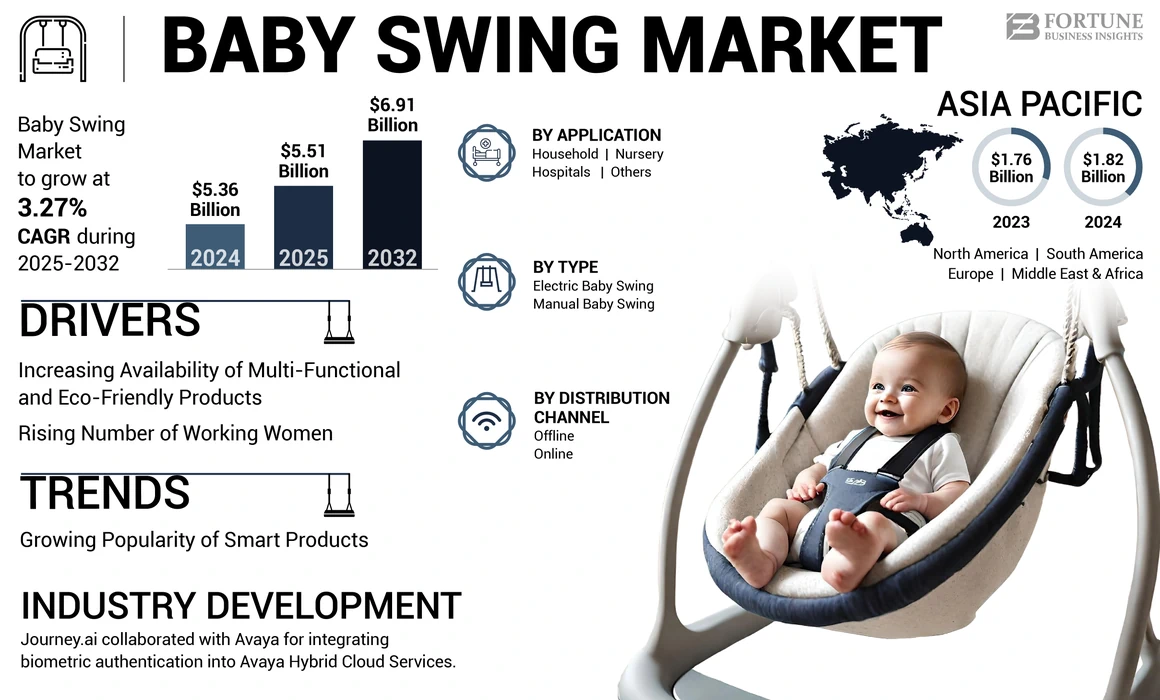

Baby Swing Market Size, Share & Industry Analysis, By Type (Electric Baby Swing and Manual Baby Swing), By Application (Household, Nursery, Hospitals, and Others), By Distribution Channel (Offline and Online), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The global baby swing market size was valued at USD 5.36 billion in 2024. The market is projected to grow from USD 5.51 billion in 2025 to USD 6.91 billion by 2032, exhibiting a CAGR of 3.27% over the forecast period. Asia Pacific dominated the baby swing market with a market share of 33.96% in 2024.

A baby swing is designed to soothe and entertain babies by mimicking rhythmic rocking motion and usually features adjustable swing speeds, reclining positions, music, and mobile toys. Furthermore, these swings are a popular choice among parents seeking to comfort, soothe, and entertain their infants. In addition, these swings provide a safe, hands-free solution for caregivers to calm and amuse their babies.

Increased awareness of infant health and safety among parents is boosting product demand. Swings equipped with various safety features, including sturdy frame, secure harness system, and adjustable speed, are gaining significant popularity among safety-conscious parents. Moreover, one of the key drivers of the market is their effectiveness in calming fussy and colicky babies. The rhythmic motion stimulation proves to be very calming and helps babies fall asleep rapidly. In addition, swings provide a safe place for babies to rest and play while parents attend to other tasks.

The expanding number of newborn babies globally, especially in high birth rate regions, fuels market growth. According to the United Nations Children's Fund (UNICEF), a U.S.-based government agency of the United Nations, the number of babies born worldwide increased from 133,990,599 in 2022 to 134,279,612 in 2023.

The increasing trend of urbanization has led individuals to move into smaller living spaces, encouraging parents to seek compact products, thus boosting demand for foldable swings. Furthermore, various major industry participants are focusing on expanding their offline presence to strengthen their position. For instance, in October 2023, HunnyHunny, an India-based baby products company, announced the launch of retail stores in Noida, Jaipur, and Bangalore.

The COVID-19 pandemic impacted the market negatively, disrupting the global supply chain owing to the shutdown of production facilities and international trade restrictions in 2020. Furthermore, the product demand declined due to the increasing adoption of essential baby products.

Global Baby Swing Market Overview

Market Size:

- 2024 Value: USD 5.36 billion

- 2025 Value: USD 5.51 billion

- 2032 Forecast Value: USD 6.91 billion, with a CAGR of 3.27% from 2025–2032

Market Share:

- Asia Pacific led with the highest market share of 33.96% in 2024

- By type, the manual baby swing segment is expected to hold a 58.75% share in 2025

- By application, the household segment is projected to generate USD 2,469.72 million in revenue by 2025

Key Country Highlights:

- Japan: Baby swing market expected to reach USD 192.38 million by 2025

- India: Projected to grow at a CAGR of 4.86% during the forecast period

- Europe: Anticipated to grow at a CAGR of 3.40%, driven by birth rates and presence of major players

Baby Swing Market Trends

Growing Popularity of Smart Products to Propel Market Growth

In recent years, there has been a notable emphasis on innovative designs to enhance comfort, safety, and convenience for both babies and parents. Increasing integration of intelligent technology by various companies, allows parents to control swing motion, stream music, and monitor sleep patterns via Bluetooth-connected smartphone apps, which boosts product demand among tech-savvy parents. Several prominent market players are launching new smart products to diversify their portfolios and boost their sales. For instance,

In July 2022, 4moms, a U.S.-based baby gear company, launched its new swing, the MamaRoo Multi-Motion Baby Swing. According to the company, this new swing features voice control with Alexa, Bluetooth app functionality for music streaming, and a touch-sensitive control panel.

- Asia Pacific witnessed baby swing market growth from USD 1.76 billion in 2023 to USD 1.82 bilion in 2024.

Download Free sample to learn more about this report.

Baby Swing Market Growth Factors

Increasing Availability of Multi-Functional and Eco-Friendly Products to Improve Global Baby Swing Market Forecast

Increasing awareness about environmental issues among individuals and the rising trend of sustainable living among environmentally conscious individuals boosts the demand for eco-friendly products. Moreover, rising concerns among parents regarding the presence of various harmful chemicals, including BPA, phthalates, and formaldehyde, drive the market growth. The demand for environmentally friendly products made using various non-toxic and organic materials, including organic cotton, bamboo, sustainably sourced wood, and non-toxic paints, is growing significantly among eco-conscious parents.

There is also a growing shift toward multi-functional products owing to urban living, busy lifestyles, and smaller living spaces. Multi-functional swings provide a hands-free solution for busy parents, allowing them to engage in other activities while ensuring their baby is soothed and entertained. Furthermore, the rising availability of smart products with Bluetooth connectivity, built-in music, and app-controlled features designed for urban cities is boosting product demand among urban dwellers.

Rising Number of Working Women to Fuel Market Expansion

The increase in the number of working women globally fuels the market growth. Working mothers often struggle to balance professional responsibilities with childcare. These products offer a practical and convenient solution by helping to soothe and entertain babies, allowing working mothers to manage their time more efficiently. Moreover, the growing trend of nuclear families has led to fewer family members to assist in childcare, thus increasing the reliance on baby care products supporting or assisting parents with daily childcare. Swings equipped with various automated features, including remote control via smartphone apps, voice activation, built-in music, and timers, are gaining significant traction among working women seeking reliable and convenient products.

RESTRAINING FACTORS

Rising Safety Concerns and Increasing Product Recalls to Hamper Market Growth

Baby swings, designed to comfort and entertain babies, come with inherent health risks, including entanglement, falls, and suffocation. Rising awareness among parents regarding potential hazards associated with baby products coupled with growing government initiatives hinders market growth. For instance, in June 2022, the U.S. Consumer Product Safety Commission (CPSC) and Fisher-Price, a baby gear brand, issued a warning after 13 deaths of infants occurred between 2009 and 2021 involving Fisher-Price Infant-to-Toddler Rockers and Newborn-to-Toddler Rockers. According to the CPSC, these products should never be used for sleeping and infants should never be left unsupervised or unrestrained in them.

Product recalls can lead to a significant drop in product demand and negatively impact the company’s brand reputation. Moreover, parents may opt for various perceived safer alternatives, including bassinets, play yards, and manual swings that offer better control over their child's safety. Moreover, various government and regulatory bodies globally, including the Consumer Product Safety Commission (CPSC), enforce stringent safety standards for baby products. Non-compliance with these standards can result in mandatory product recalls. For instance, in March 2024, the Consumer Product Safety Commission (CPSC), a government agency, recalled over 63,000 Nova Baby infant swings from Jool Baby due to the risk of suffocation.

Baby Swing Market Segmentation Analysis

By Type Analysis

Manual Baby Swings Holds Dominant Share owing to its Availability and Affordability

By type, the manual baby swing segment is expected to hold a 58.75% share in 2025. The market is segmented into electric baby swing and manual baby swing. The manual baby swing segment dominated the global baby swing market share in 2023. These swings are more affordable compared to electric swings, boosting demand among budget-conscious consumers. Moreover, the lack of need for batteries or electrical power in these products is attracting environmentally conscious consumers and making it convenient for travel or outdoor baby swing use where power sources may be limited. Furthermore, they provide a more hands-on experience for parents, allowing them to control the swinging motion and speed more directly.

The electric baby swing segment is expected to grow significantly throughout the forecast period owing to offering hands-free operation, allowing parents to multitask. Moreover, the rising availability of products with advanced features, including multiple swing speeds, built-in lullabies, and timer settings, coupled with the integration of smart technology and app control, will drive the segment’s growth in the coming years.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Household Segment Led due to Increasing Birth Rate across Countries

By application, the household segment is projected to generate USD 2,469.72 million in revenue by 2025. The global market is segmented into household, nursery, hospitals, and others. The household segment dominated the global market in 2024 owing to the increasing birth rate across countries and the rising number of babies worldwide. According to the National Center for Health Statistics (NCHS), a U.S. government agency, the birth rate count at the end of 2021 reached 3.66 million, 1% up compared to 2019 in the U.S.

The nursery segment is expected to grow significantly over the forecast period owing to the rising number of parents considering daycare and childcare programs for their babies. Some of these factors include educational benefits, enhanced cognitive & social skills, socialization, and lack of family support. Furthermore, the increasing number of working women coupled with the growing availability of nurseries will drive market growth in the coming years.

By Distribution Channel Analysis

Offline Segment Leads due to Increasing Number of Retail Stores

Based on distribution channel, the market is segmented into offline and online. The offline segment dominates the global market owing to extensive product availability and increasing offline retail presence across countries. In addition, the presence of sales executives offering personalized recommendations based on the individual's needs drives the segment’s growth. Furthermore, several prominent players are launching new stores to strengthen their presence and expand their reach across countries. For instance,

In September 2023, HunnyHunny, an India-based baby products company, launched its new stores at Phoenix Marketcity Mall in Pune, India.

In October 2022, Nuna International B.V., a Netherlands-based baby gear company, launched its new Europe’s first flagship store in Florence, Italy.

The online segment is expected to grow significantly throughout the forecast period owing to the ease of comparing different products and the rising popularity of online shopping. In addition, the increasing smartphone adoption and growing internet accessibility globally fuel the segment’s growth.

REGIONAL INSIGHTS

Geographically, the global market is segmented into North America, Europe, Asia Pacific, South America, and Middle East & Africa.

Asia Pacific Baby Swing Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the major market share in 2024 owing to the increasing number of newborns across China, Japan, Indonesia, and India, coupled with the growing working female population in the region. Moreover, the rising disposable incomes and rising awareness of infant health and safety among parents across developing countries, such as India, Japan, South Korea, and China, fuels market growth.

- The baby swing market in Japan is expected to reach USD 192.38 million by 2025.

- India is projected to witness a strong CAGR of 4.86% during the forecast period.

North America is expected to grow significantly throughout the forecast period owing to the early adoption of advanced baby care products, such as automatic electric baby swings and high consumer spending power. In addition, U.S. and Canadian consumers are willing to invest in premium products that bring comfort and ensure the well-being of a child. Moreover, the rising number of nuclear families and single parents, coupled with increasing birth rates across the U.S. and Canada, favors the North America automatic baby swing market growth.

Europe is anticipated to grow at a CAGR of 3.40% during the forecast period. Europe is expected to grow considerably throughout the forecast period owing to the increasing number of babies across the region. According to Eurostat, a government agency, in 2021, 4.09 million babies were born across the European Union. Furthermore, the presence of several prominent players, including Baby Bjorn AB, Mamas & Papas, Hauck Gmbh & Co. KG, Brevi Milano S.P.A., and Nuna International B.V., offering technologically advanced products is expected to boost product demand across the region.

South America and the Middle East & Africa markets are forecast to grow positively, fueled by the rising availability of smart and innovative products in the UAE, Saudi Arabia, and South Africa. Increasing consumer spending on baby products across these regions, drives the market growth.

KEY INDUSTRY PLAYERS

Prominent Players Focusing on Retail Expansion to Expand Reach and Strengthen Presence

Intense competitive rivalry characterizes the global market. In recent years, market players have focused on retail expansion as one of their key strategies to strengthen their presence and capture major market share. For instance, in January 2022, Nuna International B.V., a Netherlands-based baby gear company, in partnership with its local distributor, Katoji, launched its first flagship store in Daikanyama, Japan. Reputed brands, including Munchkin, offer Bluetooth-enabled products to stay competitive and achieve product differentiation. Market players also emphasize developing portable baby swings to build a strong brand reputation.

List of Top Baby Swing Companies:

- Thorley Industries LLC. (U.S.)

- Mattel, Inc. (U.S.)

- Nuna International B.V. (Netherlands)

- Brevi Milano S.P.A. (Italy)

- Kids2, LLC (U.S.)

- Newell Brands (U.S.)

- Foshan Baby Bear Technology Co., Ltd. (China)

- Hauck Gmbh & Co. KG (Germany)

- Mamas & Papas (U.K.)

- Star and Daisy (India)

- Baby Bjorn AB (Sweden)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: Graco, a baby gear brand Newell Brands Inc., launched its new SmartSense Soothing Swing with three recline positions and five harness points. According to the company, the new swing features a patented technology to automatically detect and respond to a baby's cries using 1,000 combinations of motion, songs, sounds, and vibrations.

- May 2024: Babies ‘R’ Us, a New Jersey, U.S.-based baby products retailer, announced a shop-in-shop agreement with Kohl’s, a U.S.-based omnichannel retailer, to launch Babies R Us shops within 200 Kohl’s stores across the U.S.

- March 2023: 4moms, a U.S.-based baby gear company, launched its new swing, RockaRoo Baby Rocker. According to the company, the new swing features five ranges of automated front-to-back rocking motion and interactive toy balls.

- April 2022: Mattel, a U.S.-based baby toys manufacturer, announced the expansion of its production facility in Escobedo, Mexico, with an investment of USD 50 million. According to the company, the expansion would improve the supply chain of the company.

- June 2021: Nuna International B.V., a Netherlands-based baby gear company, announced the launch of its new 289,000-square-foot distribution center and office space to expand its operations in the U.S.

REPORT COVERAGE

The report offers a comprehensive analysis, highlighting on crucial aspects such as prominent companies, type analysis, application, and distribution channels. Besides this, it provides insights into global trends and highlights significant industry developments, growth factors, and key market insights.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 3.27% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market was USD 5.36 billion in 2024 and is anticipated to reach USD 6.91 billion by 2032.

Ascending at a CAGR of 3.27%, the global market will exhibit steady growth over the forecast period (2025-2032).

By type, the manual baby swing segment dominates the market throughout the forecast period.

Rising number of working women is a crucial factor propelling market growth.

Thorley Industries LLC., Mattel, Inc., Nuna International B.V., Brevi Milano S.P.A., Kids2, LLC, and Newell Brands are the leading companies.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us