Technical Grade Glycerin Market Size, Share & Industry Analysis, By Purity (Between 95% to 99% and Above 99%), By Application (Paints & Coatings, Industrial Chemicals, Adhesives, Detergents, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

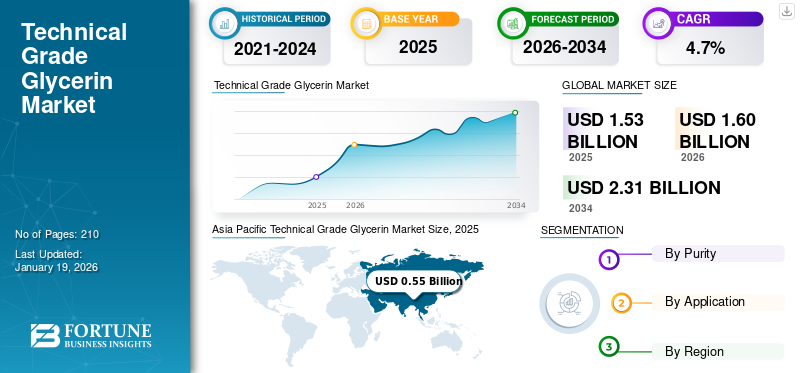

The global technical grade glycerin market size was valued at USD 1.53 billion in 2025 and is projected to grow from USD 1.60 billion in 2026 to USD 2.31 billion by 2034, exhibiting a CAGR of 4.7% during the forecast period. Asia Pacific dominated the technical grade glycerin market with a market share of 36% in 2025.

The global technical grade glycerin market is witnessing significant growth opportunities driven by various applications such as paints & coatings, chemicals, and the textiles industry. Technical grade glycerin refers to a refined form of glycerol specifically processed for industrial and non-pharmaceutical applications. It is typically derived from vegetable oils or animal fats through transesterification, saponification, or hydrolysis processes. Unlike USP or pharmaceutical-grade glycerin, technical grade may contain higher levels of impurities, but still meets stringent industrial standards. It generally appears as a clear, viscous, odorless liquid with high hygroscopic properties. Rising demand from construction, packaging, automotive manufacturing, and household cleaning industries is driving the growth of the technical grade glycerin market.

The main players working in the market include Cargill, Incorporated, Emery Oleochemicals LLC, Vantage Specialty Chemicals, Inc., BASF, and Münzer Bioindustrie GmbH.

Technical Grade Glycerin MARKET TRENDS

Rising Adoption of Petroleum-based Chemicals to Fuel Industry Development

The industrial shift toward sustainable and eco-friendly inputs, technical grade glycerin is gaining traction as a renewable, biodegradable alternative to petroleum-based chemicals. Regulatory support for green chemistry, combined with growing consumer demand for environmentally responsible products, is accelerating its adoption in paints, coatings, adhesives, and detergents. This trend is particularly strong in developed markets where environmental regulations are stringent and industrial buyers aim to align with low-carbon initiatives. In developing economies, while price sensitivity remains high, the push for eco-friendly manufacturing is creating niche opportunities for glycerin suppliers.

MARKET DYNAMICS

MARKET DRIVERS

Expanding Role of Technical Grade Glycerin in Paints and Coatings Formulations is fueling the Market Expansion

The paints and coatings industry is a major driver of the global glycerin market, driven by its functional benefits in improving product texture, stability, and performance. Glycerin acts as a hydrating agent, retaining moisture and preventing the formation of cracks in coatings during curing. It also enhances flexibility, making painted surfaces tougher to peel and environmental damage. In industrial paints, glycerin serves as a cosolvent that improves pigment dispersion, resulting in better color consistency and surface finish. The rising demand for high-performance coatings in automotive, construction, and marine applications is further increasing glycerin consumption.

MARKET RESTRAINTS

Competition from Alternative Synthetic Substitutes Is Hindering the Market Growth

The technical grade glycerin market faces strong competition from alternative raw materials and synthetic substitutes that can perform similar functions at competitive costs. In detergents, compounds such as sorbitol and polyethylene glycols can replace glycerin in moisture retention and viscosity regulation. These alternatives often offer greater formulation flexibility and more consistent quality, especially in high-volume industrial applications. Furthermore, large-scale chemical producers with an integrated supply chain can deliver substitutes at lower prices, making it harder for glycerin to maintain its demand.

MARKET OPPORTUNITIES

Growing Demand in Eco-Friendly Industrial Formulations Brings New Opportunities for Market Players

With increasing environmental awareness and sustainability regulations, industrial sectors are shifting toward bio-based raw materials, creating strong growth opportunities for technical grade glycerin. Its biodegradability, low toxicity, and renewable sourcing from vegetable oils and animal fats make it an ideal substitute for petroleum-based chemicals in various applications. This shift is further supported by corporate sustainability initiatives and government policies promoting the use of renewable industrial inputs. By positioning technical grade glycerin as a cost-effective, eco-friendly alternative, manufacturers can tap into growing markets.

- According to the Observatory of Economic Complexity (OEC), in 2023, the global trade for crude glycerin was USD 811.0 million. Indonesia and Brazil were the leading exporters, accounting for 32.8% and 12.5% of total exports, respectively.

MARKET CHALLENGE

Price Volatility Due to Feedstock Supply Fluctuations to Hinder Market Growth

Technical grade glycerin production heavily depends on feedstocks derived from biodiesel manufacturing and soap production, both of which are influenced by agricultural commodity prices. Variations in the availability and cost of vegetable oils, such as palm, soybean, and rapeseed, directly affect glycerin pricing. Additionally, the supply of crude glycerin from biodiesel plants fluctuates with changes in biodiesel demand, which is closely tied to global energy markets and government policies. This dependency makes it challenging for glycerin suppliers to maintain consistent pricing for industrial clients, especially in long-term contracts.

Download Free sample to learn more about this report.

Segmentation Analysis

By Purity

95% to 99% Segment Leads due to its Extensive Industrial Usage

Based on purity, the market is classified into above between 95% to 99%, and above 99%.

Glycerin with 95% to 99% purity level holds the largest technical grade glycerin market share due to its widespread industrial usage. This grade is suitable for paints, coatings, adhesives, and detergents, where small amounts of impurities do not compromise functionality. Its solvent, lubricating, and moisture-retention properties contribute to improved product workability, surface finish, and shelf life. Being less expensive than ultra-high purity grades, it is highly attractive for large-scale industrial use, especially in cost-sensitive markets.

Above 99% purity technical grade glycerin represents the highest quality within the technical category, offering near-pharmaceutical cleanliness for specialized industrial applications. This grade is preferred in products where minimal impurities are critical to maintaining chemical stability, such as high-performance coatings, premium adhesives, and specialty chemical formulations. Due to its exceptional hygroscopic nature and solvent properties, it ensures consistent viscosity, smooth blending, and improved product durability.

By Application

Paints & Coatings Segment Dominates Due to Its Properties

Based on applications, the market is classified into paints & coatings, industrial chemicals, adhesives, detergents, and others.

The paints & coatings segment holds the largest technical grade glycerin market share due to its solvent properties, moisture retention, and ability to enhance viscosity stability. It improves paint flow, reduces cracking, and helps maintain a uniform texture during application and drying. This grade of glycerin is often incorporated into water-based and eco-friendly formulations, contributing to better adhesion and durability of coatings. In industrial coatings, it also improves flexibility and prevents fragility over time.

In the industrial chemicals segment, the product serves as a versatile feedstock and functional additive due to its chemical stability, biodegradability, and compatibility with diverse compounds. It is used in producing plasticizers, antifreeze agents, lubricants, and resins. In chemical synthesis, glycerin acts as a reaction medium, enhancing yield and reducing by-product formation. Its eco-friendly profile positions it as a preferred alternative to certain petroleum-based solvents, especially as industries transition toward sustainable production.

The product is widely used in the adhesives sector for its plasticizing properties, ability to retain moisture, and contribution to adhesive flexibility. It enhances tackiness, prolongs shelf life, and prevents hardening, making it valuable in both water-based and hot-melt adhesive formulations. The product’s compatibility with natural and synthetic polymers allows it to be used in packaging, woodworking, and construction adhesives. Demand is particularly high in the packaging industry due to the global shift toward sustainable materials.

Technical Grade Glycerin Market Regional Outlook

By geography, the market is categorized into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Technical Grade Glycerin Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific holds the dominating in the market with a size of USD 0.55 billion in 2025 , fueled by rapid industrialization, strong manufacturing capabilities, and rising consumption across multiple end-use sectors. China leads production and demand, supported by its extensive biodiesel output and large-scale industrial chemical manufacturing. India, Japan, and South Korea are also key markets, with growing adoption of paints, coatings, adhesives, and detergents. Infrastructure development, urbanization, and rising middle-class incomes are boosting demand for construction materials, packaging adhesives, and household cleaning products.

North America

Established industrial manufacturing, a mature chemical sector, and strong demand for eco-friendly raw materials drive the growth of the region in the market. The U.S. leads consumption due to its diversified end-use industries, including paints, coatings, adhesives, and detergents. Environmental regulations promoting bio-based chemicals have further increased glycerin adoption as a sustainable alternative to petrochemical ingredients. Growth in construction and automotive coatings further supports the technical grade glycerin market growth.

Europe

Europe represents an innovation-driven market, with increased demand in industrial chemicals, paints, and eco-friendly adhesives. The EU’s stringent environmental regulations have accelerated the replacement of petrochemical solvents with bio-based alternatives such as glycerin, supporting steady consumption. Germany, France, and Italy are the primary markets, driven by advanced manufacturing and a focus on high-performance coatings and adhesives.

Latin America

Latin America’s technical grade glycerin market is expanding steadily, supported by a growing industrial base and increased adoption of bio-based chemicals. Brazil is the largest market, benefiting from its significant biodiesel production, which provides a consistent glycerin supply for domestic industries. Demand is rising in paints, coatings, and adhesives, driven by infrastructure development and housing projects across the region. Mexico also plays a key role, particularly in manufacturing adhesives and detergents for both domestic and export markets.

Middle East & Africa

The Middle East & Africa market for technical grade glycerin is developing, with growth driven by expanding manufacturing industries and rising demand for sustainable raw materials. In the Middle East, countries such as Saudi Arabia and the UAE are investing in industrial diversification, supporting the use of glycerin in paints, coatings, and adhesives. The construction boom in the Gulf region also fuels demand for coating and bonding solutions.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Companies Focus on Capacity Expansion to Dominate their Market Position

The market is highly competitive, with major players focusing on capacity expansion, sustainability, and mergers & acquisitions to strengthen their market presence. Key market players include Cargill, Incorporated, Emery Oleochemicals LLC, Vantage Specialty Chemicals, Inc., BASF, and Münzer Bioindustrie GmbH. These companies compete based on product innovation, cost efficiency, and regional dominance. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY TECHNICAL GRADE GLYCERIN COMPANIES PROFILED

- Argent Energy (Scotland)

- Cargill, Incorporated. (U.S.)

- Emery Oleochemicals LLC (U.S.)

- Vantage Specialty Chemicals, Inc. (U.S.)

- VVF (India)

- Twin Rivers Technologies, Inc. (U.S.)

- BASF (Germany)

- Vincitore Chemicals Pvt. Ltd. (India)

- Ritesh International (India)

- Münzer Bioindustrie GmbH (Germany)

KEY INDUSTRY DEVELOPMENTS

- December 2022: Argent Energy began constructing a state‑of‑the‑art glycerin refinery at its Port of Amsterdam site, marking its entry into the chemical market for the first time; the facility, developed using technology from Andreotti Impianti, is designed to produce 50,000 t/year of 99.7% pure technical‑grade glycerin.

- November 2022: Cargill announced that it has acquired Owensboro Grain Company (OGC), a fifth-generation, family‑owned soybean processing facility and refinery based in Owensboro, Kentucky. The company produces products such as protein meal, hull pellets, crude and degummed oil, biodiesel, glycerin, and industrial waxes into its North American agricultural supply chain business.

- June 2021: BASF announced that its Düsseldorf‑Holthausen site had attained both GMP+ and ISO 22000 certifications for its crude glycerin production, key industry standards that underscore rigorous food and feed safety, full-chain traceability, and quality assurance in the processing, storage, and handling of glycerin.

- October 2024: Argent Energy launched Europe’s largest facility for producing technical-grade, bio-based glycerin at its Port of Amsterdam site, converting crude glycerin a by-product of its waste-based biodiesel production into a high-purity (99.7%) product using advanced distillation and polishing technology.

REPORT COVERAGE

The global market analysis provides information on market size and forecast by all segments. It includes details on the market dynamics and market trends expected to drive the market during the forecast period. It offers information about the key regions/countries, key industry growth, new product launches, details on partnerships, mergers & acquisitions, and a number of manufacturers in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.7% from 2026-2034 |

|

Unit |

Value (USD Billion), Volume (Kiloton) |

|

Segmentation |

By Purity

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

The Technical Grade Glycerin Market was valued at USD 1.53 billion in 2025 and increased to USD 1.60 billion in 2026, with the market projected to reach USD 2.31 billion by 2034.

In 2025, the market value stood at USD 0.55 billion.

The market is expected to exhibit a CAGR of 4.7% during the forecast period (2026-2034).

Glycerin between 95% to 99% purity leads the market by purity.

The expansion of the paints & coatings industry is a key factor driving market growth.

Cargill, Incorporated, Emery Oleochemicals LLC, Vantage Specialty Chemicals, Inc., BASF, and Münzer Bioindustrie GmbH are some of the leading players in the market.

Asia Pacific dominates the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us