Anti-Biofilm Agents Market Size, Share & Industry Analysis, By Product (Dressings, Ointments/Gels, and Powders), By Molecule (Silver, Iodine, Honey, and Others), By Wound Type (Chronic Wounds and Acute Wounds), By End User (Hospitals, Wound Clinics, Home Care Settings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

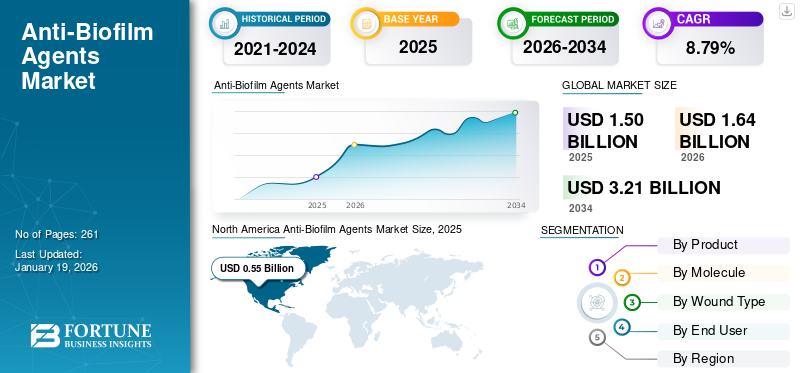

The global anti-biofilm agents market size was valued at USD 1.5 billion in 2025 and is projected to grow from USD 1.64 billion in 2026 to USD 3.21 billion by 2034, exhibiting a CAGR of 8.79% during the forecast period. North America dominated the anti-biofilm agents market with a market share of 36.49% in 2025.

Anti-biofilm agents refer to the products that can prevent the formation and growth of biofilms, which are communities of microorganisms enclosed in a self-produced matrix. The increasing prevalence of acute and chronic wounds, such as pressure ulcers, diabetic ulcers, arterial ulcers, and others, is resulting in increasing cases of biofilm formation among the patient population. The increasing number of biofilm formation cases, combined with growing awareness about the benefits of anti-biofilm products, is resulting in the increasing adoption rate of anti-biofilm products in the market. According to the 2024 data published by MDPI, biofilm formation occurs in about 60% of chronic and 10% of acute wounds among the patient population.

- For instance, according to the 2023 data published by the National Center for Biotechnology Information (NCBI), it was reported that the prevalence of diabetic foot ulcers is approximately 6.3% globally.

Additionally, the rising focus on biofilm prevention and management is increasing efforts toward strategies and guidelines among governmental organizations and key players to evaluate and establish the efficiency of various antimicrobial agents, such as specialized advanced wound dressings, powders, and others, in biofilm management and treatment. This, along with prominent players, including Smith+Nephew, Coloplast A/S, Convatec Inc., and others, is also focusing research and development activities on developing and introducing innovative products, thereby contributing to the global market growth.

Market Dynamics

Market Drivers

Increasing Prevalence of Acute & Chronic Wounds to Boost Market Growth

The growing prevalence of acute and chronic wounds, including pressure ulcers, diabetic foot ulcers, and others among the patient population, is anticipated to drive the number of cases with biofilm formation, consequently boosting the adoption of novel anti-biofilm products in the market.

- For instance, according to the data published by John Wiley & Sons, Inc., in 2021, it was estimated that the incidence of hospital-acquired pressure ulcers among hospitalized patients in the U.K. was around 8.7%.

Additionally, the growing incidence of acute wounds, such as burns, surgical wounds, is expected to increase the number of patients infected by biofilms. According to the 2023 statistics published by the National Library of Medicine, it was reported that a comprehensive meta-analysis version 3 was used to estimate the pooled prevalence of surgical site infections (SSI) among the patient population. The global pooled incidence of SSI was found to be 2.5%. Thus, the growing incidence of acute wounds is increasing the adoption rate of wound care products for treatment, which is supporting the global anti-biofilm agents market size.

The increasing occurrence of biofilm formation in wounds and awareness about the benefits of anti-biofilm agents are resulting in the focus of key players on research and development activities to develop and introduce novel anti-biofilm dressings, gels, and others in the market.

Market Restraints

Limited Diagnosis and Treatment Rates in Developing Nations to Hamper Adoption of Products

Chronic wounds such as venous leg ulcers and neuropathic ulcers can progress from mild to severe cases without timely assessments, routine diagnoses, and treatment, further leading to biofilm formation among the patients. Globally, various regional and national organizations, and others, are constantly undertaking initiatives to raise awareness among the general population and are implementing various plans to promote early and efficient diagnosis of patients suffering from chronic wounds.

However, despite the efforts of these organizations, there are increasing cases of delayed diagnosis of chronic wounds due to factors, including delayed referrals of patients with chronic wounds and a lack of expertise among physicians to identify DFU/ neuropathic ulcers, especially in the emergency departments.

- For instance, according to the statistics published by The Diabetic Foot Journal in 2023, a study was conducted to review the delays in managing chronic limb-threatening ischemia and foot ulceration in people with diabetes. This study highlighted significant delay in the diagnosis and treatment of certain conditions, specifically mentioning a range of 15 to 126 days from symptom onset to specialist healthcare assessment. Also, the subsequent median times from assessment to treatment ranged from 1 to 91 days.

Limited awareness regarding biofilm occurrence, lack of established guidelines, among others, are some of the factors resulting in delayed specialist care, further contributing to postponed diagnosis among patients, especially in emerging countries such as India, China, Brazil, etc.

Therefore, all the above factors and the lack of favorable reimbursement policies for patients with chronic wounds are primarily responsible for lower diagnosis and treatment rates, resulting in limited adoption of anti-biofilm products in emerging countries.

Market Opportunities

Increasing R&D Activities Among Key Players to Drive Market Opportunities

The rising prevalence of chronic wounds and the adoption rate of novel anti-biofilm agents, such as dressings, powders, and others, are resulting in the growing focus on research and development investments among the key players to develop and introduce novel products in the market.

- For instance, in May 2024, Convatec Inc. announced a significant clinical study result demonstrating the superiority of AQUACEL Ag+ Extra dressing in managing venous leg ulcers. This product has a significant anti-biofilm property as silver is an active ingredient.

- In January 2023, Convatec launched the ConvaFoam in the U.S. It is an advanced foam dressing designed to address the needs of healthcare providers and their patients. It can be used on a spectrum of wound types at any stage of the injury, and it also provides skin protection.

Similarly, the researchers also focus on clinical studies to study the sustainable and cost-effective potential candidates for anti-biofilm products. Along with this, rising government initiatives to raise awareness about the advantages of these anti-biofilm products are likely to boost the demand for effective wound care products, especially in emerging nations, thereby presenting a lucrative opportunity in the market.

Market Challenges

Limited Adherence to Guidelines for Biofilm Prevention & Management in Developing Countries

Various guidelines and effective strategies for the prevention & management of biofilms in wound care have been established and outlined. The primary aim of these guidelines is to reduce the prevalence of biofilm formation and to manage the removal and treatment of biofilms among patients effectively, ultimately reducing the overall duration of wound healing.

However, limited awareness in emerging countries and lower adherence to best wound management practices among healthcare providers and patients are some pivotal factors increasing the prevalence of biofilm formation among wound patients in these countries. This, along with lower adherence to guidelines for biofilm management and treatment for the patient, is also a crucial factor contributing to the increasing incidence of biofilm formation in these countries.

Other Prominent Challenges

High Cost Associated with Products to Hamper Their Adoption

The high cost associated with advanced agents and dressings is likely to hinder the adoption rate for these products in the market.

Anti-Biofilm Agents Market Trends

Introduction of Novel Anti-Biofilm Products to Fuel Product Demand

Biofilms present a huge economic burden in wound care and management. Effective wound care and biofilm prevention strategies have been implemented, but have shown limited impact. The introduction of novel anti-biofilm products is one of the major factors stimulating the anti-biofilm agents market growth. Researchers are focusing on various clinical studies to study the potential candidate for infection prevention and improving patient outcomes, which is anticipated to contribute to the increasing product demand during the forecast period. Various trials are being evaluated to understand and establish the efficiency of nanomaterials and nano-drug delivery systems, focusing on precise drug delivery of antimicrobial agents. According to 2022 data published by the National Center for Biotechnology Information (NCBI), the prevalence of biofilms is estimated to be around 80% in chronic wounds.

Key players are also focusing on developing novel anti-biofilm products and leveraging the potential benefits of nano-technology and drug delivery to support innovative therapies for biofilm prevention and treatment. Studies are evaluating zinc oxide, silver, and other nano-particles for their effectiveness in biofilm treatment by demonstrating qualities such as penetrating the biofilm matrix, reducing infection risk, and disrupting microbial colonies and structural integrity of the biofilm, among others.

- In February 2022, Asep Medical Holdings Inc. collaborated with iFyber, LLC, a preclinical contract research organization, to develop its anti-biofilm or anti-inflammatory peptide technology to manufacture wound dressings to cater to wound care management globally.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Product

Increasing Number of Product Approvals for Dressings Augmented Segment Growth

Based on product, the market is segmented into dressings, ointments/gels, and powders.

The dressings segment held a dominant market share of 67.86% in 2026. Dressings offer several benefits, such as providing an effective barrier against bacteria and contaminants, reducing biofilm occurrence among patients, helping in biofilm management, and others. The increasing benefits of these dressings, combined with the growing focus of key players on receiving approvals for their products in the market. This, along with a growing number of clinical studies among the key players to study the potential benefits of these dressings, is further likely to boost the demand for these products in the market.

- In March 2025, Imbed Biosciences received FDA Investigational Device Exemption (IDE) approval to begin clinical trials of its Silver-Gallium Synthetic Antimicrobial Matrix for treating human donor site wounds. This ultra-thin, bioresorbable matrix prevented biofilm formation and promoted healing in chronic and acute wounds.

The ointments/gels segment is anticipated to grow at a considerable CAGR during the forecast period. The rising prevalence of acute and chronic wounds, such as surgical wounds and others, among the patient population, along with rising innovations in these products by market players, are vital factors driving the segment's growth.

To know how our report can help streamline your business, Speak to Analyst

By Molecule

Increasing Clinical Studies for Silver Anti-Biofilm Dressings Boosted Segment Expansion

Based on the molecule, the market is classified into silver, iodine, honey, and others.

The silver segment dominated the market with a share of 47.62% in 2026. The dominant share can be primarily due to its distinct benefits, such as broad-spectrum antimicrobial activity, ability to reduce healing time, improved patient comfort, and wound healing outcomes among the patient population. This, along with the growing number of key players focusing on acquisitions and collaborations to conduct clinical studies for silver anti-biofilm products, is likely to augment the growth of the segment in the market.

- In August 2023, Mölnlycke AB and MediWound entered into a collaboration for the Phase III clinical trial of EscharEx in treating venous leg ulcers, where Mölnlycke AB provided its Mepilex Up, Exufiber, and Exufiber Ag dressings during the wound healing phase. This increased the utilization of the company’s anti-biofilm dressing.

On the other hand, the honey segment is expected to grow at a considerable CAGR during the forecast period. The growth is attributed to rising demand for natural molecules, including honey, due to its highest biofilm inhibition and membrane disruption rates, further supporting the focus of prominent players toward R&D activities to launch new products in the market.

By Wound Type

Increasing Prevalence of Chronic Wounds Supported Segmental Growth

On the basis of wound type, the market is segmented into chronic wounds and acute wounds.

The chronic wounds segment dominated the global market with a share of 68.15% in 2026. The growth is primarily due to the increasing prevalence of chronic wounds such as diabetic foot ulcers, pressure ulcers, and others, resulting in growing cases of biofilm formation among the patients. The increasing prevalence of chronic wounds, along with growing research and development activities to develop anti-biofilm products with natural molecules such as honey, zinc, and others, is likely to support segmental growth.

- For instance, according to the data from the American Medical Association (AMA), in 2023, approximately 18.6 million people were affected by diabetic foot ulcers globally, and 1.6 million in the U.S. annually. In that affected population, about half of diabetic foot ulcers become infected.

On the other hand, the acute wounds segment is also expected to grow with a considerable CAGR during the forecast period. The increasing prevalence of acute wounds, such as burn injuries and others, is resulting in a growing number of cases of biofilm formation among patients. This, along with growing clinical studies for anti-biofilm products to prevent and manage biofilm in acute wounds among researchers, is anticipated to drive the growth of this segment.

By End-user

Rise in Healthcare Facilities Led to Hospitals Segment’s Dominance

Based on end user, the market is segmented into hospitals, wound clinics, home care settings, and others.

The hospitals segment dominated the market share of 43.12% in 2026. The increasing prevalence of chronic wounds and higher hospitalization rates of patients suffering from biofilm formation in diabetic foot ulcers, pressure ulcers, among others, are some of the major factors responsible for the dominance of the hospitals segment in 2024. This, along with the growing number of healthcare facilities such as hospitals and others, is also expected to support the segmental growth in the market.

- For instance, according to the 2025 statistics published by Definitive Healthcare, it was reported that there are a total of 7,300 hospitals in the U.S.

On the other hand, the home care settings segment is expected to grow at the highest CAGR from 2025-2032. The segmental growth can be attributed to a rapid shift of patients toward home care settings, particularly in developed countries, combined with adequate reimbursement policies for products used in home care settings, further facilitating the demand for anti-biofilm products in the market.

Anti-Biofilm Agents Market Regional Outlook

Based on region, the market has been studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Anti-Biofilm Agents Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 0.55 billion in 2025 and USD 0.59 billion in 2026. The increasing prevalence of biofilm formation in acute and chronic wounds, increasing awareness about the benefits of anti-biofilm products, growing healthcare expenditure, and rising initiatives by key players to launch innovative products are some of the factors contributing to the growth of the market.

U.S.

The high adoption rate of innovative technologies in the U.S. and increasing healthcare expenditure are the primary factors leading to the market's growth in the country. Also, the increasing funding for R&D activities for anti-biofilm products among the key players and regulatory approvals boost the region's growth in the market. The U.S. market is projected to reach USD 0.53 billion by 2026.

- According to the 2023 statistics published by Definitive Healthcare, there are about 19,000 imaging centers in the U.S. Among all the regions, the Southeast region has the most imaging centers, with 4,975.

Europe

The Europe market is expected to grow at a considerable CAGR during the forecast period due to the presence of well-established healthcare facilities. The growth is attributed to the increasing prevalence of biofilm formation in chronic wounds, such as pressure ulcers and leg ulcers in Europe, coupled with high demand for its treatment and management, subsequently supporting the adoption rate of anti-biofilm products in the market. This, along with the growing focus of key players toward raising awareness about their anti-biofilm dressings, is likely to boost the adoption rate for anti-biofilm products in the market. The UK market is projected to reach USD 0.08 billion by 2026, while the Germany market is projected to reach USD 0.16 billion by 2026.

- In March 2025, Mölnlycke AB attended the European Wound Management Association (EWMA) 2025 to promote wound care products, including antimicrobial dressings. This created brand awareness for its products in the European market.

Asia Pacific

Asia Pacific is anticipated to register the highest growth rate during the forecast period 2025-2032. This growth is attributed to the increasing incidence of biofilm formation in acute and chronic wounds and the robust efforts of researchers to study the potential candidates that can target biofilm-forming bacteria and help in biofilm prevention and management among the patient population. This, along with the rising focus of manufacturers to expand their geographical footprint in emerging countries, is also expected to support the growing adoption rate for anti-biofilm agents in the market. The Japan market is projected to reach USD 0.1 billion by 2026, the China market is projected to reach USD 0.09 billion by 2026, and the India market is projected to reach USD 0.06 billion by 2026.

- For instance, in July 2024, researchers from Japan discovered a new enzyme phage-derived enzyme with antibacterial activity that targets E. faecalis biofilms among the patient population.

Latin America

The Latin America market is anticipated to grow with a significant CAGR during the forecast period. This is primarily attributed to the increasing prevalence of acute and chronic wounds resulting in growing cases of biofilm formation, increasing disposable income in the region, and growing demand for anti-biofilm products among the population, further leading to the adoption of these products in the region and thus boosting the growth of the market.

- For instance, according to an article published by Elsevier B.V. in 2020, it is estimated that around 1.0 million people are affected by burns annually, and of these, approximately 2,500 die due to these injuries and their aggravations in Brazil.

Middle East & Africa

Increasing prevalence of chronic wounds such as diabetic foot ulcers, venous leg ulcers, and others, along with growing focus among governmental organizations of many countries, including UAE, toward the development of high-class hospital infrastructures that offer the highest standards of care, among other factors, are likely to boost the adoption rate for these products in the market.

- According to an article published by the National Institutes of Health (NIH) in 2023, a hospital-based cross-sectional study was performed with 193 diabetic patients who attended the De Martini Hospital, Madina General Hospital, and Deynile General Hospital from August to November 2022. The study found that the prevalence of diabetic foot ulcers (DFUs) is 15.0% among study participants. A prior review of data from 19 African countries found that 13.0% of diabetes patients had foot ulcers.

Competitive Landscape

Key Industry Players

Increasing Number of Product Launches by Key Players to Foster Market Development

A robust portfolio of anti-biofilm products, combined with a strong geographical presence globally, is one of the crucial factors driving the dominance of these players in the market. Smith+Nephew, Convatec Inc., and Coloplast A/S are prominent players in the anti-biofilm agents’ industry in 2024. Moreover, the increasing focus of market players on showcasing their anti-biofilm products to increase their brand presence contributes to the global anti-biofilm agents market share.

- In March 2025, Convatec Inc. showcased its latest advanced wound care products, including anti-biofilm products, at the European Wound Management Association (EWMA) 2025 conference in Spain. This promotion increased the company’s brand awareness for anti-biofilm products.

Other key players, including URGO MEDICAL, Solventum, and others, are also growing in the market due to their increasing initiatives toward acquisitions and partnerships among the key players to expand their existing product portfolio for anti-biofilm products.

List of Key Anti-Biofilm Agent Companies Profiled

- Convatec Inc. (U.K.)

- Smith+Nephew (U.K.)

- Coloplast A/S (Denmark)

- Solventum (U.S.)

- Mölnlycke AB (Sweden)

- URGO MEDICAL (France)

- Imbed Biosciences (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2025 - Imbed Biosciences received FDA Investigational Device Exemption (IDE) approval to begin clinical trials of its Silver-Gallium Synthetic Antimicrobial Matrix for treating human donor site wounds. This ultra-thin, bioresorbable matrix prevented biofilm formation and promoted healing in chronic and acute wounds.

- February 2024 - Smith+Nephew collaborated with the U.S. Army Institute of Surgical Research to strengthen its advanced wound management segment.

- January 2024 – URGO MEDICAL participated in the Journées Cicatrisation 2024 congress in Paris, showcasing advanced wound care solutions and hosting key sessions on venous leg ulcers. The event promoted their brands in the European market.

- April 2023 - Convatec Inc. acquired innovative anti-infective and anti-biofilm nitric oxide technology to utilize the technology to launch advanced wound care products. This strengthened its presence in the European market.

- June 2022 - Smith+Nephew opened a new research and development and manufacturing facility for advanced wound management with a USD 100.0 million investment in the U.K. This helped the company to increase its brand presence in Europe.

REPORT COVERAGE

The anti-biofilm agents market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, products, molecules, wound types, and end users of the anti-biofilm products. Besides this, the global report offers insights into the market growth trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth and advancement of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.9%% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Product

|

|

By Molecule

|

|

|

By Wound Type

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market size was USD 1.5 billion in 2025 and is projected to reach USD 3.21 billion by 2034.

In 2025, the North America regional market value stood at USD 0.55 billion.

Growing at a CAGR of 8.79%, the market will exhibit steady growth over the forecast period (2026-2034).

By product, the dressings segment led the market.

The introduction of novel anti-biofilm products is driving market growth.

Convatec Inc., Smith+Nephew, and Coloplast A/S are the major players in the global market.

North America dominated the market share in 2025.

The increasing prevalence of biofilm formation in acute and chronic wounds, growing awareness about the benefits of anti-biofilm products, and others are some of the factors expected to drive the adoption of these products globally.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us