Carotenoids Market Size, Share & Industry Analysis, By Type (Astaxanthin, Beta-carotene, Lutein, Zeaxanthin, Lycopene, Canthaxanthin, and Others), By Source (Synthetic and Natural), By Form (Liquid, Powder, and Beadlet), By Application (Animal Feed, Food & Beverages, Dietary Supplements, Personal Care & Cosmetics, and Pharmaceuticals), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

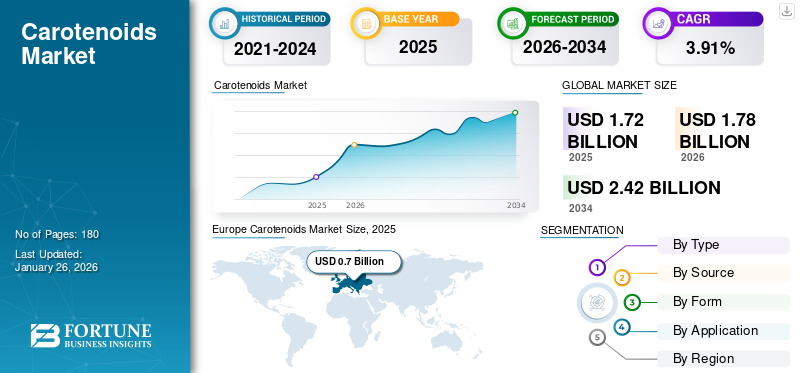

The global carotenoids market size was valued at USD 1.72 billion in 2025. The market is projected to grow from USD 1.78 billion in 2026 to USD 2.42 billion by 2034, exhibiting a CAGR of 3.91% during the forecast period 2026-2034. Europe dominated the carotenoids market with a market share of 41.00% in 2025.

Carotenoids are one of the most popular pigments that are naturally sourced from plants, algae, and photosynthetic bacteria. They enhance the overall aesthetics of food products, making them visually appealing. The wide-ranging applications of the product across both food and non-food sectors are expected to drive market growth. Moreover, various health benefits associated with the consumption of food containing carotenoids are anticipated to contribute to the product demand. For instance, consuming foods rich in beta-carotene is recommended by governments and scientific organizations such as the U.S. Department of Agriculture (USDA) and the U.S. National Cancer Institute.

Some of the prominent manufacturers operating in the market are Kemin Industries, BASF SE, Chr. Hansen Holdings A/S, Algatech Ltd., and Allied Biotech Corporation, among others.

MARKET DYNAMICS

Market Drivers

Growing Focus on Developing Nutraceutical Products to Propel Market Growth

Alternative treatment methods apart from allelopathic products for diabetes, eye disorders, and other lifestyle diseases are gaining significant popularity. The rising focus on preventive medicine has encouraged manufacturers and processors to come up with nutraceuticals such as dietary supplements and functional foods that utilize natural ingredients. Geriatric nutrition has emerged as the vital application area for carotenes owing to their high antioxidant properties, which help protect against oxidative stress associated with aging processes and pollution. All these factors are collectively contributing to the sales of carotenoids.

Growing Demand for Natural Skincare Cosmetics to Surge Product Sales

With the growing focus on health and wellness, the consciousness regarding aesthetics and appearance among consumers has increased significantly. This trend has escalated the demand for effective skincare and cosmetic products globally. Carotenoids have been identified for their antioxidant properties that can be used in skincare product formulations for improving skin tone, maintaining skin firmness, and protecting against UV light exposure.

The rise in consumer spending on natural skin brightening and anti-aging products is likely to create immense opportunities for innovative formulations, boosting market growth. For instance, according to Lucas Meyers Cosmetics, an Asian cosmetic ingredient company, naturally occurring colorless carotenoids that are found in tomatoes can be easily used in the production of natural cosmetics.

Market Restraints

High Price Difference between Synthetic Carotenoids and Natural Products to Hamper Market Growth

The high price gap between synthetic carotenoids and natural products is expected to be a major restraint on market growth, especially among low-income or developing economies. Moreover, the unregulated and excessive utilization of carotene in developed markets has been associated with health risks. These factors collectively pose significant challenges to the global carotenoids market growth.

MARKET OPPORTUNITIES

Growing Demand for Natural Ingredients to Create Several Business Opportunities

There is a growing demand for natural ingredients among consumers due to increasing concerns about the negative effects of consuming food products made with synthetic ingredients. This acts as a natural substitute for chemical products, making them a suitable ingredient for manufacturing organic and natural products, which find application in various industries such as cosmetics, food and beverages. Therefore, several carotenoid manufacturers are expanding their product lines to cater to the food and beverage, cosmetics, and pharmaceutical sectors.

CAROTENOIDS MARKET TRENDS

Growing Demand for Natural Compounds in Skincare Products to Favor Industry Growth

The carotenoids market is primarily driven by the all-natural trend that continues to gain traction across the globe. Growing regulatory restrictions on the use of synthetic feed ingredients and chemicals due to their hazardous impacts on animal health are expected to drive demand for natural products in the coming years. In the global food & beverage and cosmetics industries, consumers are increasingly favoring clean label and all-natural ingredients over synthetic products augmented due to their potential health and beauty benefits. For instance, in August 2020, Peach & Lily, a Korean skincare and beauty products company, launched an eye cream, Pure Peach Retinoic Eye Cream, that contains beta-carotene and vitamin A. The product is effective for treating problems such as dark circles, fine lines, and loose skin near the eyes.

Europe Carotenoids Market Size, 2021-2034 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Impact of Tariff War

Tariff war between the U.S. and other countries is redefining global commodity trade, with both long-term and short-term implications for international trade relations. High tariff charges imposed by the U.S. on the carotenoid-rich crop import disrupted the global supply chain significantly. These disruptions led to increased prices of raw materials, thereby raising the overall production costs of carotenoid-based supplements, food and beverages, and other related products. In response, exporters, importers, and other supply chain partners are collaborating to share and manage the increased costs. This collaborative approach is helping partners mitigate the risk of significant price hikes, which could directly impact the sales of final products in the market.

Segmentation Analysis

By Type

Beta-carotene Segment Dominates Market Due to Its Health Benefits

On the basis of type, the market is segmented into astaxanthin, beta-carotene, lutein, zeaxanthin, lycopene, canthaxanthin, and others.

The astaxanthin segment is projected to dominate the market with a share of 29.54% in 2026. At present, beta-carotene leads the market share among the different types, and its demand is extremely high. Its widespread popularity is largely attributed to its potential health benefits, including boosting immunity, improving heart health, preventing diabetes, and supporting overall well-being.

Astaxanthin accounts for the second largest market share due to its antioxidant and anti-inflammatory properties. This makes the product suitable for usage in food and beverages, dietary supplements, and personal care products.

Lutein is another major type that is used for manufacturing dietary supplements and personal care products. It is popular due to its beneficial properties in improving eye health and vision, and also its antioxidant properties.

By Source

Synthetic Segment Dominates Attributed to Its Low Cost

On the basis of source, the market is segmented into synthetic and natural.

The synthetic segment holds the major market share 72.12% in 2026, owing to its low cost and ease of extraction. The availability of carotenoids sourced from synthetic sources is currently high, boosting segment expansion.

The natural segment is projected to grow at the fastest CAGR during the forecast period as consumer preferences are changing rapidly and the demand for organic products is rising at a steady pace. The demand for pigments sourced from natural plant-based sources is amplifying, as consumers are inclined toward food, cosmetics, and other products made with natural ingredients.

By Form

Liquid Segment Dominated Market Owing to Its Wide Application in Different Industries

By form, the market is segmented into liquid, powder, and beadlet.

The liquid segment held the highest market share 52.95% in 2026. Liquid forms include liquid emulsions, oil emulsions, and liquid resins. These variants offer higher bioavailability, which enhances their use in functional food and beverages and dietary supplement manufacturing. Liquid forms are also used in aquaculture products due to their better absorption compared to other forms.

Other available formats include powder forms, which are commonly used in animal feed, food supplements, and other applications. These supplements also serve to impart color to animal feed, supplements, and other food products. However, the high moisture content in the powder form can impact the storage stability and long-term usability of these products.

By Application

To know how our report can help streamline your business, Speak to Analyst

Animal Feed Segment Commands Market Owing to Increased Usage of Carotenoids

As per the application, the market is segmented into animal feed, food & beverages, dietary supplements, personal care & cosmetics, and pharmaceuticals.

Animal feed represents the leading segment of the market share 43.81% in 2026. Carotenoids are extensively used in animal feed products for poultry, fish, or shrimp due to their coloring properties. The pigment of egg yolks, broiler skin, fish, and crustaceans is enhanced through the external incorporation of the product in their feed. Additionally, some carotenoids have the potential to boost fertility and improve the overall health of animals. Field studies have shown a positive impact of feeding beta-carotene supplements in enhancing the fertility of cattle, swine, and horses.

In the food & beverages segment, carotenoids are widely used as food colorants in processed food products such as bakery, dairy, beverages, and dietary supplements. There has been a steady and notable rise in the demand for organic and natural food offerings, driven by increasing consumer awareness about the health benefits of foods that contain natural colors. Additionally, a rising demand, manufacturing, and consumption of functional food and dietary supplements due to their health-aiding properties have further provided a fillip to natural ingredient consumption.

Carotenoids Market Regional Outlook

The market is segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Europe

Europe Carotenoids Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The market value of Europe stood at USD 0.7 billion in 2025 and is expected to hold a major share during the forecast period. The region is expected to account highest portion in the global carotenoids market share. The existence of a huge animal feed sector and a well-established cosmetics industry across the region are the main drivers of growth in the region. It is also among the most preferred food coloring agents in European markets. The United Kingdom market is projected to reach USD 0.14 billion by 2026, while the Germany market is projected to reach USD 0.22 billion by 2026.

North America

Organic and natural have become top priorities for food processors across the globe, particularly in North America, owing to their contribution to food quality, safety, social convenience, and sustainability. Consumers in the region are more conscious of their purchasing habits as food labeling, often checking food labels for ingredients origins, manufacturing practices, and the environmental impact of the supply chain. Such factors are driving the demand for natural ingredients over GMO and synthetic alternatives in developed markets. The United States market is projected to reach USD 0.30 billion by 2026.

The U.S. is one of the leading consumers of this ingredient, which is widely used in skincare, food and beverages, and other products. Carotenoid-based supplements have gained popularity among consumers due to their marketed benefits in supporting health and preventing chronic diseases. Increasing demand for natural, clean-label products continues to play a pivotal role in the growth of the market across the region.

Asia Pacific

In the Asia Pacific region, the consumption of tetraterpenoids is increasing due to their crucial role in curing Vitamin A deficiency, a major public health concern specifically among young children and pregnant women in low-income countries of Africa and Southeast Asia. Vitamin A deficiency is also a major cause of infant mortality in developing countries. Moreover, the increasing interest of international market players in expanding their business across rapidly growing Asian economies is predicted to fuel market growth across the region. The Japan market is projected to reach USD 0.10 billion by 2026, the China market is projected to reach USD 0.13 billion by 2026, and the India market is projected to reach USD 0.08 billion by 2026.

South America

In South America, the rapidly growing animal feed industry and the increasing demand for specialty feed are expected to propel market expansion in the region. Moreover, the active participation of leading manufacturing companies in countries such as Brazil and Chile is further predicted to aid market growth.

Middle East & Africa

The economic growth in Middle Eastern countries acts as one of the primary factors that is fueling the consumption and innovation of the food and beverage sector in the region. As per a report published by the Ministry of Foreign Affairs (MOFA), in UAE alone, there are around foreigners from 200 nationalities that comprise around 90% of its population. A similar demographic pattern is observed across other Middle Eastern countries, where diverse populations bring with them a wide range of cultures, dietary preferences, and food habits. As processed food demand is growing globally, food manufacturers in the Middle Eastern countries are responding by launching innovative food product lines that cater to diverse and evolving market needs. Therefore, the demand for ingredients such as carotenoids, used in food and beverages, skincare, and other sectors, is also increasing.

Competitive Landscape

Key Market Players

Key Players Emphasize New Product Development to Meet Evolving Market Demands

The global carotenoids market remains highly competitive, fueled by the emergence of private firms from the rapidly growing economies of China, India, and others. The key players in the global market are actively pursuing industry consolidation using agreements/partnerships and acquisitions. Additionally, emphasis on new product development continues to be a key strategy adopted by major companies to meet evolving market demands. On the demand side, end-use sectors are seeking carotenoid-based offerings that provide high specificity and also deliver enhanced bioavailability. For instance, Kemin Industries, one of the leaders in the food and feed ingredients industry, is investing heavily in research & development while expanding its portfolio of natural and organic ingredients.

Major Players in the Carotenoids Market

|

Rank |

Company Name |

|

1 |

Kemin Industries |

|

2 |

BASF SE |

|

3 |

Chr. Hansen Holdings A/S |

|

4 |

Algatech Ltd. |

|

5 |

Allied Biotech Corporation. |

Kemin Industries, BASF SE, Chr. Hansen Holdings A/S, Algatech Ltd., and Allied Biotech Corporation are the major players in the market. The global food safety testing market is semi-consolidated, with the top 5 players accounting for around significant portion of the market.

LIST OF KEY CAROTENOID COMPANIES PROFILED

- Allied Biotech Corporation (Germany)

- Algatech Ltd. (Israel)

- BASF SE (Germany)

- Kemin Industries (U.S.)

- Hansen Holdings A/S (Denmark)

- Givaudan (Switzerland)

- DOHLER GmbH (Germany)

- FMC Corporation (U.S.)

- Novus International Inc. (U.S.)

- Sensient Technologies (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2024: OmniActive Health Technologies collaborated with the Council for Responsible Nutrition (CRN) to create awareness about the importance of carotenoids in prenatal nutrition.

- April 2022: Wellbeing Nutrition launched three carotenoids, Lutein, RR-zeaxanthin, and RS-zeaxanthin, into the market. The products help improve eye health, reduce stress, and improve mood and sleep quality.

- April 2020: Deinove, a France-based biotechnology company, launched Luminity, an active cosmetic ingredient that is made with an extremely rare carotenoid, neurosporene. The ingredient has the potential to boost skin radiance and can safeguard the skin from overexposure to light.

- November 2019: HELM partnered with leading carotenoid manufacturers Allied Biotech to develop clear color product lines, which impart colors to energy drinks, candies, and jellies.

- May 2019: Algatech announced the launch of AstaPure-EyeQ, a natural astaxanthin powder to support eye and brain health. The newly launched product is a clinically supported and microencapsulated powder, which has double the bioavailability compared to standard products present within the market.

REPORT COVERAGE

The global carotenoids market report includes quantitative and qualitative insights into the market. It also offers a detailed regional analysis of the market share, market opportunities, market trends, regional market forecast, and growth rate for all possible market segments. This market analysis report provides various key insights into the market, an overview of related markets, the competitive landscape, recent industry developments, such as mergers & acquisitions, the regulatory scenario in critical countries, and key industry trends.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.91% from 2026 to 2034 |

|

Segmentation |

By Type, Source, Form, Application, and Region |

|

Unit |

Value (USD Million) |

| Segmentation |

By Type

By Source

By Form

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market size was valued at USD 1.72 billion in 2025.

Recording a CAGR of 3.91%, the market is expected to exhibit promising growth during the forecast period from 2026 to 2034.

By type, the beta-carotene segment leads the market.

Increasing adoption of nutraceutical products is a key factor driving market growth.

Kemin Industries, BASF SE, Chr. Hansen Holdings A/S, Algatech Ltd., and Allied Biotech Corporation are a few of the prominent players in the market.

Europe is expected to hold the major share during the forecast period.

Growing demand for natural compounds in skincare products is a key market trend.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us