Synthetic Biology Market Size, Share & Industry Analysis, By Type (Products {Instruments, and Reagents & Consumables} and Services), By Product Type (DNA Synthesis {Oligonucleotide Synthesis and Gene Synthesis}, Peptide/Protein Synthesis, and Cell Mimics), By Application (Diagnostics, Therapeutics, and Research & Development), By End-user (Pharmaceutical & Biotechnology Companies, Contract Research Organizations (CROs) & Contract Development and Manufacturing Organizations (CDMOs), and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

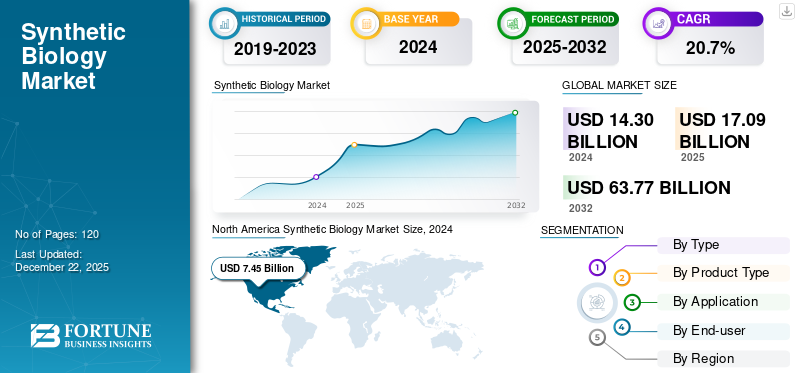

The global synthetic biology market size was valued at USD 17.09 billion in 2025. The market is projected to grow from USD 20.47 billion in 2026 to USD 95.02 billion by 2034, exhibiting a CAGR of 21.15% during the forecast period. North America dominated the synthetic biology market with a market share of 51.88% in 2025.

Synthetic biology is a scientific field where organisms are redesigned by altering their genetic material with the help of genetic engineering to create new organisms, devices or systems. It refers to redesigning of natural systems to create new systems with predictable behavior. To alter the genetic material of the organism, tools such as genome engineering, DNA sequencing and gene editing. The market includes DNA synthesis, protein engineering, and cell mimics. Some of the key players present in the market includes F. Hoffmann-La Roche Ltd, Illumina, and Thermo Fisher Scientific, who offer a wide range of these products and services.

The global market notices significant growth driven by technological advancement and new product launches. Additionally, the rise in the prevalence of genetic disorders increases the demand for advanced treatment solutions, which further contribute to the market growth during the forecast period. Moreover, factors such as the rise in research & development investment and the rise in demand for sustainable solutions, also drive the growth of the market.

Synthetic Biology Industry Landscape Overview

Market Size & Forecast:

- 2025 Market Size: USD 17.09 billion

- 2026 Market Size: USD 20.47 billion

- 2034 Forecast Market Size: USD 95.02 billion

- CAGR: 21.15% from 2026–2034

Market Share:

- North America dominated the synthetic biology market with a 51.88% share in 2025, driven by advanced research infrastructure, government funding, favorable regulatory frameworks, and strong presence of market players like Illumina, Thermo Fisher Scientific, and Roche.

- By Type, the services segment led the market in 2024 and is expected to maintain the highest CAGR through 2032. Growth is attributed to increased demand for drug development, personalized therapies, and vaccine design.

Key Country Highlights:

- United States: Strong adoption of synthetic biology products in drug development, diagnostics, and bio-manufacturing; backed by supportive FDA policies and investment in personalized medicine.

- China: Rapid biotechnology expansion and government support for domestic gene sequencing and synthesis startups; increasing collaborations with global companies.

- Japan: Focus on using synthetic biology for regenerative medicine and aging-related diseases; strong academic-industry partnerships.

- Europe: Moderate growth driven by government subsidies, R&D investments, and adoption of sustainable biological solutions; UK and Germany are leading contributors.

MARKET DYNAMICS

MARKET DRIVERS

Advancements in Synthetic Biology Technologies to Drive the Market Growth

The increase in technological advancements, such as innovation in DNA sequencing and DNA editing, is expected to drive the market growth during the forecast period. Additionally, advancement in software development also boosts market growth as, software plays a crucial role in designing biological systems.

- For instance, according to the data published in Narra J in August 2023, CRISPR-Cas9 technology is an advanced gene-editing tool that is a significant revolution in genome editing technology. Such technological advancements support the market growth.

Moreover, automation, AI and machine learning also boost the growth of the market over the forecast period.

Ongoing Launches of New Products Boost the Market Development

The rise in the incidence of genetic disorders increases the demand for the development of genetically engineered medicines such as antibodies, vaccines, and others, which upsurges the adoption of synthetic biology products and further drives the market growth.

- For instance, in June 2024, Bio-Rad extended their antibodies range and launched four new anti-idiotypic antibodies for the atezolizumab (Lemtrada), avelumab (Bavencio), obinutuzumab (Gazyvaro), and ocrelizumab (Ocrevus) drugs. The development of such new antibodies supports market growth.

MARKET RESTRAINTS

Safety Concerns Hampers the Market Growth

Synthetic biology refers to creating new biological systems by engineering existing organisms, which raises safety and security concerns for human health hampering the market growth. Additionally, containment, semantic containment and side effects also limits the market growth.

- For instance, according to the data published by the American Cancer Society in January 2025, the monoclonal antibodies injected in veins sometimes cause infusion reactions such as allergic reactions. This type of side effect limits the adoption rate of synthetic biology products, which hampers the market growth.

Additionally, changes in biosafety rules and regulations also hinders the market growth.

MARKET OPPORTUNITIES

New Product Development Boosts Market Growth in the Future

The development of new tools in this market, such as gene editing, is expected to boost the market growth in the future. Additionally, rise in the development of vaccines with the help of synthetic biology will also drive market growth.

- For instance, according to the data published on Drug Discovery & Development in May 2023, Codagenix used synthetic biology and machine learning for the development of vaccines. This type of development boosts the growth of the market.

Synthetic biology helps to design and develop vaccines quickly thus increasing the adoption of tools and products that further enhance the market growth. Moreover, synthetic biology plays an important role in the development of RNA vaccines, which trigger an immune response supporting market growth.

MARKET CHALLENGES

Ethical and Regulatory Challenges

The market has experienced rapid growth recently, however, significant ethical concerns such as biosafety risks and bioterrorism challenges the market growth. Biosafety risks include unethical access, theft, and misuse of data, which is a huge threat to humans and the environment. A set of regulations plays an important role in preventing such loss.

Bioterrorism refers to the use of viruses, bacteria, and others as a bioweapon to harm humans. Additionally, potential damage to human health and the environment also limits the growth of the market.

Moreover, high initial costs such as high research & development costs and commercial scale production costs also challenges the global synthetic biology market growth during the forecast period.

Scalability and Cost Constraints Impacts the Overall Market Growth

The sector faces significant challenges, particularly in production scalability and cost constraints. Scaling synthetic biology solutions from laboratory to industrial production is a major hurdle due to the inherent complexity of biological systems and the need for specialized infrastructure. Achieving cost-effective, large-scale production is difficult, as processes that work efficiently in controlled lab environments often encounter issues such as reduced yields, increased contamination risks, and inefficient downstream processing when scaled up. Cost constraints further compound these challenges. The high cost of research and development, combined with expensive growth media and downstream processing, makes it difficult for these products to be developed.

SYNTHETIC BIOLOGY MARKET TRENDS

Diverse Applications is a Key Trend Reshaping the Market Growth

Synthetic biology is revolutionizing medicine through personalized therapies, advanced diagnostics, and engineered cell treatments. By designing synthetic gene circuits and reprogramming cells, these products are used in precise therapies tailored to individual genetic profiles, such as CAR-T cells for cancer. Engineered microbes and diagnostics tools, such as rapid pathogen-detecting sensors, further enhance targeted treatment and early disease detection.

Integration of AI and Machine Learning is an Emerging Trend in the Market

AI and machine learning accelerates the progress by optimizing biological systems and drug discovery. Algorithms predict gene circuit behavior, model protein structures, and identify drug candidates, reducing trial-and-error in therapy design. AI also aids in analyzing patient data to customize treatments, ensuring that therapies align with unique biological needs for improved efficacy and safety. Hence, this is considered to be one of the key synthetic biology market trends.

Shift to Sustainable Production is Another Trend Aiding Market Growth

This field promotes sustainability by enabling eco-friendly drug production and biodegradable medical solutions. Engineered microbes synthesize pharmaceuticals and vaccines with lower environmental impact, while bio-based materials replace plastics in devices and implants. These innovations reduce medical waste and reliance on toxic chemicals, aligning healthcare with global sustainability goals.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic significantly influenced the market, and the demand for vaccines to treat COVID-19 increased during this period which subsequently driven the market growth. The rise in the prevalence of COVID-19 increases the demand for the development of RNA vaccines such as COVID-19 mRNA vaccines.

- For instance, in December 2020, Pfizer and BioNTech launched a COVID-19 mRNA vaccine, which got approval from the U.S. Food and Drug Administration (FDA) under an Emergency Use Authorization (EUA) to prevent coronavirus.

SEGMENTATION ANALYSIS

By Type

Services Segment Dominated the Market Due to Technological Advancements

Based on type, the market is segmented into products and services. The products segment is further classified into instruments and reagents & consumables.

The services segment dominated the market with a share of 62.00% in 2026. The service segment also has the highest CAGR over the forecast period. This is attributed to the rise in the development of new therapies and vaccines, production of biofuels, and others. Additionally, technological advancements also drives the segmental growth.

- For instance, according to the data published in the Journal of Drug Delivery Science and Technology in February 2024, the CRISPR-Cas9 technique is used to treat genetic mutations. It helps to cure diseases such as cystic fibrosis and sickle cell anemia. Such advanced techniques increase the adoption of these services and boost the segment’s growth.

Product was the second dominant segment of the market in 2024. This is due to technological developments such as the development of DNA and RNA-based vaccines, drug development, and others. Synthetic biology is used for personalized medicine and helps in reducing infection risk, which increases the adoption rate of synthetic biology products and supports the segmental growth.

- For instance, in August 2021, Zydus Cadila with DBT-BIRAC received Emergency Use Authorization (EUA) from the Drug Controller General of India (DCGI) for ZyCoV-D. It is the world’s first COVID-19 vaccine. Such innovative product development rises the growth of the segment during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Product Type

Peptide/Protein Synthesis Segment Dominated the Market Due to Rise in Demand for Peptides and Proteins

Based on the product type, the market is segmented into DNA synthesis, peptide/protein synthesis, and cell mimics.

The peptide/protein synthesis segment held the largest synthetic biology market with a share of 53.92% in 2026. The factors driving the growth of this segment include the increased in demand of peptides for drug discovery, therapeutics, research, and others. Additionally, the development of peptide-based vaccines and drugs also supports the market growth during the forecast period.

- For instance, in September 2024, Cambrex, announced that Snapdragon Chemistry, a Cambrex company, has developed new liquid-phase peptide synthesis (LPPS) technology that uses traditional active pharmaceutical ingredient (API) batch reactors. The development of these technologies increases the adoption rate and boosts the segment’s growth.

The cell mimics segment is anticipated to grow at a higher CAGR during the forecast period. The rise in demand for personalized therapies/medicine and advancement in DNA sequencing drives the growth of the segment. Furthermore, the rise in investment by government and private companies in research & development also boosts the growth.

DNA synthesis is the second-dominated segment in the market. DNA synthesis is sub-segmented into oligonucleotide synthesis and gene synthesis. This dominance is attributed to the rise in the prevalence of chronic and genetic diseases which propelling the adoption of DNA synthesis products.

By Application

Therapeutics Segment Dominated the Market Due to Increasing Use of Synthetic Biology in the Pharmaceutical Industry

By application, the market is classified into diagnostics, therapeutics, and research & development.

The therapeutics segment accounted for the largest market share in 2024, with the highest CAGR during the forecast period. The rise in pharmaceutical applications, such as developing new therapies boost the segment growth during the forecast period. Additionally, the rise in personalized medicine trends and the development of new gene therapy increase the adoption rate of synthetic biology services, which supports the segment’s growth.

- For instance, according to the data published by the National Cancer Institute, in October 2023, the Central Drugs Standard Control Organization (CDSCO), made NexCAR19 as India’s first approved CAR-T cell therapy. The government approval for such therapies raises the demand for these services, which drives the segment growth.

The research & development segment accounted for the second largest segment of the market. The rise in government and private investment in the research & development segment boosts the segment growth. Additionally, technological advancement and the need for innovative solutions drive the segmental growth during the forecast period.

The diagnostics segment holds significant with a share of 51.71% in 2026. this is majorly due to the rise in the prevalence of chronic diseases and the increase in diagnosis rates.

By End-user

Strong Demand for These Products & Services by Pharmaceutical & Biotechnology Companies Led to Segment’s Dominance

Based on the end-user, the market is segmented into pharmaceutical & biotechnology companies, CROs & CDMOs, and others.

The pharmaceutical & biotechnology companies segment dominated the market with a share of 44.53% in 2026 at highest CAGR growth rate in 2026. The rise in the utilization of these products and services in drug discovery drives the segment growth during the forecast period. Additionally, synthetic biology is used for bio-manufacturing processes such as the production of biofuels, bioplastics, and pharmaceuticals.

- For instance, according to the data published by Discover Biotechnology in February 2025, the production of biosensors helps to treat chronic diseases such as diabetes and cancer by providing a controlled release of therapeutic agents. Such type of synthetic biotechnology used in pharmaceutical & biotechnology companies boosts the segment’s growth.

The contract research organizations (CROs) & contract development and manufacturing organizations (CDMOs) segment was the second dominant segment of the market in 2024. The growth of the segment is attributed to the developed healthcare infrastructure and expertise in peptide synthesis and DNA synthesis.

The others segment includes settings such as academic institutions, and others.

SYNTHETIC BIOLOGY MARKET REGIONAL OUTLOOK

In terms of regions, the global market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

North America

North America Synthetic Biology Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America market was valued at USD 10.57 billion in 2026 and is projected to expand at a substantial CAGR during the forecast period. The North America region dominated the market in 2024. North America has developed a research infrastructure that boosts the market growth in this region. Additionally, government support plays a crucial role in the growth of the market, such as favorable regulatory policies, funding for biotechnology startups, and others. The presence of key market players in this region also boosts market growth during the forecast period. The U.S. market is projected to reach USD 9.94 billion by 2026.

- For instance, according to the data published on Today’s Clinical Lab in August 2024, IDT, announced significant upgrades in gene synthesis and launched rapid genes that boosts the market growth in this region.

U.S.

Europe

The Europe market is anticipated to grow at a moderate rate due to the increase in research & development activities. Additionally, government initiatives such as subsidies and funding programs help to increase the adoption rate of synthetic biology products or services, which drives market growth. The UK market is projected to reach USD 1.17 billion by 2026, and the Germany market is projected to reach USD 1.15 billion by 2026.

Asia Pacific

The Asia Pacific market is projected to grow at the highest CAGR over the forecast period. The growth can be attributed to the expanding biotechnology sector with a rise in investment in the healthcare sector. Additionally, the government is continuously supporting the market growth through subsidies, funding for biotechnology startups, and others. Moreover, the increase in collaboration with academic or research institutes boosts the innovation rate in the market and enhances the market growth.

Latin America

The Latin America market is expected to grow significantly during the forecast period due to the rise in demand for bio-based products. Additionally, increase in government investment in the research & development sector also supports the market growth in this region.

Middle East & Africa

The Middle East & Africa region is growing in the market due to the rise in interest in personalized medicine and the increase in government investment in the research & development sector. Additionally, technical advancements such as genetic engineering and DNA sequencing also boost the adoption rate of synthetic biology products and services. The Japan market is projected to reach USD 0.68 billion by 2026, the China market is projected to reach USD 0.76 billion by 2026, and the India market is projected to reach USD 0.43 billion by 2026.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Hoffmann-La Roche Ltd. and Illumina, Inc. Hold Significant Shares due to Their Strong Product Portfolio

The global market is partially consolidated with key players such as F. Hoffmann-La Roche Ltd., Illumina, Inc., QIAGEN, and Quest Diagnostics Incorporated. F. Hoffmann-La Roche Ltd. is recognized for its strong focus on innovation and integration of genomic technologies into clinical practice, particularly in oncology and rare diseases.

Illumina, Inc.'s strong portfolio of sequencing products and services, coupled with its wide presence globally, drives the growth of the company. In addition, these players are constantly focusing on strategic initiatives, such as the introduction of new products & services and expansion of their offerings through partnerships and other initiatives.

- For instance, in December 2023, Illumina Inc. and HaploX collaborated to provide locally manufactured sequencing instruments in China.

Quest Diagnostics, another key player, is growing owing to its product portfolio comprising diverse application areas such as autoimmune diseases, various diseases, and cardiovascular conditions.

Additionally, companies such as GeneDx and 23andMe Offer DTC testing services and provide insights into ancestry and health predispositions, which enhances their growth.

LIST OF KEY SYNTHETIC BIOLOGY COMPANIES PROFILED

- Hoffmann-La Roche Ltd(Switzerland)

- Illumina, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories, Inc (U.S.)

- Oxford Nanopore Technologies plc. (U.K.)

- Laboratory Corporation of America Holdings (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Myriad Genetics, Inc. (U.S.)

- QIAGEN (Germany)

- Quest Diagnostics Incorporated. (U.S.)

- Danaher Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- April 2024: Telesis Bio Inc. announced the commercial launch of the Gibson SOLA platform, with an aim to focus on expanding the adoption of Gibson SOLA for both DNA and mRNA.

- December 2023: The collaboration of the Allen Institute, the Chan Zuckerberg Initiative and the University of Washington announced the launched of the Seattle Hub for Synthetic Biology.

- October 2023: Evonetix announced the installation of the DNA synthesis platform with a semiconductor chip and thermal controller at the Imperial College London (ICL) to enable DNA synthesis in any lab and conduct research for human disease and infection.

- December 2023: Senti Biosciences, Inc. received FDA clearance for an investigational new drug for SENTI-202 used in the treatment of Acute Myeloid Leukemia.

- January 2020: Evonetix collaborated with imec to developed chip-based technology production on a larger scale for the third-generation DNA synthesis platform.

TRADE PROTECTIONISM

Geopolitical tensions, particularly between the U.S. and China, have led to increased scrutiny and regulatory measures affecting the biotech sector. The proposed Biosecure Act in the U.S. aims to limit collaborations with certain Chinese biotech firms, prompting Western pharmaceutical companies to seek alternative suppliers and potentially impacting global supply chains.

REPORT COVERAGE

The synthetic biology market report provides an in-depth analysis of the industry. It focuses on market segments, such as type, product type, application, and region. Besides, it offers the market forecast in relation to the current market dynamics, the impact of COVID-19, and the latest market trends. Additionally, the report consists of the global market share by various segments and the factors driving the market growth. The report also provides the competitive landscape of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

| ATTRIBUTE | DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 21.15% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Product Type

|

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 20.47 billion in 2026 and is projected to reach USD 95.02 billion by 2034.

In 2025, the market value of North America astood at USD 8.86 billion.

The market will exhibit a steady CAGR of 21.15% during the forecast period.

By type, the services segment led the market in 2025.

Rising prevalence of chronic disorders and new product launches are key factors anticipated to drive the market growth.

F. Hoffmann-La Roche Ltd. and Ilumina, Inc. are the major players in the market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us