Copper Sulfate Market Size, Share & Industry Analysis, By Grade (Agriculture Grade, Feed Grade, Electronic Grade, and Industrial Grade), By Application (Agriculture, Animal Feed, Mining & Metallurgy, Electrical & Electronics, Water Treatment, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

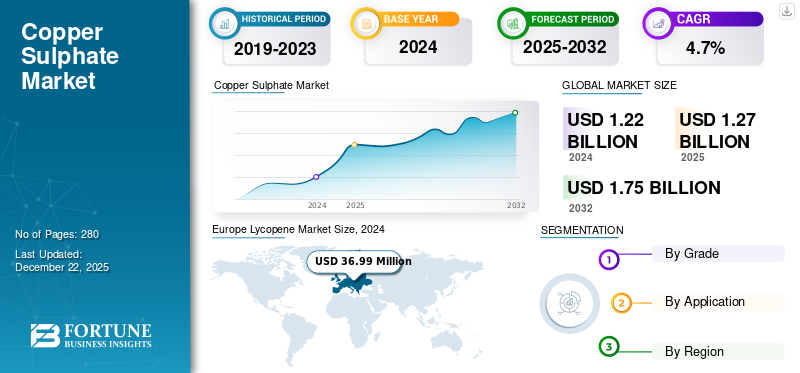

The global copper sulfate market size was valued at USD 1.27 billion in 2025 and is projected to grow from USD 1.33 billion in 2026 to USD 1.92 billion by 2034, exhibiting a CAGR of 4.7% during the forecast period. Asia Pacific dominated the copper sulfate market with a market share of 45% in 2025.

Copper sulfate is an inorganic chemical compound composed of copper and sulfate ions, commonly known as blue vitriol or bluestone. It is a versatile compound with several properties, including fungicide, algaecide, and antimicrobial agents. Its exceptional properties make it widely used in agriculture, water treatment, and various industrial processes. Its key advantages include preventing metal corrosion, inhibiting fungal growth, controlling algae, and certain pests, making it an ideal ingredient in the above-listed applications. Industrial applications are a major product demand driver, particularly in mining, chemical manufacturing, and water treatment. Its versatility in these sectors, including its usage as a fungicide, herbicide, flotation agent, and in various chemical processes, will fuel its widespread adoption in the coming years.

Old Bridge Minerals, Hebei Jinchangsheng Chemical Technology Co., Ltd., Highnic Group, Koryx Copper, and Sanginita Chemicals are identified as a few key market players. Companies are investing in cleaner, more sustainable manufacturing processes of copper sulfate to align with global initiatives for a greener future.

MARKET DYNAMICS

MARKET DRIVERS

Consistent Demand from Agriculture to Act as a Growth Engine for Market Growth

Agriculture is set to act as a market growth engine, primarily due to its use as a fungicide, herbicide, and micronutrient fertilizer. Agriculture's growth and development are crucial for meeting the increasing global demand for food and agricultural products, driven by population growth, rising incomes, and changing dietary preferences. Also, agriculture is a cornerstone of economic development, particularly in rural areas, providing livelihoods, generating income, and contributing to overall economic growth. The chemical compound is essential in controlling plant diseases and correcting soil deficiencies. It is widely used to control fungal and bacterial diseases in crops, including grapes, potatoes, and citrus fruits. Also, it's a key component in the Bordeaux mixture, a fungicide used for disease control.

In addition, the compound addresses copper deficiencies in the soil, which can hinder crop growth. Therefore, the growing global population and the need for increased food production are intensifying the demand for crop protection chemicals, thus driving the global copper sulfate market growth.

MARKET RESTRAINTS

Stringent Chemical Regulations and Presence of Substitutes May Hinder Market Growth

The chemical compound is widely adopted in various end-use industries, including but not limited to agriculture, animal feed, mining, and others. However, chemical regulations can hinder the product demand due to increasing compliance costs, limiting its use in certain applications. Stringent environmental regulations are a major factor, particularly regarding their use in agriculture and developed economies. While it is effective in many applications, it does pose environmental risks, especially related to its potential to contaminate soil and water. These environmental concerns drive the need for regulations to mitigate these risks, which translates into restrictions on its usage. Evolving regulatory standards across different regions can create uncertainty for manufacturers, who must constantly adapt to new rules. This uncertainty can make it challenging to plan production and investment, further impacting demand.

Furthermore, the compound has several substitutes depending on its application. For instance, other copper-based products, integrated pest management, and beneficial insects/fungi can be used in agriculture. Similarly, barley straw and potassium salts can effectively control pond algae. Therefore, due to the stringent chemical regulations and the presence of substitutes, the copper sulfate market is expected to experience sluggish growth in the long-term forecast.

MARKET OPPORTUNITIES

Rising Demand from Several Industries to Create Remunerative Market Opportunities

Several prominent industries are driving the product demand, including mining and metallurgy, chemical, healthcare, and infrastructure development, which are key drivers. Specifically, the increased demand for batteries, electric vehicles (EVs), and renewable energy technologies significantly boosts the need for metals such as lithium, cobalt, nickel, and copper. Growing economies and urbanization increase investment in infrastructure projects such as roads, railways, and buildings. This fuels the demand for steel, cement, and other construction materials.

Additionally, healthcare is a significant market driver, primarily due to the compound’s antimicrobial and antiseptic properties. It is used in various healthcare applications, including wound care, topical treatments, and pharmaceutical formulations, contributing to its growing demand in the sector. Therefore, the product’s multifunctional properties and wide application areas will create remunerative opportunities.

COPPER SULFATE MARKET TRENDS

Emergence of High-Purity Copper Sulfate to Drive Market Growth

The market for high-purity copper sulfate, particularly in electronics and pharmaceuticals, is growing rapidly due to the increasing demand in the electrical and electronics industry. Further, the product demand is anticipated to grow with the rising adoption of electric vehicles (EVs), renewable energy technologies, including solar and wind power, and the emerging digitalization trend. It is a key raw material used in various components and materials in the electronics industry. High-purity sulfates of copper are essential for producing high-performance electronic components, including semiconductors and printed circuit boards. Its purity ensures these components' reliable and efficient functioning in various devices.

Furthermore, the pharmaceutical industry drives the product demand primarily through its use as an antimicrobial agent, disinfectant, and sterilizer. Its ability to inhibit or destroy microorganisms makes it a valuable ingredient in certain pharmaceutical products, particularly those used for wound care and infection prevention. Growing research & development activities in the pharmaceutical sector, particularly in areas including drug delivery and diagnostics, also contribute to the demand for pure product forms.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic adversely impacted business operations in numerous ways, including the temporary suspension of production, which caused disruptions in the supply chain. However, many end-use industries, such as agriculture, animal feed, and water treatment, were among the few that had significantly less impact than other prominent end-use industries, such as mining and metallurgy. As a result, the market experienced mixed scenarios and registered overall positive year-on-year growth in 2020.

TRADE PROTECTIONISM AND GEOPOLITICAL IMPACT

Geopolitical tensions can significantly disrupt the product’s supply-demand equation by impacting mining operations, trade routes, and overall market stability. Disruptions to mining, particularly in prominent production regions, can reduce copper ore supply, which is a key raw material for copper sulfate production. For instance, many of the world's largest copper reserves are in regions prone to political instability, such as Chile, Peru, and the Democratic Republic of Congo. Trade route disruptions, such as those caused by sanctions or conflict, can affect the transportation of raw materials and finished products, leading to price fluctuations and supply shortages. Hence, any geopolitical tension can negatively impact the overall market growth.

Segmentation Analysis

By Grade

Agriculture Grade Dominated Market Owing to Wide Adoption and Versatile Functionalities

On the basis of grade, the market is segmented into agriculture grade, feed grade, electronic grade, and industrial grade.

The agriculture grade segment held a dominant global copper sulfate market share of 50.38% in 2026. The agriculture industry dominates the global demand primarily as it is highly effective and widely used as a fungicide and algaecide. Its ability to control fungal diseases and manage algae in various crops and aquatic environments makes it crucial for enhancing crop yields and maintaining healthy aquatic ecosystems. Being a key component in preventing and treating fungal diseases has made agricultural grade the most consumed in the market.

Feed grade is another prominent grade in the market, as the compound is highly utilized as an additive in animal feed. The product is in high demand for animal feed applications in developed regions such as the U.S., Germany, Italy, Netherlands, and other developed nations. The chemical compound is added to animal feed to prevent and treat copper deficiencies, significantly supporting the segment’s growth during the forecast period.

The industrial grade will likely experience moderate growth during the forecast period due to stable demand from various industries, including mining & metallurgy, chemical, water treatment, textile, etc. The chemical compounds act as flotation reagents in the mining industry, helping to separate valuable minerals from ore, and are used to control algae growth in water bodies including reservoirs, swimming pools, and industrial cooling systems. Similarly, it plays a critical role in other industries, which will catalyze market growth.

By Application

To know how our report can help streamline your business, Speak to Analyst

Agriculture Segment Dominated Market Due to Growing Focus on Correcting Copper Deficiencies in Soil

Based on application, the market is segmented into agriculture, animal feed, mining & metallurgy, electrical & electronics, water treatment, and others.

The agriculture segment will likely dominate the market share of 50.38% in 2026. The product is one of the most consumed agricultural chemicals, mainly due to its several functionalities. Its efficacy as a fungicide, fertilizer, and algaecide has made it a critical ingredient in the agrochemical industry. It's particularly effective against fungal diseases, including downy mildew and leaf spot, and can also be used to correct copper deficiencies in soil. Additionally, it acts as a molluscicide, controlling snails and slugs, and it can even be used to treat algae and bacteria in water systems. With such a wide array of application areas in agriculture alone, this segment has become the largest application segment in the market.

The electrical and electronics segment is anticipated to showcase significant growth, owing to the product’s high utilization for PCB production. The chemical compound is primarily used for electroplating and etching processes. It acts as a source of copper ions in an electrolytic solution, allowing copper deposition on the PCB surface during plating and removing unwanted copper during etching. Growing demand for advanced technologies will fuel the demand for advanced PCBs, thus increasing the product consumption.

Another important application area is mining and metallurgy, where it is utilized as a flotation agent to separate valuable minerals from waste rock. It acts as an activator by increasing the hydrophobicity (water-repelling property) of mineral surfaces, making them more likely to attach to air bubbles in the flotation cell. In addition, it is also used in electrolytic refining processes, copper plating processes, and soldering and welding processes as a flux.

COPPER SULFATE MARKET REGIONAL OUTLOOK

The market is categorized by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Copper Sulfate Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific market size stood at USD 0.57 billion in 2025 and is predicted to dominate the global market during the forecast period. China is identified as the largest producer and consumer of this product due to multiple factors, including its well-established copper industry and China’s ongoing industrialization and infrastructure projects. China’s giant copper industry enables it to produce and process large quantities of the product, and the vast presence of agricultural land, along with massive industrial activities, fuels the demand. The Japan market is projected to reach USD 0.06 billion by 2026, the China market is projected to reach USD 0.29 billion by 2026, and the India market is projected to reach USD 0.04 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is another prominent region in the global market due to the product's widespread use in agriculture, water treatment, and industrial applications. The region is a major consumer, with the U.S. being a leading country due to the presence of a massive animal feed industry. For instance, according to the International Feed Industry Federation (IFIF), the U.S. will account for around 20% of the global compound feed production in 2022, producing 240 million tons. The U.S. market is projected to reach USD 0.21 billion by 2026. The U.S. market is projected to generate sales revenue of USD 0.19 billion by the end of 2032.

Europe

The European region creates a stable demand for the product by following strict chemical regulations, sustainable farming practices, and industrial uses. The product is also widely used in various industrial processes, including electroplating, textile manufacturing, and chemical processing. These industrial applications and the electronics industry's development contribute to regional growth. The UK market is projected to reach USD 0.03 billion by 2026, and the Germany market is projected to reach USD 0.08 billion by 2026.

Latin America

Latin America is among the top exporters of the chemical compound, and countries, for instance, Chile and Peru, exported 10.06 and 9.67 kilotons of copper sulfate in 2024, respectively. However, Brazil and Mexico are identified as the primary consumers of the product due to ongoing industrial expansion and huge demand from the agriculture and animal feed industry.

Middle East & Africa

The Middle East region's industry represents a mixed scenario where a few nations have large production bases, and a few have very low chemical compound production. Countries such as South Africa and Turkey have massive production bases, whereas the GCC region mostly relies on imports to fulfill its demand. Also, the regional demand is mainly dominated by South Africa and Turkey due to massive demand from agriculture for crop protection, water treatment, and mining.

COMPETITIVE LANDSCAPE

Key Industry Players

Companies are Focusing on Purity Forms and Exploring Niche Application Areas to Create Extra Revenue Streams

Global Key players such as Old Bridge Minerals, Hebei Jinchangsheng Chemical Technology Co., Ltd., Highnic Group, Koryx Copper, and Sanginita Chemicals are more focused on organic strategies such as developing high-purity grades and exploring niche application areas to create extra revenue streams. They also collaborate strategically with various industries and invest in research and development to drive innovation. Also, the electronics industry is increasing the demand for high-purity copper sulfate, crucial in producing essential components, including semiconductors, connectors, and microchips. In response, companies, namely Hebei Jinchangsheng Chemical Technology Co., Ltd., Max Chemicals Co., Ltd., and Highnic Group, have developed pure forms of the product. Furthermore, sustainability is becoming a key differentiator, with companies offering eco-friendly solutions.

LIST OF KEY COPPER SULFATE COMPANIES PROFILED

- Ataman Chemicals (India)

- BAKIRSULFAT AS (Turkey)

- GAMBIT (Poland)

- Hebei Jinchangsheng Chemical Technology Co., Ltd. (China)

- Highnic Group (China)

- Max Chemicals Co., Ltd. (Taiwan)

- Old Bridge Minerals (U.S.)

- Sulcona (Mexico)

- Sumitomo Metal Mining Co., Ltd. (Japan)

- Vigro Chemicals PTY Ltd. (South Africa)

KEY INDUSTRY DEVELOPMENTS

- August 2023: True North Copper Limited (TNC) signed an agreement with Kanins International, under which TNC has commenced copper sulfate production at its Cloncurry Project in Queensland, Australia. The initial planned production capacity will be 12 kilotons per year, meeting the increasing demand from agriculture, mining, water treatment, and chemical manufacturing industries.

REPORT COVERAGE

The global market research report provides detailed market analysis and focuses on crucial aspects such as leading companies, grades, and applications. Also, the report offers insights into market trends and highlights vital industry developments and the competitive landscape. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.7% from 2026-2034 |

|

Unit |

Volume (Kiloton), Value (USD Billion) |

|

Segmentation |

By Grade

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 1.33 billion in 2026 and is projected to reach USD 1.92 billion by 2034.

Growing at a significant CAGR of 4.7%, the market will exhibit considerable growth over the forecast period (2026-2034).

Based on application, the agriculture segment is expected to lead the market.

The growing demand from the agriculture sector is the key factor driving the market.

Old Bridge Minerals, Hebei Jinchangsheng Chemical Technology Co., Ltd., Highnic Group, Koryx Copper, and Sanginita Chemicals are the leading players in the market.

Asia Pacific held the largest market share in 2025.

Increasing product demand from the animal feed and electronics industries are anticipated to drive the adoption of the product.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us