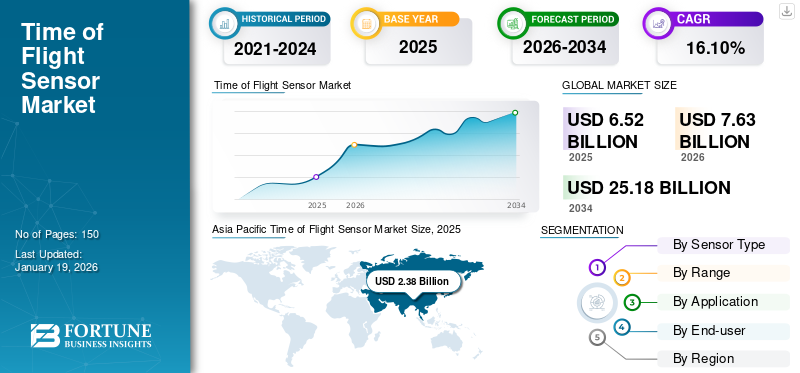

Time of Flight Sensor Market Size, Share & End-user Analysis, By Sensor Type (Direct ToF (dToF), Indirect ToF (iToF), Structured Light, and Others), By Range (Short-range, Long-range, Ultra-long-range, and Very short-range), By Application (Gesture Recognition, 3D Imaging & Mapping, Light Detection & Ranging (LiDAR), Object Detection, Camera-based Applications, and Others), By End-user (Consumer Electronics, Automotive, Industrial Automation, Healthcare, Aerospace & Defense, and Others) and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global time of flight sensor market size was valued at USD 6.52 billion in 2025. The market is projected to grow USD 7.63 billion in 2026 to USD 25.18 billion by 2034, exhibiting a CAGR of 16.10% during the forecast period. Asia Pacific dominated the time of flight sensor market with a market share of 36.50% in 2025.

The time of flight sensor market focuses on technologies that measure the travel time of light pulses to enable accurate depth sensing, distance measurements, and 3d imaging. These sensors are increasingly used in consumer electronics, automotive, industrial automation, healthcare, aerospace & defense, and others due to their precision and real-time object detection capabilities. The market is expanding due to increasing demand for immersive digital applications, the development of Advanced Driver Assistance Systems (ADAS) and autonomous vehicles, and the growing use of 3D vision technologies in smart manufacturing.

The global market is led by major players such as STMicroelectronics, Texas Instruments, Infineon Technologies, Sony Semiconductor Solutions, Samsung Electronics, ON Semiconductor, Broadcom, Panasonic, Lumentum Operations, and ams-OSRAM. These companies play a crucial role in driving innovation, advancing semiconductor technologies, and shaping the competitive landscape of the market.

The COVID-19 pandemic accelerated the adoption of smartphones, medical devices, and touchless technologies, supporting the importance of time of flight sensors in enabling digital transformation.

MARKET DYNAMICS

MARKET DRIVERS

Growing Adoption of 3D Sensing in Consumer Electronics Drives Market Expansion

Time of flight technology is increasingly being adopted in smartphones, tablets, laptops, Augmented Reality (AR) and Virtual Reality (VR) headsets, and gaming consoles to support advanced applications such as facial recognition, gesture control, depth mapping, and immersive augmented reality experiences. For instance,

- According to Advanced Television, the global smartphone market is expected to experience modest growth by August 2025, with shipments reaching 1.24 billion units, reflecting a 1.0% year-over-year increase.

The rising demand for enhanced imaging quality and interactive features is encouraging consumer electronics manufacturers to integrate time of flight sensors as a key differentiating technology in their devices. In addition, the trend toward premium smartphones and next-generation AR/VR platforms is further accelerating the time of flight sensor market share.

MARKET RESTRAINTS

High costs, Performance Limitations, And Competing Technologies to Restrain Market Development

The high cost of sensors and integration complexity limits their use in budget and mid-tier devices, thereby restricting market penetration. Additionally, time of flight sensors face performance issues in outdoor or high-light environments, where strong ambient light reduces depth accuracy. Alternative 3D sensing technologies, including structured light and stereo vision, are creating competitive pressure in the market. These solutions are often more affordable, making them attractive alternatives and hindering the time of flight sensor market growth.

MARKET OPPORTUNITIES

Rapid AR/VR and Metaverse Adoption Unlock New Growth Opportunities for Market Players

Time of flight sensors provide the depth perception, gesture control, and spatial accuracy required to deliver realistic and interactive virtual experiences. Rising deployment of AR/VR across industries such as gaming, healthcare, education, retail, and manufacturing is fueling demand for ToF sensors. For instance,

- According to a survey commissioned by Grid Raster, approximately 91% of businesses have either adopted or are planning to adopt augmented reality (AR) or virtual reality (VR) technologies.

Rising worldwide investment in immersive technologies is projected to establish ToF sensors as a fundamental enabler of next-generation digital experiences. Furthermore, continuous advancements in sensor miniaturization and cost efficiency are expected to accelerate their integration into a wider range of consumer and industrial applications.

TIME of FLIGHT SENSOR MARKET TRENDS

Integration of Time Of Flight Technology into Autonomous Driving Fuels Market Development

Automotive manufacturers are increasingly leveraging time of flight sensors for applications such as driver monitoring, gesture recognition, occupant detection, and fatigue analysis, all of which are essential for enhancing vehicle safety and user experience. These sensors are also being explored for external LiDAR-based 3D mapping and object detection, supporting the transition toward semi-autonomous and fully autonomous driving. The rising demand for intelligent mobility solutions and stricter safety regulations is further accelerating the adoption of ToF technology in the automotive sector. As a result, the automotive industry is emerging as a critical growth avenue for the ToF sensor market, complementing its established presence in consumer electronics. For instance,

- According to S&P Global, the worldwide vehicle sales are projected to reach 89.6 million units in 2025, marking a 1.7% year-over-year increase. Challenges such as high interest rates and trade uncertainties may limit this growth.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Sensor Type

Direct ToF (dToF) Segment Dominates due to High Accuracy and Long-Range Performance

Based on sensor type, the market is divided into Direct ToF (dToF), Indirect ToF (iToF), structured light, and others.

Direct ToF holds the maximum share as it offers higher accuracy, longer detection range, and better performance in outdoor and low-light conditions, making it widely preferred across automotive, robotics, and industrial applications. It held 44.56% of the share in 2026.

Indirect ToF captures the second-largest share due to its cost-effectiveness, low power consumption, and ease of integration in consumer electronics such as smartphones, tablets, and AR/VR devices.

By Range

Short-range ToF Segment Leads the Market as It is Widely Used in Smartphones and AR/VR Devices

Based on range, the market is divided into short-range, long-range, ultra-long-range, and very short-range.

Short-range ToF sensors lead the market with 47.43% of the share, as they are extensively used in smartphones, gaming consoles, and AR/VR headsets for features such as facial recognition, gesture control, and depth sensing.

Long-range ToF sensors are expected to grow at the highest CAGR due to their increasing use in automotive LiDAR, industrial automation, and drones, where depth mapping and obstacle detection are critical.

By Application

Gesture Recognition Segment Leads, Driven by the Rising Demand for Touchless Interaction

Based on application, the market is divided into gesture recognition, 3D imaging & mapping, Light Detection & Ranging (LiDAR), object detection, camera-based applications, and others.

Gesture recognition dominates the market with 29.21% of the share, as these sensors enable intuitive, touchless interactions in smartphones, AR/VR headsets, and gaming systems. Rising consumer preference for contactless technologies and immersive experiences drives widespread adoption.

3D imaging & mapping is projected to grow at the highest CAGR due to its applications in autonomous navigation, robotics, AR/VR, and industrial design, where precise depth perception and spatial awareness are critical.

By End-user

To know how our report can help streamline your business, Speak to Analyst

Consumer Electronics Segment Holds the Largest Share due to its Extensive Adoption in Personal Devices

By end-user, the market is divided into consumer electronics, automotive, industrial automation, healthcare, aerospace & defense, and others.

Consumer electronics lead the market, holding 37.4% of the global share, as these sensors are extensively integrated into smartphones, tablets, and AR/VR devices to enhance photography, facial recognition, and immersive user experiences. The high global penetration of consumer devices makes this segment the largest revenue contributor.

The automotive sector is expected to grow at the highest rate, as ToF sensors are increasingly deployed in ADAS, driver monitoring, in-cabin sensing, and LiDAR-based autonomous systems. Rising regulatory emphasis on safety, automation, and smart mobility solutions further fuels growth in this segment.

Time of Flight Sensor Market Regional Outlook

By geography, the market is categorized into North America, South America, Europe, Middle East & Africa, and Asia Pacific.

Asia Pacific Time of Flight Sensor Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific dominated the market with a valuation of USD 2.38 billion in 2025 and USD 2.81 billion in 2026. with USD 2.02 billion. The region’s dominance is due to the large-scale production and consumption of consumer electronics, particularly in countries such as China, Japan, South Korea, and India. The region is also expected to grow at the highest CAGR, supported by rapid adoption in automotive, AR/VR, and industrial automation, coupled with strong investments in 5G and smart infrastructure. The Japan market is projected to reach USD 0.65 billion by 2026. The China market is projected to reach USD 0.82 billion by 2026. The India market is projected to reach USD 0.54 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

During the forecast period, North America is growing at a CAGR of 17.3%, the second-highest amongst all regions, reaching the valuation of USD 1.73 billion in 2025. The growing investments in 3D imaging, augmented reality, and autonomous driving solutions drive the growth of the region. In addition, the U.S. drives much of North America’s dominance in the market, supported by major semiconductor manufacturers, strong R&D activities, and rapid adoption of advanced technologies across various sectors. The U.S. market is projected to reach USD 1.18 billion by 2026.

Europe also holds significant share in the market owing to early adoption of advanced technologies, strong presence of leading automotive manufacturers, and demand for AR/VR and industrial automation solutions. The market is expected to grow at a CAGR of 16.2%, reaching USD 1.84 billion in 2025. Additionally, stringent safety regulations and high investments in autonomous driving and smart manufacturing contribute to sustained market growth in these regions. The UK market is projected to reach USD 0.53 billion by 2026. The Germany market is projected to reach USD 0.45 billion by 2026.

MEA and South America are expected to grow more slowly in the market, with CAGRs of 14.9% and 14.3%, respectively, due to limited consumer electronics manufacturing bases and lower adoption of advanced sensing technologies compared to other regions. Economic constraints, coupled with delayed adoption of AR/VR, automotive automation, and smart factory solutions, further restrict the growth potential in these markets.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Launch New Products to Strengthen their Market Position

Industry participants are launching new product portfolios to boost their positioning by deploying technological advancements, addressing varioys consumer needs, and staying ahead of competitors. They prioritize portfolio enhancement and strategic collaborations, acquisitions, and partnerships to reinforce their offerings. Such strategic product launches help companies maintain and grow their market share in a rapidly evolving landscape.

LIST OF KEY TIME OF FLIGHT SENSOR COMPANIES PROFILED

- STMicroelectronics N.V. (Switzerland)

- Texas Instruments Incorporated (U.S.)

- Infineon Technologies AG (Germany)

- Sony Semiconductor Solutions Corporation (Japan)

- Samsung Electronics Co., Ltd. (South Korea)

- ON Semiconductor Corporation (U.S.)

- Broadcom Inc. (U.S.)

- Panasonic Corporation (Japan)

- Lumentum Operations LLC (U.S.)

- ams-OSRAM AG (Austria)

KEY INDUSTRY DEVELOPMENTS

- In July 2025, Meskernel introduced a 1000Hz high-speed Time-of-Flight (ToF) laser distance sensor tailored for robotics, industrial automation, and precision measurement applications. The sensor delivers advanced performance to enhance accuracy and efficiency in next-generation systems.

- In July 2025, Baumer expanded its portfolio with the launch of two new ToF sensors. The OT200 offers a compact design with an extended range, while the OT330 provides versatility through easy installation and low maintenance.

- In June 2025, Sony Semiconductor Solutions Corporation announced the IMX479 stacked dToF SPAD depth sensor for automotive LiDAR It achieves up to 20 fps, making it the fastest among high-resolution 520-pixel dToF sensors.

- In June 2025, STMicroelectronics launched its Human Presence Detection (HPD) technology for laptops, PCs, and accessories. The solution, combining FlightSense ToF sensors with AI algorithms, reduces power consumption by over 20% while enhancing security, privacy, and battery life.

- In June 2025, SensoPart introduced the FT 25-RLAP ToF sensor, capable of precise distance measurement up to 1.5 meters. It features analog output, IO-Link communication, and strong background suppression in a compact 34 x 20 x 12 mm housing.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 16.10% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Sensor Type · Direct ToF (dToF) · Indirect ToF (iToF) · Structured Light · Others (Hybrid) |

|

By Range · Short-range · Long-range · Ultra-long-range · Very short-range |

|

|

By Application · Gesture Recognition · 3D Imaging & Mapping · Light Detection & Ranging (LiDAR) · Object Detection · Camera-based Applications · Others (Security & Surveillance) |

|

|

By End-user · Consumer Electronics · Automotive · Industrial Automation · Healthcare · Aerospace & Defense Others (Retail & E-commerce) |

|

|

By Geography · North America (By Sensor Type, By Range, By Application, By End-user, and Region) o U.S. (End-user) o Canada (End-user) o Mexico (End-user) · South America (By Sensor Type, By Range, By Application, By End-user, and Region) o Brazil (End-user) o Argentina (End-user) o Rest of South America · Europe (By Sensor Type, By Range, By Application, By End-user, and Region) o U.K. (End-user) o Germany (End-user) o France (End-user) o Italy (End-user) o Spain (End-user) o Russia (End-user) o Benelux (End-user) o Nordics (End-user) o Rest of Europe · Middle East & Africa (By Sensor Type, By Range, By Application, By End-user, and Region) o Turkey (End-user) o Israel (End-user) o GCC (End-user) o North Africa (End-user) o South Africa (End-user) o Rest of Middle East & Africa · Rest of the Middle East & Africa, Asia Pacific (By Sensor Type, By Range, By Application, By End-user, and Region) o China (End-user) o India (End-user) o Japan (End-user) o South Korea (End-user) o ASEAN (End-user) o Oceania (End-user) · Rest of Asia Pacific |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 6.52 billion in 2025 and is projected to reach USD 25.18 billion by 2034.

In 2025, the market value stood at USD 2.38 billion.

The market is expected to exhibit a CAGR of 16.10% during the forecast period of 2026-2034.

The direct ToF (dToF) segment led the market by sensor type.

The key factors driving the market are the rising adoption of 3D sensing and increasing use in automotive safety systems.

STMicroelectronics N.V., Texas Instruments Incorporated, Infineon Technologies AG, Sony Semiconductor Solutions Corporation, and Samsung Electronics Co., Ltd. are some of the prominent players in the market.

Asia Pacific dominated the market in 2025.

Major factors favoring product adoption are rising demand for 3D sensing, integration in smartphones and vehicles, growth in industrial automation, and expanding healthcare and AR/VR applications.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us