Optical Transceiver Market Size, Share & COVID-19 Impact Analysis, By Transmission Rate (Less than 10 Gbps, 10 Gbps to 40 Gbps, 41 Gbps to 100 Gbps, and Beyond 100 Gbps), By Transmission Distance (Short Distance and Long Distance), By Form Factor (SFP, SFP+, CFP, QSFP, and Others), By Application (Telecommunication, Data Centers, Enterprise Networking, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

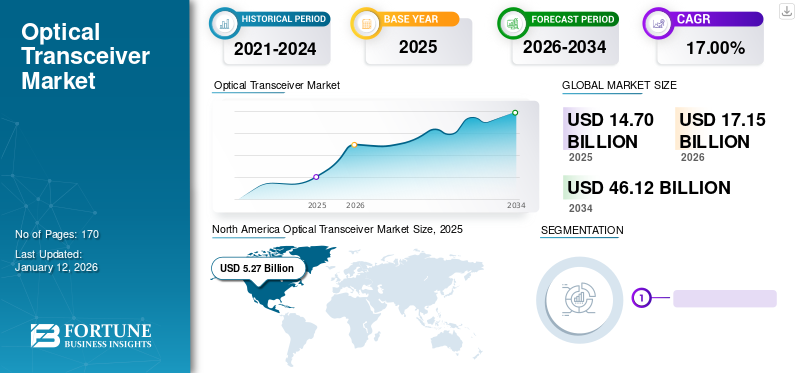

The global optical transceiver market size was valued at USD 14.7 billion in 2025. The market is projected to grow from USD 17.15 billion in 2026 to USD 46.12 billion by 2034, exhibiting a CAGR of 17.00% during the forecast period. North America dominated the global optical transceiver market with a share of 35.09% in 2025.

The optical transceiver is the core part of optical communication and comprises an optoelectronic device, such as a functional circuit and optical interface. The primary role of this transceiver is to convert electrical signals to light signals. As this transceiver helps to bridge the gap between electronic devices and fiber optic cables, it has become a significant part of the common optical module in recent years. Fiber transceivers are primarily business-to-business (B2B) products, used in telecommunication, data center, enterprise networking, and other infrastructure-related applications.

The market’s growth is mainly attributed to growing 5G deployments, the rising data center economy, advancements in fiber optic technology, and increasing demand for data transmission worldwide. According to The Groupe Speciale Mobile Association (GSMA), a non-profit organization representing the mobile ecosystem, by 2025, 5G networks are anticipated to cover one-third of the global population. The rate of 5G rollout across the Asia Pacific region is the highest globally. South Korea, Australia, China, and Japan have outperformed other countries regarding 5G network deployment.

The rising 5G deployments boost the demand for transceivers as the 5G cable network needs higher base-station/cell-site density. Optical transceivers offer the bandwidth and throughput to cater to the increasing demands of 5G networks. Moreover, transceivers play a pivotal role in providing low-latency connectivity in 5G networks, making them ideal for latency-sensitive applications, such as video conferencing applications, autonomous vehicles, and industrial automation.

Major players are increasingly launching high-rate transceivers to cater to the growing demand for transceivers required in 5G networks.

For instance,

- In 2021, Marvell and OE Solutions collaborated to offer the 100G coherent QSFP-DD optical transceiver module for 5G backhaul and metro-access applications. This transceiver facilitates the shift of 10G to 100G coherent solutions, providing the performance required for 5G and metro-access applications.

COVID-19 IMPACT

Raised Demand for High-speed Data Transmission During Pandemic Boosted Market Growth

The COVID-19 pandemic presented significant growth opportunities to major players owing to the increased demand for high-speed data transmission during the pandemic. The pandemic caused an unprecedented surge in digital technology use due to stringent social distancing measures and nationwide lockdowns. During the outbreak, demand for broadband communication services skyrocketed, with some operators registering nearly 60% upsurge in internet traffic. As the data traffic increased significantly, businesses ramped up their technology infrastructure to meet the surging demand. This resulted in increased investment in bandwidth expansion and network equipment.

In addition, the pandemic accelerated the demand for data centers worldwide. According to the Jones Lang LaSalle IP, Inc., In the U.S., data center demand reached 619.3 MW during the pandemic, representing 72.9% growth compared to 2019. This, in turn, propelled the demand for transceivers to support high-speed data transmission within and between data centers.

Optical Transceiver Market Trends

Increasing Adoption of Silicon Photonics Technology to Aid Market Growth

The use of silicon photonics as an optical medium has increased rapidly in the past several years as it helps to overcome bandwidth bottlenecks in optical communications. Silicon photonics combines photonics and electronics transceivers, enabling photoelectric conversion and transmission on a silicon chip using silicon photonics technology. The silicon photonics transceivers are compact and power-efficient devices that align with the increasing emphasis on sustainability in data center operations. The adoption of this technology is rapidly gaining momentum due to its ability to offer an inexpensive and scalable solution for high-speed data transmission. Acquisitions and product launches by key players are expected to contribute to the silicon photonics transceiver growth. For instance,

- In 2023, Jabil Inc. announced the acquisition of Intel Corporation’s silicon photonics optical modules business. Through this acquisition, Jabil will manufacture and sell Intel’s silicon photonics transceivers and develop future models of these transceivers.

Download Free sample to learn more about this report.

Optical Transceiver Market Growth Factors

Increasing Mobile Data Traffic Globally to Fuel Market Growth

According to Ericsson, Global mobile network traffic increased 33% from the second quarter of 2022 to the second quarter of 2023. In addition, the average data consumption per smartphone is anticipated to increase from 21 GB in 2023 to 56 GB in 2029. Mobile data traffic growth is majorly attributed to the rising number of smartphone users, data-intensive applications, and increasing social media video streaming by users. The overall increase in data traffic contributes to the demand for transceivers to handle the rising data volumes. In the fast-evolving data communication industry, transceivers play an important role by allowing long-distance, low-latency, high-speed, and efficient transmission of information. Optical transceivers act as the important bridge between electronic and optical signals, transferring and receiving data through optical fibers with exceptional precision and reliability.

RESTRAINING FACTORS

Compatibility Challenges and High Costs to Limit Market Growth

Several challenges are expected to limit market growth. Among them, compatibility remains a major challenge for operators and project managers. Existing optical fiber infrastructure often requires additional investments in network upgrades or modifications while installing and updating new transceivers. Advanced transceivers pose various problems in deployment as well as maintenance, which can be challenging for widespread adoption. Dealing with compatibility issues and selecting the right transceiver requires various considerations, such as wavelength, network architecture, equipment specifications, performance requirements, future expansion plans, cost factors, interface standards, and data transfer rates between optical modules. There is a limited demand for transceivers in regions with limited fiber optic infrastructure, constraining market growth in such areas. Moreover, supply chain disruptions are another major factor limiting the optical transceiver market growth.

Optical Transceiver Market Segmentation Analysis

By Transmission Rate Analysis

Beyond 100 Gbps Segment to Lead the Market Due to Increasing Demand for High-speed Data Transmission

Based on transmission rate, the market is divided into less than 10 Gbps, 10 Gbps to 40 Gbps, 41 Gbps to 100 Gbps, and beyond 100 Gbps.

The segment beyond 100 Gbps is anticipated to grow with the highest CAGR. contributing 38.95% globally in 2026. With the proliferation of emerging technologies, such as Artificial Intelligence (AI) and the increasing demand for high-speed data transmission, less than 100 Gbps are unable to cater to the market demands. To cater to the high bandwidth requirements, the demand for beyond 100 Gbps transmission rates is increasing rapidly. Beyond 100 Gbps transmission rates include 400 Gbps and 800 Gbps rates that provide high-speed data transmission required for high-performance computing (HPC), cloud computing, data centers, and telecom applications.

The 10 Gbps to 40 Gbps segment held the largest optical transceiver market share in 2022, owing to global data traffic, cloud computing expansion, and applications requiring faster and more reliable data transmission.

By Transmission Distance Analysis

Short Distance Transceivers Growth Driven its Increased Demand for Fast Communications over Short Distances

Based on transmission distance, the market is divided into short distance and long distance.

The short distance segment is expected to witness the highest growth rate during the forecast period. Short distance transceivers play a pivotal role for 5G, the Internet of Things (IoT), and edge computing applications. The IoT devices require stable and faster short distance communication within smart cities and factories, driving the demand for transceivers.

The long distance segment dominates the market with the largest share of 53.64% in 2026. owing to fiber-optic infrastructure deployment for long-haul connections and increased demand for transmitting huge volumes of data between geographically dispersed locations. Large enterprises with global offices often require long distance transceivers for stable and high-speed connectivity.

By Form Factor Analysis

Different Benefits of SFP+ Transceivers to Boost SFP+ Segment Growth

Based on form factor, the market is divided into SFP, SFP+, CFP, QSFP, and others.

The SFP+ segment is anticipated to dominate the market with the largest share of 40.52% in 2026. SFP+ transceivers are an updated version of SFP transceivers that support higher data transmission rates of up to 10 Gbps. SFP+ covers 30m to 120km transmission and is available with various connector types, including LC Duplex, LC Simplex, and RJ45. Major benefits of SFP+ transceivers include compact size, lower cost, and high speed. SFP+ offers higher speed than SFP modules, thus meeting the growing demand for high-speed data transmission.

QSFP transceivers to display rapid growth during the forecast period. QSFP stands for quad small form-factor pluggable transceiver. They are compact transceivers used for data centers and other communications standards. QSFPs are increasingly used in data center applications due to their lower power consumption and better thermal performance.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Cloud Technology Adoption to Boost Data Center Segment Growth

Based on application, the market is segmented into telecommunication, data centers, enterprise networking, and others.

The data center segment is anticipated to witness the highest growth rate during the forecast period. The data center segment is expected to lead the market, contributing 39.53% globally in 2026.Transceivers play an important role in Data Center Interconnect (DCI) to connect two or more data centers over short or long distances. In addition, transceivers connect servers within data centers, allowing faster communication between various computing nodes. During the forecast period, the data center industry is expected to grow rapidly owing to increasing cloud adoption, IoT growth, and the rise of edge computing. This, in turn, is anticipated to augment the market growth.

The telecommunication segment dominated the market in 2022 with the largest market share. Numerous factors are driving the demand for transceivers in the telecom sector. These factors include increased data traffic, optical network upgrades, and rapid 5G network deployment.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific. They are further categorized into countries.

North America Optical Transceiver Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is expected to hold the largest market share owing to the region’s well-established telecommunications infrastructure, rapid 5G deployment, and presence of key players. North America dominated the global market in 2025, with a market size of USD 5.27 billion. The U.S. has maintained its leadership in North America due to rapid data center expansion, driven by the robust demand for cloud services and the increasing volume of digital data. The U.S. is the major global hub for the data center industry, with more than 2,600 data centers spread across the country. Transceivers connect and transmit data within and between these data centers. The U.S. market is projected to reach USD 1.35 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific market is anticipated to grow with the highest growth rate during the forecast period due to growing cloud adoption, rapid 5G rollout, increasing demand for high-speed internet, and growth in data center facilities. According to GSMA, in 2022, there were more than 1.73 billion unique mobile subscribers in the Asia Pacific region. USD 130 billion is anticipated to be added to the region’s economy by 2030. It is one of the early adopters of 5G technology as of 2023. 11 countries in the region have announced the commercial availability of the 5G network, including China, South Korea, Australia, Japan, India, Malaysia, Indonesia, New Zealand, the Philippines, Singapore, and Thailand. The Japan market is projected to reach USD 0.46 billion by 2026, the China market is projected to reach USD 1.88 billion by 2026, and the India market is projected to reach USD 0.83 billion by 2026.

The market growth in Europe is driven by data center expansion and supportive government initiatives focused on enhancing digital infrastructure and growing demand for high-speed and reliable connectivity in various sectors. According to the Jones Lang LaSalle IP, Inc., Europe registered the highest demand for data center capacity (114MW) from April to June. The UK market is projected to reach USD 0.5 billion by 2026, while the Germany market is projected to reach USD 0..60 billion by 2026.

In South America, the telecommunication infrastructure growth and data center development are propelling market growth. Brazil is anticipated to lead the market owing to the country's highest number of data centers. In addition, Brazil is making rapid 5G progress compared to the other countries in this region. As per GSMA, 5G subscribers in Brazil are expected to reach 179 million by 2030 from 36.2 million in 2025. All these factors are expected to boost the demand for transceivers in this region.

The Middle East & Africa (MEA) region shows significant growth owing to government initiatives and the presence of emerging economies. UAE leads the world in terms of fiber optic connectivity. According to the FTTH council, in 2022, UAE achieved an FTTH penetration rate of 94.3%, the highest in the world.

List of Key Companies in Optical Transceiver Market

Growing Market Players’ Focus on Strengthening their Position with Continuous Developments Driving Market Growth

The global market consists of key players, such as Coherent Corp., InnoLight Technology, HiSilicon Optoelectronics Co., Ltd., Cisco Systems, Inc., Broadcom Inc., Eoptolink Technology Inc., Ltd., Accelink Technology Co. Ltd., Molex, LLC, ATOP Corporation, and Lumentum Operations LLC. These key optical transceiver companies focus on expanding their operations by adopting strategies, including product launches, mergers & acquisitions, partnerships, and collaborations.

For instance,

- In March 2023, Eoptolink Technology Inc., Ltd., a manufacturer of high-speed transceivers strengthened its product portfolio by launching a Multimode BIDI Transceiver in various versions, including 100G, 400G, and 800G. The 800G transceiver works with 4+4 fibers in an MPO-12 connector interface, facilitating a smooth transition from 400G to 800G without replacing existing fiber infrastructure.

LIST OF KEY COMPANIES PROFILED:

- Coherent Corp. (U.S.)

- InnoLight Technology (China)

- HiSilicon Optoelectronics Co., Ltd. (China)

- Cisco Systems, Inc. (U.S.)

- Broadcom Inc. (U.S.)

- Eoptolink Technology Inc., Ltd. (China)

- Accelink Technology Co. Ltd (China)

- Molex, LLC (U.S.)

- ATOP Corporation (China)

- Lumentum Operations LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: Lumentum Operations LLC, a manufacturer of optical and photonic products, acquired Cloud Light Technology Limited, a manufacturer of optical fiber transceivers, optical sensors & solutions, at a transaction value of nearly USD 750 million. With this acquisition, Lumentum will boost its cloud data center infrastructure revenue in the upcoming months.

- September 2023: Tower Semiconductor, a semiconductor manufacturing company, and InnoLight Technology, collaborated to produce multi-generation high-speed optical transceivers using Tower’s Silicon Photonics process platform (PH18). These cutting-edge transceivers are built to cater to the increasing demands of data center and telecommunication applications.

- February 2023: Hamamatsu Photonics K.K. built an optical transceiver P16671-01AS using opto-semiconductor manufacturing technology that transmits data at 1.25 Gbps. This transceiver is developed for scientific, medical, and semiconductor manufacturing equipment.

- September 2022: OE Solutions, a fiber-optic transceiver provider, announced the launch of digital coherent optical transceivers for access network applications. These products support various form factors, including QSFP28, QSFP-DD, and CPF2.

- June 2021: Source Photonics, a manufacturer of optical communication products, launched 800G optical transceivers for data center and telecommunication applications during the Optical Fiber Communication Conference (OFC) 2021 virtual event.

REPORT COVERAGE

An Infographic Representation of Optical Transceiver Market

To get information on various segments, share your queries with us

The market report offers qualitative and quantitative insights into the market and a detailed analysis of the size and growth rate for all possible segments in the market. It also provides an elaborative industry analysis with market dynamics, emerging trends, and the competitive landscape. The report also offers key insights, such as the implementation of automation in specific market segments, recent Application developments such as partnerships, mergers, funding, acquisitions, consolidated SWOT analysis of key players, business strategies of leading market players, macro and micro economic indicators, and major application trends. This detailed industry analysis provides a comprehensive view of the market and its potential for growth and development.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021 - 2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026 – 2034 |

|

Historical Period |

2021 - 2024 |

|

Growth Rate |

CAGR of 17.00% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Transmission Rate

By Transmission Distance

By Form Factor

By Application

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market is predicted to reach USD 46.12 billion by 2034.

In 2025, the market value stood at USD 14.7 billion.

The market is projected to grow at a CAGR of 17.00% during the forecast period (2026 – 2034).

The data centers segment is the leading application segment in the market.

The increasing mobile data traffic globally fuels market growth

The top players in the market are Coherent Corp., InnoLight Technology, and Cisco Systems, Inc., among others.

North America holds the largest market share due to the increased demand for data center connectivity in this region.

By form factor, the QSFP segment is expected to register the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic