Submarines Wires and Cables Market Size, Share & Industry Analysis, By Cable Type (Communication Cables and Power Cables), By Component (Dry Plant Products and Wet Plant Products), By Service Offering (Installing and Commissioning, Maintenance, and System Upgrade), By Type (Single Core and Multicore), By End-User (Offshore Wind Power Generation Plants, Intercountry and Island Connection, and Offshore Oil and Gas Plants), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

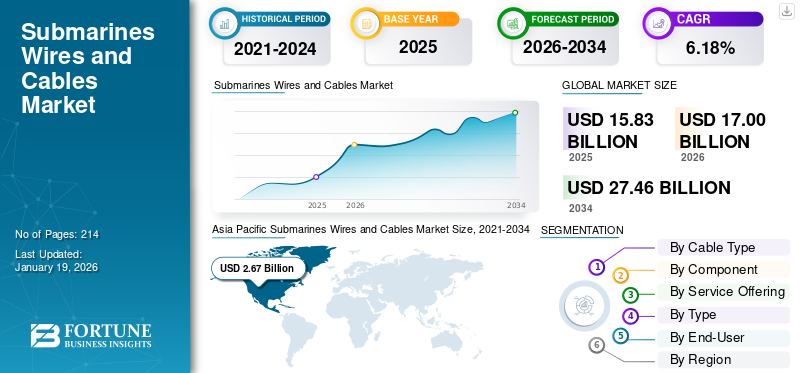

The global submarine wires and cables market size was valued at USD 15.83 billion in 2025. The global market is projected to grow from USD 17 billion in 2026 and is expected to reach USD 27.46 billion by 2034, exhibiting a CAGR of 6.18% during the forecast period. Asia Pacific dominated the submarine wires and cables market with a market share of 45.11% in 2025.

As the use of the internet, cloud computing, and digital services grows globally, there is an essential requirement for high-capacity, low-latency data links between continents and regions. Submarine cables constitute the foundation of this global data infrastructure, transmitting more than 95% of international internet traffic.

The establishment of offshore wind farms and various renewable energy initiatives necessitates strong submarine power cables to carry electricity from offshore locations to onshore networks. This is a significant element driving demand, especially in areas that are investing significantly in renewable energy. Submarines cables are used for cross border interconnectors to transmit electricity between countries.

Prysmian Group is the leading company in the market. It has continuously invested in expanding its production capacity, notably upgrading its plants in Italy and Finland. Prysmian plays a key role in major offshore wind and interconnection projects, supporting global energy transition. The company also focuses on innovation, including high-voltage DC technology for long-distance subsea transmission.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand for High-Speed Internet to Drive Market Growth

The submarine cables market growth is witnessing strong development, mainly driven by the rising demand for high-speed internet, increase of cloud services, and growth of hyper-scale data centers. Submarine fiber-optic cables serve as the foundation of worldwide data communication, linking continents and facilitating the framework for global telecommunication, cloud computing, and the implementation of 5G.

Significant technology firms such as Google, Amazon, and Meta (previously known as Facebook) are making substantial investments in exclusive submarine cable networks to boost data capacity, lower latency, and improve the dependability of their worldwide services.

SUBMARINE WIRES AND CABLES TRENDS

Growth in Offshore Wind Power Projects to Drive the Market Growth

Growth in offshore wind power projects is one of the major trends in the submarines wires and cables market growth. As countries expand their offshore wind capacity to meet renewable energy targets, there is a rising need for high voltage submarine power cables to transmit electricity from offshore turbines to onshore grids. These cables ensure efficient and reliable energy transfer over long distances and in deep water environments. With major offshore winds developments underway in Europe, China, U.S., and South Korea, demand for submarine cabling is set to surge, making it a vital component of clean energy infrastructure.

MARKET RESTRAINTS

High Installations and Maintenance Cost to Hinder Market Growth

Installing submarines cables requires significant capital investment because of the complex nature of deep-sea installation, specialized ships, and sophisticated technology involved. Maintenance is expensive and complex since repairs frequently necessitate dispatching vessels to distant ocean sites, resulting in extended service outages and elevated operational costs. Submarine cables cross through international waters and various jurisdictions, making them vulnerable to geopolitical threats such as territorial conflicts and national security issues.

MARKET OPPORTUNITY

Investment from Major Technology and Telecom Players to Boost the Market Development

Global technology firms such as Google and Meta are making significant investments in undersea fiber optic cables linking to India. This action places them in direct rivalry with prominent Indian data providers such as Reliance Jio, Bharti Airtel, and Tata Communications, particularly as the expansion of data centers is advancing quickly.

Google is set to introduce its Blue-Raman Submarine Cable System in Mumbai during the first quarter of 2025. The Blue and Raman initiative, which has a budget of USD 400 million and a capacity of 218 terabits per second, additionally features investment from the Italian Firm Sparkle.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Cable Type

Global Digital Infrastructure to Drive the Communication Cable Segment’s Growth

Based on cable type, the market is segmented into communication cables and power cables.

Communication cables are the fastest-growing segment in the market. Submarines communication cables are fiber optic cables laid on the seabed, connecting continents and enabling international internet, voice, and data traffic. The submarine communication cables are growing due to several interconnected drivers related to global digital infrastructure, data consumption, and geopolitical developments.

By Component

Surge in Higher Costs of Dry Plants to Lead the Market Share

By component, the market is segmented into dry plant products and wet plant products.

Dry plant products dominate the market share. Dry plant products referring to dry type or land-based connections within submarines cable systems, such as landing stations, transition joints, or associated onshore infrastructure, encompass higher and mandatory costs leading to a higher share in the market. Each new subsea cable requires a complete dry plant setup at both ends.

By Service Offering

Expansion in Emerging Markets to Drive the Installation and Commissioning Growth

By service offering, the market is segmented into installation and commissioning, maintenance, and system upgrade.

Installation and commissioning to dominate the market share. Regions including Africa, Southeast Asia, the Middle East, and Latin America, are installing new submarines wires and cables to improve connectivity. These markets rely heavily on turnkey installation and commissioning services from specialized providers.

By Type

Rapid Growth of Offshore Wind Farms to Drive the Single Core Growth

By type, the market is segmented into single-core and multicore.

Single core to dominate the market share. Offshore wind farms need high voltage single-core power cables to transmit electricity from turbines to offshore substations and then to onshore grids.

By End-User

High demand for Power Transmission to Drive Offshore Wind Power Generation Plants Growth

By end-user, the market is segmented into offshore wind power generation plants, intercountry and Island connections, and offshore oil and gas plants.

Offshore wind power generation dominates the market share. Offshore wind farms are often located 30-100 Km or more from the coast to tap into strong, consistent wind. This requires high-voltage submarine export cables (both HVAC and HVDC) to transmit power efficiently over long distances.

SUBMARINES WIRES AND CABLES MARKET REGIONAL OUTLOOK

The market has been analyzed regionally into: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America

The increase in internet use, cloud computing, IoT devices, and high-bandwidth applications including video streaming, is creating a significant demand for high-speed, dependable international connectivity. Submarine communication cables are crucial for managing this growing data traffic, as they offer the foundation for global internet and telecommunications infrastructure. Investments from technology leaders and content providers additionally propel this expansion to guarantee bandwidth and robustness. Medium voltage cables are mainly used in underwater power cables designed to transmit electrical energy at medium voltage levels, typically ranging from 1 kV to 35 kV in the region.

U.S.

The U.S. is among the countries that keep the highest defense budgets in the world. A large part of this budget is dedicated to the naval domain, with undersea warfare being identified as a top priority to deal with adversaries like China and Russia. As a result, there is a very significant need for the production of submarine wiring and cabling systems that are specialized.

US leadership in AI and other advanced technologies is the primary goal of the move, which involves the global underwater communication cable system that transports nearly 99% of all Internet data and enables daily financial transactions worth more than $10 trillion.

Europe

The EU manages 39 cables that solely link member nations, mainly in Northern Europe (31 cables connecting countries surrounding the Baltic Sea) and Southern Europe (8 cables linking Mediterranean countries and islands such as Malta). The most extensive submarines wires and cable initiative worldwide (~45,000 km), linking Europe (France, Spain, Portugal, Italy) to Africa and the Middle East, is anticipated to be operational in 2024 with a capacity of up to 180 Tbps.

Asia Pacific

Asia Pacific Submarines Wires and Cables Market Size, 2021-2034 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is the dominating region in the market owing to the rising population and economic growth. A 12,000 km Pan-Asia underwater cable network connecting Japan, Korea, Taiwan, Hong Kong, the Philippines, Indonesia, Singapore, Malaysia, and Thailand. It includes two fiber pairs with a designed capacity of 5 Gbps and was the initial SDH-enabled submarine cable in the area, functioning since 1997. Furthermore, it features an extension to Australia referred to as the Jasuruas cable system. Completed in 2024 by NEC, this advanced submarine cable stretches roughly 10,000 kilometers, linking China, Japan, the Philippines, Singapore, Thailand, and Vietnam. It includes several pairs of high-capacity optical fibers with a design capacity surpassing 160 Tbps, showcasing the most recent intra-Asia cable infrastructure.

Latin America

SAC (South American Crossing) is a 20,000 km circular network featuring various landing sites throughout Latin America, such as Argentina, Brazil, Chile, Panama, Peru, and Venezuela. It employs DWDM technology and links significant cities through both submarine and land-based connections. SAC-2, which is a component of the Firmina system, expands connectivity from North America to Argentina, improving throughput and redundancy for local networks.

Middle East and Africa

The increase in data traffic driven by smartphone usage, cloud computing, and the Internet of Things requires high-capacity submarine communication cables to bolster regional digital economies. Initiatives such as 2Africa (which connects 33 nations) and Umoja (which connects Africa to Australia) emphasize investments in undersea connectivity to enhance internet speeds and access, which research correlates with GDP growth and job creation. The strategic position of the Middle East as a global data center between Europe, Asia, and Africa supports investments in submarine cables to guarantee low-latency communication. Africa’s emphasis on intracontinental connectivity (for example, the Equiano cable) seeks to reduce internet expenses and stimulate technology innovation centers.

COMPETITIVE LANDSCAPE

Key Industry Players

Advancement and Utilization of Better Insulating Materials in Wires and Cables to Increase Market Growth

Nexans has recently grown its high voltage subsea cable facility in Halden, Norway, more than doubling its ability for high voltage direct current (HVDC) extruded cables. This expansion features a new 152. 89-meter high extrusion tower, Norway's tallest structure, allows for the simultaneous insulation of four cables, thereby improving production efficiency and output.

In February 2022, Nexans Obtains Contract to Provide HV Submarines Power Cables for Offshore Initiative in Arabian Gulf.

List of the Key Submarines Wires and Cables Companies Profiled in the Report

- Nexans (France)

- NEC Corporation (Japan)

- Prysmian Group (Italy)

- NKT A/S (Denmark)

- ZTT (China)

- HENGTONG GROUP CO., LTD (China)

- ALCATEL SUBMARINE NETWORKS (France)

- SubCom, LLC (U.S.)

- Sumitomo Electric Industries, Ltd. (Japan)

- LS Cables & System Ltd. (South Korea)

- Tratos (Italy)

- OCC Corporation (China)

KEY INDUSTRY DEVELOPMENTS

- In February 2025, Bharti Airtel announced that it had finalized the landing of the new SEA-ME-WE 6 submarine cable system in Chennai. The cable landing in both Mumbai and Chennai will be completely integrated with Airtel's data center division, Nxtra by Airtel, at its extensive facilities in the respective cities.

- In December 2024, NKT is increasing the capacity of its high-voltage submarine power cable factory located in Karlskrona, Sweden, by constructing a 200-meter tall cable tower. The manufacturing process will operate continuously, making the assurance of a reliable power supply a primary concern.

- In December 2024, Hellenic Cables, the cable division of Cenergy Holdings, was awarded a turnkey contract by IPTO (Independent Power Transmission Operator) for the design, provision, and installation of 150kV XLPE underground and submarine cables.

- In October 2022, NEC Corporation entered into a charter agreement with U.K.-based Global Marine Systems Limited (*1) for an optical submarine cable installation vessel for around four years.

- In September 2022, APAR Industries Ltd., an Indian producer of cables, conductors, lubricants, and specialty oils, has recently created specialized submarine cables for the Indian defense industry.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product/service processes, competitive landscape, and leading sources of submarines, wires, and cables. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.18% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Cable Type

|

|

By Component

|

|

|

By Service Offering

|

|

|

By Type

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 15.83 billion in 2025.

In 2025, the Asia Pacific market value stood at USD 7.14 billion.

The market is expected to exhibit a CAGR of 6.18% during the forecast period.

The offshore wind power generation plants segment led the market by end users.

Rising demand for high-speed internet and cloud services to drive market growth.

Some of the top major players in the market are NEC Corporation, Nexans, and Prysmian Group.

Asia Pacific dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us