Automotive Foam Market Size, Share & Industry Analysis, By Foam Type (Polyurethane foam, Polyolefin Foams, Others), By Application (Seating, Door Panels & Water shields, Instrument Panels, Bumper System, Others), By End-Use (Passenger Vehicles, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV)) Others and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

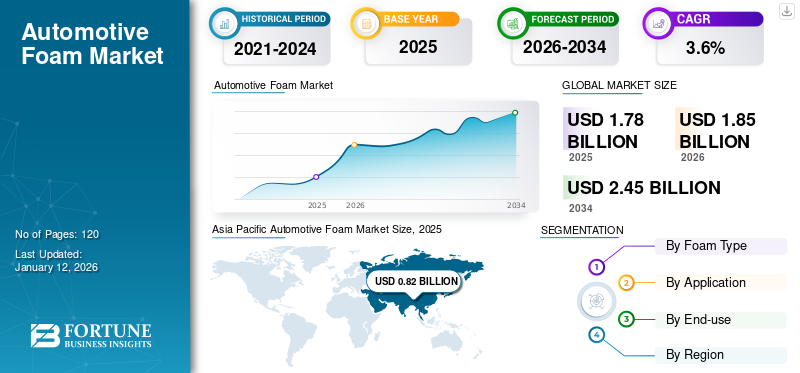

The global automotive foam market size was valued at USD 1.78 billion in 2025. The market is projected to grow from USD 1.85 billion in 2026 to USD 2.45 billion by 2034, exhibiting a CAGR of 3.6% during the forecast period. Asia Pacific dominated the automotive foam market with a market share of 46% in 2025.

Automotive foam is a family of polymeric cellular materials (e.g., polyurethane and polyolefin foams) engineered for vehicles to provide cushioning, energy absorption, acoustic and thermal insulation, sealing, and lightweight structural support across parts such as seats, headliners, door panels, instrument panels, bumpers, and NVH components. OEM lightweighting initiatives aimed at enhancing fuel efficiency and electric vehicle range, as well as meeting emissions standards, are fostering the adoption of high-performance, low-density foams over heavier alternatives. This trend is anticipated to stimulate market demand.

Furthermore, the market encompasses several major players with BASF SE, Dow Inc., Covestro AG, Huntsman Corporation, and Carpenter Co. at the forefront. Extensive portfolio with advanced product launch, and robust global presence expansion have supported the dominance of these companies in the market.

MARKET DYNAMICS

MARKET DRIVERS

Light weighting & Electrification Push to Bolster Market Demand

Automotive manufacturers face increasing pressure to reduce vehicle weight and enhance energy efficiency, thereby directly increasing demand for lightweight foams such as polyurethane and polyolefin in components including seats, headliners, door panels, and NVH parts. This trend is expected to propel the automotive foam market growth.

- The IEA reports that electric vehicle sales exceeded 17 million units in 2024, thereby increasing the scope of applications for thermal and acoustic insulation as well as components adjacent to the battery.

- Regulations such as the European Union's enhanced CO₂ standards, which aim for a 100% reduction target for new cars and vans by 2035, maintain the focus of original equipment manufacturers (OEMs) on emissions reduction per component. With an estimated global vehicle production of 92.5 million units in 2024, even modest improvements in foam content per vehicle can lead to significant overall reductions through large-volume implementation.

MARKET RESTRAINTS

Volatile PU Feedstock Costs to Limit Market Growth

Most automotive foam value chains primarily depend on polyurethane, with critical inputs such as MDI, TDI, polyols, and PO being subject to cyclical fluctuations influenced by energy prices and benzene/propylene market swings. Sudden increases in costs tend to reduce converter profit margins and complicate the establishment of long-term supply agreements with original equipment manufacturers (OEMs). Buyers often encounter quarterly repricing and regional arbitrage opportunities between Asia, Europe, and the U.S., which can disrupt sourcing strategies and increase inventory carrying costs. Independent market services consistently highlight heightened uncertainty within the margin cycle of polyurethane feedstocks over the upcoming years, necessitating foam producers to allocate budgets for price fluctuations and potential allocation events due to outages or plant turnarounds. This volatility discourages aggressive capacity expansion initiatives and may delay platform awards when cost considerations are constrained.

MARKET OPPORTUNITIES

Circularity & ELV Recycling Pathways Open New Opportunities for Automotive Foams

End-of-life vehicle (ELV) policies across Europe aim for a 95% rate of reuse or recovery and an 85% rate of reuse or recycling by weight per vehicle. These policies stimulate demand for recycled-content materials and closed-loop solutions. Innovative methods, such as the Dow-Gruppo Fiori process, are now employed to recover and chemically recycle polyurethane (PU) foam from ELVs, establishing a sustainable stream for depolymerization and polyol production. This advancement presents premium opportunities for “circular foams,” enabling Original Equipment Manufacturers (OEMs) to meet their sustainability key performance indicators (KPIs). Preliminary communications suggest that the process can extract foam without requiring complete disassembly, thereby enhancing economic viability and scalability. Suppliers that qualify recycled polyols for applications in seating and Noise, Vibration, and Harshness (NVH) components have the prospect of securing specifications for environmentally friendly trims and fleets, while simultaneously mitigating risks associated with volatility in virgin feedstocks.

AUTOMOTIVE FOAM MARKET TRENDS

Rising Demand for Quieter and More Comfortable EV Cabins is One of Significant Market Trends

Electric Vehicle (EV) architectures modify noise profiles, resulting in reduced powertrain noise and increased road and airborne sounds. This development encourages the use of sophisticated noise, vibration, and harshness (NVH) foams and multilayer composites to mitigate high-frequency hissing and low-frequency booming sounds. This pattern coincides with thermal management strategies around battery packs and the downsizing of heating, ventilation, and air conditioning (HVAC) systems, prompting foam manufacturers to focus on lighter, closed-cell, flame-retardant materials with enhanced compression resilience and acoustic damping properties. It is anticipated that original equipment manufacturers (OEMs) will increasingly issue requests for quotations (RFQs) specifying decibel reduction targets at highway speeds and weight limitations per square meter, thereby accelerating the transition from dense mats to engineered foam laminates.

MARKET CHALLENGES

Scaling Production Amid Mixed Policy Signals to Hamper Market Growth

Capacity planning becomes more challenging when policy directives and demand signals diverge across different regions. While European standards are increasingly stringent on CO₂ emissions, other markets are shifting incentives; for example, the U.S. federal electric vehicle (EV) tax credit is scheduled to expire on October 1, 2025. Industry analysts have warned that this expiration could hinder short-term EV adoption. Suppliers are required to balance EV-centric programs, which typically involve high foam content per unit, with internal combustion engine (ICE) platforms to prevent utilization declines. Incorporating the complexities of uneven regional production schedules, global vehicle output is estimated at approximately 92.5 million units in 2024. Tiered suppliers are therefore faced with intricate sales and operations planning (S&OP), tooling amortization, and labor management challenges. The resultant impact includes increased working capital requirements and elevated risk premiums incorporated into quotation processes, which may affect price competitiveness unless mitigated by gains in productivity and recycled content.

Download Free sample to learn more about this report.

Segmentation Analysis

By Foam Type

Customization of Softness, Support, and Durability of Foam Led to Segmental Growth

Based on segmentation of foam type, the market is segregated into polyurethane foam, polyolefin, and others.

Polyurethane foam segment dominated the automotive foam market share 83.24 in 2026. PU allows automotive manufacturers to customize the softness, support, and durability of a single material used in seats, headrests, armrests, and steering wheels. It easily molds into complex shapes, exhibits excellent bonding with fabrics, and maintains its integrity under extensive use. As brands pursue lighter interior designs without compromising comfort, PU’s high strength-to-weight ratio and proven capabilities in crash and energy absorption establish it as the preferred choice for seating and numerous NVH (Noise, Vibration, and Harshness) pads.

Polyolefin is expected to grow at the highest CAGR during the forecast period. Polyolefin foams, such as polyethylene (PE) and polypropylene (PP) foams, are characterized by their closed-cell structure, which effectively blocks water and air, rendering them suitable for applications including door panels, headliners, HVAC ducts, and battery-pack gaskets in electric vehicles (EVs). Their low density contributes to vehicle weight reduction. In contrast, their favorable recyclability and low volatile organic compound (VOC) emissions support increased sustainability and cabin air quality standards, predominantly important for electric and hybrid vehicle models.

By Application

Maintaining High Level of Comfort Contributed to Seating Segment Dominance

Based on application, the market is segmented into seating, door, instrument panels, bumper, and others.

The seating segment is projected to dominate the market Share 57.30 in 2026. Seats significantly influence the ride experience; therefore, automotive manufacturers seek foams that effectively balance softness, support, and durability. Polyurethane foams are easily tunable, can be molded into complex shapes, and bonded to fabrics, enabling brands to reduce weight while maintaining high levels of comfort, an important consideration for both fuel efficiency and electric vehicle range.

The bumper segment is experiencing the most rapid growth during the forecast period. Bumpers incorporate foam energy absorbers to achieve crash and pedestrian safety standards without the need for heavy metal components. Light-weighted foam materials facilitate the management of low-speed impacts, such as parking bumps, while also providing design flexibility, thereby reducing repair costs and overall vehicle weight.

The instrument panels segment is also experiencing moderate growth during the projected period. The dashboard requires soft-touch surfaces that appear premium, comply with airbag deployment regulations, and withstand solar heat. Low-VOC foams with excellent aging stability aid in meeting more stringent cabin-air standards while reducing weight compared to solid plastics.

By End-use

To Maintain a Premium Interior Experience Passenger Segment Led Growth

Based on end-use, the market is segmented into passenger, LCV, and HCV.

To know how our report can help streamline your business, Speak to Analyst

The passenger segment dominates the market with a share of 79.46% in 2026. Automakers employ foams to ensure seats are both comfortable and supportive, mitigate road and wind noise, and maintain a premium interior experience. The adoption of low-VOC and recyclable foams assists in achieving increasingly stringent air-quality and sustainability standards. Additionally, reduced weight contributes to enhanced fuel efficiency and extended electric vehicle range, leading to the continuous integration of advanced foams in seating, headliners, doors, and dashboards. Furthermore, it is projected that this segment will grow at a compound annual growth rate of 3.6% throughout the specified study period.

The light commercial vehicle (LCV) segment is also experiencing the most rapid growth during the projected period. Vans and pickups require durable foams for seats and door trims that withstand daily wear, facilitate easy cleaning, and accommodate temperature fluctuations. Lightweight, moisture-resistant foams enhance fuel efficiency and payload capacity, while effective acoustic and thermal insulation maintain comfort within cabins for delivery and service routes. Upfitters prioritize foams that are easy to cut, bond, and assemble. Furthermore, battery applications are anticipated to account for a 14.1% market share by 2025.

Automotive Foam Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

ASIA PACIFIC

Asia Pacific Automotive Foam Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the dominant share in 2025, valued at USD 0.82 billion, and also took the leading share in 2026 with USD 0.85 billion. The Asia Pacific region is recognized as the largest and most rapidly expanding region, primarily attributable to substantial automotive production volumes in China, India, Japan, and South Korea. Rising disposable incomes and increasing urbanization are actively driving passenger car sales, thereby escalating demand for comfortable seating, instrument panels, and interior applications. Additionally, government incentives promoting electric vehicle (EV) adoption in China and India further stimulate the market for high-performance foams with thermal and acoustic insulation properties. The region’s growth is also reinforced by cost-effective manufacturing processes and the ready availability of raw materials also strengthen regional growth. In 2026, the China market is estimated to reach USD 0.46 billion.

- China is the largest consumer and producer of carbon and graphite felts within the Asia Pacific region, supported by extensive ecosystems in photovoltaic, semiconductor, specialty metals, and industrial furnace industries. PAN-based felts dominate the market for routine insulation and retrofit applications, while higher-purity rayon-based grades are employed in qualified hot zones for crystal growth and advanced electronics.

To know how our report can help streamline your business, Speak to Analyst

EUROPE

Europe is anticipated to witness a notable growth in the coming years. During the forecast period, the European region is projected to record a growth rate of 3.1%, which is the second highest among all the regions, and touch the valuation of USD 0.41 Billion in 2025. In Europe, stringent environmental and sustainability regulations, such as European Union emissions standards and circular economy objectives, serve as primary catalysts for growth. The region’s well-established luxury automobile sector emphasizes high-quality interiors and noise-vibration-harshness (NVH) reduction, thereby stimulating demand for automotive foam products. Moreover, the swift transition toward electric mobility in Germany, France, and Nordic nations presents opportunities for thermal insulation foams utilized in battery systems. The focus on eco-friendly and recyclable foams further promotes innovation and widespread adoption. Backed by these factors, countries including the U.K. are expected to record the valuation of USD 0.03 Billion, Germany to record USD 0.01 Billion, and France to record USD 0.04 Billion in 2026.

NORTH AMERICA

After Europe, the market in North America is estimated to reach USD 98.83 billion in 2025 and secure the position of the third-largest region in the market. The North American market is propelled by the prominent presence of leading automotive manufacturers and Tier-1 suppliers who concentrate on lightweighting and enhancing fuel efficiency. The rising demand for increased comfort and safety features in vehicles, alongside the widespread adoption of electric vehicles (EVs) in the U.S. and Canada, is augmenting the utilization of polyurethane and polyolefin foams in seating, interior components, and insulation solutions. Additionally, regulatory pressures exerted by the Corporate Average Fuel Economy (CAFE) standards are motivating automakers to incorporate lightweight foam materials. In 2025, the U.S. market is estimated to reach USD 0.30 Billion.

LATIN AMERICA & MIDDLE EAST & AFRICA

Over the forecast period, the Latin America and Middle East & Africa regions would witness a moderate growth in this market. The Latin America market in 2025 is set to record USD 0.06 billion in its valuation. The growth of the market is driven by growing automotive assembly plants in Brazil and Mexico, catering to both domestic and export markets. Increasing consumer preference for affordable but comfortable vehicles boosts demand for foam in seating and door panels. In the Middle East & Africa, GCC is set to attain the value of USD 0.01 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players:

Acquisition and Expansion Initiatives are Essential Aspects for Growth of Companies Operating in Market

Large companies use their scale, R&D, and sustainability efforts to stay competitive, whereas regional firms focus on cost savings and proximity to local infrastructure projects. Some of the key market players include BASF SE, Dow Inc., Covestro AG, Huntsman Corporation, and Carpenter Co. These players are adopting strategies such as acquisition, expansion, and partnerships to gain share in the market.

LIST OF KEY AUTOMOTIVE FOAM COMPANIES PROFILED:

- BASF (Germany)

- Dow (Michigan)

- Covestro (Germany)

- Huntsman Corporation (U.S.)

- Recticel (Belgium)

- Carpenter Co. (U.S.)

- The Woodbridge Group (Canada)

- FXI (U.S.)

- Armacell (Luxembourg)

- JSR Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- November 2024: Woodbridge and Chengpeng have formed a joint venture to produce seat foam for commercial and passenger vehicles. Operating as Woodbridge (Changzhou) Automotive Components Co., Ltd., the new, state-of-the-art facility in Changzhou, Jiangsu Province, China is slated to start production in Q2 2025.

- April 2024: Huntsman launched a new SHOKLESS lineup introducing lightweight, durable PU foam systems for EV batteries, designed for potting and fixation at the cell, module, or pack level. The range spans low–high densities, runs on standard PU dispensing with a broad processing window, and includes a moldable encapsulant to expand design/manufacturing options. These foams aim to enhance structural and thermal protection while enabling faster processing versus non-PU alternatives.

REPORT COVERAGE

The global market analysis provides an in-depth study of market size & forecast by all the market segments included in the report. It includes details on the market dynamics and market trends expected to drive the market during the forecast period. It offers information on the technological advancements, new product launches, key industry developments, and details on partnerships, mergers & acquisitions. The market research report also encompasses a detailed competitive landscape with information on the market share and profiles of key operating players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.6% from 2026-2034 |

|

Unit |

Value (USD Billion), Volume (Kiloton) |

|

Segmentation |

By Foam Type, Application, End-use, and Region |

|

By Foam Type |

· Polyurethane Foam · Polyolefin · Others |

|

By Application |

· Seating · Door · Instrument Panels · Bumper · Others |

|

By End-use |

· Passenger · LCV · HCV |

|

By Region |

· North America (By Foam Type, Application, End-use, and Country) o U.S. o Canada · Europe (By Foam Type, Application, End-use, and Country/Sub-region) o Germany o France o U.K. o Italy o Rest of Europe · Asia Pacific (By Foam Type, Application, End-use, and Country/Sub-region) o China o India o Japan o South Korea o Rest of Asia Pacific · Latin America (By Foam Type, Application, End-use, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Foam Type, Application, End-use, and Country/Sub-region) o GCC o South Africa o Rest of the Middle East & Africa |

Frequently Asked Questions

The global automotive foam market size is projected to grow from $1.85 billion in 2026 to $2.45 billion by 2034.

In 2025, the market value stood at USD 0.82 Billion.

The market is expected to exhibit a CAGR of 3.6% during the forecast period of 2026-2034.

The Polyurethane Foam segment led the market by Foam Type.

The key factors driving the market are the rising demand for cleaner high-temperature processing.

BASF SE, Dow Inc., Covestro AG, Huntsman Corporation, and Carpenter Co. are some of the prominent players in the market.

Asia Pacific dominated the market in 2025.

Increased focus on higher-purity felts for semiconductor and clean-tech applications that are expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us