Digital Out-of-Home Advertising Market Size, Share & Industry Analysis, By Format (BillBoards, Transit Displays, Street Furniture, and Venue-based Displays), By Type (Indoor and Outdoor), By Technology Platform (Programmatic DOOH, Interactive DOOH, and Real-time/Contextual DOOH), By End Use (Retail & FMCG, Entertainment, Travel & Tourism, Government, BFSI, Healthcare, Automotive, and Real Estate), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

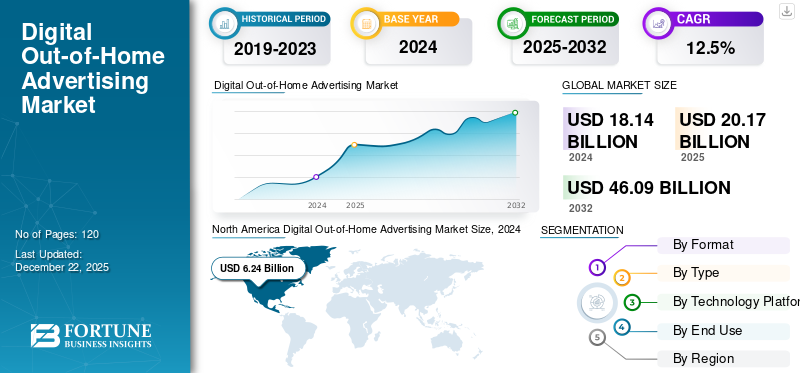

The global digital out-of-home advertising market size was valued at USD 20.17 billion in 2025. The market is projected to grow from USD 22.51 billion in 2026 to USD 56.1 billion by 2034, exhibiting a CAGR of 12.09% during the forecast period.North America dominated the global market with a share of 33.64% in 2025.

Digital Out-of-Home (DOOH) advertising combines the reach of traditional out-of-home media with the flexibility, real-time targeting, and interactivity of digital platforms, making it highly attractive to modern marketers.

The rising demand for contextual and hyper-targeted DOOH ads is transforming out-of-home advertising into a precision marketing tool. Brands already take advantage of near real-time location data to serve a relevant ad that aligns with the most recent visit to a nearby high-intent venue such (retail centers, airports, or fitness facilities) such as travel accessories to airport patrons or sportswear to patrons near fitness facilities.

Key players, including Clear Channel Outdoor, JCDecaux, and Lamar Advertising among others, are building omnichannel ecosystems that integrate outdoor displays with mobile and online campaigns. Such ecosystems help ensure cross-platform consistency and higher return on investment (ROI) for brands.

IMPACT OF GENERATIVE AI

Generative AI Technology to Boost Production of Context-based Creatives

The rise of generative AI is significantly transforming the digital out-of-home advertising industry, enabling faster, more personalized, and scalable content creation that enhances audience engagement and campaign performance. Traditionally, DOOH content production required manual design processes, limiting the number of ad variants and updates. With generative AI tools such as GPT-4 and DALL·E, advertisers are able to dynamically generate hyper-localized and context-based creatives personalized in real-time owing to factors such as, location, weather, time of day, and audience demographics. Companies such as Katalyst and Broadsign are adopting generative AI to instantly adapt creative assets for thousands of DOOH screens across cities, tailoring messages to different audiences within seconds.

IMPACT OF RECIPROCAL TARIFF

Impact of reciprocal tariff on the market is significant due to hardware supply chain and cost structure. DOOH infrastructure relies heavily on imported digital components such as LED display panels, controllers, networking equipment, and IoT sensors, many of which are sourced from global manufacturing hubs such as China, South Korea, and Taiwan. If reciprocal tariffs are levied on these imported components, it can lead to increased capital expenditure (CAPEX) for DOOH providers, delaying the rollout or upgrade of digital inventory. Moreover, higher import costs can pressure media owners to raise ad rates, making DOOH less competitive compared to other digital formats such as mobile or online display.

In the long term, reciprocal tariffs may also encourage DOOH companies to localize manufacturing, invest in domestic supply chains, or partner with alternative suppliers in tariff-exempt countries. While this shift may bring resilience, it will also involve transition costs and delays.

Market Trends

Integration of DOOH with Mobile and Omnichannel Campaigns to Accelerate Market Growth

The integration of digital out-of-home advertising DOOH with mobile and omnichannel campaigns enables advertisers to create seamless, cross-platform experiences that follow consumers throughout their daily journeys beginning in public spaces and continuing on personal devices. By combining DOOH with mobile targeting techniques such as geofencing, beacons, and device ID tracking, brands are able to deliver sequential messaging. For instance, showing a billboard ad at a transit station and then serving a follow-up offer via mobile ad within minutes.

Omnichannel integration improves attribution and performance measurement. With the help of data-driven platforms and programmatic buying, marketers are able to track location and timing of the user’s engagement with DOOH content and evaluate conversion outcomes across physical and digital channels.

Thus, the integration of DOOH with mobile and omnichannel campaigns is anticipated to drive digital out-of-home advertising market growth.

MARKET DYNAMICS

Market Drivers

Popularity of Retail Media Networks (RMNs) to Boost Market Growth

RMNs are digital advertising platforms operated by retailers that leverage their physical store locations, digital properties, and customer data to deliver targeted ads both in-store and through digital channels. With the retail sector increasingly embracing data driven marketing, RMNs provide advertisers a unique opportunity to engage consumers at the point of purchase or during the shopping journey. As retailers integrate RMNs with digital out-of-home advertising screens such as digital signage in stores, malls, and transit areas, advertisers benefit from enhanced targeting capabilities using first-party data such as purchase history, loyalty profiles, and real-time foot traffic. This collaboration improves ad relevance and engagement, leading to higher return on ad spend.

Retail giants such as Walmart, Amazon, and Kroger have launched or expanded their RMNs, incorporating DOOH to extend their advertising reach beyond e-commerce to physical stores and public spaces. Therefore, the popularity of retail media networks (RMNs) is boosting market expansion.

Market Restraints

Limited Standardization and Measurement Metrics Could Hamper Market Growth

Unlike online advertising, DOOH lacks universal standards for audience measurement, impressions, viewability, and attribution. While companies are innovating in real-time analytics and location intelligence, the absence of consistent benchmarks makes it difficult for advertisers to compare performance and justify spend across platforms or regions. Thus, limited standardization and measurement metrics may hamper the growth of the market.

Market Opportunities

Growing Demand for Contextual and Dynamic Content to Create Opportunities for Market Players

DOOH allows advertisers to display real-time, personalized, and situational content that responds to variables such as weather, time of day, traffic flow, sports scores, or even trending topics. This dynamic capability significantly boosts audience engagement and recall rates. Brands are leveraging real-time triggers, such as showing iced coffee ads during heatwaves or promoting rideshare offers during rain, to create timely, hyper-relevant interactions. This level of responsiveness enhances customer experience and maximizes campaign performance by delivering the right message to the right audience at the right moment.

As advertisers continue to prioritize ROI and personalization, dynamic content capabilities are becoming a key differentiator and growth engine within the global digital out-of-home advertising landscape. According to a Broadsign survey, 74% of advertisers are more likely to invest in DOOH when it includes dynamic and contextual targeting features. As advertisers continue shifting budgets toward performance-based and omnichannel strategies, DOOH players that offer context-aware, real-time content management tools and programmatic delivery infrastructure are gaining a competitive edge.

Therefore, growing demand for contextual and dynamic content is expected to create opportunities for market players.

SEGMENTATION ANALYSIS

By Format

Adoption of Billboards due to Increasing Urbanization Drive Segment Growth

Based on format, the market is segmented into billboards, transit displays, street furniture, and venue-based display.

Among these, the billboards segment dominated the global digital out-of-home advertising market share of 45.14% in 2026, due to superior flexibility, real-time content capabilities, and high-impact visibility in urban and transit-heavy locations. Urbanization and smart city investments are also accelerating digital billboard deployment. As recorded in 2024, over 56% of the global population has been reported to live in urban areas, according to the United Nations. Therefore, digital billboards are strategically being installed in high-traffic zones such as highways, city centers, airports, and transit hubs where visibility is maximized.

The venue-based display segment is estimated to grow at the highest CAGR during the forecast period. This owing to the display ability to deliver highly targeted, captive audience engagement in controlled, high dwell-time environments such as shopping malls, airports, stadiums, cinemas, hospitals, gyms, and entertainment venues.

By Type

Surge in Demand for Indoor DOOH due to Deeper Audience Engagement Boost Segment Growth

Based on type, the market is bifurcated into outdoor and indoor.

The indoor DOOH segment is expected to register the highest CAGR during the forecast period. Indoor digital out-of-home advertising is typically found in locations such as shopping malls, airports, cinemas, gyms, hospitals, corporate buildings, and educational campuses and offers advertisers the ability to reach consumers in controlled, captive environments. These locations often feature longer stay times and less distraction, allowing for deeper brand exposure and greater ad recall compared to outdoor or mobile formats.

The outdoor segment captured the largest market with a share of 60.44% in 2026. The demand for outdoor digital out-of-home (DOOH) advertising is increasing significantly due to a combination of shifting consumer mobility patterns, regulatory changes, and urban infrastructure upgrades.

By Technology Platform

Popularity of Programmatic DOOH to Surge Due to its Flexibility

By technology platform, the market is segmented into programmatic DOOH, interactive DOOH, and real-time/contextual DOOH.

Among these, the programmatic DOOH segment dominated the market with a share of 65.51% in 2026 and is estimated to grow at the highest CAGR during the forecast period. Programmatic DOOH allows advertisers to buy and deliver ads in real time based on dynamic data such as location, audience demographics, weather, time of day, and events, favoring segment growth. This flexibility ensures that the right message reaches the right audience at the right moment, increasing campaign relevance and effectiveness. In addition, programmatic DOOH leverages audience analytics, foot traffic data, and mobile location intelligence to provide advertisers with detailed campaign performance metrics and attribution. This transparency helps justify spending and optimize future campaigns based on real-world impact.

The DOOH advertising sector is witnessing the rise of interactive technology platforms as the growing segment by CAGR, and this growth is certainly driven by an increasing desire for immersive and engaging ad experiences. Interactive technology platforms often combine technologies such as touchscreens, AR/VR, gesture recognition, and AI personalization which allows for static ads to become engaging two-way interactions, especially in high-traffic areas such as malls, transit locations, and smart cities.

By End Use

To know how our report can help streamline your business, Speak to Analyst

Retail & FMCG to Dominate as Companies Combine First-Party Shopper Data With DOOH to Create Hyper-Targeted Campaigns

Based on end use, the market has been segmented into retail & FMCG, entertainment, travel & tourism, government, BFSI, healthcare, automotive, and real estate.

Among these, the retail & FMCG segment dominated the market with a share of 33.5% in 2026 and is estimated to grow at the highest CAGR during the forecast period. Retailers and FMCG brands leverage DOOH’s ability to deliver targeted messages based on time of day, weather, promotions, or inventory levels. For example, advertising ice cream on a hot day or highlighting discounts during peak shopping hours makes the ads more relevant and effective. Furthermore, the rise of retail media networks allows FMCG brands to combine first-party shopper data with DOOH to create hyper-targeted campaigns. This data-driven approach improves ad personalization and drives higher conversion rates.

The healthcare sector in the Digital Out-of-Home (DOOH) advertising space is expected to grow with the significant CAGR as it accelerates with targeted campaigns in hospitals, pharmacies, and wellness centers. Healthcare brands continue to use DOOH in many different ways such as patient education (e.g., vaccine awareness, chronic healthcare management), promoting their telemedicine services, and showcasing new medical products in areas of high foot fall.

DIGITAL OUT-OF-HOME ADVERTISING MARKET REGIONAL OUTLOOK

The market has been geographically studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific. Each region has been further studied across countries.

North America

North America Digital Out-of-Home Advertising Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market by capturing the maximum share in 2024. North america dominated the market with a valuation of USD 6.78 billion in 2025 and USD 7.4 billion in 2026.The demand for digital out-of-home (DOOH) advertising in North America is growing rapidly, driven by the convergence of macroeconomic, technological, and consumer behavior trends that are reshaping the advertising landscape. The region is leading the global expansion of retail media networks (RMNs) platforms such as Walmart Connect, Target Roundel, and Kroger Precision Marketing, who are now integrating in-store DOOH screens into their advertising offerings. These DOOH touchpoints, embedded within grocery aisles, checkout lanes, and pharmacy sections, offer FMCG brands access to real-time, first-party shopper data, and the ability to deliver promotional messages at the moment of decision-making.

Download Free sample to learn more about this report.

In the U.S., the market is expected to experience a strong growth rate during the forecast period. The U.S. is a global hub for live entertainment and sports. The aggressive digital transformation of NFL, NBA, MLB, and MLS stadiums, coupled with new infrastructure, such as the Las Vegas Sphere and SoFi Stadium, has turned these venues into premium DOOH zones. These locations are equipped with immersive LED walls, interactive kiosks, and branded digital zones, offering advertisers real-time fan engagement with contextual campaigns during live events. The U.S. market is valued at USD 5.8 billion by 2026.

Asia Pacific

Asia Pacific is expected to grow at the highest CAGR during the forecast period, due to rapid urbanization, increased smartphone penetration, digital transformation of public infrastructure, and rising retail and transit footfall. The country also records a rising adoption of digital technologies across transportation, retail, and entertainment sectors, where public screens are increasingly used for dynamic and targeted advertising. For instance, China's extensive metro systems and airports have integrated digital displays powered by real-time data, while India's smart city initiatives are fueling the rollout of digital billboards and transit displays in Tier 1 and Tier 2 cities. The Japan market is valued at USD 1.41 billion by 2026, the China market is valued at USD 2.51 billion by 2026, and the India market is valued at USD 0.78 billion by 2026.

Europe

Europe is estimated to witness significant growth over the coming years, due to the widespread deployment of digital screens in transportation hubs, retail centers, and public venues across major cities such as London, Paris, Berlin, and Amsterdam. Europe’s strong regulatory environment promoting privacy and transparency has further increased advertiser confidence in digital out-of-home advertising campaigns. The UK market is valued at USD 0.7 billion by 2026, and the Germany market is valued at USD 0.83 billion by 2026.

Middle East & Africa

The region is estimated to witness robust growth as governments are investing heavily in smart cities development, infrastructure modernization, and the expansion of the retail and hospitality sectors. In Dubai, Riyadh, Saudi Arabia and other cities, the expansion of modern transit systems, airports, and commercial hubs has led to the deployment of sophisticated digital display networks. For instance, Dubai’s Smart City initiative has integrated thousands of digital screens in metro stations, malls, and public spaces, making it one of the fastest-growing DOOH markets in the region.

South America

The region is expected to grow at a steady rate. The rise of e-commerce and digital retail in South America is driving the demand for in-store digital signage and mall-based digital out-of-home advertising networks, enhancing shopper engagement at the point of purchase.

Competitive Landscape

Key Industry Players

Market Players Opt for Merger and Acquisition Strategies to Expand Their Presence

Leading DOOH firms such as JCDecaux, OUTFRONT Media, and Clear Channel Outdoor Holdings are heavily investing in data integration and audience analytics and are partnering with mobile data providers and leveraging AI to deliver contextual and measurable campaigns. Companies are also embracing interactive technologies such as facial recognition, QR codes, and augmented reality (AR) to enhance consumer interaction and drive engagement rates. Strategic partnerships and acquisitions also play a crucial role as companies are acquiring regional media networks or tech startups to enhance geographical reach and technological capabilities.

Long List of Companies Studied

- JCDecaux (France)

- Clear Channel Outdoor (U.S.)

- Lamar Advertising (U.S.)

- OUTFRONT Media (U.S.)

- Ströer SE & Co. KGaA (Germany)

- Ocean Outdoor (U.K.)

- Focus Media (China)

- Alliance Media (South Africa)

- Daktronics (U.S.)

- Talon Outdoor Ltd (U.K.)

- QMS Media Limited (Australia)

- EyeMedia LLC. (China)

- Exterion Media Group (U.K.)

… and more

KEY INDUSTRY DEVELOPMENTS:

- May 2025 – Lamar Advertising acquired Premier Outdoor Media and this acquisition enhances Lamar’s position in the greater Philadelphia and New York markets.

- April 2025 – JCDecaux, in partnership with Viooh, introduced a programmatic DOOH offering.

- February 2025 – Daktronics launched energy-efficient digital billboard technology that features eco-conscious display options, including an optional Green Mode for added energy savings.

- January 2025 – Talon acquired Out of Home Masters to strengthen Talon’s position in Europe and establish a platform for further growth.

- October 2024 – DLM Media entered a partnership with CETV Now to fulfill the demand and opportunity for digital advertising in venues across the U.S.

REPORT COVERAGE

The market research report provides a detailed analysis. It focuses on key points, such as leading companies, offerings, and applications. Besides this, it offers an understanding of the latest market trends and highlights key industry developments. In addition to the above-mentioned factors, it contains several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.09% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Format

By Type

By Technology Platform

By End Use

By Region

|

|

Companies Profiled in the Report |

• JCDecaux (France) • Clear Channel Outdoor (U.S.) • Lamar Advertising (U.S.) • OUTFRONT Media (U.S.) • Ströer SE & Co. KGaA (Germany) • Ocean Outdoor (U.K.) • Focus Media (China) • Alliance Media (South Africa) • Daktronics (U.S.) • Talon Outdoor Ltd (U.K.) |

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to record a valuation of USD 56.1 billion by 2034.

In 2025, the market was valued at USD 20.17 billion.

The market is projected to grow at a CAGR of 12.09% during the forecast period of 2026-2034.

By type, the outdoor segment is expected to lead the market in terms of share.

Popularity of retail media networks (RMNs) is a key factor driving market growth.

JCDecaux, Clear Channel Outdoor, Lamar Advertising, OUTFRONT Media, Ströer SE & Co. KGaA are the top players in the market.

North America is expected to hold the highest market share.

By end use, the retail & FMCG segment is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us