soaps & detergents segment is likely to display a CAGR of 6.49% during the forecast period.

SODA ASH MARKET REGIONAL OUTLOOK

By region, the market is studied across Asia Pacific, Latin America, North America, Europe, and the Middle East & Africa.

Asia Pacific

Asia Pacific Soda Ash Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific occupies the leading share of the global market and is poised to emerge as the fastest-growing region in the future. The regional market value in 2025 was USD 9.32 billion, and in 2023, the market value led the region by USD 15.28 billion. The growth is mainly fueled by the rising demand from the glass manufacturing industry, where soda ash is a key raw material. Additionally, the region's robust growth in the construction and automobile sectors further amplifies the demand for glass, consequently increasing demand for the product consumption. Expanding demand for detergents and cleaning agents in crowded countries, such as China and India, is contributing significantly to the soda ash market growth. The market in China is expected to hit USD 7.71 billion in 2026, whereas India is likely to reach USD 0.96 billion and Japan is projected to hit USD 0.24 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

The market in North America is growing due to its extensive use in the glass manufacturing industry, especially for container and flat glass production. North America region is to be anticipated as the fourth-largest market with USD 1.18 billion in 2026. Additional demand stems from its applications in detergents and soap manufacturing, along with the growing focus on water treatment processes. These industries' consistent growth and advancements in production technologies further propel market expansion in North America.

The market in the U.S. is primarily driven by the availability of large natural trona reserves. The U.S. market size is estimated to be USD 1.02 billion in 2026. The country produces the product mostly through natural methods, making it more sustainable and cost-effective. The country’s automotive and glass manufacturing industry is the largest consumer in this sector. Additionally, growing focus on water treatment is further boosting the market expansion.

Europe

Europe is projected to showcase substantial growth in the global market during the forecast period. The region is anticipated to account for the second-highest market size of USD 2.39 billion in 2026, exhibiting the second-fastest growing CAGR of 6.09% during the forecast period. The increase in the construction sector, particularly in Eastern Europe, is driving the demand for glass. The expanding automotive industry, which uses glass extensively, also supports the product need in Europe. Moreover, ongoing advancements in water treatment technologies, particularly for pH regulations, further contribute to the rising demand within the region. The market value in U.K. is expected to be USD 0.23 billion in 2025.

On the other hand, Germany is projecting to hit USD 0.55 billion and France is likely to hold USD 0.30 billion in 2025.

Latin America and Middle East & Africa

Latin America and the Middle East & Africa regions are forecasted to grow moderately during the assessment period. The Middle East & Africa is expected to be the third-largest market with a value of USD 0.51 billion in 2026. The escalating natural sodium carbonate production in countries such as Turkey contributes to market growth in the Middle East & Africa. Economic development and increasing consumer spending in Latin American countries further drive the demand for products, boosting market progress. Additionally, ecological regulations promoting cleaner methods and more sustainable industrial practices are encouraging inventions and adaptation within these regions, supporting long-term market growth. The Saudi Arabia is expected to be USD 0.07 billion in 2025.

Competitive Landscape

KEY INDUSTRY PLAYERS

Key Players Focus on Expansion Strategies to Increase Their Market Share

In terms of the competitive landscape, the market depicts the presence of established and emerging companies. Solvay, Şişecam, Tata Chemicals Ltd., Ciner Group, DCW Ltd., and NIRMA are some of the key players in this market. Key players in the market are investing heavily in advanced technologies to increase product output. Strategies such as higher operational efficiency and novel technology improvement are central to their growth initiatives. Additionally, major players focus on acquisition and expansion activities to increase their market share.

List of Key Soda Ash Companies Profiled

- Tata Chemicals Ltd. (India)

- Ciner Group (Turkey)

- NIRMA (India)

- Solvay (Belgium)

- DCW Ltd. (India)

- Shandong Haihua Group Co., Ltd. (China)

- Sudarshan Mineral (India)

- Şişecam (Turkey)

- Angel Chemicals Private Limited (India)

- Radhe Enterprise (India)

- InoChem (Saudi Arabia)

KEY INDUSTRY DEVELOPMENTS

- December 2023: Solvay introduced a new soda ash production process named e.Solvay process. This new technology promises to cut CO₂ emissions by 50%, reduce energy, water, and salt consumption by 20%, and decrease limestone use and residues by 30%.

- June 2023: Tata Chemicals announced a USD 968.0 million capex plan, including a 380 KT salt capacity addition in the U.K. and Mithapur, India. This would boost its global salt capacity to 2.3 MT and India’s to 1.8 MT. The investments aimed to support growth, sustainability, and increased production across key product lines.

- March 2023: Şişecam and Ciner Group announced a significant investment in port infrastructure in California, U.S., aimed at supporting the logistics needs of their expanding natural soda ash operations in the country.

- May 2022: Solvay acquired the remaining 20% minority stake from AGC in their Green River, Wyoming soda ash joint venture for USD 120 million, becoming the sole owner. This acquisition strengthens Solvay’s leadership in trona-based sodium carbonate production and supports its sustainability goals by expanding its supply of lower carbon-intensive sodium carbonate.

- September 2019: Solvay increased its soda ash production capacity by 600 KT at its Green River, Wyoming, U.S. facility to meet rising global demand, especially for glass manufacturing and lithium extraction.

REPORT COVERAGE

The research report provides a detailed market analysis and focuses on crucial aspects such as leading companies, types, product types, and applications. In addition, it provides quantitative data regarding volume and value, market analysis, research methodology for market data, insights into market trends, vital industry developments, and the competitive landscape. In addition to the abovementioned factors, the report encompasses various factors contributing to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Million Tons) |

|

Growth Rate |

CAGR of 6.5% during 2026-2034 |

|

Segmentation |

By Type

|

|

By Product Type

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 15.02 billion in 2025 and is projected to reach USD 26.54 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 9.32 billion.

Growing at a CAGR of 6.5%, the market is expected to exhibit rapid growth during the forecast period.

By application, the glass segment dominated the market in 2025.

Increasing infrastructure investments are a key factor driving market growth.

Asia Pacific dominates the market.

Increasing demand in glass manufacturing and its growing usage in automotive applications are expected to drive product adoption in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us