Surgical Cosmetic Procedures Market Size, Share & Industry Analysis, By Procedure (Breast Augmentation [Breast Implants {Saline Breast Implants and Silicone Breast Implants}, and Tissue Expanders], Liposuction, Eyelid Surgery, Abdominoplasty, Rhinoplasty, and Others), By Gender (Female, and Male), By Age Group (18 Years & Younger, 19 to 34 Years, 35 to 50 Years, 51 to 64 Years, and 65 Years and Above), By Provider (Hospitals & Specialty Clinics and Spas & Cosmetic Surgery Centers), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

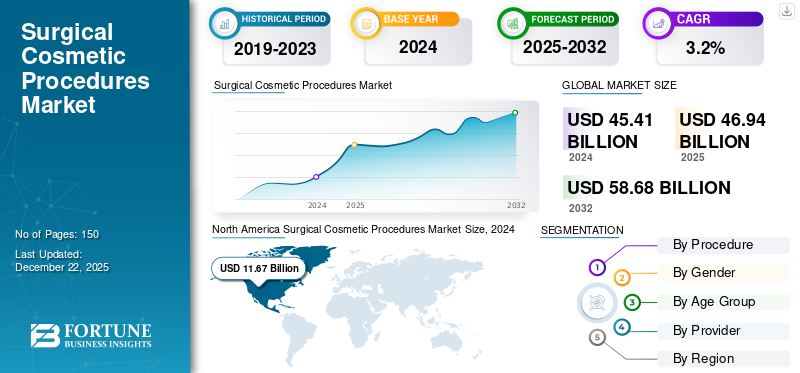

The global surgical cosmetic procedures market size was valued at USD 46.94 billion in 2025. The market is projected to grow from USD 48.45 billion in 2026 to USD 62.84 billion by 2034, exhibiting a CAGR of 3.30% during the forecast period. North America dominated the surgical cosmetic procedures market with a market share of 66.85% in 2025.

Surgical cosmetic procedures are being performed globally to enhance and reshape specific body parts. They can include procedures such as rhinoplasty, abdominoplasty, breast augmentation, etc. Cosmetic surgical procedures aim to change a person's appearance and address cosmetic concerns. The global market is driven by increasing awareness about aesthetic procedures, a growing number of cosmetic surgeries, and rising disposable income & beauty consciousness.

- For example, according to the American Society of Plastic Surgeons (ASPS) 2024 report, published in September 2024, around 304,181 breast augmentation procedures were performed in the U.S. as of September 2023. This number was increased to 306,196 by September 2024.

Furthermore, the market comprises several small and mid-size companies, including Johnson & Johnson Services, Inc., GC Aesthetics, MicroAire, Tiger Aesthetics Medical, LLC, and Establishment Labs. These market players are focusing on attending medical conferences to create consumer product awareness.

- For instance, in June 2025, GC Aesthetics participated in the ISAPS Olympiad World Congress 2025, from 18th to 21st June 2025, at the Sands Expo & Convention Centre at Marina Bay Sands, Singapore. During the event, the company showcased its complete portfolio of cosmetic products, including breast implants.

MARKET DYNAMICS

Market Drivers

Rising Number of Surgical Cosmetic Procedures and Minimally Invasive Surgeries are Driving Market Growth

The rising number of plastic surgeries is significantly contributing to the growth of the overall market. The surgical procedures include breast augmentation, liposuction, eyelid surgery, and rhinoplasty. The rising preference for these treatments increases patient volumes and drives the surgical cosmetic procedures market growth.

- For example, as per the data provided by the International Society of Aesthetic Plastic Surgery in June 2024, around 2.2 million liposuctions and 1.1 million rhinoplasty procedures were performed in 2023 across the globe.

Furthermore, minimally invasive cosmetic surgeries are associated with less pain and provide shorter recovery times. Due to these facts, consumers are adopting minimally invasive procedures, thereby driving market growth.

- For example, as per the data provided by the American Society of Plastic Surgeons in June 2024, nearly 25.4 million cosmetic minimally invasive procedures were performed in the U.S. in 2023.

Market Restraints

Risks of Post-operative Complications and Availability of Alternatives are Hindering Market Growth

Despite technological advancements, surgical procedures still carry risks such as infections, scarring, nerve damage, and unsatisfactory results, leading to the discouragement of patients.

- For example, as per the data provided by the U.S. Food & Drug Administration in December 2023, the complications and adverse outcomes of breast implants include capsular contracture, breast implant-associated anaplastic large cell lymphoma (BIA-ALCL), breast cancer, connective tissue disease, and many others.

Furthermore, the availability of non-surgical procedures, such as Botox, dermal fillers, laser treatments, and many others, is gaining popularity as they are less risky, more affordable, and require minimal downtime, drawing attention from surgical options.

Market Opportunities

Growing Awareness About Surgical Cosmetic Procedures via Campaigns Considered a Significant Growth Opportunity

The growing cosmetic & dermatology specialty administrations focus on organizing campaigns to create awareness among consumers regarding cosmetic procedures' benefits, safety, and efficacy, creating growth opportunities for market players. In addition, the companies are also showcasing their cosmetic product portfolio in campaigns to create brand awareness among consumers.

- For example, in May 2023, the American Cosmetic Association announced the launch of the "Cosmetic & Plastic Surgery Awareness Day" campaign. The campaign took place on 11th May 2023 to promote cosmetic and plastic surgery awareness. This campaign featured educational events, social media campaigns, and informative resources designed to help individuals make informed decisions about cosmetic and plastic surgery.

Market Challenges

High Cost of Cosmetic Treatments in Developed Countries is Key Challenge Restricting Market Expansion

Surgical cosmetic procedures are expensive in developed nations, such as the U.S. and the U.K., compared to other countries due to various factors, including the cost of the products, the provider's expertise, geographic location, and the demand for cosmetic procedures. These are some of the main challenges faced by market players in recent years.

- For example, as per the data provided by HAYATMED Health & Beauty, in the U.K., the average cost of breast implants is USD 3,831.4 to USD 8,940.0, not covering all services. The surgery alone is around USD 4,597.7, with the surgeon's fee ranging from USD 3,831.4 to USD 11,494.3, depending on the location.

- Also, as per the same source, in Australia, breast implant prices range from USD 6,596.3 to USD 9,894.5, covering all services. The surgeon's fee is about USD 4,287.6.

Therefore, the high cost of cosmetic procedures and related products limits their adoption in lower-income countries, hampering the market growth.

Rise in Number of Cosmetic Surgeries Performed by Underqualified Practitioners is Hampering Market Growth

One of the critical challenges facing the market is the increasing number of procedures being performed by under-qualified or unlicensed practitioners. This significantly raises the risk of complications, poor surgical outcomes, and patient dissatisfaction, ultimately damaging the market growth.

Download Free sample to learn more about this report.

SURGICAL COSMETIC PROCEDURES MARKET TRENDS

Growing Medical Tourism for Surgical Cosmetic Treatments in Developing Nations Drives Market Trends

Medical tourism in cosmetic surgery has grown exponentially over the last decade. The rising demand for cosmetic procedures is mainly due to the lower cost of these treatments in some countries. Several countries, namely Turkey, Mexico, South Korea, Thailand, and many others, have been the preferred locations for cosmetic procedures for the past few years. This is due to high-quality treatments and affordable pricing provided by these nations for cosmetic surgeries such as breast augmentation, rhinoplasty, and many others. Moreover, developing nations have advanced clinics with technologically advanced equipment for cosmetic procedures that attract more individuals for aesthetic procedures.

- For example, according to HayatMed clinic specializing in cosmetic and restorative care, breast surgery costs in Turkey range from USD 3,950.2 to USD 4,491.3, including surgery, premium implants, VIP transfers, and aftercare. On the other hand, the average breast surgery price ranges from USD 6,500 to USD 15,000 in the U.S. (including only surgery).

- As per the data provided by the World Tourism Forum Institute in March 2025, South Korea has cemented its status as the global capital of beauty tourism, attracting over 100,000 international visitors annually for cosmetic procedures and skincare treatments. The country's medical tourism industry is flourishing with its pioneering aesthetic innovations and the influence of K-beauty trends.

Rising Demand for Natural-Looking Outcomes Creates New Market Trends

The rising people's preference for natural-looking results over dramatic or overly enhanced appearances is one of the major trends enhancing market growth. In recent years, the younger population has been looking for cosmetic surgeries that subtly enhance their features, intending to look refreshed and authentic rather than overdone.

SEGMENTATION ANALYSIS

By Procedure

Increasing Regulatory Approvals of Breast Implants Globally are Responsible for Dominance of Breast Augmentation Segment

Based on procedure, the market is segmented into breast augmentation, liposuction, eyelid surgery, abdominoplasty, rhinoplasty, and others. The breast augmentation segment is further divided into breast implants and tissue expanders. Moreover, the breast implants segment is further categorized into saline breast implants and silicone breast implants.

The breast augmentation segment dominated the global market in 2024 and is anticipated to grow at a considerable CAGR during the forecast period. The increasing regulatory approvals and the launch of breast implants used to perform breast augmentation procedures are some of the main factors driving the segment's growth.

- For instance, in May 2024, Bimini Health Tech received the U.S. Food and Drug Administration (FDA) approval to launch our rebranded Puregraft Serene Breast Implants in the U.S. market.

On the other hand, the eyelid surgery segment is anticipated to grow at the highest CAGR during the forecast period. The segment's growth is mainly attributed to the rising number of people undergoing eyelid surgeries to enhance their appearance.

- For example, as per the data provided by the International Society of Aesthetic Plastic Surgery in June 2024, nearly 1.7 million people underwent eyelid surgeries in 2023 across the globe.

Moreover, the liposuction segment held a moderate market share in 2024 and is projected to grow at a moderate CAGR from 2025 to 2032. Technological advancements in liposuction devices and the growing popularity of liposuction procedures among a larger population are important factors driving segmental growth.

Furthermore, the rhinoplasty segment is expected to grow at the second-largest CAGR from 2025 to 2032, owing to growing consciousness about physical appearance among the young population.

By Gender

Female Segment to Dominate Market Due to Higher Demand for Aesthetic Procedures Among Women

Based on gender, the market is categorized into female and male.

The female segment is projected to hold the dominant share of the market throughout the forecast period. This growth is primarily attributed to the higher demand for aesthetic procedures among women, leading to the high proportion of females undergoing cosmetic procedures.

- For instance, as per the data provided by the International Society of Aesthetic Plastic Surgery in September 2023, around 85.7% of the total number of aesthetic procedures were done on females in 2022, and only 14.3% were done on males.

On the other hand, the male segment is anticipated to grow considerably throughout the forecast period. The considerable growth in male patients undergoing surgical cosmetic treatments to enhance their appearance is one of the main factors driving segmental growth during the forecast period.

- For example, as per the data provided by the International Society of Aesthetic Plastic Surgery in June 2024, around 352,302 gynecomastia and 339,086 liposuction procedures were performed on males in 2023 across the globe.

By Age Group

35 to 50 Years Segment Dominated Market Due to the High Adoption Rate of Non-surgical Cosmetic Treatment Compared to Other Age Groups

Based on age group, the market is categorized into 18 years & younger, 19 to 34 years, 35 to 50 years, 51 to 64 years, and 65 years and above.

The 35 to 50 years segment dominated the global market in 2024 and is anticipated to grow at the highest CAGR during the forecast period. The growth of this segment is primarily attributed to the fact that the population of 35 to 50 years has a higher tendency to adopt innovative cosmetic procedures than other age groups.

- For example, as per the data provided by the International Society of Aesthetic Plastic Surgery in June 2024, approximately 700,328 women aged between 35-50 years went for breast augmentation procedures globally.

The 19 to 34 years segment is projected to grow at the second-largest CAGR from 2025-2032. The segment's growth is primarily attributed to the fact that the individuals of this age group are aesthetically focused and highly active on social media platforms, increasing their interest in cosmetic procedures.

Furthermore, the 51 to 64 years segment is expected to grow moderately during the forecast period. The higher interest of this age group in addressing signs of aging and maintaining a youthful appearance through surgical procedures (rather than non-surgical) that minimize wrinkles and rejuvenate the face is driving segmental growth.

By Provider

Hospitals & Specialty Clinics Led due to the Higher Number of Cosmetic Procedures Performed in These Facilities

On the basis of provider, the market is categorized into hospitals & specialty clinics and spas & cosmetic surgery centers.

The hospitals & specialty clinics segment dominated the market by accounting for the major global surgical cosmetic procedures market share in 2024. The dominance of this segment is mainly attributed to the increasing number of inpatient and outpatient admissions in hospitals & specialty clinics for cosmetic procedures. For example, as per the data provided by the International Society of Aesthetic Plastic Surgery in September 2023, approximately 47.4% of cosmetic procedures were carried out in hospitals and 31.1% in specialty clinics worldwide in 2022.

The spas & cosmetic surgery centers segment is expected to grow considerably during the forecast period. The growth of the segment is mainly attributed to the increasing number of medical spas and cosmetic surgery centers across the globe.

- For example, as per the data provided by the American Society for Dermatologic Surgery, Inc. in October 2023, the growth of medical spas in the U.S. is exponential. In 2021, the American Medical Spa Association reported 7,430 spas in the U.S., which increased to 8,841 in 2022.

SURGICAL COSMETIC PROCEDURES MARKET REGIONAL OUTLOOK

In terms of region, the global market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Surgical Cosmetic Procedures Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 12.14 billion in 2025 and USD 12.53 billion in 2026. The region accounted for 66.85% market share in 2025. The presence of advanced healthcare infrastructure, high concentration of licensed practitioners, and increasing acceptance of aesthetic procedures are important factors driving market growth in this region.

Moreover, the growing launch of cosmetic products used to perform surgical cosmetic procedures is one of the important factors driving market growth in the U.S.

- For example, in May 2025, Johnson & Johnson Services, Inc. announced the launch of MENTOR MemoryGel Enhance Breast Implants in the U.S. market.

Europe

Europe accounted for the third-largest share of the market in 2024, owing to the increasing number of people undergoing surgical cosmetic procedures across Europe.

- For example, as per the data provided by the British Association of Aesthetic Plastic Surgeons (BAAPS) in April 2025, around 5,202 breast augmentation procedures and 3,138 blepharoplasties (eyelid surgeries) were performed in the U.K. in 2024.

Asia Pacific

The market in the Asia Pacific region is anticipated to grow at the second-largest CAGR throughout the forecast period. The market growth in this region is primarily attributed to the availability of various medical information platforms linking users and healthcare providers across Asia Pacific countries. Also, increasing awareness about cosmetic procedures that enhance aesthetics is another factor driving market growth in this region.

- For instance, Gangnam Unni, South Korea's leading beauty and medical information platform, linked more than 6.7 million users with 3,700 dermatology and plastic surgery clinics across South Korea and Japan in 2024.

Latin America

Latin America accounted for the second-largest share of the market in 2024. The market in this region is expected to grow at the highest CAGR throughout the forecast period. The market growth in this region is primarily attributed to the rise in the number of surgical cosmetic procedures performed across Latin American countries.

- For example, as per the data provided by the International Society of Aesthetic Plastic Surgery in June 2024, nearly 2.2 million surgical cosmetic procedures were performed in 2023 in Brazil.

Middle East & Africa

The market in the Middle East & Africa is expected to grow steadily throughout the forecast period. The market growth in this region is mainly attributed to the presence of many cosmetic surgery clinics providing aesthetic treatments.

COMPETITIVE LANDSCAPE

Key Industry Players

Growing Market Players’ Emphasis on New Product Launches to Enhance their Product Portfolio

The market consists of key companies such as Johnson & Johnson Services, Inc., MicroAire, POLYTECH Health & Aesthetics GmbH, and MTF Biologics, among others, providing an extensive range of cosmetic products for surgical cosmetic surgeries. The rising market players' focus on launching new products in the global market is one of the important factors contributing to their substantial position in the global market.

- For instance, in September 2024, POLYTECH Health & Aesthetics GmbH announced the launch of Opticon Plus Breast Implant in the European market to expand its aesthetic portfolio.

Moreover, companies such as Black & Black Surgical, Marina Medical Inc., and KARL STORZ SE & Co. KG are entering into strategic collaborations and acquisitions to expand their geographic footprint in the global market.

List of Key Surgical Cosmetic Procedure Companies Profiled

- Johnson & Johnson Services, Inc. (U.S.)

- Black & Black Surgical (U.S.)

- MicroAire (U.S.)

- Marina Medical Inc. (U.S.)

- Tiger Aesthetics Medical, LLC (U.S.)

- KARL STORZ SE & Co. KG (Germany)

- POLYTECH Health & Aesthetics GmbH (Germany)

- MTF Biologics (U.S.)

- Establishment Labs (Costa Rica)

- GC Aesthetics (Ireland)

KEY INDUSTRY DEVELOPMENTS

- March 2025 - POLYTECH Health & Aesthetics GmbH announced the establishment of a direct subsidiary in the U.K. This strategic investment reinforced POLYTECH's commitment to providing world-class aesthetics and breast reconstruction solutions in one of Europe's most important markets.

- February 2025 - POLYTECH Health & Aesthetics GmbH established direct operations in Sweden, Finland, and Denmark. This strategic move enhanced the company's ability to foster closer relationships with leading plastic surgeons while providing seamless access to world-class educational resources and expertise in product applications.

- December 2024 - GC Aesthetics announced the initiation of a significant multi-center and prospective clinical study in Europe to evaluate and confirm the safety, effectiveness, and patient satisfaction associated with the innovative PERLE smooth opaque round breast implant.

- November 2023 - Establishment Labs received National Medical Products Administration (NMPA) approval in China for Motiva implants.

- September 2020 - POLYTECH Health & Aesthetics GmbH announced the launch of unique B-Lite lightweight breast implants in the European market.

REPORT COVERAGE

The global surgical cosmetic procedures market report provides a detailed competitive landscape and market insights. In addition to the global market size, it covers regional analysis of different market segments, profiles of key market players, and market dynamics. Moreover, the market report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.30% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Procedure

|

|

By Gender

|

|

|

By Age Group

|

|

|

By Provider

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 46.94 billion in 2025 and is projected to reach USD 62.84 billion by 2034.

In 2025, the market value in North America stood at USD 12.14 billion.

The market will exhibit steady growth at a CAGR of 3.30% during the forecast period (2025-2032).

By procedure, the breast augmentation segment led the market.

The rising number of surgical cosmetic procedures and the growing adoption of minimally invasive surgeries drive market growth.

Johnson & Johnson Services, Inc., MicroAire, POLYTECH Health & Aesthetics GmbH, and MTF Biologics are the major players operating in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us