Thai Cuisine Market Size, Share & Industry Analysis, By Type (Tom Yum, Pad Thai, Gaeng, Thai Fried Rice, and Others), By Food Type (Vegetarian and Non-Vegetarian), By Distribution Channel (Retail and Food Service), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

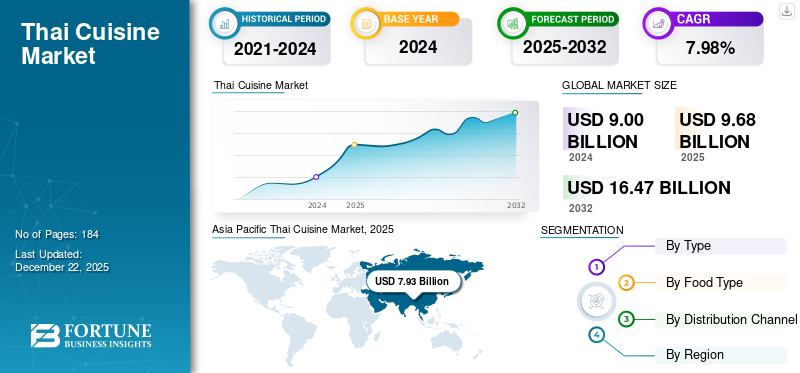

The global Thai cuisine market size was valued at USD 9.68 billion in 2025. The market is projected to grow from USD 10.43 billion in 2026 to USD 19.27 billion by 2034, exhibiting a CAGR of 7.98% during the forecast period. Asia Pacific dominated the thai cuisine market with a market share of 70.74% in 2025.

The popularity of Thai cuisine among all regions and the growing number of tourists visiting Asian countries are major factors boosting the growth of the market. Thai cuisine is a diverse culinary practice characterized by a distinctive blend of flavors, including sweet, salty, sour, and spicy, often composed with a strong aromatic element. It underlines fresh, local ingredients and uses a variety of cooking methods such as deep-frying, stir-frying, and steaming. The cuisine is also influenced by neighboring countries and regions, resulting in regional variations. Major players analyzed in the market forecast include MTY Food Group Inc., Narathai Cuisine Co., Ltd., Blue Elephant, Greyhound Café, and Exquisine Global.

Thai Cuisine Market Snapshot & Highlights

Market Size & Forecast

- 2025 Market Size: USD 9.68 billion

- 2026 Market Size: USD 10.43 billion

- 2034 Forecast Market Size: USD 19.27 billion

- CAGR: 7.98% from 2026–2034

Market Share

- Asia Pacific held a 70.74% share in 2025, driven by Thailand’s tourism, street food culture, and regional demand.

- By type, Pad Thai dominated due to global popularity and balanced flavors.

- By food type, non-vegetarian dishes led, supported by strong demand for shrimp and chicken-based meals.

Key Country Highlights

- Thailand: Culinary tourism and government certifications fuel global expansion.

- United States: High Thai diaspora and strong restaurant demand.

- China: Rapid growth in Thai food service chains.

- UAE: Rising imports and premium Thai cuisine launches.

Market Dynamics

Market Drivers

Favorable Government Initiatives to Boost Thai Cuisine Popularity, Supports Market Growth in Thailand

Thailand is the largest Thai cuisine market in the world. The tourism sector in Thailand is on an upward trajectory and is expected to continue to boom in the future as well. As per the Tourism Authority of Thailand (TAT), foreign arrivals are expected to be around 40 million in 2025. The ministry expects a 7.5% increase in tourism revenue compared to 2024, with 29 million short-haul tourists and 11 million long-haul tourists. As food and hospitality are intertwined with the tourism sector, the boom in this field is also expected to support Thai cuisine market growth.

The government of Thailand regularly undertakes several measures to boost tourism. Some of these campaigns undertaken by the tourism ministry include the “WOW! Thailand Passport Privileges” campaign to enhance the experience of tourists visiting the country. Such strategies have helped the government to make food hygienic, tasty, and appealing to the consumer.

Balanced Flavor Profile of Thai Cuisine to Support Market Growth

Thai dishes are well known for their diverse range of flavors. Popular Thai dishes such as Tom Yum and Pad Thai provide a balanced mixture of sour, sweet, bitter, and spicy taste to the consumer while eating. Ingredients such as lime leaves and chili paste are commonly used to make dishes, and the spiciness is balanced with coconut milk, which adds sweetness and richness. This balanced flavor profile of the food is unique and attractive to consumers in Western countries.

Thai Cuisine is mainly shaped by the cultural exchanges of Thailand with China, India, Malaysia, and other countries. Unique spices, cooking techniques, and locally freshly sourced ingredients are used to prepare various dishes. Some of the most popularly used ingredients in Thai Cuisine include coconut milk, chilies, lemongrass, lime, and tamarind. Different regions of Thailand have their own distinct flavor profiles, which help diversify the food offerings and consumers experience a balance of sweet, salty, sour, and spicy flavors.

Market Restraints

Obstacles in Availability of Raw Material and Substitutes to Hinder Market Growth

There are several other Asian cuisine substitutes available in the market, which is a major factor hindering the market’s growth. Southeast Asian cuisines such as Vietnamese, Cambodian, or Malaysian provide a similar range of flavors by combining Indian, Chinese, or Japanese ingredients and cooking techniques in their dishes.

Thai cuisines heavily rely on ingredients that are sourced from local markets. Thus, to recreate the flavor and texture of the dish, the food service providers need to source similar types of ingredients. However, food service providers that are present outside Thailand face the difficulty of sourcing authentic ingredients or procuring them at a high price, which increases the overall production cost of the dish, making it expensive for end consumers.

Market Opportunities

Expansion in Foodservice Sector to Create Growth Opportunities in Untapped Markets

Thai people are migrating from their homeland to other countries, and are bringing Thai culture and cuisine into these regions. As per data provided by the International Organization for Migration 2024, the U.S. had 256,642 Thai nationals, South Korea had 159,264 Thai nationals, Germany had 84,324 Thai nationals, Australia had 82,292 Thai nationals and Japan had 53,087 Thai nationals in 2020. As migrants integrate into society, the amalgamation of food cuisine with that of the other country creates a richer and more diverse food offering for consumers. Thai food has found broader appeal among large sections of the community outside Thailand. Experimentation with local food flavors and incorporating them into traditional cooking methods also helped the restaurants to make their food appealing to international consumers. Outside Thailand, the popularity of Thai cuisine supported the expansion of Thai restaurants in different countries. As per data provided by the Department of Foreign Trade of Thailand, there are 17,478 Thai restaurants across the world. The Commerce Ministry of Thailand also provides a certification named “Thai SELECT” certification for prepackaged Thai food products, which ensures that the products are cooked using traditional Thai cooking methods and provide authentic Thai flavors.

Thai Cuisine Market Trends

Innovative Marketing Campaigns and Expansion of Plant Based Menus to Create Opportunities for Food Exploration and Innovation

Marketing across digital platforms helps foodservice operators engage with consumers, strengthen brand identity, and increase sales. Food bloggers visiting different food service establishments help consumers know about new food options available in local markets and encourage them to explore new tastes in popular as well as less-known establishments. Thai restaurants, which are established in other countries, as well as restaurants in Thailand have been able to attract new consumers by engaging them with their product offerings. Collaboration with celebrity chefs, broadcasting menus through TV programs, and advertising products through online and offline media help to solidify brand image, and such strategies help make their dishes appealing to consumers.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic drastically changed the global markets and significantly affected different industries, including food service. During the pandemic, heavy restrictions were imposed on dine-in food services. Hence, many hotels and restaurants were closed partially or fully. Many consumers were reluctant to dine out in a confined food service setting due to the possibility of getting affected by COVID-19. Hence, the expenditure and visits to restaurants fell dramatically during the pandemic.

Foodservice operators across the world were affected during the pandemic. All hotels, cafes, and facilities in China, Thailand, and India were shut from mid-January to March in the wake of the COVID-19 pandemic. Hence, sales of commercial dining services almost reached their all-time lows. Similarly, the U.S. was severely affected by the pandemic from June to October 2020. Almost all dine-out facilities were shut down due to the spread of disease, and hence, the food industry was also impacted negatively.

Segmentation Analysis

By Type

Pad Thai Segment Dominates Due to Widespread Popularity and Product Availability

On the basis of type, the market is segmented into Tom Yum, Pad Thai, Gaeng, Thai Fried Rice, and others.

The Pad Thai segment is expected to hold a significant share of the global Thai cuisine market. Pad Thai is one of the favorite Thai meals around the world. Its attraction lies in its symphony of flavors, such as sweet, salty, sour, and spicy, which make it a favorite dish for food enthusiasts seeking authentic and distinct flavors.

The Tom Yum segment is expected to grow significantly in the global market with 26% of the share in 2025. Tom Yum Goong, which is a spicy Thai soup with shrimp, is known to be one of the best Thai dishes across the globe. It contains a mix of spicy, sour, and aroma tastes, which appeals to consumers seeking distinct flavors. The expansion of Thai packaged foods and restaurants across the globe has further increased its accessibility and popularity.

The gaeng (curries) category is expected to achieve a high CAGR of 9.10% during the forecast period in the global market. Thai curries such as green curry, red curry, and massaman curry are popular worldwide for their pungency of flavor and aroma of spices. These food items attract more consumer attention toward exotic and authentic food experiences.

To know how our report can help streamline your business, Speak to Analyst

By Food Type

Non-Vegetarian Segment Dominates Due to High Demand for Non-Vegetarian Thai Dishes

On the basis of food type, the market is analyzed across vegetarian and non-vegetarian.

The non-vegetarian segment dominated the market share by 69% in 2024. Thai cuisine is renowned for incorporating a high amount of meat, seafood, and chicken into signature dishes such as Tom Yum (spicy shrimp soup), Pad Thai (stir-fried noodles with chicken or shrimp), and other curries such as Gaeng Keow Wan (green curry with chicken).

These foods constitute the backbone of Thai cuisine and have enormous demand from consumers all over the world. Non-vegetarian food items such as chicken and pork-based QSR foods dominate the menu. These dishes are convenient to consume, thus increasing their demand in international markets.

The vegetarian segment is expected to grow significantly. Individuals are becoming more health-aware, which creates a growing demand for vegetable food and vegetarian meals. The popularity of fresh food such as tofu, rice, and herbs, translates to Thai cuisine being naturally suitable for vegetarians. There is increased awareness about the environmental impact of meat production, and more people are turning to vegetarian meals. This is especially evident among young adults and working professionals in larger cities.

By Distribution Channel

Food Service Segment Dominated Market Due to Popularity of Thai Restaurants Worldwide

Based on distribution channel, the market is divided into retail and food service.

The food service segment dominates the global Thai cuisine market. This segment is expected to register strong CAGR of 7.95% during the forecast period. Growing urbanization and urban population have fueled demand for convenience food, such as Quick Service Restaurants (QSRs) and cloud kitchens. QSRs, with a significant market share, are positioned well to capitalize on the demands of quick value-for-money food, such as popular Thai dishes, including Pad Thai and Tom Yum. Growing online activity and online ordering of food has fueled demand for cloud kitchens, which are cost-effective and capture growing demand for online food ordering.

The retail segment is expected to exhibit considerable growth rate. The food retail business has been revolutionized by the growth of food ordering websites. Thai food websites that allow customers to order Thai food have made it easier for people to access Thai food. The growth of live shopping and social influencer marketing in Thailand has also increased retail food business sales. The retail segment is expected to attain 24% of the market share in 2025.

Thai Cuisine Market Regional Outlook

By region, the market is studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America

Asia Pacific Thai Cuisine Market, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The increasing demand for cross-cultural foods has raised the popularity of Thai cuisine in North America. Its combination of sweetness, saltiness, sourness, and bitterness offers a diversified culinary experience for everyone. Americans are getting bolder in their approach to foods and are open to experimenting with world foods, international culinary experiences, and varied flavors. This has affected the popularity of Thai cuisine on the basis of its dynamic flavors and health-oriented ingredients, such as fresh vegetables and herbs.

The exponential immigration of Thai immigrants to the U.S. after the Vietnam War introduced Thai food to American homes. It was during 1970 that nearly 5,000 Thai immigrants migrated to the U.S., setting up restaurants and providing authentic Thai food. Los Angeles emerged as a hub of Thai culinary development, with shops such as Bangkok Market providing authentic ingredients and assisting in the preparation of more authentic Thai food. The U.S. market is expected to hit USD 1.12 billion in 2026.

Europe

Europe is the third-largest region, which is anticipated to reach USD 1.03 billion in 2026. Street food culture in Europe has been a platform for promotion of various cuisines, such as Thai. Customers are attracted by the sensory nature, convenience, and affordability of street food, which is expected to increase demand for exotic and genuine overseas flavors. Thai street food, with its strong flavor and ingredients such as lemongrass and lime leaves, is suitable for European customers' growing preference for overseas cuisines. The international success of Thai cuisine is based on its distinctive mixture of taste (sweet, sour, salty, bitter, and umami) and the use of culinary influences of neighboring countries such as China and India. This food blending is attractive to European consumers' demand for cross-cultural dining. Projects such as the tie-up between Thailand and Belgium's "Flanders Kitchen Rebels" have promoted gastronomic cultural exchange. The U.K. market is expected to reach USD 0.2 billion in 2026. Germany market is predicted to hit USD 0.25 billion in 2026. and France will likely to be USD 0.16 billion in 2025.

Asia Pacific

Asia Pacific is anticipated to be the second-largest region with a value of USD 7.93 billion in 2026, exhibiting a CAGR of 7.62% and holds a significant Thai cuisine market share due to several interconnected reasons. As the origin of Thai cuisine, Thailand contributes significantly, with a large food services market supported by a robust street food culture and an emerging Quick-Service Restaurant (QSR) segment. Thailand is also among the top destinations for culinary tourism, which attracts food enthusiasts from across the world. Asia Pacific is a hub for the export of processed foods due to its geographical proximity to Thailand, which reduces transportation costs and offers ready-to-consume foods through the supply chain.

Economic growth and higher urbanization of Asia Pacific have led to increased consumer spending on eating out. Urban populations in India, according to the National Institute of Urban Affairs, grew six times since 1951 to 377.1 million in 2011 and can expand to 590 million by 2030. Furthermore, the affordability of street food and the widespread presence of Thai cuisine in high-end dining venues ensure extensive market penetration. The Indian market is expected to reach USD 0.08 billion in 2026. China market is predicted to hit USD 0.64 billion and Japan will likely to be USD 1.25 billion in 2026.

South America

South America is projected to become the fourth-largest market with a size of USD 0.36 billion in 2025. South American urbanization has been accompanied by increasing middle-class growth with increased disposable incomes. Due to migration from rural areas into cities, customers seek diversity in dining food, including restaurants serving international cuisines such as Thai food. Urban areas have access to restaurants that serve original and fusion Thai cuisine, appealing to consumers' changing preferences for exotic tastes.

Rising global tourism and cultural exchange have exposed South Americans to different international cuisines, including Thai food. The distinctive harmony of Thai dishes' flavors has appealed to domestic palates. Thailand's gastro-diplomacy initiative, "Global Thai," which began in 2002, has greatly increased the popularity of Thai food in the world by encouraging cultural affinities via cuisine. The initiative helped Thai restaurants open across the world, developing cultural consciousness and culinary enthusiasm.

Middle East & Africa

The UAE is emerging as a significant market for Thai food and foodstuffs because of its cosmopolitan culture and increasing demand for original, healthy, and quality food. The UAE is dependent on imports for food because of its arid climate and low agricultural potential. The UAE market is estimated to hit USD 0.05 billion in 2025. Activities such as the Thai Food Festival 2024 promote original Thai food and its cultural heritage while also driving consumer demand. The UAE's youth generation increasingly eats healthy food, further driving demand for Thai products. Regional market players are launching new items to establish a healthy presence in Thai cuisine. For instance, in December 2024, SCG International introduced Siam Signature, a premium Thai food and beverage brand, at Tamimi Markets in An Nuzhah, Saudi Arabia. This was a historic step in introducing authentic Thai flavors to the Saudi market, further enhancing cultural and economic ties between Thailand and Saudi Arabia.

Competitive Landscape

Key Market Players

Launching Premium Category Thai Cuisine Dishes and Thai Meals is Emerging as a Major Strategy

The established key players in the global Thai cuisine market are embarking on two key strategies, marketing/promotions and base expansion, in order to gain a competitive advantage in the market. Following this, the food service and retail food companies are also concentrating on investments/partnerships/collaborations and new product launches.

The Thai cuisine market is witnessing rapid growth around the world because of the growing consumer interest in diverse and authentic culinary experiences and increasing expenditure on innovative food items. Thus, by observing this trend and the popularity of Thai food, the food service operators/manufacturers are working toward marketing and promotion, which boosts brand recognition and fosters customer loyalty.

List of Key Thai Cuisine Companies Studied

- Blue Elephant Group (Thailand)

- Narathai Cuisine Co., Ltd. (Thailand)

- Saneh Jaan (Thailand)

- MTY Food Group Inc. (Canada)

- Siam House DC, Inc. (U.S.)

- Exquisine Global (Thailand)

- McCormick & COMPANY, INCORPORATED (U.S.)

- R-HAAN (Thailand)

- Nahm Fine Thai Cuisine (U.S.)

- Greyhound Café (U.K.)

Key Industry Developments

- January 2025 – Westbridge Foods, one of the leading developers or importers of Asian food in the U.K., launched a Thai-specialist ready meal brand named Kitchen Joy in the Tesco stores of the country. The product range includes rice and noodle-based frozen meals across 580 stores in the U.K.

- January 2025 – Ready-to-eat Thai sauce manufacturer WATCHAREE’S launched a noodle meat kit line in the U.S. market. The product line includes Thai Peanut Noodles, Thai Red Curry Noodles, and Thai Coconut Curry Noodles.

- December 2024 – SCG International launched a premium Thai food brand named Siam Signature, which provides authentic Thai flavors in the Saudi Arabian food market. The key products sold under this brand include ready-made sauces and meal kits, Halal-certified snacks, and others.

- October 2024 – The exporter of frozen Thai desserts, Eve Global Trade, launched new ready-to-eat frozen desserts in the U.S. and other international markets. The company launched its products, Kanomthai Chujai and Pada Sweet.

- May 2024 – Authentic Asia launched single-serve frozen meals in the U.S. market. The product range includes Thai-style coconut curry chicken, Thai basil stir-fried beef, and others.

Report Coverage

The Thai cuisine market research report analyzes the market in-depth and highlights crucial aspects such as prominent companies, competitive landscape, type, food type, and distribution channel. Besides this, it provides insights into market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, it encompasses several factors contributing to the market's growth over recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.98% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Food Type

By Distribution Channel

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 9.68 billion in 2025 and is anticipated to record a valuation of USD 19.27 billion by 2034.

The global market will exhibit a CAGR of 7.98% during the forecast period of 2026-2034.

By type, the Pad Thai segment is predicted to dominate the market during the forecast period.

Favorable government initiatives are expected to boost Thai cuisines popularity and support its market growth.

MTY Food Group Inc., Narathai Cuisine Co., Ltd., and Blue Elephant are some of the leading players globally.

Asia Pacific dominated the global market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us