Synthetic Absorbable Sutures Market Size, Share & Industry Analysis, By Product (Monofilament and Multifilament/Braided), By Material (Polyglactin 910, Poliglecaprone 25, Polydioxanone, and Others), By Application (Gynecology, Orthopedics, Cardiology, General Surgery, and Others), By End-user (Hospitals & ASCs, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

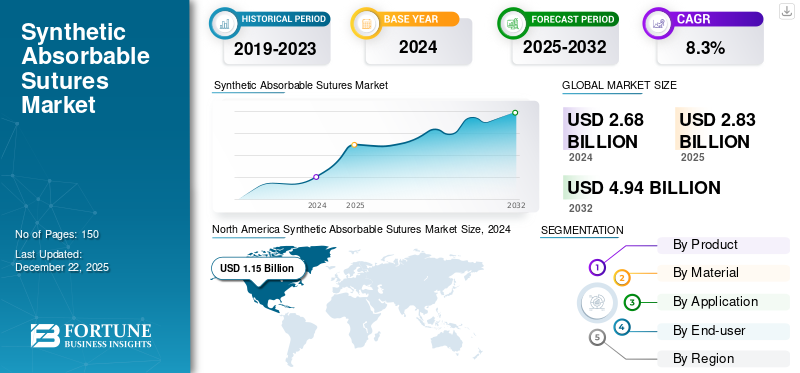

The global synthetic absorbable sutures market size was valued at USD 2.83 billion in 2025 and is projected to grow from USD 3 billion in 2026 to USD 5.99 billion by 2034, exhibiting a CAGR of 9% during the forecast period. North america dominated the synthetic absorbable sutures market with a market share of 42.64% in 2025.

Synthetic absorbable sutures are made from synthetic materials such as Polyglactin 910, Poliglecaprone 25, and others, and are designed to be absorbed by the body over time. These sutures are used to close wounds or incisions in the body. They are mainly useful in surgeries where removing the suture material after the wound has healed is difficult.

The market growth is driven by a rise in the number of surgeries across the globe, which require synthetic resorbable sutures to perform surgeries.

- For instance, as per the data published by the World Health Organization (WHO) in June 2021, around 21.0% of all childbirths were performed by cesarean section (C-section) worldwide in 2020. This proportion of childbirths by C-section is anticipated to increase to 29.0% by the end of 2030.

The market consists of different key companies such as Dolphin Sutures, Lotus Surgicals Pvt Ltd., Johnson & Johnson Services, Inc., Medico, B. Braun SE, and Suture Planet. These companies are emphasizing on participating in medical conferences to create brand awareness among consumers.

MARKET DYNAMICS

Market Drivers

High Burden of Surgical Procedures Worldwide to Augment the Market Growth

The rising volume of surgical procedures worldwide significantly drives the synthetic absorbable sutures market growth. As healthcare infrastructure improves and access to medical care expands, there has been a significant increase in both elective and emergency surgeries. These include procedures such as cesarean sections, appendectomies, orthopedic repairs, and cardiovascular interventions, all of which require effective wound closure solutions. The synthetic dissolvable sutures are increasingly preferred in these surgeries due to its greater absorption rate, high tensile strength, and reduced risk of adverse tissue reactions compared to natural sutures.

- For example, as per the information revealed by the Mass General Brigham Incorporated, in November 2024, more than 900,000 cardiac surgeries have been performed every year in the U.S.

- Similarly, according to information provided by the GOV.U.K. in May 2024, around 37.8% of deliveries were performed by caesarean section in the U.K. in 2023.

- Also, as per the data provided by the National Center for Biotechnology Information (NCBI) in November 2023, the 728 hospitals of China (including Hong Kong) performed 71,693 surgeries for congenital heart diseases.

Moreover, the growing aging population continues to drive surgical demand for procedures including angioplasty, joint replacements, and many others, thereby contributing to market growth.

Market Restraints

The Increasing Preference for Advanced Wound Closures over Synthetic Absorbable Sutures is Restricting Market Growth

The increasing healthcare professionals' reliance on alternative wound closure techniques, limits the adoption of synthetic dissolvable sutures. The healthcare providers are preferring alternatives, such as tissue adhesives, hemostats, and surgical staplers due to their multiple benefits, such as rapid application, reduced tissue trauma, and improved surgical outcomes. Furthermore, the skin staplers are widely used in emergency surgeries for rapid closure, as they significantly reduce operating time.

- For instance, as per the data published by the Suture Planet in February 2025, the surgical staplers enable quicker application, ensuring secure closure, reducing infection risks, and tissue damage.

Consequently, the increasing use of alternatives such as surgical staples, adhesive tapes, and tissue sealants by healthcare professionals is expected to restrain the market growth over the forecast period.

Market Opportunities

The Growth in Medical Infrastructure Across Developing Nations Presents Substantial Opportunity for Market Expansion

The rapidly evolving healthcare infrastructure, especially in developing nations, is creating substantial opportunities for the synthetic absorbable sutures market growth. This growth is primarily driven by the rise in number of surgeries and growing adoption of synthetic sutures for wound closure, as they are associated with a lower risk of infection than natural sutures. Additionally, establishing new hospitals and specialty clinics in developing nations further supports the market growth.

- In June 2025, Inamdar Multispecialty Hospital announced the launch of a new Dental & Face Surgery Clinic in Pune, India, to provide 24/7 emergency care to the patients.

- In June 2025, Hospitales MAC extended its presence in the State of Mexico by launching a new facility in Naucalpan, rebranding the former Río de la Loza hospital as Hospital MAC Lomas Verdes. This new hospital would provide advanced medical care for patients suffering from chronic diseases.

Therefore, improving hospital infrastructure is important in enhancing surgical procedure volume by enhancing access, expanding infrastructure, and offering advanced care. As the volume of surgeries increases, the demand for synthetic absorbable sutures rises, surging market growth.

Market Challenges

Post-surgical Complications of Synthetic Resorbable Sutures is a Key Market Challenge

Although synthetic absorbable sutures are widely used due to their predictable absorption rates and reduced need for suture removal, they are associated with some limitations. One of the major concern is post-surgical complications, such as inflammatory responses, allergic reactions, wound dehiscence, and infections at the suture site. These issues arise due to individual patient sensitivity to suture materials, improper technique, or use in high-tension wounds. These complications affect the adoption of synthetic resorbable sutures among healthcare providers.

SYNTHETIC ABSORBABLE SUTURES MARKET TRENDS

Increasing Launch of Technologically Advanced Synthetic Absorbable Sutures is the Global Market Trend

The synthetic absorbable sutures market is growing significantly due to ongoing technological innovations, including bioengineered and antimicrobial-coated resorbable sutures. These advancements are gaining traction due to increasing regulatory approvals, leading to product launches and rising awareness about the clinical benefits of these sutures among surgeons.

- For instance, in September 2023, Genesis MedTech obtained regulatory approval from China's National Medical Products Administration (NMPA) for the market launch of its resorbable sutures with antibacterial protection.

Moreover, the knotless absorbable sutures have been rapidly adopted in minimally invasive orthopedic, cardiovascular, and laparoscopic surgeries, where precise tension and reduced tissue trauma are critical. Surgeons across the globe favor these sutures for their ability to minimize the risk of infection, eliminate the need for suture removal, and provide consistent wound closures without the complexities of knot tying. These are some of the important market trends enhancing market growth.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Product

The Benefits Associated with Multifilament/Braided Sutures are Responsible for the Segment’s Dominance

Based on product, the market is segmented into monofilament and multifilament/braided.

The multifilament/braided segment is expected to dominate the market throughout the forecast period. The multifilament resorbable sutures offer various advantages, such as high tensile strength, superior handling characteristics, and greater knot security. Due to these advantages, medical professionals prefer multifilament sutures for surgical procedures, driving the segment's growth in the forthcoming years.

- For instance, according to the article published by Peters Surgical in July 2024, braided multifilament sutures are commonly used in cardiac surgery and for securing prosthetic materials owing to their superior tensile strength.

On the other hand, the monofilament segment is estimated to grow considerably during the forecast period. The extensive use of monofilament sutures in vascular and microvascular surgeries due to their lower friction coefficient makes them easy to pass through tissues, thus enhancing the segment's growth.

By Material

The Increasing Launch of Polyglactin 910 Synthetic Sutures by Market Players Leads to its Dominance

Based on material, the market is divided into polyglactin 910, poliglecaprone 25, polydioxanone, and others.

The polyglactin 910 segment is expected to dominate the market from 2025 to 2032, and accounted for the major global synthetic absorbable sutures market share in 2024. The increasing market players' focus on launch of novel synthetic sutures made up of polyglactin 910 is one of the important factors driving the segmental growth.

- For instance, in August 2023, Healthium Medtech Limited launched TRUMASTM, a range of synthetic absorbable sutures designed to address challenges faced during suturing in minimal access surgeries across the Indian market.

Furthermore, the Poliglecaprone 25 and Polydioxanone segments are anticipated to grow moderately during the forecast period, owing to the increasing launch of these sutures in the global market.

By Application

Rising Orthopedic Surgical Interventions Contributes to Segment's Dominance

Based on application, the market is categorized into gynecology, orthopedics, cardiology, general surgery, and others.

The orthopedics segment is estimated to dominate the market during the forecast period, owing to the rising number of orthopedic procedures worldwide.

- For example, as per the data provided by the Canadian Institute for Health Information (CIHI) in September 2024, over 117,000 hip and knee replacements were performed in Canada in fiscal year 2021-2022. This hip and knee replacement number was 5.9% higher compared to the previous year.

The gynecology segment is expected to grow substantially during the forecast period, owing to a rise in the number of deliveries by cesarean section.

- For example, as per the data provided by the Canadian Institute for Health Information (CIHI) in February 2024, the total C-section rate was 33.4% in Canada in fiscal year 2023. This mshowcases that around 33.4% of deliveries were done by cesarean section across Canada in 2023.

The general surgery segment is anticipated to grow moderately during the forecast period, owing to the rising number of general surgical procedures such as cholecystectomy, appendectomy, and herniorrhaphy across the globe.

The cardiology segment is projected to grow at the second-largest CAGR during the forecast period. This is mainly attributed to the increasing usage of synthetic resorbable sutures in cardiac surgeries.

- For example, as per the data provided by the Australian Institute of Health and Welfare in December 2024, around 43,700 percutaneous coronary interventions (PCIs) were performed on patients admitted to hospital in the 2021-22 period in Australia.

By End-user

Dominance of Hospitals & ASCs Segment is due to Rise in Number of Patient Admissions for Surgical Procedures

Based on end-user, the market is divided into hospitals & ASCs, specialty clinics, and others.

The hospitals & ASCs segment is projected to dominate the market throughout the forecast period. This is mainly due to increasing patient hospitalization for surgical procedures and advanced care.

- For instance, as per the data published by the Australian Institute of Health and Welfare in May 2025, around 735,460 patients were admitted to hospitals between 2022 and 2023 in Australia for surgical procedures. This number was increased to 778,466 from 2023 to 2024.

The specialty clinics segment is expected to grow at the second-largest CAGR during the forecast period. The opening of new specialty clinics worldwide to provide specialized care for special conditions enhances the segmental growth.

- For example, in May 2024, the North West London Elective Orthopaedic Center was officially opened at Central Middlesex Hospital.

Others segment is projected to grow at a stagnant CAGR throughout the forecast period, owing to increasing utilization of synthetic absorbable sutures at medical institutes for training purposes.

SYNTHETIC ABSORBABLE SUTURES MARKET REGIONAL OUTLOOK

On the basis of regions, the global market can be divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Synthetic Absorbable Sutures Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market, with the market size valued at USD 1.21 billion in 2025 and increasing to USD 1.27 billion in 2026, maintaining its leading position. The presence of advanced healthcare infrastructure, favorable reimbursement policies, and high adoption of advanced surgical tools in medical facilities across the North America region are anticipated to fuel the market growth in the coming years.

The higher number of medical conferences occurring in the U.S., involving the participation of market players showcasing synthetic absorbable sutures, is also anticipated to enhance the market growth.

- For instance, in June 2025, Dolphin Sutures announced its participation at the FIME 2025. This event was held from 11th to 13th June 2025 in the Miami Beach Convention Center, Florida, U.S. The company highlighted its synthetic absorbable sutures during the conference to create product awareness among healthcare professionals.

Europe

The Europe region accounted for the third-largest share of the market in 2024. The market is anticipated to grow at the second-largest CAGR during the forecast period. The rise in the number of operations, including cardiac surgeries, orthopedic surgeries, general surgeries, and others across the region has been fueling the demand for synthetic absorbable sutures, thereby driving market growth.

- For instance, as per the data provided by the National Adult Cardiac Surgery Audit (NACSA) in January 2023, approximately 24,807 cardiac surgeries were conducted in the U.K. from April 2021 to March 2022.

Asia Pacific

The market in the Asia Pacific region is expected to grow at the highest CAGR during the forecast period. The market growth in this region is driven by the rising medical tourism and an escalation in surgical procedures, particularly minimally invasive and cosmetic surgeries.

Moreover, the presence of several key players across the region providing synthetic resorbable sutures is an additional factor supplementing market growth in this region. For example, Dolphin Sutures, Lotus Surgicals Pvt Ltd, Medico, Suture Planet, ORION SUTURES INDIA PVT. LTD., and Dynek Pty Ltd, among others, are some of the key players providing synthetic resorbable sutures in the Asia Pacific market.

Latin America and Middle East & Africa

The market in Latin America and the Middle East & Africa is anticipated to grow at a stagnant CAGR during the forecast period. The high burden of chronic diseases and the rising number of surgical procedures across Latin America and the Middle East & Africa are some of the important factors enhancing market.

COMPETITIVE LANDSCAPE

Key Industry Players

Increasing Involvement of Market Players in Medical Events Creates Brand Recognition Among Healthcare Professionals

The DemeTECH Corporation, Johnson & Johnson Services, Inc., Dynek Pty Ltd, and ORION SUTURES INDIA PVT. LTD, among others, are major market players actively involved in providing synthetic absorbable sutures across the globe. The increasing focus of these players on attending medical events to create product awareness among healthcare professionals is contributing to their substantial position in the global market.

- For example, in October 2024, Corza Medical launched a new line of Onatec ophthalmic microsurgical sutures at the American Academy of Ophthalmology (AAO) conference 2024. This event took place in Chicago, U.S., from 18th to 21st October 2024.

The other companies operating in the market are Dolphin Sutures, Healthium Medtech Limited, Suture Planet, and Medico. These companies are focus on new product launches, facility expansion, and strategic collaborations to expand their footprints in the global market.

List of Key Synthetic Absorbable Sutures Companies Profiled

- Johnson & Johnson Services, Inc. (U.S.)

- DemeTECH Corporation (U.S.)

- Dolphin Sutures (India)

- Lotus Surgicals Pvt Ltd (India)

- Medtronic (Ireland)

- Suture Planet (India)

- Braun SE (Germany)

- Medico (China)

- Healthium Medtech Limited (India)

- ORION SUTURES INDIA PVT. LTD. (India)

- Unisur Lifecare (India)

- Dynek Pty Ltd (Australia)

- MANI,INC. (Japan)

KEY INDUSTRY DEVELOPMENTS

- January 2025 - Suturion AB participated in the Arab Health 2025, a medical conference held in Dubai, UAE. The company showcased its suture products during the event to enhance brand visibility and engage with healthcare providers.

- October 2024 - ORION SUTURES INDIA PVT. LTD. announced its participation at Africa Health 2024, a medical event that took place in South Africa. The company exhibited at stall number H2.E17 to create awareness about its braided dissolvable stitches among consumers.

- March 2024 - Futura Surgicare Pvt Ltd collaborated with Novo Integrated Sciences to enter the U.S. market.

- November 2022 - Ur24Technology Inc. entered into a strategic partnership with DemeTECH Corporation to enhance its surgical product portfolio.

- June 2021 - Genesis Medtech completed the acquisition of Horcon, a China-based suture manufacturer, as a part of its strategy to broaden its surgical device portfolio.

REPORT COVERAGE

The global synthetic absorbable sutures market report provides a detailed competitive landscape and market insights. In addition to the market size, it covers regional analysis of different market segments, profiles of key market players, and market dynamics. Moreover, the market report encompasses several factors contributing to the market's growth over recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product · Monofilament · Multifilament/Braided |

|

By Material · Polyglactin 910 · Poliglecaprone 25 · Polydioxanone · Others |

|

|

By Application · Gynecology · Orthopedics · Cardiology · General Surgery · Others |

|

|

By End-user · Hospitals & ASCs · Specialty Clinics · Others |

|

|

By Region · North America (by Product, by Material, by Application, by End-user, and by Country/Sub-Region) o U.S. o Canada · Europe (by Product, by Material, by Application, by End-user, and by Country/Sub-Region) o Germany o U.K. o France o Italy o Spain o Scandinavia o Rest of Europe · Asia Pacific (by Product, by Material, by Application, by End-user, and by Country/Sub-Region) o China o Japan o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (by Product, by Material, by Application, by End-user, and by Country/Sub-Region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (by Product, by Material, by Application, by End-user, and by Country/Sub-Region) o GCC o South Africa · Rest of Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 2.83 billion in 2025 and is projected to reach USD 5.99 billion by 2034.

In 2025, the market value stood at USD 2.83 billion.

The market will exhibit steady growth at a CAGR of 8.3% during the forecast period (2026-2034).

By product, the multifilament/braided segment led the market.

The rising prevalence of chronic diseases and the growing number of surgeries worldwide are important factors enhancing market growth.

DemeTECH Corporation, Johnson & Johnson Services, Inc., Dynek Pty Ltd, and Dolphin Sutures are the major players operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us