Therapeutic Neurotoxin Market Size, Share & Industry Analysis, By Type (Botulinum Toxin Type A and Botulinum Toxin Type B), By Application (Chronic Migraine, Spasticity, Overactive Bladder, Cervical Dystonia, Blepharospasm, and Others), By End-user (Hospitals, Specialty Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

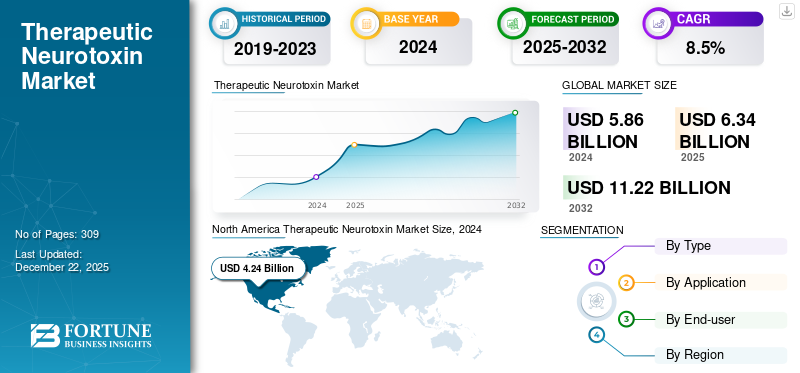

The global therapeutic neurotoxin market size was valued at USD 6.34 billion in 2025. The market is projected to grow from USD 6.86 billion in 2026 to USD 13.39 billion by 2034, exhibiting a CAGR of 8.73% during the forecast period. North America dominated the therapeutic neurotoxin market with a market share of 61.39% in 2025.

Therapeutic neurotoxins, such as botulinum toxin types A and B, are widely used to treat conditions such as chronic migraines, cervical dystonia, spasticity, blepharospasm, and overactive bladder. The rising geriatric population and the increasing incidence of neurological disorders significantly contribute to the market’s growth.

Therapeutic neurotoxin comes from Clostridium botulinum, an anaerobic, gram-positive, motile, spore-forming bacterium that, under anaerobic conditions, generates a protease exotoxin. This endotoxin leads to muscle paralysis, which helps inhibit the pain experienced with migraines. The presence of robust products for neurological conditions and regulatory approvals for expanded indications is expected to boost market growth during the forecast period.

- For instance, in June 2023, Merz Pharma received approval for using XEOMIN to treat focal spasticity of the lower limb from the Medicines and Healthcare products Regulatory Agency (MHRA) in the U.K.

Leading companies such as AbbVie Inc., Ipsen Pharma, and Revance Therapeutics continuously invest in R&D to widen therapeutic indications. Strategic collaborations, product launches, and expanding medical applications continue to shape a competitive landscape in the therapeutics neurotoxin market.

- In January 2023, Revance Therapeutics, Inc.’s Biologics License Application (sBLA) was accepted by the U.S. FDA for the treatment of cervical dystonia in adults.

MARKET DYNAMICS

MARKET DRIVERS

Rising Prevalence of Neurological Diseases to Boost Market Growth

The rise in prevalence of neurological diseases such as chronic migraine, muscle spasticity, and others globally is expected to drive market growth during the forecast period. Botulinum toxin is used to treat migraines and ease the symptoms of many other neurological conditions, such as hyper salivation, cervical dystonia. Thus, the rising prevalence of these conditions increases the demand for therapeutic neurotoxins.

- In March 2024, the data published by WHO stated that in 2021, headache disorders affected approximately 40.0% of the global population, i.e., 3.10 billion people.

Such a large number of people affected by chronic migraine and headache disorders underscores the demand for adequate treatment. Neurotoxins help reduce headache frequency and severity in patients with chronic migraine.

MARKET RESTRAINTS

High Cost and Potential Side Effects of Treatment May Hinder Market Growth

High treatment costs and potential side effects of this therapy may limit accessibility in low-income regions. The high cost is further associated with inadequate reimbursement policies for neurotoxin treatment for therapeutic purposes in lower-income countries, leading to decreased adoption.

- For instance, in October 2023, as per the study published by the Cureus Journal of Medical Science, a study was performed to evaluate the effectiveness of OnabotulinumtoxinA (Botox) and anti-calcitonin gene-related peptide (anti-CGRP) in the treatment of migraine headaches. The study found that Botox injections for migraines, administered every three months, result in a total therapy cost of around USD 3,000. Thus high cost of treatment makes it very difficult for many individuals to afford, and lowers compliance.

Furthermore, there are significant side effects associated with the therapy, such as muscle weakness, neck pain, eyelid ptosis, and others. Such effects associated with neurotoxins decrease their adoption and hamper the therapeutic neurotoxin market growth.

MARKET OPPORTUNITIES

Expansion of Therapeutic Neurotoxin Clinical Applications Offer Lucrative Opportunities

Neurotoxins are widely used for treating spasticity, migraine, and cervical dystonia. However, many neurological conditions are increasingly being treated with neurotoxins such as neuropathic pain, psychiatric diseases, and depression.

While established therapies for depression exist, many patients fail to respond to any combination of oral antidepressants and psychotherapy. Thus, the development of new treatment approaches for depression is needed.

Many research studies are performed to find out the effects of botulinum toxin A on depression. BoNT/A has been shown to modulate amygdala activity, providing a mechanistic link between BoNT/A and its antidepressant activity.

Additionally, BoNT/A therapy has several potential advantages as a psychiatric therapeutic. The depot drug must be administered in an outpatient setting that lasts on average of three months, allowing fewer office visits for patients and physicians and thereby enhancing therapeutic adherence. Moreover, many key companies are focusing on clinical studies to boost the commercialization of neurotoxins for neuropsychiatric conditions.

- In March 2024, Healis Therapeutics, Inc. collaborated with Massachusetts General Hospital (MGH) to conduct upcoming clinical trials assessing the safety and efficacy of CKDB-501A, a BoNT/A neuromodulator, which is being evaluated for the treatment of neuropsychiatric conditions, including major depressive disorder (MDD), PTSD, and social anxiety disorder (SAD).

MARKET CHALLENGES

Biosimilar Competitions to Challenge Market Growth

Biosimilars have emerged as a significant challenge to the therapeutic neurotoxin market. These biologically similar drugs offer comparable safety and efficacy to branded neurotoxins at a reduced cost, thereby intensifying price-based competition. Additionally, healthcare systems and insurers increasingly favor cost-effective biosimilars, pressuring established companies to reduce prices. Emerging players are focusing on developing and receiving approval for Botox biosimilars, further challenging market growth.

- For instance, in September 2024, AEON Biopharma, Inc., a clinical-stage biopharmaceutical company developing a botulinum toxin complex through the 351(k) biosimilar pathway, announced that it has received the official meeting minutes from a recent Biosimilar Initial Advisory (BIA) meeting with the U.S. Food and Drug Administration (FDA). The meeting focused on AEON’s ABP-450 (prabotulinumtoxinA) injection, which is being developed as a biosimilar to BOTOX (onabotulinumtoxinA).

THERAPEUTIC NEUROTOXIN MARKET TRENDS

Development of Needle-free Treatment to Offer a Prominent Trend

There is a rising demand for new drug delivery methods for various primary axillary hyperhidrosis, as traditional neurotoxin needle injections offer discomfort and anxiety in patients.

To address this, various key companies focus on developing and offering a potentially less painful and more accessible alternative for managing excessive sweating.

One promising approach is the intradermal delivery of botulinum toxin through topical application, which may reduce primary axillary hyperhidrosis without the need for multiple injections. This method offers better patient comfort and provides a potentially superior treatment option than current botulinum toxin injections.

- For instance, in January 2025, Dermata Therapeutics, Inc., collaborated with Revance to evaluate the topical application of Xyngari, topical Spongilla powder, with Daxxify. The companies intend to evaluate Xyngari with Daxxify for the topical treatment of primary axillary hyperhidrosis.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Large Number of Product Approvals Boosted Botulinum Toxin Type A Segment Growth

Based on type, the market is divided into botulinum toxin type A and botulinum toxin type B.

The botulinum toxin type A segment dominated the global market share in 2024 and is projected to grow with the highest CAGR in the upcoming years. The dominant share of the segment is due to the presence of many approved products for therapeutic purposes, which consist of botulinum toxin type A.

Increasing research and development activities by key players and regulatory approvals for Botox type A are expected to boost the segment’s growth in the market.

- For instance, in November 2023, Merz Pharma received approval for using Xeomin (incobotulinumtoxinA) from the Australian Therapeutic Goods Administration (TGA). With the approval, the company enters the Australian market to treat adults and children with chronic sialorrhea or excessive drooling.

The botulinum toxin type B segment held a considerably lower market share in 2024. The segment’s slower growth can be attributed to the presence of a single botulinum toxin type B product. However, ongoing clinical trials aimed at expanding its application are likely to contribute to the growth of the segment.

- For instance, in October 2020, according to the EU Clinical Trials Register, a safety and efficacy study for MYOBLOC was conducted to treat adult lower limb spasticity.

By Application

Product Approvals by Regulatory Bodies Drive Spasticity Segment’s Dominance

Based on application, the market is segmented into spasticity, chronic migraine, blepharospasm, cervical dystonia, overactive bladder, and others.

The spasticity segment held the dominant share of the market driven by the increasing number of muscular spasticity cases worldwide and the rising demand for therapeutic neurotoxin products to relax muscles. Additionally, an increasing number of product approvals and label extensions for already available products to treat spasticity further boost the segment’s growth.

- In July 2021, AbbVie Inc. (Allergan Aesthetics) announced that the U.S. FDA approved the label expansion for BOTOX to include eight new muscles for treating upper limb spasticity.

The chronic migraine segment held the second-largest therapeutic neurotoxin market share and is expected to grow significantly throughout the forecast period. The growth of the segment is attributed to the presence of a large number of the global population suffering from chronic migraine and headache-related disorders. Furthermore, key companies with approved neurotoxin products for migraine treatment are expected to boost the segment’s growth.

The cervical dystonia and overactive bladder segments are expected to grow substantially during the forecast period driven by rising awareness of treating these medical conditions with neurotoxins. Additionally, rising regulatory approvals and product launches are expected to boost the segment’s growth during the forecast period.

- For instance, in August 2023, Revance Therapeutics, Inc. received approval for DAXXIFY (DaxibotulinumtoxinA-lanm), a botulinum toxin injection for the treatment of cervical dystonia in adults from the U.S. FDA.

By End-user

Growing Neurological Conditions Encouraged Hospitals Segment Growth

Based on end-user, the market is segmented into hospitals, specialty clinics, and others.

The hospitals segment held the largest market share in 2024 due to a rise in the number of neurological conditions and a shift toward hospital settings for the administration of neurotoxin. Additionally, increasing affordable treatment offerings by hospitals has increased patient access to Botox therapy.

- For instance, in January 2020, the Queen Elizabeth Hospital and Basil Hetzel Institute for Translational Health Research helped list Botox therapy under the Pharmaceutical Benefits Scheme that aided in recovery for patients suffering from spasticity after stroke..

The specialty clinics segment held the second-largest share of the market, owing to the presence of advanced healthcare infrastructure for specific conditions and adequate facilities for patient care.

Therapeutic Neurotoxin Market Regional Outlook

Based on region, the global market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Therapeutic Neurotoxin Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market, generating a revenue of USD 4.6 billion in 2025. The presence of advanced healthcare infrastructure and adequate diagnosis and treatment capabilities has led to increased adoption of therapeutic neurotoxin in the region. Additionally, the presence of key players with recent developments, favorable reimbursement policies, and supportive government initiatives is expected to boost market growth in the region. The U.S. market is expected to reach USD 4.86 billion by 2026.

- For instance, in December 2024, Merz Pharma announced that Health Canada had approved XEOMIN (incobotulinumtoxinA) for the treatment of post-stroke lower limb spasticity involving the ankle and foot in adults.

The U.S. dominated the market in North America in 2024 due to the presence of key market players with advanced product offerings. Additionally, a rise in the acceptance rate of neurotoxins for therapeutic purposes among people also supports market growth.

Europe

Europe is the second-largest region in the market fueled by the rising prevalence of neurological conditions, stroke-associated spasticity in the regions, and the presence of key market players focused on high-end research and development activities to launch new products. The UK market is anticipated to reach USD 0.12 billion by 2026, while the Germany market is estimated to reach USD 0.22 billion by 2026.

- For instance, in June 2022, Ipsen Pharma received a positive opinion in Europe for the adoption of Dysport in managing urinary incontinence in adults with neurogenic detrusor overactivity, which can be caused due to a spinal cord injury or multiple sclerosis.

Asia Pacific

Asia Pacific is expected to grow faster during the forecast period. This growth is attributed to the rise in the prevalence of chronic diseases and increasing research and development activities aimed at improving patient outcomes. The Japan market is forecast to reach USD 0.35 billion by 2026, the China market is set to reach USD 0.23 billion by 2026, and the India market is likely to reach USD 0.06 billion by 2026.

- For instance, in June 2021, Merz Pharma and Teijin Pharma Limited received additional approval from Japan's Ministry of Health, Labor and Welfare to market Xeomin for intramuscular injection to treat lower limb spasticity.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa are expected to grow with considerable CAGR during the forecast period. The growing prevalence of chronic diseases such as cervical dystonia, overactive bladder, and chronic migraine is driving market growth in these regions. Moreover, key companies are focused on expanding their presence in these regions.

- For instance, in January 2025, Hugel Inc. received approval for Botulax, a botulinum toxin, in the UAE. It is approved for the treatment of upper extremity spasticity post-stroke as well as for aesthetic uses.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focus on Getting Regulatory Approvals to Gain Competitive Edge

The global therapeutic neurotoxin market demonstrates a consolidated competitive landscape, with companies such as AbbVie Inc., Ipsen Pharma, and Merz Pharma dominating the global market, accounting for a significant share of global revenue.

Abbvie Inc. (Allergan Aesthetics) held the largest share of the market, owing to its strong product portfolio, which includes the market-leading products BOTOX Cosmetic and BOTOX Therapeutic. The company's consistent efforts to participate in clinical trials to expand Botox’s application areas are also contributing to its growth in this market.

- For instance, in February 2021, AbbVie Inc. (Allergen Aesthetics) announced that the U.S. FDA approved BOTOX to treat detrusor (bladder) in pediatric patients of 5 years of age or older.

Merz Pharma, Ipsen Pharma, and other players also held considerable market share in 2024. Their strong performance in the therapeutics segments has helped maintain their competitive position in the market. These companies are also focusing on getting regulatory approvals for new indications of existing products, which is expected to further support their market growth.

LIST OF KEY THERAPEUTIC NEUROTOXIN COMPANIES PROFILED

- AbbVie Inc. (U.S.)

- Ipsen Pharma (France)

- Merz Pharma (Germany)

- Medytox (South Korea)

- HUGEL, Inc. (South Korea)

- REVANCE (U.S.)

- Supernus Pharmaceuticals, Inc. (U.S.)

- Shanghai Fosun Pharmaceutical (Group) Co., Ltd. (China)

- DAEWOONG PHARMACEUTICAL CO., LTD. (South Korea)

KEY INDUSTRY DEVELOPMENTS

- January 2024: Revance Therapeutics, Inc. received permanent J-code (J0589) for DAXXIFY from the U.S. Centers for Medicare & Medicaid Services (CMS), indicated for treating cervical dystonia in adults.

- December 2023: Medytox launched NEWLUX, a next-generation botulinum toxin product that removes animal-derived components from the raw-material production to prevent animal-antigen-mediated allergic reactions.

- February 2022: Merz Pharma (Merz Therapeutics) expanded its strategic partnership with Vensica Therapeutics by investing USD 3.0 million in the Israel-based start-up. The investment follows the license and collaboration agreement between the two companies to utilize Merz’s botulinum toxin type A (Xeomin) for the innovative ultrasound-assisted delivery catheter by Vensica.

- February 2022: Healis Therapeutics acquired the exclusive license from AbbVie to develop botulinum toxin to treat Major Depressive Disorder (MDD).

- January 2024: Ipsen Pharma announced results from the AboLiSh study to evaluate the effectiveness and utilization of Dysport with the injection guidance technique in people with lower-limb spasticity.

REPORT COVERAGE

The global therapeutic neurotoxin market research report provides market size and forecast by all segments. It also details the market dynamics and trends that expected to drive the market’s growth during the forecast period. The report offers information on key regions, industry developments, new product launches, details on partnerships, and mergers & acquisitions. Additionally, the report aims to offer a detailed analysis of pipeline candidates and pricing analysis of key products. The market outlook covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.73% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size stood at USD 6.34 billion in 2025 and is projected to reach USD 13.39 billion by 2034.

In 2025, the market value of North America stood at USD 4.6 billion.

Growing at a CAGR of 8.73%, the market will exhibit steady growth during the forecast period (2026-2034).

By application, the spasticity segment led the market.

The rise in prevalence of key diseases and the expansion of approved products drive the market.

AbbVie Inc., Ipsen Pharma, and Merz Pharma are the top players in the market.

North America dominated the market with a share of 61.39% in 2025.

The launch of novel delivery methods, ensuring the safety and efficacy of these products, contributes to the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us