DNA Polymerases Market Size, Share & Industry Analysis, By Type (Prokaryotic {DNA Polymerase I, DNA Polymerase II, DNA Polymerase III, and Others}, and Eukaryotic {DNA Polymerase α (alpha), DNA Polymerase δ (delta), and Others}), By Formulation (Standard and Thermostable), By Application (DNA Amplification, DNA Sequencing, DNA Cloning, and Others), By End User (Pharmaceutical and Biotechnology Companies, Academic & Research Institutes, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

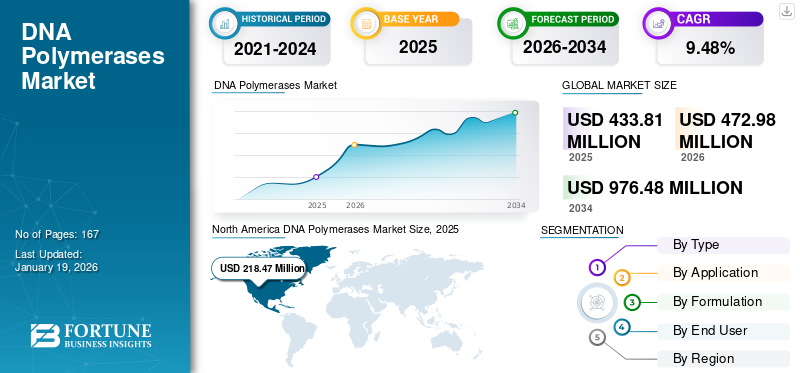

The global DNA polymerases market size was valued at USD 433.81 million in 2025. The market is projected to grow from USD 472.98 million in 2026 to USD 976.48 million by 2034, exhibiting a CAGR of 9.48% during the forecast period. North America dominated the DNA polymerases market with a market share of 50.36% in 2025.

Polymerases are vital for polymerase chain reaction procedures and next-generation sequencing, which are widely used in genetic testing and research activities. The widespread use of DNA polymerase in PCR and NGS technologies supports their growth in molecular diagnostics and research. This is further driven by the use of NGS and PCR for diagnostics and precision medicine across the globe. This is further supported by the falling costs of NGS procedures and increasing awareness about early diagnosis of critical diseases.

Furthermore, the market players such as Takara Bio Inc., Thermo Fisher Scientific, Inc., New England Biolabs, and Agilent Technologies Inc., are at the forefront of this market. Strong global presence coupled with a broad product portfolio of these companies support the leading position of these companies.

MARKET DYNAMICS

MARKET DRIVERS

Rapid Expansion of Genomics and Precision Medicine to Propel Market Growth

The most significant driver for the market is the rapid expansion of genomics research & emphasis on development of precision medicine. DNA polymerases are actively used in various genome related researches. Additionally, the need for precise genetic analysis and personalized medicine are fueling the demand for the DNA polymerase products.

Moreover, in recent years, the number of gene and cell therapy based clinical trials is rapidly increasing. Along with this, pharmaceutical companies are focusing on the development of innovative therapies using genetic engineering. All these factors are driving the market growth.

- For instance, a research study was published in Medical Xpress in June 2025 which stated that the researchers have discovered a new promising method for gene therapy by successfully restarting inactive genes.

MARKET RESTRAINTS

High Cost of High-Fidelity Enzymes to Restrict Market Expansion

High fidelity DNA polymerases are costlier compared to standard Taq polymerase. The high cost of these enzymes is a result of intensive research & development cost, complex production process, and proprietary intellectual property rights. This makes these high-fidelity enzymes less affordable for smaller academic laboratories and price-sensitive regions such as Latin America and the Middle East & Africa. This impacts the adoption of products, in turn limiting the overall market growth to certain extent.

- For example, as per the study published in National Center for Biotechnology Information (NCBI) in November 2021, commercial price of cDNA synthesis kits ranges from USD 287 – USD 575 per 50–100 reactions.

MARKET OPPORTUNITIES

Focus on Expanding Point-of-Care and Rapid Diagnostics to Create Lucrative Growth Opportunities

With the rapidly increasing demand for rapid diagnostics especially in the field of infectious disease diagnosis, the polymerases with innovative formulations such as glycerol-free, lyophilization-ready formulations are gaining traction among the end-users. The marketspace is witnessing a rising adoption of PCR in Point-of-Care (POC) diagnostics which has created growth opportunities for the operating players.

- For instance, in April 2024, Speed Pty Ltd. launched a qPCR test capable of detecting 14 respiratory viruses simultaneously, delivering fast results at a competitive price.

DNA POLYMERASES MARKET TRENDS

Shift toward Customized DNA Polymerases is One of the Significant Market Trends

In recent years, the marketspace is witnessing a shift toward the use of customized enzymes in various workflows. This involves modifying existing enzymes or finding naturally occurring ones that can perform specific tasks according to the need of specific workflow. Some of the factors responsible for this shift include addressing limitations of natural polymerases, enabling specialized applications, and others.

- For instance, myPOLS Biotec, a part of Medix Biochemica Group, offers services for engineering customized DNA polymerases.

MARKET CHALLENGES

Complex Manufacturing and Quality Compliance to Hamper Market Growth

Complex manufacturing and quality compliance for DNA polymerases is one of the challenging factors for the overall DNA polymerases market growth. This challenge is intensified by the need for specialized equipment, personnel, and stringent quality control, limiting access for smaller labs and developing economies. Additionally, for the production of high-purity, GMP-compliant DNA polymerase that can be used for therapeutic as well as diagnostic purposes requires advanced biomanufacturing facilities resulting in creating the entry barrier.

- For instance, according to Promega Corporation, the manufacturing process of GoTaq MDx polymerase must be undertaken under GMP conditions. However, non-compliance to these standards limits the product supply, in turn hampering the market growth.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

High Demand for Prokaryotic Polymerases Contributed to Segmental Growth

On the basis of the segmentation of type, the market is classified into prokaryotic and eukaryotic. The prokaryotic segment is further divided into DNA polymerase I, DNA polymerase II, DNA polymerase III, and others. Whereas, the eukaryotic segment is divided into DNA polymerase α (alpha), DNA polymerase δ (delta), and others.

The prokaryotic segment dominated the DNA polymerases market with highest share in 2024. Established role of these enzymes in diagnostics & research along with cost advantages & scalability of these enzymes has resulted in the dominance of this segment in the market. Additionally, high commercial availability of these products also supports the segment’s dominance.

- For instance, prominent entities such as Thermo Fisher Scientific Inc., Takara Bio Inc., and New England Biolabs have built large product portfolios of prokaryotic enzymes.

By Application

Wide Range of Research Applications Fuels Growth of DNA Amplification Segment

In terms of application, the market is categorized into DNA amplification, DNA sequencing, DNA cloning, and others.

The DNA amplification segment accounted for the largest DNA polymerases market share in 2024. Increasing usage of PCR as gold standard technology, expansion in clinical diagnostics especially in infectious disease testing, and compatibility with new emerging technologies such as CRISPR & NGS are the prominent factors bolstering the segmental growth.

- For instance, according to the article published by the LANCET Regional Health America in June 2024, Brazil was severely affected by COVID-19, with over 37 million cases as of December 2023. This propelled the demand for rtPCR test for diagnosis and use of Taq polymerases.

By Formulation

Advantages of Thermostable Polymerases Supported Segment Growth

Based on formulation, the market is segmented into standard and thermostable.

The thermostable DNA polymerases segment held the dominating position in 2024. Thermostable polymerases have widespread applications in molecular biology and clinical PCR workflows. Several advantages such as stability in high-temperature denaturation cycles, advances in these enzymes, and superior accuracy, GC-rich template tolerance, and longer amplicon capabilities have supported the dominance of the segment.

- For instance, leading market players such as New England Biolabs, Thermo Fisher Scientific Inc. are some of the key players in the market. These companies offer a comprehensive range of thermostable DNA polymerase enzymes. These companies have mentioned various advantages of these products.

By End User

Strong Focus on Innovative Therapies Based on Genetic Information by Pharmaceutical and Biotechnology Companies Propelled Segment Growth

Based on end-user, the market is segmented into academic & research institutes, pharmaceutical and biotechnology companies, and others.

In 2024, the pharmaceutical and biotechnology companies accounted for the largest share in the market. The segment growth is driven by government investments in healthcare, the rise of new drug formulations, and strategic partnerships among companies to enhance market presence and innovation.

- For instance, in October 2024, Takara Bio Europe expanded its Gothenburg site to include a custom manufacturing lab for PCR and qPCR enzymes, especially polymerases. This facility is designed to cater to the molecular biology needs of researchers and biotech companies across Europe, the Middle East, and Africa (EMEA).

DNA Polymerases Market Regional Outlook

By region, the market is categorized into Europe, Asia Pacific, North America, Latin America, and the Middle East & Africa.

North America

North America DNA Polymerases Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America held the dominant share in 2025 with a revenue generation of USD 218.47 million and also took the leading share in 2026 with USD 236.63 million. Factors such as heavy influx of investment in research activities especially in genomics, presence of well-established market players, and active involvement of the research community in research & development activities have majorly driven the regional market growth.

- For instance, in July 2025, Takara Bio Europe partnered with MACHEREY-NAGEL for the distribution of high-quality bioanalysis products across several European countries.

The U.S. has a well-established biotechnology sector with extensive research infrastructure, supporting the development and application of DNA modifying enzymes including DNA polymerases. Additionally, the U.S. is at the forefront of adopting new technologies, including gene editing tools such as CRISPR-Cas9, which rely on DNA modifying enzymes for precise genetic modifications.

Asia Pacific

Other significant regions such as Asia Pacific and Europe are anticipated to witness noteworthy growth in the coming years. Over the study period, the Europe region is estimated to grow at a CAGR of 9.96%. The region held the second leading position throughout the forecast period and is estimated to touch the valuation of USD 117.0 million in 2025. This is primarily due to the advancing research capabilities in these regions leading to high demand for these enzymes. Furthermore, the market in Asia Pacific is estimated to reach USD 72.2 million in 2025 and secure the position of third-largest region in the market.

Middle East & Africa and Latin America

Over the forecast period, the Middle East & Africa and Latin America regions are anticipated to witness a moderate growth. Latin America market in 2025 is set to record USD 16.6 million as its valuation. The increasing focus of market players toward the development of advanced digital PCR kits & products for efficient diagnosis further drive usage in these regions.

COMPETITIVE LANDSCAPE

Key Industry Players

Strong Focus on Global Distribution and Strategic Initiatives by Key Companies Supported their Leading Position

The marketspace for DNA polymerase enzymes is fragmented with the presence of several global as well as domestic players actively operating in the market. Frequent new product launches, focus on market expansion through strategic initiatives, and collaboration with other players are some of the key characteristics of the market.

Agilent Technologies Inc., New England Biolabs, Thermo Fisher Scientific Inc., and Takara Bio Inc., are some of the leading entities in the global market. Active involvement in strategic partnerships and acquisitions to expand their product portfolios, strong global presence, and wide portfolio of advanced products are some of the factors supporting the dominance of these companies.

On the other hand, other prominent players such as Promega Corporation, Merck KGaA, QIAGEN, and others are also undertaking various strategies to maintain their market position.

LIST OF KEY DNA POLYMERASES COMPANIES PROFILED

- Takara Bio Inc. (Japan)

- Thermo Fisher Scientific Inc. (U.S.)

- New England Biolabs (U.S.)

- Promega Corporation (U.S.)

- QIAGEN (Germany)

- Agilent Technologies Inc. (U.S.)

- Merck KGaA (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Bio-Rad Laboratories, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- October 2024: Takara Bio Europe expanded its Gothenburg site to include a custom manufacturing lab for enzymes, including PCR and qPCR enzymes.

- August 2023: ArcticZymes Technologies (AZT) launched its new product, AZtaq DNA Polymerase. AZtaq is a high-quality thermostable DNA polymerase suitable for use in polymerase chain reaction (PCR) applications.

- April 2022: Molecular Assemblies, Inc., in collaboration with Codexis, Inc. announced the results of their partnership for the engineering of enzymes to deliver differentiated solutions for the enzymatic synthesis of DNA.

- February 2022: New England Biolabs launched New LyoPrime Luna Probe One-Step RT-qPCR Mix with UDG. It has reverse transcriptase and hot start Taq DNA polymerase, for optimized specificity and robustness, in addition to room temperature setup after resuspension.

- January 2020: Meridian Bioscience, Inc. introduced the High-Specificity Pfu HS Mix, which is a high-fidelity DNA polymerase designed for companion diagnostic (CDx) and clinical testing.

REPORT COVERAGE

The global DNA polymerases market analysis provides an in-depth study of market size & forecast by all the market segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. The market forecast report offers information on the technological advancements, new product launches, key industry developments, and details on partnerships, mergers & acquisitions. The market research report also encompasses detailed competitive landscape with information on the market share and profiles of key operating players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.48% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Formulation

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

The global DNA polymerases market size was valued at USD 433.81 million in 2025. The market is projected to grow from USD 472.98 million in 2026 to USD 976.48 million by 2034, exhibiting a CAGR of 9.48% during the forecast period.

In 2025, the market value stood at USD 218.47 million.

The market is expected to exhibit a CAGR of 9.48% during the forecast period.

The DNA amplification segment led the market by application.

The key factors driving the market are the expansion of precision medicine & genomics, rising adoption of PCR & isothermal amplification in diagnostics and others.

New England Biolabs, Agilent Technologies, Thermo Fisher Scientific Inc., and Takara Bio Inc., are some of the key players in the market.

North America dominated the market in 2025.

Strong emphasis on genomics research coupled with focus development of gene based therapies are some of the factors that are expected to favor the product adoption.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us